12 minute read

Exness Fees - What You Need to Pay?

Understanding the fee structure is crucial for anyone who plans to trade with Exness. As a leading forex broker, Exness offers competitive pricing and transparent fee policies that can help you manage your trading costs effectively. Whether you're a beginner or an experienced trader, being aware of the different fees you may encounter is key to optimizing your trading strategy and maximizing profits.

Exness provides a variety of trading accounts, each with its own fee structure, including spreads, commissions, and swap fees. Additionally, there are other potential costs such as deposit and withdrawal fees, inactivity fees, and more. In this guide, we’ll break down all the fees associated with trading on Exness, helping you understand what you need to pay and how to manage these costs for a more efficient trading experience.

Types of Fees at Exness

Exness offers a transparent and straightforward fee structure, allowing traders to understand the costs associated with their trades. Below are the primary types of fees you may encounter when trading with Exness:

Spread

What is Spread?Spread is the difference between the bid (buy) and ask (sell) prices of a currency pair or other trading instrument. It is the most common cost for traders on Exness and is typically how Exness earns revenue on most of its accounts.

How it WorksThe spread is typically smaller for more liquid instruments, such as major forex pairs like EUR/USD, and larger for exotic or less-traded assets. Exness offers both fixed and floating spreads, depending on the account type.

When You PayYou pay the spread each time you open a trade. The cost is reflected in the price of the instrument you're trading, as the spread is included in the bid-ask price.

Commission

What is Commission?Commission is a fixed fee charged on each trade and is typically associated with accounts that offer raw spreads (such as the Raw Spread or Zero accounts). This fee is charged for every transaction (buying and selling), usually as a percentage or flat rate per lot traded.

How it WorksFor example, if you are trading a raw spread account, the spread may be very low, but a small commission per lot is charged to cover the broker’s costs. This ensures that traders get tighter spreads with transparent commission fees.

When You PayThe commission is paid every time you open or close a trade, depending on your account type. Exness typically charges commission based on the volume of the trade and the instrument being traded.

Swap Fees

What are Swap Fees?Swap fees (or rollover fees) are the charges applied to positions that remain open overnight. These fees are based on the difference in interest rates between the two currencies in the currency pair being traded. If the interest rate differential is in your favor, you may receive a swap credit; if not, you will be charged a swap fee.

How it WorksSwap fees vary depending on the currency pair and the direction of the trade (buy or sell). They can be positive or negative, meaning you could either earn or pay for holding a position overnight.

When You PaySwap fees are automatically applied to any positions held overnight and are typically charged at the end of the trading day (usually around 5 PM server time). For positions held longer than a day, this fee is repeated every day the position remains open.

Deposit and Withdrawal Fees

What are Deposit and Withdrawal Fees?Exness offers a variety of payment methods for depositing and withdrawing funds, including bank transfers, e-wallets, and credit/debit cards. While Exness does not charge fees for most deposit and withdrawal methods, some third-party payment processors may charge transaction fees.

How it WorksExness covers the fees for deposits and withdrawals for most methods, such as e-wallets. However, some specific payment methods or certain currencies may incur a fee. It's important to check the payment provider’s terms for any additional charges.

When You PayFees are charged when you make deposits or withdrawals using certain payment methods. The exact fees depend on the method you choose and the country of residence.

Inactivity Fees

What are Inactivity Fees?Exness may charge an inactivity fee if your account is dormant for an extended period of time. This fee applies if there has been no trading activity or transactions (such as deposits or withdrawals) in your account over a specified time frame.

How it WorksThe inactivity fee helps cover administrative costs associated with dormant accounts. The exact amount and period of inactivity required to trigger the fee can vary by account type.

When You PayIf there is no trading activity or financial transactions for a certain period (typically 6 months), the inactivity fee may be charged. This fee is deducted from the account balance until you resume activity.

Types of Fees at Exness

Start Trading: Open Exness Account or Visit Website

Fee Structures by Account Type

Exness offers several account types to cater to different trading needs, each with its own fee structure. These account types differ in terms of spreads, commissions, and other factors that influence trading costs. Understanding the fee structures associated with each account type is crucial for selecting the one that best suits your trading style. Below is a breakdown of the fee structures for the most common Exness account types:

1. Standard Account

Spread: The Standard Account typically offers fixed spreads, meaning the difference between the bid and ask prices remains constant. The spread is usually higher than the spread offered on raw spread accounts, but this account type does not charge a commission.

Commission: There is no commission charged on trades in the Standard Account, which makes it a straightforward option for traders who prefer predictable costs.

Swap Fees: Swap fees are applied to positions held overnight, as in other accounts, but these will vary based on the instrument and the interest rate differential between the currencies being traded.

Best For: Beginner traders or those who prefer simplicity with no additional commission charges.

2. Pro Account

Spread: The Pro Account offers variable (floating) spreads, which can be tighter compared to the Standard Account, especially for more liquid instruments like major currency pairs.

Commission: The Pro Account does not charge a commission on trades, making it suitable for traders who prefer tighter spreads without the added cost of a commission fee.

Swap Fees: Similar to the Standard Account, swap fees apply if you hold positions overnight.

Best For: Intermediate traders who seek tighter spreads and flexible trading without commission charges.

3. Raw Spread Account

Spread: The Raw Spread Account provides the tightest spreads, often starting at 0 pips for major pairs like EUR/USD. This account type is ideal for traders who want the lowest possible spread.

Commission: Unlike the Standard and Pro accounts, the Raw Spread Account charges a commission per trade. The commission is usually based on the trading volume, and is applied for each trade (both when you open and close a position).

Swap Fees: Swap fees apply in the same way as other account types, depending on the position’s duration.

Best For: Experienced traders who prefer low spreads and are comfortable with paying a commission based on trading volume.

4. Zero Account

Spread: The Zero Account offers zero spreads for most instruments, meaning you pay no bid-ask spread. This is particularly attractive for traders who prefer to trade without the cost of spread widening during volatile market conditions.

Commission: The Zero Account charges a commission per trade, similar to the Raw Spread Account. The commission is typically higher than that of the Raw Spread Account, but it’s offset by the absence of a spread.

Swap Fees: Swap fees are also applied on positions held overnight, just as with the Raw Spread Account.

Best For: Advanced traders who are comfortable with a higher commission but want to avoid spread costs and need the tightest possible cost structure for trading.

5. Standard Cent Account

Spread: The Standard Cent Account offers fixed spreads starting at approximately 0.3 pips. This account type is specifically designed for beginners and those who want to trade with smaller amounts.

Commission: There is no commission on trades in the Standard Cent Account, making it a simple and low-cost entry-level option.

Swap Fees: Swap fees are applied for overnight positions.

Best For: Novice traders or those who want to trade with smaller lot sizes and low deposit requirements.

Start Trading: Open Exness Account or Visit Website

How to Minimize Fees

Minimizing fees is crucial for maximizing your profitability and ensuring that your trading costs remain as low as possible. Exness offers several ways to help traders reduce the fees they encounter, including strategies for selecting the right account type, payment methods, and trading practices. Here are some tips on how to minimize fees when trading on Exness:

Choose the Right Account Type

Selecting the most suitable account type is one of the most effective ways to minimize fees. If you're focused on tight spreads and can handle commissions, the Raw Spread or Zero Account might be ideal, as they offer some of the lowest spreads available. However, if you’re looking for simplicity without the added cost of commissions, the Standard Account offers a cost-effective option, albeit with wider spreads.

Use Payment Methods with Low or No Fees

Exness offers a variety of deposit and withdrawal methods, some of which come with no fees at all. For example, e-wallets like Skrill, Neteller, or Perfect Money typically have lower fees for deposits and withdrawals compared to bank transfers.

Take Advantage of Promotions or Fee Waivers

Exness occasionally runs promotions where they offer reduced fees for specific deposit methods or trading conditions. Keep an eye on promotions available through your Exness account or announcements from Exness, as they may include fee reductions or even fee waivers on certain trades or transactions.

Minimize Swap Fees

Swap fees can accumulate over time, especially if you keep positions open overnight. One of the best ways to minimize swap fees is by avoiding overnight positions or keeping your trades open for shorter durations.

Trade with Larger Volumes

Trading in larger volumes (larger lot sizes) can sometimes help minimize commission costs, as the fixed commission charged on smaller volumes may not be as favorable. If your strategy supports larger trades, consider adjusting your position sizes to optimize the cost-benefit of commissions and spreads.

Monitor Inactivity and Account Fees

To avoid inactivity fees, ensure that you engage in regular trading or make deposits/withdrawals to keep your account active. Many brokers, including Exness, charge inactivity fees if an account remains dormant for extended periods.

Start Trading: Open Exness Account or Visit Website

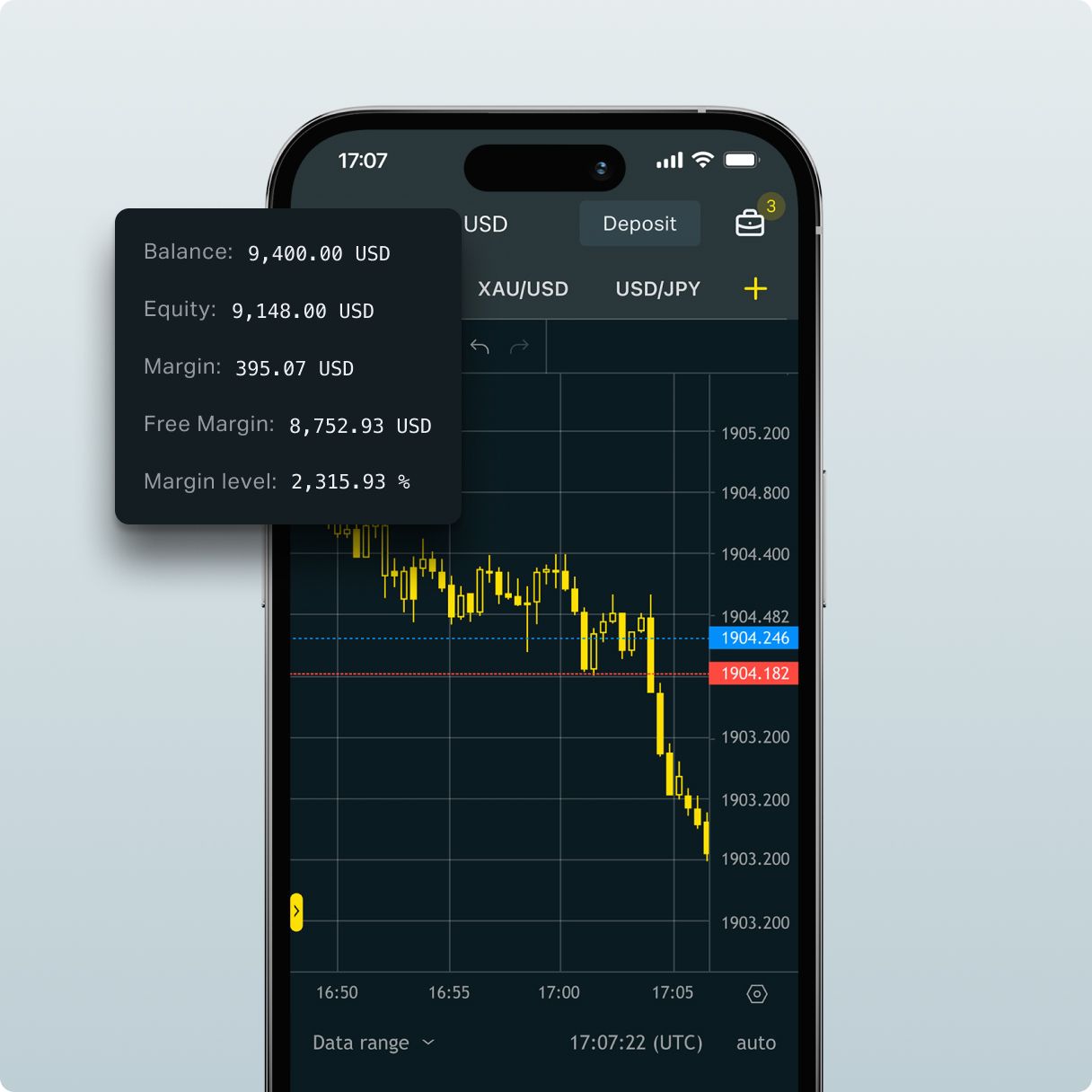

Exness Fee Transparency

Exness is committed to maintaining a high level of fee transparency, ensuring that traders have full visibility into the costs associated with their trading activities. All fees, including spreads, commissions, and swap rates, are clearly outlined and easily accessible on the Exness website and within the trading platform. This allows traders to make informed decisions when choosing account types, as each type has its own fee structure. Exness ensures that there are no hidden fees or unexpected charges, providing clients with straightforward, real-time updates on any changes to fees, giving them the necessary tools to effectively manage trading costs.

Moreover, Exness goes a step further in promoting transparency by offering detailed breakdowns of fees in your Personal Area. Traders can review historical trading costs, including commission fees, swap fees for overnight positions, and charges related to deposits and withdrawals. The platform also features a Fee Calculator, allowing users to estimate the costs of their trades based on account type and chosen instruments. This clear access to fee information not only helps traders plan their strategies effectively but also enhances trust in Exness, as it adheres to strict regulatory requirements for full disclosure of all fees, further demonstrating its commitment to integrity and client protection.

Conclusion

Understanding the fees associated with trading on Exness is crucial for managing costs and optimizing your trading strategy. Exness offers a variety of account types with clear and transparent fee structures, including spreads, commissions, and swap fees, ensuring that traders can select the most suitable option based on their preferences. By choosing the right account type, using cost-effective payment methods, and being mindful of factors like inactivity fees and swap charges, you can minimize your overall trading costs.

Exness’s commitment to fee transparency, along with real-time updates and detailed breakdowns in your Personal Area, makes it easy for traders to stay informed about the costs they incur. Whether you’re a beginner or an experienced trader, Exness provides the tools and information you need to manage your fees effectively and make smarter trading decisions.

FAQ

What fees do I need to pay when trading on Exness?

Traders on Exness are primarily charged for spreads, commissions, and swap fees. Additional fees may apply for deposits, withdrawals, and account inactivity, depending on the account type and payment method used.

Are Exness’s spreads fixed or variable?

Exness offers both fixed and variable spreads, depending on the account type. Fixed spreads are available with the Standard account, while Raw Spread and Zero accounts offer variable spreads, typically tighter for more liquid instruments.

Does Exness charge any commission on trades?

Yes, Exness charges a commission on certain account types, such as the Raw Spread and Zero accounts. The commission is based on the trade volume and is charged in addition to the spread.

Are swap fees applied to all trades?

Swap fees apply to positions that are held overnight. They depend on the interest rate differential between the two currencies in a forex pair and may be positive or negative. Traders can avoid swap fees by closing positions before the market close or using swap-free accounts.

Are there any fees for deposits and withdrawals on Exness?

Exness covers most deposit and withdrawal fees for popular payment methods. However, some third-party payment processors may charge additional fees, depending on the payment method and your country of residence.

How can I avoid inactivity fees on my Exness account?

To avoid inactivity fees, make sure to trade regularly or make deposits/withdrawals in your account. If your account is inactive for a prolonged period (typically 6 months), Exness may charge an inactivity fee.