11 minute read

Does Exness work in Uganda? Is it Legal?

Forex trading has gained significant traction in Uganda over the past decade, driven by increased internet access, financial literacy, and a growing interest in global markets. Among the many brokers available to Ugandan traders, Exness stands out as a globally recognized name. But the question remains: Does Exness work in Uganda? In this in-depth guide, we’ll explore everything Ugandan traders need to know about using Exness, from its legality and functionality to its features, benefits, and potential drawbacks. By the end of this article, you’ll have a clear understanding of whether Exness is the right platform for your trading journey in Uganda.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? A Brief Overview

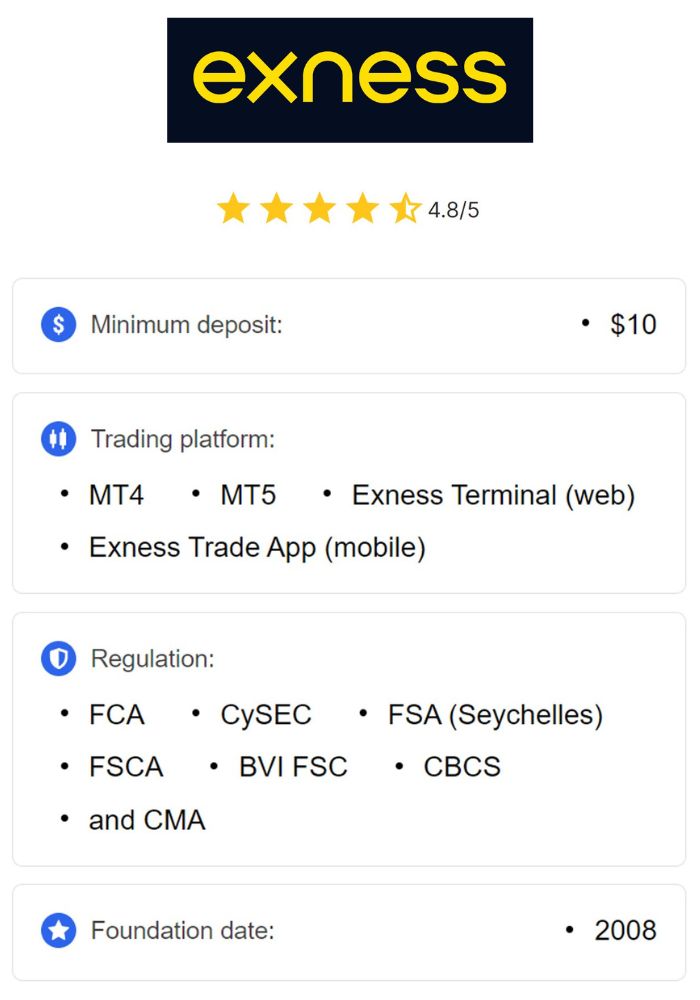

Exness is a global forex and CFD (Contract for Difference) broker established in 2008. Headquartered in Cyprus, the company has grown into one of the world’s largest retail forex brokers, serving millions of clients across more than 190 countries. Known for its competitive trading conditions, transparency, and innovative technology, Exness offers traders access to a wide range of financial instruments, including forex pairs, commodities, cryptocurrencies, stocks, and indices.

The broker operates under multiple regulatory licenses from top-tier authorities, such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa, among others. This regulatory oversight ensures that Exness adheres to strict standards of financial integrity, client fund protection, and operational transparency—qualities that are crucial for traders in emerging markets like Uganda.

But does this global giant cater to the specific needs of Ugandan traders? Let’s dive deeper.

Is Forex Trading Legal in Uganda?

Before exploring Exness’s operations in Uganda, it’s essential to understand the legal landscape of forex trading in the country. Forex trading is legal in Uganda, and its popularity has surged in recent years due to the availability of online platforms and mobile trading apps. However, the regulatory framework for forex trading in Uganda is still developing.

The Bank of Uganda (BoU) is the primary authority overseeing financial institutions in the country, while the Capital Markets Authority (CMA) regulates securities and capital markets. Although the CMA has guidelines for licensing forex brokers, Uganda does not yet have a robust, specific regulatory framework dedicated to forex trading. This means that forex brokers operating in Uganda are not required to hold a local CMA license, and many Ugandan traders rely on internationally regulated brokers like Exness.

The absence of strict local regulation doesn’t make forex trading illegal—it simply shifts the responsibility to traders to choose reputable, globally regulated platforms. Exness, with its strong international regulatory credentials, fits this mold perfectly. So, yes, Exness is legal to use in Uganda, provided traders comply with local financial laws, such as tax obligations on trading profits.

Does Exness Operate in Uganda?

The short answer is yes—Exness operates in Uganda and accepts Ugandan clients. The broker’s global reach extends to East Africa, including Uganda, where it has gained popularity among traders for its reliability and accessibility. Exness does not have a physical office in Uganda, but its online platform is fully functional for Ugandan users, offering seamless account registration, trading, and fund management.

💥 Trade with Exness now: Open An Account or Visit Brokers

Ugandan traders can access Exness’s services through its website (www.exness.com) or mobile app, available on both Android and iOS devices. The platform supports trading on MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most widely used trading platforms in the world. Additionally, Exness offers a proprietary web-based terminal, making it easy for beginners and experienced traders alike to get started.

Exness tailors its services to meet the needs of Ugandan traders by offering local payment methods, such as MTN Mobile Money and Airtel Money, alongside traditional options like bank cards and e-wallets (e.g., Skrill and Neteller). This localization ensures that Ugandans can deposit and withdraw funds conveniently, a critical factor in determining whether a broker "works" in a specific market.

How Does Exness Work in Uganda?

To understand how Exness functions for Ugandan traders, let’s break it down into key operational aspects:

1. Account Registration

Opening an Exness account from Uganda is straightforward and takes just a few minutes. Here’s how it works:

Visit the Exness website or download the mobile app.

Click on “Open Account” and provide your email address, phone number, and country of residence (select Uganda).

Complete the Know Your Customer (KYC) verification by uploading a government-issued ID (e.g., passport or national ID) and proof of address (e.g., utility bill).

Choose your preferred account type (more on this later) and set up your trading platform.

Once your account is verified—typically within 24-48 hours—you’re ready to start trading.

2. Trading Platforms

Exness offers three main platforms for Ugandan traders:

MetaTrader 4 (MT4): A classic platform known for its user-friendly interface and robust technical analysis tools.

MetaTrader 5 (MT5): An advanced version of MT4 with additional features like more timeframes, economic calendars, and support for a broader range of instruments.

Exness Terminal: A web-based platform that requires no download, ideal for traders who prefer simplicity and mobility.

All platforms are fully compatible with Uganda’s internet infrastructure, whether you’re trading from Kampala, Gulu, or a rural area with stable connectivity.

3. Financial Instruments

Exness provides Ugandan traders with access to over 100 forex pairs, including major pairs like EUR/USD and exotic pairs involving the Ugandan Shilling (UGX). Beyond forex, you can trade:

Commodities (e.g., gold, oil)

Cryptocurrencies (e.g., Bitcoin, Ethereum)

Stocks and indices (e.g., Apple, NASDAQ)

This variety allows Ugandan traders to diversify their portfolios and capitalize on global market trends.

4. Deposits and Withdrawals

Exness supports multiple payment methods tailored to Uganda’s financial ecosystem:

Mobile Money: MTN Mobile Money and Airtel Money are popular options, with deposits starting as low as $10 (approximately UGX 37,000) and withdrawals processed within 24 hours.

Bank Cards: Visa and Mastercard are accepted, though processing times may take 3-5 business days.

E-Wallets: Skrill, Neteller, and Perfect Money offer fast transactions with minimal fees.

Bank Transfers: Available for larger amounts, though they may incur higher fees and longer processing times.

Exness does not charge deposit or withdrawal fees for most methods, though third-party providers (e.g., banks or mobile money operators) may apply their own charges.

5. Leverage and Spreads

Exness is renowned for offering some of the highest leverage in the industry—up to 1:Unlimited for forex trading. This means Ugandan traders can control large positions with minimal capital, though it comes with increased risk. Spreads are competitive, starting from 0.0 pips on professional accounts and 0.3 pips on standard accounts, making Exness cost-effective for active traders.

Is Exness Regulated in Uganda?

Exness is not directly regulated by the Capital Markets Authority (CMA) or the Bank of Uganda (BoU), as it operates as an international broker under its global entities. Instead, Ugandan clients are onboarded through Exness’s Seychelles-based entity, regulated by the Financial Services Authority (FSA). Additionally, Exness holds licenses from:

FCA (UK): Ensures high standards of client protection and transparency.

CySEC (Cyprus): Oversees operations in the European Union.

FSCA (South Africa): Adds credibility in the African market.

While these regulators don’t have jurisdiction in Uganda, they impose strict rules on Exness, such as segregating client funds from company funds and offering negative balance protection. This means that even without local regulation, Ugandan traders benefit from international safeguards, making Exness a safe and reliable choice.

Benefits of Using Exness in Uganda

Why should Ugandan traders consider Exness? Here are the key advantages:

1. Low Entry Barrier

With a minimum deposit of just $10 for standard accounts, Exness is accessible to beginners and small-scale traders in Uganda. The availability of cent accounts (with deposits as low as $1) further lowers the entry barrier, allowing newbies to practice with minimal risk.

2. Competitive Trading Conditions

Exness offers tight spreads, fast execution speeds (as low as 0.01 seconds), and unlimited leverage, giving Ugandan traders a competitive edge in the global market.

3. Localized Support

Exness provides 24/7 customer support in English, a language widely spoken in Uganda. Traders can reach out via live chat, email, or phone for assistance with account issues, technical problems, or trading queries.

4. Educational Resources

For Ugandan traders looking to improve their skills, Exness offers webinars, tutorials, and market analysis tools through its website and Trading Central partnership. This is particularly valuable in a market where financial education is still growing.

5. Mobile Trading

The Exness mobile app allows Ugandans to trade on the go, a crucial feature in a country where mobile penetration exceeds 70%, according to the Uganda Communications Commission (UCC).

Potential Drawbacks of Exness in Uganda

While Exness is a strong contender, it’s not without limitations:

1. Lack of Local Regulation

Since Exness isn’t regulated by the CMA, Ugandan traders don’t have local recourse in case of disputes. They must rely on international regulators, which may complicate resolution processes.

2. Withdrawal Delays

Some Ugandan users report occasional delays in withdrawals, especially during high market volatility or when using bank transfers. Mobile money withdrawals, however, are typically faster.

3. Currency Conversion Fees

If your account is denominated in USD rather than UGX, you may incur conversion fees when depositing or withdrawing funds, depending on your payment method.

4. Unregulated Forex Environment

Uganda’s broader forex market lacks stringent oversight, which could expose traders to risks if they choose less reputable brokers. While Exness itself is trustworthy, the unregulated local environment is a consideration.

How to Get Started with Exness in Uganda

Ready to trade with Exness? Follow these steps:

Register: Sign up on the Exness website or app with your details.

Verify Your Account: Submit your ID and proof of address for KYC compliance.

Deposit Funds: Choose a payment method (e.g., MTN Mobile Money) and fund your account.

Download a Platform: Install MT4, MT5, or use the web terminal.

Start Trading: Analyze the markets, set your risk parameters, and place your first trade.

For beginners, consider starting with a demo account to practice without risking real money.

Exness vs. Other Brokers in Uganda

How does Exness stack up against competitors like XM, FXTM, or HotForex in Uganda? Here’s a quick comparison:

Exness: Lowest spreads (from 0.0 pips), unlimited leverage, and local mobile money support.

XM: Offers bonuses and promotions, but spreads start at 1.6 pips on standard accounts.

FXTM: Strong educational resources, though leverage caps at 1:1000.

HotForex: Diverse account types, but higher minimum deposits ($50+).

Exness excels in cost-effectiveness and flexibility, making it a top choice for Ugandan traders seeking value and performance.

Tips for Ugandan Traders Using Exness

To maximize your experience with Exness, consider these tips:

Start Small: Use a cent or standard account with a low deposit to test the waters.

Manage Risk: Leverage is a double-edged sword—use stop-loss orders to protect your capital.

Stay Informed: Leverage Exness’s market analysis tools to track trends.

Monitor Fees: Opt for mobile money to avoid high bank transfer costs.

Comply with Taxes: Keep records of your profits for tax reporting, as forex gains may be subject to capital gains tax in Uganda.

Does Exness Work Well in Uganda? The Verdict

So, does Exness work in Uganda? Absolutely. Exness not only operates seamlessly in the country but also caters to the unique needs of Ugandan traders with low-cost accounts, local payment options, and a robust trading infrastructure. Its international regulation adds a layer of trust, despite the lack of local oversight from the CMA. Whether you’re a beginner dipping your toes into forex or an experienced trader seeking competitive conditions, Exness delivers a reliable and efficient platform.

However, it’s not perfect. The absence of local regulation and occasional withdrawal delays are worth noting. Still, these drawbacks are minor compared to the broker’s overall strengths. Exness remains a top-tier option for Ugandan traders looking to tap into global financial markets.

Conclusion: Should You Trade with Exness in Uganda?

If you’re a Ugandan trader asking, “Does Exness work in Uganda?” the answer is a resounding yes. With its user-friendly platforms, low entry costs, and tailored support for the Ugandan market, Exness is a viable and trustworthy choice. It bridges the gap between Uganda’s emerging forex scene and the global trading ecosystem, empowering traders to pursue financial opportunities with confidence.

💥 Trade with Exness now: Open An Account or Visit Brokers

Ready to take the plunge? Sign up with Exness today and explore the world of forex trading from the comfort of your home in Uganda. Have questions or experiences to share? Drop a comment below—I’d love to hear from you!

Read more: