11 minute read

Exness Standard vs Pro Account Review: Which is better?

When it comes to choosing a trading account with Exness, one of the world’s leading forex and CFD brokers, traders often find themselves torn between the Exness Standard Account and the Exness Pro Account. Both account types cater to different trading styles, experience levels, and financial goals, making the decision a critical one for maximizing profitability and ensuring a smooth trading experience. In this in-depth review, we’ll explore the features, advantages, disadvantages, and key differences between the Exness Standard vs Pro accounts to help you determine which is better suited for your needs.

Exness, established in 2008, has earned a stellar reputation for its transparency, competitive trading conditions, and robust regulatory framework. With millions of clients worldwide, the broker offers a variety of account types, including the beginner-friendly Standard account and the advanced Pro account designed for seasoned traders. Whether you’re new to forex trading or a professional looking to optimize your strategy, understanding the nuances of these accounts is essential. Let’s dive into this comprehensive comparison to uncover which account reigns supreme: Standard or Pro?

What is Exness? A Quick Overview

Before we jump into the specifics of the Standard vs Pro accounts, let’s set the stage with a brief overview of Exness. Founded over 15 years ago, Exness has grown into one of the largest retail forex brokers globally, offering access to a wide range of financial markets, including forex, commodities, indices, cryptocurrencies, and stocks. The broker is regulated by top-tier authorities like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), ensuring a secure and reliable trading environment.

Exness is renowned for its low spreads, fast execution speeds, and flexible account options, making it a go-to choice for traders of all levels. The Standard vs Pro accounts are two of its most popular offerings, each tailored to distinct trader profiles. But how do they stack up against each other? Let’s break it down step by step.

Exness Standard Account: A Beginner’s Best Friend

The Exness Standard Account is designed with simplicity and accessibility in mind, making it an excellent choice for beginners and casual traders. It’s a commission-free account with no minimum deposit requirement (though the amount may vary depending on your payment method), allowing traders to start with as little as $1. This low entry barrier is one of the standout features that sets the Standard account apart from many competitors.

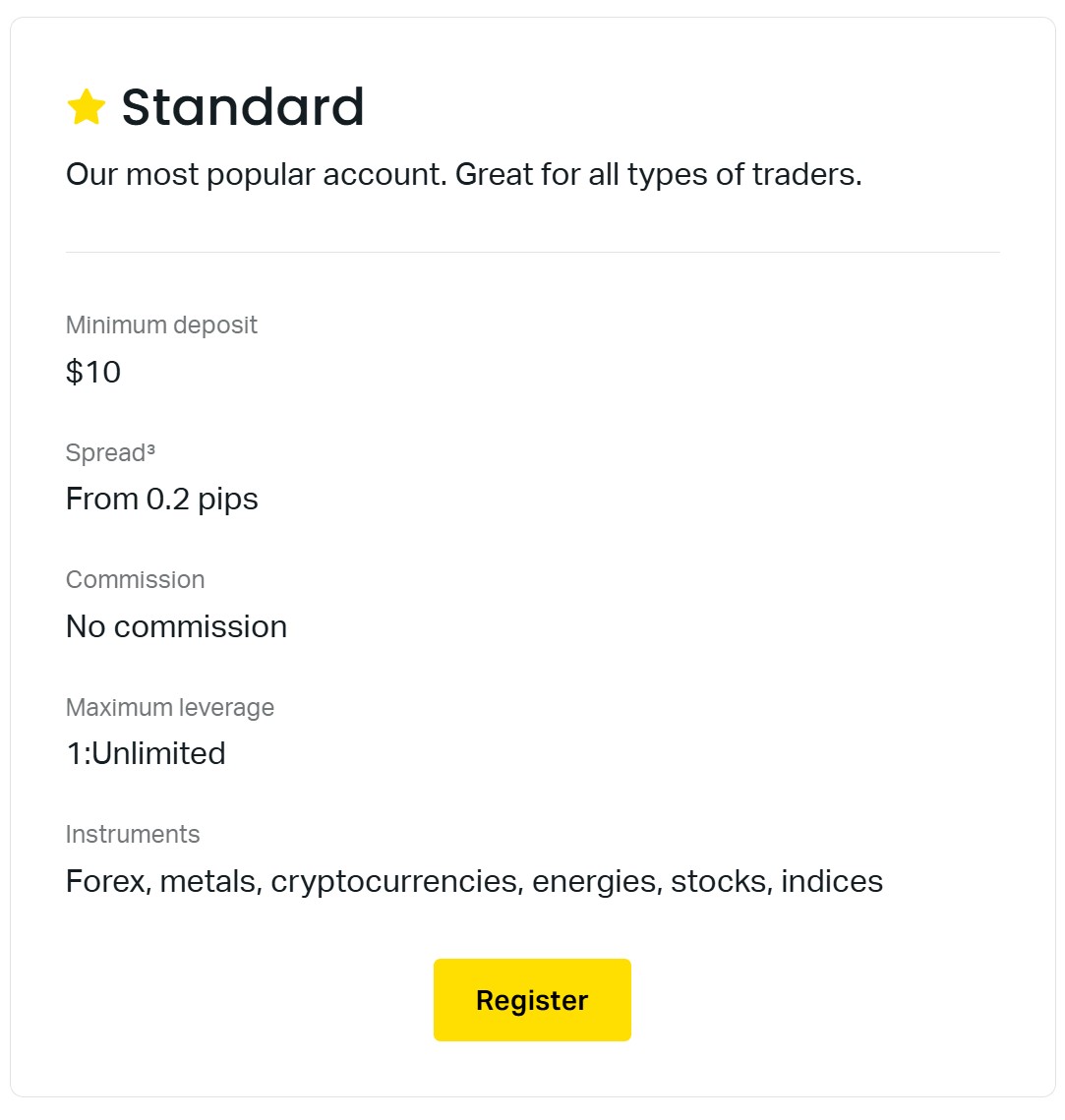

Key Features of the Exness Standard Account

Minimum Deposit: No fixed minimum (depends on payment processor, typically starts at $1).

Spreads: Variable, starting from 0.3 pips.

Commission: None—commission-free trading.

Leverage: Up to 1:2000 (varies by region and asset).

Execution Type: Market execution (no requotes).

Trading Instruments: Over 120+ instruments, including forex, metals, cryptocurrencies, and indices.

Platforms: Available on MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Advantages of the Standard Account

Low Entry Barrier: With no mandatory minimum deposit, the Standard account is perfect for traders with limited capital or those testing the waters in forex trading.

Commission-Free: The absence of commissions keeps trading costs predictable and manageable, especially for small-volume traders.

Versatility: Access to a wide range of trading instruments allows beginners to diversify their portfolios early on.

User-Friendly: The straightforward structure and market execution make it easy for novices to navigate without overwhelming complexity.

High Leverage: The option for leverage up to 1:2000 gives traders the flexibility to amplify their positions, though it comes with increased risk.

Disadvantages of the Standard Account

Wider Spreads: Starting at 0.3 pips, spreads are higher compared to the Pro account, which can eat into profits for frequent traders.

Not Ideal for Scalping: The wider spreads and market execution may not suit high-frequency trading strategies like scalping.

Limited Advanced Features: Experienced traders might find the lack of tighter spreads and premium tools restrictive.

Who Should Choose the Standard Account?

The Exness Standard Account is ideal for:

Beginners who want a low-cost, low-risk entry into trading.

Casual traders who don’t trade frequently and prefer simplicity.

Small-volume traders looking to experiment without committing significant capital.

1️⃣ Open Exness Standard MT4 Account

2️⃣ Open Exness Standard MT5 Account

Exness Pro Account: Built for the Pros

The Exness Pro Account, as the name suggests, is tailored for experienced traders who demand advanced features, tighter spreads, and faster execution. Unlike the Standard account, the Pro account requires a higher minimum deposit (typically $200, depending on your region), but it offers a more professional-grade trading environment in return.

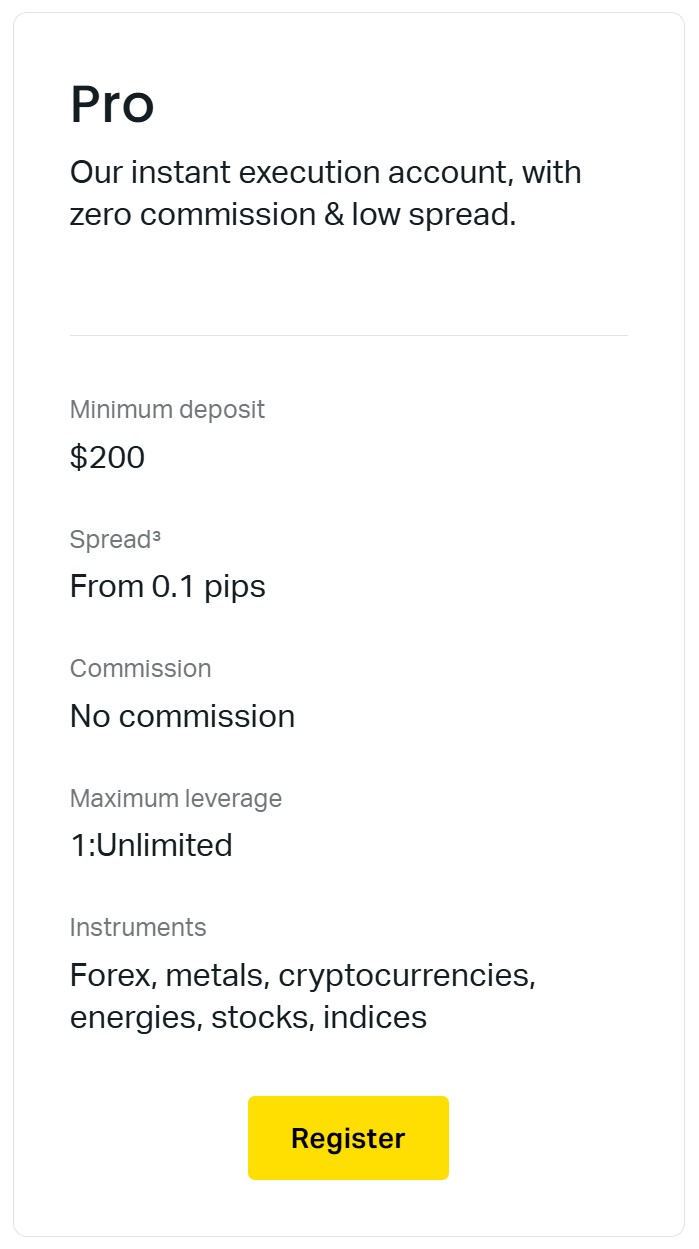

Key Features of the Exness Pro Account

Minimum Deposit: $200 (varies by region).

Spreads: Variable, starting from 0.1 pips.

Commission: None—commission-free trading (unlike some other professional accounts like Raw Spread or Zero).

Leverage: Up to 1:2000 (varies by region and asset).

Execution Type: Instant execution or market execution (trader’s choice).

Trading Instruments: Over 120+ instruments, including forex, metals, cryptocurrencies, and indices.

Platforms: Available on MT4 and MT5.

Advantages of the Pro Account

Tighter Spreads: Starting at 0.1 pips, the Pro account offers significant cost savings for high-frequency and large-volume traders.

Flexible Execution: Traders can choose between instant execution (for price certainty) or market execution (for speed), catering to various strategies.

Cost-Effective for Scalpers: The low spreads and fast execution make it ideal for scalping and day trading.

Advanced Tools: Access to premium analytical tools and a professional trading environment enhances decision-making.

High Leverage: Like the Standard account, leverage up to 1:2000 provides flexibility for experienced traders who can manage risk effectively.

Disadvantages of the Pro Account

Higher Minimum Deposit: The $200 entry requirement may deter beginners or traders with limited funds.

Complexity: The advanced features and execution options might overwhelm novices who lack trading experience.

Not for Small Volumes: The benefits of tighter spreads are most noticeable with larger trade sizes, making it less cost-effective for small-volume traders.

Who Should Choose the Pro Account?

The Exness Pro Account is best suited for:

Experienced traders who require lower spreads and advanced tools.

Scalpers and day traders who rely on fast execution and minimal costs.

High-volume traders looking to optimize profitability on frequent trades.

3️⃣ Open Exness Pro MT4 Account

4️⃣ Open Exness Pro MT5 Account

Head-to-Head Comparison: Standard vs Pro Account

Now that we’ve explored the individual features of both accounts, let’s put them side by side to highlight the key differences and similarities. This comparison will help you weigh the pros and cons based on your trading goals.

1. Minimum Deposit

Standard: No fixed minimum (starts at $1 depending on payment method).

Pro: $200 (varies by region).

Winner: Standard—for its accessibility to traders with limited capital.

2. Spreads

Standard: Starts at 0.3 pips.

Pro: Starts at 0.1 pips.

Winner: Pro—for its tighter spreads, which benefit frequent traders.

3. Commission

Standard: None.

Pro: None.

Winner: Tie—both accounts are commission-free, a rarity among brokers.

4. Execution Type

Standard: Market execution only.

Pro: Choice of instant or market execution.

Winner: Pro—for its flexibility, catering to diverse strategies.

5. Leverage

Standard: Up to 1:2000.

Pro: Up to 1:2000.

Winner: Tie—both offer high leverage, though risk management is key.

6. Trading Instruments

Standard: 120+ instruments.

Pro: 120+ instruments.

Winner: Tie—both provide access to the same extensive range.

7. Ideal User

Standard: Beginners, casual traders, small-volume traders.

Pro: Experienced traders, scalpers, high-volume traders.

Winner: Depends on your experience and goals.

Trading Costs: Which Account Saves You More?

Trading costs are a critical factor in determining the profitability of your trades. Let’s break down how the Standard vs Pro accounts compare in terms of spreads and overall expenses.

Spreads and Cost Efficiency

Standard Account: With spreads starting at 0.3 pips, the Standard account is cost-effective for traders who don’t execute many trades daily. For example, a 1-lot trade on EUR/USD with a 0.3-pip spread costs $3 in spread fees.

Pro Account: Spreads starting at 0.1 pips reduce the cost to $1 per lot on the same trade. For a trader executing 10 trades daily, this translates to $20 in savings compared to the Standard account.

Real-World Example

Imagine you’re a day trader placing 20 trades per day with a 1-lot size on EUR/USD:

Standard Account: 20 trades x 0.3 pips = $60/day in spread costs.

Pro Account: 20 trades x 0.1 pips = $20/day in spread costs.

Savings: $40/day, or $200/week, with the Pro account.

For high-frequency traders, the Pro account clearly offers better value. However, for a casual trader placing only 1-2 trades per day, the difference is negligible, making the Standard account sufficient.

Execution Speed and Trading Strategies

Execution speed can make or break a trading strategy, especially for scalpers and day traders. Here’s how the two accounts differ:

Standard Account Execution

The Standard account uses market execution, meaning trades are executed at the best available market price. While this ensures no requotes, it may result in slippage during volatile conditions, which could impact profitability for fast-paced strategies.

Pro Account Execution

The Pro account offers a choice between instant execution (executes at the quoted price with potential requotes) and market execution. This flexibility allows traders to tailor their execution to their strategy:

Scalping: Instant execution ensures price certainty, ideal for quick trades.

Day Trading: Market execution provides speed, suitable for volatile markets.

Which is Better for Your Strategy?

Swing Trading or Long-Term Investing: The Standard account’s market execution is sufficient, as speed is less critical.

Scalping or Day Trading: The Pro account’s tighter spreads and execution options give it an edge.

Leverage and Risk Management

Both accounts offer leverage up to 1:2000, one of the highest in the industry. While this amplifies potential profits, it also increases risk. Here’s how to approach it:

Standard Account: Beginners should use lower leverage (e.g., 1:100) to minimize risk while learning.

Pro Account: Experienced traders can leverage the full 1:2000, provided they have robust risk management in place.

Exness also provides negative balance protection, ensuring you never lose more than your deposit—a safety net for both accounts.

Platform Compatibility and Tools

Both the Standard vs Pro accounts are available on MetaTrader 4 and MetaTrader 5, two of the most popular trading platforms. These platforms offer:

Advanced charting tools.

Technical indicators.

Automated trading via Expert Advisors (EAs).

However, the Pro account’s tighter spreads and execution options make it better suited for traders using EAs or advanced strategies, as every pip counts.

Which Account is Better for Beginners?

For those new to trading, the Standard Account is the clear winner. Its low entry cost, commission-free structure, and simplicity provide a gentle introduction to forex trading. Beginners can start small, learn the ropes, and scale up as they gain confidence without needing to commit to a $200 deposit upfront.

Which Account is Better for Experienced Traders?

For seasoned traders, the Pro Account shines. The tighter spreads, flexible execution, and professional-grade features cater to sophisticated strategies like scalping, day trading, and high-volume trading. The initial $200 deposit is a small price to pay for the cost savings and enhanced trading conditions it offers.

Real User Feedback: What Traders Say

To add a real-world perspective, let’s look at what traders are saying about these accounts:

Standard Account Users: “It’s perfect for starting out. I deposited $10 and was trading within minutes. Spreads are decent for casual trading.” – John, beginner trader.

Pro Account Users: “The 0.1-pip spreads are a game-changer for my scalping strategy. Execution is lightning-fast, and I’ve cut my costs significantly.” – Maria, professional trader.

Final Verdict: Standard vs Pro—Which is Better?

So, which Exness account is better: Standard or Pro? The answer depends on you—your experience, trading style, and financial resources.

Choose the Standard Account If:

You’re a beginner or casual trader.

You have limited capital and want to start small.

You prioritize simplicity over advanced features.

Choose the Pro Account If:

You’re an experienced trader or scalper.

You trade frequently and need tighter spreads.

You’re willing to invest $200 for a premium trading experience.

Our Recommendation

For Beginners: Start with the Standard account to build your skills and confidence. You can always upgrade to Pro later.

For Pros: Go straight for the Pro account to maximize efficiency and profitability.

How to Open an Exness Account

Ready to get started? Opening an account with Exness is quick and easy:

Visit the Exness website and click “Register.”

Fill in your details and verify your identity.

Choose your account type (Standard or Pro).

Deposit funds via bank card, e-wallet, or cryptocurrency.

Download MT4 or MT5 and start trading!

Conclusion: Make the Right Choice for Your Trading Journey

The Exness Standard vs Pro Account debate boils down to your individual needs. The Standard account offers an accessible, beginner-friendly option with no minimum deposit and commission-free trading, while the Pro account delivers tighter spreads, advanced tools, and flexibility for experienced traders. Both are excellent choices within their respective domains, backed by Exness’s reputation for reliability and innovation.

Take a moment to assess your trading goals, experience level, and budget. Whether you opt for the simplicity of the Standard account or the precision of the Pro account, Exness provides the tools and conditions to succeed. Which will you choose? Let us know in the comments below, and happy trading!

1️⃣ Open Exness Standard MT4 Account

2️⃣ Open Exness Standard MT5 Account

3️⃣ Open Exness Pro MT4 Account

4️⃣ Open Exness Pro MT5 Account

Read more: