11 minute read

Does Exness Work in Dubai? A Comprehensive Guide for Traders

from Exness Global

Dubai, a glittering metropolis in the United Arab Emirates (UAE), has solidified its position as a global financial hub, attracting traders and investors from around the world. With its strategic location, business-friendly environment, and advanced infrastructure, it’s no surprise that forex trading has gained immense popularity in the region. Among the many brokers vying for attention in this competitive market, Exness stands out as a globally recognized name. But the question on many traders’ minds is: Does Exness work in Dubai? In this in-depth guide, we’ll explore Exness’s operations, its legality, features, and suitability for traders in Dubai. Whether you’re a beginner or an experienced trader, this article will provide the clarity you need to make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? A Quick Overview

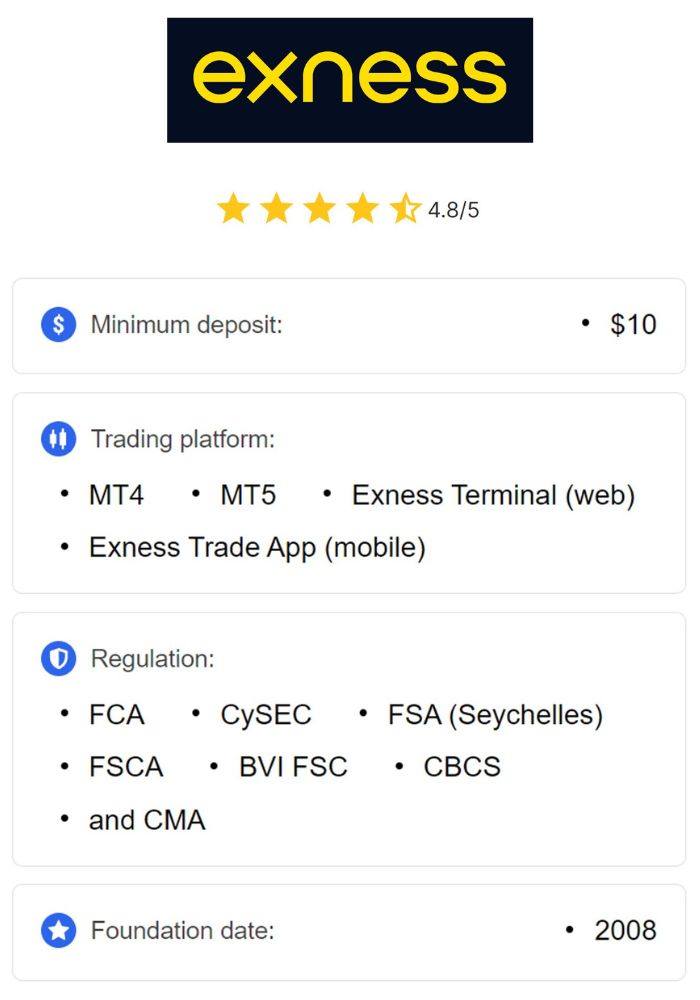

Before diving into whether Exness works in Dubai, let’s establish what Exness is and why it matters. Founded in 2008, Exness is a Cyprus-based forex and CFD (Contracts for Difference) broker that has grown into one of the largest players in the global trading industry. With a monthly trading volume exceeding $3 trillion and over 500,000 active clients worldwide, Exness has built a reputation for reliability, transparency, and innovation.

Exness offers a wide range of financial instruments, including forex pairs, cryptocurrencies, stocks, indices, commodities, and metals. Its key selling points include ultra-low spreads starting from 0.0 pips, high leverage options (up to 1:Unlimited in some cases), and lightning-fast withdrawal processing. The broker supports popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal, catering to traders of all levels.

But how does this global giant fare in a unique market like Dubai? Let’s break it down step by step.

Forex Trading in Dubai: The Legal Landscape

To understand whether Exness works in Dubai, we first need to examine the regulatory environment for forex trading in the UAE. Dubai operates under a dual financial regulatory system, which is critical to assessing any broker’s operations in the region.

The Dubai Financial Services Authority (DFSA)

The Dubai Financial Services Authority (DFSA) is the primary regulator for financial activities within the Dubai International Financial Centre (DIFC), a free economic zone in Dubai. The DFSA oversees forex brokers, banks, and other financial institutions operating in the DIFC, enforcing strict standards for transparency, client fund protection, and market integrity. To legally operate within the DIFC, a broker must obtain a DFSA license, which involves meeting rigorous requirements such as maintaining adequate capital reserves and segregating client funds.

The UAE Central Bank and Securities and Commodities Authority (SCA)

Outside the DIFC, the broader UAE financial sector is regulated by the UAE Central Bank and the Securities and Commodities Authority (SCA). The Central Bank oversees monetary policy and financial stability, while the SCA regulates securities, commodities, and forex trading across the UAE. Forex trading is fully legal in the UAE, but brokers must comply with local laws, including anti-money laundering (AML) and know-your-customer (KYC) regulations.

Can Residents Trade with International Brokers?

Here’s the key point: UAE residents, including those in Dubai, are permitted to trade with international brokers that are not necessarily regulated by the DFSA or SCA, as long as the broker operates legally under its own jurisdiction’s regulations. This opens the door for offshore brokers like Exness to serve Dubai-based traders without needing a local license.

Does Exness Have a License in Dubai?

Exness is regulated by multiple reputable authorities worldwide, which bolsters its credibility. These include:

Cyprus Securities and Exchange Commission (CySEC): A top-tier European regulator overseeing Exness (Cy) Ltd.

Financial Conduct Authority (FCA): The UK’s stringent regulator for Exness (UK) Ltd.

Financial Sector Conduct Authority (FSCA): South Africa’s regulator for Exness’s operations in that region.

Seychelles Financial Services Authority (FSA): Regulates Exness (SC) Ltd, the entity serving most non-EU clients, including those in Dubai.

However, Exness does not hold a DFSA license or a specific SCA registration. This means it doesn’t have a physical office or local regulatory approval in Dubai. Instead, it operates as an offshore broker, leveraging its international licenses to provide services to traders in the UAE.

Is This a Problem?

Not necessarily. The lack of a DFSA license doesn’t make Exness illegal in Dubai. UAE laws allow residents to engage with offshore brokers as long as the broker complies with its own regulatory obligations and doesn’t violate local laws (e.g., by offering unlicensed financial advice within the UAE). For Dubai traders outside the DIFC, Exness is a viable option, provided they understand the implications of trading with an offshore entity.

Does Exness Work in Dubai? The Practical Answer

Yes, Exness works in Dubai in the sense that traders in the emirate can access its platform, open accounts, deposit funds, trade, and withdraw profits without legal restrictions. Exness operates digitally, meaning it doesn’t require a physical presence in Dubai to serve its clients. Here’s how it functions practically:

Account Setup

Opening an Exness account from Dubai is straightforward. Traders can visit the official Exness website, register online, and complete the verification process by submitting identification documents and proof of address. The process is fast and entirely digital, making it accessible to anyone with an internet connection in Dubai.

💥 Trade with Exness now: Open An Account or Visit Brokers

Trading Platforms

Exness offers a suite of platforms tailored to different trading styles:

MetaTrader 4 (MT4): Ideal for beginners with its user-friendly interface.

MetaTrader 5 (MT5): Advanced tools for experienced traders.

Exness Web Terminal: A browser-based option requiring no downloads.

Exness Mobile App: Perfect for trading on the go.

These platforms are fully functional for Dubai traders, offering real-time data, charting tools, and seamless execution.

Payment Methods

Exness supports a variety of deposit and withdrawal methods that cater to UAE residents, including:

Bank Cards: Visa and MasterCard for instant deposits.

E-Wallets: Skrill, Neteller, and Perfect Money.

Cryptocurrencies: Bitcoin and Tether (USDT).

Local Bank Transfers: Available through select online banking options.

Most transactions are processed instantly or within minutes, a feature that sets Exness apart from many competitors. Importantly, Exness does not charge fees for deposits or withdrawals, though third-party payment providers may apply their own charges.

Trading Conditions

Exness offers some of the best trading conditions in the industry, which appeal to Dubai traders:

Spreads: Starting from 0.0 pips on premium accounts like Raw Spread and Zero.

Leverage: Up to 1:2000 or even unlimited leverage on certain instruments (subject to account type and regulatory restrictions).

Instruments: Over 100 forex pairs, plus CFDs on stocks, indices, cryptocurrencies, and commodities.

These features make Exness a competitive choice for Dubai’s diverse trading community.

Is Exness Safe for Dubai Traders?

Safety is a top concern for any trader, especially when dealing with an offshore broker. Exness takes several measures to ensure client security:

Regulatory Compliance

Exness’s licenses from CySEC, FCA, FSCA, and FSA require it to adhere to strict standards, such as:

Segregated Funds: Client money is kept separate from company funds in top-tier banks.

Negative Balance Protection: Ensures traders don’t lose more than their deposits.

Regular Audits: Independent audits verify financial transparency.

While these regulations don’t fall under UAE jurisdiction, they align with global best practices, offering a layer of protection for Dubai traders.

Security Features

Exness employs advanced encryption to safeguard data and transactions. Its platforms are also equipped with two-factor authentication (2FA) to prevent unauthorized access.

Reputation

With over 15 years in the industry and a massive client base, Exness has earned a solid reputation for reliability. It has won numerous awards for trading conditions, customer support, and transparency, further reassuring Dubai traders of its legitimacy.

Tailored Features for Dubai Traders

Exness goes beyond basic functionality to cater specifically to the needs of traders in Dubai and the UAE:

Islamic Accounts

For Muslim traders adhering to Sharia law, Exness offers swap-free Islamic accounts. These accounts eliminate overnight interest charges, making them compliant with Islamic finance principles. Available across all account types, they ensure that Dubai’s Muslim traders can participate in forex markets without compromising their beliefs.

Arabic Support

Exness provides customer support in Arabic, alongside 14 other languages, available 24/7 via live chat, email, and phone. This localization enhances the user experience for Arabic-speaking traders in Dubai.

High Leverage

Dubai traders often seek high-leverage options to maximize their capital. Exness’s leverage of up to 1:2000 (or unlimited in some cases) is among the highest in the industry, though it comes with increased risk that traders must manage carefully.

Pros and Cons of Using Exness in Dubai

Pros

Global Regulation: Licensed by top-tier authorities like CySEC and FCA.

Competitive Conditions: Low spreads, high leverage, and fast withdrawals.

Accessibility: Easy account setup and UAE-friendly payment methods.

Islamic Accounts: Swap-free options for Sharia-compliant trading.

24/7 Support: Multilingual assistance, including Arabic.

Cons

No Local License: Not regulated by DFSA or SCA, limiting local oversight.

Offshore Status: Potential challenges in dispute resolution compared to DFSA-regulated brokers.

High Leverage Risks: Unlimited leverage can lead to significant losses if not managed properly.

How to Start Trading with Exness in Dubai

Ready to try Exness in Dubai? Here’s a step-by-step guide:

Visit the Website: Go to Exness: Open An Account or Visit Brokers

Create an Account: Provide your email, phone number, and personal details.

Verify Your Identity: Upload a government-issued ID and proof of address.

Deposit Funds: Choose a payment method and fund your account (minimum deposit varies by account type, starting as low as $10).

Choose a Platform: Download MT4, MT5, or use the web terminal.

Start Trading: Explore the markets and execute your first trade.

The entire process can be completed in under an hour, making it hassle-free for Dubai residents.

Alternatives to Exness in Dubai

While Exness works well in Dubai, it’s worth considering DFSA-regulated alternatives for traders who prioritize local oversight:

IG Group: Offers a wide range of instruments and DFSA regulation.

Saxo Bank: Known for advanced tools and DIFC compliance.

AvaTrade: A popular choice with a DFSA license and robust educational resources.

These brokers provide similar trading conditions but operate under UAE-specific regulations, offering additional legal recourse.

Does Exness Have an Office in Dubai?

Exness does not have a physical office in Dubai. Its operations are entirely online, managed through its global entities, primarily Exness (SC) Ltd in Seychelles. This digital-first approach allows Exness to serve Dubai traders efficiently without the overhead of a local branch. For support, traders rely on Exness’s online channels, which are responsive and effective.

Why Dubai Traders Choose Exness

Despite the lack of a local license, Exness remains a top choice for many Dubai traders. Here’s why:

Cost Efficiency: Ultra-low spreads and no commission on standard accounts keep trading costs down.

Speed: Instant withdrawals ensure quick access to funds, a priority for fast-paced traders.

Flexibility: A variety of account types (Standard, Raw Spread, Zero, Pro) suit different strategies.

Global Reach: Access to international markets aligns with Dubai’s cosmopolitan trading community.

Potential Risks to Consider

While Exness works in Dubai, traders should be aware of potential risks:

Regulatory Gaps: Without DFSA oversight, resolving disputes may involve international regulators, which could be slower.

Market Volatility: High leverage amplifies both profits and losses, especially in volatile markets.

Third-Party Fees: Payment providers may charge fees not controlled by Exness.

To mitigate these risks, traders should practice sound risk management, such as using stop-loss orders and avoiding over-leveraging.

Exness vs. the Competition: How It Stacks Up

Compared to other brokers in Dubai, Exness excels in cost and speed but lags in local regulation. For example:

Exness vs. IG Group: IG offers DFSA regulation but higher spreads.

Exness vs. Saxo Bank: Saxo provides advanced tools but requires a higher minimum deposit.

Exness vs. AvaTrade: AvaTrade has a DFSA license but less competitive leverage options.

Your choice depends on whether you prioritize local oversight or global trading flexibility.

The Future of Exness in Dubai

As Dubai’s forex market continues to grow, Exness may consider obtaining a DFSA license to strengthen its presence. For now, its offshore model works effectively, supported by its global reputation and tailored features. With the UAE’s fintech sector evolving, Exness is well-positioned to adapt and remain a key player in the region.

Conclusion: Does Exness Work in Dubai?

Yes, Exness works in Dubai. Traders in the emirate can access its platform, trade a wide range of instruments, and enjoy competitive conditions without legal barriers. While it lacks a DFSA license, its international regulations, robust safety measures, and localized features make it a reliable choice for Dubai residents. Whether you’re drawn to its low spreads, high leverage, or Islamic accounts, Exness offers a compelling package for forex enthusiasts in this financial hub.

💥 Trade with Exness now: Open An Account or Visit Brokers

If you’re considering Exness, weigh its pros and cons against your trading goals. For those prioritizing local regulation, DFSA-licensed brokers may be a better fit. But for cost-conscious traders seeking flexibility and speed, Exness is hard to beat. Ready to get started? Sign up today and explore what Exness has to offer in Dubai’s dynamic trading landscape.

Read more: