14 minute read

Exness Standard vs Pro Account: A Detailed Comparison

Introduction to Exness

Overview of Exness as a Brokerage

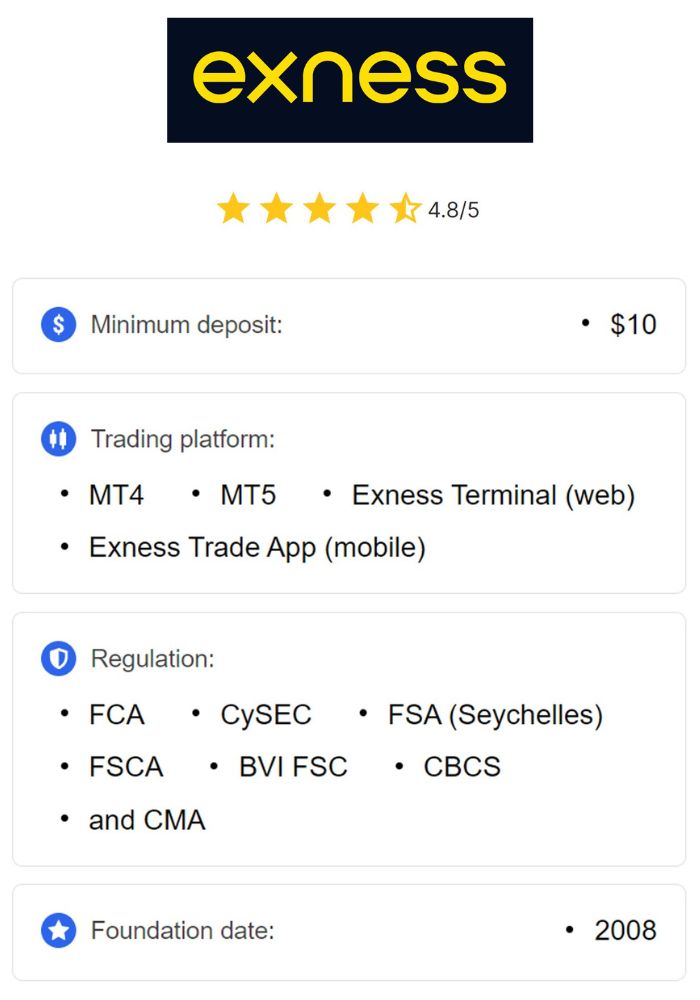

Exness is a globally recognized trading platform that offers access to various financial markets, including forex, cryptocurrencies, commodities, and indices. Founded in 2008, Exness has become one of the preferred brokers for both beginner and experienced traders due to its transparent fee structure, competitive spreads, and advanced trading tools. Exness caters to millions of clients worldwide and provides a user-friendly experience across different account types and platforms, making it accessible to a diverse range of traders. With offerings in multiple languages and support for various currencies, Exness ensures that users can trade comfortably and effectively regardless of their location.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Regulatory Compliance and Safety of Funds

Exness operates under the strict supervision of multiple reputable regulatory authorities, such as the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). This high level of regulation guarantees that Exness adheres to global trading standards, ensuring a secure trading environment for its clients. Exness maintains client funds in segregated accounts and implements negative balance protection, so traders never lose more than their deposited amount. By prioritizing security and transparency, Exness reassures traders that their investments are protected in accordance with international financial regulations.

Understanding Account Types

What is a Standard Account?

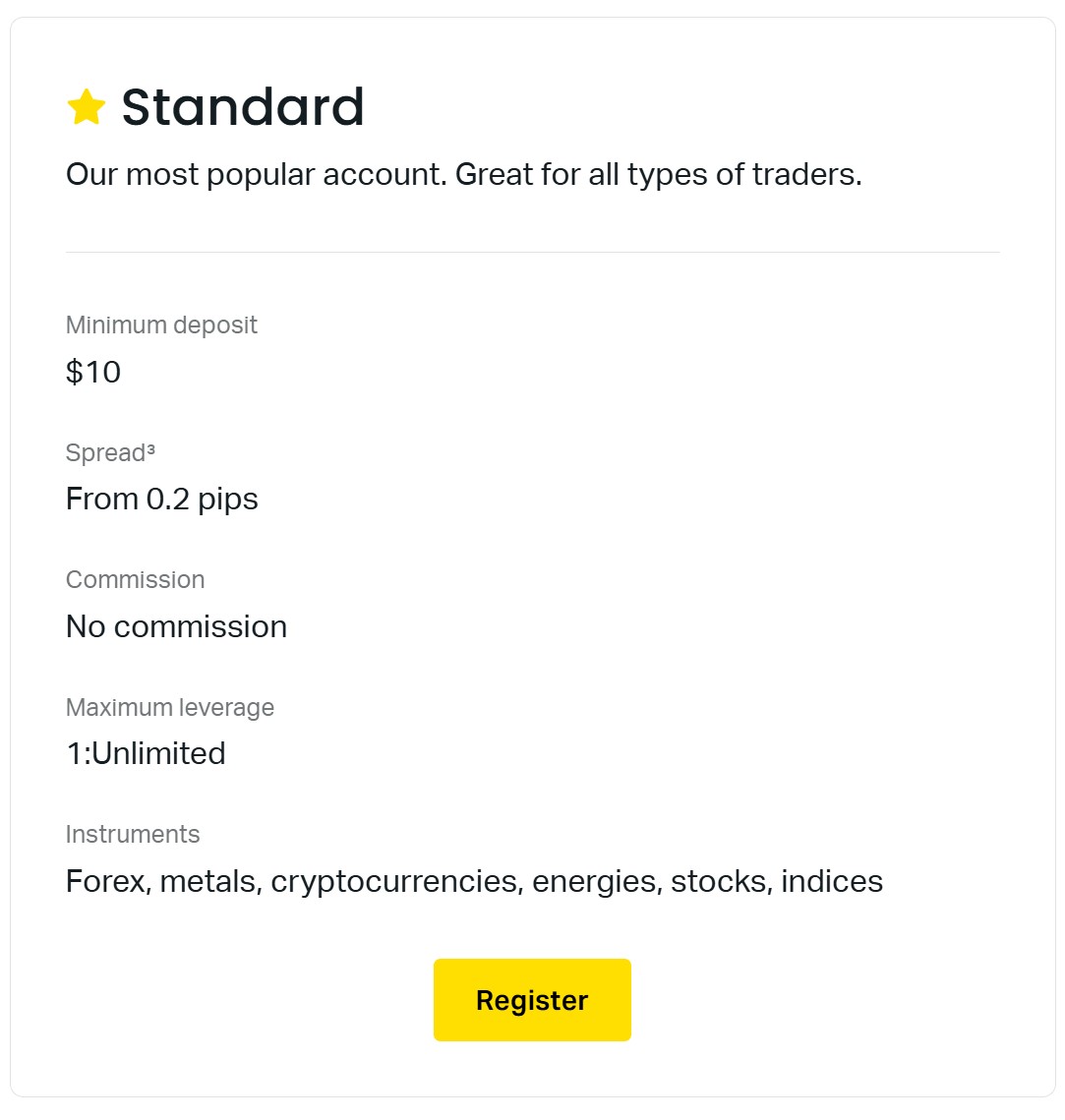

The Exness Standard account is designed to meet the needs of beginner traders and those looking for a low-cost entry into forex trading. It provides a straightforward, commission-free trading experience with slightly wider spreads. The Standard account requires no minimum deposit, allowing users to start trading with any amount they’re comfortable with. This account type also includes access to essential trading instruments, making it ideal for those who want to familiarize themselves with forex trading before committing significant funds.

What is a Pro Account?

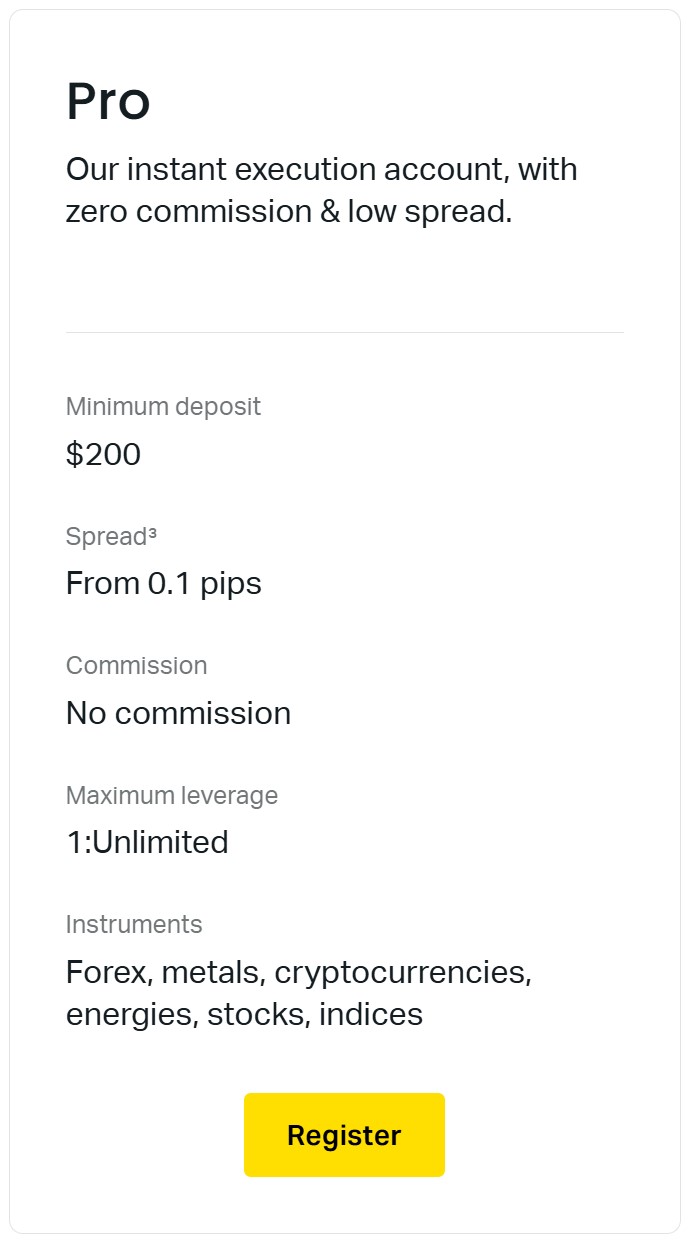

The Exness Pro account caters to more experienced traders who prioritize lower spreads and require advanced trading features. This account type offers narrower spreads than the Standard account and is well-suited for high-frequency and high-volume trading. Although the Pro account requires a minimum deposit, it provides access to advanced trading tools, faster execution speeds, and more competitive spreads. For traders who are comfortable with a higher capital commitment and seek a professional-grade trading experience, the Pro account is an excellent choice.

Key Features of the Exness Standard Account

Spreads and Commissions

The Standard account operates on a variable spread model with no additional commission charges. Spreads are slightly wider compared to the Pro account, which may affect the cost-efficiency of high-frequency trades. However, the absence of commissions makes the Standard account ideal for traders who want to avoid hidden fees and keep their trading costs manageable. With a straightforward pricing structure, users can easily calculate their potential profits and losses without factoring in commission fees.

Leverage Options

Exness offers high leverage on the Standard account, with leverage reaching up to 1:2000 for certain assets. This high leverage provides traders with increased market exposure, allowing them to control larger positions with relatively smaller capital. While high leverage can amplify profits, it also increases risk, so traders should use leverage responsibly and consider their risk tolerance. The flexibility of leverage in the Standard account is particularly advantageous for traders with smaller capital who wish to maximize their potential returns.

Minimum Deposit Requirements

One of the standout features of the Standard account is that it has no minimum deposit requirement. This makes it accessible for traders of all financial backgrounds, allowing them to start with any amount they feel comfortable investing. The no-minimum policy is especially beneficial for beginners who want to test the platform without committing significant funds upfront. This flexibility helps traders gain experience and gradually increase their capital as they build confidence in their trading abilities.

1️⃣ Open Exness Standard MT4 Account

2️⃣ Open Exness Standard MT5 Account

Trading Instruments Available

The Standard account provides access to a wide array of trading instruments, including major forex pairs, commodities, indices, and cryptocurrencies. This diverse selection allows traders to build a varied portfolio and explore different markets, enhancing their trading experience. For beginners and casual traders, the range of instruments offered in the Standard account is more than sufficient to experiment with various trading strategies and identify their preferences.

Key Features of the Exness Pro Account

Spreads and Commissions

The Pro account offers tighter spreads, particularly on major forex pairs, making it more cost-effective for high-volume and professional traders. Although it may involve small commissions on certain trades, the lower spreads can lead to substantial cost savings over time. This pricing structure is beneficial for traders who execute multiple trades daily, as even small reductions in spread can add up to significant savings. The Pro account’s competitive spreads make it appealing to traders who prioritize precision and lower trading costs.

Leverage Options

Like the Standard account, the Pro account offers high leverage of up to 1:2000, giving experienced traders the ability to control larger positions with a relatively modest capital investment. However, with greater leverage comes increased responsibility, as it can magnify both gains and losses. The leverage flexibility allows Pro account users to implement various trading strategies, but it requires disciplined risk management to prevent significant losses.

Minimum Deposit Requirements

The Pro account has a minimum deposit requirement of $200, which may vary depending on the region or chosen currency. While this may be a higher entry barrier than the Standard account, it is a manageable amount for most serious traders seeking a professional-grade trading environment. The minimum deposit requirement ensures that traders have enough funds to take advantage of the account’s advanced features, which are designed for more experienced users.

3️⃣ Open Exness Pro MT4 Account

4️⃣ Open Exness Pro MT5 Account

Trading Instruments Available

Pro account users have access to an extensive range of trading instruments, including additional forex pairs and commodities. This broader selection enables advanced traders to diversify their portfolios further and experiment with various market sectors. The expanded range of instruments available to Pro account holders is tailored to meet the needs of professional traders looking for specialized assets and greater flexibility in building their trading strategies.

Trading Platforms Offered by Exness

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is widely popular for its user-friendly interface, advanced charting tools, and support for automated trading via Expert Advisors (EAs). Both Standard vs Pro accounts are compatible with MT4, enabling traders to perform technical analysis, execute trades efficiently, and manage their positions. MT4’s customizable features make it suitable for traders of all experience levels, allowing them to personalize their trading environment.

MetaTrader 5 (MT5)

MetaTrader 5 (MT5) builds on MT4’s capabilities, offering additional features such as more timeframes, expanded charting options, and an economic calendar integrated within the platform. MT5 also supports a wider range of order types and enhanced analytical tools, making it ideal for professional traders using Exness Pro accounts. The availability of MT5 allows users to take advantage of advanced functionalities for a more comprehensive trading experience.

Exness Proprietary Platform

In addition to MT4 and MT5, Exness offers its proprietary trading platform, designed for simplicity and ease of use. Available on both web and mobile, the Exness platform is perfect for traders who prefer a streamlined, intuitive interface. It provides essential tools for effective trading, making it a convenient choice for both Standard vs Pro account holders who want quick access to their accounts without sacrificing core features.

Comparing Spreads and Commissions

Spread Differences between Standard vs Pro Accounts

The Standard account has variable spreads, which are generally wider than those available in the Pro account. Pro account spreads are more competitive, especially for major forex pairs like EUR/USD, reducing the overall cost for high-frequency traders. Choosing between these accounts depends on individual trading needs; the Pro account’s tighter spreads benefit traders prioritizing precision, while the Standard account’s commission-free structure appeals to those who want simplicity.

Commission Structure Analysis

Exness operates a commission-free model for the Standard account, while the Pro account may include minimal commission charges on high-value trades. Although the Pro account’s lower spreads offset these commissions, traders should consider their trading volume and style when selecting an account. High-frequency traders who prioritize tighter spreads may find the Pro account more cost-effective, whereas casual traders might prefer the commission-free Standard account.

Understanding Leverage in Trading

Leverage for Standard Account Users

Standard account users can access leverage of up to 1:2000, offering significant exposure to market movements. This high leverage can enhance profit potential but requires disciplined risk management due to the amplified impact of price changes. Traders new to leverage should start with lower levels and gradually increase as they gain experience, balancing profit potential with manageable risk.

Leverage for Pro Account Users

The Pro account offers the same leverage level as the Standard account, up to 1:2000, allowing experienced traders to take full advantage of high-leverage opportunities. Pro account holders who understand leverage mechanics and are skilled at managing margin requirements can use this feature to maximize returns. However, Pro account users should remain mindful of the risks and apply prudent leverage to protect their capital.

Account Management and Support Services

Customer Support for Standard Account Holders

Exness provides 24/7 customer support for Standard account users through live chat, email, and phone. The platform also offers a comprehensive FAQ section and educational resources, enabling traders to troubleshoot common issues independently. Exness’s dedicated support for Standard account holders ensures that beginners have access to the assistance they need as they learn the platform.

Customer Support for Pro Account Holders

In addition to general support, Pro account holders may have access to specialized account managers who offer personalized assistance and insights. This enhanced support service is beneficial for experienced traders managing large positions or dealing with complex trading inquiries. Exness’s priority support for Pro users helps them stay focused on their trading activities with quick and effective resolutions to their concerns.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Withdrawal and Deposit Methods

Payment Methods for Standard Accounts

Exness offers a variety of deposit and withdrawal options for Standard account holders, ensuring flexibility and convenience. Traders can fund their accounts through credit/debit cards, bank transfers, and popular e-wallets like Skrill, Neteller, and Perfect Money. Exness also supports regional payment methods, making it easier for traders in different countries to transact. Most deposits are instant, and Exness generally does not charge fees for these transactions. However, some payment providers may apply their own charges, so traders should be aware of any fees that may apply depending on the chosen payment method.

Payment Methods for Pro Accounts

Similar to the Standard account, the Pro account offers the same comprehensive range of payment methods, including bank transfers, credit/debit cards, and e-wallets. Pro account holders benefit from the same fee-free structure, allowing them to deposit and withdraw funds without incurring additional charges from Exness. For Pro users, transactions may also be prioritized, which means faster processing times, particularly for withdrawals. This ensures that high-volume traders can manage their funds efficiently and access their earnings without delay.

Processing Times for Withdrawals

Exness aims to process withdrawal requests promptly, with most withdrawals from both Standard vs Pro accounts completed within a few hours. E-wallet withdrawals are typically instant, while credit/debit card and bank transfer withdrawals may take longer, depending on the bank’s processing time. Exness does not impose withdrawal limits, but minimum withdrawal amounts vary based on the payment method. Pro account holders may experience slightly faster processing times, particularly for larger amounts, as Exness prioritizes high-value clients.

Currency Conversion Fees

For traders who deposit or withdraw in a currency other than their account’s base currency, currency conversion fees may apply. Exness strives to offer competitive conversion rates, but traders should monitor exchange rates closely to minimize costs. Using a payment method that matches the account’s base currency can help reduce currency conversion expenses. Exness also provides real-time currency rate information within the platform, allowing traders to stay informed about any potential fees or rate fluctuations during transactions.

User Experience and Feedback

Reviews from Standard Account Traders

Standard account users often commend Exness for its accessibility, user-friendly interface, and commission-free trading. The lack of a minimum deposit requirement allows new traders to test the platform and begin trading without a significant financial commitment. Many users appreciate the responsive customer support, which helps them navigate the platform, especially when they encounter issues as beginners. While some users have noted wider spreads compared to the Pro account, they often view the simplicity of a commission-free model as a fair trade-off for the higher spread structure.

Reviews from Pro Account Traders

Pro account traders typically highlight the tighter spreads and faster execution times as significant advantages. For experienced traders, the lower spreads make the Pro account more cost-effective, especially for high-frequency trading. Pro account holders also appreciate the advanced tools available to them, allowing for more sophisticated analysis and strategy implementation. Many Pro account users find Exness’s support for high-volume trading beneficial, as it provides an optimized environment for active and professional traders. However, some traders mention the minimum deposit requirement as a minor drawback, although they generally agree that the account’s benefits justify the initial investment.

Pros and Cons of Exness Standard Account

Advantages of Using the Standard Account

No Minimum Deposit: The lack of a minimum deposit requirement makes the Standard account accessible to beginners and traders with limited funds.

Commission-Free Trading: Standard account holders do not incur commission charges, simplifying cost calculations and providing a transparent fee structure.

Wide Range of Trading Instruments: The Standard account includes access to forex pairs, commodities, indices, and cryptocurrencies, offering diverse investment options for traders.

User-Friendly Platform: Exness’s interface for the Standard account is intuitive and easy to navigate, making it ideal for beginners who are just starting in forex trading.

Disadvantages of Using the Standard Account

Higher Spreads: The Standard account generally has wider spreads compared to the Pro account, which can increase trading costs, especially for high-frequency traders.

Limited Advanced Features: While the Standard account offers essential trading tools, it lacks some advanced features and analytics that experienced traders might find necessary.

Pros and Cons of Exness Pro Account

Advantages of Using the Pro Account

Lower Spreads: The Pro account provides tighter spreads, which can lead to lower trading costs, particularly for those trading in high volumes or engaging in scalping strategies.

Access to Advanced Tools: Pro account holders benefit from advanced analytical tools and features that support in-depth market analysis, allowing for more sophisticated trading strategies.

Faster Execution Speeds: The Pro account offers faster execution, making it suitable for professional traders who require timely order placement for optimal performance.

Priority Customer Support: Pro users may have access to dedicated account managers and priority support, which ensures quick assistance when handling complex trading issues or larger transactions.

Disadvantages of Using the Pro Account

Minimum Deposit Requirement: The Pro account requires a minimum deposit, which may deter some traders, particularly those who are not ready to invest a larger amount upfront.

Potential Commission Fees: Although spreads are lower, some high-value trades may involve nominal commission fees, which should be considered by traders calculating their overall costs.

Which Account is Right for You?

Considerations for Beginners

The Standard account is generally more suitable for beginners who are new to forex trading or have limited trading capital. With no minimum deposit and a commission-free structure, it offers a risk-managed way to enter the forex market. Beginners can benefit from Exness’s educational resources, low entry barriers, and wide selection of trading instruments, allowing them to build experience without a significant financial commitment. The user-friendly platform and customer support also help new traders feel more confident as they learn the basics of trading.

Considerations for Experienced Traders

For experienced traders who require tighter spreads, faster execution speeds, and access to advanced analytical tools, the Pro account is a better choice. The lower spreads make it more cost-effective for high-frequency and large-volume trades, while the enhanced support services offer peace of mind for professionals managing substantial funds. Traders who are comfortable with the minimum deposit requirement and are ready to take advantage of the Pro account’s premium features will find it a valuable option that aligns with their trading goals.

Conclusion

Choosing between the Exness Standard vs Pro accounts ultimately depends on your trading experience, goals, and financial resources. The Standard account provides a simple, low-cost entry point suitable for beginners, while the Pro account offers a more tailored experience for seasoned traders seeking lower spreads, advanced tools, and priority support. Both accounts are backed by Exness’s commitment to security, customer service, and diverse trading options, ensuring that traders can enjoy a reliable and versatile trading experience regardless of the account they choose.

Read more: