9 minute read

Exness Review Uganda: Legit, Safe, Is a good broker?

Forex trading has gained immense popularity in Uganda over the past decade, driven by increased internet penetration, mobile technology, and a growing interest in global financial markets. Among the many brokers vying for the attention of Ugandan traders, Exness stands out as a globally recognized name. But how does Exness perform for traders in Uganda? Is it a reliable, legal, and worthwhile platform for beginners and seasoned traders alike? In this in-depth Exness review for Uganda, we’ll explore everything you need to know—from its regulatory status and account types to trading conditions, payment methods, and customer support—updated for 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview for Ugandan Traders

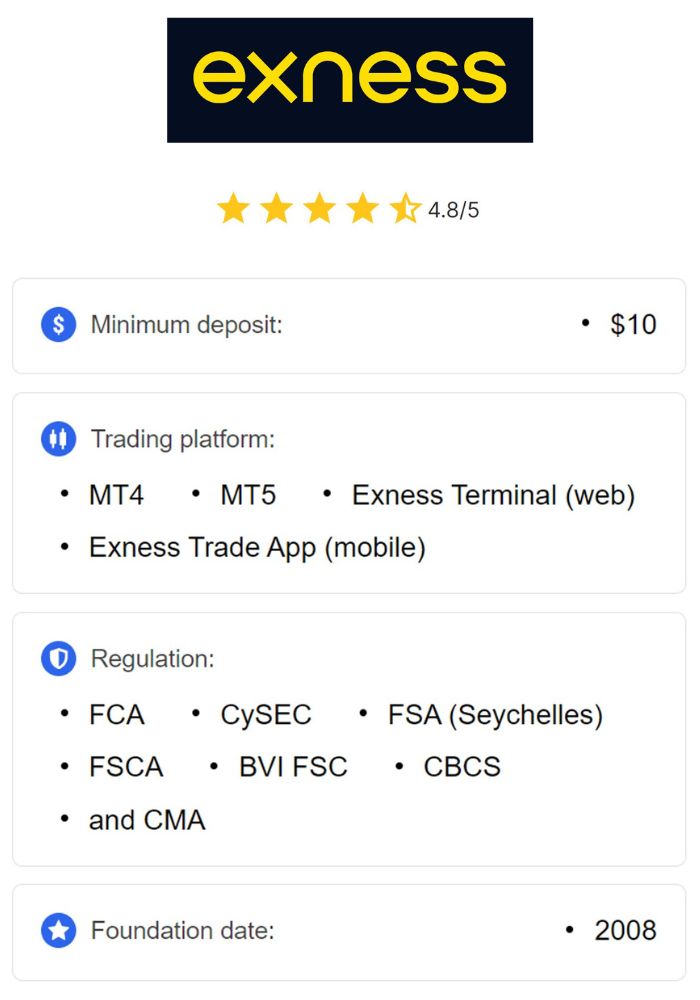

Exness is a Cyprus-based forex and CFD (Contract for Difference) broker founded in 2008. Over the years, it has grown into one of the world’s largest retail brokers, serving over 700,000 active clients and processing monthly trading volumes exceeding $4 trillion. Known for its competitive spreads, fast execution speeds, and innovative features like unlimited leverage, Exness has built a strong reputation globally, including in African markets like Uganda.

For Ugandan traders, Exness offers access to a wide range of financial instruments, including forex pairs, cryptocurrencies, stocks, indices, and commodities. The broker supports popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Trade app, making it accessible to traders of all experience levels. But before diving into the specifics, let’s address a key question: Is Exness legal and regulated in Uganda?

Is Exness Legal and Regulated in Uganda?

Forex trading is legal in Uganda, and the financial sector is overseen by the Bank of Uganda (BoU) and the Capital Markets Authority (CMA). However, Uganda does not yet have a specific regulatory framework dedicated to forex brokers. The CMA primarily focuses on securities and capital markets, while forex trading remains a relatively unregulated space locally. This means that Ugandan traders often rely on international brokers like Exness, which operate under global regulatory licenses.

Exness is not directly regulated by the CMA or any Ugandan authority. Instead, it operates under multiple international licenses from reputable bodies, including:

Cyprus Securities and Exchange Commission (CySEC): A Tier-1 regulator in the European Union, ensuring high standards of transparency and client fund protection.

Financial Conduct Authority (FCA): A top-tier regulator in the UK, known for its stringent oversight.

Financial Services Authority (FSA): Based in Seychelles, this regulates Exness (SC) Ltd, the entity Ugandan traders typically register under.

Other Licenses: Exness also holds licenses from the Financial Sector Conduct Authority (FSCA) in South Africa, the Central Bank of Curaçao and Sint Maarten (CBCS), and the Financial Services Commission (FSC) in Mauritius and the British Virgin Islands.

While Exness lacks direct CMA regulation, its global licenses ensure compliance with international standards, such as segregating client funds, adhering to anti-money laundering (AML) policies, and providing transparent trading conditions. For Ugandan traders, this multi-layered regulation offers a level of security and trustworthiness, even without local oversight. In short, yes, Exness is legal to use in Uganda, and its international reputation adds credibility.

Exness Account Types: Which One Suits Ugandan Traders?

One of Exness’s strengths is its variety of account types, catering to different trading styles and experience levels. Ugandan traders can choose from the following options:

Standard Account

Minimum Deposit: $1 (highly accessible for beginners).

Spreads: Starting from 0.3 pips.

Leverage: Up to 1:2000 (or unlimited under specific conditions).

Commission: None.

Best For: New traders or those testing the platform with minimal risk.

Standard Cent Account

Minimum Deposit: $1.

Spreads: Starting from 0.3 pips.

Leverage: Up to 1:2000.

Commission: None.

Unique Feature: Trades are measured in cents, ideal for beginners practicing with small amounts.

Best For: Absolute beginners looking to minimize risk.

Pro Account

Minimum Deposit: $200.

Spreads: Starting from 0.1 pips.

Leverage: Up to 1:2000.

Commission: None.

Best For: Experienced traders seeking low spreads and instant execution.

Raw Spread Account

Minimum Deposit: $200.

Spreads: Starting from 0.0 pips.

Leverage: Up to 1:2000.

Commission: Up to $3.50 per lot per side.

Best For: Scalpers and day traders who prioritize tight spreads.

Zero Account

Minimum Deposit: $200.

Spreads: 0.0 pips on 95% of the trading day for major pairs.

Leverage: Up to 1:2000.

Commission: From $0.05 per lot per side (varies by instrument).

Best For: High-volume traders needing the lowest possible costs.

Additionally, Exness offers Islamic accounts (swap-free) for Muslim traders in Uganda who adhere to Sharia law, ensuring no interest is charged on overnight positions. Ugandan traders can also open a demo account with virtual funds to practice strategies risk-free.

For most Ugandan traders, the Standard or Standard Cent accounts are excellent starting points due to their low entry barriers. More experienced traders may prefer the Pro, Raw Spread, or Zero accounts for their competitive conditions.

Trading Conditions: Spreads, Leverage, and Execution

Exness is renowned for its favorable trading conditions, which are a significant draw for Ugandan traders.

Spreads: Exness offers some of the tightest spreads in the industry. Standard accounts start at 0.3 pips, while Raw Spread and Zero accounts can go as low as 0.0 pips. This is particularly beneficial for trading major pairs like EUR/USD or commodities like gold, which are popular among Ugandans.

Leverage: Exness provides flexible leverage, ranging from 1:2 to 1:2000, with the option for unlimited leverage under specific conditions (e.g., a minimum equity of $1,000 and 10 completed trades). High leverage can amplify profits but also increases risk, so Ugandan traders should use it cautiously.

Execution Speed: Exness boasts ultra-fast execution speeds, averaging 0.01 seconds, with no requotes. This is critical for scalpers and day traders who rely on quick market entry and exit.

These conditions make Exness a competitive choice compared to other brokers in Uganda, especially for traders focused on cost-efficiency and speed.

💥 Trade with Exness now: Open An Account or Visit Brokers

Payment Methods for Ugandan Traders

Exness supports a variety of payment methods tailored to the needs of Ugandan traders, ensuring seamless deposits and withdrawals:

Mobile Money: Options like MTN Mobile Money and Airtel Money are widely used in Uganda, offering instant deposits and fast withdrawals.

Bank Transfers: Available for those preferring traditional methods, though processing times may take 1-3 business days.

Credit/Debit Cards: Visa and Mastercard are supported, with instant deposits and withdrawals processed within 24 hours.

E-Wallets: Skrill, Neteller, and Perfect Money provide additional flexibility for tech-savvy traders.

Notably, Exness does not charge deposit or withdrawal fees, though third-party providers (e.g., banks or mobile money operators) may apply small charges. The minimum deposit of $1 for Standard and Standard Cent accounts makes Exness highly accessible to Ugandans, especially compared to brokers requiring $100 or more.

How to Open an Exness Account in Uganda

Opening an account with Exness is straightforward for Ugandan residents. Here’s a step-by-step guide:

Visit the Exness Website: Go to Exness: Open An Account or Visit Brokers

Fill in Details: Provide your email, phone number, and country (Uganda).

Verify Your Identity: Upload a government-issued ID (e.g., passport or national ID) and proof of address (e.g., utility bill).

Choose an Account Type: Select from Standard, Pro, or other options based on your needs.

Deposit Funds: Use mobile money, bank transfer, or another method to fund your account.

Start Trading: Download MT4, MT5, or the Exness Trade app and begin trading.

The process typically takes 5-10 minutes, and verification is completed within 24 hours, making it quick and efficient.

Exness Trading Platforms: MT4, MT5, and More

Exness supports multiple platforms to suit different trading preferences:

MetaTrader 4 (MT4): A classic platform favored by beginners and experts for its simplicity and robust tools.

MetaTrader 5 (MT5): An advanced option with additional features like more timeframes, indicators, and asset classes.

Exness Trade App: A mobile-friendly app for trading on the go, offering real-time quotes, account management, and instant withdrawals.

Web Terminal: A browser-based platform requiring no downloads, ideal for traders with limited device storage.

For Ugandan traders, the Exness Trade app is particularly useful due to its compatibility with mobile devices—a primary internet access point in Uganda. All platforms support the Ugandan Shilling (UGX) as a base currency, eliminating conversion fees for local users.

Pros and Cons of Exness for Ugandan Traders

Pros:

Low minimum deposit ($1) makes it beginner-friendly.

Tight spreads starting from 0.0 pips reduce trading costs.

High leverage (up to 1:2000 or unlimited) offers flexibility.

Fast and fee-free withdrawals via mobile money.

Multi-regulated globally, ensuring safety and transparency.

Excellent customer support available 24/7 in English and Swahili.

Cons:

Not regulated by Uganda’s CMA, relying on offshore licenses.

High leverage poses risks for inexperienced traders.

Limited educational resources compared to some competitors.

No local physical office in Uganda for in-person support.

Customer Support: How Does Exness Serve Ugandans?

Exness provides 24/7 customer support via live chat, email, and phone, with agents fluent in English and Swahili—two widely spoken languages in Uganda. Response times are typically fast, and the support team is knowledgeable about trading issues, account management, and payment queries. While there’s no local office in Uganda, the online support system is robust enough to address most concerns effectively.

Exness vs. Other Brokers in Uganda

How does Exness stack up against competitors like XM, FBS, or HotForex in Uganda?

Exness vs. XM: XM offers a $30 no-deposit bonus for new traders, which Exness lacks. However, Exness has lower spreads and a lower minimum deposit ($1 vs. XM’s $5).

Exness vs. FBS: FBS provides more promotional bonuses, but Exness excels in execution speed and leverage options.

Exness vs. HotForex: HotForex is regulated by more African authorities (e.g., Kenya’s CMA), but Exness offers tighter spreads and a broader range of base currencies, including UGX.

For Ugandan traders prioritizing low costs and flexibility, Exness often comes out ahead.

Tips for Trading with Exness in Uganda

Start with a Demo Account: Practice risk-free to understand the platform and market dynamics.

Use Mobile Money: Leverage MTN or Airtel for quick, cost-effective transactions.

Manage Leverage: High leverage can lead to significant losses—set strict risk limits.

Focus on Major Pairs: Stick to EUR/USD or USD/JPY for tighter spreads and liquidity.

Stay Informed: Monitor economic news affecting the Ugandan Shilling and global markets.

Is Exness Worth It for Ugandan Traders in 2025?

Exness is a strong contender for Ugandan traders in 2025, thanks to its low entry barriers, competitive trading conditions, and reliable global regulation. While it lacks local CMA oversight, its international licenses and transparent operations provide ample security. Beginners will appreciate the $1 minimum deposit and cent accounts, while advanced traders benefit from tight spreads and high leverage.

💥 Trade with Exness now: Open An Account or Visit Brokers

However, success with Exness—or any broker—depends on your trading strategy, risk management, and market knowledge. For Ugandans looking to explore forex trading, Exness offers a solid platform to start and grow. Ready to try it? Visit exness.com to open an account and experience it for yourself.

Read more: