10 minute read

Does Exness work in Nigeria? Is it Legal?

Forex trading has surged in popularity across Nigeria in recent years, driven by economic opportunities, technological advancements, and a growing interest in financial independence. As one of the world’s leading forex brokers, Exness frequently comes up in conversations among Nigerian traders. But a pressing question remains: Does Exness work in Nigeria? In this in-depth guide, we’ll explore everything you need to know about using Exness in Nigeria, including its legality, functionality, benefits, challenges, and practical tips for Nigerian traders. Whether you’re a beginner or an experienced trader, this article will provide clarity and actionable insights.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? An Overview of the Broker

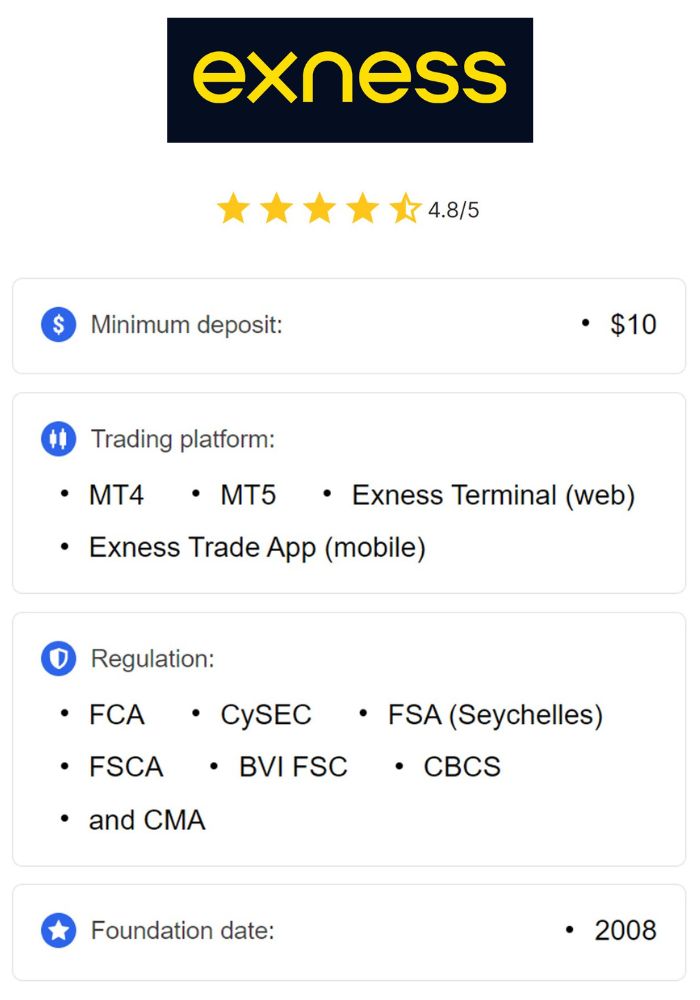

Before diving into its operations in Nigeria, let’s establish what Exness is. Founded in 2008, Exness is a globally recognized forex and CFD (Contract for Difference) broker headquartered in Limassol, Cyprus. Over the years, it has grown into one of the largest brokers worldwide, boasting over 700,000 active clients and a monthly trading volume exceeding $4 trillion as of recent reports. Exness offers trading on a wide range of financial instruments, including forex pairs, commodities, cryptocurrencies, indices, and stocks.

What sets Exness apart is its commitment to transparency, competitive trading conditions, and cutting-edge technology. The broker provides access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary web terminal and mobile app. With features like tight spreads, high leverage (up to 1:2000), and instant withdrawals, Exness has built a strong reputation among traders globally. But how does this translate to the Nigerian market? Let’s find out.

Is Forex Trading Legal in Nigeria?

To determine whether Exness works in Nigeria, we first need to understand the legal landscape of forex trading in the country. Forex trading is indeed legal in Nigeria, but it operates within a regulatory framework that is still evolving. The Central Bank of Nigeria (CBN) is the primary authority overseeing foreign exchange activities, while the Securities and Exchange Commission (SEC) regulates investment-related activities, including aspects of forex trading.

The CBN does not explicitly ban forex trading for individuals, but it imposes strict controls on foreign exchange transactions to stabilize the Nigerian Naira and prevent illegal financial activities. For instance, in 2021, the CBN introduced measures to restrict forex trading through unregulated platforms, aiming to curb speculative trading and protect the economy. Despite these restrictions, Nigerian traders can legally trade forex with international brokers like Exness, provided they comply with local laws, such as declaring income for tax purposes.

The key takeaway? Forex trading is permissible in Nigeria, but the lack of a dedicated forex regulatory body means traders often rely on brokers regulated by international authorities. This brings us to Exness’s regulatory status and its implications for Nigerian users.

Is Exness Regulated for Nigerian Traders?

Exness operates under multiple regulatory licenses from reputable financial authorities worldwide, which enhances its credibility. These include:

Cyprus Securities and Exchange Commission (CySEC) – License number 178/12

Financial Conduct Authority (FCA) in the UK – Register number 730729

Financial Sector Conduct Authority (FSCA) in South Africa – License number 51024

Financial Services Authority (FSA) in Seychelles – License number SD025

Central Bank of Curaçao and Sint Maarten (CBCS) – License number 0003LSI

These licenses ensure that Exness adheres to strict standards for transparency, client fund protection, and fair trading practices. However, Exness is not directly regulated by the CBN or SEC in Nigeria. This doesn’t mean it’s illegal for Nigerians to use Exness; rather, it operates as an offshore broker under its international licenses. Nigerian traders are onboarded through entities like Exness (SC) Ltd, regulated by the FSA in Seychelles.

For Nigerian traders, this global regulation offers a layer of security, including segregated client funds (kept separate from company funds), negative balance protection, and regular audits by firms like Deloitte. While it’s not locally regulated, Exness’s adherence to international standards makes it a trusted option for many Nigerian traders.

Does Exness Accept Nigerian Clients?

Yes, Exness accepts Nigerian clients. The broker explicitly lists Nigeria among the countries where it offers services, as confirmed by its official website and customer support. Nigerians can register accounts, deposit funds, trade, and withdraw profits using Exness’s platforms. There are no country-specific restrictions barring Nigerians from accessing Exness, unlike some jurisdictions (e.g., the USA or Canada) where Exness does not operate due to regulatory constraints.

To register with Exness from Nigeria, the process is straightforward:

Visit the official Exness website: Open An Account or Visit Brokers

Provide your email and phone number.

Verify your identity with a government-issued ID (e.g., passport or driver’s license) and proof of address (e.g., utility bill).

Choose your account type and base currency (NGN is available).

Once your account is verified, you can start trading. Exness’s accessibility to Nigerians is a strong indicator that it “works” in the country, but let’s explore how it functions in practice.

How Does Exness Work in Nigeria?

Exness operates seamlessly in Nigeria, offering the same features and tools available to traders worldwide, with some adaptations for the local market. Here’s a breakdown of how it works:

1. Account Types and Trading Platforms

Exness provides a variety of account types tailored to different trading styles:

Standard Account: Ideal for beginners, with low spreads (from 0.3 pips) and no commission.

Standard Cent Account: Perfect for new traders, using cents instead of dollars to minimize risk.

Pro Account: For experienced traders, offering instant execution and low spreads.

Raw Spread Account: Features ultra-low spreads (from 0.0 pips) with a small commission.

Zero Account: Offers zero spreads on major pairs for most of the trading day, with a commission.

Nigerian traders can access these accounts via MT4, MT5, or the Exness mobile app, all of which are compatible with Nigeria’s robust telecommunications infrastructure. The platforms support trading in forex, cryptocurrencies (e.g., Bitcoin, Ethereum), commodities (e.g., gold, oil), and more.

2. Deposits and Withdrawals

Exness supports multiple payment methods suited for Nigerian traders:

Bank Transfers: Via local Nigerian banks like Wema Bank, with deposits credited within hours.

Card Payments: Visa and Mastercard are accepted, with instant deposits.

E-Wallets: Options like Skrill, Neteller, and Perfect Money are available.

Mobile Money: Local solutions like Flutterwave or Paystack may be supported, depending on updates.

Cryptocurrency: Bitcoin and USDT deposits/withdrawals are increasingly popular.

A standout feature is Exness’s support for Naira (NGN) as a base currency, allowing traders to avoid currency conversion fees. Deposits are typically instant or processed within 24 hours, while withdrawals are fast—often completed within a few hours to a day, which is faster than many competitors.

3. Leverage and Trading Conditions

Exness offers some of the highest leverage in the industry—up to 1:2000 (or unlimited in some cases), depending on account equity and regulatory restrictions. This high leverage appeals to Nigerian traders looking to maximize small capital, though it comes with increased risk. Spreads are competitive, starting at 0.0 pips on premium accounts, and execution speeds are rapid, thanks to Exness’s advanced technology.

4. Customer Support

Exness provides 24/7 customer support in English, which is widely spoken in Nigeria. Traders can reach out via live chat, email, or phone. While there’s no local office or phone number in Nigeria, the support team is responsive and equipped to assist with technical or account-related queries.

5. Educational Resources

For Nigerian beginners, Exness offers webinars, tutorials, market analysis, and demo accounts. These resources help traders build skills and confidence, addressing the steep learning curve often associated with forex trading.

In summary, Exness works efficiently in Nigeria, offering a full suite of trading tools, localized payment options, and robust support. But are there any challenges?

💥 Trade with Exness now: Open An Account or Visit Brokers

Challenges of Using Exness in Nigeria

While Exness functions well in Nigeria, traders may encounter some hurdles:

1. Regulatory Ambiguity

Since Exness isn’t regulated by the CBN or SEC, it operates in a regulatory gray area. While its international licenses provide security, Nigerian traders lack direct recourse to local authorities in case of disputes. This isn’t a dealbreaker, but it requires extra caution.

2. Currency Restrictions

The CBN occasionally imposes restrictions on forex transactions, such as limits on foreign currency outflows. These policies can delay withdrawals or affect payment processing, though Exness mitigates this with NGN support and local bank options.

3. Internet Connectivity

Nigeria’s internet infrastructure is improving, but rural areas may experience inconsistent connectivity. This could disrupt trading, especially for scalpers or day traders relying on real-time data.

4. Economic Volatility

The fluctuating value of the Naira impacts trading costs and profits. High inflation and currency devaluation may reduce the purchasing power of withdrawals, a challenge not unique to Exness but relevant to all forex trading in Nigeria.

Despite these challenges, Exness remains a viable option, especially with its flexible features and trader-friendly policies.

Benefits of Trading with Exness in Nigeria

Why choose Exness over other brokers? Here are the key advantages for Nigerian traders:

Low Costs: Tight spreads (from 0.0 pips) and no hidden fees make trading affordable.

High Leverage: Up to 1:2000 leverage allows small accounts to scale quickly (with caution).

Fast Withdrawals: Instant or same-day withdrawals beat industry averages.

NGN Support: Trading in Naira eliminates conversion losses.

Global Regulation: Licenses from top-tier authorities ensure safety and transparency.

User-Friendly Platforms: MT4, MT5, and the mobile app cater to all skill levels.

These benefits align with Nigeria’s growing forex community, where affordability, accessibility, and speed are top priorities.

How to Get Started with Exness in Nigeria

Ready to trade with Exness? Follow these steps:

Register: Sign up on the Exness website with your details.

Verify: Submit ID and proof of address for account approval (usually within 24 hours).

Deposit: Fund your account using a local bank transfer, card, or e-wallet (minimum deposit as low as $1 for some accounts).

Choose a Platform: Download MT4/MT5 or use the web terminal.

Start Trading: Practice with a demo account, then go live with real funds.

Pro Tip: Start with the Standard Cent Account if you’re new—it’s low-risk and beginner-friendly.

Exness Alternatives for Nigerian Traders

While Exness is a strong contender, other brokers also cater to Nigerians:

FXTM: Offers local support and SEC compliance.

HotForex (HFM): Known for competitive spreads and regional presence.

OANDA: Provides low fees and reliable platforms.

These brokers may appeal to traders seeking locally regulated options, though Exness’s global reputation and features often give it an edge.

User Experiences: What Nigerian Traders Say

Feedback from Nigerian traders on platforms like Trustpilot and forex forums is largely positive. Many praise Exness for its fast withdrawals, low spreads, and reliable platforms. However, some note occasional delays in bank withdrawals due to CBN policies—a challenge beyond Exness’s control. Overall, the sentiment reflects satisfaction with its functionality in Nigeria.

Is Exness Safe for Nigerian Traders?

Safety is paramount in forex trading. Exness’s multiple regulatory licenses, segregated funds, and negative balance protection make it a secure choice. Regular audits by Deloitte further bolster its credibility. While it’s not locally regulated, its global oversight aligns with international safety standards, offering Nigerian traders peace of mind.

Conclusion: Does Exness Work in Nigeria?

Yes, Exness works in Nigeria—and it works well. It accepts Nigerian clients, supports Naira transactions, and provides a robust trading experience tailored to the local market. While regulatory ambiguity and economic factors pose challenges, Exness’s transparency, low costs, and advanced tools make it a top choice for Nigerian traders. Whether you’re looking to trade forex, crypto, or commodities, Exness delivers a reliable platform backed by global standards.

💥 Trade with Exness now: Open An Account or Visit Brokers

If you’re considering Exness, weigh its benefits against your trading goals and risk tolerance. For many Nigerians, it’s a gateway to the global financial markets, offering opportunities to grow wealth in a dynamic economy. Ready to start? Sign up today and explore what Exness has to offer.

Read more: