17 minute read

Exness Pro Account Review: Pros and Cons

Introduction to Exness

Overview of the Company

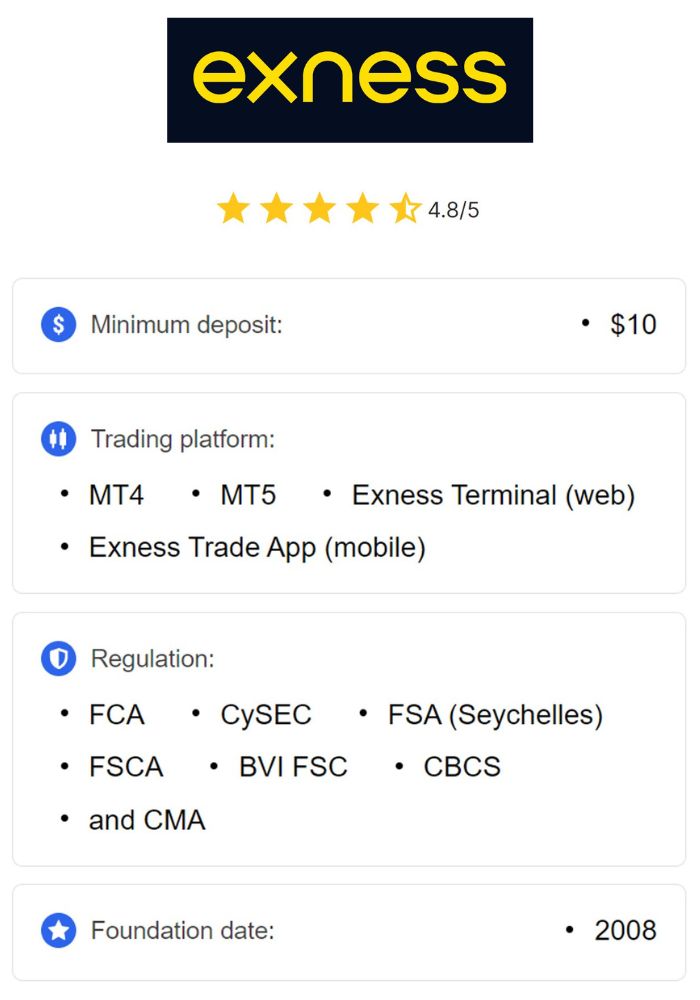

Exness is a well-established online broker offering a range of trading services to retail and institutional clients worldwide. Founded in 2008, the company has earned a reputation for providing excellent trading conditions, advanced trading tools, and strong customer support. Exness operates in several regions, offering access to a broad spectrum of financial instruments, including forex, commodities, indices, and cryptocurrencies. The company is known for its transparent approach and a commitment to regulatory compliance, making it a popular choice for traders of all levels.

The Exness Pro Account is one of its premium offerings designed to cater to more experienced traders, offering advanced features and flexibility in trading. With a focus on low spreads, high leverage, and the availability of sophisticated trading platforms, the Exness Pro Account aims to meet the needs of professional traders seeking optimal conditions for trading.

Regulatory Framework

Exness operates under the jurisdiction of several regulatory authorities, ensuring that it meets international standards for security, transparency, and fairness. The company is regulated by various financial watchdogs, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). These regulatory bodies play a critical role in ensuring the protection of traders' funds and maintaining a fair trading environment.

Regulation is an important factor for traders when choosing a broker, as it ensures that the broker adheres to strict guidelines and offers a secure and trustworthy platform. Exness’s regulatory compliance enhances its reputation and makes it a reliable choice for those looking for a safe and regulated trading environment.

What is a Pro Account?

Definition and Purpose

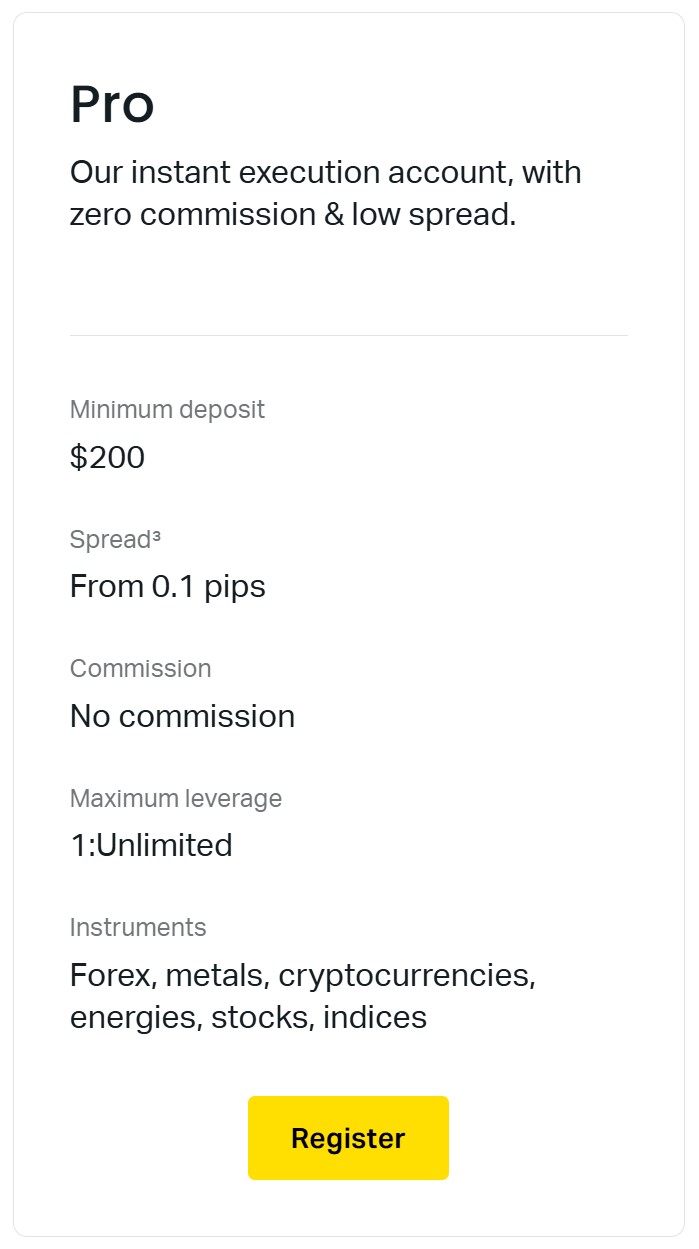

A Pro Account at Exness is designed for experienced traders who require access to advanced trading features and more favorable trading conditions. The Pro Account provides a range of benefits, including low spreads, high leverage, and the ability to trade on a variety of financial instruments. The purpose of the Pro Account is to offer traders with higher trading volumes and more complex strategies the tools and conditions necessary to execute their trades effectively.

The Pro Account is particularly suited for those who are familiar with the intricacies of forex and other markets, as it provides access to more specialized services that can support more aggressive trading strategies. It allows traders to take advantage of Exness’s robust infrastructure, including the fastest execution speeds and tight spreads, which are essential for professional-level trading.

Key Features of Exness Pro Account

Exness’s Pro Account offers several key features that differentiate it from other account types. These include:

Tight Spreads: The Pro Account offers some of the tightest spreads available, which is beneficial for traders looking to minimize transaction costs.

High Leverage: Traders can access leverage up to 1:2000, which allows them to control larger positions with a smaller amount of capital. However, high leverage also increases the potential risk.

Low Commission Fees: Compared to other account types, the Pro Account offers lower commission fees on trades, making it ideal for high-volume traders.

Access to Premium Trading Tools: Pro Account holders have access to advanced trading tools and analysis features, enabling them to make more informed decisions.

Fast Execution Speeds: The Pro Account offers fast order execution speeds, reducing the likelihood of slippage and improving the overall trading experience.

Account Types Offered by Exness

Comparison of Different Account Types

Exness offers a variety of account types to cater to the needs of different traders. The most common accounts are:

Standard Account: This is ideal for beginner traders and those with smaller budgets. It offers competitive spreads and no commission fees, but leverage is limited to lower levels compared to the Pro Account.

Pro Account: The Pro Account offers more advanced features, including tighter spreads, higher leverage, and lower commissions. It is suitable for experienced traders who require better trading conditions.

Raw Spread Account: The Raw Spread Account offers ultra-low spreads, but it comes with a commission fee on trades. It is suitable for high-frequency traders who need to trade at the lowest possible cost.

Zero Account: This account offers zero spreads, but traders must pay a small commission per trade. It is designed for traders who want to minimize spread costs.

Each account type at Exness is designed to cater to specific trading needs, with the Pro Account standing out for its low costs, high leverage, and access to professional-grade tools.

Benefits of Choosing Pro Account

The Exness Pro Account offers several advantages for experienced traders:

Lower Transaction Costs: With tighter spreads and lower commission fees, the Pro Account helps traders reduce their transaction costs, allowing for better profitability in the long run.

Advanced Trading Tools: The Pro Account offers access to premium tools such as advanced charting, real-time market analysis, and economic calendars. These tools can help traders make more informed decisions.

Higher Leverage: The high leverage options available on the Pro Account allow traders to maximize their potential profit from smaller market movements.

Faster Execution: With fast execution speeds, the Pro Account reduces the likelihood of slippage, ensuring that trades are executed at the desired price.

The combination of these features makes the Pro Account ideal for serious traders who require the best conditions for their strategies.

Opening an Exness Pro Account

Step-by-Step Registration Process

Opening a Pro Account with Exness is a simple and straightforward process. Here are the steps involved:

Visit the Exness Website: Go to the official Exness website and click on the “Open an Account” button.

Choose Account Type: Select the Pro Account option from the list of available account types.

Fill in the Registration Form: Provide personal information, such as your name, email address, phone number, and country of residence.

Submit Identification Documents: To comply with anti-money laundering (AML) regulations, Exness will ask you to submit identification documents such as a passport or national ID card and proof of address.

Verify Your Account: After submitting your documents, Exness will verify your identity. This process can take a few hours to a few days, depending on the volume of verification requests.

Deposit Funds: Once your account is verified, you can deposit funds using one of the available payment methods and start trading.

Required Documentation

To open a Pro Account with Exness, you’ll need to provide the following documents:

Proof of Identity: A government-issued document such as a passport, national ID card, or driver’s license.

Proof of Address: A utility bill, bank statement, or government document that clearly shows your name and residential address.

Proof of Payment Method: Depending on the deposit method you choose, Exness may ask for additional verification of your payment method, such as a screenshot of your e-wallet or a bank statement.

These documents are required to ensure compliance with financial regulations and to protect against fraud.

Trading Conditions on Pro Account

Spreads and Commissions

The Pro Account offers some of the most competitive spreads in the industry. Traders can benefit from tight spreads starting from 0.1 pips on major currency pairs, which significantly reduces trading costs. Additionally, commission fees are kept low, making it ideal for traders who execute a high volume of trades.

The combination of low spreads and low commissions means that traders can keep their transaction costs down, improving the profitability of their trades.

Leverage Options

One of the key features of the Exness Pro Account is its high leverage. Traders can access leverage up to 1:2000, which allows them to control larger positions with a smaller amount of capital. While high leverage offers the potential for greater profits, it also increases the risk of substantial losses, so it is essential for traders to use leverage wisely.

Exness also offers flexible leverage options, allowing traders to adjust the leverage on their accounts depending on their risk tolerance and trading strategy.

Available Trading Instruments

Major Currency Pairs

Exness offers a wide range of major currency pairs for trading on the Pro Account, including EUR/USD, GBP/USD, USD/JPY, and AUD/USD. These pairs are the most traded in the forex market and offer tight spreads, high liquidity, and lower volatility, making them popular among both novice and professional traders.

In addition to major pairs, Exness also provides access to minor and exotic currency pairs, allowing traders to diversify their portfolios and take advantage of more market opportunities.

CFDs and Commodities

In addition to forex, Exness Pro Account holders can also trade CFDs (Contracts for Difference) on various financial instruments, including commodities like gold, oil, and natural gas. CFDs allow traders to speculate on the price movements of assets without owning the underlying asset, providing greater flexibility and more trading opportunities.

Exness offers a wide variety of CFDs, including stocks, indices, and commodities, enabling traders to diversify their portfolios and hedge against market risks.

Trading Platforms Supported

MetaTrader 4 vs. MetaTrader 5

Exness supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, two of the most popular platforms in the industry. Both platforms are available for use with the Pro Account, and each offers unique features:

MetaTrader 4 (MT4): MT4 is widely used by traders for its simplicity and ease of use. It offers basic charting tools, expert advisors (EAs), and a user-friendly interface. Many traders prefer MT4 for its stability and reliability.

MetaTrader 5 (MT5): MT5 is a more advanced platform, offering additional features such as more timeframes, advanced charting tools, and the ability to trade a wider range of instruments, including stocks and futures. MT5 is ideal for traders who require more powerful trading tools.

Both platforms offer automated trading, multiple chart views, and the ability to run custom indicators, making them excellent choices for traders using the Pro Account.

Mobile Trading Features

Exness offers mobile trading apps for both MT4 and MT5, allowing traders to manage their trades and monitor the markets on the go. The mobile apps are available for both Android and iOS devices, and they offer many of the same features as the desktop versions of the platforms. Traders can place orders, analyze charts, and check account balances from their mobile devices, providing flexibility and convenience.

Funding and Withdrawal Options

Deposit Methods

Exness offers a wide range of deposit methods to accommodate the diverse needs of its global clientele. These methods include traditional options like bank transfers, as well as more modern, convenient methods such as credit and debit cards (Visa, MasterCard), and popular e-wallets like Skrill, Neteller, and WebMoney. Cryptocurrency deposits are also available for traders who prefer digital currencies.

Deposits are usually processed instantly or within a few hours, depending on the method chosen. Exness does not charge any fees for most deposit methods, although some payment providers may charge their own fees. The availability of multiple deposit options makes it easy for traders to fund their accounts, regardless of their location or preferred payment method.

Withdrawal Process and Fees

Exness strives to provide fast and efficient withdrawal services. Most withdrawals are processed within hours, depending on the payment method used. Clients can withdraw funds using the same methods they used to deposit, ensuring a seamless process. The withdrawal process is straightforward and can be done directly from the client's Exness account dashboard.

In terms of fees, Exness does not charge withdrawal fees for most methods. However, some payment processors may impose their own fees, particularly for international bank transfers or certain e-wallet transactions. Clients should always check the specific terms and conditions related to their chosen withdrawal method to ensure they are aware of any additional fees.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Customer Support Services

Availability and Response Times

Exness provides 24/7 customer support to its users, ensuring that traders have access to assistance whenever needed. The support team is available through multiple channels, including live chat, email, and phone. The response time is typically fast, with live chat being the most immediate option for resolving urgent inquiries. Exness is committed to providing timely and professional assistance to traders, addressing any concerns related to account management, technical issues, or trading inquiries.

Many users report that Exness’s customer service is responsive and knowledgeable. Support agents are trained to handle various queries, from basic account issues to more complex technical problems. The ability to reach support at any time of day or night, combined with fast response times, ensures that traders can quickly get the help they need, regardless of time zone.

Contact Methods

Exness offers several contact methods to suit the preferences of its global client base. Traders can reach the support team via live chat, which is available directly on the Exness website and provides real-time communication with support agents. Additionally, clients can contact Exness via email for less urgent matters or if they prefer a written response. For traders who prefer to speak directly with a support representative, Exness also offers phone support.

Exness also provides social media support through channels like Facebook and Twitter, allowing clients to engage with the company and receive assistance via these platforms. The company’s multilingual support team ensures that traders from different regions can communicate in their native language, making customer support accessible to a wide audience.

Security Measures in Place

Data Protection Protocols

Exness takes the security of its clients' personal and financial information seriously. The company uses advanced encryption technologies, such as SSL (Secure Socket Layer) protocols, to protect sensitive data during transmission. This ensures that all data exchanged between the client’s device and Exness servers remains private and secure.

In addition to encryption, Exness follows strict security standards to prevent unauthorized access to client information. The company complies with regulatory data protection requirements, ensuring that clients' privacy is maintained at all times. These protocols are designed to provide peace of mind to traders, knowing that their data is safeguarded against potential threats.

Fund Segregation Practices

Exness also implements strict fund segregation practices to ensure the protection of clients' funds. Client funds are held in separate accounts from Exness's own operating funds, as required by financial regulators. This means that, in the unlikely event of the company facing financial difficulties, client funds are protected and cannot be used to cover the company’s liabilities.

Segregating client funds is an essential measure to ensure that traders’ capital is safe and remains accessible, regardless of the company’s financial situation. By adhering to these best practices, Exness ensures that traders can have confidence in the safety of their funds when using the platform.

Pros and Cons of Exness Pro Account

Advantages for Traders

The Exness Pro Account offers several key advantages that make it an appealing choice for experienced traders. One of the main benefits is the tight spreads, which can significantly reduce trading costs and improve the overall profitability of trades. The high leverage available on the Pro Account, up to 1:2000, provides traders with the ability to maximize their potential profits from relatively small market movements.

Additionally, the Pro Account offers low commission fees, which is beneficial for traders who execute a high volume of trades. The account also provides access to advanced trading tools, such as professional charting and market analysis, which are essential for traders looking to execute more sophisticated strategies. The fast execution speeds offered by the Pro Account further improve the trading experience, allowing traders to enter and exit trades swiftly without experiencing significant slippage.

Limitations and Drawbacks

While the Exness Pro Account offers many benefits, it does come with certain limitations. One potential drawback is the high leverage it provides, which, while it can amplify profits, also significantly increases the risk of losses. Traders must exercise caution and implement sound risk management strategies when using high leverage.

Another limitation of the Pro Account is the higher minimum deposit requirement compared to other account types offered by Exness. This may make the Pro Account less accessible to beginner traders or those with limited capital. Additionally, the account is designed for more experienced traders, meaning that beginners may find the advanced features and tools overwhelming.

User Experience and Reviews

Customer Feedback Highlights

Feedback from Exness Pro Account users is generally positive, with many traders praising the competitive spreads and high leverage offered by the account. Traders also appreciate the advanced tools and fast execution speeds, which contribute to a smoother and more efficient trading experience. Many users have reported that the Pro Account allows them to trade with confidence, knowing they have access to the best conditions for their strategies.

On the downside, some traders have mentioned that the high minimum deposit required for the Pro Account can be a barrier for beginners or those with smaller trading capital. However, for professional traders who are looking for high-level trading features, the benefits of the Pro Account outweigh the drawbacks.

Expert Opinions

Industry experts also recognize the Exness Pro Account as a solid choice for experienced traders. Many experts highlight the tight spreads and low commissions as standout features that make it an attractive option for high-frequency traders. Additionally, the high leverage and access to advanced trading tools are often praised as key advantages for professional traders who require precision and flexibility in their strategies.

Some experts caution that while the Pro Account offers excellent trading conditions, it is best suited for those who are experienced and can handle the risks associated with high leverage. Overall, the Pro Account is recommended for traders who need a reliable and feature-rich platform to execute advanced strategies.

Educational Resources Available

Webinars and Tutorials

Exness provides a variety of educational resources to help traders improve their skills and gain a deeper understanding of the markets. One of the most popular offerings is the range of webinars and tutorials available to clients. These live and recorded sessions cover a variety of topics, from basic trading concepts to advanced strategies. Webinars are conducted by professional traders and market analysts, providing valuable insights that can help traders at all experience levels.

The tutorials offered by Exness are designed to help traders get the most out of their trading accounts. These resources are available in multiple languages, making them accessible to traders from different regions. Whether you are a beginner looking to learn the basics or an experienced trader aiming to refine your strategies, Exness’s educational content is a valuable tool for enhancing your trading knowledge.

Market Analysis Tools

In addition to webinars and tutorials, Exness provides access to market analysis tools, which are particularly valuable for Pro Account holders. These tools include real-time market data, economic calendars, and advanced charting features, which help traders stay informed about market trends and events that may affect their trades.

The market analysis tools offered by Exness are designed to complement the advanced features available on the Pro Account, providing traders with all the resources they need to make informed decisions and execute successful trading strategies.

Conclusion

The Exness Pro Account offers a range of advanced features that make it an excellent choice for experienced traders. With competitive spreads, high leverage, and access to professional-grade tools, the Pro Account provides the conditions needed for successful trading. Although the high leverage and higher minimum deposit may not suit every trader, the benefits far outweigh the limitations for those with the experience to manage the risks.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Overall, Exness stands out as a reputable and reliable broker, with its Pro Account being particularly suitable for traders looking for low trading costs, advanced tools, and fast execution speeds. If you’re an experienced trader ready to take your trading to the next level, the Exness Pro Account is a strong option to consider.

Read more: