7 minute read

What are EUR/USD Spreads on Exness?

The EUR/USD spread on Exness is the difference between the buying price (ask) and the selling price (bid) of the EUR/USD currency pair. As one of the most popular major currency pairs, EUR/USD typically experiences tight spreads, especially during times of high market liquidity when both the European and U.S. markets are active. The spread is one of the key trading costs that traders need to consider, as it can directly impact overall profitability. On Exness, the spread for EUR/USD can vary depending on factors like the account type, market conditions, and volatility. Traders can choose from Standard, Pro, or Raw Spread accounts, with tighter spreads typically available on Pro or Raw Spread accounts.

Exness offers competitive spreads for EUR/USD, starting as low as 0.1 pips for Pro accounts during normal market conditions, while Raw Spread accounts can offer spreads starting from 0.0 pips with a commission fee per trade. EUR/USD spreads may widen during volatile market conditions, such as geopolitical events or economic data releases, when market liquidity is lower. To minimize trading costs, it’s essential for traders to understand spread trends and the best times to execute trades. By selecting the right Exness account type, traders can optimize their trading strategies to take advantage of tighter spreads and improve overall profitability.

What Are Spreads in Forex Trading?

The spread is the difference between the buying price (ask price) and the selling price (bid price) of a currency pair. For EUR/USD, the spread is the gap between the price at which you can buy the euro and sell the dollar, or vice versa. Spreads are one of the key trading costs in the forex market, alongside commission fees, and are influenced by a range of factors including market liquidity, trading frequency, and volatile market conditions.

Why Are Spreads Important?

Understanding spreads is essential for traders because they directly affect trading costs. A tighter spread means lower costs for executing a trade, which is especially important for short-term traders or those who trade with high frequency. On the other hand, wider spreads may occur during volatile market conditions, such as geopolitical events or economic announcements, leading to increased trading costs. Therefore, it is crucial to monitor spread trends and select the right account type based on your trading style.

Start Trading: Open Exness Account or Visit Website

How Do EUR/USD Spreads Vary on Exness?

On Exness, the EUR/USD spreads can vary depending on several factors, such as the account type you choose, market conditions, and liquidity. Exness offers competitive spreads on major currency pairs like EUR/USD, with the ability to provide tighter spreads under certain circumstances. The spread on EUR/USD tends to be narrower when the market liquidity is high, such as during regular trading hours or when major market participants are active. Conversely, in volatile market conditions, such as after economic data releases or geopolitical events, spreads may widen significantly due to the decrease in market liquidity and increased market volatility.

Types of Exness Accounts and Their Impact on EUR/USD Spreads

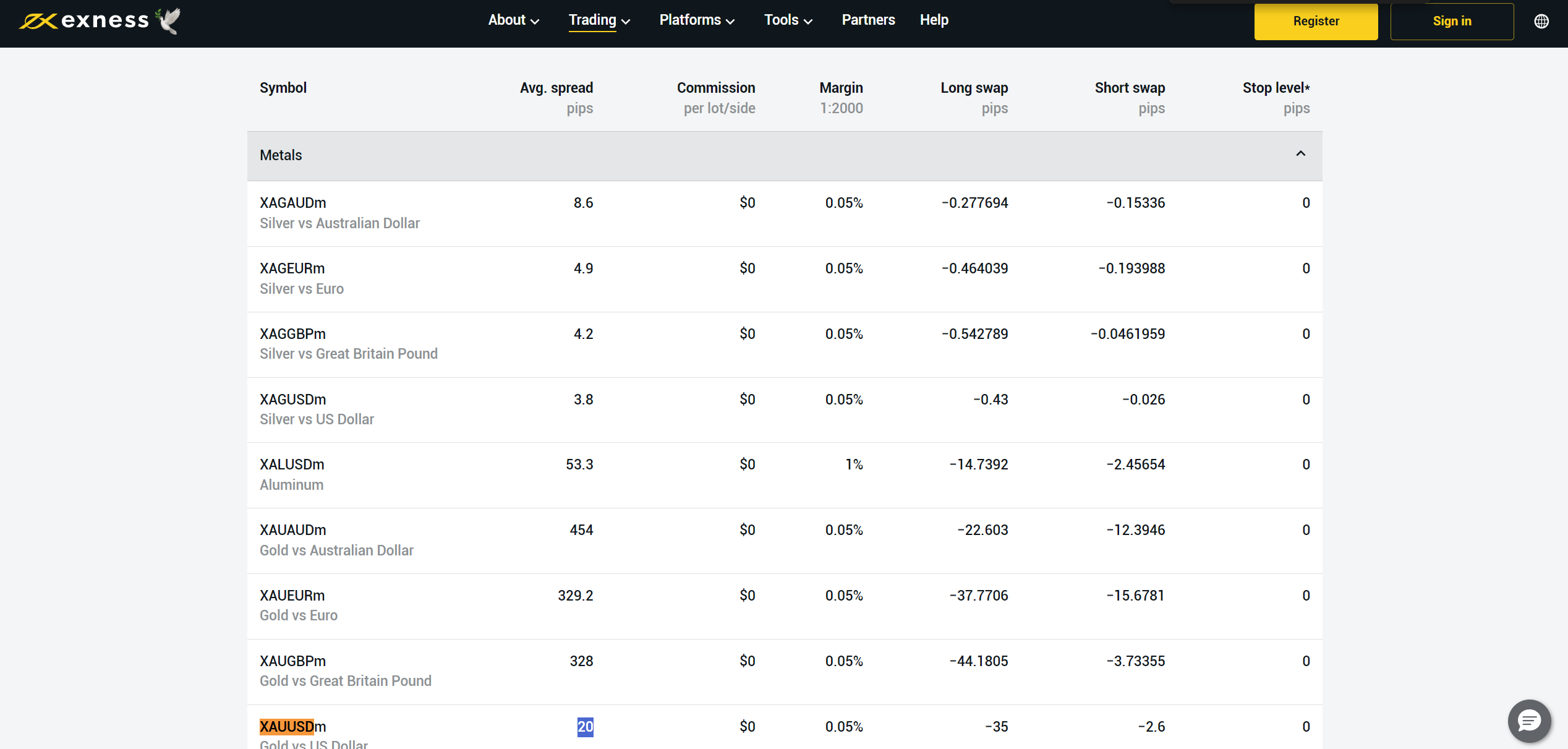

Exness offers several account types, and the spread conditions can vary depending on the account you choose. Here’s a breakdown of the common account types and how they impact EUR/USD spreads:

Standard Account

Spreads: Typically, the EUR/USD spread on a Standard account is variable, and the spread may widen during high volatility periods.

Minimum Deposit: As low as $1.

Best for: Beginner traders who prefer no commission and lower minimum deposits.

Spread Example: During stable market conditions, spreads for EUR/USD can start as low as 0.9 pips, but during high volatility, it may increase.

Pro Account

Spreads: Offers lower spreads compared to the Standard account, with EUR/USD spreads starting at 0.1 pips during stable market conditions.

Minimum Deposit: Typically higher than Standard accounts.

Best for: Experienced traders who need tighter spreads for more active trading.

Spread Example: During normal market hours, EUR/USD spreads can be as low as 0.1 pips, but may widen in periods of low liquidity.

Factors Affecting EUR/USD Spreads on Exness

1. Market Liquidity

High liquidity generally results in tighter spreads. EUR/USD, being a highly liquid pair, usually enjoys low spreads during normal trading hours when market participants are active. Exness offers tight spreads for major currency pairs, but these can widen during periods of lower liquidity, like after market close or during the weekend gap.

Start Trading: Open Exness Account or Visit Website

2. Market Volatility

During volatile market conditions, such as after major economic announcements, market spreads tend to widen. EUR/USD spreads might be wider during volatile events like central bank meetings or geopolitical issues that affect market sentiment. It’s essential to be aware of these conditions and adjust your trading strategy accordingly.

3. Geopolitical Events and News

Geopolitical events and economic news releases can significantly impact spread conditions. For example, EUR/USD may experience higher spreads during Brexit-related news or U.S. Federal Reserve policy changes. Traders should be aware of such events as they can affect EUR/USD spreads and overall trading costs.

Managing Trading Costs with EUR/USD Spreads

1. Monitor Spreads

Keeping an eye on spread trends can help you determine the best time to trade. For short-term traders, tight spreads are crucial for profitability. You can check the current spread and trading conditions through the Exness terminal or Exness trading platforms before entering a trade.

2. Use a Demo Account

If you are new to forex trading, using a demo account can help you get accustomed to spread conditions without risking real capital. On Exness, you can open a demo account to practice trading EUR/USD and experiment with different account types to see which offers the best spreads for your trading style.

3. Consider Market Conditions

Understand that market conditions directly affect spread behavior. During periods of high liquidity, such as when both the European market and the U.S. market are open, EUR/USD spreads are typically tighter. During low liquidity periods, such as weekends or holidays, spreads tend to widen.

Conclusion

The EUR/USD spread on Exness is an important consideration for traders seeking to minimize trading costs and maximize profitability. By understanding spread trends, monitoring market conditions, and choosing the right account type, traders can take advantage of competitive spreads and lower costs. Whether you are a beginner using a demo account or an experienced trader actively engaging in forex trading, Exness offers a range of tools and account types to optimize your trading strategy. Keep in mind that spreads will vary depending on market conditions, so it’s crucial to stay informed and adjust your approach accordingly.

FAQs about EUR/USD Spreads on Exness

What are the typical EUR/USD spreads on Exness?

The EUR/USD spread on Exness can start from 0.0 pips for Raw Spread accounts and 0.1 pips for Pro accounts during favorable market conditions. Standard accounts typically have variable spreads, which may be wider during volatile market conditions.

How do volatile market conditions affect EUR/USD spreads?

In volatile market conditions, such as during economic reports or geopolitical events, EUR/USD spreads can widen significantly. It is crucial for traders to monitor the current spread and adjust their trading strategies accordingly.

Can I get tighter spreads for EUR/USD on Exness?

Yes, Exness offers tighter spreads for EUR/USD on Pro and Raw Spread accounts, which are designed for more active traders. These accounts provide access to competitive spreads during normal market hours when liquidity is high.

How can I reduce trading costs with EUR/USD?

To reduce trading costs when trading EUR/USD, choose an account with tighter spreads, such as a Raw Spread account, and trade during periods of high market liquidity. Avoid trading during periods of low liquidity, like weekends or holidays, when spreads are typically wider.