10 minute read

Exness vs Pepperstone Comparison: Which is better?

In the fast-paced world of online forex trading, selecting the right broker can make or break your trading journey. Two names that consistently stand out in the industry are Exness and Pepperstone. Both brokers have earned reputations for reliability, competitive trading conditions, and robust platforms, making them popular choices among traders worldwide. But which one is truly better for you? In this in-depth Exness vs Pepperstone comparison, we’ll explore every aspect of these brokers—from regulation and fees to trading platforms, account types, and customer support—to help you decide which aligns best with your trading goals in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

The forex market continues to evolve, with traders seeking brokers that offer low costs, advanced tools, and a secure environment. Whether you’re a beginner testing the waters or an experienced trader scalping the markets, this article will provide a comprehensive breakdown to guide your decision-making process. Let’s dive into the details!

Overview of Exness and Pepperstone

What is Exness?

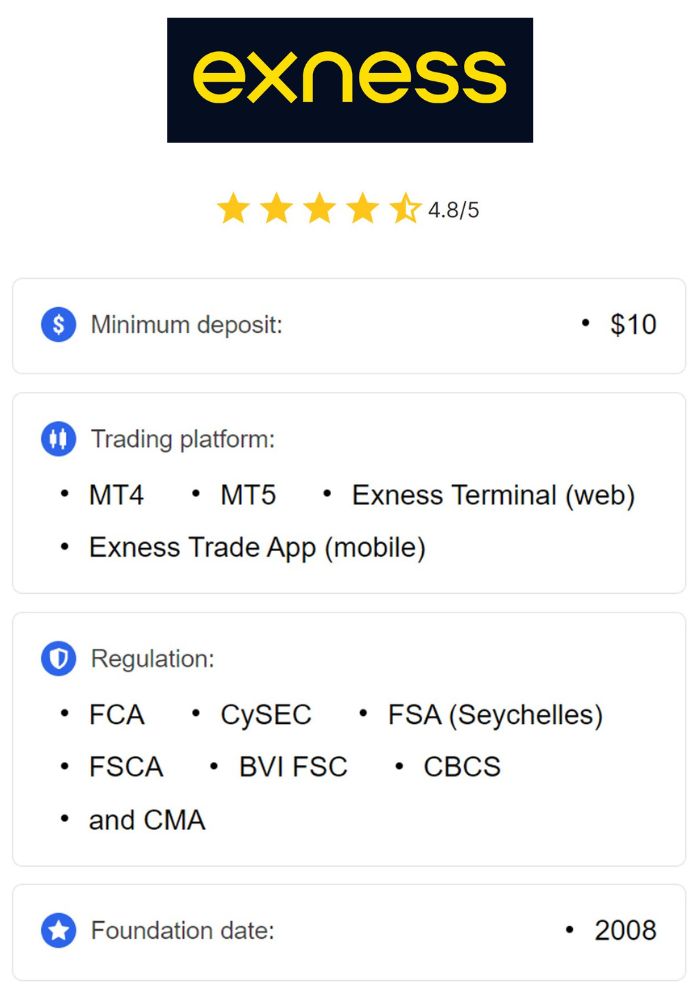

Founded in 2008, Exness has grown into one of the largest forex brokers globally, boasting a monthly trading volume exceeding $4.5 trillion and serving over 800,000 active clients. Headquartered in Cyprus, Exness is renowned for its transparency, competitive spreads starting from 0.0 pips, and high leverage options that can go as high as 1:2000 or even unlimited in some regions. The broker caters to a diverse audience, offering a wide range of tradable assets, including forex, cryptocurrencies, commodities, indices, and stocks.

Exness prides itself on its user-friendly platforms, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal. With a focus on innovation and client satisfaction, Exness has become a go-to choice for traders seeking flexibility and low-cost trading.

What is Pepperstone?

Pepperstone, established in 2010 in Melbourne, Australia, has quickly risen to prominence as a leading forex and CFD broker. With offices in London, Dubai, and Cyprus, Pepperstone serves over 400,000 clients worldwide and processes an average daily trading volume of $12.55 billion. Known for its lightning-fast execution speeds (averaging 30 milliseconds) and competitive pricing, Pepperstone appeals to both novice and professional traders.

Pepperstone offers a variety of trading platforms, including MT4, MT5, cTrader, and TradingView, alongside a broad selection of instruments like forex, commodities, indices, cryptocurrencies, and stock CFDs. Its reputation for reliability and top-tier regulation makes it a strong contender in this comparison.

Regulation and Safety: Which Broker is More Trustworthy?

When choosing a forex broker, safety is paramount. Both Exness and Pepperstone are regulated by multiple authorities, but their regulatory frameworks differ slightly.

Exness Regulation

Exness operates under a multi-jurisdictional regulatory structure, ensuring compliance with global financial standards. Its key regulators include:

Cyprus Securities and Exchange Commission (CySEC): Oversees its European operations, offering investor protection up to €20,000 via the Investor Compensation Fund.

Financial Conduct Authority (FCA) in the UK: Ensures strict compliance and client fund segregation.

Financial Services Authority (FSA) in Seychelles: Regulates its international arm, catering to non-EU clients.

Additional licenses from the FSCA (South Africa), CMA (Kenya), and FSC (Mauritius and BVI).

While Exness’s top-tier regulation (CySEC, FCA) inspires confidence, its subsidiaries in offshore jurisdictions like Seychelles handle most retail clients outside Europe. This means lower investor protection for non-EU traders, though client funds remain segregated and secure.

Pepperstone Regulation

Pepperstone also boasts robust regulation from top-tier authorities:

Australian Securities and Investments Commission (ASIC): Ensures high standards for its Australian operations.

Financial Conduct Authority (FCA): Covers its UK entity with client fund protection up to £85,000.

Cyprus Securities and Exchange Commission (CySEC): Regulates its EU operations.

Additional oversight from DFSA (Dubai), BaFin (Germany), and CMA (Kenya).

Pepperstone’s regulation is slightly more consistent across its entities, with stronger protections for clients in regulated regions like the UK, EU, and Australia. Its global reputation for transparency and compliance gives it a slight edge in trustworthiness.

Verdict: Regulation and Safety

Both brokers are trustworthy, with Pepperstone holding a marginal advantage due to its broader coverage by top-tier regulators and more comprehensive investor protection schemes. However, Exness remains a secure option, especially for traders comfortable with its offshore entities.

Account Types: Flexibility for All Traders

Your trading style and experience level will influence which broker’s account offerings suit you best. Let’s compare the account types provided by Exness and Pepperstone.

Exness Account Types

Exness offers five main account types, catering to a wide range of traders:

Standard Account: Ideal for beginners, with no minimum deposit (though $1 is recommended), spreads from 0.3 pips, and no commissions.

Standard Cent Account: Perfect for novices, allowing trading in cents with a $1 minimum deposit and spreads from 0.3 pips.

Raw Spread Account: Designed for advanced traders, featuring raw spreads from 0.0 pips and a commission of $3.50 per lot per side.

Zero Account: Offers 0.0 pip spreads on 30 major instruments for 95% of the trading day, with commissions starting at $0.05 per lot per side.

Pro Account: Tailored for professionals, with instant execution, spreads from 0.1 pips, and no commissions.

Exness also provides Islamic (swap-free) accounts across all types, making it inclusive for Muslim traders.

Pepperstone Account Types

Pepperstone keeps it simpler with two primary account types:

Standard Account: Suited for beginners, with no commissions and spreads starting from 1.0 pips. No minimum deposit is required.

Razor Account: Geared toward active traders, offering raw spreads from 0.0 pips and a commission of $3.50 per lot per side.

Like Exness, Pepperstone offers Islamic accounts and supports a demo account for practice.

Verdict: Account Types

Exness wins in terms of variety, offering more options for beginners (Standard Cent) and professionals (Zero, Pro). Pepperstone’s streamlined approach is excellent for traders who prefer simplicity, but it lacks the diversity Exness provides.

💥 Trade with Exness now: Open An Account or Visit Brokers

Trading Fees and Spreads: Where’s the Better Deal?

Trading costs directly impact profitability, so let’s examine the fee structures of Exness and Pepperstone.

Exness Fees and Spreads

Standard Account: Spreads average 0.9–1.0 pips on EUR/USD, with no commissions.

Raw Spread Account: Spreads from 0.0 pips, commission of $3.50 per lot per side.

Zero Account: Spreads from 0.0 pips on major pairs, commissions as low as $0.05 per lot per side.

Non-Trading Fees: No deposit or withdrawal fees; inactivity fees apply after 12 months ($5/month).

Exness stands out for its ultra-low commissions on the Zero account and no hidden fees, making it cost-effective for high-volume traders.

Pepperstone Fees and Spreads

Standard Account: Spreads average 1.0–1.1 pips on EUR/USD, commission-free.

Razor Account: Spreads from 0.0 pips, commission of $3.50 per lot per side.

Non-Trading Fees: No inactivity fees; free deposits and withdrawals (except bank wire, which may incur third-party fees).

Pepperstone’s Razor account offers competitive pricing, and the lack of inactivity fees is a bonus for occasional traders.

Verdict: Fees and Spreads

Exness edges out Pepperstone with tighter spreads and lower commissions on its Zero account, making it ideal for scalpers and high-frequency traders. Pepperstone’s no-inactivity-fee policy is a plus for less active traders, but its spreads are slightly higher on the Standard account.

Trading Platforms: Technology That Drives Success

A broker’s platform can define your trading experience. Both Exness and Pepperstone offer industry-standard and proprietary options.

Exness Trading Platforms

MetaTrader 4 (MT4): Reliable and widely used, with extensive tools for analysis and automation.

MetaTrader 5 (MT5): Advanced features like more timeframes, hedging, and additional indicators.

Exness Terminal: A web-based platform with a sleek interface, Trading Central integration, and mobile compatibility.

Exness Trade App: A mobile app for on-the-go trading with real-time quotes and instant withdrawals.

Exness’s proprietary platforms enhance accessibility, especially for beginners who may find MT4/MT5 overwhelming.

Pepperstone Trading Platforms

MetaTrader 4 (MT4): Enhanced with 28 smart trader tools and Autochartist.

MetaTrader 5 (MT5): Offers advanced charting and algorithmic trading.

cTrader: Popular among pros for its intuitive design and fast execution.

TradingView: Integrated for social trading and advanced charting.

Pepperstone’s diverse platform lineup, especially cTrader and TradingView, appeals to traders seeking cutting-edge technology.

Verdict: Trading Platforms

Pepperstone takes the lead with its broader range of platforms, including cTrader and TradingView, which cater to advanced traders. Exness’s proprietary offerings are solid but less versatile.

Tradable Instruments: Variety Matters

The range of assets available can influence your diversification strategy. Let’s compare what each broker offers.

Exness Tradable Instruments

Forex: Over 90 currency pairs, including majors, minors, and exotics.

Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and more.

Commodities: Gold, silver, oil.

Indices: Major global indices like S&P 500 and FTSE 100.

Stocks: Limited selection of stock CFDs.

Exness excels in forex and crypto, making it a favorite for currency and digital asset traders.

Pepperstone Tradable Instruments

Forex: 65 currency pairs, covering majors, minors, and some exotics.

Cryptocurrencies: Bitcoin, Ethereum, Ripple, etc.

Commodities: Gold, silver, oil, and soft commodities.

Indices: Over 20 global indices.

Stock CFDs: More than 900 global stocks.

ETFs: Available for diversified trading.

Pepperstone’s extensive stock CFDs and ETF offerings give it an edge for traders looking beyond forex.

Verdict: Tradable Instruments

Pepperstone wins with a broader selection, especially in stock CFDs and ETFs. Exness is better suited for forex and crypto enthusiasts.

💥 Trade with Exness now: Open An Account or Visit Brokers

Leverage: High Risk, High Reward

Leverage can amplify profits but also increases risk. Here’s how the two brokers compare.

Exness Leverage

Retail Clients: Up to 1:2000 (or unlimited in some regions), depending on account equity and jurisdiction.

EU/UK Clients: Capped at 1:30 due to regulatory restrictions.

Exness’s high leverage is a standout feature for experienced traders outside regulated zones.

Pepperstone Leverage

Retail Clients: Up to 1:500 (non-EU/UK); 1:30 in the EU/UK.

Professional Clients: Up to 1:500 in most regions.

Pepperstone offers competitive leverage but doesn’t match Exness’s extreme levels.

Verdict: Leverage

Exness is the clear winner for traders seeking maximum leverage, though Pepperstone’s offering is still robust for most strategies.

Deposits and Withdrawals: Ease of Access

Efficient funding and withdrawal processes are critical for traders.

Exness Deposits and Withdrawals

Minimum Deposit: $1 (Standard/Cent); $200 (Pro/Raw/Zero).

Methods: Bank cards, e-wallets (Skrill, Neteller), crypto, and local payments.

Fees: No internal fees; instant processing for most methods.

Currencies: Supports over 75 deposit currencies.

Exness’s low entry point and fee-free transactions are major advantages.

Pepperstone Deposits and Withdrawals

Minimum Deposit: None (though $200 is recommended).

Methods: Bank cards, wire transfers, e-wallets (PayPal, Skrill), and crypto.

Fees: Free for most methods; bank wire may incur third-party fees.

Currencies: Supports 10 base currencies.

Pepperstone’s flexibility with no minimum deposit is appealing, but withdrawal fees for bank wires are a drawback.

Verdict: Deposits and Withdrawals

Exness takes the lead with instant, fee-free transactions and broader currency support.

Customer Support: Who’s There When You Need Them?

Reliable support can save the day during trading hiccups.

Exness Customer Support

Availability: 24/7 via live chat, email, and phone.

Languages: Over 15 languages, including English, Arabic, and Chinese.

Response Time: Fast and responsive, with a reputation for efficiency.

Pepperstone Customer Support

Availability: 24/5 (weekdays only).

Languages: Multiple, including English, Spanish, and Thai.

Response Time: Quick and professional, though limited to business days.

Verdict: Customer Support

Exness wins with 24/7 availability, giving it an edge for weekend traders.

Educational Resources and Tools

Both brokers offer resources to enhance trading skills.

Exness Education

Webinars, tutorials, and articles.

Market analysis via Trading Central.

Economic calendar and calculators.

Pepperstone Education

Extensive webinars, guides, and videos.

Autochartist and smart trader tools.

TradingView integration.

Verdict: Education

Pepperstone offers more comprehensive tools and resources, making it better for learning traders.

Final Verdict: Exness vs Pepperstone—Which is Better?

After dissecting every angle of this Exness vs Pepperstone comparison, the answer depends on your needs:

Choose Exness if: You want ultra-low spreads, high leverage (up to 1:2000), a variety of account types, and 24/7 support. It’s ideal for forex and crypto traders, especially scalpers and high-volume traders.

Choose Pepperstone if: You prioritize top-tier regulation, a wide range of platforms (cTrader, TradingView), and diverse instruments like stock CFDs and ETFs. It’s perfect for advanced traders and those valuing execution speed.

In 2025, both brokers remain exceptional choices, but Exness shines for cost-conscious forex traders, while Pepperstone excels for versatility and professional-grade tools. Test both with a demo account to see which fits your style!

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: