11 minute read

Is Exness Good For Scalping? Review Broker 2025

Scalping is one of the most exhilarating and fast-paced strategies in forex trading, appealing to traders who thrive on quick decisions and small, frequent profits. As a high-frequency trading method, scalping demands a broker that offers tight spreads, rapid execution, and a robust platform—qualities that can make or break a scalper’s success. Among the many brokers available, Exness stands out as a popular choice for traders worldwide. But is Exness good for scalping? In this guide, we’ll explore Exness’s features, account types, trading conditions, and more to determine if it’s the ideal broker for scalpers.

💥 Trade with Exness now: Open An Account or Visit Brokers

Whether you’re a beginner dipping your toes into scalping or a seasoned trader refining your strategy, this article will provide the insights you need to decide if Exness aligns with your trading goals. Let’s dive into the world of scalping and see how Exness measures up!

What Is Scalping in Forex Trading?

Before evaluating Exness, let’s clarify what scalping entails. Scalping is a trading strategy where traders aim to profit from tiny price movements, often holding positions for mere seconds or minutes. Unlike day trading or swing trading, which focus on larger market trends, scalping involves executing dozens—or even hundreds—of trades daily, each targeting a profit of just a few pips.

Key characteristics of scalping include:

High Trade Volume: Scalpers rely on accumulating small gains across many trades.

Short Timeframes: Trades are typically executed on 1-minute (M1) or 5-minute (M5) charts.

Precision and Speed: Success hinges on fast order execution and minimal latency.

Low Costs: Tight spreads and low fees are critical, as high costs can erode small profits.

Scalping demands a broker that supports this rapid-fire approach with competitive conditions and reliable technology. So, where does Exness fit in? Let’s start by understanding the broker itself.

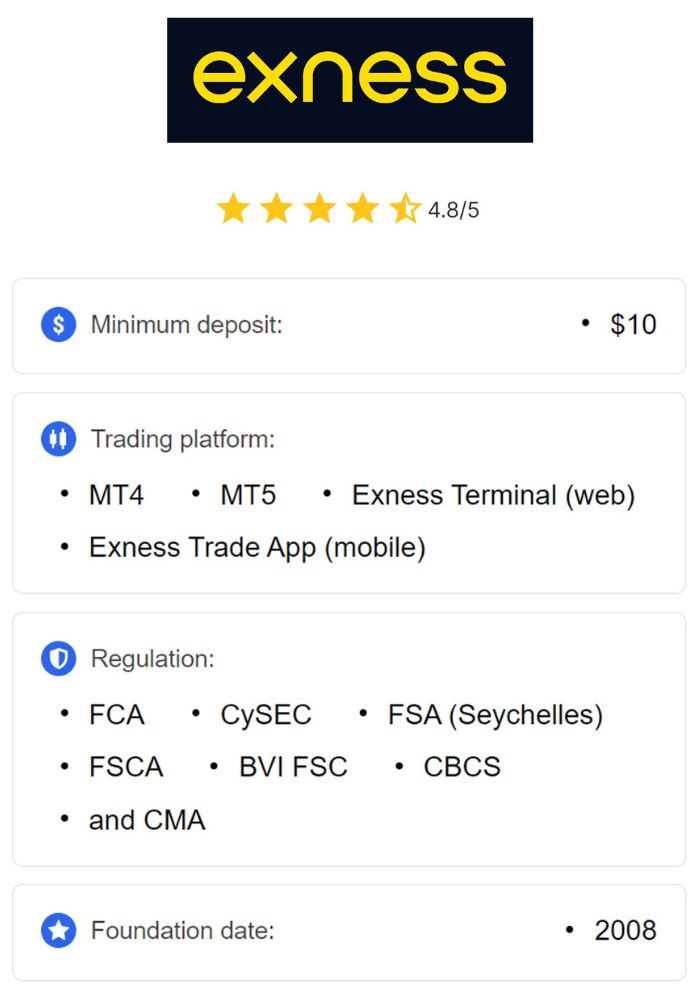

Exness: A Snapshot of the Broker

Founded in 2008, Exness has grown into a global powerhouse in the forex and CFD trading industry. Headquartered in Cyprus, the broker serves millions of clients across 190+ countries, offering access to forex pairs, commodities, indices, stocks, and cryptocurrencies. Exness is renowned for its transparency, competitive pricing, and cutting-edge trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal.

Exness operates under multiple international licenses, such as:

CySEC (Cyprus Securities and Exchange Commission): A top-tier EU regulator.

FCA (Financial Conduct Authority): The UK’s respected authority.

FSCA (Financial Sector Conduct Authority): South Africa’s regulatory body.

FSA (Financial Services Authority): Seychelles-based oversight.

These credentials underscore Exness’s commitment to client security and ethical practices, which is reassuring for scalpers entrusting their funds to the broker. But legality and reputation are just the beginning—scalping success depends on specific trading conditions. Let’s examine how Exness caters to scalpers.

Why Broker Choice Matters for Scalping

Scalping is unforgiving when it comes to broker performance. A delay of a few milliseconds, a slightly wider spread, or a glitchy platform can turn a profitable trade into a loss. Here’s what scalpers need from a broker:

Tight Spreads: The difference between the bid and ask price must be minimal to maximize profit margins.

Fast Execution: Orders must be filled instantly to capture fleeting price movements.

Low Commissions: High-frequency trading amplifies transaction costs, so fees must be competitive.

Reliable Platforms: A stable, feature-rich platform is essential for real-time analysis and execution.

High Leverage: Scalpers often use leverage to amplify small gains, though it increases risk.

No Restrictions: Some brokers ban scalping or impose limits—scalpers need freedom to operate.

With these criteria in mind, let’s assess Exness’s offerings and see if it meets the needs of scalpers.

Exness Trading Conditions for Scalping

Exness provides a range of features that could make it an excellent fit for scalping. Here’s a detailed breakdown:

1. Spreads: Tight Enough for Scalping?

Spreads are a scalper’s lifeline. The narrower the spread, the less price movement is needed to break even or profit. Exness offers variable spreads that fluctuate based on market conditions, but its accounts are designed to keep costs low:

Standard Account: Spreads start at 0.2 pips on major pairs like EUR/USD. While decent for casual traders, this may not be tight enough for hardcore scalpers.

Pro Account: Spreads drop to 0.1 pips with no commissions, offering a better deal for frequent traders.

Raw Spread Account: Spreads start at 0.0 pips, with a fixed commission of $3.50 per lot per side. This is a scalper’s dream, minimizing costs on high-volume trades.

Zero Account: Spreads are 0.0 pips on major pairs for most of the trading day, with a small commission. This account is tailored for precision trading like scalping.

For example, on EUR/USD—one of the most popular pairs for scalping—Exness’s Raw Spread and Zero accounts consistently deliver spreads below 0.1 pips during peak liquidity hours (e.g., London-New York overlap). This competitiveness makes Exness a strong contender for scalpers aiming to keep costs razor-thin.

2. Execution Speed: Lightning-Fast or Lagging?

Scalping thrives on speed. Even a millisecond delay can lead to slippage, where the executed price differs from the intended price, eating into profits. Exness boasts ultra-fast execution speeds, with orders filled in milliseconds thanks to its advanced infrastructure:

ECN-Like Execution: The Raw Spread and Zero accounts use market execution, connecting traders directly to liquidity providers for minimal delays.

No Requotes: Exness avoids requotes, ensuring trades are executed at the quoted price or better.

VPS Hosting: Exness offers free Virtual Private Server (VPS) access for clients with a $500 deposit and recent trading activity. A VPS reduces latency by running trades on a remote server closer to the broker’s data centers.

Testing shows Exness’s execution averages under 10 milliseconds, a figure that rivals top-tier brokers like IC Markets or Pepperstone. For scalpers, this speed is a game-changer, enabling them to capitalize on rapid market shifts.

💥 Trade with Exness now: Open An Account or Visit Brokers

3. Commissions and Fees: Affordable for High Frequency?

Scalping’s high trade volume amplifies the impact of fees. Exness structures its costs to accommodate frequent traders:

Standard Account: No commissions, but spreads (0.2+ pips) may add up over dozens of trades.

Pro Account: Zero commissions and tighter spreads (0.1 pips), balancing cost and efficiency.

Raw Spread Account: Ultra-low spreads (0.0 pips) with a $3.50 commission per lot per side—predictable and scalable for high-volume scalping.

Zero Account: 0.0 spreads on major pairs, with commissions starting at $0.05 per lot per side on select instruments, rising slightly for others.

Compared to competitors, Exness’s commission-based accounts (Raw Spread and Zero) offer some of the lowest total costs for scalping. For instance, scalping 10 lots daily on EUR/USD with the Raw Spread account incurs $70 in commissions, offset by near-zero spreads—a cost-effective setup for active traders.

4. Leverage: Amplifying Scalping Gains

Leverage is a double-edged sword in scalping, magnifying both profits and risks. Exness provides unlimited leverage on some accounts (capped at 1:2000 in practice for most clients), depending on equity and trading volume:

Standard and Pro Accounts: Up to 1:2000, adjustable based on account balance.

Raw Spread and Zero Accounts: Similarly high leverage, ideal for scalping small price moves with minimal capital.

For example, with $100 and 1:1000 leverage, a scalper controls a $100,000 position, turning a 5-pip gain into $50—significant for a quick trade. However, scalpers must pair high leverage with tight stop-losses to manage risk, as volatility can wipe out gains fast.

5. Platform Support: Tools for Scalpers

Scalping requires a platform that’s fast, reliable, and customizable. Exness delivers with:

MetaTrader 4 (MT4): A scalping staple with one-click trading, customizable charts, and Expert Advisors (EAs) for automated scalping strategies.

MetaTrader 5 (MT5): An upgraded version with more timeframes, indicators, and faster processing—perfect for advanced scalpers.

Exness Terminal: A web-based platform with a minimalist design, quick order placement, and real-time analytics.

MT5’s depth of market (DOM) feature and additional indicators (e.g., tick charts) give scalpers an edge in analyzing micro-movements. Plus, Exness’s platforms support EAs, allowing scalpers to automate strategies—a boon for those trading around the clock.

6. Scalping Policies: Freedom to Trade

Some brokers restrict scalping or impose penalties like wider spreads during volatile periods. Exness, however, explicitly allows scalping across all account types with no restrictions. This policy, combined with stable spreads during news events (e.g., NFP releases), ensures scalpers can operate freely without unexpected hurdles.

Exness Account Types for Scalping

Exness offers multiple account types, each with features that cater to different trading styles. Here’s how they stack up for scalping:

1. Standard Account

Spreads: From 0.2 pips.

Commissions: None.

Minimum Deposit: $10.

Best For: Beginners testing scalping with low capital.

While affordable, the wider spreads make it less ideal for aggressive scalping compared to professional accounts.

2. Pro Account

Spreads: From 0.1 pips.

Commissions: None.

Minimum Deposit: $200.

Best For: Intermediate scalpers seeking tighter spreads without commissions.

The Pro account strikes a balance, offering cost efficiency and decent execution for moderate scalping.

3. Raw Spread Account

Spreads: From 0.0 pips.

Commissions: $3.50 per lot per side.

Minimum Deposit: $200.

Best For: High-frequency scalpers prioritizing minimal spreads.

This account’s near-zero spreads and predictable commissions make it a top pick for serious scalpers.

4. Zero Account

Spreads: 0.0 pips on major pairs (95% of the time).

Commissions: From $0.05 per lot per side, varying by instrument.

Minimum Deposit: $200.

Best For: Precision scalpers targeting major pairs.

The Zero account’s ultra-tight spreads on key forex pairs like EUR/USD or USD/JPY make it a scalping powerhouse.

Recommendation for Scalpers

For most scalpers, the Raw Spread and Zero accounts are the best choices. Their low spreads and fast execution cater directly to the demands of high-frequency trading, while the modest $200 minimum deposit keeps them accessible.

Pros of Scalping with Exness

Exness offers several advantages that align with scalping needs:

Ultra-Low Spreads: Raw Spread and Zero accounts provide spreads starting at 0.0 pips, minimizing trading costs.

Blazing Execution: Millisecond-level order filling reduces slippage and maximizes precision.

Flexible Leverage: Up to 1:2000 allows scalpers to amplify small gains, though caution is advised.

Scalping-Friendly Policies: No restrictions or hidden penalties ensure freedom to trade.

Advanced Tools: MT5, VPS, and EAs support both manual and automated scalping strategies.

Global Regulation: Trusted licenses enhance fund security and reliability.

These strengths position Exness as a scalper’s ally, offering the tools and conditions needed to thrive in fast-moving markets.

Cons of Scalping with Exness

No broker is perfect. Here are some potential drawbacks for scalpers:

Commissions on Pro Accounts: While spreads are low, the Raw Spread and Zero accounts’ commissions may add up for ultra-high-volume traders.

Limited Stock CFDs: Scalpers diversifying into stocks may find Exness’s 90+ stock CFDs less extensive than competitors.

Learning Curve: Beginners may struggle with MT5’s advanced features or leverage management.

Variable Spreads: Standard account spreads can widen during volatility, impacting cost predictability.

For dedicated forex scalpers, these cons are minor, but they’re worth considering based on your trading style.

How Exness Compares to Competitors

To gauge Exness’s scalping prowess, let’s compare it to two popular brokers:

Exness vs. IC Markets

Spreads: Both offer 0.0 pips on Raw accounts; IC Markets’ commissions are slightly lower ($3 vs. $3.50 per lot per side).

Execution: Comparable speeds, though IC Markets edges out with more liquidity providers.

Platforms: Both support MT4/MT5; Exness adds its Terminal.

Verdict: IC Markets may appeal to ultra-competitive scalpers, but Exness holds its own with flexibility and tools.

Exness vs. Pepperstone

Spreads: Pepperstone’s Razor account matches Exness’s 0.0 pips, with commissions at $3.50 per lot.

Execution: Both excel, with Pepperstone slightly ahead in latency.

Regulation: Pepperstone’s ASIC license adds a layer of trust; Exness’s multi-jurisdiction oversight is equally robust.

Verdict: Pepperstone is a close rival, but Exness’s unlimited leverage and VPS offer stand out.

Exness competes neck-and-neck with industry leaders, often surpassing them in cost and accessibility for scalpers.

Tips for Scalping Success with Exness

To maximize Exness’s scalping potential, consider these strategies:

Choose the Right Account: Opt for Raw Spread or Zero for the tightest spreads and lowest costs.

Leverage VPS: Use Exness’s free VPS to reduce latency and ensure 24/5 uptime.

Focus on Major Pairs: Trade EUR/USD or USD/JPY during peak hours for optimal liquidity and spreads.

Automate with EAs: Deploy scalping bots on MT5 to execute trades faster than manual inputs.

Manage Risk: Use tight stop-losses (e.g., 2-5 pips) and limit leverage to protect your capital.

Test First: Practice on Exness’s demo account to refine your strategy risk-free.

These tips can help you harness Exness’s strengths and mitigate scalping’s inherent risks.

Real Trader Feedback on Exness for Scalping

Scalpers who use Exness often praise its low spreads and fast execution. On forums like Forex Factory and Reddit, users highlight the Raw Spread account’s cost efficiency and the broker’s reliability during volatile sessions. Some note occasional spread widening on Standard accounts during news events, but professional accounts receive consistent acclaim. Overall, Exness enjoys a strong reputation among scalping enthusiasts.

Conclusion: Is Exness Good for Scalping?

So, is Exness good for scalping? Absolutely. With its ultra-low spreads (0.0 pips on Raw Spread and Zero accounts), lightning-fast execution, high leverage, and scalping-friendly policies, Exness ticks all the boxes for a top-tier scalping broker. Its advanced platforms (MT4, MT5, and Terminal) and free VPS further enhance its appeal, catering to both manual and automated scalpers. While minor drawbacks like commissions or limited stock CFDs exist, they’re outweighed by Exness’s strengths for forex-focused scalping.

💥 Trade with Exness now: Open An Account or Visit Brokers

For traders seeking a reliable, cost-effective, and flexible platform, Exness is a standout choice. Ready to scalp with Exness? Open a demo account today and test its conditions for yourself. Have you scalped with Exness? Drop your thoughts in the comments below—let’s keep the conversation going!

Read more: How to open account in Exness in India