10 minute read

Does Exness Work in Kenya? A Comprehensive Guide for Kenyan Traders

Forex trading has surged in popularity across Africa, and Kenya is no exception. With improved internet access, growing financial literacy, and the rise of mobile money platforms like M-Pesa, Kenyans are increasingly exploring opportunities in the global financial markets. Among the many forex brokers available, Exness stands out as a globally recognized name. But the big question remains: Does Exness work in Kenya? In this in-depth guide, we’ll explore Exness’s operations in Kenya, its regulatory status, features, benefits, and everything else Kenyan traders need to know to make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Broker

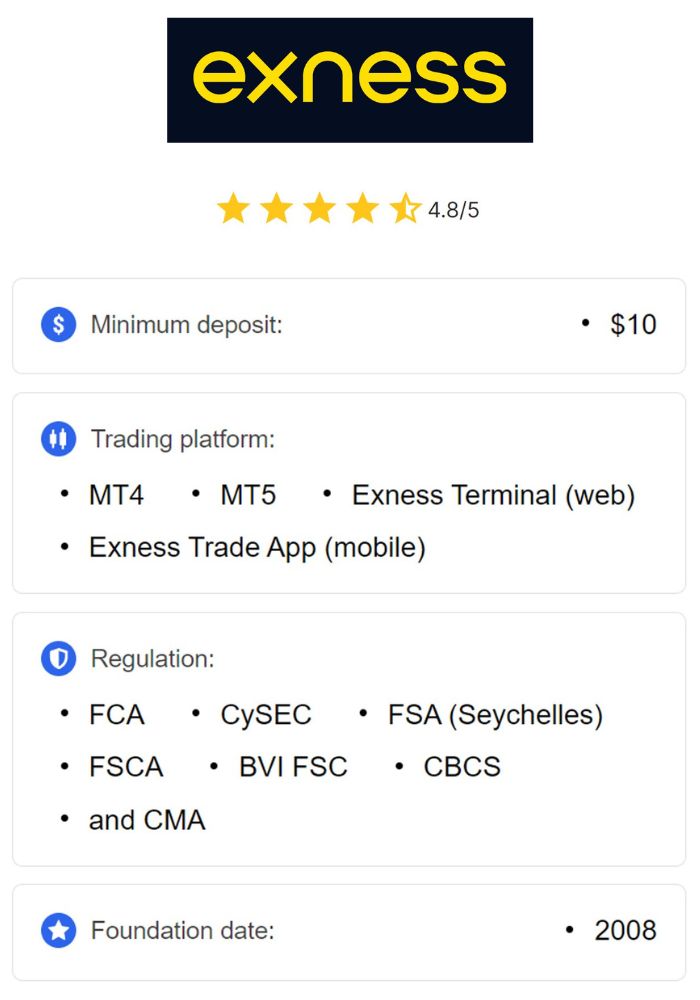

Before diving into whether Exness works in Kenya, let’s first understand what Exness is. Founded in 2008 by Petr Valov and Igor Lychagov, Exness is a multi-asset brokerage firm headquartered in Cyprus. Over the past 15+ years, it has grown into one of the largest retail forex brokers in the world, serving over 800,000 active traders globally. The broker offers trading in forex, contracts for difference (CFDs) on stocks, indices, commodities, and cryptocurrencies, making it a versatile platform for traders of all levels.

Exness prides itself on its advanced technology, tight spreads, fast execution speeds, and client-focused services. It operates under a robust regulatory framework, holding licenses from multiple reputable financial authorities worldwide. But how does this translate to its functionality and legality in Kenya? Let’s break it down.

Forex Trading in Kenya: A Growing Market

To determine whether Exness works in Kenya, it’s essential to understand the forex trading landscape in the country. Forex trading is legal in Kenya and has seen tremendous growth over the past decade. Factors contributing to this rise include:

Increased Internet Penetration: With affordable smartphones and reliable internet, more Kenyans can access online trading platforms.

Mobile Money Integration: Services like M-Pesa have made it easier for traders to deposit and withdraw funds.

Financial Education: Growing awareness of forex trading as a potential income source has spurred interest among young Kenyans.

The Capital Markets Authority (CMA) is the primary regulatory body overseeing forex trading in Kenya. Established under the Capital Markets Act, the CMA ensures that financial markets operate transparently and that investors are protected from fraud and unethical practices. Forex brokers offering services to Kenyan residents are expected to comply with CMA regulations, which raises the question: Is Exness regulated in Kenya?

Is Exness Regulated in Kenya?

One of the most critical factors for any trader choosing a broker is regulation. A regulated broker provides assurance that your funds are secure and that the platform adheres to strict financial standards. So, does Exness operate legally in Kenya?

The answer is yes. Exness (KE) Limited, a subsidiary of the Exness Group, is licensed by the Capital Markets Authority (CMA) in Kenya as a non-dealing online foreign exchange broker under license number 162. This license allows Exness to legally offer its services to Kenyan traders while complying with local laws. Unlike some offshore brokers that operate in a regulatory gray area, Exness’s CMA license demonstrates its commitment to transparency and client protection in the Kenyan market.

In addition to its Kenyan license, Exness holds regulatory approvals from several top-tier authorities worldwide, including:

Cyprus Securities and Exchange Commission (CySEC): Regulates Exness’s operations in Europe.

Financial Conduct Authority (FCA): Oversees its activities in the UK (for non-retail clients).

Financial Sector Conduct Authority (FSCA): Licenses Exness in South Africa.

Financial Services Authority (FSA): Regulates its operations in Seychelles.

This multi-jurisdictional oversight enhances Exness’s credibility, ensuring that Kenyan traders benefit from international standards of security and fairness, even if they’re trading under the local CMA license.

Does Exness Work in Kenya? The Practical Answer

Now that we’ve established Exness’s legal standing in Kenya, let’s address the practical question: Does it actually work for Kenyan traders? The short answer is yes, and here’s why.

1. Accessibility for Kenyan Nationals

Exness accepts Kenyan nationals and residents as clients without restrictions. The registration process is straightforward: visit the Exness website Open An Account or Visit Brokers, provide your email, and submit local identification documents (e.g., a Kenyan ID or passport). There are no blocks or barriers preventing Kenyans from signing up, making Exness fully accessible.

2. M-Pesa Integration

One of the standout features for Kenyan traders is Exness’s integration with M-Pesa, Kenya’s leading mobile money service. With over 40 million users, M-Pesa is a cornerstone of financial transactions in Kenya. Exness allows traders to deposit and withdraw funds using M-Pesa with no additional fees, making it convenient and cost-effective. This seamless integration sets Exness apart from many competitors and ensures that Kenyan traders can manage their accounts effortlessly.

3. Localized Support

Exness has a local presence in Kenya, including a representative office in Nairobi. This office provides customer support and educational resources tailored to Kenyan traders. Support is available 24/7 via phone, email, live chat, and social media in English and Swahili, ensuring that language is never a barrier.

4. Low Minimum Deposit

Exness caters to traders of all budgets. You can start trading with as little as $1 (approximately KES 130 as of March 2025), making it accessible for beginners or those with limited capital. This low entry point is a significant advantage in a market like Kenya, where many traders are just starting out.

5. Trading Platforms

Exness offers popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are widely used by Kenyan traders. These platforms are available on desktop, web, and mobile devices, ensuring flexibility. Additionally, Exness provides its proprietary Exness Trade app, which offers a user-friendly interface and real-time market updates—perfect for trading on the go.

Key Features of Exness for Kenyan Traders

Exness isn’t just functional in Kenya—it’s packed with features that make it a compelling choice. Here’s what Kenyan traders can expect:

Competitive Spreads and Low Fees

Exness is known for its tight spreads, starting from 0.0 pips on certain account types (e.g., Raw Spread and Zero accounts). For Standard accounts, spreads are competitive, starting at 0.3 pips. There are no hidden fees, and withdrawals via M-Pesa are processed instantly in most cases, with 95% completed in under a minute.

High Leverage Options

Exness offers leverage up to 1:Unlimited for experienced traders, depending on account equity and trading experience. For beginners, leverage is capped at safer levels (e.g., 1:2000), reducing risk while still providing flexibility. This high leverage is a draw for Kenyan traders looking to maximize their capital.

Diverse Trading Instruments

Kenyan traders can access over 200 financial instruments on Exness, including:

Forex: 107 currency pairs, including major, minor, and exotic pairs.

CFDs: Stocks, indices, metals (gold, silver), energies (oil), and cryptocurrencies (Bitcoin, Ethereum).

This variety allows traders to diversify their portfolios and capitalize on global market opportunities.

Account Types

Exness offers multiple account types to suit different trading styles:

Standard Account: Ideal for beginners with no commissions and low spreads.

Standard Cent: Perfect for testing strategies with micro-lots and a $1 minimum deposit.

Pro Account: Designed for experienced traders with instant execution.

Raw Spread: Offers ultra-low spreads with a small commission per lot.

Zero Account: Provides zero spreads on top instruments for a commission.

This flexibility ensures that both novice and seasoned traders find an account that fits their needs.

Fund Security

Exness prioritizes the safety of client funds through:

Segregated Accounts: Client funds are kept separate from company funds in Tier 1 banks.

Negative Balance Protection: Traders cannot lose more than their deposited amount.

Regular Audits: Conducted by firms like Deloitte to ensure compliance and transparency.

For Kenyan traders, the CMA license adds an extra layer of assurance that their investments are protected under local regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers

Benefits of Trading with Exness in Kenya

Why should Kenyan traders choose Exness over other brokers? Here are the top benefits:

1. Tailored for the Kenyan Market

Exness understands the unique needs of Kenyan traders. From M-Pesa support to Swahili-language assistance, the broker has localized its services to enhance accessibility and convenience.

2. Fast and Reliable Execution

Exness’s trading engine uses advanced algorithms to deliver execution speeds in milliseconds. This is crucial during volatile market conditions, ensuring Kenyan traders can enter and exit trades precisely.

3. Educational Resources

Exness provides free educational content, including webinars, tutorials, and market analysis. For Kenyan traders new to forex, these resources are invaluable for building skills and confidence.

4. No Inactivity Fees

Unlike some brokers, Exness doesn’t charge fees for dormant accounts, making it cost-effective for traders who trade sporadically.

5. Instant Withdrawals

Exness’s “Your money is yours” philosophy shines through with instant withdrawals. Kenyan traders can access their profits via M-Pesa without delays, a feature that enhances trust and satisfaction.

Challenges and Considerations

While Exness works seamlessly in Kenya, there are a few considerations:

1. Learning Curve for Beginners

The variety of account types and platforms might overwhelm new traders. However, Exness mitigates this with its demo accounts and educational support.

2. Leverage Risks

High leverage (e.g., 1:2000 or 1:Unlimited) can amplify both profits and losses. Kenyan traders should use it cautiously and understand risk management.

3. Limited Local Regulation Scope

While Exness is CMA-licensed, its non-dealing broker status means it acts as an intermediary rather than a market maker. Disputes must be resolved through Exness’s international channels rather than the CMA directly, though this is standard for regulated offshore brokers.

How to Get Started with Exness in Kenya

Ready to trade with Exness? Here’s a step-by-step guide:

Visit the Website: Go to Exness: Open An Account or Visit Brokers

Sign Up: Enter your email, phone number, and create a password.

Verify Your Account: Submit your Kenyan ID or passport and proof of address.

Deposit Funds: Use M-Pesa, bank cards, or other methods to fund your account (minimum $1).

Choose a Platform: Download MT4, MT5, or the Exness Trade app.

Start Trading: Explore the markets and execute your first trade.

The process takes just a few minutes, and you’ll be ready to trade in no time.

Exness vs. Competitors in Kenya

How does Exness stack up against other CMA-licensed brokers like FXPesa (EGM Securities), Scope Markets, and Pepperstone? Here’s a quick comparison:

Regulation: All are CMA-licensed, but Exness’s global licenses (FCA, CySEC) add extra credibility.

Spreads: Exness offers tighter spreads (e.g., 0.0 pips on Zero accounts) compared to competitors’ averages.

Payment Methods: Exness’s M-Pesa integration is a standout feature, though others also support it.

Minimum Deposit: Exness’s $1 entry point is lower than most competitors ($5–$100).

Exness often edges out rivals with its technology, low costs, and localized services, making it a top choice for Kenyan traders.

User Reviews and Reputation

Kenyan traders generally rate Exness highly. On platforms like Trustpilot, it boasts a 4.5/5 rating based on thousands of reviews globally. Local feedback highlights:

Fast withdrawals via M-Pesa.

Reliable customer support.

Competitive trading conditions.

Occasional complaints about platform glitches or verification delays exist, but Exness’s responsive support team typically resolves these quickly.

Does Exness Work in Kenya? The Verdict

So, does Exness work in Kenya? Absolutely. It’s not only functional but also one of the best options for Kenyan traders. With its CMA license, M-Pesa integration, low minimum deposit, and robust trading platforms, Exness ticks all the boxes for accessibility, legality, and performance. Whether you’re a beginner testing the waters with a $1 deposit or a pro leveraging advanced tools, Exness delivers a frictionless trading experience tailored to the Kenyan market.

If you’re considering forex trading in Kenya, Exness is a reliable, secure, and feature-rich choice. Sign up today, explore its offerings, and take your first step toward financial growth in the global markets.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: