14 minute read

Exness Raw Spread vs Zero Account Review

Exness Raw Spread vs Zero Account Review is an essential guide for traders looking to understand the core differences between these two account types offered by Exness, a well-recognized broker in the trading arena. Both account types serve distinct trading strategies and market needs, making it crucial for traders to comprehend their features, advantages, and limitations. This review aims to provide a deep dive into each account, helping you make an informed choice that aligns with your trading style.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

When choosing a broker, it's vital to select a platform that supports your trading ambitions seamlessly. Exness has emerged as a reputable name in the Forex landscape, known for its wide range of offerings and robust trading infrastructure.

Overview of Exness as a Broker

Exness was founded in 2008 and has since built a solid reputation in the online trading sector. The company offers various financial instruments, including forex, commodities, and cryptocurrencies, catering to both beginners and seasoned traders. Its commitment to transparency, innovative technology, and user-friendly platforms sets it apart from many other brokers in the market.

Exness operates under multiple jurisdictions, ensuring compliance with regulatory standards in different regions. This not only enhances the trustworthiness of the brokerage but also reassures clients regarding the safety of their funds.

Key Features and Advantages

Exness offers several key features that make it appealing to traders:

Variety of Accounts: From raw spread accounts to zero accounts, traders can choose what best suits their trading needs.

Competitive Spreads: Exness provides some of the most competitive spreads in the industry, which can be advantageous for scalpers and day traders.

Flexible Leverage: Traders benefit from flexible leverage options, allowing them to enhance their trading capacity while managing risk effectively.

Advanced Trading Platforms: Exness supports popular trading platforms like MetaTrader 4 and MetaTrader 5, providing advanced tools for technical analysis and automated trading.

Overall, Exness stands out as a broker that prioritizes trader satisfaction by offering numerous features designed to enhance trading performance.

Understanding Raw Spread Account

In the trading world, understanding account types is crucial because they significantly affect trading outcomes. The Raw Spread Account is one such type that caters to specific trading preferences.

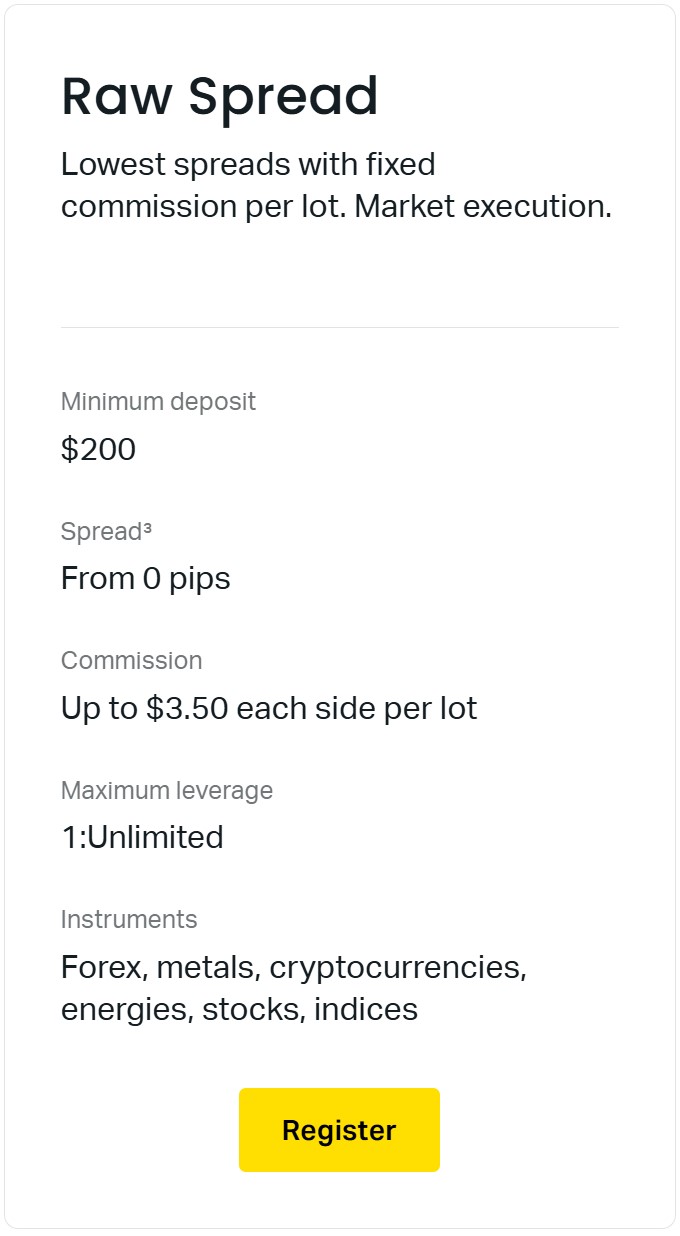

Definition of Raw Spread Account

A Raw Spread Account typically offers traders access to the underlying market spreads from liquidity providers without any markup. This means that the spreads are often narrower compared to standard accounts, providing lucrative opportunities for experienced traders who employ strategies like scalping or high-frequency trading.

The absence of additional costs on spreads allows traders to enter and exit positions more efficiently, maximizing potential profit margins. However, it’s pivotal to note that while the spreads may be tighter, there are commissions per trade that must be considered.

Key Characteristics of Raw Spread Accounts

Raw Spread Accounts have distinct characteristics that define their appeal. Primarily, traders benefit from direct market access that reflects real market conditions.

The account also usually features variable spreads, which fluctuate according to market demand and supply. This variability can lead to lower costs during times of high liquidity yet higher costs during low activity periods.

Moreover, Raw Spread Accounts are ideal for algorithmic and high-volume traders, as they demand rapid execution speeds and minimal slippage.

Pros and Cons of Raw Spread Accounts

Like any financial product, Raw Spread Accounts come with advantages and disadvantages.

On the positive side, the main advantage is the ability to trade at market prices with minimal markup. This can significantly reduce the cost of trading for those who are executing a large number of trades. Additionally, the ease of accessing liquidity can enhance trading efficiency.

Conversely, one downside is the commission structure, which could deter traders who prefer all-inclusive pricing models. Additionally, the fluctuating spreads may lead to increased costs during volatile market conditions, potentially impacting profitability.

1️⃣ Open Exness Raw Spread MT4 Account

2️⃣ Open Exness Raw Spread MT5 Account

Understanding Zero Account

In contrast to the Raw Spread Account, the Zero Account offers a different approach to trading costs and execution.

Definition of Zero Account

The Zero Account refers to an account type that features no spreads; instead, traders pay a commission on trades. This account is designed to attract traders who prefer predictable costs associated with their trades rather than dealing with varying spreads.

This model is particularly appealing during volatile market conditions when spreads might widen unexpectedly. The predictability of commissions allows for better planning and budgeting of trading expenses.

Key Characteristics of Zero Accounts

Zero Accounts possess distinctive characteristics that cater to different trading styles. Notably, they generally feature fixed commission fees that remain constant regardless of market conditions, allowing for clearer cost management.

Additionally, traders can expect fast execution times, similar to Raw Spread Accounts, promoting efficiency in fulfilling trading orders quickly. Moreover, Zero Accounts usually support a range of trading strategies, including scalping and hedging, thereby appealing to a diverse audience of traders.

Pros and Cons of Zero Accounts

Evaluating the pros and cons of Zero Accounts provides insight into their suitability for various traders.

On the upside, the lack of spreads means that traders can engage in cost-effective trading, especially in stable market conditions. Fixed commissions add much-needed transparency around costs, enabling traders to calculate expenses accurately before executing trades.

However, the commission charges can offset the initial savings related to the absence of spreads, particularly for traders with smaller account sizes or those who execute fewer trades. Therefore, understanding one's trading frequency is essential when considering this account type.

3️⃣ Open Exness Zero MT4 Account

4️⃣ Open Exness Zero MT5 Account

Trading Conditions Comparison

Both the Raw Spread vs Zero accounts offer unique trading conditions that suit different trader profiles and strategies. A careful comparison helps in identifying the most appropriate option.

Spreads and Commissions

In comparing spreads and commissions, Raw Spread Accounts offer variable spreads directly derived from market conditions, with commissions added on top. This dynamic creates opportunities for traders during liquid market hours, where narrower spreads can be capitalized upon.

On the other hand, Zero Accounts operate on a commission-based model, eliminating spreads altogether. Though this condition provides greater cost predictability, the commission structure must be carefully assessed, as it can impact overall profitability, especially if trades accumulate rapidly.

Leverage Options

Leverage is another crucial aspect where these accounts differ. Generally, Exness provides flexible leverage across both account types, allowing traders to gear their positions according to their risk appetite. While higher leverage can amplify profits, it equally increases risk exposure, necessitating effective risk management strategies.

Minimum Deposit Requirements

Minimum deposit requirements can also influence decisions between account types. Typically, both account types at Exness require a relatively low minimum deposit, making them accessible to both beginner and advanced traders. Nonetheless, confirming the exact requirements before proceeding is advisable to ensure they align with individual investment strategies.

Execution Speed and Order Types

Execution speed and available order types play significant roles in determining how effective a trading strategy will be.

Market Execution Explained

Market execution is a feature supported by both account types, emphasizing the need for rapid order fulfillment at the current market price. This type of execution is crucial for strategies like scalping, where every second counts.

Swift execution minimizes slippage, giving traders the confidence that orders will be filled promptly and at expected levels. This reliability can enhance overall trading performance, turning potential profits into tangible results.

Different Order Types Available

Both account types offer a variety of order types that cater to diverse trading strategies. These include market orders, limit orders, and stop-loss orders, among others. Having a range of order types allows traders to express their market views flexibly and adjust their strategies based on current market dynamics.

The flexibility afforded to traders through varied order types can significantly impact their strategies, allowing for more nuanced approaches to market entry and exit.

Impact on Trading Strategy

The execution speed and order types available on both account types directly influence trading strategies. Traders who rely on precise market timing may find the Raw Spread Account more beneficial due to tighter spreads during active market conditions. Conversely, those who favor strategic entries and exits may gravitate towards the stability offered by the Zero Account.

Ultimately, the choice of account should reflect one’s trading strategy, risk tolerance, and long-term goals.

Asset Availability in Both Accounts

An essential aspect of choosing between the Raw Spread vs Zero accounts is the variety of assets available for trading.

Currency Pairs Offered

Both accounts provide access to a broad selection of currency pairs, offering traders ample opportunities to exploit fluctuations in global currency markets. Major pairs, cross-currency pairs, and even exotic currencies are accessible, catering to a diverse range of trading strategies and preferences.

Having a multitude of currency pairs allows traders to diversify their portfolios and mitigate risks associated with concentrated investments in single markets.

Commodities, Indices, and Cryptocurrencies

In addition to forex trading, both account types support a variety of commodities, indices, and cryptocurrencies. These options allow traders to capitalize on different market movements and trends beyond traditional currency trading.

Access to commodities such as gold and crude oil, along with indices representing various global markets, provides traders with substantial diversification in their trading approach. Furthermore, with the rise of cryptocurrencies, having easy access to crypto trading can enhance potential revenue streams for traders willing to navigate this volatile market.

Access to Forex Markets

Both account types seamlessly integrate with major forex markets, allowing traders to respond quickly to volatility and trends. This capability is critical for maximizing opportunities within the constantly evolving forex landscape.

The combination of asset availability and access to diverse markets strengthens the case for traders to explore the various offerings of Exness, finding the best fit for their trading ambitions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Account Management and User Experience

Account management and user experience are paramount when evaluating a broker's offerings. An intuitive interface combined with efficient account handling can greatly influence a trader's performance.

Ease of Opening an Account

Exness has streamlined the account opening process, making it user-friendly and efficient. Traders can easily register online and complete their verification within minutes, allowing them to start trading without unnecessary delays.

A hassle-free account setup process is particularly attractive to new traders who may feel overwhelmed by complex verification systems common in the industry.

Trading Platforms Provided

Exness supports popular trading platforms like MetaTrader 4 and MetaTrader 5, renowned for their functionality and user-friendliness. These platforms come equipped with advanced charting tools, comprehensive indicators, and automated trading capabilities.

The flexibility in platform choice ensures that traders can utilize the tools they are most comfortable with, enhancing their overall trading experience. Further integration of mobile applications enables traders to manage their accounts on-the-go, aligning with modern trading lifestyles.

Customer Support Services

Effective customer support plays a crucial role in a trader's experience. Exness offers 24/7 customer support through various channels, including live chat, email, and phone. This accessibility ensures traders can resolve issues promptly, maintaining confidence in their trading activities.

Proficient customer service enhances the overall trading experience, as it provides reassurance and assistance when needed, leading to higher levels of satisfaction among users.

Risk Management Features

In trading, effective risk management is crucial in safeguarding investments and optimizing returns. Both account types come with various risk management features.

Use of Stop Loss and Take Profit Orders

Stop loss and take profit orders are fundamental tools in a trader's arsenal. These features help limit losses and lock in profits, respectively, ensuring that emotional decision-making does not derail trading strategies.

Traders utilizing Raw Spread vs Zero accounts can comfortably implement these features to maintain strict control over their positions. By setting predefined parameters for exiting trades, traders can minimize risk and enhance their chances of achieving consistent profitability.

Margin Requirements and Calculations

Margin requirements serve as another layer of risk management that traders must consider. Understanding margin calculations across account types helps in determining the extent of leverage used and the amount of capital required for trades.

With both Raw Spread vs Zero accounts typically offering high leverage options, the importance of sound margin management cannot be overstated. Failure to grasp how margin works can lead to margin calls, thus jeopardizing trading positions.

Who Should Choose Raw Spread Account?

When deciding on an account type, identifying the ideal trader profile for each option is essential.

Ideal Trader Profile

Raw Spread Accounts are tailored for active traders who execute multiple trades throughout the day. Scalpers, day traders, and those engaged in high-frequency trading can greatly benefit from the low spreads, as their trading strategies often involve numerous transactions.

Traders who prioritize speed and precision and can monitor market conditions closely are likely to find success in this account type.

Recommended Trading Strategies

Strategies that focus on short-term price movements, such as scalping and arbitrage, align well with the characteristics of Raw Spread Accounts. Being able to enter and exit positions quickly at narrow spreads increases the probability of capturing small price shifts for profit.

Additionally, traders employing algorithmic trading strategies can harness the benefits of lower spreads and swift execution to optimize their trading programs effectively.

Who Should Choose Zero Account?

Conversely, Zero Accounts cater to a different segment of traders.

Ideal Trader Profile

Zero Accounts are ideally suited for traders who prefer a transparent cost structure and are less concerned about minor fluctuations in spreads. Swing traders and those who adopt longer-term positions may find these accounts more fitting, as commissions provide clarity around trading expenses.

Traders who prioritize stability and predictability in their trading costs would benefit more from the Zero Account setup.

Recommended Trading Strategies

Strategies that involve longer holding periods, such as swing trading or positional trading, are more suited to the Zero Account. These approaches often do not require rapid execution, making the fixed commission structure a manageable expense for traders.

Furthermore, risk-averse traders who wish to maintain clearer visibility on costs will appreciate the predictability that comes with Zero Accounts, allowing them to strategize more effectively.

Case Studies: Traders’ Experiences

Understanding real-world experiences can shed light on the practical implications of choosing between Raw Spread vs Zero accounts.

Successful Trades with Raw Spread Account

Traders who utilize the Raw Spread Account often share success stories stemming from the narrower spreads they can exploit. For example, a scalper might execute dozens of trades daily, benefiting from tight spreads during peak market hours.

By leveraging the reduced costs associated with each transaction, these traders can achieve impressive cumulative gains, illustrating how favorable trading conditions can lead to tangible results.

Successful Trades with Zero Account

Conversely, traders using Zero Accounts describe their successes in terms of predictable costs leading to enhanced overall performance. A swing trader may recount how understanding their commission costs allowed for better risk-reward assessments, ultimately bolstering their profitability over time.

The ability to forecast expenses linked to trade executions granted them the insight needed to refine their strategies, demonstrating the value of this account type in catering to methodical trading approaches.

Regulatory Standards and Safety Measures

Choosing a broker entails an understanding of the regulatory environment and the measures taken to protect traders.

Licenses and Regulation of Exness

Exness operates under various licenses globally, adhering to stringent regulatory requirements. This compliance reinforces the broker’s credibility and demonstrates its commitment to maintaining a secure trading environment for its clients.

Traders can rest assured that their funds are held with the utmost integrity, given that regulated brokers must adhere to laws governing fair trading practices and client fund protection.

Security of Funds and Data Protection

Ensuring the security of client funds and data is a priority for Exness. The broker employs advanced encryption technologies and robust security protocols to safeguard sensitive information. They also maintain segregated accounts to ensure client funds are kept separate from the company's operational funds.

By focusing on data protection and secure transactions, Exness builds trust among its clientele, reinforcing its position as a reliable trading partner.

Conclusion

In the quest for optimal trading performance, understanding the nuances between account types is critical. The Exness Raw Spread vs Zero Account Review illustrates how each account caters to different trader profiles, strategies, and preferences.

Whether you're inclined towards the flexibility and lower spreads of the Raw Spread Account or the stability and transparency of the Zero Account, the choice ultimately rests on your trading style and goals. Each option presents its own set of advantages and considerations, guiding you toward a trading approach that aligns with your aspirations. By taking the time to evaluate your needs and reviewing both account types thoroughly, you can embark on your trading journey informed and prepared.

Read more: