11 minute read

Is Exness Legal in UAE? A Comprehensive Guide for Traders

The United Arab Emirates (UAE) has emerged as a global financial hub, attracting traders and investors from around the world. With its robust economy, strategic location, and progressive regulatory framework, the UAE offers a fertile ground for forex and CFD trading. Among the many brokers vying for attention in this market, Exness stands out as a prominent name. But a critical question lingers for UAE-based traders: Is Exness legal in UAE? In this in-depth article, we’ll explore Exness’s legal status, regulatory compliance, trading features, and everything you need to know to make an informed decision as a trader in the UAE in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

Understanding Forex Trading in the UAE

Before diving into Exness’s legality, it’s essential to understand the broader context of forex trading in the UAE. Forex trading, which involves buying and selling currency pairs to profit from exchange rate fluctuations, is entirely legal in the UAE. The country’s financial authorities have established a well-regulated environment to ensure transparency, security, and fairness in the financial markets.

The UAE’s financial ecosystem is overseen by several key regulatory bodies:

Central Bank of the UAE (CBUAE): Responsible for monetary policy and financial stability, the CBUAE indirectly influences forex trading by regulating banks and financial institutions.

Securities and Commodities Authority (SCA): The SCA governs financial markets on the UAE mainland, including forex and commodities trading, ensuring brokers comply with local laws.

Dubai Financial Services Authority (DFSA): Operating within the Dubai International Financial Centre (DIFC), the DFSA regulates financial services, including forex trading, in this free zone.

Financial Services Regulatory Authority (FSRA): Part of the Abu Dhabi Global Market (ADGM), the FSRA oversees financial activities in this financial free zone.

These bodies collectively ensure that forex trading in the UAE adheres to strict standards, protecting traders from fraud and unethical practices. However, the UAE allows its residents to trade with both locally regulated and internationally licensed brokers, provided they meet certain compliance requirements. This brings us to the core question: Where does Exness fit into this framework?

What Is Exness? An Overview of the Broker

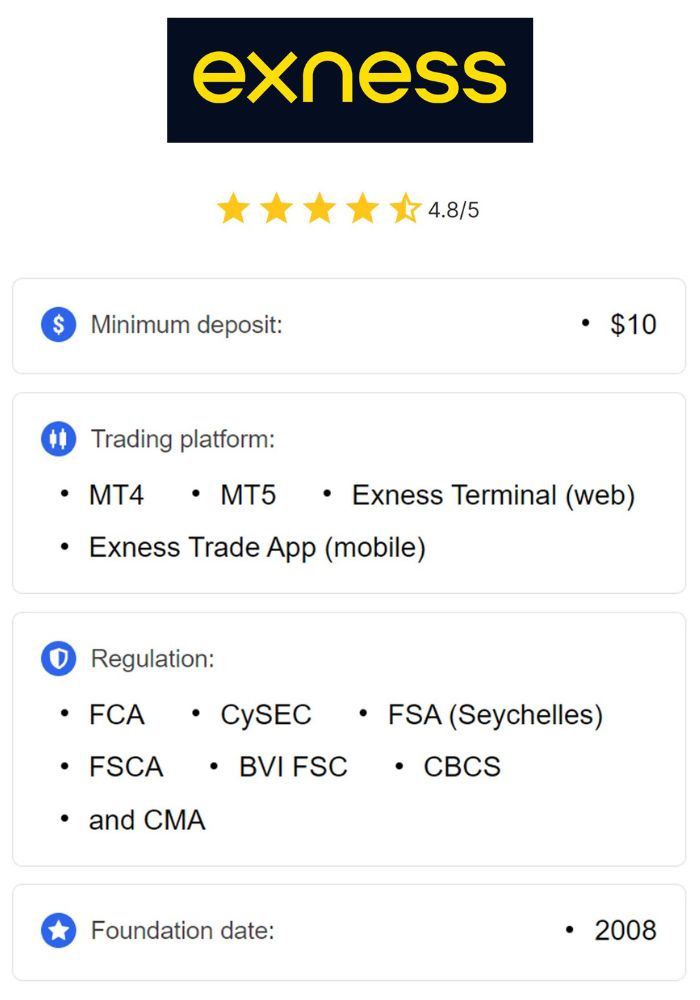

Exness is a globally recognized forex and CFD broker founded in 2008. With over 15 years of operation, it has built a reputation for reliability, transparency, and innovation. Headquartered in Cyprus, Exness serves millions of clients worldwide, offering trading in forex pairs, commodities, indices, stocks, and cryptocurrencies. The broker is known for its competitive trading conditions, including tight spreads, high leverage, and fast execution speeds.

Exness operates through multiple entities, each regulated by different authorities, allowing it to cater to a diverse international clientele. Its user-friendly platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with its proprietary Exness Terminal and mobile app, make it a popular choice among traders of all experience levels. But how does this global broker align with UAE laws and regulations?

Is Exness Legal in the UAE?

The short answer is yes, Exness is legal for traders in the UAE to use. However, the full picture requires a deeper look at its regulatory status and how it operates within the UAE’s legal framework.

Exness’s Regulatory Status

Exness is not directly regulated by UAE-specific authorities such as the SCA, DFSA, or FSRA. Instead, it operates under licenses from several reputable international regulatory bodies, including:

Financial Conduct Authority (FCA) – UK: One of the world’s most stringent regulators, the FCA ensures brokers maintain high standards of transparency and client fund protection.

Cyprus Securities and Exchange Commission (CySEC) – Cyprus: A key regulator within the European Union, CySEC enforces compliance with EU financial directives.

Financial Sector Conduct Authority (FSCA) – South Africa: The FSCA oversees financial markets in South Africa, adding another layer of credibility to Exness.

Financial Services Authority (FSA) – Seychelles: The FSA regulates Exness’s global entity, catering to clients outside heavily regulated jurisdictions like the EU or UK.

💥 Trade with Exness now: Open An Account or Visit Brokers

While Exness lacks a local UAE license, this does not render it illegal. The UAE permits residents to trade with offshore brokers that hold valid international licenses, as long as these brokers comply with global standards for anti-money laundering (AML), know-your-customer (KYC), and client fund protection. Exness meets these requirements through its multi-jurisdictional regulation, making it a legitimate option for UAE traders.

How Exness Operates in the UAE

For UAE-based traders, Exness typically operates under its global entity, Exness (SC) Ltd, regulated by the FSA in Seychelles. This entity allows Exness to offer its full range of services, including high leverage and a broad selection of trading instruments, without the restrictions imposed by regulators like the FCA or CySEC in their respective jurisdictions.

The UAE’s financial laws do not prohibit residents from opening accounts with offshore brokers like Exness. In fact, many UAE traders prefer international brokers for their flexibility, competitive conditions, and access to global markets. Exness’s adherence to international regulatory standards ensures that UAE clients can trade with confidence, knowing their funds are secure and their transactions are transparent.

Verdict: Legal and Accessible

Exness is legal in the UAE because:

Forex trading is permitted under UAE law.

Exness holds licenses from reputable global regulators.

The UAE allows trading with offshore brokers that meet international compliance standards.

For traders in Dubai, Abu Dhabi, or elsewhere in the UAE, Exness is a viable and lawful option, provided they comply with local tax and financial reporting obligations.

Why Choose Exness in the UAE?

Now that we’ve established Exness’s legality, let’s explore why it’s a popular choice among UAE traders. Exness offers a range of features tailored to the needs of both novice and experienced traders, making it a standout broker in the competitive forex market.

1. Competitive Trading Conditions

Exness is renowned for its low-cost trading environment:

Tight Spreads: Starting from 0.0 pips on certain account types, Exness minimizes trading costs.

High Leverage: UAE traders can access leverage up to 1:2000 or even unlimited leverage (subject to conditions), allowing for greater market exposure with smaller capital.

Fast Execution: With ultra-fast order execution, Exness ensures minimal slippage, a critical factor for active traders.

These conditions are particularly appealing in the UAE, where traders often seek to maximize returns in a dynamic market.

2. Diverse Account Types

Exness offers a variety of account types to suit different trading styles:

Standard Account: Ideal for beginners, with low minimum deposits and no commissions.

Standard Cent Account: Perfect for new traders testing strategies with micro-lots.

Pro Account: Designed for experienced traders, offering instant execution and low spreads.

Raw Spread Account: Features ultra-low spreads with a small commission per lot.

Zero Account: Provides zero spreads on top instruments, ideal for high-volume traders.

This flexibility allows UAE traders to choose an account that aligns with their experience level and financial goals.

3. Islamic (Swap-Free) Accounts

The UAE has a significant Muslim population, and Exness caters to this demographic by offering Islamic accounts. These swap-free accounts comply with Sharia law by eliminating overnight interest charges, making forex trading accessible to observant Muslim traders. This feature enhances Exness’s appeal in the UAE market.

4. Advanced Trading Platforms

Exness supports industry-leading platforms:

MetaTrader 4 (MT4): A widely used platform with robust charting and automation tools.

MetaTrader 5 (MT5): An upgraded version with additional features like more timeframes and order types.

Exness Terminal: A web-based platform for trading without downloads.

Exness Trade App: A mobile app for trading on the go, complete with real-time data and analysis.

These platforms are optimized for UAE traders, offering Arabic language support and compatibility with local devices and internet speeds.

5. Local Payment Options

Exness supports a range of deposit and withdrawal methods tailored to UAE clients:

Local Bank Transfers: Compatible with UAE banks for seamless transactions.

Credit/Debit Cards: Visa and Mastercard are widely accepted.

E-Wallets: Options like Skrill, Neteller, and Perfect Money offer fast processing.

Cryptocurrencies: Bitcoin and USDT deposits cater to tech-savvy traders.

Most transactions are instant and fee-free, ensuring UAE traders can manage their funds efficiently.

6. 24/7 Customer Support

Exness provides round-the-clock support in multiple languages, including Arabic and English. This is a significant advantage for UAE traders, who can resolve issues or seek assistance at any time, aligning with the region’s active trading hours.

How to Start Trading with Exness in the UAE

If you’re convinced that Exness is a suitable broker, here’s a step-by-step guide to get started:

Step 1: Register an Account

Visit the official Exness website.

Click “Sign Up” and enter your email, phone number, and country (select UAE).

Create a secure password and submit the form.

Step 2: Verify Your Identity

Upload a government-issued ID (e.g., Emirates ID or passport).

Provide proof of address (e.g., utility bill or bank statement).

Complete the KYC process, which typically takes a few hours.

Step 3: Deposit Funds

Log in to your Exness account.

Navigate to the “Deposit” section.

Choose a payment method (e.g., bank transfer, card, or e-wallet).

Enter the amount and confirm the transaction.

Step 4: Choose a Trading Platform

Download MT4, MT5, or use the Exness Terminal/App.

Log in with your account credentials.

Step 5: Start Trading

Select your preferred instruments (forex, stocks, etc.).

Set your leverage and risk parameters.

Place your trades and monitor your positions.

This straightforward process ensures UAE traders can begin their journey with Exness quickly and securely.

Pros and Cons of Using Exness in the UAE

Like any broker, Exness has its strengths and limitations. Here’s a balanced look:

Pros

Legal and Regulated: Operates under international licenses, ensuring safety.

Low Costs: Tight spreads and no hidden fees reduce trading expenses.

High Leverage: Up to 1:2000 or unlimited leverage for experienced traders.

Islamic Accounts: Swap-free options cater to UAE’s Muslim traders.

Fast Withdrawals: Instant processing enhances fund accessibility.

Localized Support: Arabic-speaking support available 24/7.

Cons

No Local Regulation: Lacks a DFSA or SCA license, which some traders may prefer.

Limited Educational Resources: Beginners may need external learning materials.

Offshore Entity Risks: Trading under the Seychelles entity may lack certain protections offered by EU/UK regulators.

For most UAE traders, the pros outweigh the cons, but it’s worth considering your priorities before committing.

Comparing Exness to Other Brokers in the UAE

To provide context, let’s compare Exness to other popular brokers in the UAE:

Exness vs. XM

Regulation: XM is regulated by DFSA, giving it a local edge, while Exness relies on international licenses.

Spreads: Exness offers tighter spreads (0.0 pips) compared to XM (0.1 pips).

Leverage: Exness’s 1:2000 exceeds XM’s 1:888.

Exness vs. FXTM

Regulation: FXTM has a DFSA license, unlike Exness.

Account Types: Both offer diverse options, but Exness’s zero-spread accounts stand out.

Withdrawals: Exness processes withdrawals instantly, while FXTM may take longer.

Exness vs. IC Markets

Regulation: IC Markets lacks UAE regulation, similar to Exness.

Spreads: Both offer ultra-low spreads, but Exness’s leverage is higher.

Platforms: Exness’s proprietary app gives it an edge over IC Markets’ MT4/MT5 focus.

Exness holds its own against competitors, particularly for traders prioritizing cost and flexibility.

Safety and Security with Exness

Safety is a top concern for UAE traders. Exness ensures client protection through:

Segregated Funds: Client money is kept separate from company funds.

Negative Balance Protection: Prevents losses exceeding your deposit.

Regular Audits: Conducted by independent bodies to maintain transparency.

SSL Encryption: Secures data and transactions on its platforms.

While the Seychelles entity doesn’t offer investor compensation schemes (unlike FCA or CySEC jurisdictions), Exness’s global reputation and compliance measures provide a high level of trust.

Exness’s Reputation Among UAE Traders

Feedback from UAE traders is overwhelmingly positive. Many praise Exness for its low spreads, fast withdrawals, and reliable platforms. Some users note occasional delays in support during peak times, but these are rare. On platforms like Trustpilot and Forex Peace Army, Exness consistently scores above 4 stars, reflecting its strong standing in the trading community.

The Future of Exness in the UAE

Exness continues to expand its presence in the Middle East, including the UAE. With the region’s forex market growing, Exness may pursue local regulation (e.g., a DFSA license) to strengthen its foothold. For now, its international licenses and tailored services keep it competitive and relevant for UAE traders.

Conclusion: Is Exness the Right Choice for UAE Traders?

Exness is undeniably legal in the UAE, operating within the bounds of international regulations and UAE laws. Its competitive trading conditions, diverse account options, and localized features make it an excellent choice for traders in Dubai, Abu Dhabi, and beyond. While it lacks a local UAE license, its global regulatory framework ensures safety and reliability.

For UAE traders seeking a cost-effective, flexible, and trustworthy broker, Exness ticks all the boxes. Whether you’re a beginner exploring forex or a seasoned trader diversifying your portfolio, Exness offers the tools and support to succeed. Ready to start? Sign up today and experience trading with one of the world’s leading brokers

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: