14 minute read

Where Can I Find Exness Signal Groups? A Complete Guide

Trading signals are a valuable resource for traders aiming to enhance their strategies and make informed decisions in the forex market. Exness signal groups, accessible through the company's platform and associated communities, provide insights into market movements, trading strategies, and potential opportunities across various instruments like currency pairs, commodities, and CFDs. These signals, often derived from detailed technical analysis and expert indicators, help traders navigate complex financial markets with greater confidence. Whether you seek free signals or paid subscriptions, Exness offers tools and resources that cater to both retail clients and experienced investors.

As a securities dealer registered with multiple regulatory bodies, including the Financial Services Authority and the Financial Services Commission, Exness ensures a high level of reliability and compliance. Traders can integrate signals into their routines while using Exness's platforms, supported by robust tools for social trading and decision-making. However, it’s essential to acknowledge the general risk warning: trading leveraged products like CFDs carries a risk of losing all invested capital. By combining reliable signals, informed strategies, and a clear understanding of risks, traders can improve their potential for successful trades while navigating the dynamic financial markets.

Introduction of Exness Trade

Exness signal groups are a valuable resource for traders seeking insights and strategies to navigate the forex and broader financial markets. These groups, available through Exness’s platform and associated communities, provide trading signals based on detailed technical analysis, market trends, and expert insights. With signals covering various trading instruments like currency pairs, commodities, and CFDs, they cater to both beginners and experienced traders aiming for successful trades. Traders can access free signals or explore premium options for more advanced analysis, enhancing their trading decisions and strategies under the Exness brand.

As a securities dealer registered with regulatory bodies like the Financial Services Authority and Financial Services Commission, Exness ensures a high level of trust and compliance. However, while integrating signals into trading routines can boost potential profits, traders should be mindful of the general risk warning: trading leveraged products like CFDs carries the risk of losing all invested capital. By combining the insights provided in signal groups with disciplined decision-making and proper risk management, traders can effectively engage in dynamic financial markets while safeguarding their investment value.

Start Trading: Open Exness Account or Visit Website

What Are Exness Signal Groups?

Exness signal groups are communities or platforms where traders can access trading signals related to forex, cryptocurrencies, indices, and other financial instruments available on the Exness platform. These signals are typically generated through technical analysis, fundamental research, or automated algorithms, and they aim to provide actionable insights, such as entry and exit points, market trends, and potential trade setups.

These groups cater to traders of all experience levels, offering valuable guidance for those who might need help analyzing markets or identifying trading opportunities. Signal groups associated with Exness often share insights via various channels, such as MetaTrader tools, social media platforms like Telegram or WhatsApp, and community forums. Signals may include chart patterns, indicators, or economic events that influence market movements, giving traders an edge in making informed decisions.

Exness signal groups can be categorized into two main types: official sources and community-driven or third-party groups. Official sources may include signals integrated into MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms or content shared directly through Exness's official channels. Community-driven groups, on the other hand, are often run by experienced traders or analysts who share their strategies with others. While signal groups can be a useful tool for enhancing trading strategies, traders are advised to evaluate the reliability and credibility of the sources before acting on the provided information.

Official Exness Signal Sources

Exness offers several official channels for accessing trading signals, ensuring reliability and credibility for traders seeking actionable insights. These signals are designed to help traders make informed decisions, whether they are analyzing market trends, identifying trade opportunities, or fine-tuning their strategies. Below are the primary official sources for Exness trading signals:

1. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) Platforms

Exness integrates trading signals directly into the MT4 and MT5 platforms, which are accessible to all registered traders. These signals come from reputable third-party providers within the platforms’ signal service sections. Traders can subscribe to signals and have them automatically executed on their accounts or manually implement the suggested strategies.

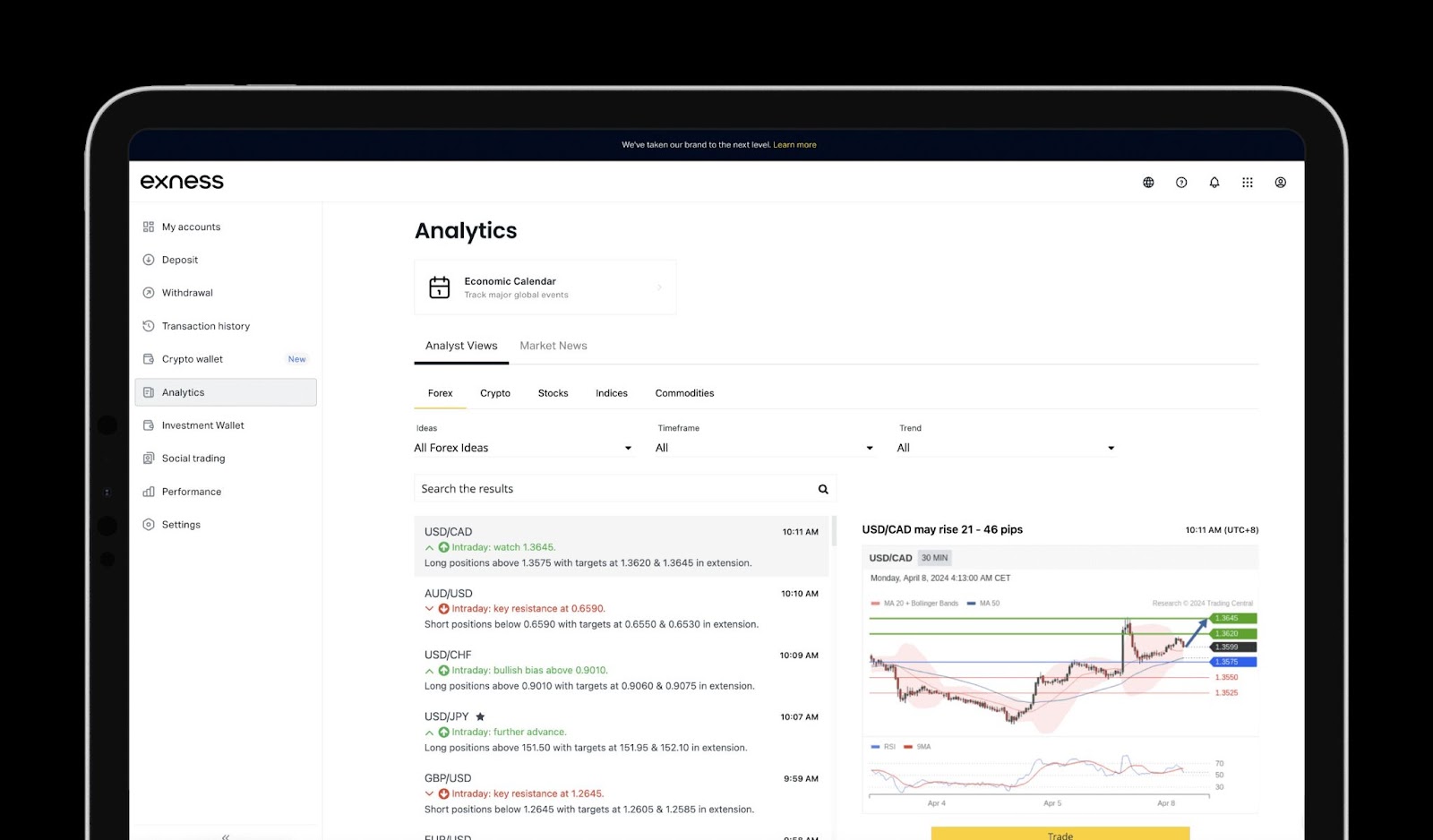

2. Exness Personal Area

The Exness Personal Area is a central hub where traders can access tools and resources, including market insights. Here, you may find links to official signal services or resources that can guide your trading decisions. Notifications or updates in this area often include trading ideas, market movements, and other insights from Exness.

3. Exness Blog and Market Analysis

Exness maintains an official blog and market analysis section on its website, where trading strategies, insights, and market trends are regularly shared. These updates provide traders with fundamental and technical analysis, helping them stay informed about economic events and key market drivers.

4. Exness Economic Calendar

While not a direct signal source, the economic calendar provided by Exness highlights upcoming economic events, announcements, and data releases. Traders can use this information to anticipate market movements and align their strategies with significant events.

5. Exness Academy

Exness offers educational resources, including webinars, articles, and videos, that often include insights into using signals effectively. This content helps traders learn how to interpret and apply trading signals in their decision-making processes.

6. Exness Social Media Channels

Exness’s official social media platforms, such as YouTube, Facebook, and Twitter, may share market updates, trading ideas, and tips. These updates are often curated by experts and provide valuable context for ongoing market conditions.

Community-Based Signal Groups

Community-based signal groups are an alternative source of trading signals for Exness users, providing market insights and trade ideas shared by traders, analysts, or enthusiasts. These groups are typically hosted on popular platforms like Telegram, WhatsApp, Facebook, and Reddit, where members collaborate to share signals, discuss market trends, and exchange strategies. While these groups are not officially affiliated with Exness, they cater to its users, offering a space for interaction and mutual learning.

One of the main benefits of community-based signal groups is the diverse perspectives they offer. Signals and market updates often come from traders with varying levels of expertise, enabling members to gain new insights and learn different trading approaches. Additionally, these groups provide real-time updates, helping traders stay informed about fast-moving market developments. For beginners, such communities can be a valuable resource for learning from experienced traders and asking questions about trading strategies.

However, it’s important to approach community-based signal groups with caution. Not all signals shared in these groups are reliable, as contributors may lack the expertise to provide accurate recommendations. Some groups may also be scams, offering unrealistic promises or charging excessive fees for signals. To mitigate risks, traders should verify the credibility of the group and cross-check signals with their own analysis. Signals from these groups should be treated as supplementary information rather than the sole basis for trades.

To make the most of community-based signal groups, traders should use them as a reference and combine the shared signals with their own research and technical analysis. Engaging in discussions and asking questions can further enhance understanding and provide clarity on market trends. By choosing reputable groups and approaching the information critically, traders can leverage these communities to improve their trading strategies while minimizing risks.

Subscription-Based Signal Services

Subscription-based signal services offer traders access to professional and consistent trading signals in exchange for a fee. These services are often provided by experienced traders, market analysts, or specialized companies that use technical analysis, fundamental research, or automated algorithms to generate actionable insights. Exness traders can integrate these signals into their trading strategies, leveraging expert insights to enhance their decision-making.

One of the main advantages of subscription-based signal services is the reliability and consistency they offer. Since these services are provided by professionals with a vested interest in maintaining their credibility, they often include well-researched signals with clear entry, exit, and risk management recommendations. Many providers also offer additional features, such as detailed market analysis, real-time alerts, and customer support, which can be particularly beneficial for traders seeking a structured approach to trading.

Exness traders can access subscription-based signal services through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms feature an integrated marketplace where traders can browse and subscribe to signal providers directly. Once subscribed, signals can be automatically executed on the trader’s account, making it easy to follow expert recommendations. Traders can also customize the level of automation, allowing them to retain control over their trading decisions.

However, it’s essential to carefully evaluate subscription-based signal services before committing to a provider. Factors such as the provider’s track record, the quality of past signals, and transparency about their methods should be assessed. Additionally, traders should consider the cost of the subscription and whether it aligns with their budget and trading goals. Beware of providers who promise guaranteed profits, as these claims are often unrealistic and may indicate a scam.

For Exness users, subscription-based signal services can be a valuable tool for improving trading performance and gaining insights from experts. By choosing reputable providers and integrating signals with personal analysis, traders can enhance their strategies while maintaining control over their trading decisions. These services are best used as a complement to a well-rounded trading approach, combining expert insights with independent research and risk management.

Start Trading: Open Exness Account or Visit Website

How to Choose Reliable Signal Groups

Choosing reliable signal groups is crucial for traders who want to use trading signals effectively while minimizing risks. With numerous signal groups available, especially for Exness users, it’s important to evaluate their credibility, performance, and alignment with your trading goals. Here are some key factors to consider when selecting reliable signal groups:

Verify Credibility and Transparency

A reliable signal group should have a proven track record of success and be transparent about its methods. Look for groups that share verifiable historical performance data, such as past trades and success rates. Avoid groups that make unrealistic promises, such as guaranteed profits, as these claims often indicate a scam.

Research the Signal Provider

Examine the background and expertise of the signal provider. Experienced traders or analysts with a solid understanding of the market are more likely to provide accurate and actionable signals. Check reviews, testimonials, or ratings from other traders to gauge the provider's reputation and reliability.

Evaluate the Signal Content

Reliable signal groups provide clear, actionable information, including entry and exit points, Stop Loss and Take Profit levels, and the rationale behind the trade. Signals should also include risk management guidelines to help you protect your capital. Avoid groups that share vague or incomplete signals.

Test the Signals

Before fully committing to a signal group, test its signals on a demo account. This allows you to evaluate the accuracy and effectiveness of the signals without risking real money. Monitor how the signals perform over time and ensure they align with your trading style.

Assess Communication Channels

The best signal groups use reliable and convenient communication platforms, such as Telegram, WhatsApp, or email alerts, to share timely updates. Ensure that the group’s communication is consistent and responsive, with quick updates during volatile market conditions.

Watch Out for Red Flags

Be cautious of groups that charge excessively high fees without providing evidence of their value. Avoid groups that pressure you to make quick decisions or subscribe immediately. Signal providers should allow you time to assess their service before making a commitment.

Align with Your Trading Goals

Choose signal groups that match your trading preferences and goals. For instance, if you focus on short-term forex trades, look for groups that specialize in high-frequency or day trading signals. Similarly, long-term investors should seek groups that emphasize fundamental analysis and broader market trends.

Benefits and Risks of Using Signal Groups

Signal groups can be a powerful tool for traders looking to streamline their decision-making process and access professional insights. These groups provide ready-to-use trading signals, saving traders the time and effort required for extensive market research. For beginners, signal groups are particularly valuable as they offer expert guidance and insights into market trends, entry and exit points, and risk management strategies. By observing how experienced traders generate and act on signals, members of these groups can enhance their understanding of market dynamics and improve their trading skills.

One of the primary advantages of signal groups is the real-time updates they provide. These groups share signals promptly, enabling traders to react quickly to market changes, which is crucial in fast-moving markets like forex and cryptocurrencies. Additionally, for traders who lack confidence or are uncertain about their strategies, signal groups can provide a sense of reassurance by offering professionally curated insights and recommendations.

However, relying on signal groups is not without risks. A significant concern is over-reliance, where traders may follow signals blindly without conducting their own research. This approach can hinder the development of critical analytical skills, leaving traders ill-prepared to navigate markets independently. Furthermore, not all signal groups are transparent about their methods or track records. Unreliable or poorly-researched signals can lead to significant losses, especially for traders who don’t apply proper risk management.

Another major risk is the prevalence of scams within signal groups. Some groups make exaggerated claims of guaranteed profits or charge exorbitant fees without providing high-quality signals. Traders must exercise caution and verify the credibility of a group before subscribing or acting on its signals. Additionally, even reliable signals cannot eliminate market risks entirely, as unexpected events or volatility can still lead to losses.

To strike a balance, traders should treat signal groups as supplementary tools rather than definitive solutions. It’s essential to combine signals with independent analysis and apply robust risk management techniques, such as using Stop Loss and Take Profit levels. Starting with a demo account to test the reliability of signals can also help mitigate risks. When used responsibly, signal groups can enhance a trader’s strategies and decision-making process, but they should always complement, not replace, a trader’s personal expertise and diligence.

Start Trading: Open Exness Account or Visit Website

Conclusion

Finding reliable Exness signal groups can enhance your trading experience by providing valuable insights, expert recommendations, and real-time updates on market trends. Whether you choose official sources like MetaTrader platforms and Exness market analysis or explore community-based groups and subscription services, the key is to verify the credibility and quality of the signals.

While signal groups can save time and offer expert guidance, they should be used as supplementary tools alongside your own research and analysis. By combining the insights from signal groups with proper risk management and a solid trading strategy, you can make more informed decisions and improve your trading performance. Take the time to explore and choose signal groups that align with your goals, and always approach them with caution and a critical mindset for the best results.

FAQs

What are Exness signal groups?

Exness signal groups are platforms or communities where traders share trading signals, market insights, and strategies to help others make informed decisions.

Where can I find official Exness signals?

Official Exness signals can be accessed through MetaTrader 4 and 5 platforms, the Exness Personal Area, the Exness website's market analysis section, and the economic calendar.

Are there community-based Exness signal groups?

Yes, Exness-related signal groups are available on platforms like Telegram, WhatsApp, and Facebook. These are community-driven groups where traders share signals and strategies.

Can I use subscription-based signal services with Exness?

Yes, you can use subscription-based signal services that integrate with MetaTrader 4 or 5. These services provide expert-curated signals for a fee.

How do I verify the reliability of a signal group?

Check the group’s track record, credibility of the provider, and the quality of signals. Test the signals on a demo account before committing to live trading.

What are the benefits of using Exness signal groups?

Signal groups save time, provide expert guidance, and offer real-time market updates. They also help traders learn by observing strategies shared by experienced traders.

Are there risks in using signal groups?

Yes, risks include over-reliance on signals, potential scams, and poorly-researched signals. Always combine signals with your own analysis and risk management strategies.