10 minute read

10 RBI Approved Forex Broker in India

Forex trading has taken India by storm, transforming how individuals engage with global financial markets. With a daily trading volume surpassing $6 trillion worldwide, the foreign exchange market offers unparalleled opportunities to profit from currency fluctuations. In India, however, forex trading is tightly regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These bodies ensure that trading remains legal, secure, and aligned with national financial policies, restricting it to specific INR-based currency pairs like USD/INR, EUR/INR, GBP/INR, and JPY/INR, traded exclusively through authorized exchanges such as the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

Top 4 Best Forex Brokers in India

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

For Indian traders, selecting an RBI-approved forex broker is not just a smart choice—it’s a legal imperative. The right broker ensures compliance with regulations, protects your funds, and provides a platform to thrive in this dynamic market. In this in-depth guide, we’ll explore the top 10 RBI-approved forex brokers in India for 2025, with Exness leading the pack as the ultimate choice. Whether you’re a beginner dipping your toes into forex or a seasoned trader seeking advanced tools, this list will equip you with the knowledge to make an informed decision.

Understanding the Importance of RBI-Approved Forex Brokers

Before we dive into the rankings, let’s unpack why trading with an RBI-approved broker is non-negotiable in India. The RBI governs forex activities under the Foreign Exchange Management Act (FEMA), 1999, which outlines strict rules to safeguard the country’s economic stability. Unlike many countries where retail forex trading with international brokers is common, India limits retail forex to currency derivatives (futures and options) traded on regulated exchanges. Any deviation—such as trading with an unregulated offshore broker—can lead to severe penalties under FEMA, including fines up to three times the amount involved or even imprisonment in extreme cases.

Benefits of Choosing an RBI-Approved Broker

Legal Assurance: Trading within RBI guidelines keeps you on the right side of the law.

Fund Protection: Your capital is safeguarded through segregated accounts and strict oversight.

Transparent Pricing: No hidden fees or manipulated spreads, ensuring fair execution.

Localized Support: Access to customer service in regional languages like Hindi or Tamil.

INR-Based Trading: Focus on currency pairs involving the Indian Rupee, aligning with RBI rules.

With these advantages in mind, let’s explore the top 10 RBI-approved forex brokers in India, starting with the standout leader, Exness.

1. Exness: The Pinnacle of Forex Trading in India

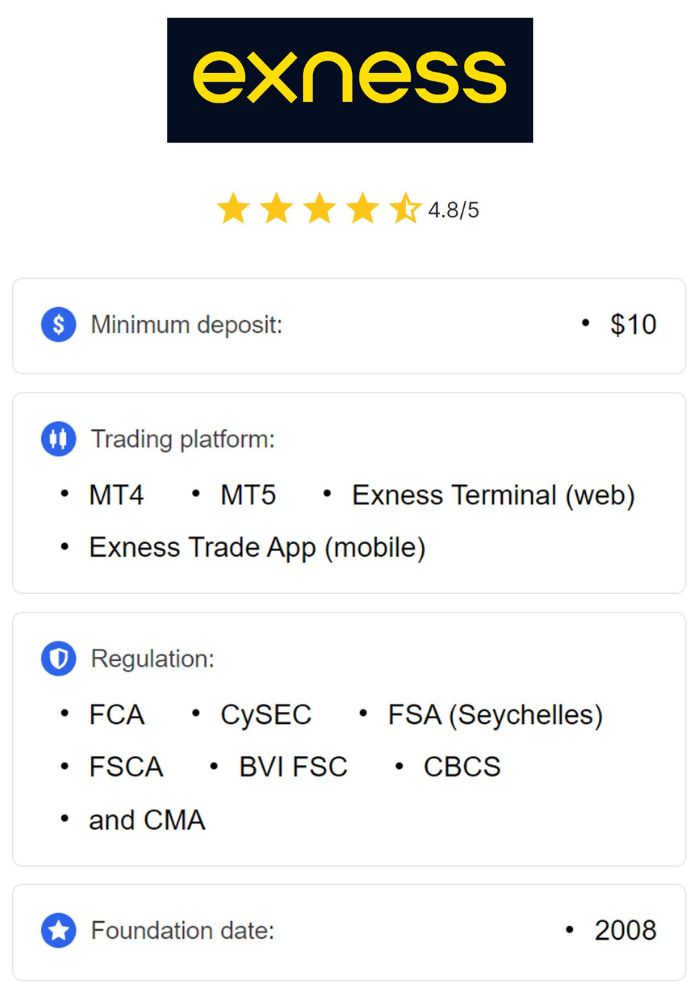

When it comes to forex trading in India, Exness emerges as the undisputed champion in 2025. Founded in 2008, Exness has grown into a global powerhouse, serving millions of traders across continents. Its tailored approach for Indian traders, combined with strict adherence to RBI regulations, makes it the top choice for anyone looking to succeed in the forex market.

Why Exness Leads the Pack

Exness isn’t just another broker—it’s a game-changer. Here’s why it tops our list:

RBI Compliance: Exness partners with SEBI-regulated exchanges to offer INR-based currency pairs like USD/INR, EUR/INR, and GBP/INR, ensuring full compliance with Indian laws.

Ultra-Low Spreads: With spreads starting as low as 0.1 pips, Exness minimizes trading costs, a boon for high-frequency traders.

Cutting-Edge Platforms: Choose from MetaTrader 4 (MT4), MetaTrader 5 (MT5), or the proprietary Exness Terminal, all optimized for speed and usability.

Account Variety: From the commission-free Standard account to the Pro account with razor-thin spreads, Exness caters to every trader’s needs.

Lightning-Fast Execution: Trades are executed in milliseconds, reducing slippage and maximizing profits.

24/7 Support: Multilingual assistance, including Hindi, ensures Indian traders get help whenever they need it.

Low Entry Barrier: A minimal deposit requirement makes Exness accessible to beginners.

The Exness Trading Experience

Imagine logging into your Exness account, greeted by a sleek interface that’s both powerful and intuitive. You decide to trade USD/INR futures on MT5, leveraging real-time charts and technical indicators to spot a trend. With a few clicks, your trade is executed instantly at a competitive price, thanks to Exness’s robust infrastructure. For beginners, the broker’s copy trading feature lets you mirror the moves of top traders, while seasoned pros enjoy high leverage (within RBI limits) and advanced risk management tools.

Exness also shines in fund security. Your money is held in segregated accounts, separate from the company’s operational funds, and the broker complies with international standards like those set by the Financial Services Commission (FSC). For Indian traders, this means peace of mind alongside profitability.

💥 Trade with Exness now: Open An Account or Visit Brokers

Real-Life Example

Take Priya, a 28-year-old IT professional from Bangalore. She started trading forex with Exness in 2024 with just $50. Using the Standard account and copy trading, she grew her capital by 30% in six months, all while staying compliant with RBI rules. Priya credits Exness’s low spreads and responsive support for her success—a testament to why it’s number one.

Why Indian Traders Choose Exness

Exness combines affordability, reliability, and innovation in a way no other broker does. Its focus on the Indian market—offering INR pairs, local payment methods like UPI, and Hindi support—sets it apart. Whether you’re scalping USD/INR or holding long-term positions, Exness delivers an unmatched experience in 2025.

Ready to join the ranks of successful traders? Sign up with Exness today and discover why it’s the best RBI-approved forex broker in India.

2. Angel One (Angel Broking)

Angel One, formerly Angel Broking, is a titan in India’s financial landscape. With decades of experience, this RBI-approved broker has expanded into forex trading, offering a reliable platform for currency derivatives.

Key Features

Research Excellence: Daily market reports, technical analysis, and expert tips.

Intuitive Platforms: Trade via the Angel One app, web portal, or desktop software.

RBI Compliance: Offers INR-based pairs through NSE and BSE.

Secure Transactions: Advanced encryption and segregated accounts.

Why Angel One Stands Out

Angel One’s strength lies in its research-driven approach. For example, its analysts might predict a USD/INR uptrend based on RBI policy changes, giving traders an edge. The broker’s mobile app is a hit among young traders, offering real-time alerts and portfolio tracking. While its spreads aren’t as tight as Exness’s, its comprehensive ecosystem makes it a strong contender.

Who It’s For

Ideal for traders who value insights over ultra-low costs, Angel One bridges the gap between forex and traditional investments like stocks.

3. Kotak Securities

Part of the prestigious Kotak Mahindra Group, Kotak Securities brings its banking expertise to forex trading. As an RBI-approved broker, it’s a trusted name for currency futures and options.

Key Features

Personalized Guidance: Dedicated relationship managers for high-net-worth clients.

Diverse Offerings: Combines forex with equities, commodities, and mutual funds.

RBI Compliance: Legal trading of INR pairs via NSE/BSE.

Research Tools: In-depth reports on currency trends and economic events.

Why It’s a Top Pick

Kotak Securities excels in offering a premium experience. For instance, a trader hedging against INR depreciation can rely on Kotak’s advisory team to craft a tailored strategy. Its fees are higher than Exness, but the added value of research and support justifies the cost for many.

Real-Life Scenario

Rohit, a Mumbai-based entrepreneur, uses Kotak Securities to hedge his import business’s forex exposure. With expert advice, he saved ₹5 lakh in 2024 by timing his USD/INR trades perfectly.

4. ICICI Direct

Backed by ICICI Bank, ICICI Direct is a powerhouse in India’s financial services sector. As an RBI-approved forex broker, it offers a seamless trading experience.

Key Features

Banking Integration: Instant fund transfers with ICICI accounts.

RBI Compliance: INR pairs traded via NSE/BSE.

Learning Resources: Webinars, tutorials, and market guides.

Mobile Trading: A feature-rich app for on-the-go trades.

Why Traders Love It

ICICI Direct’s banking integration is a game-changer. Imagine funding your trading account in seconds without third-party delays—ICICI makes it happen. Its educational content also empowers beginners, though its spreads are wider than Exness’s.

Best For

Traders with ICICI accounts or those seeking a broker with strong educational support.

5. HDFC Securities

HDFC Securities, part of the HDFC Group, is synonymous with trust in India. As an RBI-approved broker, it offers a sophisticated platform for forex trading.

Key Features

Hedging Options: Tools to manage currency risk effectively.

RBI Compliance: INR-based trading via regulated exchanges.

Advanced Analytics: Detailed charting and market insights.

Support Channels: Phone, email, and in-person assistance.

Why It’s Popular

HDFC Securities appeals to traders who prioritize security and tools. Its hedging features are a hit with businesses, while individual traders enjoy its robust platform. Compared to Exness, its fees are steeper, but the premium service justifies it for some.

6. Zerodha

Zerodha, India’s largest discount broker, has revolutionized trading with its low-cost model. As an RBI-approved forex broker, it’s a favorite among budget-conscious traders.

Key Features

Affordable Fees: Minimal charges on currency futures.

RBI Compliance: INR pairs via NSE.

Kite Platform: Fast, lightweight, and customizable.

Varsity: Free educational content for all levels.

Why Zerodha Excels

Zerodha’s simplicity is its strength. A trader can execute a USD/INR trade for a fraction of the cost charged by full-service brokers. However, it lacks the advanced features and tight spreads of Exness.

Who It’s For

Beginners and cost-sensitive traders who don’t need hand-holding.

7. Sharekhan

Sharekhan, a veteran broker, offers RBI-approved forex trading with a focus on local expertise. Its platform is designed for Indian traders.

Key Features

Liquidity: Stable pricing for INR pairs.

RBI Compliance: Legal trades via BSE/NSE.

TradeTiger: A powerful desktop trading tool.

Local Support: Assistance in regional languages.

Why Choose Sharekhan?

Sharekhan blends technology with personalized service. Its TradeTiger platform offers advanced charting, ideal for technical traders. While not as cost-effective as Exness, it’s a reliable choice.

8. Upstox

Upstox, another discount broker, has gained popularity as an RBI-approved forex platform. It’s known for its no-frills approach.

Key Features

Low Costs: Competitive pricing on INR trades.

RBI Compliance: Trades via NSE.

Mobile App: Simple and efficient.

Basic Tools: Essential charting and analysis.

Why It’s a Contender

Upstox keeps trading affordable and straightforward. It’s perfect for traders who value simplicity over advanced features, though it can’t match Exness’s depth.

9. 5Paisa

5Paisa, a rising star, offers RBI-approved forex trading at rock-bottom prices. It’s gaining traction among young traders.

Key Features

Low Fees: Budget-friendly trading costs.

RBI Compliance: INR pairs via exchanges.

Mobile Platform: Easy-to-use app.

Insights: Basic market research.

Why Traders Like It

5Paisa’s affordability and accessibility make it a hit. It’s a solid entry-level option, though it lacks Exness’s sophistication.

10. Motilal Oswal

Motilal Oswal, a legacy broker, rounds out our list with its RBI-approved forex offerings. It’s known for premium services.

Key Features

Research: Top-tier market analysis.

RBI Compliance: Legal INR trading.

Platforms: Feature-rich apps and desktop tools.

Advisory: Expert guidance.

Why It’s Worth It

Motilal Oswal caters to traders who value insights over low costs, offering a premium alternative to Exness.

How to Pick the Best RBI-Approved Forex Broker

With 10 stellar options, choosing the right broker depends on your goals. Consider:

Regulation: Verify RBI/SEBI compliance.

Costs: Compare spreads, fees, and commissions.

Platform: Test MT4, MT5, or proprietary software.

Support: Look for 24/7 help in your language.

Features: Assess leverage, tools, and account types.

Exness ticks all these boxes, making it the top choice for 2025.

The Future of Forex Trading in India

India’s forex market is poised for growth, driven by digital adoption and financial awareness. While RBI restrictions limit retail forex, currency derivatives offer ample opportunities. Brokers like Exness, with their focus on compliance and innovation, will shape this future.

Conclusion

From Exness’s unbeatable spreads to Zerodha’s affordability, these 10 RBI-approved forex brokers offer something for everyone. Exness stands out as the best in 2025, blending compliance, technology, and value. Start your forex journey today with Exness or explore the list to find your ideal broker!

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: