11 minute read

Is Exness a South African Broker? A Comprehensive Review for Traders

When it comes to forex trading, choosing the right broker is a critical decision that can shape your financial journey. For traders in South Africa, one question often arises: Is Exness a South African broker? This query reflects the growing interest in Exness, a globally recognized trading platform, and its relevance to the South African market. In this in-depth article, we’ll explore Exness’s origins, its regulatory status, its offerings for South African traders, and whether it qualifies as a "South African broker." By the end, you’ll have a clear understanding of what Exness brings to the table and how it fits into the South African trading landscape.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? A Brief Overview

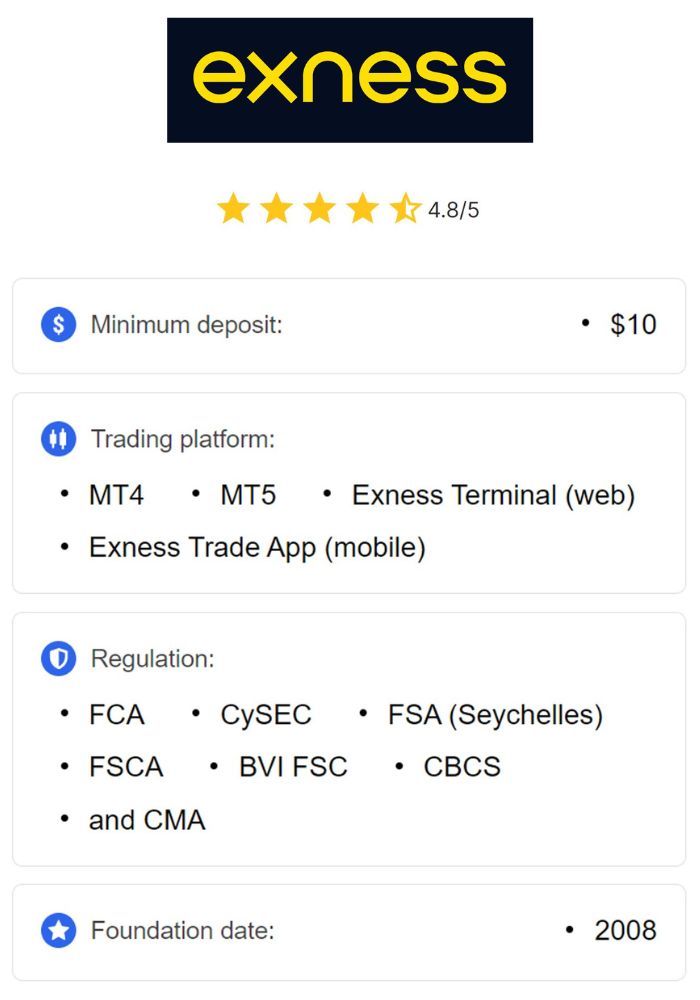

Exness is a well-established online forex and CFD (Contract for Difference) broker that has been operating since 2008. Founded by a group of like-minded professionals with a passion for finance and technology, Exness has grown into one of the world’s leading retail brokers. Headquartered in Limassol, Cyprus, the company serves over 1 million active clients globally and boasts a monthly trading volume exceeding $4 trillion as of early 2025. Its reputation is built on transparency, competitive trading conditions, and cutting-edge technology, making it a popular choice among traders worldwide.

But does its global presence mean it’s a South African broker? To answer this, we need to dig deeper into its operations, regulatory framework, and how it caters to South African traders specifically.

Exness’s Global Footprint: Where Does It Operate?

Exness operates as a multi-jurisdictional broker with offices and entities registered in several countries, including Cyprus, the United Kingdom, Seychelles, and South Africa. This global structure allows Exness to offer its services to traders in diverse regions while adhering to local and international regulations. For South African traders, the key entity to focus on is Exness ZA (Pty) Ltd, which is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa under license number 51024.

This FSCA regulation is a significant factor, as it demonstrates Exness’s commitment to complying with South African financial laws. However, it’s worth noting that while Exness has a regulated entity in South Africa, many South African traders are onboarded through its Seychelles-based entity, Exness (SC) Ltd. This dual-structure approach raises questions about whether Exness can truly be classified as a "South African broker." Let’s break this down further.

Is Exness a South African Broker? Understanding Its Regulatory Status

To determine if Exness qualifies as a South African broker, we must first examine its regulatory framework, as this is a cornerstone of any broker’s identity and trustworthiness.

Exness and the FSCA: Local Regulation in South Africa

The Financial Sector Conduct Authority (FSCA) is South Africa’s primary financial regulatory body, responsible for overseeing financial service providers, including forex brokers. Exness ZA (Pty) Ltd, the South African arm of the Exness Group, holds an FSCA license (FSP 51024). This license authorizes Exness to operate as a financial service provider in South Africa, ensuring that it adheres to local standards for transparency, client fund protection, and fair trading practices.

For South African traders, FSCA regulation offers a layer of security. It mandates that brokers segregate client funds from company funds, maintain adequate capital reserves, and provide clear disclosures about trading risks. This local oversight suggests that Exness has a legitimate presence in South Africa, aligning it with the characteristics of a "South African broker."

The Seychelles Connection: A Global Perspective

Despite its FSCA-regulated entity, Exness often onboards South African clients through its Seychelles-based entity, regulated by the Financial Services Authority (FSA) under license SD025. This offshore registration has sparked debate among traders. Seychelles is known for its lighter regulatory environment compared to jurisdictions like South Africa, the UK, or the EU. As a result, some South African traders may wonder if this offshore onboarding diminishes Exness’s status as a local broker.

However, this practice is not unique to Exness. Many global brokers use offshore entities to streamline operations and offer competitive trading conditions, such as higher leverage, which may be restricted under stricter local regulations. Importantly, Exness’s Seychelles entity still provides robust safety features, including negative balance protection and regular audits by reputable firms like Deloitte. This ensures that even traders onboarded offshore benefit from a secure trading environment.

Other Regulatory Licenses: A Multi-Tiered Approach

Beyond South Africa and Seychelles, Exness holds licenses from several top-tier regulators, including:

Cyprus Securities and Exchange Commission (CySEC) – License 178/12

Financial Conduct Authority (FCA) in the UK – License 730729

Financial Services Commission (FSC) in Mauritius and the British Virgin Islands

This multi-regulatory framework enhances Exness’s credibility on a global scale. For South African traders, it means they’re dealing with a broker that meets international standards, even if their accounts are managed through an offshore entity. So, while Exness isn’t exclusively a South African broker, its FSCA license and tailored services for the region make it a strong contender in the local market.

💥 Trade with Exness now: Open An Account or Visit Brokers

How Does Exness Cater to South African Traders?

Regulation aside, a broker’s suitability for a specific market depends on how well it meets the needs of local traders. Let’s explore the features and services that make Exness appealing to South Africans.

Support for the South African Rand (ZAR)

One of Exness’s standout features for South African traders is its support for accounts denominated in South African Rand (ZAR). This eliminates the need for currency conversion when depositing or withdrawing funds, saving traders from exchange rate fees and fluctuations. By offering ZAR-based accounts, Exness demonstrates an understanding of the local market’s needs, a trait often associated with South African brokers.

Localized Payment Methods

Exness supports a variety of payment methods tailored to South African preferences, including:

Bank Transfers: Compatible with major South African banks like Standard Bank, FNB, and Absa.

Credit/Debit Cards: Visa and Mastercard options for quick transactions.

E-Wallets: Popular options like Skrill and Neteller.

Local Payment Systems: Methods like EFT (Electronic Funds Transfer) and mobile payment solutions.

The availability of instant deposits and withdrawals—often processed in under a minute—further enhances convenience for South African users. These localized options reflect Exness’s efforts to integrate seamlessly into the South African financial ecosystem.

Competitive Trading Conditions

Exness is renowned for its competitive trading conditions, which resonate well with South African traders:

Low Spreads: Starting from 0.0 pips on certain account types (e.g., Raw Spread and Zero accounts), making it cost-effective for high-frequency traders.

High Leverage: Up to 1:2000 (or unlimited in some cases), allowing traders to maximize their capital, though this comes with increased risk.

Wide Range of Instruments: Over 100 forex pairs, including ZAR crosses (e.g., USD/ZAR, GBP/ZAR), plus CFDs on cryptocurrencies, metals, indices, and stocks.

These features cater to both novice and experienced traders, offering flexibility and affordability—key considerations for South Africa’s growing forex community.

Trading Platforms and Tools

Exness provides access to industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on desktop, mobile, and web. Additionally, its proprietary Exness Terminal offers a user-friendly alternative for traders who prefer a streamlined experience. South African traders benefit from real-time market data, advanced charting tools, and automated trading capabilities, ensuring they have the resources to succeed in volatile markets.

Customer Support in Local Languages

Exness offers 24/7 customer support in multiple languages, including English, which is widely spoken in South Africa. While it doesn’t provide a local phone number, traders can reach out via live chat, email, or the Exness Help Center. This accessibility ensures that South African clients receive timely assistance, further aligning Exness with local expectations.

Comparing Exness to Other South African Brokers

To fully assess whether Exness is a South African broker, it’s helpful to compare it to other popular brokers in the region, such as XM, FXTM, and IG Markets—all of which are also FSCA-regulated.

Exness vs. XM

XM is another globally recognized broker with an FSCA license. Like Exness, it offers ZAR accounts and competitive spreads. However, XM places a stronger emphasis on educational resources, which may appeal more to beginners. Exness, on the other hand, excels in low spreads and high leverage, making it a favorite among experienced traders.

Exness vs. FXTM

FXTM (ForexTime) is well-established in South Africa, with a local office and FSCA regulation. It provides extensive market analysis and educational content, whereas Exness focuses more on trading execution speed and cost efficiency. South African traders onboarded through Exness’s Seychelles entity might miss out on the same level of local oversight as FXTM clients.

Exness vs. IG Markets

IG Markets is a premium broker with a strong FSCA presence, offering advanced tools for professional traders. While IG provides a broader range of stock CFDs, Exness stands out with its forex and crypto offerings, tighter spreads, and no withdrawal fees. For cost-conscious South African traders, Exness often has the edge.

While these competitors have a more pronounced local footprint, Exness’s combination of FSCA regulation, ZAR support, and tailored services positions it as a viable option in the South African market.

Pros and Cons of Trading with Exness in South Africa

Pros

FSCA Regulation: Local entity ensures compliance with South African laws.

ZAR Accounts: No currency conversion hassles.

Low Costs: Tight spreads and no deposit/withdrawal fees.

High Leverage: Up to 1:2000, ideal for maximizing capital.

Fast Transactions: Instant withdrawals enhance user experience.

Global Reputation: Backed by multiple international licenses.

Cons

Offshore Onboarding: Many South African clients are registered via Seychelles, not the FSCA entity.

Limited Educational Resources: Less focus on beginner-friendly content compared to competitors.

No Local Office: Lack of a physical presence may concern some traders.

Is Exness Safe for South African Traders?

Safety is a top priority for any trader, and Exness delivers on multiple fronts:

Fund Segregation: Client funds are kept separate from company funds, a requirement under FSCA and other regulations.

Negative Balance Protection: Traders cannot lose more than their account balance, protecting against debt.

Audits by Deloitte: Regular independent audits ensure financial transparency.

SSL Encryption: Advanced security protocols safeguard personal and financial data.

While the offshore onboarding might raise eyebrows, Exness’s long history (since 2008) and global trustworthiness mitigate these concerns. For South African traders, it’s a safe and reliable choice, provided they understand the regulatory nuances.

Why South African Traders Choose Exness

South Africa’s forex market has seen rapid growth, driven by increasing internet access, financial literacy, and a desire for alternative income streams. Exness has capitalized on this trend by offering:

Accessibility: Low minimum deposits (as little as $10 for Standard accounts) make it beginner-friendly.

Diverse Instruments: From forex to cryptocurrencies, traders can diversify their portfolios.

Community Engagement: Exness participates in local events and sponsorships, building trust among South African traders.

These factors have helped Exness establish a vibrant trading community in the region, even if it’s not a purely South African broker.

Final Verdict: Is Exness a South African Broker?

So, is Exness a South African broker? The answer is both yes and no—it depends on how you define the term.

Yes: Exness has an FSCA-regulated entity (Exness ZA (Pty) Ltd), supports ZAR accounts, and offers localized payment methods, making it deeply integrated into the South African market.

No: Its global headquarters are in Cyprus, and many South African traders are onboarded through its Seychelles entity, suggesting it’s more of an international broker with a South African presence.

Ultimately, Exness transcends the label of a "South African broker" by offering a hybrid model: it combines local compliance with global reach. For South African traders, this means access to world-class trading conditions backed by a reputable, regulated platform.

Tips for South African Traders Considering Exness

If you’re a South African trader thinking about joining Exness, here are some tips:

Verify Your Account Type: Choose an account (e.g., Standard, Pro, Raw Spread) that matches your trading style and experience level.

Understand Leverage Risks: High leverage can amplify profits but also losses—use it wisely.

Check Payment Options: Opt for methods like EFT or bank cards for seamless ZAR transactions.

Leverage Demo Accounts: Practice with Exness’s free demo account to test strategies risk-free.

Stay Informed: Monitor Exness’s website for updates on regulations or promotions.

Conclusion

Exness may not be a South African broker in the traditional sense, but it’s undeniably a strong player in the South African forex market. With its FSCA license, ZAR support, and competitive offerings, it bridges the gap between local relevance and global excellence. Whether you’re a beginner exploring forex or a seasoned trader seeking low-cost trades, Exness provides a reliable, secure, and efficient platform to meet your needs.

For South African traders asking, Is Exness a South African broker?, the real question might be: Does it deliver what I need as a South African trader? Based on its features, reputation, and adaptability, the answer is a resounding yes. Ready to start your trading journey? Exness could be the partner you’re looking for.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: