10 minute read

Is Exness Banned in India? Review Broker 2025

Forex trading has surged in popularity across India in recent years, driven by advancements in technology, increased internet access, and a growing interest in financial markets. Among the many brokers available to traders worldwide, Exness stands out as a globally recognized platform offering competitive trading conditions. However, a recurring question among Indian traders is: Is Exness banned in India? This article aims to provide a clear, detailed answer by exploring the legal status of Exness in India, the country’s forex trading regulations, and practical considerations for traders. By the end, you’ll have a thorough understanding of whether Exness is a viable option for Indian forex enthusiasts.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Platform

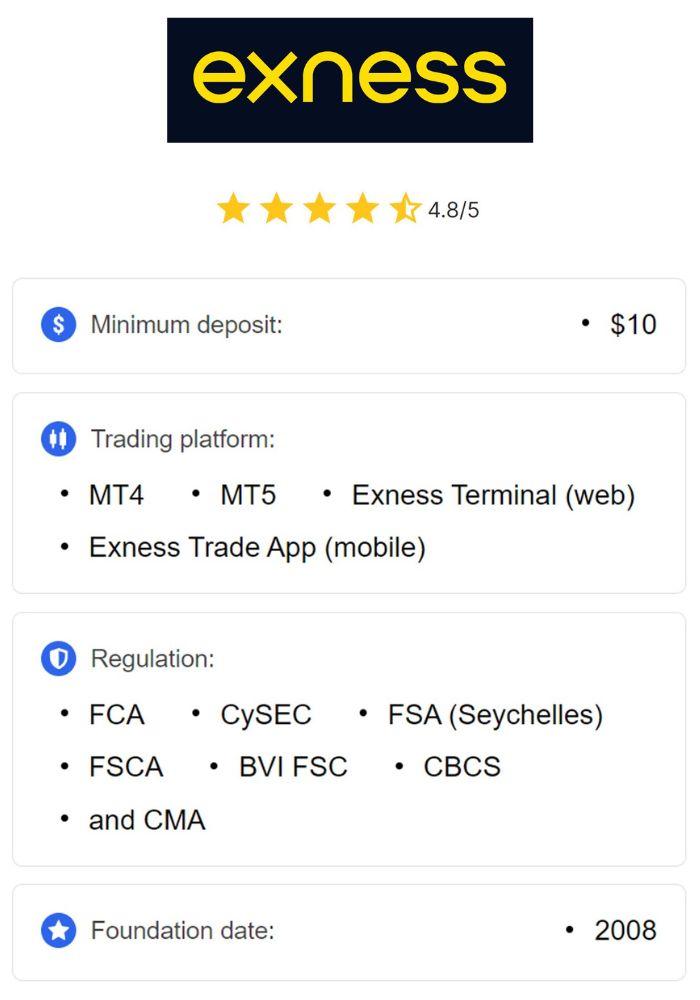

Before diving into the legalities, let’s establish what Exness is. Founded in 2008, Exness is an international forex and CFD (Contract for Difference) broker headquartered in Cyprus. It has grown into one of the largest retail brokers globally, serving over 700,000 active clients and processing a monthly trading volume exceeding $4 trillion. Exness is renowned for its low spreads, high leverage (up to 1:2000 in some regions), fast execution, and a wide range of financial instruments, including forex pairs, commodities, cryptocurrencies, indices, and stocks.

Exness operates under multiple regulatory licenses, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) in Seychelles. These credentials enhance its reputation as a trustworthy broker on the global stage. But how does this translate to its operations in India? To answer that, we need to examine the regulatory framework governing forex trading in the country.

Forex Trading in India: Understanding the Legal Framework

Forex trading in India is not illegal, but it is tightly regulated by two key authorities: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These bodies work together to ensure financial stability, protect investors, and prevent unauthorized capital outflows. Let’s break down the rules that apply to forex trading and how they affect platforms like Exness.

The Role of the Reserve Bank of India (RBI)

The RBI is India’s central bank and the primary regulator of foreign exchange transactions. Under the Foreign Exchange Management Act (FEMA) of 1999, the RBI sets strict guidelines on how Indian residents can engage in forex trading. One of the most critical rules is that forex trading is only permitted with currency pairs involving the Indian Rupee (INR). Examples include USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs, such as EUR/USD or GBP/USD, is considered a violation of FEMA regulations.

Additionally, the RBI mandates that all forex transactions must occur through authorized dealers—typically banks or financial institutions licensed by the RBI. Offshore brokers like Exness, which are not registered as authorized dealers in India, fall into a gray area under this framework.

The Role of the Securities and Exchange Board of India (SEBI)

SEBI oversees India’s securities and derivatives markets, including currency derivatives traded on recognized stock exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). SEBI-registered brokers offer access to INR-based forex pairs, ensuring compliance with local laws. Unlike the RBI, SEBI does not directly regulate offshore forex brokers. However, its oversight of domestic brokers creates a clear distinction between regulated local trading and the use of international platforms like Exness.

Key Restrictions for Indian Traders

INR-Based Pairs Only: Indian residents can legally trade forex only if the INR is one of the currencies in the pair.

Authorized Dealers: Transactions must go through RBI-approved entities, not offshore brokers.

No Offshore Accounts: Opening trading accounts with international brokers for non-INR pairs is restricted under FEMA.

These restrictions are designed to prevent illegal capital flows and maintain economic stability. But where does Exness fit into this picture?

Is Exness Banned in India? The Straight Answer

No, Exness is not explicitly banned in India.There is no official statement from the RBI or SEBI declaring Exness illegal or prohibiting Indian traders from using the platform. However, its legal status in India is nuanced due to the lack of SEBI regulation and its operation as an offshore broker.

Exness is not registered with SEBI or authorized by the RBI as a forex dealer. This means it does not have the specific licenses required to offer forex trading services directly to Indian residents under local laws. Despite this, Exness continues to accept Indian clients and provides access to its platform, including INR-based currency pairs like USD/INR and EUR/INR. Indian traders can sign up, deposit funds, and trade using Exness, but the legality of their activities depends on how they use the platform.

💥 Trade with Exness now: Open An Account or Visit Brokers

The Gray Area: Trading Non-INR Pairs

While Exness itself is not banned, trading non-INR pairs (e.g., EUR/USD, GBP/JPY) through the platform is where Indian traders risk violating FEMA regulations. Exness offers a vast selection of currency pairs, many of which do not involve the INR. Although the platform does not restrict Indian users from trading these pairs, doing so could technically breach Indian law. The responsibility falls on the trader to ensure compliance, not necessarily on Exness.

Recent Developments and Rumors

Posts on platforms like X have occasionally claimed that Exness has been declared illegal by the RBI. For instance, a post, suggested that Exness is unauthorized under FEMA and that trading on it could lead to legal trouble. However, no official RBI circular or SEBI announcement supports this claim as of the current date. Such rumors likely stem from confusion over India’s strict forex regulations rather than a specific ban on Exness.

How Does Exness Operate for Indian Traders?

Despite its lack of local regulation, Exness remains accessible to Indian traders and has tailored its services to suit the market. Here’s how it functions in India:

Account Registration

Indian residents can easily register for an Exness account using basic personal information. The process is straightforward and does not explicitly block Indian IP addresses or require local licensing verification.

Payment Methods

Exness supports a variety of payment options for Indian users, including:

UPI (Unified Payments Interface): A popular digital payment system in India.

NetBanking: Direct bank transfers via Indian banks.

E-wallets: Options like Skrill and Neteller, though usage may depend on compliance with RBI rules.

Bank Cards: Visa and Mastercard payments are accepted.

These localized payment methods make it convenient for Indian traders to deposit and withdraw funds, often within 24 hours.

Trading Options

Exness offers INR-based pairs like USD/INR and EUR/INR, which align with RBI regulations. However, its full range of over 100 currency pairs, including non-INR options, is also available. Traders must exercise caution and stick to INR pairs to stay compliant.

Leverage and Spreads

Exness is known for its high leverage (up to 1:2000) and tight spreads, which appeal to traders seeking to maximize returns. While these features are attractive, Indian traders should be aware that SEBI-regulated brokers typically cap leverage at much lower levels (e.g., 1:50) for currency derivatives.

Customer Support

Exness provides 24/7 customer support in multiple languages, including English and Hindi, catering to Indian users. This accessibility enhances the trading experience and builds trust among clients.

Risks of Trading with Exness in India

While Exness is not banned, using an unregulated offshore broker carries risks for Indian traders. Here are the key concerns:

Legal Risks

Trading non-INR pairs or transferring funds to an offshore account without RBI approval could violate FEMA. Penalties may include fines, account freezes, or legal action, though enforcement against individual retail traders has been rare.

Lack of Local Oversight

Since Exness is not SEBI-regulated, Indian traders lack the investor protection offered by domestic brokers. In case of disputes or broker insolvency, recourse may be limited to Exness’s international regulators (FCA, CySEC), which do not have jurisdiction in India.

Fund Safety Concerns

Exness adheres to global standards like segregating client funds and offering compensation schemes (e.g., up to €20,000 via the Financial Commission). However, without SEBI oversight, some traders may feel less secure about their deposits.

Tax Implications

Profits from forex trading are taxable in India as business income or capital gains, depending on the holding period. Using an offshore broker like Exness may complicate tax reporting, especially if funds are moved internationally.

Is Exness Safe for Indian Traders?

From a global perspective, Exness is a reputable broker. Its regulation by top-tier authorities like the FCA and CySEC, combined with its long track record since 2008, suggests a high level of reliability. Features like negative balance protection, transparent pricing, and fast withdrawals further bolster its credibility. For Indian traders sticking to INR pairs, Exness can be a safe and practical choice, provided they understand the legal boundaries.

However, safety also depends on compliance. Trading within FEMA guidelines (i.e., INR pairs only) minimizes risks, while venturing into non-INR pairs could expose traders to legal and financial uncertainties.

Alternatives to Exness for Indian Traders

For those wary of using an offshore broker, SEBI-regulated alternatives offer a fully compliant option. Examples include:

ICICI Direct: Offers currency derivatives trading on NSE and BSE.

Zerodha: A popular broker with access to INR-based forex pairs.

Upstox: Another SEBI-registered platform for forex and other instruments.

These brokers provide lower leverage and fewer trading options compared to Exness but ensure full legal protection and compliance with Indian regulations.

How to Trade Legally with Exness in India

If you choose to use Exness, here’s how to stay on the right side of the law:

Stick to INR Pairs: Trade only USD/INR, EUR/INR, or other INR-based pairs available on Exness.

Use Local Payment Methods: Deposit and withdraw funds via UPI or NetBanking to avoid scrutiny over international transfers.

Report Income: Declare forex profits in your tax returns to comply with Indian tax laws.

Start with a Demo Account: Test the platform risk-free before committing real money.

Monitor Regulations: Stay updated on RBI and SEBI announcements, as policies may evolve.

The Future of Exness in India

The forex trading landscape in India is dynamic, with potential for regulatory changes. Some analysts predict that the RBI and SEBI may ease restrictions on international brokers to accommodate growing demand. If Exness were to seek SEBI registration or partner with a local entity, it could solidify its position in the Indian market. Until then, its status remains one of accessibility with caveats.

Conclusion: Is Exness Banned in India?

To sum up, Exness is not banned in India. It operates legally as an offshore broker and is accessible to Indian traders, but its lack of SEBI regulation places it in a gray area. Indian traders can use Exness safely and legally by limiting themselves to INR-based currency pairs and adhering to FEMA guidelines. However, those seeking full regulatory protection may prefer SEBI-registered brokers.

💥 Trade with Exness now: Open An Account or Visit Brokers

For forex enthusiasts, Exness offers a robust platform with competitive features, but caution and awareness of local laws are essential. Whether you’re a beginner or an experienced trader, understanding the legal nuances will help you make an informed decision. So, is Exness banned in India? No—but it’s up to you to use it responsibly.

Read more: