11 minute read

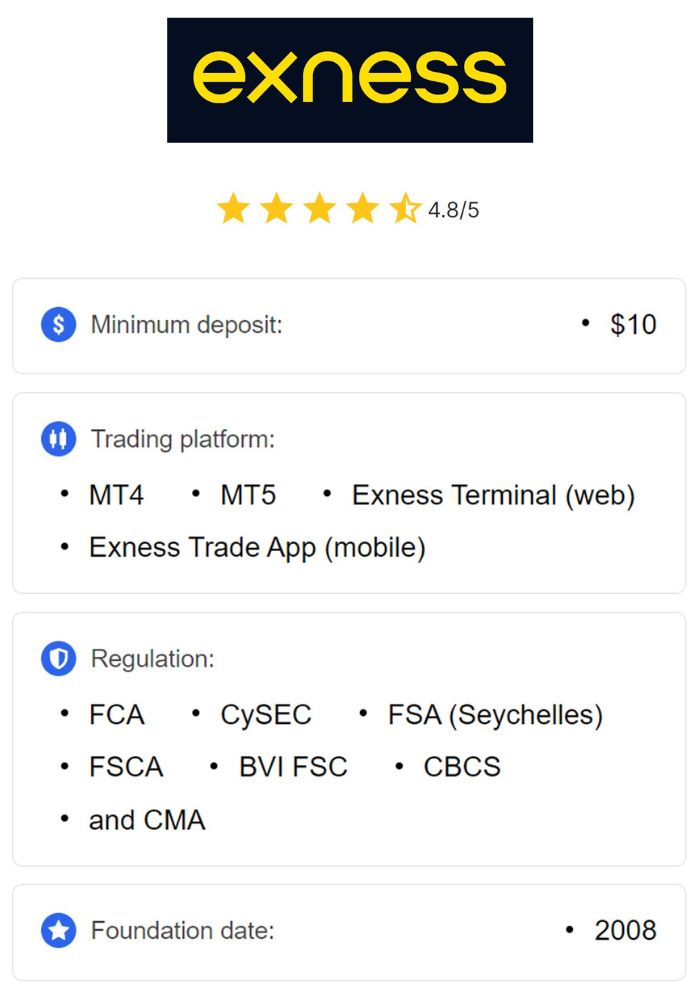

Is Exness Regulated in Kenya? Review Broker 2025

from Exness Global

Forex trading has surged in popularity across Africa, and Kenya is no exception. With its growing economy and increasing access to the internet, more Kenyans are exploring online trading platforms to diversify their income streams. Among the many brokers available, Exness stands out as a globally recognized name. However, a critical question lingers for Kenyan traders: Is Exness regulated in Kenya? This article dives deep into Exness’s regulatory status, its operations in Kenya, and what this means for local traders. Whether you’re a beginner or an experienced forex enthusiast, this guide will equip you with the knowledge to make informed decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Broker

Before addressing the regulation question, let’s understand what Exness is. Founded in 2008, Exness is a multi-asset brokerage firm offering trading services in forex, commodities, indices, stocks, and cryptocurrencies. Headquartered in Cyprus, the company has grown to serve millions of clients worldwide, boasting a monthly trading volume exceeding $2.5 trillion as of recent reports. Its appeal lies in its competitive spreads, fast execution speeds, and a user-friendly platform that caters to traders of all levels.

Exness operates under a decentralized model with multiple entities regulated by various financial authorities globally. This structure allows it to offer tailored services depending on the region. For Kenyan traders, Exness has gained traction due to its accessibility, low-cost trading options, and robust customer support. But the big question remains: does it comply with Kenyan regulations?

Understanding Forex Regulation in Kenya

To determine whether Exness is regulated in Kenya, we first need to explore the regulatory landscape for forex trading in the country. The primary authority overseeing financial markets in Kenya is the Capital Markets Authority (CMA). Established under the Capital Markets Act, the CMA is responsible for licensing and supervising entities involved in securities, derivatives, and forex trading. Its mandate includes protecting investors, ensuring market integrity, and promoting financial stability.

Forex trading in Kenya has seen exponential growth, but the regulatory framework is still evolving. The CMA requires brokers offering forex services to Kenyan residents to obtain a license as a non-dealing online forex broker or a similar designation, depending on their operations. Licensed brokers must adhere to strict guidelines, such as maintaining adequate capital, segregating client funds, and providing transparent reporting.

However, the CMA’s jurisdiction primarily applies to firms with a physical presence or significant operations in Kenya. This creates a gray area for international brokers like Exness, which operate online and serve Kenyan clients remotely. To fully assess Exness’s status, we must examine both its local and international regulatory credentials.

Is Exness Regulated by the CMA in Kenya?

Let’s cut to the chase: Exness (KE) Limited, a specific entity under the Exness Group, is indeed regulated by the Capital Markets Authority in Kenya. It holds license number 162 as a non-dealing online foreign exchange broker. This license was granted to Tadenex Limited, which later rebranded to Exness (KE) Limited, with registration number PVT-LRUDJJB. The CMA’s oversight ensures that this entity complies with Kenyan financial laws, offering a layer of protection for local traders.

A non-dealing broker, as defined by the CMA, does not execute trades on behalf of clients but acts as an intermediary, connecting traders to liquidity providers or the broader forex market. This distinguishes it from dealing brokers, which may take the opposite side of a client’s trade. For Kenyan traders, this means Exness (KE) Limited operates within a regulated framework, providing assurance of transparency and accountability.

💥 Trade with Exness now: Open An Account or Visit Brokers

However, there’s a nuance to consider. While Exness (KE) Limited is CMA-regulated, not all Exness services accessed by Kenyans fall under this entity. Many traders interact with Exness through its international platforms (e.g., exness.com), which are governed by other regulatory bodies. This dual structure complicates the question of regulation, so let’s explore Exness’s global credentials next.

Exness’s Global Regulatory Framework

Exness operates as a group of companies, each regulated by reputable financial authorities in different jurisdictions. This multi-entity approach allows it to comply with regional laws while maintaining a global presence. Here’s a breakdown of its key regulatory licenses:

Cyprus Securities and Exchange Commission (CySEC)

Entity: Exness (Cy) Ltd

License Number: 178/12

CySEC is a Tier-1 regulator in the European Union, known for its stringent standards. It oversees Exness’s operations in Europe, ensuring client fund segregation, negative balance protection, and adherence to MiFID II regulations.

Financial Conduct Authority (FCA) – United Kingdom

Entity: Exness (UK) Ltd

Financial Services Register Number: 730729

The FCA is another top-tier regulator, enforcing high standards of financial conduct. However, Exness (UK) Ltd does not serve retail clients, limiting its relevance to Kenyan traders.

Financial Sector Conduct Authority (FSCA) – South Africa

Entity: Exness ZA (Pty) Ltd

FSP Number: 51024

The FSCA regulates Exness’s operations in South Africa, a market with similarities to Kenya’s emerging forex scene.

Seychelles Financial Services Authority (FSA)

Entity: Exness (SC) Ltd

License Number: SD025

The FSA is a lighter regulatory body compared to CySEC or FCA, often used by brokers for offshore operations.

Financial Services Commission (FSC) – Mauritius and British Virgin Islands

Entities: Exness (MU) Ltd and Exness (VG) Ltd

These licenses cater to clients outside the European Economic Area (EEA), including parts of Africa.

Central Bank of Curaçao and Sint Maarten (CBCS)

Entity: Exness B.V.

License Number: 0003LSI

This applies to specific jurisdictions outside the EEA.

For Kenyan traders using Exness’s international platforms (e.g., Exness (SC) Ltd or Exness (MU) Ltd), these global licenses apply rather than the CMA license. While these regulators impose standards like fund segregation and fair trading practices, they don’t fall under Kenyan jurisdiction, raising questions about local enforceability.

Does Exness’s CMA License Cover All Kenyan Traders?

Here’s where it gets tricky. The CMA license held by Exness (KE) Limited applies specifically to its operations under the domain exness.ke. This entity targets Kenyan traders and complies with local laws. However, many Kenyans register accounts through Exness’s global website (exness.com), which routes them to entities like Exness (SC) Ltd or Exness (MU) Ltd. These international entities are not regulated by the CMA, meaning traders using them rely on offshore oversight rather than Kenyan protections.

This distinction matters because the CMA can directly intervene in disputes involving Exness (KE) Limited, such as fund mismanagement or unfair practices. For traders under offshore entities, resolving issues may involve navigating foreign regulators, which can be more complex and less accessible for Kenyans.

Is It Safe to Trade with Exness in Kenya?

Safety is a top concern for any trader, and regulation is a key factor in assessing it. Here’s how Exness measures up:

Pros of Trading with Exness

CMA Regulation (Exness (KE) Limited): The local entity’s license ensures compliance with Kenyan laws, offering a safety net for traders using exness.ke.

Global Oversight: Licenses from CySEC, FCA, and FSCA reflect Exness’s commitment to high standards, even for offshore entities.

Fund Security: Exness segregates client funds from company assets across all entities, reducing the risk of loss in case of insolvency.

Reputation: With over 15 years in the industry and millions of clients, Exness has built a solid track record of reliability.

Transparency: The broker provides clear information about spreads, fees, and execution, minimizing hidden costs.

Cons and Risks

Offshore Entities: Traders using non-CMA-regulated entities rely on foreign regulators, which may not prioritize Kenyan interests.

Regulatory Gaps: Kenya’s forex laws are still developing, and offshore brokers operate in a legal gray area unless CMA-licensed.

Limited Local Recourse: Disputes with offshore entities may require international arbitration, a daunting process for individual traders.

For most Kenyan traders, Exness is a safe choice, especially when using the CMA-regulated entity. However, due diligence is essential—verify which entity you’re signing up with and understand the applicable regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers

How Does Exness Compare to CMA-Regulated Competitors?

Kenya hosts several CMA-licensed brokers, such as Scope Markets and Pepperstone (via its Kenyan entity). How does Exness stack up?

Spreads and Fees: Exness is known for ultra-low spreads (e.g., 0.0 pips on some accounts), often outpacing local competitors.

Platform Options: Exness offers MetaTrader 4, MetaTrader 5, and a proprietary app, matching or exceeding the tech of CMA-licensed peers.

Local Presence: Unlike some competitors with physical offices in Nairobi, Exness (KE) Limited operates online, which may limit face-to-face support.

Global Reach: Exness’s international network gives it an edge in liquidity and instrument variety over smaller, locally-focused brokers.

For traders prioritizing cost and technology, Exness often comes out ahead. However, those valuing a physical presence might prefer fully localized brokers.

Why Regulation Matters for Kenyan Traders

Regulation isn’t just a buzzword—it’s a safeguard. Here’s why it’s critical:

Fund Protection: Regulated brokers must segregate client funds, ensuring your money isn’t misused.

Dispute Resolution: A local regulator like the CMA can mediate conflicts, offering faster recourse than offshore bodies.

Market Integrity: Regulation curbs fraudulent practices, fostering trust in the forex industry.

Compliance with Local Laws: CMA-licensed brokers align with Kenya’s anti-money laundering and tax regulations, reducing legal risks for traders.

Unregulated or poorly regulated brokers pose risks like sudden account closures, withdrawal issues, or outright scams—issues Kenya’s CMA has warned about since 2021.

How to Verify Exness’s Regulation in Kenya

Want to confirm Exness’s status yourself? Follow these steps:

Check the CMA Website: Visit www.cma.or.ke and search the “Licensed Entities” section for “Exness (KE) Limited” or license number 162.

Review Exness’s Site: Go to exness.ke for details on its Kenyan license or exness.com for global entities.

Contact Support: Exness’s 24/7 customer service can clarify which entity you’re dealing with.

Cross-Check Global Regulators: Verify licenses with CySEC (www.cysec.gov.cy), FCA (www.fca.org.uk), or others listed earlier.

Transparency is key—don’t hesitate to ask Exness for documentation if needed.

Exness’s Offerings for Kenyan Traders

Beyond regulation, what does Exness bring to the table for Kenyans?

Account Types: Options like Standard, Pro, and Zero accounts cater to beginners and pros alike.

Payment Methods: Supports M-Pesa, bank cards, and e-wallets, aligning with local preferences.

Education: Free webinars, tutorials, and market analysis help traders sharpen their skills.

Leverage: Up to 1:2000 (depending on the entity), offering flexibility but requiring caution.

Support: 24/7 multilingual assistance, including Swahili, ensures accessibility.

These features make Exness a compelling choice, regulated or not, but always weigh them against your risk tolerance.

The Legal Gray Area of Offshore Brokers in Kenya

Kenya’s forex market operates in a unique space. While the CMA regulates local entities, offshore brokers like Exness (SC) Ltd can still serve Kenyans without a physical presence. The Capital Markets Act technically requires firms targeting Kenyans to be CMA-licensed, yet enforcement is inconsistent for online platforms. This loophole allows traders to access global brokers but leaves them exposed if issues arise.

In 2021, the CMA and Central Bank of Kenya (CBK) issued warnings about unregulated offshore brokers, citing risks of scams and financial losses. While Exness isn’t named in these alerts (thanks to its reputable status), the broader caution applies to its non-CMA entities.

Should You Choose Exness as a Kenyan Trader?

So, is Exness the right broker for you? It depends on your priorities:

Opt for Exness (KE) Limited if you want CMA-backed security and local compliance. Use exness.ke to sign up.

Choose Offshore Entities if you prioritize lower costs and broader features, accepting the trade-off of foreign regulation.

Consider Alternatives if you prefer a broker with a physical Kenyan office or a different risk profile.

Ultimately, Exness offers a blend of reliability, affordability, and flexibility that appeals to many Kenyans. Its CMA license for Exness (KE) Limited is a strong point, while its global credentials bolster trust for offshore users.

Tips for Safe Forex Trading in Kenya

Wherever you trade, safety comes first. Here’s how to protect yourself:

Research Your Broker: Confirm its regulatory status and read user reviews.

Start Small: Test the platform with a demo account or minimal deposit.

Understand Leverage: High leverage (e.g., 1:2000) amplifies both gains and losses—use it wisely.

Secure Your Account: Enable two-factor authentication and monitor transactions.

Stay Informed: Follow CMA updates and forex news to spot red flags.

Conclusion: Exness and Kenya—A Regulated Path Forward

To answer the core question: Yes, Exness is regulated in Kenya through Exness (KE) Limited, holding CMA license number 162. This entity ensures compliance with local laws, making it a safe choice for traders seeking domestic oversight. For those using Exness’s global platforms, robust international regulation from bodies like CySEC and FSCA provides a comparable level of security, albeit without direct CMA jurisdiction.

💥 Trade with Exness now: Open An Account or Visit Brokers

Kenya’s forex market is ripe with opportunity, and Exness positions itself as a leader by balancing local and global strengths. Whether you’re drawn to its low spreads, diverse instruments, or educational resources, Exness offers a solid foundation for trading—provided you choose the right entity for your needs. As always, do your homework, assess your goals, and trade responsibly.

Read more: Is Exness Regulated in Nigeria?