15 minute read

Best Exness Account: Exness Account Types Overview Update

The world of online trading is vast, filled with opportunities and challenges. One key factor that can significantly influence a trader's success is the choice of the broker and their account types. In this article, we will delve into the Best Exness Account: Exness Account Types Overview Update, exploring the features, benefits, and suitability of different account types offered by Exness, one of the leading brokers in the industry.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

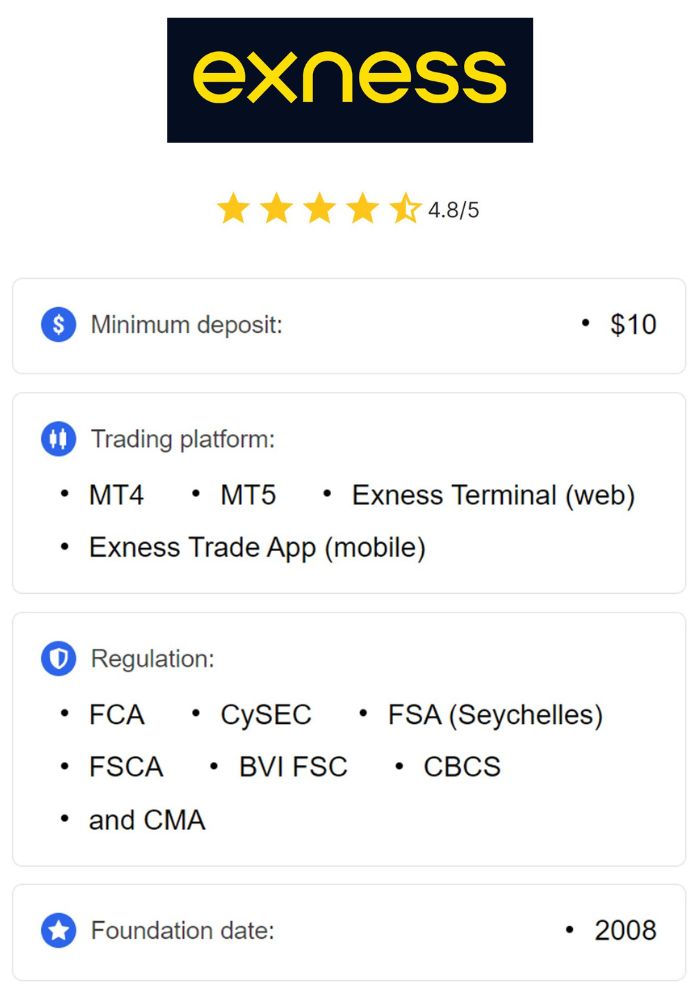

Exness is a well-established online trading platform that has gained popularity among traders worldwide. Founded in 2008, it has maintained a strong reputation for providing exceptional trading services across various financial instruments, including forex, commodities, cryptocurrencies, and indices.

What is Exness?

Exness is not just another trading platform; it's a comprehensive brokerage firm that offers an array of services tailored to suit both novice and experienced traders. It operates under multiple regulatory authorities, which adds a layer of trust and legitimacy to its operations. Exness allows traders to access real-time market data, advanced charting tools, and a wide range of trading instruments, empowering them to make informed trading decisions.

Overview of Exness Services

From the moment a trader registers with Exness, they are greeted with a multitude of services designed to enhance their trading experience. This includes tight spreads, high leverage options, and a variety of account types to choose from, allowing traders to align their trading strategies with the most suitable account features. Additionally, Exness provides educational resources and customer support that caters to the needs of users at all skill levels.

Importance of Choosing the Right Account Type

Choosing the right account type with Exness can be a game-changer for your trading journey. Each account type comes with its unique set of features that can cater to different trading styles and preferences.

Understanding Your Trading Needs

Before diving into the specifics of Exness account types, it's essential for traders to understand their individual trading needs. Are you a beginner looking to experiment with small trades, or a seasoned professional seeking to maximize profits through advanced strategies? The answers to these questions will help guide your decision on which account type to select.

Impact on Trading Strategy

The account type influences various facets of your trading strategy, including risk management, position sizing, and potential profitability. For instance, a standard account might be ideal for beginners who need lower minimum deposits and less complexity in spreads, while more experienced traders may prefer accounts that offer raw spreads for enhanced precision and flexibility in their strategies.

Overview of Exness Account Types

Exness offers several account types tailored to meet the varying needs of traders. Understanding each account type is crucial in making an informed choice.

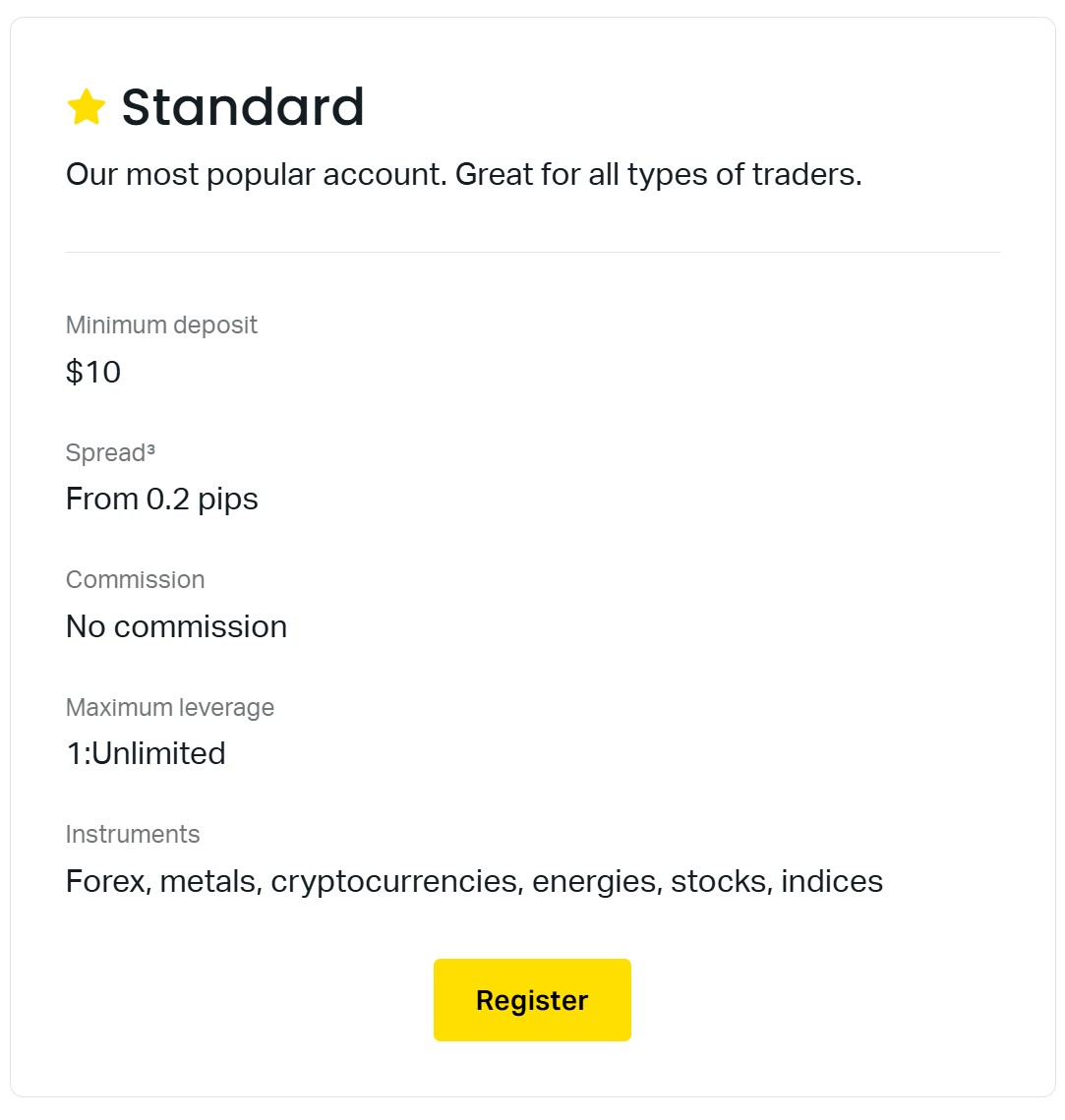

Standard Account

The Standard Account is considered one of the most user-friendly options available, particularly for newcomers to trading. This account type is designed to provide a straightforward trading experience without overwhelming the user with complex features.

With a low minimum deposit requirement and competitive spreads, the Standard Account serves as an excellent entry point for many traders. It also enables access to a plethora of trading instruments, giving users the chance to explore different markets without significant financial risk.

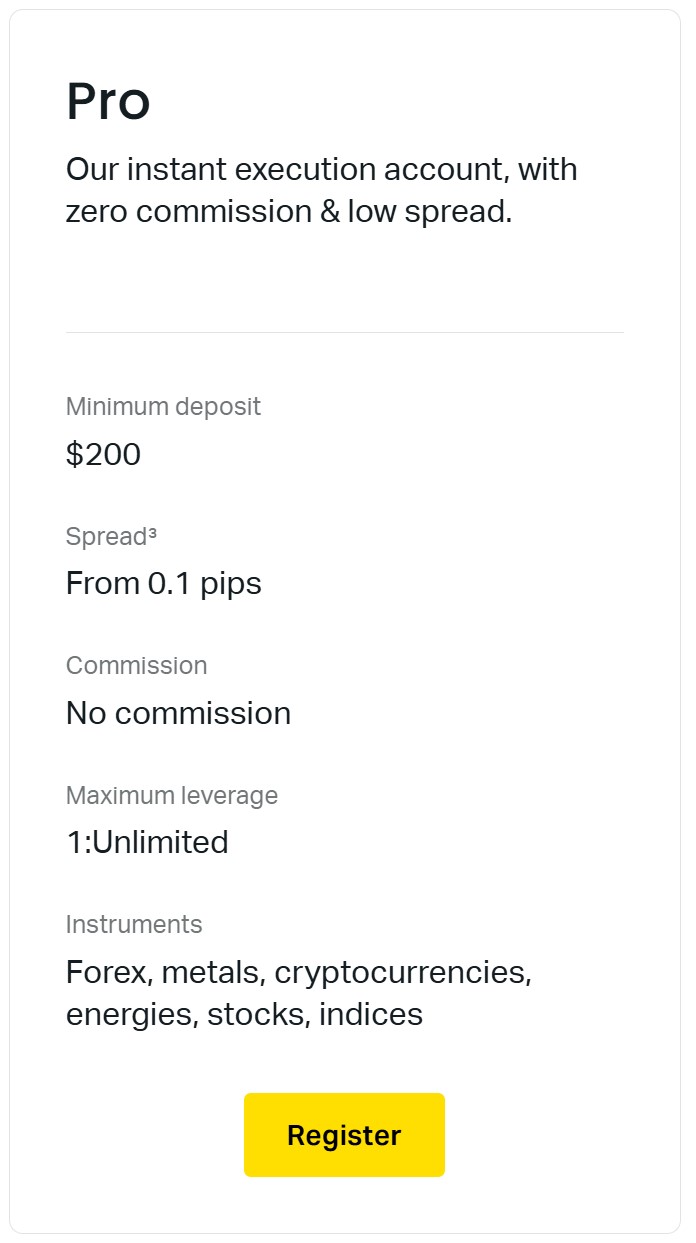

Pro Account

The Pro Account is ideal for traders who have moved beyond the beginner stage and are looking for more sophisticated trading features. This account type typically offers tighter spreads and higher leverage, making it suitable for those employing advanced trading strategies.

Traders subscribing to the Pro Account have the opportunity to engage in deeper market analysis and utilize more complex tools, thus maximizing their potential returns on investment. The Pro Account balances simplicity with opportunities for amplified trading efficiency.

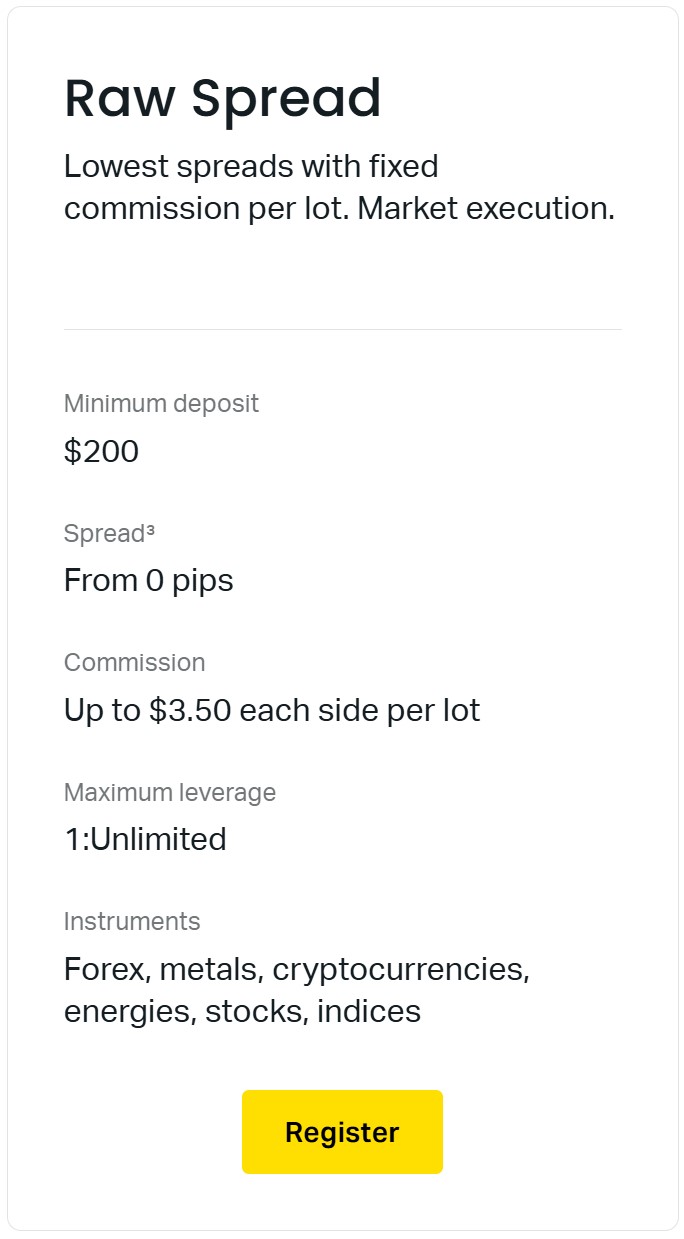

Raw Spread Account

For traders focused on achieving the best possible pricing, the Raw Spread Account is a standout choice. As the name suggests, this account type features raw spreads that allow for minimal trading costs, enabling traders to capitalize on market fluctuations more effectively.

This account type is perfect for liquidity providers and seasoned traders who execute high volumes of trades. The Raw Spread Account empowers users to devise intricate trading strategies based on precise price action rather than broader spread averages.

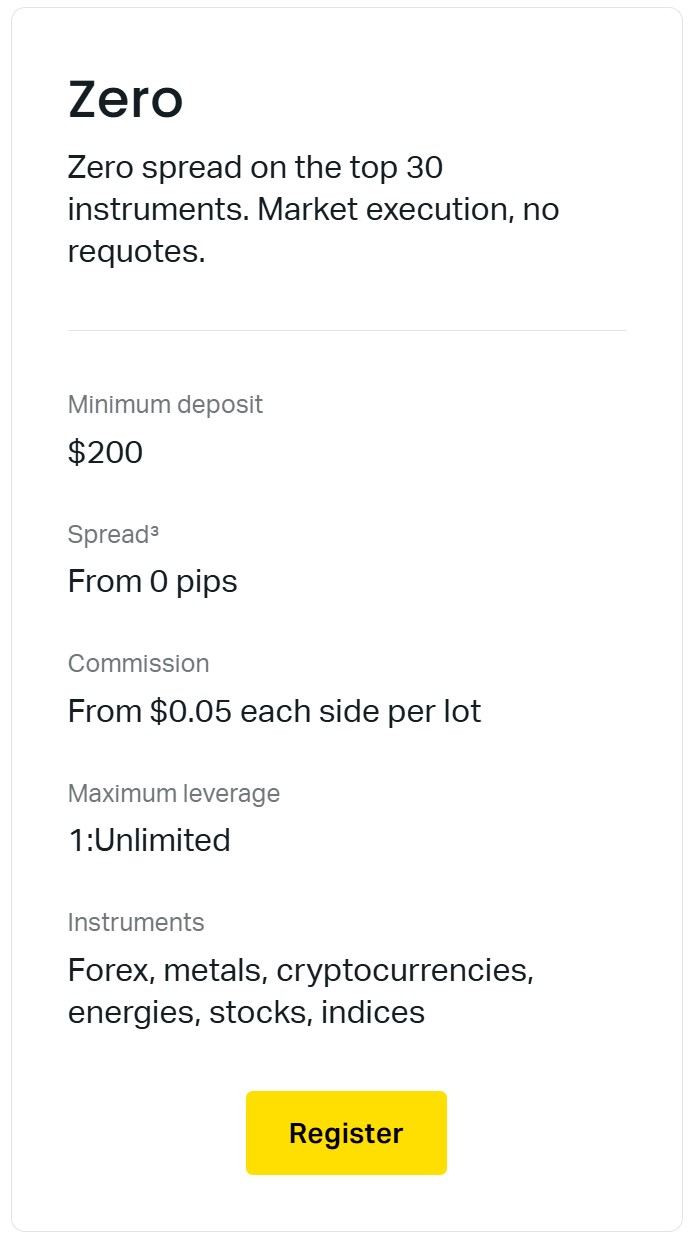

Zero Account

As the name implies, the Zero Account offers zero spreads during certain market conditions, making it one of the most attractive options for active traders. However, this account type does come with a commission per trade, which is something traders must consider when evaluating overall trading costs.

The Zero Account is suitable for scalpers and day traders who require immediate execution of trades and minimal slippage. Its structure encourages frequent trading activity, thus catering to individuals with a fast-paced trading style.

Key Features of Each Account Type

When assessing which Exness account type to choose, it's critical to consider the key features that differentiate them from one another.

Leverage Options

One of the most significant advantages of trading with Exness is the generous leverage options. Depending on the account type, traders can access leverage up to 1:2000.

This means that even with a small amount of capital, traders can control larger positions in the market. While high leverage can amplify profits, it is also essential to manage risk appropriately, as it can lead to substantial losses if not utilized wisely.

Spreads and Commissions

The cost of trading is heavily influenced by the spread and commissions charged by the broker. For instance, the Standard Account typically has wider spreads but no commissions, making it cost-effective for casual traders.

On the other hand, the Raw Spread and Zero Accounts offer tighter spreads but implement commission fees, appealing primarily to high-frequency traders aiming to benefit from minute price movements.

Minimum Deposit Requirements

Minimum deposit requirements vary significantly across Exness account types. The Standard Account usually requires a lower initial deposit, making it accessible for new traders.

In contrast, the Raw Spread and Zero Accounts might necessitate a higher deposit due to their advanced features catering to serious traders. Understanding these requirements helps users plan their trading budget accordingly.

Detailed Analysis of the Standard Account

The Standard Account is often regarded as the most suitable option for new traders venturing into the world of forex and other financial instruments.

Benefits of the Standard Account

One of the primary benefits of the Standard Account is its user-friendly interface, allowing beginners to grasp the basics of trading without being overwhelmed.

Additionally, it typically comes with a lower minimum deposit requirement, enabling traders to open an account with funds they can afford to risk. The absence of commissions on trades allows for a more straightforward understanding of trading costs.

✅ Open Exness Standard MT4 Account

✅ Open Exness Standard MT5 Account

Ideal User Profile

The Standard Account is particularly advantageous for novice traders, hobbyists, or anyone looking to test their strategies in real market conditions without committing large amounts of capital.

It’s perfect for those who want to learn the ropes of trading while still having access to valuable trading tools and a wide array of instruments.

In-Depth Look at the Pro Account

Moving on to the Pro Account, this option is designed for more experienced traders who seek advanced features and flexibility in their trading approach.

Advantages for Professional Traders

The Pro Account delivers numerous advantages that resonate with professional traders. Tight spreads and low latency help optimize trading performance, allowing for quick executions and better profit margins.

Moreover, the ability to use high leverage gives traders the potential to magnify their earnings while maintaining a manageable risk profile. The Pro Account is particularly effective for those employing scalping and day-trading strategies, where precision is paramount.

Comparison with Other Accounts

When comparing the Pro Account with the Standard Account, it's evident that the Pro Account offers additional layers of sophistication suited for a more experienced audience.

While the Standard Account provides a great introduction, the Pro Account builds on that foundation by offering tighter spreads and higher leverage options, making it a next step for those ready to tackle more complex trading environments.

Exploring the Raw Spread Account

The Raw Spread Account presents unique opportunities for traders focused on achieving the best price execution.

Unique Selling Points

A standout feature of the Raw Spread Account is undoubtedly its ultra-tight spreads, which appeal to traders looking to maximize their profitability on small market movements.

By providing traders with direct access to interbank prices, the Raw Spread Account ensures low trading costs, making it ideal for professionals who employ high-volume trading strategies.

✅ Open Exness Raw Spread MT4 Account

✅ Open Exness Raw Spread MT5 Account

Who Should Consider This Account?

The Raw Spread Account is particularly suited for seasoned traders and institutional investors who prioritize price accuracy over simplified trading experiences.

Those who engage in algorithmic trading or high-frequency trading may benefit significantly from the premium features this account offers, facilitating their complex strategies.

Comprehensive Guide to the Zero Account

The Zero Account stands out as an option that appeals to active traders seeking to capitalize on rapid market movements.

Specific Market Conditions

The Zero Account achieves its zero-spread nature during specific market conditions, making it incredibly beneficial for traders who thrive in volatile markets. This account type allows for quicker entries and exits, minimizing the impact of spreads on profitable trades.

However, it is important to note that while it offers zero spreads, there is a commission per trade that traders should factor into their overall cost calculations.

✅ Open Exness Zero MT4 Account

✅ Open Exness Zero MT5 Account

Usage Scenarios

Scalpers and day traders will find the Zero Account particularly attractive, given its structure that promotes short-term trading strategies.

The seamless execution of trades characteristic of this account type enables traders to seize opportunities as they arise, making it a favored choice for those who require speed and precision in their trading activities.

Comparing Exness Account Types

Choosing the right account type can significantly influence your trading outcomes, making it essential to compare the distinctive features of each.

Performance Metrics

When analyzing performance metrics such as spreads, commissions, and leverage, it becomes clear that different accounts cater to varying trader needs.

For example, while the Standard Account might be ideal for beginners due to its simplicity, the Pro Account offers enhanced capabilities for those seeking to implement advanced strategies. The Raw Spread and Zero Accounts, meanwhile, excel in providing cost-effective trading solutions for high-volume traders.

Risk Management Strategies

Risk management is a crucial aspect of trading success. Each Exness account type presents unique risks and reward structures—traders must align their chosen account with their risk tolerance and trading objectives.

Understanding how each account type accommodates risk management techniques will ultimately aid in creating a robust trading plan.

Choosing the Right Account Based on Trading Style

A trader's personal style dictates which Exness account type will serve them best. By analyzing individual trading methods, a suitable account can be selected.

Scalping

For scalpers, the Zero and Raw Spread Accounts present the most attractive features. With fast execution speeds and low trading costs, these accounts enable quick trades that capitalize on minor price changes.

Traders engaged in scalping require precise conditions, and both the Zero and Raw Spread Accounts are structured to meet these needs effectively.

Day Trading

Day traders benefit from the Pro Account, which allows for a combination of tight spreads and high leverage, accommodating the need for quick entries and exits throughout the trading day.

The Pro Account is optimized for active trading, providing day traders with the tools to navigate the fast-paced market environment successfully.

Swing Trading

Swing traders may find the Standard Account more advantageous, as it offers a user-friendly interface with adequate features to analyze longer-term market trends without the complexity of tighter spreads and commissions.

The Standard Account allows swing traders to focus on strategic investments without being bogged down by excessive trading costs associated with high-frequency trading.

Regulatory Compliance and Safety Measures

When selecting a trading platform, regulatory compliance and safety measures are paramount considerations. Exness prioritizes these aspects to ensure traders can operate with confidence.

Exness Regulation Overview

Exness is regulated by multiple authorities, including the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

These regulatory measures serve to protect traders by ensuring that Exness adheres to strict operational standards, and provides assurance of fair trading practices.

Security of Funds

The security of funds is another fundamental pillar of trustworthiness in online trading. Exness employs multiple security protocols, including segregated accounts for client funds, which ensures that traders’ money is kept separate from the company's operational funds.

This level of safeguarding provides traders with peace of mind, knowing that their investments are protected against financial disputes or insolvencies.

How to Open an Exness Account

Opening an account with Exness is a straightforward process, designed to facilitate user convenience while maintaining security.

Step-by-Step Registration Process

To begin, a prospective trader must visit the Exness official website and fill out the registration form. This form requires basic information such as name, email address, and phone number. After submitting the form, the trader will receive a confirmation email and be guided through the next steps.

Once the account is created, users can log in to their Exness account and proceed with their trading journey, choosing the account type that aligns with their trading objectives.

Verification Requirements

To comply with regulations and ensure the security of funds, Exness requires account verification.

Traders are required to submit identification documents such as a passport or driver's license, along with proof of address. Document verification is usually completed swiftly, allowing traders to access their accounts and start trading without prolonged delays.

Tools and Resources for Exness Account Holders

Exness recognizes the importance of equipping traders with the right tools and resources to maximize their trading effectiveness.

Trading Platforms Overview

Exness provides its users with access to popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their versatility, reliability, and rich functionalities, including advanced charting tools, technical indicators, and automated trading capabilities.

Both platforms are readily accessible via desktop and mobile applications, granting users the flexibility to trade anytime, anywhere.

Educational Resources Available

Education is a cornerstone of successful trading, and Exness offers a suite of educational resources for traders at all skill levels.

These resources include webinars, tutorials, and articles covering various topics such as trading strategies, market analysis, and risk management. By providing traders access to quality educational materials, Exness fosters an environment conducive to continuous learning and improvement.

Customer Support and Assistance

Effective customer support is critical for any trading platform, and Exness takes pride in offering comprehensive assistance to its users.

Contact Methods

Exness provides multiple contact methods for customer support, including live chat, email, and phone support. The live chat feature is particularly popular among traders for its immediacy, allowing users to resolve queries quickly.

Additionally, Exness offers a detailed FAQ section on their website, addressing common concerns and providing instant solutions for traders.

Support Hours and Availability

Exness customer support is available 24/7, ensuring that traders can seek help whenever necessary. Whether facing a technical issue or needing clarification on account types, traders can rely on responsive customer service at any time of day.

Recent Updates to Exness Account Types

As part of its commitment to enhancing the trading experience, Exness frequently updates its account types and features to adapt to changing market conditions and user feedback.

Changes in Features or Policies

Recently, Exness has made notable improvements to its account offerings, including adjustments to minimum deposit requirements and the introduction of new trading instruments.

These updates reflect Exness’s responsiveness to market demands and aim to create a more inclusive trading environment for both new and experienced traders.

Enhancements for User Experience

User experience is at the forefront of Exness's operational philosophy. Recent upgrades to the user interface of the trading platform have made navigation smoother and more intuitive.

Improvements in order execution speeds and the addition of analytical tools further enrich the trading experience, enabling users to analyze markets more thoroughly and make informed trading decisions.

Common Questions About Exness Accounts

Navigating the complexities of trading accounts can lead to various questions. Below are some common inquiries that prospective traders often have about Exness accounts.

FAQs on Account Types

Many traders wonder which account type is best for them, and the answer often depends on their individual trading style and objectives.

For instance, beginners may feel comfortable starting with a Standard Account, while professionals might be drawn to the Raw Spread or Zero Accounts. Understanding the specific features of each account is essential in making the right choice.

Troubleshooting Common Issues

Another frequent concern involves troubleshooting issues related to account access, trade execution, or withdrawal processes.

Exness customer support is equipped to handle these problems, and their FAQ section provides answers to commonly encountered issues, helping traders find resolutions without unnecessary delays.

Conclusion

In conclusion, choosing the Best Exness Account: Exness Account Types Overview Update is an essential step for traders looking to embark on their trading journey. Each account type offers unique features and benefits that cater to different trading styles, objectives, and experience levels.

Whether you are a beginner seeking a simple entry point or a seasoned trader in pursuit of advanced trading tools, Exness has an account type that can meet your needs. By understanding the nuances of each account and leveraging the tools and resources available, traders can elevate their trading experience and work towards achieving their financial goals. Remember that the choice of an account type can significantly impact your trading strategy and overall success in the dynamic world of online trading.

Read more: