14 minute read

Exness forex trading app is legal in India?

The world of forex trading has taken the financial landscape by storm, offering individuals the chance to profit from the ever-shifting values of global currencies. In India, where economic growth and digital innovation are rapidly transforming how people invest, platforms like the Exness forex trading app have emerged as popular tools for traders seeking to tap into this lucrative market. But amid the excitement, a critical question lingers for Indian users: Is the Exness forex trading app legal in India? The answer isn’t a simple yes or no—it’s wrapped in layers of regulation, compliance, and practical considerations that every trader must understand.

💥 Trade with Exness now: Open An Account or Visit Brokers

In this in-depth guide, we’ll explore the legal status of forex trading in India, scrutinize Exness’s operations within this framework, and equip you with the knowledge to trade confidently and lawfully. Whether you’re a beginner dipping your toes into forex or an experienced trader eyeing Exness’s advanced features, this article will clarify the opportunities and risks involved. Let’s dive into the details and uncover the truth about using the Exness forex trading app in India.

What is Forex Trading, and Why Does Exness Stand Out?

Forex trading, or foreign exchange trading, is the act of exchanging one currency for another to capitalize on changes in their relative values. Picture this: you buy U.S. dollars with Indian rupees when the exchange rate is favorable, then sell them back when the dollar strengthens, pocketing the difference. It’s a simple concept, but the scale is staggering—over $7 trillion changes hands daily in the forex market, dwarfing even the biggest stock exchanges. Unlike traditional markets, forex operates around the clock, five days a week, connecting traders in cities like Mumbai, London, New York, and Tokyo.

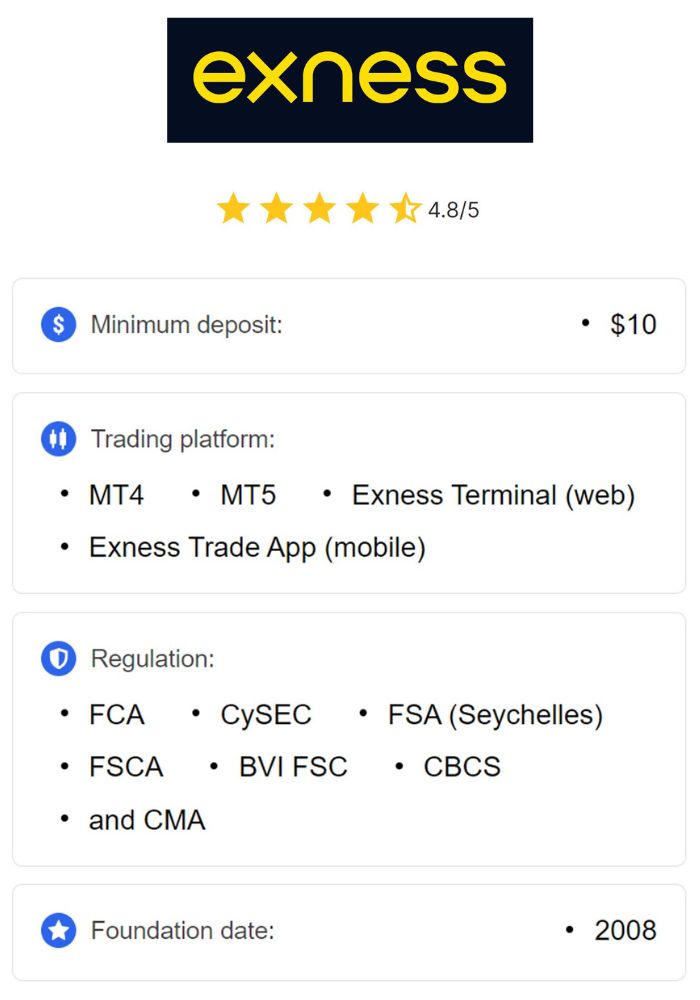

This global accessibility has fueled its appeal in India, where a growing middle class and widespread smartphone use have democratized financial markets. Enter Exness, a forex broker that’s captured the attention of Indian traders since its founding in 2008. Based in Cyprus, Exness has grown into a global powerhouse, serving millions of clients with a suite of tools designed for both novices and pros. Its mobile app, in particular, is a standout, offering real-time price feeds, sophisticated charting capabilities, lightning-fast trade execution, and a withdrawal system that processes funds in seconds.

What makes Exness so attractive? For one, it boasts some of the lowest spreads in the industry—meaning the difference between buying and selling prices is minimal, maximizing your profits. It also offers high leverage, letting traders control large positions with small investments, though this comes with heightened risk. Add to that a sleek, intuitive interface and 24/7 customer support in multiple languages, and it’s easy to see why Indian traders are flocking to the platform. But popularity alone doesn’t settle the legality question. To answer that, we need to unpack India’s forex trading rules and see how Exness fits into them.

The Legal Landscape of Forex Trading in India

Forex trading in India isn’t a free-for-all—it’s tightly regulated to safeguard the economy and protect individual investors. The framework hinges on two key players: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), operating under the Foreign Exchange Management Act (FEMA) of 1999. These entities work in tandem to ensure that foreign exchange activities don’t destabilize the rupee or drain India’s reserves, a concern rooted in the country’s history of balance-of-payments challenges.

The RBI’s Oversight

As India’s central bank, the RBI calls the shots on foreign exchange. It allows forex trading but imposes strict boundaries. First, Indian residents can only trade currency pairs that include the Indian Rupee (INR). That means you’re limited to combinations like USD/INR (U.S. dollar vs. rupee), EUR/INR (euro vs. rupee), GBP/INR (British pound vs. rupee), and JPY/INR (Japanese yen vs. rupee). These pairs are offered as derivatives—specifically futures and options—on recognized exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

Why the restriction? The RBI wants to prevent speculative trading in non-INR pairs like EUR/USD or GBP/JPY, which could lead to uncontrolled capital outflows. Trading these pairs through offshore brokers is explicitly prohibited under FEMA, and violations can trigger penalties ranging from fines to legal action. The RBI also mandates that all forex transactions—deposits, withdrawals, and profits—flow through authorized channels, such as Indian bank accounts or payment systems approved by the central bank, like UPI or Netbanking.

SEBI’s Role in the Mix

While the RBI sets the macro rules, SEBI focuses on the micro—regulating brokers, exchanges, and investor protections within India’s securities markets. For forex, SEBI oversees INR-based currency derivatives traded on platforms like the NSE or BSE. Any broker offering these services domestically must register with SEBI, submit to regular audits, and comply with transparency standards. This ensures that traders have recourse if something goes wrong, a safety net that’s critical in a market as volatile as forex.

But here’s the catch: SEBI’s authority doesn’t extend to international brokers like Exness, which operate outside India’s borders. This creates a jurisdictional gap that complicates the legality question. To trade legally, Indians must either use SEBI-registered brokers for INR pairs or navigate the rules when dealing with offshore platforms—a balancing act we’ll explore next.

Is the Exness Forex Trading App Legal in India?

So, where does the Exness forex trading app stand in this regulatory maze? The answer is nuanced: Yes, it’s legal in India, but only under specific conditions. Let’s break it down step by step.

Exness’s Global Credentials

Exness isn’t some fly-by-night operation—it’s a well-established broker with a robust regulatory foundation. It holds licenses from top-tier authorities like the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA), among others. These bodies enforce strict rules on capital adequacy, client fund segregation, and fair trading practices. For instance, Exness keeps client money in separate accounts from its operational funds, reducing the risk of loss if the company faces financial trouble. It also offers negative balance protection, meaning you can’t lose more than you deposit—a reassuring feature for risk-averse traders.

Globally, these credentials make Exness a trusted name. But in India, the picture shifts because it lacks local registration with SEBI or the RBI. Without a domestic license, Exness operates as an offshore broker, accessible to Indian traders via its app or website but not directly supervised by Indian regulators.

💥 Trade with Exness now: Open An Account or Visit Brokers

Aligning Exness with Indian Laws

Under FEMA, Indian residents can legally use offshore platforms like Exness, but they must adhere to the RBI’s restrictions. The golden rule is to trade only INR-based pairs. If you use the Exness app to speculate on USD/INR or EUR/INR, you’re within the legal framework, provided your funds move through RBI-approved channels. For example, depositing rupees from your Indian bank account and withdrawing profits back to it keeps everything above board.

However, the Exness app also offers a vast array of non-INR pairs—EUR/USD, GBP/JPY, AUD/CAD, and more. These are off-limits for Indian residents under FEMA. Trading them could be interpreted as an unauthorized capital outflow, putting you at risk of scrutiny from the RBI or even legal consequences. In practice, enforcement is inconsistent—many traders quietly use offshore brokers for non-INR pairs without immediate repercussions—but the risk remains.

The takeaway? The Exness forex trading app is legal in India if you play by the rules: stick to INR pairs, use compliant payment methods, and declare your earnings for tax purposes. Stray into non-INR territory, and you’re venturing into a gray area that could complicate your financial and legal standing.

Why Indian Traders Are Drawn to Exness

Despite the regulatory hurdles, Exness has carved out a strong foothold among Indian traders. Its appeal lies in a combination of cutting-edge features and practical benefits that cater to the needs of a diverse trading community. Let’s explore what sets it apart.

A Seamless User Experience

The Exness app is designed with simplicity and power in mind. Whether you’re a beginner learning the ropes or a seasoned trader executing complex strategies, the interface is intuitive and responsive. Real-time price updates keep you in sync with the market, while advanced charting tools—think candlestick patterns, moving averages, and RSI indicators—help you analyze trends and time your trades. For Indian traders juggling busy schedules, the app’s mobile-first design means you can trade on the go, whether you’re commuting in Mumbai or relaxing in Goa.

Cost Efficiency That Packs a Punch

Trading costs matter, especially in forex where profits can be razor-thin. Exness shines here with some of the tightest spreads available—often as low as 0.0 pips on major pairs. Lower spreads mean you keep more of your gains, a perk that resonates with India’s cost-conscious traders. The app also minimizes hidden fees, with transparent pricing that builds trust—a stark contrast to some brokers that nickel-and-dime users with unexpected charges.

Lightning-Fast Withdrawals

One of Exness’s biggest selling points is its withdrawal speed. Imagine this: you close a profitable trade, request a withdrawal, and within seconds—yes, seconds—the funds hit your account. Exness claims to process 95% of withdrawals instantly, a feat that’s rare in the brokerage world. For Indian traders, this is a game-changer, especially compared to domestic platforms where payouts can take days. Quick access to cash means you can reinvest, pay bills, or simply enjoy your earnings without delay.

Leverage: A Double-Edged Sword

Exness offers flexible leverage, sometimes as high as 1:2000, depending on your account type and market conditions. This lets you control a $20,000 position with just $10, amplifying your potential returns. Indian traders love this flexibility, as it stretches limited capital further. But here’s the flip side: high leverage magnifies losses too. A small market move against you could wipe out your account, so discipline and risk management are non-negotiable when using this feature.

Support in Your Language

India’s linguistic diversity is a strength, and Exness taps into it with 24/7 customer support in English, Hindi, and other regional languages. Whether you’re troubleshooting a technical issue or seeking trading advice, help is a chat or call away. This multilingual approach bridges the gap for traders in rural areas or smaller cities, where English fluency might be a barrier.

The Risks of Trading with Exness in India

No platform is perfect, and Exness comes with its share of risks—especially in India’s unique regulatory environment. Awareness is your first line of defense, so let’s unpack the potential pitfalls.

The Regulatory Gray Zone

Since Exness isn’t registered with SEBI or the RBI, it operates beyond India’s direct oversight. Globally, its licenses are rock-solid, but they don’t carry the same weight locally. If a dispute arises—say, a withdrawal glitch or a trading error—you’d need to appeal to regulators in Cyprus or the UK, not Mumbai or Delhi. This distance could delay resolutions or leave you without the robust protections SEBI offers domestic brokers.

Legal Exposure from Non-INR Pairs

The temptation to trade EUR/USD or other non-INR pairs on Exness is real—they’re often more volatile and liquid, offering bigger profit potential. But as we’ve established, this violates FEMA. While the RBI doesn’t actively monitor every trader’s account, a crackdown isn’t out of the question. In 2022, the central bank added dozens of forex brokers to its “Alert List” of unauthorized entities, signaling a tougher stance. Exness hasn’t made that list, but trading non-INR pairs could still flag your activity if audited.

Fund Safety Questions

Exness takes fund security seriously, segregating client money and offering negative balance protection. But without SEBI’s local safeguards—like mandatory compensation schemes—Indian traders might feel less secure. If Exness faced insolvency (unlikely given its track record), your recourse would hinge on foreign jurisdictions, not Indian courts. For risk-averse traders, this lack of domestic backing is a red flag.

Market Risks Amplified

Forex is inherently volatile, and Exness’s high leverage can turn small missteps into big losses. Indian traders, especially newcomers, might overestimate their skills or underestimate market swings, leading to financial strain. The app’s ease of use is a blessing, but it can also lull users into overconfidence—a risk that’s universal but worth highlighting.

How to Use Exness Legally and Safely in India

Ready to trade with Exness? You can do so legally and securely by following these practical steps.

Focus on INR-Based Pairs

Stick to USD/INR, EUR/INR, GBP/INR, or JPY/INR. These pairs align with RBI guidelines and keep you compliant. Exness offers them alongside its broader catalog, so you’re not missing out—just filtering your options.

Use Approved Payment Channels

Fund your account with rupees via an Indian bank transfer, UPI, or Netbanking. Withdrawals should follow the same route, ensuring a paper trail that satisfies FEMA. Avoid unregulated methods like cryptocurrency unless the RBI explicitly greenlights them (unlikely as of now).

Declare Your Earnings

Forex profits are taxable in India as business income under the Income Tax Act. Keep detailed records of your trades and consult a tax professional to calculate your liability. Failing to report earnings could invite penalties from the Income Tax Department, even if your trading is otherwise legal.

Stay Updated on RBI Policies

The RBI’s stance on forex evolves. Its Alert List, last updated in 2024, names platforms it considers risky, but Exness remains absent. Check the RBI website periodically or follow financial news to stay ahead of regulatory shifts that could affect offshore brokers.

Start Small and Practice

Exness offers a demo account with virtual funds—use it. Spend a few weeks testing strategies, mastering the app’s tools, and building confidence before risking real money. When you go live, start with a modest deposit (say, ₹10,000) to limit exposure while you learn the ropes.

Exploring Alternatives to Exness

If Exness’s offshore status gives you pause, India has SEBI-regulated options worth considering. These brokers offer INR-based forex trading with full legal backing, though they may lack Exness’s global flair.

Zerodha: The Homegrown Favorite

Zerodha is a household name in India, known for its low-cost stock and forex trading. It offers USD/INR and other INR pairs via the NSE, fully compliant with SEBI and RBI rules. Its Kite app is sleek and reliable, though spreads and leverage are less competitive than Exness.

Upstox: Affordable and Accessible

Upstox mirrors Zerodha’s model, blending affordability with a user-friendly platform. It’s SEBI-registered, supports INR forex derivatives, and appeals to budget-conscious traders. Withdrawals take longer than Exness’s instant payouts, but the local oversight adds peace of mind.

ICICI Direct: The All-in-One Solution

Backed by ICICI Bank, this platform integrates forex with stocks, mutual funds, and more. It’s pricier than Zerodha or Upstox but offers robust support and compliance, making it ideal for traders who value stability over cost.

These alternatives prioritize legal clarity over Exness’s flexibility, a trade-off that depends on your priorities.

What Indian Traders Think of Exness

The court of public opinion offers valuable insights. Across forums like Reddit, Quora, and X, Indian traders share mixed but mostly positive experiences with Exness.

Many rave about its speed and efficiency. One Reddit user wrote, “I’ve used Exness for a year—low spreads and withdrawals in under a minute are unreal. No Indian broker comes close.” Another praised its leverage, saying, “Turning ₹5,000 into ₹50,000 in a month was possible because of Exness’s options.”

Skeptics, though, flag the legal uncertainty. A Quora post cautioned, “It’s great until you trade EUR/USD—then you’re rolling the dice with FEMA.” Others worry about disputes: “If something goes wrong, who do I call? SEBI won’t help with an offshore broker.”

The consensus? Exness excels for those who stay within INR boundaries, but it’s not foolproof for the reckless.

Wrapping Up: Is Exness Right for You?

So, is the Exness forex trading app legal in India? Yes—if you trade INR-based pairs, use RBI-approved payments, and report your income. Its lack of SEBI registration doesn’t make it illegal; it just shifts the compliance burden onto you. With its low costs, fast withdrawals, and global reach, Exness offers a compelling edge over domestic brokers, but it demands vigilance to stay on the right side of the law.

For cautious traders, SEBI-regulated platforms like Zerodha or ICICI Direct might feel safer. For the adventurous willing to master the rules, Exness unlocks a world of opportunity. Either way, start with its demo account, study the market, and trade smart. The forex world is yours to conquer—just keep it legal.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

FAQs

Can I legally trade with Exness in India?Yes, by sticking to INR pairs like USD/INR and using approved payment methods.

Is Exness regulated in India?No, it’s regulated by FCA, CySEC, and FSA, not SEBI or RBI.

What if I trade non-INR pairs on Exness?It’s a FEMA violation, risking penalties or account issues.

Are my funds safe with Exness?Exness segregates funds and offers protections, but lacks SEBI’s local safety net.

Should I choose Exness or a SEBI broker?Exness for cost and flexibility; SEBI brokers for legal security.

Read more: