11 minute read

Does Exness Allow News Trading?

News trading is a dynamic strategy that involves leveraging market volatility during major economic or geopolitical events to capture quick profits. For traders who specialize in this approach, having the right platform is essential. Exness, a globally recognized broker, is well-equipped to support news trading with its ultra-fast execution, tight spreads, and advanced analytical tools. The platform’s robust infrastructure and features are designed to handle the high-speed demands and unpredictability of news-driven markets.

Why Exness is Suitable for News Trading

Exness is an excellent choice for news trading due to its ultra-fast trade execution and tight spreads, which are critical for capitalizing on the rapid market movements that follow major news events. The platform’s customizable leverage allows traders to maximize their exposure while managing risk effectively. Exness also provides instant order execution with minimal slippage, ensuring that trades are executed at desired levels during high-volatility periods. Additionally, its integration with TradingView gives traders access to real-time market data, alerts, and advanced charting tools, enabling quick decision-making. With 24/7 customer support and reliable technology, Exness ensures that news traders have the tools and infrastructure needed to react swiftly and profitably to market-moving news.

What is News Trading?

News trading is a strategy where traders aim to capitalize on the market volatility caused by major economic or geopolitical news events. These events often result in significant price movements, providing opportunities for traders to profit from rapid changes in market sentiment.

How News Trading Works

News trading involves leveraging market volatility triggered by significant economic, political, or financial news events to capitalize on rapid price movements. Traders monitor economic calendars for key announcements such as interest rate decisions, employment reports, GDP data, and corporate earnings. These events often create sudden shifts in market sentiment, leading to increased volatility. News traders analyze the impact of these events, using strategies like trading the breakout of price levels or entering positions based on anticipated market reactions. Effective news trading requires real-time market data, fast execution to capitalize on short-lived opportunities, and robust risk management to navigate the unpredictability of post-news price movements.

Why Traders Use News Trading

Traders use news trading to capitalize on the heightened volatility and rapid price movements that often follow significant economic or political announcements. News events such as central bank decisions, employment data, or geopolitical developments can create substantial market shifts, offering traders opportunities for quick profits. This approach appeals to traders who thrive in dynamic environments and are skilled at analyzing market sentiment. With the right tools, such as real-time data, fast execution platforms, and economic calendars, news trading enables traders to react swiftly to market changes, leveraging these events for high-reward, short-term strategies. It’s a popular choice for those looking to exploit volatility spikes and capitalize on immediate market reactions.

Risks of News Trading

News trading carries significant risks due to the high volatility and unpredictability associated with market reactions to major events. Price movements following news releases can be erratic, leading to increased slippage, wider spreads, and difficulty in executing trades at desired levels. Additionally, sudden reversals or market overreactions can result in unexpected losses, even for well-planned trades. News trading also requires precise timing, as delays in execution can diminish profitability or magnify losses. Moreover, relying solely on anticipated outcomes can be risky if the market interprets news differently than expected. Effective risk management, such as setting stop-loss orders and trading with a reliable, fast-execution platform, is essential to navigate these challenges successfully.

Start Trading: Open Exness Account or Visit Website

Exness and News Trading

Exness is a broker that supports news trading, making it a popular choice for traders who want to capitalize on the rapid price movements triggered by significant economic or geopolitical events. With its trader-friendly features, competitive trading conditions, and reliable infrastructure, Exness provides a solid platform for executing news trading strategies.

Why Exness is Suitable for News Trading

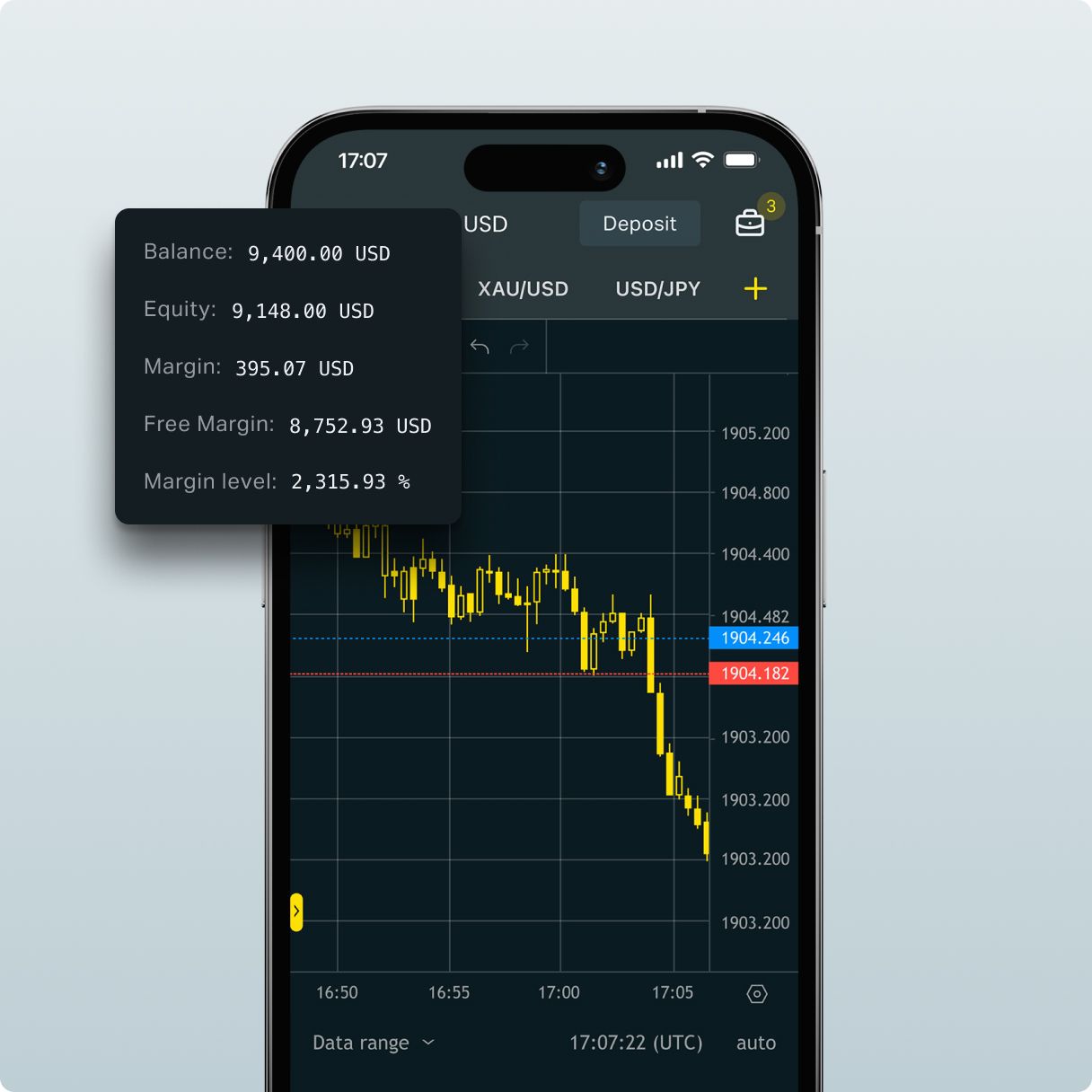

Exness is a top choice for traders seeking to capitalize on news-driven market volatility. With its advanced tools and robust infrastructure, the platform supports quick decision-making during high-impact events. High execution speed ensures trades are completed swiftly, a critical factor during volatile market conditions. Tight spreads, even under news volatility, make trading cost-effective, while the diverse range of instruments, such as forex pairs, commodities, and indices, allows traders to explore multiple opportunities.

Exness also provides traders with essential resources like an economic calendar, helping them track key events and plan strategies. With no restrictions on news trading, you can freely execute your plans during volatile periods. Additionally, the platform’s leverage options up to 1:Unlimited enable you to amplify potential gains when markets react to major events. These features make Exness a standout platform for news trading.

Features That Support News Trading with Exness

Exness provides several features that make it an excellent platform for news trading. Its ultra-fast trade execution ensures that traders can enter and exit positions quickly during high-volatility periods, reducing the risk of slippage. Exness offers tight spreads, even during market turbulence, helping traders optimize their profits. The platform’s customizable leverage enables traders to adjust their risk exposure for high-impact events. Additionally, Exness integrates with TradingView, providing advanced charting tools, real-time market data, and custom alerts to track news-driven price movements.

Challenges of News Trading on Exness

While Exness provides a supportive environment for news trading, the inherent nature of trading during high-impact news events presents unique challenges. Understanding these challenges can help traders prepare and mitigate potential risks.

Market Volatility

The Challenge: News events often lead to rapid and unpredictable price movements.

Impact: Volatility can result in sharp reversals, increasing the risk of losses for traders without proper risk management.

Spread Widening

The Challenge: Spreads may widen temporarily during high-impact news events.

Impact: This increases trading costs and may affect profitability, especially for short-term trades.

Order Slippage

The Challenge: Slippage occurs when orders execute at a price different from the intended level due to fast-moving markets.

Impact: Traders may not get their desired entry or exit prices, impacting the effectiveness of their strategies.

Execution Delays

The Challenge: High market activity during news events can cause temporary execution delays, even with fast platforms like Exness.

Impact: Missed opportunities or suboptimal trade entries.

Emotional Trading

The Challenge: The fast-paced nature of news trading can lead to impulsive decisions.

Impact: Emotional trading can result in overtrading, poor risk management, or deviation from the plan.

Risk of Over-Leveraging

The Challenge: Exness offers high leverage, but using too much leverage during volatile times can amplify losses.

Impact: Over-leveraging can quickly erode account balances during adverse price movements.

Tips for News Trading on Exness

To trade news effectively on Exness, start by using the economic calendar to track key events like interest rate decisions or employment reports. Plan your strategy ahead of time, identifying critical levels and setting stop-loss and take-profit orders to manage risk. Leverage Exness’s integration with TradingView to monitor real-time price movements and use alerts for instant updates on market shifts. Opt for tight spreads and ensure your account has sufficient margin to handle the increased volatility. Additionally, practice disciplined risk management by limiting your exposure to a percentage of your account balance. With Exness ultra-fast execution and customizable leverage, you can capitalize on rapid price movements while staying in control of your trades.

Start Trading: Open Exness Account or Visit Website

Key Advantage for News Traders on Exness

One of the standout advantages for news traders on Exness is its ultra-fast trade execution, which is critical during high-volatility periods following major news events. When market conditions are rapidly changing, the ability to open and close trades within milliseconds can make the difference between profit and loss. Exness’s advanced infrastructure ensures minimal slippage and precise order fulfillment, even in volatile markets. Coupled with tight spreads and instant withdrawals, Exness provides a trading environment that supports the swift decision-making and efficient execution required for successful news trading. This speed and reliability give news traders the confidence to react promptly and capitalize on market-moving opportunities.

Managing Risk During News Trading with Exness

Managing risk is crucial for successful news trading, and Exness offers a range of features to help traders navigate the volatility of news-driven markets. The platform’s customizable leverage allows traders to adjust their exposure based on their risk tolerance, ensuring they maintain control even during sharp price swings. Stop-loss and take-profit orders can be set up directly on Exness, enabling automated exits to protect capital or lock in profits when the market moves rapidly. Additionally, Exness’s negative balance protection ensures that traders cannot lose more than their account balance, providing peace of mind during volatile trading sessions. Combined with real-time alerts and market updates via TradingView, Exness equips traders with the tools they need to manage their risk effectively while taking advantage of news-based opportunities. Disciplined risk management and the use of these features can help traders maximize gains while mitigating potential losses.

Exness Tools for Monitoring Market Volatility

Exness provides a variety of tools to help traders effectively monitor market volatility, which is crucial for making informed decisions, especially during news events. The platform’s integration with TradingView offers advanced charting and technical analysis capabilities, including indicators like Bollinger Bands, Average True Range (ATR), and volatility indices that measure market fluctuations in real-time. Additionally, Exness provides access to an economic calendar, enabling traders to anticipate high-impact events and prepare for potential price movements. Customizable alerts ensure traders stay updated on sudden market changes, while real-time price updates and detailed market data help them react swiftly. These tools, combined with Exness’s fast execution and tight spreads, create a robust environment for monitoring and capitalizing on market volatility. Whether you’re a news trader or focusing on trend reversals, Exness equips you with the insights needed to navigate dynamic markets.

How Exness Tight Spreads Benefit News Traders

Exness tight spreads are a significant advantage for news traders who thrive in high-volatility markets. During major news events, spreads can widen dramatically across many platforms, increasing the cost of entering and exiting trades. Exness mitigates this issue by maintaining competitive spreads even during volatile conditions, enabling traders to optimize their profits and minimize costs. Tight spreads ensure that more of the market movement translates directly into trader gains, making it easier to capitalize on rapid price swings. This cost-efficiency, combined with Exness’s fast execution and low latency, allows news traders to enter the market quickly and benefit from opportunities as they arise. For traders who rely on precision and timing, Exness’s consistently tight spreads are a key factor in maximizing the profitability of news-driven trading strategies.

Why Exness Is a Preferred Platform for News Traders

Exness is a preferred platform for news traders due to its combination of fast execution, tight spreads, and advanced analytical tools. During high-volatility news events, Exness ensures trades are executed in milliseconds, minimizing slippage and allowing traders to capitalize on rapid market movements. Its tight spreads keep transaction costs low, even during periods of increased volatility, enhancing profitability. The platform’s integration with TradingView provides traders with real-time data, customizable alerts, and advanced charting tools, enabling swift and informed decisions. Additionally, Exness offers flexible leverage, instant withdrawals, and robust risk management features like negative balance protection, ensuring traders can trade confidently and efficiently. These features make Exness a reliable and powerful platform for executing news-driven trading strategies.

Conclusion

News trading with Exness offers significant opportunities for traders to capitalize on market volatility during major economic events. With features like high execution speed, tight spreads, and robust trading platforms, Exness provides the tools necessary for effective news trading. However, it’s essential to approach this fast-paced strategy with preparation and caution.

By leveraging Exness’ economic calendar, practicing on a demo account, and managing risks effectively, traders can navigate the challenges of news trading while maximizing their potential for success. Whether you’re a seasoned trader or exploring news trading for the first time, Exness offers a supportive environment to help you achieve your trading goals.

FAQ

Does Exness allow news trading?

Yes, Exness fully supports news trading and imposes no restrictions during major news events.

Are spreads affected during news trading on Exness?

Spreads may widen temporarily during high-impact news events due to market volatility, but Exness strives to keep them competitive.

How can I prepare for news trading with Exness?

Use Exness’ economic calendar to track upcoming events, practice on a demo account, and set proper risk management levels like stop-loss and take-profit orders.

What instruments are best for news trading on Exness?

Major forex pairs (e.g., EUR/USD, GBP/USD), commodities like gold, and indices are commonly impacted by news and offer great opportunities for news trading.

Does Exness restrict trading during major news events?

No, Exness does not restrict trading during news events, allowing traders to execute their strategies freely.

What is the best leverage for news trading on Exness?

The best leverage depends on your risk tolerance. While Exness offers leverage up to 1:Unlimited, it’s recommended to use leverage responsibly to manage risk effectively.