10 minute read

Does Exness work in Pakistan? Is it Legal?

Forex trading has surged in popularity worldwide, and Pakistan is no exception. With millions of individuals exploring financial markets as a means of investment, platforms like Exness have caught the attention of Pakistani traders. But one question looms large: Does Exness work in Pakistan? In this in-depth guide, we’ll explore everything you need to know about using Exness in Pakistan, from its operational status and regulatory framework to its features, benefits, and potential challenges. Whether you’re a beginner or a seasoned trader, this article will provide clarity and actionable insights.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? An Overview of the Platform

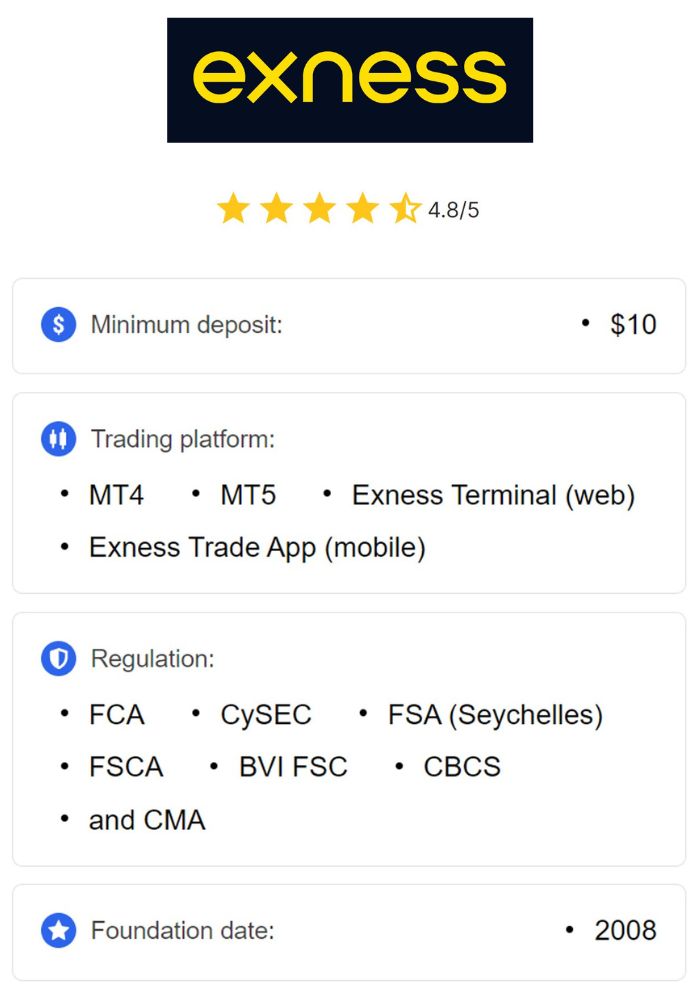

Exness is a globally recognized online trading platform established in 2008. Headquartered in Cyprus, it has grown into one of the most trusted names in forex and Contracts for Difference (CFD) trading. The broker offers access to a wide range of financial instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. Known for its competitive spreads, high leverage options, and lightning-fast execution speeds, Exness caters to traders of all experience levels.

What sets Exness apart is its commitment to transparency and reliability. The platform processes billions of dollars in trading volume monthly and serves clients in over 200 countries. For Pakistani traders, the appeal lies in its accessibility, user-friendly interface, and robust trading tools like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). But does it truly work in Pakistan? Let’s dive deeper.

Does Exness work in Pakistan?

The short answer is yes, Exness is available in Pakistan. Pakistani traders can sign up, open accounts, deposit funds, and trade on the platform without any explicit restrictions from Exness itself. The broker operates as an international entity, offering its services globally, including to residents of Pakistan. However, availability is only part of the equation—legality, practicality, and functionality are equally important considerations.

Exness does not have a physical office in Pakistan, but its online platform is fully accessible via desktop and mobile devices. Traders can register using their email addresses, complete the Know Your Customer (KYC) verification process, and start trading within minutes. The platform supports multiple languages, including English and Urdu, making it convenient for Pakistani users.

The Legal Status of Exness in Pakistan

To determine whether Exness works in Pakistan, we must first address its legal standing. Forex trading in Pakistan is regulated by two primary authorities: the Securities and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan (SBP). The SECP oversees financial markets, ensuring transparency and protecting investors, while the SBP manages foreign exchange policies and currency transactions.

Forex Trading Regulations in Pakistan

Forex trading is legal in Pakistan, but it operates in a somewhat gray area when it comes to international brokers. The SECP regulates local brokers and financial institutions, requiring them to obtain licenses to operate legally. However, international brokers like Exness are not directly regulated by the SECP. Instead, Exness operates under licenses from reputable global authorities, including:

Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA) in the UK

Financial Services Authority (FSA) in Seychelles

Financial Sector Conduct Authority (FSCA) in South Africa

These licenses ensure that Exness adheres to strict international standards for transparency, client fund protection, and fair trading practices. While this provides a layer of security for Pakistani traders, it does not mean Exness is explicitly licensed by Pakistani regulators.

Is Exness Legal in Pakistan?

Exness is not banned in Pakistan, and there are no specific laws prohibiting Pakistani residents from trading with international brokers. The SBP has issued warnings about the risks of forex trading and advised citizens to use regulated brokers, but it has not explicitly outlawed platforms like Exness. As a result, Pakistani traders can legally use Exness, though they should be aware of the lack of local regulatory oversight.

This ambiguity means that while Exness works in Pakistan from a practical standpoint, traders assume some responsibility for ensuring compliance with local laws, such as tax reporting and foreign exchange regulations.

How Does Exness Operate in Pakistan?

Exness operates seamlessly in Pakistan through its online infrastructure. Here’s how it works for Pakistani traders:

Account Registration

Getting started with Exness is straightforward:

Visit the official Exness website: Open An Account or Visit Brokers

Provide your email address and country (Pakistan).

Complete the KYC process by submitting identification documents (e.g., passport, national ID).

Choose an account type and deposit funds.

The registration process takes just 5-10 minutes, and approval is typically instant once verification is complete.

Trading Platforms

Exness offers Pakistani traders access to industry-leading platforms:

MetaTrader 4 (MT4): A popular choice for its simplicity, advanced charting, and automated trading via Expert Advisors (EAs).

MetaTrader 5 (MT5): An upgraded version with additional features like more timeframes, an economic calendar, and enhanced analytical tools.

Exness Web Terminal: A browser-based option for trading without software downloads.

Exness Trade App: A mobile app for iOS and Android, offering full trading functionality on the go.

These platforms are compatible with devices commonly used in Pakistan, ensuring a smooth trading experience.

Account Types

Exness provides multiple account types to suit different trading styles:

Standard Account: Ideal for beginners, with no minimum deposit and spreads starting at 0.3 pips.

Standard Cent Account: Perfect for testing strategies with micro-lots and a low entry barrier (minimum deposit of $1).

Pro Account: Designed for experienced traders, offering instant execution and a $200 minimum deposit.

Raw Spread Account: Features ultra-low spreads (from 0.0 pips) with a commission of $3.5 per lot.

Zero Account: Offers zero spreads on major instruments for a commission-based fee.

Pakistani traders can choose an account based on their capital and risk tolerance.

Deposit and Withdrawal Options

Funding an Exness account from Pakistan is convenient, with several payment methods available:

Bank Cards: Visa and Mastercard are widely accepted.

Bank Transfers: Local bank transfers are supported, though processing may take 1-3 business days.

E-Wallets: Options like Skrill, Neteller, and Perfect Money are available for faster transactions.

Cryptocurrencies: Bitcoin, Ethereum, and other digital currencies offer instant deposits and withdrawals.

Exness does not charge deposit or withdrawal fees, though third-party providers (e.g., banks) may apply charges. Withdrawals are processed quickly, often within hours, depending on the method.

💥 Trade with Exness now: Open An Account or Visit Brokers

Does Exness Work Well in Pakistan? Key Features and Benefits

Exness isn’t just available in Pakistan—it performs exceptionally well for local traders. Here’s why:

1. Competitive Spreads and Low Costs

Exness offers some of the tightest spreads in the industry, starting from 0.0 pips on certain accounts. This reduces trading costs, making it attractive for Pakistani traders who want to maximize profits.

2. High Leverage Options

With leverage up to 1:2000 (and even unlimited leverage in some cases), Exness allows traders to control large positions with minimal capital. This is a double-edged sword—while it amplifies potential gains, it also increases risk, so proper risk management is crucial.

3. Fast Execution Speeds

Exness boasts execution speeds averaging 0.1 seconds, thanks to its global server network. This ensures minimal slippage, even during volatile market conditions—a significant advantage for scalpers and day traders in Pakistan.

4. Islamic (Swap-Free) Accounts

Pakistan, being a Muslim-majority country, has a high demand for Sharia-compliant trading accounts. Exness offers swap-free accounts, eliminating interest charges on overnight positions in accordance with Islamic finance principles.

5. Robust Security Measures

Exness segregates client funds from company funds, storing them in tier-1 banks. It also provides negative balance protection, ensuring traders don’t lose more than their deposits—a reassuring feature for risk-averse Pakistani users.

6. Educational Resources and Support

Exness provides webinars, tutorials, and market analysis to help traders improve their skills. Its customer support is available 24/7 via live chat, email, and phone, with Urdu-speaking agents available to assist Pakistani clients.

Challenges of Using Exness in Pakistan

While Exness works effectively in Pakistan, there are some challenges to consider:

1. Lack of Local Regulation

As Exness is not regulated by the SECP, Pakistani traders may have limited recourse in case of disputes. Relying on international regulators like CySEC or the FCA may not provide the same level of local protection.

2. Currency Conversion Costs

Exness accounts are denominated in major currencies like USD or EUR, not Pakistani Rupees (PKR). This means traders may incur conversion fees when depositing or withdrawing funds, depending on their payment method.

3. Internet Connectivity

Forex trading requires a stable internet connection. While urban areas in Pakistan like Karachi, Lahore, and Islamabad have reliable internet, rural traders may face disruptions that affect their experience on Exness.

4. Limited Local Presence

Without a physical office or local representatives in Pakistan, resolving complex issues may take longer compared to dealing with a locally regulated broker.

How Does Exness Compare to Other Brokers in Pakistan?

To assess whether Exness truly works in Pakistan, let’s compare it to other popular brokers:

Exness vs. Local Brokers (e.g., AKD Securities, Topline Securities)

Regulation: Local brokers are SECP-regulated, offering more direct oversight, while Exness relies on international licenses.

Costs: Exness typically offers lower spreads and no commission on Standard accounts, unlike many local brokers.

Features: Exness provides advanced platforms (MT4/MT5) and higher leverage, which local brokers may not match.

Exness vs. International Competitors (e.g., XM, OctaFX)

Spreads: Exness’s raw spreads (0.0 pips) are competitive with XM and OctaFX.

Leverage: Exness’s 1:2000 leverage exceeds XM’s 1:888 and OctaFX’s 1:500, giving it an edge for aggressive traders.

Accessibility: All three brokers are accessible in Pakistan, but Exness stands out with its swap-free accounts and multilingual support.

Exness holds its own against both local and international rivals, making it a strong contender for Pakistani traders.

Real User Experiences: What Pakistani Traders Say About Exness

Feedback from Pakistani traders highlights Exness’s strengths and weaknesses:

Positive Reviews: Many praise the platform’s low spreads, fast withdrawals, and reliable execution. The availability of Islamic accounts is a frequent highlight.

Negative Feedback: Some users mention currency conversion fees and the lack of PKR support as minor inconveniences. A few report delays in withdrawals during peak times, though this is rare.

Overall, Exness enjoys a solid reputation among Pakistani traders, with most describing it as a trustworthy and efficient platform.

Tips for Using Exness in Pakistan

To make the most of Exness, consider these practical tips:

Start with a Demo Account: Test strategies risk-free before committing real funds.

Choose the Right Payment Method: Opt for e-wallets or crypto to avoid bank transfer delays and fees.

Leverage Wisely: High leverage can amplify losses—use it cautiously.

Stay Informed: Follow Exness’s market analysis and economic calendar to make informed trades.

Comply with Local Laws: Report trading income to tax authorities to avoid legal issues.

Conclusion: Does Exness Work in Pakistan?

Yes, Exness works in Pakistan—and it works well. The platform is fully accessible, legally permissible, and packed with features tailored to Pakistani traders’ needs, from swap-free accounts to high leverage and low-cost trading. While it lacks local regulation, its international licenses and robust security measures provide a level of trust that many local brokers struggle to match.

💥 Trade with Exness now: Open An Account or Visit Brokers

For Pakistani traders seeking a reliable, efficient, and globally recognized platform, Exness is a compelling choice. However, it’s essential to weigh the benefits against potential challenges like currency conversion costs and the absence of SECP oversight. By approaching it with knowledge and caution, you can harness Exness’s capabilities to thrive in the forex market.

Ready to give it a try? Sign up for an Exness account today and explore the world of trading from Pakistan. Happy trading!

Read more: