9 minute read

Is Forex Trading Safe in India? A Comprehensive Guide

Forex trading has taken the world by storm, offering individuals the chance to profit from fluctuations in global currency markets. In India, this financial activity has gained traction among retail investors looking to diversify their portfolios and tap into a market that operates 24/5. However, a pressing question looms large for many: Is forex trading safe in India? With tales of scams, regulatory hurdles, and financial risks circulating online, it’s natural to wonder whether this venture is a secure option for Indian traders. This in-depth guide explores the safety of forex trading in India, dissecting its legal framework, risks, benefits, and practical steps to ensure a secure trading experience. Whether you’re a novice or an experienced trader, this article will equip you with the knowledge to navigate the Indian forex landscape confidently.

💥 Trade with Exness now: Open An Account or Visit Brokers

Understanding Forex Trading: The Basics

Forex, short for foreign exchange, involves trading one currency for another in a decentralized global market. It’s the largest financial market in the world, with a daily trading volume exceeding $7 trillion as of recent estimates. Unlike stock markets with centralized exchanges, forex operates over-the-counter (OTC), meaning transactions happen electronically between banks, institutions, and individual traders worldwide.

In India, forex trading typically revolves around currency pairs like USD/INR (US Dollar/Indian Rupee), EUR/INR (Euro/Indian Rupee), GBP/INR (British Pound/Indian Rupee), and JPY/INR (Japanese Yen/Indian Rupee). Traders speculate on whether one currency will rise or fall against another, aiming to profit from these price movements. For example, if you believe the US dollar will strengthen against the rupee, you’d buy USD/INR; if it weakens, you’d sell.

But is forex trading safe in India? The answer hinges on several factors: regulation, broker reliability, market risks, and personal preparedness. Let’s dive into each aspect to uncover the truth.

The Legal Landscape: Forex Trading Regulations in India

Safety in forex trading begins with legality. In India, the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) govern financial markets, including forex. The Foreign Exchange Management Act (FEMA) of 1999 sets the foundation for forex-related activities, aiming to regulate cross-border transactions and maintain economic stability.

What’s Allowed Under Indian Law?

Currency Pairs: Retail forex trading in India is restricted to specific INR-based pairs (USD/INR, EUR/INR, GBP/INR, JPY/INR) traded on recognized exchanges like the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or Metropolitan Stock Exchange (MSE). Trading exotic pairs or cross-currency pairs (e.g., EUR/USD) directly with offshore brokers is not permitted for retail traders.

Authorized Platforms: Only SEBI-regulated brokers and RBI-authorized dealers (typically banks) can facilitate forex trading. These entities ensure compliance with FEMA guidelines.

Purpose Limitation: Forex transactions for individuals are allowed for specific purposes like travel, education, or remittances, but speculative trading is confined to regulated exchange platforms.

What’s Illegal?

Trading with unregulated offshore brokers offering margin trading on non-INR pairs is considered illegal under FEMA. Such brokers often lure traders with high leverage (e.g., 1:500) and promises of quick profits, but they operate outside India’s jurisdiction, posing significant risks.

Remitting funds abroad for speculative trading purposes without RBI approval violates capital control laws, potentially leading to penalties or account freezes.

The Safety Net of Regulation

SEBI and RBI oversight provides a safety net by ensuring licensed brokers adhere to strict standards, such as maintaining client funds in segregated accounts and offering transparent pricing. Trading on exchanges also reduces counterparty risk, as trades are cleared through a central system. However, the restriction on offshore brokers means Indian traders miss out on global platforms’ advanced tools and broader pair options—a trade-off for safety.

So, is forex trading safe in India legally? Yes, when conducted through regulated channels. Straying into the unregulated offshore space, however, invites legal and financial peril.

💥 Trade with Exness now: Open An Account or Visit Brokers

Risks of Forex Trading in India: What Could Go Wrong?

Even within a regulated framework, forex trading isn’t risk-free. Understanding these risks is crucial to assessing its safety.

1. Market Volatility

Forex markets are notoriously volatile, driven by economic data, geopolitical events, and central bank policies. For instance, a US Federal Reserve rate hike could spike USD/INR overnight, wiping out leveraged positions. While volatility creates profit opportunities, it also amplifies losses, especially for inexperienced traders.

2. Leverage Risks

Leverage—borrowing funds to amplify trades—is a double-edged sword. In India, SEBI caps leverage at 1:50 for major INR pairs, lower than the 1:500 offered by some offshore brokers. Even at 1:50, a small adverse move (e.g., 2%) could erase your margin if you’re fully leveraged, making risk management critical.

3. Broker Fraud

While SEBI-regulated brokers are safer, scams persist in the unregulated space. Offshore brokers may manipulate prices, delay withdrawals, or disappear with funds. In 2022, the RBI flagged several unauthorized platforms targeting Indian traders, highlighting the ongoing threat.

4. Operational Challenges

India’s forex market operates within limited hours via exchanges, unlike the 24-hour global OTC market. Technical glitches, internet outages, or delayed execution can disrupt trades, especially during high-impact news events.

5. Lack of Education

Many Indian traders dive into forex without understanding technical analysis, risk management, or market dynamics. This knowledge gap increases the likelihood of losses, undermining the perception of safety.

Mitigating Risks

Use stop-loss orders to cap losses.

Trade with regulated brokers only.

Start with a demo account to practice risk-free.

Limit leverage to match your risk tolerance.

Forex trading in India carries inherent risks, but they’re manageable with discipline and caution. Safety depends on how well you navigate these challenges.

Benefits of Forex Trading: Why It’s Appealing in India

Despite the risks, forex trading offers compelling advantages that enhance its appeal—and perceived safety—when approached wisely.

1. High Liquidity

The forex market’s massive volume ensures tight spreads and easy entry/exit, reducing the risk of being stuck in a trade. For INR pairs on Indian exchanges, liquidity is robust, thanks to institutional participation.

2. Accessibility

Online platforms from SEBI-regulated brokers like Zerodha, ICICI Direct, or Angel One make forex accessible to anyone with a smartphone and internet connection. Minimum deposits are often low (e.g., ₹10,000), lowering the entry barrier.

3. Diversification

Forex offers a hedge against stock market downturns, as currency movements often correlate inversely with equities. For Indian investors reliant on NSE stocks, this diversification adds a layer of financial safety.

4. Regulated Environment

Trading via exchanges eliminates counterparty risk and ensures transparency, a stark contrast to unregulated OTC markets. The Investor Protection Fund (IPF) on exchanges can also compensate losses up to ₹25 lakh in case of broker default.

5. Profit Potential

With proper strategy, forex can yield significant returns. For example, a 1% move in USD/INR with 1:20 leverage could double a small investment—though losses are equally possible.

These benefits suggest forex trading can be safe and rewarding in India, provided traders respect its regulated boundaries and inherent volatility.

How Safe Are Forex Brokers in India?

The broker you choose is a linchpin of trading safety. In India, brokers fall into two categories: regulated and unregulated.

SEBI-Regulated Brokers

Examples: Zerodha, ICICI Securities, HDFC Securities.

Safety Features:

Funds held in segregated accounts.

Regular audits by SEBI and exchanges.

Transparent fee structures (e.g., ₹20-40 per lot).

Access to INR pairs only, per RBI rules.

Drawbacks: Limited leverage and pair options compared to global platforms.

Unregulated Offshore Brokers

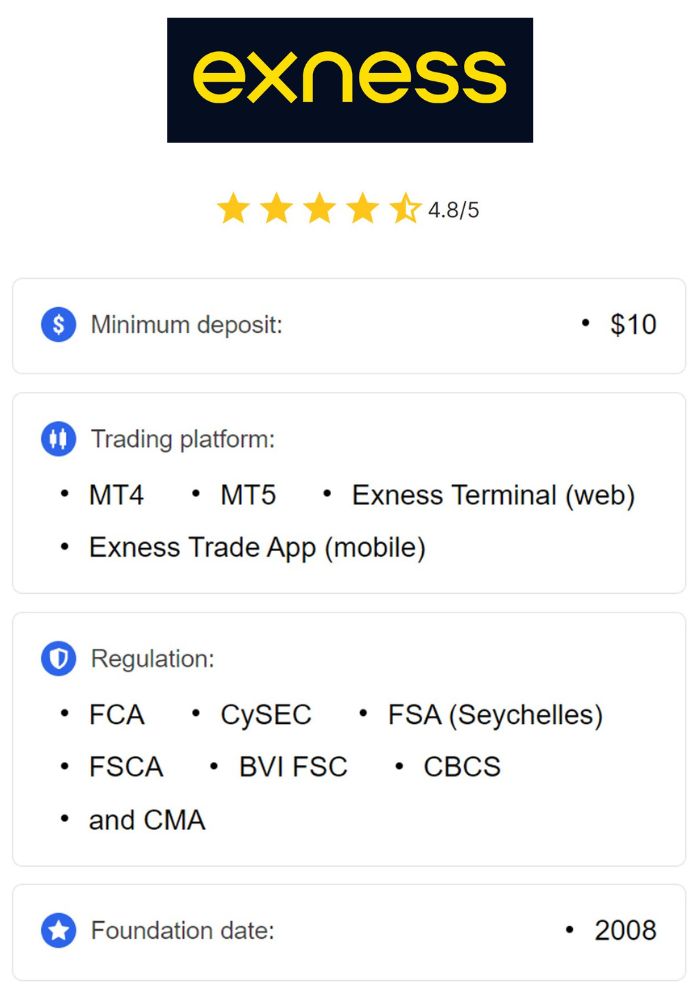

Examples: Names like Exness, FBS, or OctaFX often pop up in ads targeting Indians.

Risks:

No SEBI oversight, meaning no legal recourse in disputes.

High leverage (1:500+) tempts overtrading.

Withdrawal delays or outright refusal reported in forums like Forex Peace Army.

Legality: Using these brokers violates FEMA, risking penalties.

Red Flags to Watch For

Promises of “guaranteed profits” or “zero risk.”

Lack of SEBI registration or RBI authorization.

Pressure to deposit large sums quickly.

Offshore registration in obscure jurisdictions (e.g., St. Vincent).

To verify a broker’s safety:

Check SEBI’s registered broker list on www.sebi.gov.in.

Confirm exchange membership (NSE, BSE, MSE).

Read reviews on platforms like Trustpilot, but cross-check for authenticity.

Forex trading is safe in India with SEBI-regulated brokers, but offshore options are a gamble—both legally and financially.

Technology and Safety: The Role of Trading Platforms

Modern forex trading relies heavily on technology, which can enhance or undermine safety depending on its quality.

Secure Platforms

Regulated brokers offer platforms like Kite (Zerodha) or TradeRiser (ICICI), featuring:

SSL encryption to protect data.

Two-factor authentication (2FA) for logins.

Real-time price feeds and order execution.

Mobile Trading

Apps allow trading on the go, but safety hinges on:

Fast execution to avoid slippage.

Reliable connectivity—crucial in India’s patchy network zones.

Regular updates to fix bugs.

Algo Trading

Some platforms support automated trading via APIs, reducing human error. However, faulty algorithms or power outages can lead to unintended losses, so testing on demos is essential.

A robust platform bolsters safety by minimizing technical risks, but traders must ensure their own internet and device security (e.g., avoiding public Wi-Fi).

Taxation and Financial Safety

Forex profits in India are taxable, impacting your net returns and financial planning.

Tax Rules

Profits from currency derivatives (futures/options) on exchanges are treated as business income, taxed per your income slab (5%-30% plus cess).

Losses can be offset against other business income, offering some relief.

No long-term capital gains apply, unlike stocks.

Safety Implications

Compliance avoids penalties or audits, preserving your capital.

Accurate record-keeping (e.g., via broker statements) ensures transparency.

Consult a tax professional to optimize your forex earnings legally, enhancing your financial safety.

Critical Perspective: Is Regulation Enough?

India’s regulated forex environment offers safety, but it’s not foolproof. SEBI’s leverage caps and pair restrictions protect novices but frustrate advanced traders seeking global exposure. Enforcement against offshore brokers is lax—many operate via VPNs or local agents, exploiting regulatory gaps. Moreover, regulation doesn’t eliminate market risk; 70-80% of retail traders still lose money, per global stats.

Safety isn’t just about rules—it’s about education, discipline, and realistic expectations. A regulated broker won’t save you from poor decisions.

Practical Steps to Trade Forex Safely in India

Here’s how to maximize safety:

Choose a Regulated Broker: Stick to SEBI-registered firms like Zerodha or Angel One.

Start Small: Use a demo account, then trade micro-lots (1,000 units) to limit exposure.

Learn the Basics: Master candlestick charts, support/resistance, and indicators like RSI.

Manage Risk: Risk only 1-2% of your capital per trade; use stop-losses religiously.

Stay Informed: Track RBI circulars (www.rbi.org.in) and economic calendars for INR events.

Avoid Offshore Traps: Resist ads promising overnight riches—they’re often scams.

Forex Trading Safety: A Balanced Verdict

So, is forex trading safe in India? Yes—if you trade within SEBI’s framework, choose reputable brokers, and approach it with skill and caution. The regulated environment minimizes fraud and legal risks, while exchange-traded pairs offer liquidity and transparency. Yet, safety isn’t guaranteed; volatility, leverage, and human error can erode gains.

💥 Trade with Exness now: Open An Account or Visit Brokers

For Indian traders, forex is a calculated risk worth exploring, not a reckless plunge. Equip yourself with knowledge, stick to the rules, and it can be a secure avenue to financial growth. Ready to start? Open a demo account today and test the waters—safely.

Read more: