11 minute read

Is forex trading legal in Iran? A Comprehensive Guide

Forex trading, or foreign exchange trading, has emerged as one of the most dynamic financial markets globally, with a daily trading volume exceeding $7 trillion. It attracts millions of participants worldwide, from institutional investors to individual retail traders, all seeking to profit from currency fluctuations. However, the legality of forex trading varies significantly across countries, shaped by local regulations, economic conditions, and geopolitical factors. In Iran, a nation with a complex economic landscape and a population of over 85 million, the question "Is forex trading legal in Iran?" sparks curiosity and debate. This article explores the legal status of forex trading in Iran, delving into the regulatory framework, cultural considerations, economic challenges, and practical implications for traders.

Top 4 Best Forex Brokers in Iran

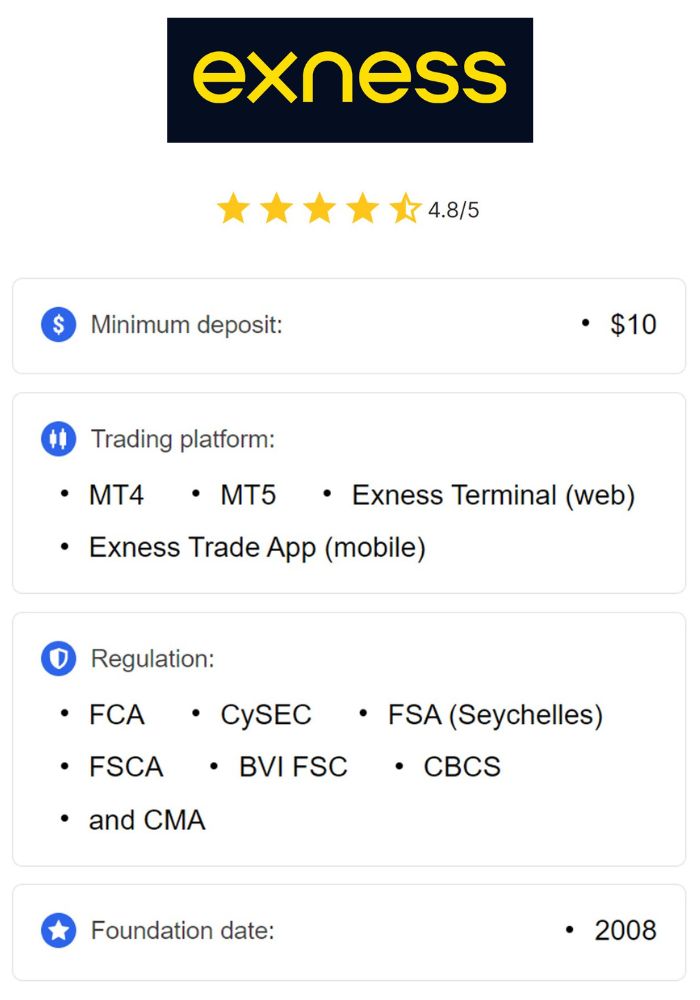

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Understanding Forex Trading: A Global Perspective

Before diving into the specifics of Iran, let’s establish what forex trading entails. Forex, short for foreign exchange, involves the buying and selling of currencies in pairs, such as USD/EUR or GBP/JPY. Traders speculate on the rise or fall of one currency’s value against another, driven by factors like economic data, political events, and market sentiment. The forex market operates 24/5, offering unparalleled liquidity and accessibility through online platforms and brokers.

Globally, forex trading is legal in most countries, though it is subject to varying degrees of regulation. In the United States, for instance, the Commodity Futures Trading Commission (CFTC) oversees forex brokers, while the Financial Conduct Authority (FCA) regulates the market in the UK. These bodies ensure transparency, protect traders, and prevent fraudulent activities. However, in nations like Iran, where economic policies are heavily influenced by government control and international sanctions, the legal landscape becomes murkier.

The Economic Context of Iran: A Foundation for Forex Trading

Iran’s economy provides critical context for understanding forex trading’s legal status. As a major oil-producing country, Iran relies heavily on petroleum exports, which account for a significant portion of its GDP. However, decades of international sanctions, particularly from the United States and the European Union, have isolated Iran from global financial systems, restricted access to foreign currency, and destabilized its economy. The Iranian rial (IRR), the nation’s official currency, has experienced severe depreciation, with exchange rates fluctuating wildly in recent years.

For example, in 2012, the rial lost over 50% of its value in a matter of days due to tightened sanctions targeting the Central Bank of Iran (CBI). The unofficial exchange rate for USD/IRR hovers far above the official rate, reflecting a dual-rate system that complicates financial activities. This economic volatility fuels interest in forex trading among Iranians, who see it as a potential hedge against inflation and a means to preserve wealth. But does this interest align with legal permissibility?

Is forex trading legal in Iran?

The short answer to "Is forex trading legal in Iran?" is yes, but with significant caveats. Unlike some countries that explicitly ban forex trading (e.g., North Korea), Iran does not categorically prohibit it. However, the practice operates in a gray area, governed by a mix of financial regulations, religious principles, and practical enforcement challenges.

💥 Trade with Exness now: Open An Account or Visit Brokers

The Role of the Central Bank of Iran (CBI)

The Central Bank of Iran (CBI) is the primary authority overseeing the country’s monetary policies and foreign exchange transactions. The CBI’s mission includes stabilizing the rial, managing inflation, and controlling currency outflows—tasks made difficult by sanctions and economic instability. While the CBI regulates official currency exchange through licensed banks and exchange houses, it has not issued a clear stance classifying forex trading as fully legal or illegal for individual retail traders.

In practice, the CBI permits forex transactions under specific conditions:

Licensed Brokers: Forex trading is legal if conducted through brokers or financial institutions authorized by the CBI. These entities must comply with stringent guidelines, including limits on leverage (typically capped at 1:10) and adherence to anti-money laundering (AML) protocols.

Islamic Compliance: Iran, as an Islamic Republic, adheres to Sharia law, which prohibits usury (riba) and speculative gambling (maysir). Forex trading must align with these principles, often through swap-free (Islamic) accounts that eliminate interest charges on overnight positions.

Currency Control: The CBI imposes strict controls on foreign currency outflows to prevent capital flight, a concern heightened by sanctions. Unauthorized trading outside regulated channels risks violating these restrictions.

Historical Shifts in Regulation

Forex trading’s legal status in Iran has evolved over time. Prior to 2011 (1390 in the Persian calendar), forex activities were more openly permitted, with some local brokers operating legally. However, the Tehran Stock Exchange Organization declared forex trading illegal that year, citing concerns over currency outflows and speculative losses. This ban targeted unregulated brokers and platforms, pushing forex trading into a semi-legal realm.

Since then, the government has oscillated between cracking down on unauthorized traders and tacitly tolerating the practice. In 2012, Iranian authorities arrested 20 individuals labeled "forex manipulators," signaling a hardline stance against illegal currency speculation. Yet, the absence of a comprehensive legal framework leaves room for interpretation, allowing many Iranians to trade through offshore brokers despite the risks.

Forex Trading and Sharia Law: A Cultural Dimension

Iran’s Islamic identity adds a unique layer to the forex trading debate. Sharia law governs financial transactions, requiring them to be free of interest, excessive uncertainty, and gambling-like speculation. Traditional forex trading, with its leverage and overnight interest (swap fees), often conflicts with these principles. However, the rise of Islamic forex accounts has bridged this gap.

What Are Islamic Forex Accounts?

Islamic forex accounts, also known as swap-free accounts, eliminate interest charges on positions held overnight. Instead of earning or paying interest, brokers adjust their fee structures to comply with Sharia. Many international brokers catering to Iranian traders—such as XM, IC Markets, and Octa—offer these accounts, making forex trading accessible to Muslim investors without violating religious tenets.

Religious Rulings on Forex

Iranian religious authorities have not issued a unified fatwa (ruling) on forex trading’s permissibility. Some scholars argue it is halal (permissible) if conducted through legitimate brokers and without excessive risk, aligning it with trade rather than gambling. Others view it as haram (forbidden) due to its speculative nature and potential for fraud. For devout traders, consulting a local religious expert is advisable to ensure compliance with personal beliefs and national norms.

Challenges of Forex Trading in Iran

Even if forex trading is technically legal under certain conditions, Iranian traders face significant hurdles that complicate participation. These challenges stem from economic, technological, and geopolitical factors.

1. International Sanctions

Sanctions imposed by the U.S. and EU severely limit Iran’s access to global financial systems. Major payment processors like PayPal, Visa, and Mastercard are unavailable, forcing traders to rely on alternative methods such as cryptocurrencies (e.g., Bitcoin) or local intermediaries for deposits and withdrawals. Offshore brokers serving Iranians must navigate these restrictions, often increasing transaction costs and risks.

2. Banking Restrictions

Iranian banks are disconnected from SWIFT, the international payment network, making cross-border transactions slow and expensive. Traders must use domestic exchanges or unofficial channels, which can expose them to fraud or legal scrutiny. The CBI’s tight grip on foreign currency further restricts liquidity, driving many to the parallel (black) market, where rates are higher but unregulated.

3. Internet and Technology Barriers

Forex trading relies on fast, reliable internet and advanced platforms like MetaTrader 4 or 5. In Iran, internet infrastructure lags behind global standards, with frequent outages and slow speeds hampering real-time trading. Sanctions also limit access to cutting-edge software and tools, putting Iranian traders at a competitive disadvantage.

4. Lack of Local Regulation

While the CBI oversees authorized brokers, it does not regulate offshore platforms, which dominate the Iranian forex market. This regulatory gap leaves traders vulnerable to scams, unregulated leverage, and broker insolvency. Without domestic oversight, pursuing legal recourse in cases of fraud is nearly impossible.

5. Economic Volatility

The rial’s instability amplifies forex trading risks. A sudden drop in its value can wipe out profits or trigger margin calls, especially for traders using high leverage. While volatility creates opportunities, it demands sophisticated risk management—a skill many novice Iranian traders lack.

Opportunities for Forex Trading in Iran

Despite these challenges, forex trading offers compelling opportunities for Iranians willing to navigate the complexities.

1. Hedging Against Inflation

With inflation rates often exceeding 30% annually, the rial’s purchasing power erodes rapidly. Forex trading allows individuals to convert savings into stable currencies like the U.S. dollar or euro, preserving wealth amid economic turmoil.

2. Income Potential

For skilled traders, forex presents a lucrative income stream. The market’s 24-hour nature accommodates Iran’s time zone (IRST, UTC+3:30), enabling participation during peak trading hours in Europe and North America. Success stories of Iranian expatriates trading profitably abroad inspire locals to explore the market.

3. Access to Global Brokers

Reputable international brokers, such as Pepperstone, AvaTrade, and FP Markets, accept Iranian clients, offering advanced platforms, educational resources, and Islamic accounts. These brokers provide a lifeline to the global market, bypassing local restrictions.

4. Rise of Cryptocurrency Solutions

Sanctions have accelerated cryptocurrency adoption in Iran, with platforms like LocalBitcoins facilitating forex funding. Traders can convert rials to Bitcoin, deposit with brokers, and withdraw profits in crypto, circumventing banking barriers.

How to Trade Forex Legally in Iran: A Step-by-Step Guide

For Iranians interested in forex trading, adhering to legal and practical guidelines is crucial. Here’s a roadmap to get started:

Step 1: Educate Yourself

Understand forex basics—currency pairs, pips, leverage, and technical analysis. Free resources like Babypips.com or broker-provided webinars can build foundational knowledge.

Step 2: Choose a Reputable Broker

Select an offshore broker regulated by a trusted authority (e.g., CySEC, ASIC, or FCA). Verify they offer Islamic accounts and accept Iranian clients. Popular options include:

Exness: Low spreads and multilingual support.

IC Markets: High execution speeds and Islamic options.

Octa: Minimal deposit requirements (starting at $25).

Step 3: Open an Account

Register online, providing identity verification (e.g., passport or national ID). Opt for a swap-free account if required by religious beliefs.

Step 4: Fund Your Account

Use cryptocurrencies, e-wallets (e.g., Perfect Money), or local exchangers to deposit funds, as traditional banking options are limited. Start with a small amount to test the waters.

Step 5: Practice with a Demo Account

Most brokers offer demo accounts with virtual funds. Practice strategies risk-free before committing real capital.

Step 6: Start Trading

Begin with low leverage (e.g., 1:10) and a clear risk management plan. Monitor economic news affecting the rial and major currencies.

Step 7: Stay Compliant

Report profits to tax authorities, as forex earnings are subject to income tax in Iran. Consult a financial advisor to ensure compliance with local laws.

The Risks of Illegal Forex Trading in Iran

Trading outside regulated channels carries steep consequences. Under Article 49 of Iran’s Securities Law, unauthorized forex activities can lead to:

Imprisonment (1-6 months).

Fines up to three times the profits earned.

Confiscation of assets.

Brokers operating illegally face harsher penalties, including prosecution as fraudsters. Victims of scams, while not heavily punished, receive little legal protection, underscoring the importance of due diligence.

Public Perception and Market Trends

Forex trading enjoys growing popularity in Iran, particularly among younger, tech-savvy individuals. Online forums and social media platforms like Telegram host communities sharing tips and broker recommendations. However, public trust in the market is tempered by tales of scams and losses, reinforcing the need for education and regulation.

The CBI’s efforts to stabilize the rial—such as launching the NIMA system in 2018 to manage forex for exporters and importers—signal a gradual acknowledgment of currency trading’s role in the economy. Whispers of potential forex market reforms suggest a shift toward greater openness, though sanctions remain a formidable barrier.

Comparing Iran to Other Countries

How does Iran’s forex landscape stack up globally? In Turkey, a regional neighbor, forex trading is legal but tightly regulated, with leverage capped at 1:10 and brokers requiring local licenses. In contrast, Saudi Arabia permits forex through Sharia-compliant brokers, supported by robust financial infrastructure. Iran’s isolation and regulatory ambiguity set it apart, though its traders share the same profit-driven motivations.

Conclusion: Navigating the Forex Frontier in Iran

So, is forex trading legal in Iran? The answer is a qualified yes—it’s permissible through regulated, Sharia-compliant channels but fraught with challenges like sanctions, banking limitations, and enforcement gaps. For Iranians, forex offers a tantalizing opportunity to engage with global markets, hedge against economic instability, and pursue financial independence. Yet, it demands caution, education, and strategic planning to succeed.

💥 Trade with Exness now: Open An Account or Visit Brokers

As Iran’s economy evolves and global pressures shift, the legal status of forex trading may clarify. Until then, prospective traders must weigh the risks and rewards, leveraging offshore solutions and emerging technologies to participate responsibly. Whether you’re a novice or seasoned trader, understanding Iran’s unique context is the first step to mastering its forex frontier.

Read more: