7 minute read

Is Trading on Exness Profitable? A Real Example

Trading with Exness can be profitable, but like any trading platform, profitability depends on the trader's experience, strategy, and risk management. Exness offers competitive spreads, fast execution, and a wide range of trading instruments, which can potentially optimize trading opportunities. However, there are no assurances of profit since market conditions can shift and leverage can both optimize profits and risks. If we analyze an example of real-life trade on Exness, then it will be more understandable how profitable elements function, such as good risk management and market movement knowledge.

Why Choose Exness?

Competitive Spreads and Low Trading Costs

Exness is known for its competitive spreads, which help reduce overall trading costs. This is especially important for traders who use high leverage and need to optimize their trading strategy for maximum profitability. By offering tight spreads and low exchange commission, Exness allows traders to keep more of their profits.

Advanced Trading Tools and Resources

Traders on Exness have access to advanced charting tools, technical indicators, and market analysis to better understand market trends. These resources are crucial for profitable trading as they enable traders to make informed decisions. Whether you are using technical analysis or fundamental analysis, Exness provides the tools that traders need to navigate the volatile markets successfully.

Automated Trading Capabilities

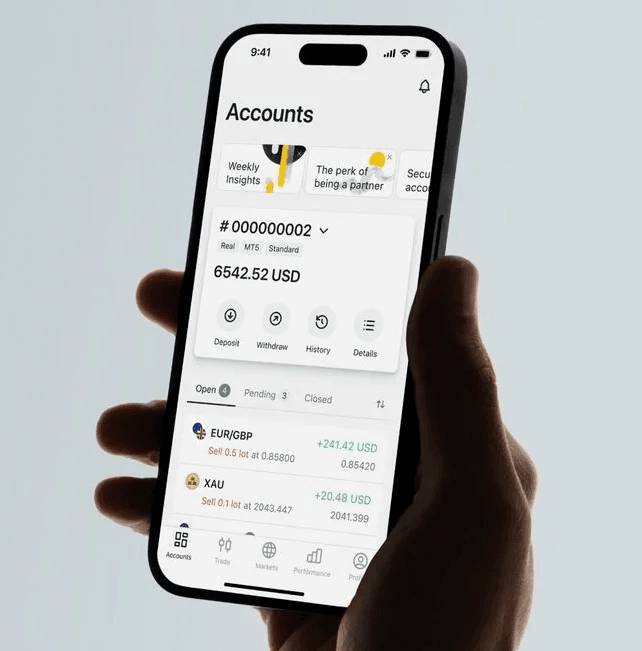

Exness also supports automated trading through platforms like MetaTrader 4 and MetaTrader 5, which include expert advisors. These tools help traders implement their trading strategies without the need for constant manual intervention. For traders who want to capitalize on future price movements based on market sentiment or economic data, automated trading can be a game-changer.

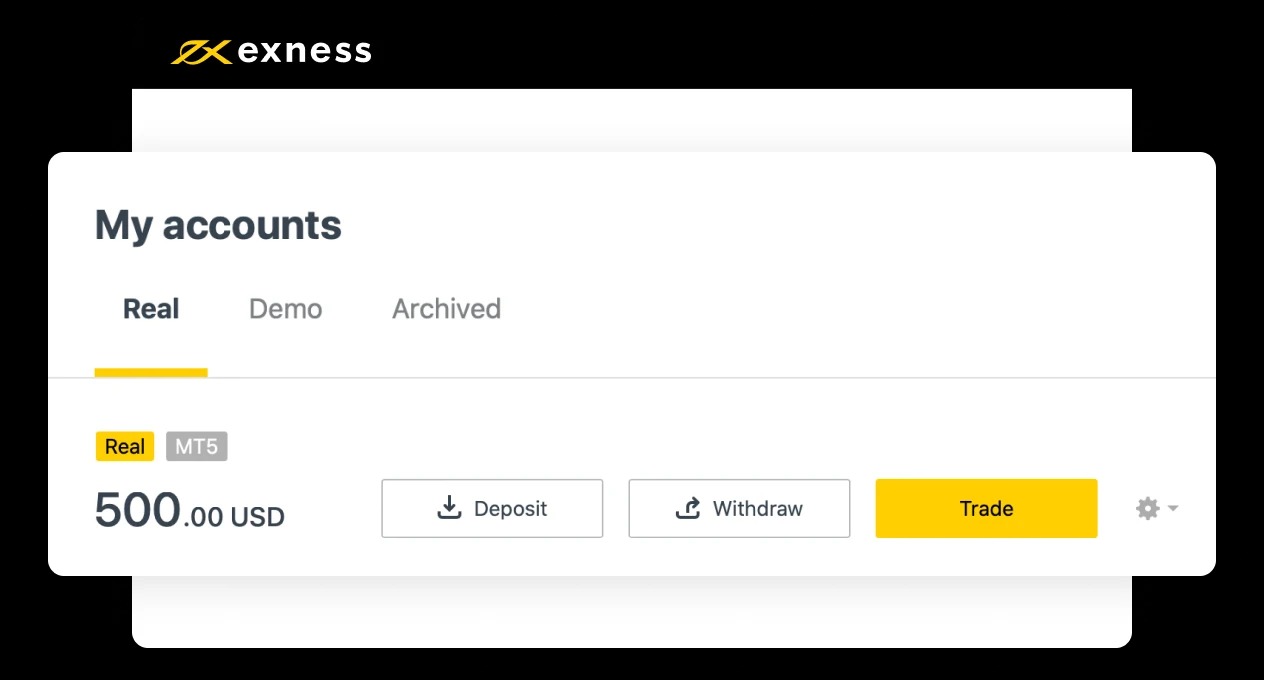

Real Example of Profitable Trading on Exness

Let’s consider the journey of John, an experienced forex trader who has been trading on Exness for over a year. John’s trading strategy relies on technical analysis using support and resistance levels, moving averages, and candlestick patterns. He also uses fundamental analysis to stay updated on economic news and market sentiment.

1. Initial Setup and Analysis:

John begins his day by analyzing market trends and checking the economic calendar for any upcoming economic data releases that could affect commodity markets or currency pairs. He uses Exness’s advanced charting tools to assess price movements and set up his trading plan.

2. Market Entry:

Based on his analysis, John identifies a volatile market condition in the EUR/USD pair. He sets his trade entry points, stops, and limits while paying close attention to liquidity providers and market dynamics. The low spreads on Exness allow him to enter and exit the market with minimal cost.

3. Managing Risk:

John uses negative balance protection to ensure that he doesn’t lose more money than he has in his account. He also applies proper risk management strategies by never risking more than 2% of his capital on a single trade.

4. Profit Realization:

After a few hours of monitoring the market conditions, John’s trade hits his target. He makes a significant profit due to the accuracy of his analysis, favorable trading conditions, and the tight spreads offered by Exness.

5. Review and Learning:

After each trade, John reviews his performance, learns from his mistakes, and refines his trading strategy. This continuous process helps him to improve and become a more profitable trader over time.

Start Trading: Open Exness Account or Visit Website

Profitability Depends on the Trader

While Exness provides a platform with low trading costs, competitive spreads, and advanced tools, profitability ultimately depends on how well a trader executes their trading strategy. Managing risk, emotional trading, and consistency play a significant role in determining whether a trader will be successful.

Key Factors That Affect Profits on Exness

1. Trading Strategy

Having a clear and well-defined trading strategy is key to profitability. Whether you’re using technical analysis, fundamental analysis, or a combination of both, a solid trading plan can help you achieve consistent profits.

2. Market Conditions

Profitable traders are adept at reading market trends and adapting their strategy to fit market conditions. Exness provides a wide range of financial instruments, including currency pairs, commodities, and stocks, to take advantage of various market dynamics.

3. Risk Management

Using proper risk management techniques is vital for profitable trading. This includes setting stop-loss orders, using proper leverage, and never risking more than you can afford to lose. Exness’s negative balance protection ensures that traders cannot lose more than the funds they have in their accounts.

4. Emotional Trading

One of the biggest challenges for traders is managing their emotions. Emotional trading can lead to rash decisions, such as overleveraging or chasing the market. The key to long-term profitability is staying disciplined and sticking to your trading plan.

5. Leverage and Margin

Using high leverage can amplify both gains and losses. Exness offers flexible leverage options, allowing traders to choose the level that best suits their risk tolerance. However, experienced traders understand that leverage should be used carefully to manage risk effectively.

Is Exness a Good Broker for Forex Trading?

Low Trading Costs: Exness offers low trading costs with tight spreads and low commission fees. This is beneficial for both retail clients and institutional traders.

Regulation: Exness is regulated by several financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission (FSC), ensuring a safe and secure trading environment.

Advanced Tools and Platforms: Exness offers a range of advanced trading tools, such as MetaTrader 4, MetaTrader 5, and advanced charting tools, which help traders make informed decisions.

Educational Resources: Exness provides educational materials for both beginners and experienced traders. These resources help traders improve their skills and trading strategies.

Negative Balance Protection: Exness offers negative balance protection, ensuring traders don’t lose more than their account balance.

Disadvantages of Trading on Exness

High Leverage Risk: While Exness offers high leverage, it can increase the risk of significant losses if not managed properly.

Emotional Trading: Traders need to stay disciplined and avoid emotional trading, which can result in impulsive decisions that hurt profitability.

Key Takeaways

Trading on Exness can be profitable with the right strategy, risk management, and emotional control.

Low trading costs and tight spreads make Exness an attractive option for experienced traders.

Exness’s low spreads, advanced tools, and negative balance protection create favorable trading conditions for profitable trading.

Risk management is crucial, as emotional trading and poor trade execution can quickly turn profitable trades into losses.

Market conditions, such as volatile markets and market sentiment, must be analyzed carefully to make informed trading decisions.

Frequently Asked Questions (FAQs)

Is Exness profitable for beginners?

Yes, Exness can be profitable for beginners if they use the demo account to practice and gain trading experience. Exness also provides educational resources to help beginners understand market analysis and trading strategies.

How do I manage risk on Exness?

You can manage risk on Exness by using stop-loss orders, setting appropriate leverage, and never risking more than a small percentage of your trading capital per trade.

What trading styles are best for Exness?

Exness supports various trading styles, including scalping, day trading, and position trading. The platform’s low spreads and advanced charting tools make it suitable for all types of traders.

Can I trade on Exness with a small budget?

Yes, Exness offers low minimum deposit requirements and allows trading with smaller amounts, making it accessible to new traders with limited capital.

What is Exness’s approach to emotional trading?

Exness provides tools to help traders manage risk and stick to their trading plan, minimizing the impact of emotional trading. However, it is still up to the trader to stay disciplined.