11 minute read

Is Exness Regulated in Uganda? A Comprehensive Guide for Traders

Forex trading has gained significant traction in Uganda over the past decade, driven by increased internet access, mobile technology, and a growing interest in global financial markets. As more Ugandans explore opportunities in forex trading, questions about the safety, legality, and reliability of brokers like Exness have become increasingly common. One of the most pressing inquiries is: Is Exness regulated in Uganda? This article aims to provide a detailed, well-researched answer to this question while offering valuable insights into Exness’s operations, the Ugandan regulatory landscape, and what it means for local traders.

💥 Trade with Exness now: Open An Account or Visit Brokers

Whether you're a beginner looking to dip your toes into forex trading or an experienced trader seeking a trustworthy broker, understanding Exness’s regulatory status is crucial. In this 5,000-word guide, we’ll explore every aspect of this topic, from Exness’s global credentials to Uganda’s financial oversight framework, ensuring you have all the information you need to make an informed decision.

What Is Exness? An Overview of the Broker

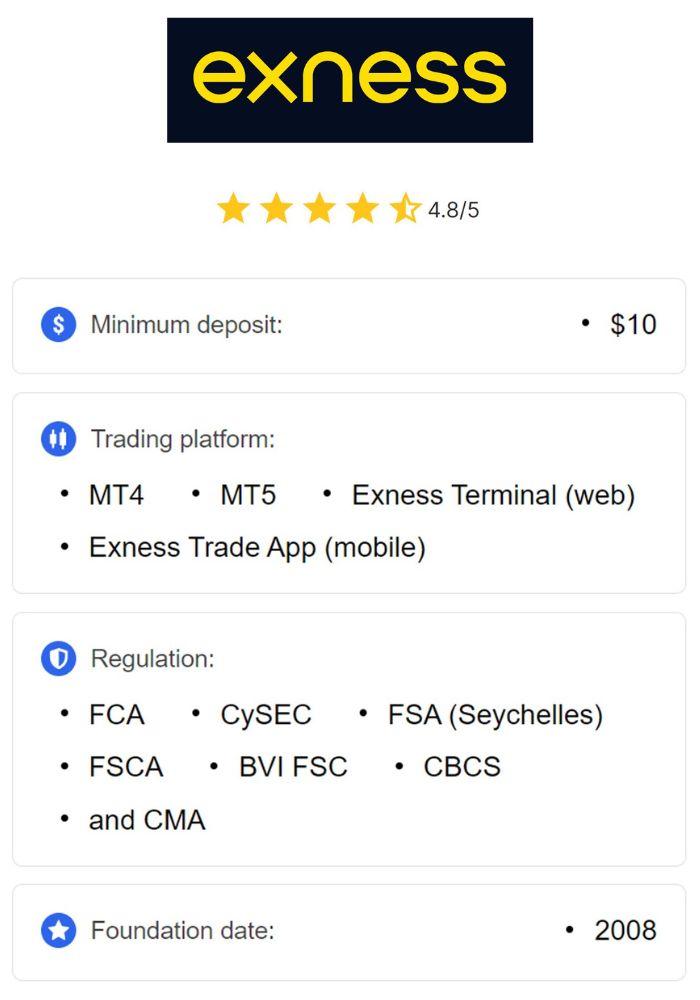

Before diving into the regulatory specifics, let’s establish what Exness is and why it’s a popular choice among traders worldwide, including in Uganda. Founded in 2008, Exness is a global forex and Contracts for Difference (CFD) broker headquartered in Cyprus. Over the years, it has built a strong reputation for its competitive trading conditions, advanced technology, and client-focused services.

Exness offers a wide range of trading instruments, including forex pairs, cryptocurrencies, commodities, indices, and stocks. It provides traders with access to industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary Exness Terminal and mobile trading apps. Known for its tight spreads, fast execution speeds, and flexible leverage options (up to unlimited leverage in some cases), Exness caters to traders of all experience levels.

In Uganda, Exness has gained popularity due to its low minimum deposit requirements (starting at just $1 for standard accounts), support for local payment methods like mobile money, and a user-friendly interface. But popularity alone doesn’t guarantee safety or legitimacy. To determine whether Exness is a reliable choice for Ugandan traders, we need to examine its regulatory status—both globally and within Uganda.

The Importance of Regulation in Forex Trading

Before addressing Exness’s status in Uganda, it’s essential to understand why regulation matters in forex trading. The forex market is a decentralized, global marketplace where currencies are traded 24/5. While this offers immense opportunities, it also attracts unscrupulous actors who may exploit unsuspecting traders. Regulation serves as a safeguard, ensuring that brokers operate transparently, protect client funds, and adhere to ethical standards.

A regulated broker must comply with strict guidelines set by financial authorities. These typically include segregating client funds from company assets, maintaining adequate capital reserves, and providing transparent pricing. Regulation also offers traders recourse in case of disputes, as oversight bodies can investigate and penalize non-compliant brokers.

For Ugandan traders, choosing a regulated broker is especially important given the country’s evolving financial landscape. While forex trading is legal in Uganda, the regulatory framework is still developing, leaving gaps that unregulated brokers could exploit. This makes it critical to assess whether Exness meets the necessary standards to operate safely in the Ugandan market.

Is Exness Regulated Globally?

Exness is a multi-regulated broker, meaning it holds licenses from several reputable financial authorities worldwide. These global regulations provide a strong foundation for its credibility and safety, even in countries like Uganda where it may not have direct local oversight. Let’s break down Exness’s key regulatory licenses:

1. Cyprus Securities and Exchange Commission (CySEC)

Exness is regulated by CySEC under its Cyprus-based entity, Exness (Cy) Ltd. CySEC is a Tier-1 regulator within the European Union (EU), known for its stringent standards. This license ensures compliance with EU financial laws, including the Markets in Financial Instruments Directive (MiFID II), which emphasizes client protection and transparency.

2. Financial Conduct Authority (FCA) – United Kingdom

The FCA, another Tier-1 regulator, oversees Exness (UK) Ltd. The FCA is renowned for its rigorous oversight of financial institutions, enforcing rules on fund segregation, risk management, and fair trading practices. While Exness (UK) Ltd primarily serves institutional clients, this license bolsters the broker’s global reputation.

3. Financial Services Authority (FSA) – Seychelles

Exness (SC) Ltd, the entity most relevant to Ugandan traders, is regulated by the FSA in Seychelles. Although the FSA is considered a Tier-3 regulator (less stringent than CySEC or FCA), it still imposes requirements for financial stability and client fund protection. This is the entity under which most international clients, including those in Uganda, trade.

4. Other Regulatory Bodies

Exness also holds licenses from:

Financial Sector Conduct Authority (FSCA) in South Africa.

Capital Markets Authority (CMA) in Kenya.

Financial Services Commission (FSC) in Mauritius and the British Virgin Islands (BVI).

Central Bank of Curaçao and Sint Maarten (CBCS).

These licenses demonstrate Exness’s commitment to operating within a regulated framework across multiple jurisdictions. However, the question remains: does this global regulation extend to Uganda, and is it sufficient for local traders?

The Regulatory Landscape in Uganda

To fully answer whether Exness is regulated in Uganda, we need to examine the country’s financial regulatory environment. Uganda’s financial sector is overseen by several institutions, but forex trading falls into a somewhat gray area due to the lack of a dedicated forex-specific regulator.

1. Bank of Uganda (BOU)

The Bank of Uganda is the country’s central bank, responsible for monetary policy and the stability of the financial system. It regulates banks and other financial institutions but does not directly oversee forex brokers. Its focus is primarily on maintaining the value of the Ugandan Shilling (UGX) and supervising traditional banking activities.

2. Capital Markets Authority (CMA)

The Capital Markets Authority is Uganda’s primary regulator for securities and investment markets. Established under the Capital Markets Authority Act of 1996, the CMA licenses and supervises entities involved in stocks, bonds, and collective investment schemes. In 2017, the CMA introduced guidelines for forex brokers, requiring them to obtain a license to operate legally in Uganda. However, enforcement of these guidelines has been limited, and many international brokers, including Exness, operate without a CMA license.

3. Uganda Securities Exchange (USE)

The USE oversees the trading of securities like stocks and bonds but has no jurisdiction over forex trading.

The State of Forex Regulation in Uganda

Forex trading is legal in Uganda, and the CMA’s 2017 guidelines represent a step toward formal regulation. However, the framework remains underdeveloped compared to countries with mature financial markets. Many Ugandan traders rely on international brokers regulated by foreign authorities, as local licensing is not yet mandatory for offshore brokers serving Ugandan clients. This brings us to the core question: does Exness hold a CMA license, or does its global regulation suffice?

Is Exness Regulated in Uganda?

The short answer is: Exness is not directly regulated by the Capital Markets Authority (CMA) in Uganda. It does not hold a local license from the CMA or any other Ugandan regulatory body. However, this does not mean Exness is illegal or unsafe for Ugandan traders. Let’s unpack this further.

Exness’s Operations in Uganda

Exness operates in Uganda as an offshore broker, primarily through its Seychelles-regulated entity, Exness (SC) Ltd. This entity serves clients in numerous countries outside the European Economic Area (EEA), including Uganda. As an offshore broker, Exness is not required to obtain a CMA license to offer services to Ugandan residents, provided it complies with international standards and local laws.

💥 Trade with Exness now: Open An Account or Visit Brokers

Legal Status in Uganda

Forex trading with international brokers like Exness is legal in Uganda, even without direct CMA oversight. The CMA’s guidelines apply primarily to brokers physically based in Uganda or actively soliciting Ugandan clients under a local entity. Since Exness operates globally and does not have a physical presence in Uganda, it falls outside the CMA’s direct jurisdiction. Ugandan traders can legally open accounts with Exness, deposit funds, and trade, as long as they comply with local tax and financial reporting requirements.

Does Global Regulation Suffice?

While Exness lacks a Ugandan license, its regulation by CySEC, FCA, FSA, and other authorities provides a robust layer of protection. These licenses ensure:

Segregation of Client Funds: Your money is kept separate from Exness’s operational funds, reducing the risk of misuse.

Transparency: Exness must adhere to strict reporting and auditing standards.

Dispute Resolution: Regulators offer mechanisms to address issues between traders and the broker.

For Ugandan traders, this global oversight is a significant advantage, especially in the absence of a strong local regulatory framework. However, it’s worth noting that the Seychelles FSA, which governs the entity serving Uganda, is less stringent than Tier-1 regulators like the FCA or CySEC. This means that while Exness is regulated, the level of protection may not be as comprehensive as it is for clients under EU or UK jurisdictions.

Benefits of Trading with Exness in Uganda

Despite not being regulated by the CMA, Exness offers several advantages that make it appealing to Ugandan traders:

1. Low Entry Barrier

Exness’s minimum deposit of $1 for standard accounts makes it accessible to beginners with limited capital—a key consideration in Uganda, where disposable income may be modest for many.

2. Local Payment Options

Exness supports deposits and withdrawals via mobile money (e.g., MTN Mobile Money, Airtel Money), bank cards, and e-wallets like Skrill and Neteller. This aligns with Uganda’s widespread use of mobile payment systems.

3. Competitive Trading Conditions

With spreads starting from 0.0 pips on premium accounts, fast execution, and high leverage options, Exness provides a cost-effective and flexible trading environment.

4. Educational Resources

Exness offers webinars, tutorials, and market analysis, helping Ugandan traders build their skills in a market where financial literacy is still growing.

5. Reliable Platforms

Access to MT4, MT5, and the Exness Trade App ensures traders can operate seamlessly, even in areas with limited internet connectivity.

Risks and Considerations for Ugandan Traders

While Exness has many strengths, there are risks and limitations to consider:

1. Lack of Local Regulation

Without CMA oversight, Ugandan traders may have limited local recourse in case of disputes. You’d need to rely on the Seychelles FSA or other regulators, which could complicate resolution processes.

2. Offshore Regulation

The FSA in Seychelles is less rigorous than Tier-1 regulators, potentially offering weaker investor protection compared to brokers regulated by the FCA or CySEC.

3. Currency Conversion Fees

Trading in USD or other foreign currencies may incur conversion costs when depositing or withdrawing in UGX, impacting profitability.

4. Market Volatility

Uganda’s economic conditions, including currency fluctuations and inflation, can affect forex trading outcomes, regardless of the broker.

How to Open an Exness Account in Uganda

If you’re convinced Exness is a good fit, here’s how to get started:

Visit the Exness Website: Go to Exness: Open An Account or Visit Brokers

Register: Provide your email, phone number, and country (Uganda).

Verify Your Identity: Upload a government-issued ID (e.g., passport or national ID) and proof of address (e.g., utility bill).

Deposit Funds: Choose a payment method like mobile money or bank transfer.

Start Trading: Download MT4, MT5, or the Exness app and begin trading.

The process is quick, typically taking 5-10 minutes, and Exness’s KYC (Know Your Customer) verification ensures security.

Comparing Exness to Other Brokers in Uganda

How does Exness stack up against competitors like XM, HotForex, or FXTM? Here’s a brief comparison:

Regulation: XM and FXTM are also regulated by CySEC and FCA, offering similar global credibility. HotForex (HF Markets) is regulated by the FSCA and others.

Minimum Deposit: Exness’s $1 entry point is lower than XM ($5) and FXTM ($10).

Local Support: None of these brokers are CMA-regulated, but Exness’s mobile money integration gives it an edge for Ugandan users.

Leverage: Exness’s unlimited leverage is a standout feature, though XM and FXTM offer up to 1:1000.

Exness holds its own with competitive offerings, particularly for cost-conscious traders.

Is Exness Safe for Ugandan Traders?

Safety is a top concern, and Exness’s track record supports its reliability. With over 15 years in operation, millions of clients worldwide, and multiple regulatory licenses, Exness has proven its stability. Its membership in the Financial Commission, which provides up to €20,000 in compensation per client in case of insolvency, adds another layer of security.

For Ugandan traders, the key is to practice sound risk management—start small, use demo accounts, and avoid over-leveraging—given the lack of local oversight.

Conclusion: Should You Trade with Exness in Uganda?

So, is Exness regulated in Uganda? Not directly by the CMA, but its global licenses from CySEC, FCA, FSA, and others ensure a high standard of operation. For Ugandan traders, Exness offers a legal, accessible, and reliable platform to engage in forex trading, backed by competitive conditions and robust technology.

💥 Trade with Exness now: Open An Account or Visit Brokers

While the absence of local regulation is a consideration, Exness’s international oversight, low entry barriers, and tailored services make it a strong contender for Ugandan traders. If you prioritize affordability, flexibility, and a globally trusted brand, Exness is worth exploring. Just be sure to trade responsibly and stay informed about Uganda’s evolving forex regulations.

Read more: