10 minute read

Is Exness Registered in India? A Comprehensive Guide for Indian Traders

Forex trading has surged in popularity across India in recent years, driven by technological advancements, increased internet access, and a growing interest in global financial markets. Among the many brokers vying for the attention of Indian traders, Exness stands out as a globally recognized name. Established in 2008, Exness has built a reputation for its competitive trading conditions, user-friendly platforms, and robust international presence. However, one question looms large for Indian traders: Is Exness registered in India? This article dives deep into Exness’s registration status, its regulatory framework, the legal landscape of forex trading in India, and what it all means for traders in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Broker

Before addressing the core question, let’s first understand what Exness is and why it’s a popular choice among traders worldwide. Exness is a global forex and Contracts for Difference (CFD) broker headquartered in Cyprus. Since its inception, it has grown to serve millions of clients across more than 100 countries, offering a wide range of financial instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies.

Exness is known for its low spreads, high leverage options (up to unlimited leverage in some cases), and fast execution speeds. Traders can access its services through industry-standard platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Web Terminal. The broker also emphasizes transparency, with features like segregated client funds and negative balance protection, making it a trusted name in the forex industry.

For Indian traders, Exness offers additional appeal with localized payment methods such as UPI and Netbanking, as well as customer support in English and Hindi. But despite its global credibility and tailored offerings, the question remains: Does Exness comply with India’s regulatory requirements?

The Regulatory Landscape of Forex Trading in India

To determine whether Exness is registered in India, we must first explore the regulatory framework governing forex trading in the country. Forex trading in India is tightly controlled, primarily by two key authorities: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI).

The Role of the Reserve Bank of India (RBI)

The RBI is India’s central bank and the primary regulator of foreign exchange transactions. Under the Foreign Exchange Management Act (FEMA) of 1999, the RBI oversees all forex-related activities to maintain economic stability and prevent illegal financial flows. According to FEMA, Indian residents are restricted to trading only currency pairs that include the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. These trades must occur on recognized exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) through SEBI-registered brokers.

The RBI also prohibits Indian residents from engaging in forex trading with offshore brokers for non-INR currency pairs (e.g., EUR/USD) unless explicitly authorized. This restriction aims to curb unregulated capital outflows and protect traders from potential fraud.

The Role of the Securities and Exchange Board of India (SEBI)

SEBI is the regulatory body responsible for overseeing India’s securities and financial markets. While its primary focus is on stocks, mutual funds, and derivatives, SEBI also plays a crucial role in regulating forex trading when it occurs through recognized exchanges. For a broker to legally offer forex trading services in India, it must be registered with SEBI and comply with its stringent guidelines, which include:

Client Fund Segregation: Brokers must keep client funds separate from company funds.

Transparency: Full disclosure of fees, spreads, and trading conditions is mandatory.

Regular Audits: Brokers must undergo independent financial audits.

INR Pair Restriction: Only INR-based currency pairs can be traded legally.

SEBI registration ensures that brokers operate within India’s legal framework, offering traders a layer of protection against malpractice. Without SEBI registration, a broker’s operations in India fall into a regulatory gray area.

Is Exness Registered in India?

Now, let’s address the central question: Is Exness registered in India? The straightforward answer is no. Exness is not registered with either the RBI or SEBI, the two authorities that govern forex trading in India. This means Exness does not hold a local license to operate as a broker within the country’s borders.

However, this lack of registration does not necessarily make Exness illegal or unsafe for Indian traders. Exness operates as an international broker under a robust global regulatory framework, which we’ll explore next.

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness’s Global Regulatory Status

While Exness is not registered in India, it is regulated by several reputable international financial authorities. These licenses ensure that the broker adheres to high standards of transparency, security, and client protection. Exness’s regulatory bodies include:

Cyprus Securities and Exchange Commission (CySEC): License number 178/12. CySEC regulates Exness (Cy) Ltd, ensuring compliance with European Union financial standards.

Financial Conduct Authority (FCA): Registration number 730729. The FCA oversees Exness (UK) Ltd, one of the UK’s most stringent regulators.

Financial Services Authority (FSA) Seychelles: License number SD025. This regulates Exness (SC) Ltd, catering to clients outside the European Economic Area (EEA).

Financial Services Commission (FSC) Mauritius: License number GB20025294. This governs Exness (MU) Ltd, focusing on non-bank financial services.

These global licenses demonstrate Exness’s commitment to maintaining a secure and ethical trading environment. Features like segregated accounts, regular audits, and negative balance protection align with international best practices. However, these regulations do not automatically extend to India, where local compliance with RBI and SEBI is required.

Can Indian Traders Use Exness Legally?

Given that Exness is not registered in India, the legality of using it as an Indian trader depends on how you engage with the platform. Here’s a breakdown:

Trading INR-Based Pairs

Indian traders can legally trade INR-based currency pairs (e.g., USD/INR) through SEBI-registered brokers on recognized exchanges. While Exness offers INR pairs, it is not SEBI-registered, meaning trading these pairs through Exness technically falls outside India’s legal framework. However, enforcement of this restriction on individual traders is rare, placing it in a gray area.

Trading Non-INR Pairs

Trading non-INR currency pairs (e.g., EUR/USD) with an offshore broker like Exness is explicitly prohibited under FEMA. Indian residents engaging in such trades risk violating RBI regulations, which could lead to penalties or legal action, though such cases are uncommon for retail traders.

Practical Implications

In practice, many Indian traders use Exness without facing immediate repercussions. The broker accepts Indian clients, allows deposits via local payment methods, and provides a seamless trading experience. However, the lack of SEBI registration means Indian traders may not have recourse to local authorities in case of disputes, relying instead on Exness’s international regulators.

Why Isn’t Exness Registered in India?

Exness’s decision not to register in India likely stems from strategic and regulatory challenges:

Strict Regulatory Requirements: SEBI and RBI impose stringent rules, including restrictions on leverage, hedging, and currency pairs. These may conflict with Exness’s global offerings, such as unlimited leverage and non-INR pair trading.

Focus on Global Markets: As an international broker, Exness prioritizes jurisdictions with broader market access rather than tailoring its services to India’s restrictive forex environment.

Operational Complexity: Establishing a local presence and obtaining SEBI registration involves significant costs and compliance efforts, which may not align with Exness’s business model.

Advantages of Trading with Exness for Indian Traders

Despite its lack of registration in India, Exness remains a popular choice among Indian traders for several reasons:

Competitive Trading Conditions

Low Spreads: Exness offers tight spreads starting from 0.0 pips on certain accounts, reducing trading costs.

High Leverage: Options up to unlimited leverage allow traders to maximize positions with minimal capital.

Fast Execution: Advanced servers ensure quick order execution, minimizing slippage.

User-Friendly Platforms

Exness provides access to MT4, MT5, and its proprietary mobile app, all of which are intuitive and packed with tools like real-time charts, technical indicators, and economic calendars.

Localized Support

Payment Methods: Indian traders can deposit and withdraw funds using UPI, Netbanking, and other local options.

Customer Support: 24/7 support in English and Hindi ensures accessibility.

Global Trustworthiness

Exness’s regulation by top-tier authorities like the FCA and CySEC, combined with its transparency (e.g., publishing trading volume data), instills confidence among users.

Risks of Using Exness in India

While Exness offers compelling benefits, there are risks Indian traders should consider:

Lack of Local Oversight

Without SEBI or RBI registration, Exness is not accountable to Indian authorities. In disputes over withdrawals or account issues, traders may need to rely on international regulators, which can be time-consuming and less effective.

Regulatory Gray Area

Trading non-INR pairs or using offshore brokers like Exness could violate FEMA, exposing traders to potential legal risks, though enforcement is typically lax for small-scale retail traders.

Taxation Challenges

Forex earnings must be reported under Indian tax laws. Using an offshore broker like Exness may complicate tax compliance, as transactions occur outside India’s regulated framework.

How to Trade Safely with Exness in India

If you choose to trade with Exness despite its lack of registration, here are some tips to minimize risks:

Stick to INR Pairs: Focus on USD/INR or other INR-based pairs to align with RBI guidelines.

Use Legal Payment Methods: Opt for transparent, traceable options like UPI or bank transfers.

Monitor Regulations: Stay updated on RBI and SEBI policies to avoid unintentional violations.

Secure Your Account: Enable two-factor authentication and follow best practices for online security.

Understand Terms: Familiarize yourself with Exness’s policies, especially regarding withdrawals and dispute resolution.

Alternatives to Exness for Indian Traders

For those wary of using an unregistered broker, several SEBI-regulated alternatives offer forex trading within India’s legal framework:

Zerodha

Regulation: SEBI-registered.

Offerings: Currency derivatives on NSE and BSE.

Pros: Low fees, robust platform.

Cons: Limited to INR pairs, no global forex options.

ICICI Direct

Regulation: SEBI-registered.

Offerings: Forex trading via currency futures.

Pros: Trusted brand, local support.

Cons: Higher costs compared to offshore brokers.

HDFC Securities

Regulation: SEBI-registered.

Offerings: INR-based forex trading.

Pros: Reliable, compliant with Indian laws.

Cons: Fewer trading tools than Exness.

These brokers prioritize compliance but may lack the global reach and advanced features of Exness.

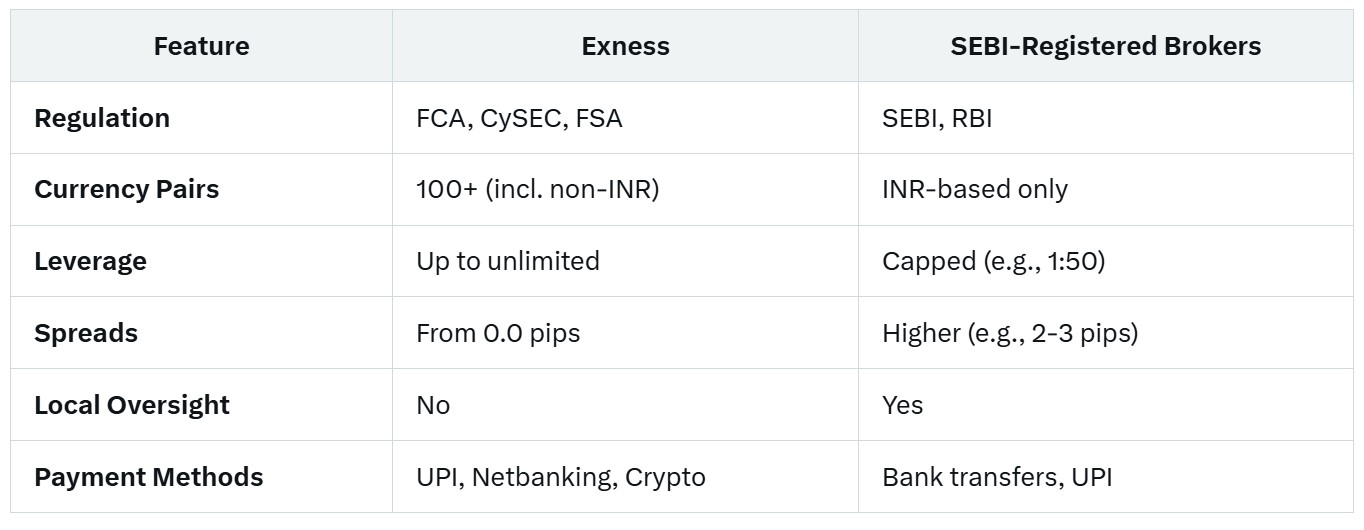

Exness vs. SEBI-Registered Brokers: A Comparison

Exness excels in flexibility and cost-efficiency, while SEBI-registered brokers offer legal security.

What Indian Traders Need to Know in 2025

Exness remains unregistered in India but continues to attract traders with its global credentials and tailored services. Here’s a summary of key takeaways:

Not Registered: Exness lacks SEBI or RBI approval, placing it outside India’s formal regulatory framework.

Globally Regulated: Licenses from FCA, CySEC, and others ensure a secure trading environment.

Legal Gray Area: Trading INR pairs is safer, while non-INR trades carry regulatory risks.

Practical Use: Many Indian traders use Exness without issues, but caution is advised.

Conclusion: Should You Trade with Exness in India?

Exness is not registered in India, but its international reputation and robust offerings make it a compelling option for traders willing to navigate the regulatory gray area. For those prioritizing compliance, SEBI-registered brokers like Zerodha or ICICI Direct are safer alternatives. Ultimately, your decision should weigh Exness’s advantages—low costs, advanced tools, and global access—against the potential risks of operating outside India’s legal framework.

If you’re an Indian trader considering Exness, stay informed about local regulations, trade responsibly, and prioritize security. Whether you choose Exness or a local broker, understanding the landscape is key to a successful forex trading journey in 2025.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: