10 minute read

Is Exness Regulated in UAE? A Comprehensive Guide for Traders

The forex trading landscape in the United Arab Emirates (UAE) has grown tremendously in recent years, attracting both novice and seasoned traders. Among the many brokers vying for attention in this thriving market, Exness stands out as a globally recognized name. However, one question frequently arises among UAE-based traders: Is Exness regulated in UAE? This article dives deep into Exness’s regulatory status, its operations in the UAE, and what it means for traders looking for a secure and reliable platform in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

With the UAE’s reputation as a financial hub in the Middle East, understanding the regulatory framework for forex brokers is crucial. Whether you’re a beginner exploring trading opportunities or an experienced investor seeking clarity, this guide will provide you with everything you need to know about Exness and its legitimacy in the UAE.

What Is Exness? An Overview of the Broker

Before addressing the core question—Is Exness regulated in UAE?—let’s first explore what Exness is and why it’s a popular choice among traders worldwide.

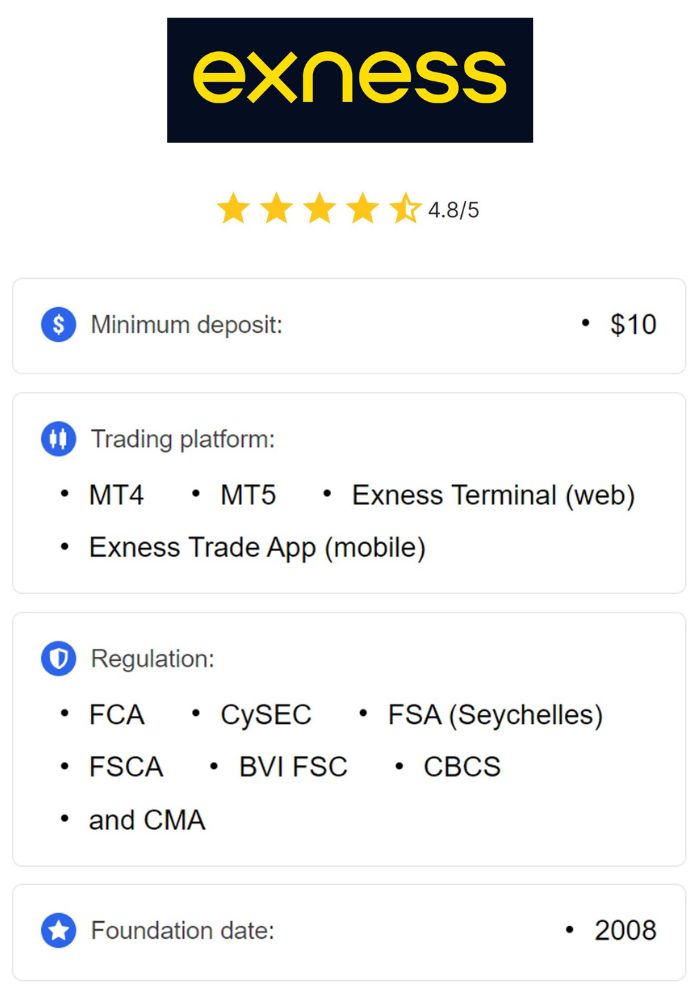

Founded in 2008, Exness is a global forex and Contracts for Difference (CFD) broker headquartered in Cyprus. Over the past 17 years, it has built a strong reputation for offering competitive trading conditions, advanced technology, and a user-friendly experience. Exness provides access to a wide range of financial instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. Its platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are well-regarded for their reliability and functionality.

Exness has grown into one of the largest brokers globally, boasting a monthly trading volume exceeding $4 trillion and serving over 500,000 active clients. Its appeal lies in features like tight spreads, high leverage (up to 1:2000 or unlimited in some cases), instant withdrawals, and a variety of account types tailored to different trading needs. For UAE traders, Exness also offers Islamic (swap-free) accounts, multilingual support, and localized payment options, making it an attractive option in the region.

But popularity alone doesn’t guarantee legitimacy. To determine whether Exness is a safe choice for UAE traders, we must examine its regulatory status—both globally and within the UAE.

The Importance of Regulation in Forex Trading

Regulation is the backbone of trust in the forex industry. It ensures that brokers operate transparently, protect client funds, and adhere to ethical practices. For traders, choosing a regulated broker offers several key benefits:

Fund Security: Regulated brokers are required to segregate client funds from company assets, reducing the risk of misuse or loss in case of insolvency.

Transparency: Oversight from regulatory bodies mandates clear pricing, fair execution, and honest disclosure of fees and risks.

Dispute Resolution: Traders can seek recourse through regulators if issues arise with a broker.

Market Integrity: Regulation prevents fraudulent activities, fostering a stable trading environment.

In the UAE, where forex trading is legal and increasingly popular, regulation plays a vital role in protecting investors. But who oversees forex brokers in the UAE, and does Exness fall under their jurisdiction? Let’s explore the regulatory landscape.

Forex Regulation in the UAE: Who’s in Charge?

The UAE has a sophisticated financial regulatory framework designed to maintain stability and protect investors. Several authorities oversee financial activities, including forex trading:

1. UAE Central Bank (CBUAE)

The Central Bank of the UAE is the primary monetary authority, responsible for maintaining financial stability and regulating banks and financial institutions. While it doesn’t directly oversee forex brokers, its policies influence the broader financial ecosystem.

2. Securities and Commodities Authority (SCA)

The SCA is the main regulator for forex trading and other financial markets outside the UAE’s financial free zones. It licenses brokers, enforces compliance with local laws, and ensures transparency and client protection. Forex brokers operating on the UAE mainland typically require SCA approval.

3. Dubai Financial Services Authority (DFSA)

The DFSA regulates financial services within the Dubai International Financial Centre (DIFC), a free zone in Dubai. It oversees forex brokers, banks, and other financial entities operating within the DIFC, enforcing strict standards for compliance and investor protection.

4. Financial Services Regulatory Authority (FSRA)

Part of the Abu Dhabi Global Market (ADGM), another financial free zone, the FSRA regulates financial activities, including forex trading, within its jurisdiction. It aligns with international best practices to ensure a secure trading environment.

For a broker to operate legally in the UAE, it must obtain a license from one of these bodies, depending on its operational scope (mainland or free zone). So, where does Exness fit into this framework?

Is Exness Regulated in UAE? The Answer

The short answer to Is Exness regulated in UAE? is: No, Exness is not directly regulated by a UAE authority such as the SCA, DFSA, or FSRA. However, this doesn’t mean it’s illegal or unsafe for UAE traders to use Exness. Let’s break it down.

Exness’s Global Regulatory Status

Exness operates under a multi-jurisdictional regulatory framework, holding licenses from several reputable international authorities:

Cyprus Securities and Exchange Commission (CySEC): License No. 178/12. CySEC regulates Exness in the European Union, ensuring compliance with EU financial standards.

Financial Conduct Authority (FCA): Registration No. 730729 (Exness UK Ltd). The FCA is one of the world’s most respected regulators, overseeing Exness’s UK operations.

Financial Services Authority (FSA): License No. SD025 (Seychelles). This allows Exness to serve clients globally under international standards.

Financial Sector Conduct Authority (FSCA): License No. 51024 (South Africa). Enhances Exness’s credibility in African markets.

Other Licenses: Exness also holds licenses from the Central Bank of Curaçao and Sint Maarten (CBCS), Financial Services Commission (FSC) in Mauritius and the British Virgin Islands, and the Capital Markets Authority (CMA) in Kenya.

These licenses demonstrate Exness’s commitment to global compliance, transparency, and client protection. The broker adheres to strict standards, such as segregating client funds, implementing anti-money laundering (AML) measures, and undergoing regular audits.

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness in the UAE Context

While Exness does not hold a specific license from the SCA, DFSA, or FSRA, it operates as an offshore broker for UAE clients. UAE laws do not explicitly prohibit residents from trading with internationally regulated brokers like Exness, provided the broker complies with global standards and doesn’t misrepresent its status.

In practice, many UAE traders use offshore brokers without issue, as long as the brokers are licensed by reputable authorities (e.g., FCA, CySEC). Exness’s international licenses provide a layer of security and credibility, even without direct UAE regulation.

Why Doesn’t Exness Have a UAE License?

There are several possible reasons Exness hasn’t pursued a local UAE license:

Global Operations: Exness serves clients worldwide and may prioritize international licenses that allow broader flexibility.

Cost and Complexity: Obtaining a UAE license (e.g., from the SCA or DFSA) involves significant costs, local office requirements, and compliance with stringent regulations.

Offshore Model: Many global brokers operate successfully in the UAE as offshore entities, catering to clients without needing local oversight.

For UAE traders, the lack of direct regulation doesn’t necessarily equate to risk, provided the broker’s global credentials are strong—as they are with Exness.

Is Trading with Exness Legal in the UAE?

Yes, trading with Exness is legal for UAE residents, provided they comply with local financial laws. Forex trading itself is permitted in the UAE, and there are no restrictions preventing individuals from using offshore brokers like Exness. UAE banks also process transactions with Exness seamlessly, further indicating its acceptance in the region.

However, traders should exercise due diligence:

Verify Licensing: Confirm Exness’s regulatory status on its official website or through the regulators’ public registers.

Understand Risks: Offshore brokers may not offer the same level of local recourse as UAE-regulated entities in case of disputes.

Tax Compliance: Ensure trading activities align with UAE tax regulations, though forex profits are currently tax-free for individuals.

In summary, while Exness isn’t regulated in the UAE, its international licenses and compliance with global standards make it a legitimate option for traders in Dubai, Abu Dhabi, and beyond.

How Does Exness Ensure Safety for UAE Traders?

Even without UAE-specific regulation, Exness implements robust measures to protect its clients:

1. Segregated Client Funds

Exness keeps client funds in separate accounts from its operational capital, ensuring they’re safeguarded against misuse or loss.

2. Negative Balance Protection

UAE traders benefit from negative balance protection, meaning they can’t lose more than their deposited amount, even during volatile market conditions.

3. Multi-Factor Authentication

Exness uses advanced security protocols, including two-factor authentication (2FA), to prevent unauthorized account access.

4. Transparent Operations

The broker provides clear information about spreads, fees, and trading conditions, audited regularly by firms like Deloitte.

5. Membership in the Financial Commission

Since 2021, Exness has been part of the Financial Commission, offering up to €20,000 in compensation per client in case of insolvency (though this applies to specific jurisdictions).

These features align with international best practices, offering UAE traders a secure environment despite the lack of local oversight.

Exness Features Tailored for UAE Traders

Exness goes beyond regulatory compliance to cater specifically to UAE clients:

Islamic Accounts: Swap-free accounts comply with Sharia law, appealing to Muslim traders in the UAE.

Arabic Support: 24/7 customer service in Arabic ensures accessibility for local users.

Local Payment Methods: Options like bank transfers, credit/debit cards, and e-wallets (e.g., Skrill, Neteller) suit UAE preferences.

Adjusted Trading Hours: During Ramadan, Exness adjusts schedules to accommodate UAE traders’ needs.

These tailored offerings enhance Exness’s appeal in the region, even without a UAE license.

Comparing Exness to UAE-Regulated Brokers

To provide a balanced perspective, let’s compare Exness to brokers regulated by the SCA or DFSA:

Advantages of Exness

Global Reach: Multiple international licenses enhance its credibility worldwide.

Trading Conditions: Tight spreads, high leverage, and instant withdrawals outshine many local competitors.

Diverse Instruments: Offers a broader range of assets than some UAE-regulated brokers.

Disadvantages

No Local Oversight: Lacks direct SCA or DFSA regulation, potentially limiting local dispute resolution options.

Offshore Risks: Slightly higher risk compared to brokers with UAE-specific licenses.

UAE-Regulated Alternatives

Brokers like Axiory or Saxo Bank, regulated by the DFSA, offer local oversight but may have higher fees or fewer trading options. Ultimately, the choice depends on whether you prioritize local regulation or Exness’s global strengths.

Should UAE Traders Choose Exness in 2025?

So, Is Exness regulated in UAE? No, it isn’t—but that doesn’t make it an unsafe or illegal choice. Its robust international licenses, client-focused features, and strong reputation make it a viable option for UAE traders. Here’s a quick decision guide:

Choose Exness If:

You value competitive trading conditions and a wide range of instruments.

You’re comfortable with an offshore broker regulated by top-tier authorities like the FCA and CySEC.

You want fast transactions and localized support.

Look Elsewhere If:

You prefer a broker with direct SCA or DFSA regulation for added local security.

You’re new to trading and need extensive educational resources (Exness’s offerings are limited).

How to Start Trading with Exness in the UAE

Ready to try Exness? Here’s a step-by-step guide:

Visit the Official Website: Go to Exness: Open An Account or Visit Brokers

Register an Account: Provide your email, country (UAE), and a secure password.

Verify Your Identity: Submit KYC documents (e.g., passport, utility bill) for compliance.

Choose an Account Type: Options include Standard, Pro, Raw Spread, or Zero accounts.

Deposit Funds: Use local methods like bank cards or e-wallets.

Download a Platform: Install MT4, MT5, or use the web terminal.

Start Trading: Explore forex, crypto, and more.

The process takes just a few minutes, and you can begin with as little as $10 (depending on the account type).

Conclusion: Is Exness a Safe Bet for UAE Traders?

Exness may not be regulated in the UAE by local authorities, but its global licenses from CySEC, FCA, and others provide a solid foundation of trust. For UAE traders in 2025, Exness offers a compelling mix of security, flexibility, and tailored features—making it a strong contender in the forex market.

Before committing, weigh your priorities: Do you need local regulation, or are you comfortable with Exness’s international credentials? Either way, always trade responsibly, research thoroughly, and ensure your financial goals align with your chosen platform.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: