20 minute read

What type of broker is Exness?

When considering what type of broker is Exness, it is essential to delve into various aspects that define its operational model, regulatory framework, trading offerings, and overall reputation in the online brokerage industry. As a leading online broker, Exness has positioned itself as a comprehensive platform for traders around the globe, and understanding its features can provide insights into how well it caters to diverse trading needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Overview and Background

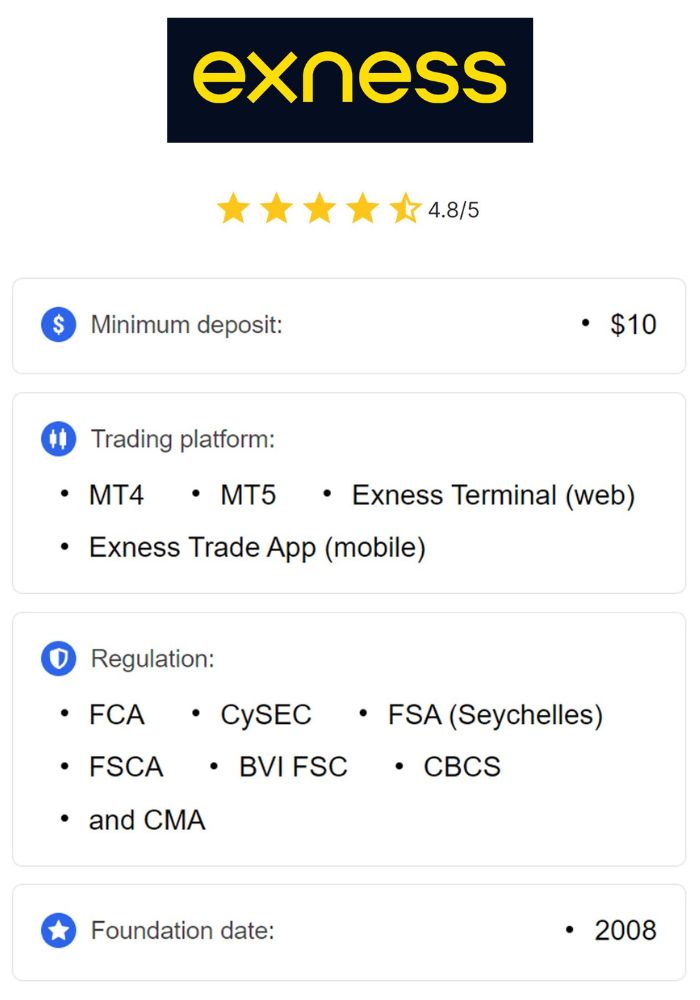

Since its inception in 2008, Exness has made significant strides in establishing itself as a formidable player in the financial markets. Specializing in Forex and Contracts for Difference (CFDs) trading, the broker has attracted clients from over 200 countries and territories. The company's rapid growth reflects its commitment to providing high-quality tools, competitive trading conditions, and user-friendly services tailored for both novice and experienced traders alike.

The core philosophy driving Exness revolves around empowering traders by equipping them with advanced technologies, a wide range of trading instruments, and exceptional customer support. This approach not only helps clients navigate the complexities of the financial markets but also fosters a sense of community among traders who seek to enhance their skills and knowledge. By maintaining a focus on accessibility and continuous improvement, Exness has solidified its standing as an innovative leader in the online brokerage arena.

Mission and Vision

Exness's mission is anchored in delivering a seamless and transparent trading experience, which encompasses several key objectives:

Facilitating Access to Global Markets: The broker aims to connect investors worldwide with a vast array of financial instruments, thus opening doors to countless opportunities for wealth generation.

Delivering Advanced Technology: Through cutting-edge trading platforms and tools, Exness optimizes trading performance, enabling users to execute trades efficiently while taking advantage of market movements.

Prioritising User Experience: Exceptional customer service and educational resources are at the forefront of Exness’s operations, ensuring that traders receive the support they need throughout their trading journeys.

Maintaining Transparency and Security: Operating within a regulated environment, Exness prioritizes data security and fairness, fostering trust among its clientele.

Ultimately, Exness envisions promoting financial inclusion by empowering clients to achieve their financial goals amidst a dynamic global landscape. By staying committed to technological innovation and client satisfaction, Exness aspires to remain at the forefront of the online brokerage industry, offering a reliable platform for all traders.

Regulatory Framework

Licensing Information

A crucial aspect of any reputable broker is its regulatory standing, and Exness does not falter in this regard. Operating under an extensive network of international regulatory licenses, Exness adheres to the highest standards set by prominent financial authorities.

Regulatory compliance demonstrates the broker's commitment to ethical practices and accountability, reassuring clients that their funds and trading activities are managed responsibly. Exness is regulated by several esteemed bodies, including the Financial Commission, Cyprus Securities and Exchange Commission (CySEC), and the Mauritius Financial Services Commission (FSC).

Each regulatory body imposes stringent requirements that brokers must fulfill, encompassing capital adequacy, reporting standards, and operational transparency. These measures help establish a safe trading environment, bolstering client confidence in Exness's capabilities.

Regulatory Authorities and Compliance

Exness maintains its integrity through its affiliation with multiple regulatory authorities, which serve as a safeguard for clients. By adhering to the regulations upheld by these organizations, Exness meets critical industry standards related to:

Capital Adequacy: The broker ensures sufficient reserves to cover potential risks and obligations owed to clients, providing peace of mind while trading.

Anti-Money Laundering (AML) and Combatting the Financing of Terrorism (CFT): Robust protocols are implemented to identify and prevent illicit activities, safeguarding the overall integrity of the trading platform.

Client Funds Segregation: By separating client funds from their own operating capital, Exness guarantees that clients’ deposits remain protected even if the broker faces insolvency.

Transparency and Disclosure: Clients receive clear and accessible information regarding trading conditions, fees, and associated risks, promoting informed decision-making.

These compliance measures are foundational to building trust with clients, illustrating Exness's dedication to providing a secure and ethical trading environment.

Types of Trading Accounts Offered

Standard Accounts

Exness recognizes that every trader is unique, which is why it offers a variety of account types to cater to different trading styles and experiences. For beginners, the Standard Account serves as an ideal entry point into the world of online trading.

Traders benefit from a low minimum deposit requirement, enabling them to start with a relatively small investment. This accessibility encourages individuals to build their confidence and refine their strategies without risking substantial capital. Moreover, standard accounts come with tight spreads and quick order execution, minimizing slippage and delays, which is crucial for new traders learning the ropes.

Additionally, access to popular trading platforms like MetaTrader 4 and 5 equips users with advanced trading features and customization options. This combination of user-friendly conditions and powerful tools empowers novice traders to develop their skills effectively.

Pro Accounts

For more experienced traders, Exness offers Pro Accounts, which cater specifically to those seeking high-volume trading opportunities. These accounts are designed for those who require optimized trade execution without the burden of commission fees, allowing for enhanced profitability when trading large volumes.

Pro accounts feature raw spreads, providing a transparent pricing structure that reflects actual market liquidity. This translates to better pricing for serious traders who focus on maximizing returns. Furthermore, the fast execution speeds associated with Pro Accounts facilitate prompt order completion, ensuring that traders can capitalize on market fluctuations in real time.

With improved trading conditions and streamlined workflows, Pro Accounts offer seasoned traders the tools necessary to optimize their strategies and harness profitable opportunities effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

ECN Accounts

Exness also provides ECN Accounts for traders who demand direct market access (DMA). This account type allows users to connect directly with liquidity providers, participating in a raw market environment characterized by ultra-low spreads and heightened transparency.

By accessing deep liquidity pools, traders can achieve swift order execution, which is particularly advantageous for those engaging in scalping or automated trading strategies. Enhanced flexibility and control over trading decisions further amplify the appeal of ECN accounts, allowing traders to tailor their approaches according to specific market conditions.

As such, ECN Accounts represent an invaluable offering for traders seeking a comprehensive and efficient trading experience in the online marketplace.

Islamic Accounts

Recognizing the needs of Muslim traders, Exness offers Islamic Accounts, also known as swap-free accounts. These accounts comply with Sharia law, which prohibits interest charges (swaps) incurred due to holding positions overnight.

While Islamic accounts share the same features as Standard, Pro, and ECN accounts, they are uniquely designed to eliminate swap fees. This commitment to inclusivity ensures that traders from diverse backgrounds can participate in forex and CFD trading without compromising their beliefs.

By catering to the diverse needs of its clientele, Exness demonstrates its dedication to providing a welcoming and accommodating trading environment for all.

Trading Platforms Available

MetaTrader 4 Features

Exness grants its clients access to the widely acclaimed MetaTrader 4 (MT4) platform, celebrated for its robust features and customization capabilities. MT4’s intuitive user interface appeals to both novice and experienced traders, making it easy for anyone to navigate the platform.

One of the standout features of MT4 is its advanced charting tools, which enable traders to conduct detailed technical analysis and visualize market trends effectively. Traders can leverage these tools to identify potential trading opportunities and develop rigorous trading strategies.

Furthermore, MT4 supports Expert Advisors (EAs), allowing users to automate their trading actions based on predefined rules and conditions. This capability not only saves time but also enables traders to take advantage of market fluctuations, even when they cannot actively monitor their accounts.

With customizable indicators and a diverse range of order types, MT4 provides a comprehensive trading environment that can be tailored to individual preferences and strategies.

MetaTrader 5 Features

Taking the advancements of MT4 a step further, MetaTrader 5 (MT5) represents the next generation of trading platforms. It boasts an array of enhanced features designed to improve the overall trading experience.

MT5 facilitates faster order execution, improving price accuracy and allowing traders to respond swiftly to changes in the market. Additionally, the platform offers expanded market depth, presenting a clearer picture of available liquidity for various instruments. This level of transparency can greatly benefit traders looking to make informed decisions.

Moreover, MT5 integrates an economic calendar and real-time market news, providing users with valuable insights that can influence trading strategies. The platform's advanced algorithmic trading capabilities allow for more sophisticated automated trading strategies, appealing to quantitative traders seeking to leverage data-driven approaches.

As a result, MT5 stands out as a cutting-edge platform that enhances traders' capabilities while providing access to a broader range of financial instruments.

Mobile Trading Applications

Understanding the importance of flexibility in today’s fast-paced environment, Exness offers mobile trading apps for both Android and iOS devices. These applications empower traders to access their accounts and execute trades on the go, ensuring that they never miss an opportunity.

Through the mobile trading app, users can stay updated with real-time market data, prices, and charts across all available instruments. Quick order execution features enable traders to act promptly, capitalizing on price movements even when away from their desktops.

Account management tools integrated into the app offer convenience, allowing users to monitor account information, track trade history, and manage deposit/withdrawal options seamlessly. Custom notifications and alerts can be set up to signal specific price movements, further enhancing traders' ability to make timely decisions.

Overall, the availability of mobile trading applications underscores Exness's commitment to delivering an adaptive and user-centric trading experience, meeting the demands of modern traders.

Market Instruments and Asset Classes

Forex Trading

Exness excels in providing access to the Forex market, recognized as the largest and most actively traded financial market globally. Within this realm, the broker offers a diverse range of major, minor, and exotic currency pairs, creating ample opportunities for traders to diversify their portfolios and capitalize on market fluctuations.

The expansive selection of currency pairs enables traders to participate in various trading strategies, whether they focus on long-term investments or short-term trading tactics. Moreover, Exness’s competitive pricing and favorable trading conditions empower traders to maximize their potential profits when navigating the Forex market.

As traders analyze economic indicators, geopolitical events, and other influential factors, they can leverage Exness's robust trading infrastructure to execute their strategies proficiently and take advantage of shifting market dynamics.

CFDs on Stocks and Commodities

In addition to Forex, Exness allows traders to engage in Contracts for Difference (CFDs) trading. These derivative instruments enable users to speculate on the price movement of underlying assets—such as stocks and commodities—without the need to own the asset itself.

This approach broadens traders’ horizons, allowing them to explore opportunities beyond traditional Forex trading. With access to a variety of stocks, commodities, indices, and other assets, Exness clients can implement diverse trading strategies and react to market trends accordingly.

The appeal of CFDs lies in their flexibility, granting traders the potential for profit even during bearish market phases. Coupled with Exness’s user-friendly platforms and responsive customer support, traders can confidently explore the world of CFDs.

Cryptocurrency Offerings

As the cryptocurrency market continues to expand and evolve, Exness embraces this emerging asset class by offering access to trade several prominent cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and others. This proactive approach positions Exness as a forward-thinking broker attuned to the evolving interests of its clientele.

Cryptocurrencies present unique opportunities for traders seeking diversification and exposure to innovative financial instruments. Given the inherent volatility of the cryptocurrency market, Exness equips its clients with the necessary tools and resources to navigate these dynamic assets effectively.

By combining advanced trading platforms with competitive conditions for cryptocurrency trading, Exness enables traders to capitalize on this rapidly growing market while managing risks appropriately.

Spreads and Commission Structure

Spread Types

Exness is known for its competitive spread offerings across various account types. Spreads represent the difference between the buying and selling price of an asset and significantly impact trading costs and profitability.

For traders using Standard Accounts, tight spreads ensure affordable trading conditions, making it feasible for novices to enter the market without incurring excessive fees. Pro Accounts feature raw spreads, which reflect the true cost of market liquidity, appealing to experienced traders focused on optimizing their profit margins.

Moreover, ECN Accounts feature ultra-low spreads that provide access to the best market prices, allowing traders to execute transactions with minimal costs. Overall, Exness's diverse spread structures cater to different trading preferences, ensuring that clients can find a suitable option aligned with their strategies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Commission Fees for Different Accounts

Exness adopts a commission structure that varies depending on the account type selected by traders. While Standard Accounts typically do not incur commissions, Pro and ECN Accounts may have structured commission fees based on trading volume.

The absence of commission fees on Standard Accounts makes this option particularly attractive for novice traders looking to gain experience without incurring additional costs. Conversely, Pro and ECN traders can benefit from competitive commission rates, especially when conducting high-volume trades.

Understanding the commission structure is essential for traders to evaluate the overall cost of their trading activities and choose the account type that aligns with their financial objectives. By offering varied commission arrangements, Exness ensures flexibility and affordability for its diverse clientele.

Leverage Options

Maximum Leverage Offered

Leverage is a crucial tool in trading, enabling traders to control larger positions with a smaller amount of capital. Exness offers impressive leverage options, reaching up to 1:2000, depending on the asset class and account type.

Such high leverage allows traders to amplify their potential profits; however, it is important to remember that it also magnifies risks. The ability to employ leverage affords traders the flexibility to implement diversified strategies and seize opportunities across various markets, giving them the edge needed to compete effectively.

Risk Considerations with High Leverage

While high leverage can lead to larger profits, it also presents inherent risks that traders must understand. Increased leverage means that even minor market fluctuations can result in significant losses, which may exceed initial investments. Therefore, it is crucial for traders to adopt sound risk management practices and establish clear limits on their leverage usage.

Educating oneself on the implications of leveraging is essential, particularly for novice traders who may be unfamiliar with the increased risks involved. By approaching high-leverage trading with caution, traders can maximize their opportunities while safeguarding their capital.

Deposit and Withdrawal Methods

Supported Payment Methods

Exness prioritizes convenience in its deposit and withdrawal processes by offering a wide variety of payment methods. Clients can choose from options such as credit/debit cards, bank wire transfers, e-wallets like Skrill and Neteller, and local payment solutions depending on their region.

This diversity in payment methods ensures that traders have flexibility in funding their accounts and withdrawing their profits. Furthermore, Exness continually evaluates and expands its payment options to accommodate the changing needs of its clientele.

Processing Times and Fees

Exness’s commitment to efficiency extends to processing times for deposits and withdrawals. Many payment methods offered are processed instantly, allowing traders to fund their accounts and commence trading promptly. However, processing times may vary based on the chosen method and the local banking regulations that apply.

While Exness does not impose fees for deposits, it is essential for traders to consider potential fees charged by third-party payment providers. Transparency in fees and processing times reinforces Exness's dedication to providing a smooth and hassle-free trading experience.

Customer Support Services

Availability of Support Channels

Exness places great importance on customer support and ensures that clients receive assistance whenever needed. Various support channels are available, including live chat, email support, and phone support, catering to users’ preferences and urgency levels.

Live chat support allows clients to receive immediate assistance, making it a preferred choice for traders requiring quick answers to their inquiries. Email support, on the other hand, is suitable for less urgent matters, allowing users to submit detailed questions or requests.

Furthermore, Exness provides multilingual support, making it easier for clients from various backgrounds to communicate with the support team effectively. The commitment to accessible customer support reinforces Exness's dedication to enhancing the overall trading experience for its clientele.

Quality of Customer Service

The quality of customer service plays a pivotal role in shaping clients' perceptions of a broker. Exness consistently receives positive feedback regarding the professionalism and responsiveness of its support staff.

Clients often commend the knowledgeable support representatives who are well-equipped to address a wide range of queries, from technical issues to account-related concerns. This level of expertise not only instills confidence in traders but also contributes to a sense of partnership between Exness and its clients.

By prioritizing customer satisfaction and continuously improving its support offerings, Exness demonstrates its commitment to building lasting relationships with traders.

Educational Resources and Tools

Webinars and Tutorials

Exness recognizes the value of education in the trading world and offers an array of resources to support traders in their learning journeys. The broker hosts regular webinars conducted by experienced professionals, covering topics ranging from trading strategies to market analysis.

These webinars provide participants with valuable insights and the opportunity to interact with experts, fostering a collaborative learning environment. In addition to webinars, Exness offers instructional tutorials that guide traders through various aspects of the trading platforms, tools, and strategies.

By investing in educational resources, Exness empowers its clients to enhance their skills and improve their trading performance, ultimately contributing to their long-term success.

Market Analysis and Research Tools

In addition to educational content, Exness provides access to market analysis and research tools designed to keep traders informed and prepared for changing market conditions. Regular market updates, analysis reports, and economic calendars equip clients with the knowledge they need to make informed trading decisions.

By having access to relevant data and insights, traders can identify potential trading opportunities, evaluate market sentiment, and adapt their strategies accordingly. The emphasis on research and analysis highlights Exness's commitment to supporting traders in their pursuit of success.

Security Measures

Data Protection Protocols

Exness prioritizes the safety and privacy of its clients by implementing robust data protection protocols. With the growing concern surrounding cybersecurity, the broker employs advanced encryption technologies to safeguard sensitive client information.

By utilizing Secure Socket Layer (SSL) encryption, Exness ensures that all personal and financial data transmitted between clients and the trading platform remains confidential and secure. This level of data protection enhances clients' trust in the broker, allowing them to trade with peace of mind.

Fund Segregation Practices

In addition to data protection measures, Exness adheres to strict fund segregation practices. Client funds are held in separate accounts from the broker's operating capital, ensuring that clients’ money is protected even in the unlikely event of the broker facing financial difficulties.

This practice aligns with regulatory requirements and underscores Exness's commitment to transparency and accountability. By prioritizing the safety of clients' funds, Exness fosters a trustworthy trading environment conducive to long-term success.

User Experience and Feedback

Client Reviews and Ratings

User experience is a vital component of any broker's reputation, and Exness has garnered noteworthy accolades from its clients. Numerous reviews highlight the broker's commitment to innovation, user-friendly platforms, and competitive trading conditions.

Many traders appreciate the versatility offered by Exness, particularly in terms of account types, trading instruments, and platform accessibility. Positive feedback often emphasizes the supportive customer service team and the broker's dedication to addressing client needs promptly.

However, like any broker, Exness also faces occasional criticisms from certain clients. Understanding these reviews and ratings is essential for prospective traders to gauge the overall experience associated with the broker.

Common Complaints and Issues

While Exness enjoys a strong reputation, some common complaints may arise from clients. Issues such as technical glitches, withdrawal delays, or misunderstandings relating to trading conditions can occasionally surface.

Exness acknowledges the significance of addressing such concerns promptly and transparently. By maintaining open communication channels and a focus on continuous improvement, the broker strives to resolve client issues effectively, reinforcing trust and credibility.

Advantages of Choosing Exness

Innovative Technology and Platforms

One of the primary advantages of choosing Exness lies in its commitment to innovative technology and state-of-the-art trading platforms. Both MT4 and MT5 provide traders with advanced features and tools, facilitating a superior trading experience.

The emphasis on technology enables traders to implement and test their strategies efficiently while accessing a wide range of financial instruments. This strong technological foundation sets Exness apart from many competitors in the online brokerage space.

Competitive Trading Conditions

In addition to technological innovation, Exness offers competitive trading conditions that cater to diverse clientele. From low spreads and flexible leverage options to diverse account types and rapid execution speeds, the broker creates an optimal environment for traders to pursue their financial goals.

Furthermore, the absence of commission fees on certain accounts amplifies the appeal of Exness, especially for novice traders seeking effective entry points into the market.

Disadvantages and Limitations

Restricted Access in Certain Regions

While Exness boasts a global clientele, it is worth noting that access to its services may be restricted in certain regions due to regulatory limitations. Some countries impose restrictions on online trading, which may limit traders' ability to open accounts with Exness.

Prospective clients should thoroughly review their local regulations before proceeding to ensure compliance. Awareness of these limitations can help traders make informed decisions about their choice of broker.

Potential Drawbacks of High Leverage

Although high leverage presents opportunities to amplify profits, it also introduces significant risks. Traders, particularly those with limited experience, may find themselves exposed to potential losses that exceed their initial investment.

It's imperative for all traders to approach leverage cautiously and employ robust risk management techniques. Building a solid understanding of the implications of high leverage is vital to successful trading, regardless of one’s experience level.

Comparison with Other Brokers

How Exness Stands Against Competitors

When evaluating what type of broker is Exness, it is helpful to compare its offerings with those of other brokers in the industry. Exness distinguishes itself through its commitment to advanced technology, user-friendly platforms, and competitive trading conditions.

By providing a diverse range of account types and trading instruments, Exness accommodates a wide spectrum of clients, from beginners to experienced traders. Furthermore, the emphasis on customer support and educational resources showcases Exness's dedication to fostering long-term partnerships with clients.

Unique Selling Points of Exness

Exness's unique selling points include its robust trading platforms, extensive regulatory compliance, and commitment to transparency. The broker's focus on technological innovation ensures that clients have access to cutting-edge tools that enhance their trading experiences.

Additionally, the wide range of account types and instruments available presents traders with numerous choices, allowing them to align their trading with their individual objectives and preferences. Collectively, these factors contribute to Exness's reputation as a leading online broker in the competitive landscape.

Conclusion

In exploring what type of broker is Exness, we uncover a multifaceted platform dedicated to providing a superior trading experience. With a commitment to innovation, regulatory compliance, and client empowerment, Exness has established itself as a trusted partner for traders worldwide.

From diverse account offerings and competitive trading conditions to advanced trading platforms and robust customer support, Exness successfully addresses the diverse needs of its clientele. While certain limitations exist, the overall strengths and advantages of Exness position it as a compelling choice for anyone looking to venture into the world of online trading.

Whether you're a novice trader eager to learn or an experienced professional seeking advanced tools, Exness presents a dynamic environment where traders can thrive and achieve their financial aspirations.

Read more: