10 minute read

How to Open an Account with Exness?

Opening an account with a reliable forex broker is the first step toward a successful trading journey. As one of the most trusted names in the industry, Exness offers a seamless account setup process that caters to traders of all experience levels. Whether you’re a beginner looking to explore forex trading or a seasoned trader ready to expand your portfolio, Exness provides a secure and efficient platform to get started.

This guide walks you through the step-by-step process of creating an account with Exness. From registration and verification to choosing the right account type and platform, we’ll cover everything you need to know to start trading with confidence. Let’s dive in and set up your Exness account today!

Introduction of Exness Account

An Exness account is your gateway to one of the most advanced and trader-friendly forex platforms in the world. Whether you are a beginner exploring the financial markets or an experienced trader looking for a reliable partner, an Exness account offers everything you need to succeed. With access to multiple trading instruments, customizable account types, and cutting-edge platforms like MetaTrader 4 and MetaTrader 5, Exness provides a secure and efficient environment for traders.

Setting up an Exness account is quick and straightforward, enabling you to start trading in minutes. Supported by world-class regulation, transparent practices, and 24/7 multilingual support, Exness ensures that your trading experience is both seamless and secure. From demo accounts for practice to professional accounts with advanced features, Exness has tailored solutions to meet your trading needs. Let’s explore the key features and benefits of opening an Exness account!

Start Trading: Open Exness Account or Visit Website

Types of Exness Account

Exness provides a variety of account types designed to meet the diverse needs of traders, from beginners to seasoned professionals. Each account type offers unique features and trading conditions, ensuring that traders can choose an option that aligns with their goals, experience level, and risk tolerance.

The Standard Account is Exness’ most popular offering, ideal for beginners and intermediate traders. This account features competitive spreads starting from 0.3 pips and requires no commission on trades, making it a cost-effective choice. With a minimum deposit as low as $10 and leverage up to 1:unlimited (depending on jurisdiction), the Standard Account offers accessibility and flexibility for traders just starting out or looking for a straightforward trading experience.

For those new to trading or wanting to practice with minimal financial risk, the Standard Cent Account is an excellent choice. It allows traders to execute trades in cent lots instead of standard lots, significantly reducing exposure. This account is perfect for beginners transitioning from demo accounts to live trading or for experienced traders testing new strategies in a real-money environment. It is available exclusively on the MT4 platform and features the same competitive conditions as the Standard Account.

Experienced traders seeking advanced features may opt for the Pro Account, which is tailored to meet the needs of professionals. This account offers instant execution, tight spreads starting from 0.1 pips, and no commission on trades. With a minimum deposit of $200, it provides an optimal trading environment for those who value precision and fast execution speeds.

For traders focused on minimizing costs, the Raw Spread Account offers raw market spreads as low as 0.0 pips. This account is particularly popular among scalpers and high-frequency traders due to its low fixed commission of $3.50 per lot per side. Similarly, the Zero Account caters to traders who prefer zero spreads on key instruments. With fixed commissions starting at $0.2 per lot per side, this account provides predictable costs, making it a preferred choice for those who trade high volumes.

Additionally, Exness offers a Demo Account for traders who want to practice in a risk-free environment. This account simulates live market conditions and comes with unlimited virtual funds, making it ideal for beginners learning to trade or experienced traders testing new strategies.

With its range of accounts, Exness ensures that traders can find a solution that fits their specific needs. Whether you are just starting or looking for advanced tools and tighter trading conditions, Exness has an account type designed to help you succeed.

Step-by-Step Guide to Opening an Account with Exness

Step 1: Visit the Exness Website

Start by navigating to the official Exness website at www.exness.com. Ensure you are on the official platform to protect your personal and financial information.

Step 2: Register for an Account

Click the “Sign Up” or “Open Account” button on the homepage.

Enter your email address and create a strong password.

Select your country of residence from the dropdown menu.

Agree to the terms and conditions, then click “Continue.”

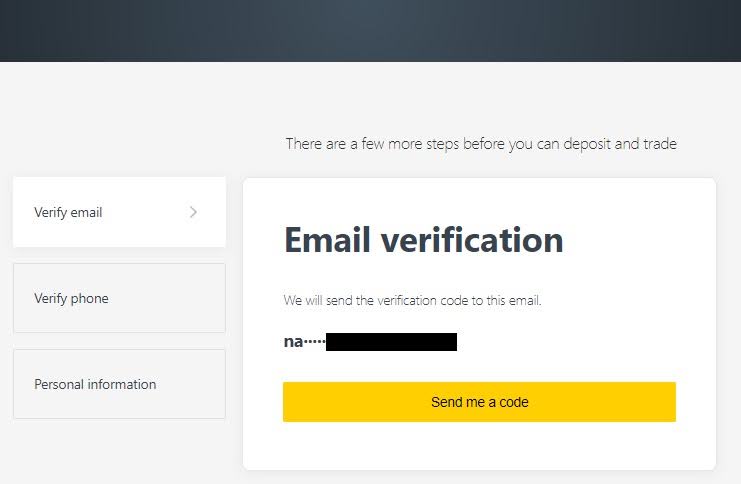

Step 3: Verify Your Email and Phone Number

After registration, you’ll receive an email with a verification link. Click on it to confirm your email.

Provide your phone number and enter the verification code sent via SMS to secure your account.

Step 4: Complete Your Personal Information

Log in to your Exness Personal Area.

Fill in your personal details, such as full name, date of birth, and address.

Double-check your information for accuracy to avoid issues during verification.

Step 5: Submit Documents for Verification

To comply with regulatory standards, Exness requires proof of identity (POI) and proof of residence (POR). Upload the following:

Proof of Identity: Passport, national ID, or driver’s license.

Proof of Residence: Utility bill, bank statement, or any document that shows your address and matches the details you provided. Exness will review your documents, and verification typically takes a few hours.

Step 6: Choose Your Account Type

Select an account type based on your trading goals:

Standard Account: Ideal for beginners.

Pro Account: Suited for experienced traders.

Raw Spread or Zero Spread Accounts: Designed for professionals seeking low spreads.

Optionally, open a Demo Account to practice trading without real financial risk.

Step 7: Set Up a Trading Platform

Choose from MetaTrader 4 (MT4), MetaTrader 5 (MT5), or the Exness Terminal.

Download the platform for your preferred device (desktop, mobile, or web).

Log in using the credentials provided in your Personal Area.

Step 8: Deposit Funds

Access the Deposit section in your Personal Area.

Select a payment method (e.g., bank transfer, e-wallet, cryptocurrency).

Enter the amount and follow the instructions to complete the transaction.

Ensure you meet the minimum deposit requirement for your chosen account type.

Step 9: Start Trading

Once your deposit is confirmed, log in to the trading platform.

Explore the available trading instruments and set up your first trade.

Use the platform’s tools and features to analyze markets and execute trades confidently.

Start Trading: Open Exness Account or Visit Website

Verification of Exness Account

Verifying your Exness account is a vital step to ensure the security of your trading activities and to comply with global regulatory standards. This process not only protects your account but also grants you full access to all the features that Exness offers, including unlimited deposits, withdrawals, and trading activities. Verification is mandatory for compliance with anti-money laundering (AML) and Know Your Customer (KYC) policies, which are designed to create a secure and transparent trading environment.

The verification process starts by logging into your Exness Personal Area through the official website. Here, you will need to provide accurate personal information, including your full name, date of birth, and current residential address. It’s crucial that these details match the information on your official documents to avoid delays or complications during the verification process.

Next, you will need to verify your email and phone number. A verification link will be sent to your registered email address, and a code will be sent via SMS to your phone. Completing these steps ensures that your contact details are secure and accurate.

The final stage involves submitting your Proof of Identity (POI) and Proof of Residence (POR). For identity verification, you can use a passport, national ID card, or driver’s license. The document must be valid, unexpired, and clearly display your name, photo, and date of birth. For address verification, you can submit a utility bill, bank statement, or government-issued letter that matches the address provided during registration. The POR document must not be older than six months, and all details should be clear and legible.

Exness typically reviews submitted documents within a few hours, notifying you via email or in your Personal Area once the verification is complete. In case of any issues, feedback will be provided to help you make the necessary corrections. To ensure a smooth process, use high-quality images of your documents and ensure all information is visible and accurate.

Completing the verification process unlocks the full potential of your Exness account. Verified accounts enjoy unrestricted access to all features, faster transaction processing, and enhanced security. By verifying your account, you are not only complying with industry regulations but also securing a reliable and seamless trading experience with Exness.

Conclusion

Exness offers a robust range of account types and features tailored to meet the needs of traders at all levels. From beginners starting with the Standard or Standard Cent accounts to professionals seeking tighter spreads and advanced tools through the Pro, Raw Spread, or Zero accounts, Exness provides flexibility and reliability. The inclusion of a Demo Account ensures that traders can practice and refine their strategies in a risk-free environment before committing real funds.

With its user-friendly platforms, competitive trading conditions, and commitment to transparency, Exness empowers traders to achieve their financial goals. Whether you prioritize low costs, access to diverse trading instruments, or advanced execution capabilities, Exness delivers a seamless and secure trading experience. By choosing the account type that best aligns with your objectives, you can confidently embark on or enhance your trading journey with Exness.

Start Trading: Open Exness Account or Visit Website

FAQs

What types of accounts does Exness offer?

Exness offers a variety of accounts, including Standard, Standard Cent, Pro, Raw Spread, Zero, and Demo Accounts. Each is tailored to different trading styles and experience levels.

What is the minimum deposit required to open an Exness account?

The minimum deposit varies by account type. For Standard Accounts, it starts as low as $10, while Pro, Raw Spread, and Zero Accounts typically require a minimum deposit of $200.

What is the difference between Standard and Pro Accounts?

The Standard Account is commission-free and ideal for beginners, with spreads starting from 0.3 pips. The Pro Account is tailored for experienced traders, offering instant execution and tighter spreads starting from 0.1 pips.

Is a Demo Account available for practice?

Yes, Exness provides a Demo Account with unlimited virtual funds, allowing traders to practice strategies or learn trading without risking real money.

Can I trade with unlimited leverage on Exness?

Exness offers flexible leverage, including up to 1:unlimited for eligible accounts. However, leverage availability may depend on the trader’s region and account type.

What trading platforms are supported by Exness accounts?

Exness accounts are compatible with MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary Exness Terminal, accessible via desktop, web, and mobile devices.

How secure is my money in an Exness account?

Exness ensures fund security by maintaining segregated accounts, offering negative balance protection, and undergoing regular audits by third-party firms like Deloitte.