9 minute read

How Does Exness Zero Spread Work for XAUUSD?

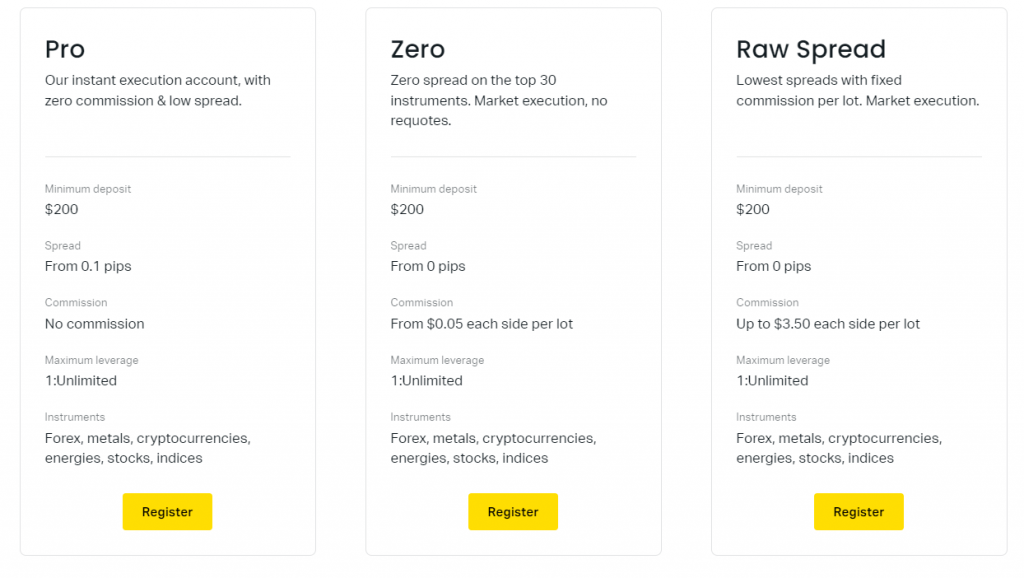

Exness Zero Spread Account offers a unique opportunity for traders to access tight spreads of 0.0 pips on various trading instruments, including XAU/USD (gold). Unlike standard accounts, where spreads typically start from 1.0 pips or more, the Zero Spread Account allows traders to execute trades with no spread cost at all. Instead, traders pay a fixed commission fee per trade, making this account particularly beneficial for high-frequency traders or those using high-volume trading strategies. The Exness Zero Spread Account is well-suited for traders who want to capitalize on small price movements in XAU/USD without the added spread costs that can often eat into profits during volatile market periods.

This zero spread account is designed for traders looking for predictable costs and who are willing to accept a fixed commission structure in exchange for tighter spreads. The fixed commission fees are calculated precisely, making it easier for traders to manage trading costs and estimate the potential profits of each trade. The Exness Zero Spread Account is particularly attractive for traders who wish to take advantage of high market volatility, such as during major economic announcements or geopolitical events, where market trends can lead to significant price movements. By offering lower trading costs and competitive trading conditions, Exness allows traders to minimize costs while maximizing their trading success, especially in markets like XAU/USD that experience frequent fluctuations.

What is Exness Zero Spread Account?

The Exness Zero Spread Account is a special account type offered by Exness that provides zero spreads on certain instruments, including XAUUSD, the most popular gold trading pair in the forex market. Zero spreads mean there is no difference between the ask price and bid price, so traders can enter and exit positions at the same price. However, it’s important to note that Exness charges a fixed commission fee for each trade. While this may initially seem like an added cost, it offers traders the advantage of lower trading costs compared to traditional variable spreads.

This type of account is ideal for high-frequency traders, scalpers, or those who engage in day trading, as tight spreads are crucial for making quick trades and minimizing transaction costs. Unlike standard accounts, where spreads can fluctuate due to market conditions, the Exness Zero Spread Account offers a predictable cost structure with a fixed commission, which makes cost calculations more precise.

How Exness Zero Spread Works for XAUUSD

Exness zero spread feature for XAUUSD works by offering zero pips between the buy and sell prices. In most traditional accounts, spreads are variable, meaning they increase during periods of high market volatility or low liquidity. However, with the Zero Spread Account, the spread on XAUUSD remains fixed at 0.0 pips regardless of market conditions. This allows traders to minimize trading costs and focus on their trading strategies without worrying about fluctuations in the spread.

It’s important to keep in mind that while the spread is zero, Exness still applies a fixed commission fee to each trade. This commission is clear and transparent, meaning traders can easily calculate trading costs before executing their trades. The fixed commission fee is usually based on the trading volume and the specific trading account type. For high-frequency traders, the combination of zero spread and fixed commission fees results in lower overall transaction costs.

Key Advantages of Exness Zero Spread Account

Lower Trading Costs

With the Exness Zero Spread Account, traders benefit from zero spreads on XAUUSD and other selected pairs. This results in significantly lower trading costs for each trade, especially in volatile market periods. Traders can make quick decisions without worrying about the spread widening during periods of high market volatility, which is common in many other brokers’ variable spread accounts.

Precision in Cost Calculations

Traders who use the Exness Zero Spread Account can expect predictable costs due to the fixed commission structure. This is beneficial for traders who require precise cost calculations when executing multiple trades. The fixed commission remains the same regardless of market movements, allowing traders to accurately estimate transaction costs and plan their trading strategies accordingly.

Start Trading: Open Exness Account or Visit Website

Ideal for High-Frequency and Scalping Traders

Traders engaging in high-frequency trading or scalping can take advantage of zero spreads to execute multiple trades with minimal cost impact. Since these trading styles often rely on small price movements, having zero spreads ensures that even the smallest price movements can lead to potential profits without the burden of fluctuating spreads.

Risks and Considerations with Exness Zero Spread Account

While the Exness Zero Spread Account offers great benefits, it’s important to be aware of the risks involved, especially for those who are new to trading or who use high leverage.

Fixed Commission Fees

The fixed commission fees are a key component of the zero spread account, and while this structure offers predictable costs, it’s essential to factor in these fees when calculating potential profits. Traders need to consider transaction costs carefully, especially if their trading volume is high. Even with zero spreads, the commission can still add up over time, particularly for day traders and high-frequency traders.

High Risk of Losing in Volatile Markets

Although the zero spread offers lower trading costs, traders should be mindful of volatile market conditions, especially when trading high-risk instruments like XAUUSD. In fast-moving markets, even a small price movement can lead to substantial gains or losses. Risk management strategies are crucial, particularly when using leverage to amplify positions.

Not Ideal for Long-Term Traders

For long-term traders or those who hold positions for several days or weeks, the zero spread account might not be the best option. The fixed commission fees might outweigh the benefits of zero spreads if the trader is not executing frequent trades. For those who prefer buy-and-hold strategies, an account with wider spreads but no commissions could be more appropriate.

How to Open Exness Zero Spread Account

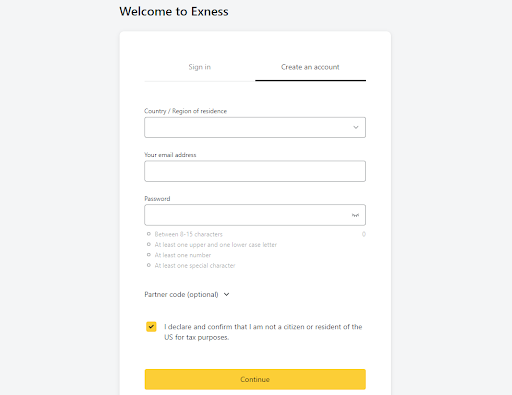

Opening an Exness Zero Spread Account is simple and can be done in just a few steps:

Visit the Exness Website: Go to the official Exness website to start the registration process.

Choose the Account Type: Select the Zero Spread Account from the available account types.

Submit Verification Documents: Upload the required documents for account verification, such as proof of identity and address.

Fund Your Account: Make a deposit using your preferred payment method. Exness supports various options, including bank wire transfers, e-wallets, and cryptocurrency deposits.

Start Trading: Once your account is set up, you can begin trading XAUUSD and other instruments with zero spreads and fixed commission fees.

Start Trading: Open Exness Account or Visit Website

Exness vs Other Brokers: How Does Zero Spread Compare?

Exness Zero Spread Account stands out in comparison to other brokers. Many brokers offer variable spreads that widen during periods of high market volatility, making the cost structure unpredictable. In contrast, Exness offers a fixed commission with zero spreads, ensuring that traders can accurately predict their trading costs and take advantage of tighter spreads. For traders who prefer certainty in their cost structure, Exness offers a significant advantage.

Key Factors to Consider When Using Exness Zero Spread Account

The Exness Zero Spread Account offers traders significant advantages, especially for high-frequency traders or those who engage in scalping strategies. One of the most important factors to consider is the fixed commission fees that apply to each trade. While the zero spread ensures there’s no difference between buy and sell prices, the fixed commission can affect overall trading costs. Traders need to estimate trading costs carefully to ensure that the commission structure doesn’t outweigh the savings made from zero spreads, particularly in high-volume trading scenarios.

Another factor to consider is the market volatility. While Exness offers competitive trading conditions, spreads may still be influenced by volatile market conditions, particularly during major economic announcements or volatile market periods. The zero spread account is ideal when the market is stable, but during times of heightened market volatility, traders should consider the trading volume and the impact of fixed commissions on their overall costs. It’s crucial to have risk management strategies in place when trading during these times.

Lastly, the Exness Zero Spread Account is best suited for traders who require precise cost calculations and those looking for lower trading costs. The fixed spreads remain constant, and traders benefit from predictable costs, making it easier to estimate profits and losses in different trading conditions. However, it’s important to note that Exness UK Ltd, registered in Wales under Companies House, provides this service under the Cyprus Securities and Financial Conduct Authority regulations. This ensures a safe and regulated environment for retail traders seeking efficient forex trading options.

How Exness Zero Spread Account Compares to Standard Accounts

The Exness Zero Spread Account stands out compared to Standard accounts due to its zero spread offering on major currency pairs like XAUUSD and other popular instruments. In contrast, Standard accounts typically feature variable spreads, which can fluctuate based on market conditions and liquidity. While zero spreads provide cost certainty for traders, Standard accounts may have wider spreads, making them less predictable, especially for traders executing multiple trades.

Additionally, Standard accounts generally do not charge commission fees, unlike the Exness Zero Spread Account, which applies a fixed commission on each trade. This can make Standard accounts more attractive for beginner traders or those with a lower trading volume, as they don’t have to deal with the added complexity of commission fees. However, for experienced traders seeking tight spreads and lower trading costs, the Exness Zero Spread Account offers a significant advantage, especially when paired with high-frequency trading strategies.

Frequently Asked Questions (FAQ)

What are the benefits of the Exness Zero Spread Account?

The main benefits are zero spreads on popular instruments like XAUUSD, predictable trading costs, and a fixed commission structure, ideal for high-frequency traders and those looking for lower trading costs.

Does Exness charge any hidden fees with the Zero Spread Account?

No, Exness does not have hidden fees. While the spread is zero, there is a fixed commission fee per trade, which is clearly stated upfront.

Can I use the Zero Spread Account for long-term trading?

The Exness Zero Spread Account is best suited for high-frequency trading or scalping strategies. For long-term traders, the commission fees might not make it the most cost-effective option.

How does Exness Zero Spread compare with other brokers?

Exness offers zero spreads and fixed commission fees, which is more predictable than brokers that offer variable spreads, especially during volatile market periods.