11 minute read

Is Exness a Good Forex Broker for Indian Traders?

Forex trading has gained significant popularity in India, attracting both novice and experienced traders seeking opportunities in the global financial markets. However, choosing the right broker is crucial for a successful trading experience. Exness, a globally recognized forex and CFD broker, has established itself as a trusted name in the industry with its competitive trading conditions, advanced platforms, and commitment to transparency.

For Indian traders, finding a broker that aligns with local needs—such as seamless deposit and withdrawal methods, tailored trading features, and strong regulatory practices—is essential. In this article, we explore whether Exness meets the specific requirements of Indian traders. From its account types and trading instruments to its support for INR transactions and customer service, we’ll evaluate if Exness is a good fit for India’s growing trading community.

Overview of Exness as a Global Forex Broker

Exness is a leading global forex and CFD broker, renowned for its transparency, innovative trading features, and strong regulatory framework. Established in 2008, the broker has grown to become one of the most trusted names in the industry, catering to traders across more than 190 countries. With its user-friendly platforms, competitive trading conditions, and commitment to client security, Exness has earned its reputation as a reliable partner for both novice and professional traders.

Start Trading: Open Exness Account or Visit Website

Global Presence and Market Reach

Exness operates in key financial hubs, including Europe, Asia, the Middle East, and Africa, with offices in Cyprus, the United Kingdom, South Africa, and Seychelles, among others. The broker processes trading volumes exceeding $4 trillion monthly, supported by a robust infrastructure that accommodates a global clientele. Its multilingual customer support, available 24/7, ensures that traders worldwide receive timely and effective assistance.

Regulation and Trust

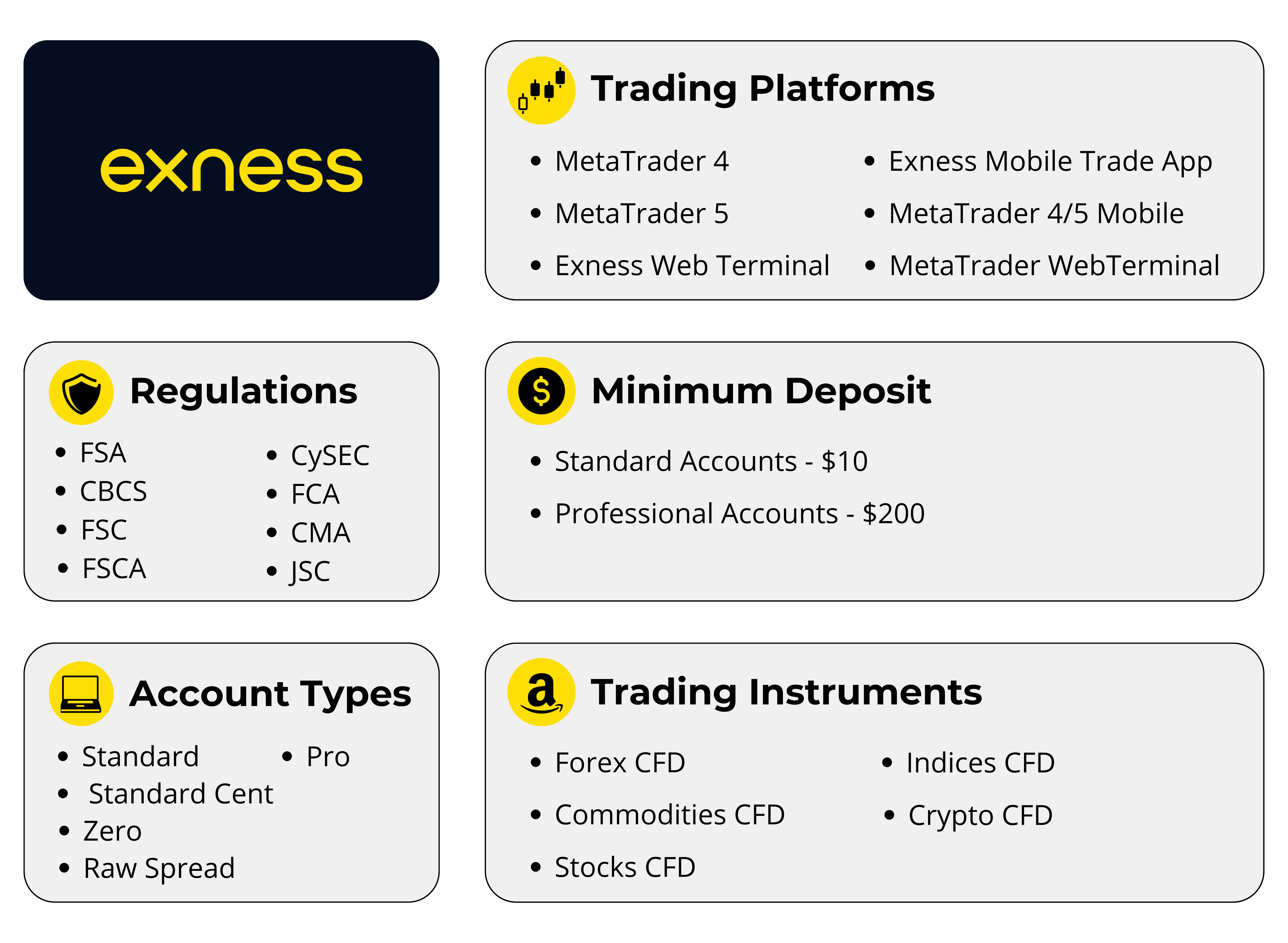

Exness is regulated by top-tier financial authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, and the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses reflect the broker’s commitment to adhering to strict international standards, ensuring transparency and client fund protection. Additionally, Exness undergoes regular audits by Deloitte, further enhancing its credibility.

Comprehensive Trading Offerings

Exness offers a wide range of trading instruments, including over 100 forex pairs, metals, cryptocurrencies, indices, and energies. This extensive portfolio allows traders to diversify their strategies and access global markets efficiently. With flexible leverage options (up to 1:unlimited for eligible accounts) and low trading costs, Exness provides an optimal trading environment.

Advanced Trading Platforms

Exness supports popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal. These platforms are equipped with advanced charting tools, technical indicators, and support for algorithmic trading, enabling users to execute trades seamlessly across desktop, web, and mobile devices.

Commitment to Security and Transparency

Client security is a top priority for Exness. The broker maintains segregated accounts for client funds and offers negative balance protection to safeguard traders from market volatility. Additionally, its transparent pricing, instant withdrawal system, and membership in the Financial Commission demonstrate its dedication to creating a trustworthy trading environment.

Regulation and Compliance

Exness is a highly regulated forex and CFD broker, committed to providing a secure and transparent trading environment for its clients worldwide. The broker operates under the supervision of several top-tier financial authorities, ensuring that it adheres to strict compliance standards and international best practices. This regulatory framework plays a pivotal role in building trust with traders, including those in India.

Exness is licensed by reputable bodies such as the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the United Kingdom, and the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses mandate that Exness complies with robust financial standards, including client fund segregation, transparent operations, and regular audits. Additionally, the Seychelles Financial Services Authority (FSA) and the Capital Markets Authority (CMA) in Kenya oversee Exness’ operations in regions outside the European Union, further extending its global regulatory coverage.

While Exness is not directly regulated by Indian authorities such as the Reserve Bank of India (RBI) or the Securities and Exchange Board of India (SEBI), its adherence to international financial standards ensures a high level of trust and security. Indian traders can benefit from the broker’s transparent practices, though it’s essential to understand and comply with local laws regarding forex trading and INR transactions.

Potential Regulatory Concerns for Indian Traders in Forex Trading

Forex trading presents significant opportunities for Indian traders to engage in global financial markets, but it also comes with regulatory concerns that must be addressed. While international brokers like Exness provide a secure and transparent trading environment, Indian traders should be aware of the legal and compliance implications of participating in forex trading from India.

Legal Status of Forex Trading in India

The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) regulate financial markets in India. Forex trading is legal in India, but it is restricted to trading currency pairs that include the Indian Rupee (INR). These pairs, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR, are permitted and can be traded on recognized exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Trading non-INR currency pairs or engaging with brokers not regulated by Indian authorities could lead to regulatory issues.

Use of International Brokers

Many Indian traders turn to international brokers like Exness for their extensive trading instruments, advanced platforms, and favorable conditions. However, Exness, while regulated by top-tier international authorities, is not directly regulated by the RBI or SEBI. Indian traders using such brokers must ensure they comply with the Foreign Exchange Management Act (FEMA), which governs forex transactions in India. Violating FEMA guidelines, such as trading prohibited currency pairs or transferring funds abroad without proper authorization, could result in penalties.

Risk of Offshore Transactions

Depositing and withdrawing funds with international brokers typically involves offshore transactions. While Exness offers convenient local payment methods, traders should be cautious of any legal implications tied to remittance under FEMA. It is advisable to use legitimate channels for fund transfers and avoid unregulated or high-risk methods.

Lack of Local Legal Recourse

Indian traders using international brokers may face limited legal recourse in case of disputes. While brokers like Exness provide robust client protection through global regulatory frameworks and membership in organizations like the Financial Commission, local traders cannot rely on Indian regulatory bodies for assistance. This highlights the importance of choosing reputable brokers and understanding their dispute resolution processes.

Taxation Implications

Earnings from forex trading are taxable in India under capital gains or business income, depending on the nature of trading activity. Traders must accurately declare their profits and comply with Indian tax laws. Failure to do so may lead to penalties or legal consequences.

Benefits for Indian Traders

Exness offers several advantages tailored to meet the needs of Indian traders, making it a preferred choice for those looking to participate in the global forex market. From flexible trading options to user-friendly features, Exness creates an environment that combines convenience, accessibility, and transparency for Indian traders.

1. Local Payment Methods

Exness provides Indian traders with convenient deposit and withdrawal options, including local bank transfers, UPI, and e-wallets. These methods simplify fund management and reduce the hassle of offshore transactions, making the trading process seamless. Additionally, the broker supports instant withdrawals, allowing traders to access their funds within seconds, even on weekends.

2. Low Minimum Deposit

Exness has a low barrier to entry, making it accessible to traders of all experience levels. With minimum deposits starting at just $10 for Standard Accounts, beginners can start trading without significant financial commitment. This feature is particularly beneficial for Indian traders who want to test the waters or trade with limited capital.

3. High Leverage Options

Exness offers flexible leverage, including up to 1:unlimited for eligible accounts. This enables Indian traders to open larger positions with smaller capital investments, amplifying potential returns. However, the broker also emphasizes responsible trading by providing educational resources on leverage and risk management.

4. Advanced Trading Platforms

Exness supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Terminal, providing Indian traders with access to powerful tools for technical analysis, algorithmic trading, and real-time market insights. These platforms are accessible across desktop, web, and mobile devices, ensuring flexibility and convenience.

5. 24/7 Multilingual Customer Support

Exness offers round-the-clock customer support in multiple languages, including English, ensuring that Indian traders receive timely assistance. This support extends to technical issues, account management, and trading-related queries, enhancing the overall trading experience.

6. No Overnight Fees

Indian traders benefit from Exness’ policy of zero overnight fees on major forex pairs, most minors, gold, cryptocurrencies, and indices. This feature is particularly advantageous for traders who hold positions for longer periods.

7. Educational Resources

Exness provides an extensive library of educational materials, including webinars, articles, and market analysis. These resources are invaluable for Indian traders, especially beginners, who can use them to build their knowledge and improve their trading strategies.

Customer Support and Local Relevance

Exness prioritizes delivering top-notch customer support and tailoring its services to meet the unique requirements of traders worldwide, including those in India. By offering accessible assistance and localized features, Exness ensures that Indian traders can enjoy a seamless and supportive trading experience that aligns with their needs.

The broker provides 24/7 multilingual customer support, including in English, which is widely spoken and understood in India. Traders can reach out through live chat, email, or phone to resolve queries related to account setup, trading platforms, deposits, withdrawals, or technical issues. The availability of round-the-clock support is particularly beneficial for Indian traders who operate across various time zones in global markets. The Exness support team is trained to handle a wide array of concerns with efficiency, ensuring minimal disruption to traders’ activities.

To enhance its appeal to Indian traders, Exness has integrated localized features that make its platform more relevant and accessible. For example, the broker supports popular Indian payment methods such as UPI, local bank transfers, and e-wallets, simplifying deposit and withdrawal processes. Additionally, the availability of instant withdrawals ensures that Indian traders can access their funds quickly and without unnecessary delays—a critical feature for traders who prioritize liquidity and fast financial transactions.

Conclusion

Exness emerges as a highly suitable forex broker for Indian traders, offering a robust combination of global reliability and locally relevant features. With strong regulatory backing, tailored account options, competitive trading conditions, and advanced platforms, Exness provides Indian traders with a secure and efficient trading environment.

Start Trading: Open Exness Account or Visit Website

The broker’s commitment to customer support, including 24/7 multilingual assistance and user-friendly educational resources, further enhances its appeal. Localized payment methods, low minimum deposits, and instant withdrawals address the specific needs of Indian traders, making trading accessible and convenient.

FAQs

Is Exness regulated and safe for Indian traders?

Yes, Exness is regulated by top-tier authorities such as CySEC, FCA, and FSCA. While it’s not directly regulated by Indian authorities, its adherence to international standards ensures safety and transparency for Indian traders.

Can Indian traders deposit and withdraw funds easily with Exness?

Yes, Exness supports local payment methods popular in India, such as UPI, local bank transfers, and e-wallets. The broker also offers instant withdrawals, ensuring quick and hassle-free access to funds.

What is the minimum deposit required for Indian traders?

Exness offers a low minimum deposit starting at $10 for Standard Accounts, making it accessible for traders with limited capital.

Does Exness offer INR-based trading pairs?

While Exness provides access to over 100 forex pairs, including major and minor currencies, INR-based pairs may be limited. Traders should verify the available options on the platform.

What platforms are available for Indian traders?

Exness supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal. These platforms are accessible via desktop, web, and mobile devices, ensuring flexibility for Indian traders.

Is customer support available for Indian traders?

Yes, Exness provides 24/7 customer support in English, ensuring Indian traders receive prompt assistance for account, technical, or trading-related queries.

Are there educational resources for Indian traders?

Exness offers a range of educational materials, including webinars, tutorials, and articles. These resources help Indian traders improve their skills and make informed trading decisions.