6 minute read

How Much is the Gold Spread on Exness?

Gold trading is a popular choice for many traders, especially during times of economic uncertainty or market volatility. One of the important factors traders need to consider when trading gold (XAU/USD) is the spread, which is the difference between the buying price and the selling price. In this article, we’ll take a closer look at how gold spreads work on Exness, what affects these spreads, and how you can take advantage of competitive spreads when trading gold.

What is the Gold Spread on Exness?

The gold spread on Exness refers to the difference between the bid (selling) and ask (buying) prices of gold in the XAU/USD pair. The size of the spread can vary depending on factors such as market liquidity, volatility, and trading conditions. Typically, Exness offers tight spreads on XAU/USD, especially during regular trading hours when market liquidity is high. This means that traders can enter and exit positions more efficiently with lower trading costs.

As of the latest updates, Exness offers competitive spreads for gold trading, with tight spreads starting as low as 0.3 pips for the XAU/USD pair under normal market conditions. However, during high volatility or news events, the spreads may widen slightly due to increased market movements and liquidity changes.

Start Trading: Open Exness Account or Visit Website

Factors Affecting the Gold Spread on Exness

Several factors influence the gold spreads on Exness. Understanding these factors can help you time your trades better and take advantage of narrower spreads for lower trading costs.

1. Market Volatility and Liquidity

The spread on gold can widen or narrow depending on market volatility and liquidity levels. During periods of high market volatility, such as geopolitical tensions or major economic announcements, spreads may increase because of less market liquidity. In contrast, during stable market conditions with high trading volume, the gold spread tends to be tighter, offering traders better costs for entering and exiting the market.

Start Trading: Open Exness Account or Visit Website

2. Interest Rates and Inflation

Economic factors such as interest rates, inflation rates, and the overall economic environment also play a role in determining gold prices and spreads. When interest rates rise, investors may move capital out of precious metals like gold, which can affect market liquidity and spread conditions. Gold is often seen as a safe haven asset, meaning that during times of economic uncertainty or high inflation, demand for gold increases, potentially affecting gold spreads.

3. Geopolitical Tensions

Geopolitical events, such as wars, trade disputes, or changes in government policies, can impact gold prices significantly. This can lead to wider spreads as traders react to the uncertainty, causing fluctuations in market liquidity. Exness provides tools for monitoring these market developments, helping traders stay updated and adjust their trading strategy accordingly.

How Exness Offers Competitive Gold Spreads

Exness is known for providing competitive spreads on a variety of financial instruments, including gold. Exness offers a low-cost trading environment for investors and traders looking to trade XAU/USD. The broker provides narrow spreads on gold during the most liquid trading hours when there is significant market activity. These tight spreads reduce the overall trading cost for investors, especially for those who trade frequently or with high trading volumes.

Additionally, Exness offers a variety of account types to meet different traders’ needs. For example, Pro accounts typically offer tighter spreads on XAU/USD, which is ideal for experienced traders who want to minimize trading costs. Meanwhile, traders who are just starting out can use the Standard account with slightly wider spreads, but still with low fees and a low minimum deposit requirement.

How to Optimize Your Trading with Gold Spreads

Here are some tips to help you optimize your trading strategy when using Exness for gold trading:

1. Choose the Right Account Type

Depending on your trading frequency and risk tolerance, you should choose the account type that offers the best spreads for your needs. If you are an active trader who frequently enters and exits positions, a Pro account or Raw Spread account will provide you with tighter spreads on XAU/USD.

2. Time Your Trades

The EUR/USD spread and gold spreads can vary depending on market conditions and trading volume. By trading during active market hours, such as during the overlap between the London and New York sessions, you can take advantage of tight spreads when liquidity is high. Avoid trading during periods of low market liquidity, like on weekends or during off-hours, as this can lead to wider spreads.

3. Use Technical Indicators

Using technical indicators, such as Bollinger Bands, Moving Averages, or the Relative Strength Index (RSI), can help you anticipate potential price movements in the gold market. This allows you to enter and exit trades more effectively, especially when market volatility is high.

FAQ

How much is the gold spread on Exness?

The gold spread on Exness can start as low as 0.3 pips for the XAU/USD pair during stable market conditions. However, during volatile market conditions, the spread may widen due to changes in market liquidity.

Why do gold spreads widen during volatile market conditions?

Gold spreads tend to widen during periods of high market volatility because liquidity decreases and market participants become less active. Events like economic reports, geopolitical tensions, or interest rate changes can cause wider spreads.

Can I reduce my trading costs with Exness gold spreads?

Yes, you can reduce your trading costs by choosing the right account type. Pro accounts and Raw Spread accounts offer tighter spreads on XAU/USD, which is beneficial for experienced traders or those who engage in frequent trading.

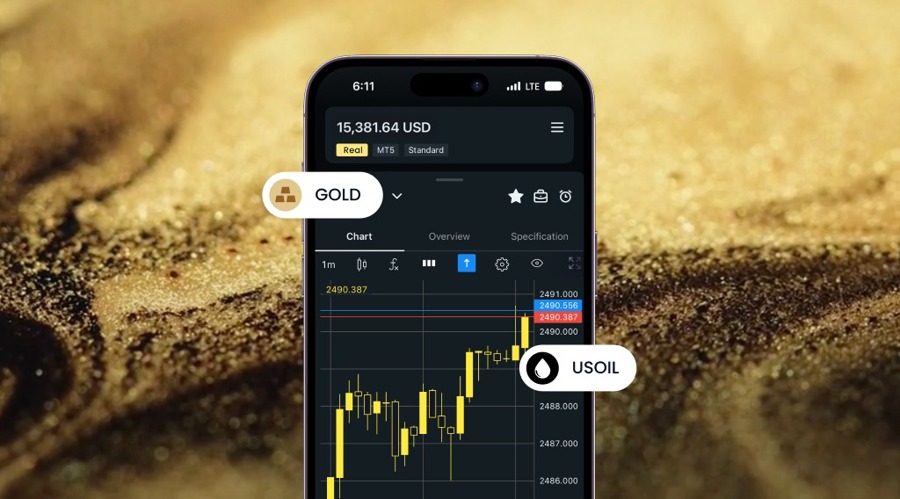

How do I monitor gold spreads on Exness?

You can monitor gold spreads directly through the Exness trading platform. The platform displays live spreads for gold trading, allowing you to track current spread conditions and time your trades accordingly.