15 minute read

XAUUSD Contract Size on Exness

Trading gold through the XAUUSD pair is a favored choice among traders due to its high liquidity and significance as a safe-haven asset. However, understanding the concept of contract size is critical for optimizing your trading strategy and managing risk effectively. The contract size determines the volume of gold in each trade, influencing factors such as margin requirements, pip value, and potential profit or loss.

On Exness, traders have access to a range of flexible contract sizes, catering to diverse trading styles and account sizes. Whether you’re trading standard contracts of 100 troy ounces, mini contracts of 10 troy ounces, or micro contracts of just 1 troy ounce, Exness provides options that allow you to tailor your positions to align with your financial goals and risk tolerance. This adaptability ensures that both beginners and seasoned traders can participate confidently in the gold market.

By understanding how contract size works and leveraging Exness’s tools, such as the Gold Trading Calculator, you can fine-tune your trading approach, manage your exposure, and capitalize on the opportunities offered by the dynamic XAUUSD market.

What is Contract Size in XAUUSD Trading?

The contract size in XAUUSD trading represents the standardized amount of gold in a trading position, influencing margin requirements, pip value, and potential profit or loss. This metric is key for managing trades effectively, aligning strategies with financial goals, and navigating market volatility. Understanding the contract size helps traders assess market conditions and make informed decisions when trading gold as a safe-haven asset in dynamic financial markets.

In XAUUSD trading, the standard contract size equals 100 troy ounces of gold. Brokers like Exness cater to different trading styles by offering flexible options such as mini contracts (10 troy ounces) and micro contracts (1 troy ounce). These smaller sizes suit retail clients, enabling them to manage risk effectively and lower trading costs. Such flexibility allows traders to adopt diverse strategies, whether focusing on short-term market fluctuations or long-term price movements influenced by economic indicators or geopolitical events.

Choosing the right contract size is crucial for balancing risk tolerance and profit targets. A standard contract amplifies potential gains or losses, with each pip movement worth $10, while a micro contract offers controlled exposure at $1 per pip movement. This adaptability, coupled with Exness’s competitive spreads and advanced tools, empowers traders to execute trades efficiently and align with their trading style. Leveraging tools like the Gold Trading Calculator helps experienced and new traders optimize their outcomes in the XAUUSD market.

Contract Size Options on Exness

Exness provides a range of contract size options for XAUUSD trading, designed to cater to traders with diverse strategies, experience levels, and account sizes. These options enable traders to choose a contract size that aligns with their financial goals and risk tolerance, offering maximum flexibility in the dynamic gold market.

1. Standard Contracts

The standard contract size on Exness represents 100 troy ounces of gold. This is the industry benchmark and is ideal for experienced traders or those managing larger accounts. A single pip movement in this contract size equates to $10, offering significant profit potential while requiring careful risk management.

2. Mini Contracts

Mini contracts represent 10 troy ounces of gold, making them a popular choice for intermediate traders or those looking to scale their positions moderately. With a pip value of $1, mini contracts strike a balance between risk and reward, providing manageable exposure to the gold market.

3. Micro Contracts

Micro contracts are the smallest available size, representing just 1 troy ounce of gold. They are particularly beneficial for beginners or traders with smaller account balances. Each pip movement in a micro contract is worth $0.10, allowing for precise risk management and experimentation with strategies without significant financial exposure.

4. Fractional Contracts

Exness also supports fractional contract sizes, enabling traders to fine-tune their positions even further. This feature is particularly useful for implementing specific risk management strategies or aligning trades with available account equity.

Standard Contract Sizes for XAUUSD

In XAUUSD trading, contract size refers to the volume of gold represented in a single trade, and it plays a crucial role in determining the financial outcomes of your trades. The most widely used standard in the gold trading market is the 100 troy ounce contract size, which is commonly referred to as a standard contract. This size serves as the benchmark for calculating key trading metrics such as pip value, margin requirements, and potential profit or loss.

For traders who prefer smaller positions or have lower risk tolerance, there are alternatives to the standard contract size:

Mini Contracts: Representing 10 troy ounces of gold, mini contracts are a popular choice for intermediate traders or those scaling up from smaller positions. They offer a balance between potential returns and controlled risk.

Micro Contracts: Representing just 1 troy ounce of gold, micro contracts are ideal for beginners or traders who want to fine-tune their trades. They allow for precise control over risk exposure, making them an excellent choice for smaller accounts.

The financial impact of these contract sizes varies based on market movements. For instance: In a standard contract, a one-pip movement in XAUUSD is worth $10. For a mini contract, the same movement is worth $1. In a micro contract, a one-pip movement is valued at just $0.10.

This tiered structure allows traders to choose a contract size that aligns with their trading goals and risk appetite. Exness enhances this flexibility by offering customizable contract sizes and competitive trading conditions, ensuring that traders at all levels can access and succeed in the XAUUSD market. With these options, you can effectively manage your exposure and optimize your gold trading strategy.

Start Trading: Open Exness Account or Visit Website

How Contract Size Impacts XAUUSD Trading

The contract size you choose for trading XAUUSD significantly influences your trading outcomes, from potential profits and losses to the required margin and risk exposure. Understanding these impacts is essential for making informed decisions and optimizing your gold trading strategy.

1. Profit and Loss Potential

Contract size determines the volume of gold you are trading, which directly affects the monetary value of each pip movement. For instance:

A standard contract (100 troy ounces) results in a $10 profit or loss for every pip movement in the XAUUSD price.

A mini contract (10 troy ounces) changes the profit or loss to $1 per pip.

A micro contract (1 troy ounce) reduces the impact to $0.10 per pip.

Larger contract sizes amplify both potential profits and losses, making them suitable for traders with high-risk tolerance and larger accounts. Conversely, smaller contract sizes provide a more controlled exposure, ideal for risk-averse traders or those with smaller capital.

2. Margin Requirements

The contract size directly impacts the margin required to open and sustain a position. Larger contracts demand more margin, which means a trader must have sufficient funds in their account to support the trade. Leverage can help reduce the initial capital requirement, but it also increases risk, especially with larger contracts. For smaller contract sizes, the margin requirement is lower, allowing traders to participate in the market without overexposing their accounts.

3. Risk Management and Account Safety

Choosing the right contract size is crucial for managing risk. Larger contract sizes can lead to significant gains but also pose the risk of substantial losses if the market moves against your position. Smaller contracts enable more precise risk control, allowing traders to set tighter stop-loss levels and maintain a healthy margin level in volatile markets.

4. Scalability and Flexibility

Flexible contract sizes allow traders to adapt their strategies to changing market conditions. For instance, during high volatility, a trader might reduce their contract size to limit risk. Similarly, as account equity grows, traders can scale up their positions to maximize profit potential while maintaining a consistent risk management approach.

5. Impact on Trading Strategy

The choice of contract size affects how you execute your trading strategy. For short-term traders like scalpers, smaller contracts might be more appropriate due to rapid market movements. On the other hand, swing traders or position traders might prefer larger contracts to capitalize on long-term price trends.

Calculating the Right Contract Size

Gold trading on the XAUUSD market has become a strategic choice for many traders at Exness, offering flexibility through competitive spreads and customizable leverage. The standard contract size for XAUUSD, equivalent to 100 troy ounces, allows both retail clients and experienced traders to assess market conditions and make informed trading decisions. With tools like fundamental and technical analysis, Exness empowers traders to anticipate price movements in the dynamic gold market, ensuring robust risk management while exploring profit opportunities in volatile markets influenced by economic indicators and geopolitical events.

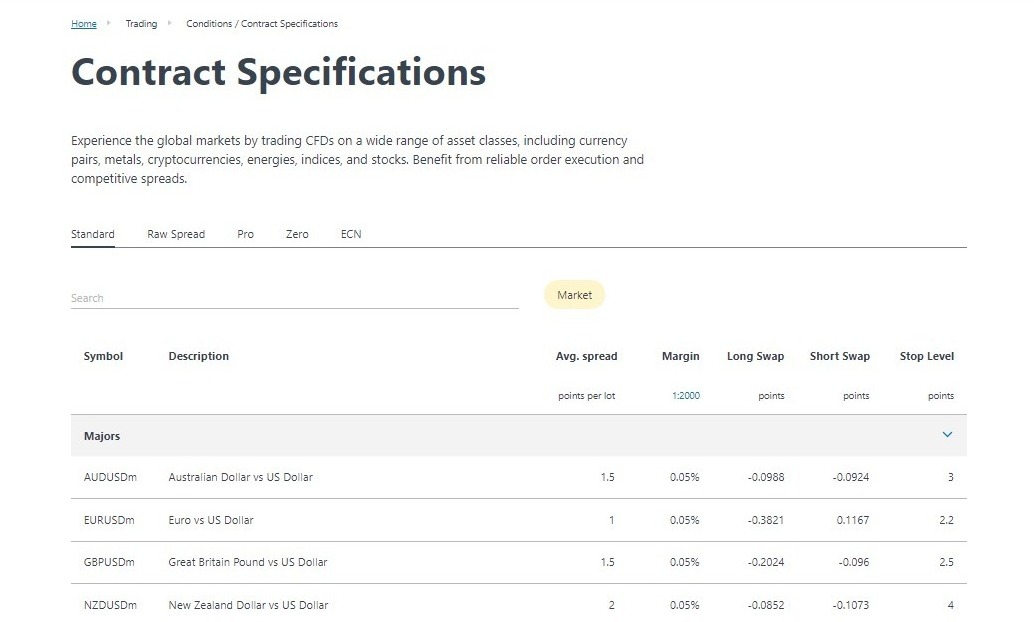

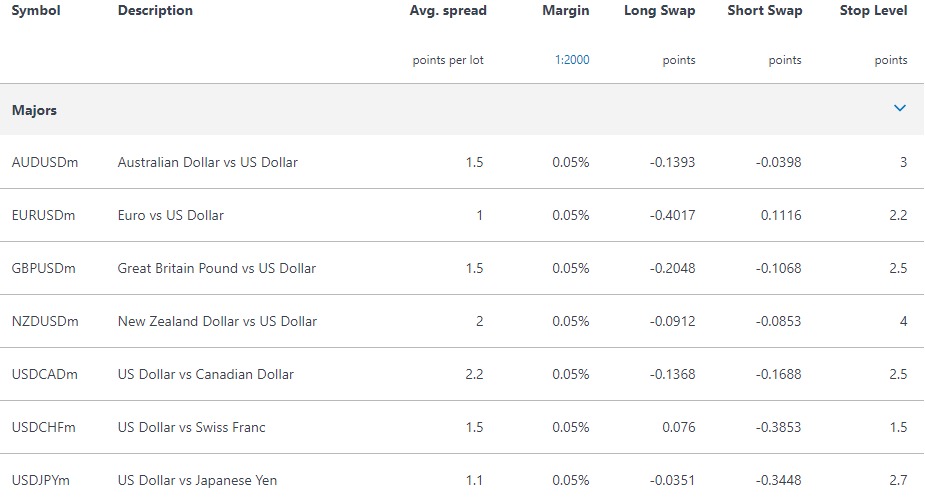

Operating under the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), among others, Exness provides regulated and transparent services to its clients. These include a diverse range of trading platforms, from MetaTrader 4 (MT4) to browser-based solutions, enabling traders to execute multiple strategies, manage risk effectively, and capitalize on market fluctuations. The integration of advanced analytical tools ensures traders can respond swiftly to market volatility, achieving lower trading costs and potential profits.

Risk management is central to Exness’s trading philosophy, particularly in markets like XAUUSD, known for significant price fluctuations. By leveraging tools like the Exness Gold Trading Calculator, traders can align contract sizes with their risk tolerance and financial objectives. This not only minimizes the risks of losing money rapidly but also supports executing multiple trades in volatile conditions, a strategy favored by swing traders and those employing both fundamental and technical analyses.

Exness’s compliance with applicable laws across several financial entities ensures that its services cater to diverse retail and professional clients globally. The company's clear communication of buy and sell prices, competitive spreads, and contact details reflects a commitment to transparency. Whether trading gold as a safe haven asset or leveraging XAUUSD for speculative gains, traders can proceed with confidence, knowing their activities are supported by robust regulatory oversight and cutting-edge trading solutions.

Benefits of Flexible Contract Sizes on Exness

Exness offers flexible contract sizes for XAUUSD trading, providing traders with significant advantages to suit their individual trading needs. These flexible options cater to traders of all experience levels, from beginners with smaller accounts to seasoned professionals managing larger portfolios. By offering diverse contract sizes, Exness ensures a tailored trading experience that promotes better risk management and strategic alignment.

Accessibility for All Traders

Flexible contract sizes, including micro (1 troy ounce), mini (10 troy ounces), and standard contracts (100 troy ounces), make XAUUSD trading accessible to everyone. Beginners can start with micro contracts to test strategies and build confidence without risking large amounts of capital. Meanwhile, experienced traders can scale up to standard contracts to maximize profit potential.

Enhanced Risk Management

The ability to choose smaller contract sizes allows traders to control their risk exposure more effectively. For example, micro and mini contracts enable precise adjustments to position sizes, helping traders maintain healthy risk-to-reward ratios. This flexibility is especially valuable during periods of high market volatility, where controlled exposure is crucial.

Scalability for Growing Accounts

As traders gain experience and grow their account balances, Exness’s flexible contract sizes make it easy to scale positions. Starting small with micro or mini contracts and gradually moving to standard contracts allows traders to align their trading volume with their evolving financial goals and risk appetite.

Customization for Diverse Strategies

Different trading strategies require varying levels of exposure. Scalpers, for example, often prefer smaller contract sizes to navigate quick market movements, while swing traders or position traders might opt for larger contracts to capitalize on long-term trends. Exness’s fractional contracts further enable fine-tuning of position sizes to match specific strategies.

Reduced Barriers to Entry

Flexible contract sizes eliminate barriers for traders with limited capital. By allowing trades at smaller volumes, Exness ensures that more people can participate in the gold market without the need for substantial upfront investments. This inclusivity fosters learning and growth for newer traders.

Efficient Use of Leverage

Traders using leverage can optimize their contract sizes to match their available margin and risk tolerance. Smaller contract sizes make it easier to avoid over-leveraging, ensuring sustainable trading practices while taking advantage of the leverage options offered by Exness.

Improved Capital Allocation

With flexible contract sizes, traders can allocate capital more effectively across multiple trades or instruments. For instance, instead of committing all resources to one large position, traders can diversify their portfolio by opening multiple smaller positions, reducing risk while maintaining market exposure.

Start Trading: Open Exness Account or Visit Website

Tips for Managing XAUUSD Contract Sizes

Managing contract sizes effectively is a critical aspect of trading XAUUSD, as it directly impacts risk, potential profits, and account sustainability. Proper contract size management helps traders align their trades with their financial goals and navigate the dynamic gold market confidently. Here are some key tips for managing XAUUSD contract sizes:

1. Start Small and Scale Up Gradually

For beginners or traders testing new strategies, it’s wise to start with smaller contract sizes, such as micro contracts (1 troy ounce). This minimizes risk exposure while providing room to learn and refine your approach. As your confidence, experience, and account balance grow, you can gradually scale up to mini or standard contracts.

2. Consider Your Risk Tolerance

Before entering any trade, evaluate how much risk you are willing to take. A general rule is to limit your risk to no more than 1–2% of your account balance per trade. For example, if your account has $10,000, you should not risk more than $100–$200. Adjust your contract size accordingly to ensure you stay within these limits.

3. Align Contract Sizes with Market Volatility

Gold prices can be highly volatile, especially during major economic events. During periods of high volatility, consider reducing your contract size to mitigate the impact of sudden price swings. Smaller contract sizes help you maintain control and avoid significant losses.

4. Use Stop-Loss Orders

Pair your chosen contract size with a well-placed stop-loss order to limit potential losses. Calculate the appropriate stop-loss level based on the contract size and your risk tolerance. For example, with a micro contract, setting a $10 stop-loss would mean risking $10 per troy ounce of movement.

5. Leverage Fractional Contracts

Exness offers fractional contract sizes, allowing traders to fine-tune their positions. This flexibility is particularly useful for traders seeking to balance their exposure or implement precise strategies. Fractional contracts enable you to optimize risk while maintaining desired market exposure.

6. Account for Leverage

Leverage can amplify your trading capacity, allowing you to trade larger contract sizes with less capital. However, higher leverage also increases risk. Ensure your chosen contract size does not overextend your margin, leaving room for market fluctuations.

7. Regularly Monitor and Adjust

Review your trades regularly to ensure your contract sizes align with your account balance and market conditions. If your account grows, you may increase your contract size proportionally. Conversely, if your balance decreases, scaling down contract sizes can help protect your capital.

8. Use the Exness Gold Trading Calculator

Simplify the process of managing contract sizes by using the Exness Gold Trading Calculator. This tool helps you determine the optimal contract size based on your account balance, stop-loss level, and risk percentage, ensuring precise and informed trading decisions.

Conclusion

Managing XAUUSD contract sizes effectively is fundamental to successful gold trading, as it directly influences risk, potential profits, and trading sustainability. By carefully selecting the appropriate contract size, traders can align their positions with their financial goals, risk tolerance, and market conditions. This level of precision allows for more controlled exposure to the dynamic gold market, minimizing unnecessary risks and enhancing the potential for consistent returns.

Exness provides a flexible range of contract sizes, including micro, mini, and standard contracts, as well as fractional options, making XAUUSD trading accessible to traders of all levels. Combined with advanced tools like the Exness Gold Trading Calculator, traders can determine the ideal contract size for their strategy, ensuring they make informed and calculated decisions.

Whether you are a beginner exploring the market or an experienced trader scaling up your strategy, managing contract sizes is a crucial component of your overall success. With the right approach and the resources offered by Exness, you can confidently navigate the XAUUSD market, optimize your trades, and achieve your trading objectives.

FAQs

What is a contract size in XAUUSD trading?

A contract size in XAUUSD trading represents the amount of gold being traded. Standard sizes include 100 troy ounces (standard contract), 10 troy ounces (mini contract), and 1 troy ounce (micro contract).

How does contract size affect XAUUSD trading?

Contract size directly impacts your profit, loss, margin requirement, and pip value. Larger contract sizes offer higher profit potential but come with greater risk, while smaller sizes provide more controlled exposure.

What contract size options does Exness offer for XAUUSD?

Exness offers flexible options, including micro (1 troy ounce), mini (10 troy ounces), standard (100 troy ounces), and fractional contracts, catering to traders of all levels.

Can beginners trade smaller contract sizes on Exness?

Yes, Exness provides micro and mini contracts, ideal for beginners. These smaller sizes help minimize risk while allowing traders to gain experience and refine strategies.

Does leverage impact the contract size I can trade?

Yes, leverage reduces the margin required to open a trade, enabling you to trade larger contract sizes. However, higher leverage also increases risk, so use it cautiously.

What tools can I use to manage contract sizes on Exness?

Exness offers the Gold Trading Calculator, which helps traders calculate the optimal contract size based on their account balance, risk percentage, and stop-loss levels, ensuring precise and informed decisions.