NEW REPORT: 900,000 BLACK HOUSEHOLDS MIGHT MISS OUT ON HOMEOWNERSHIP!

H

omeownership is among the topmost ways of building intergenerational wealth for many families. Even though it may not be the best option for everyone, there is strong evidence supporting that people who own homes are better off than the people renting. Given the importance of homeownership, what comes to mind is the question of why housing equity is not shared evenly. If you compare the homeownership gap between the African American families and the white families in the 1960s, you will notice that the gap has only grown wider today. Part of the reason for this is the structural barriers to homeownership resulting from the great depression, not to forget the many natural disasters and the most recent COVID-19 all of which are hitting the black families the hardest. In addition to that, the changes that will impact homeownership rates in the country in the coming years will affect the wealth-building capacity of many US households, especially the families that are already facing these challenges. A new report from Urban Institute highlights what the homeownership rates will look like in 20 years’ time if the current policies remain unchanged. According to this report, while by the year 2040, there will be an additional 6.9 million new homeowners, the national homeownership rate will decline by 3 percentage points from a projected 65 percent. From the year 1990 to 2010, household growth has averaged 12.4 million per decade and from 2010 to 2020, the average rate of growth has been 7.3 million new homeowners.

22

l

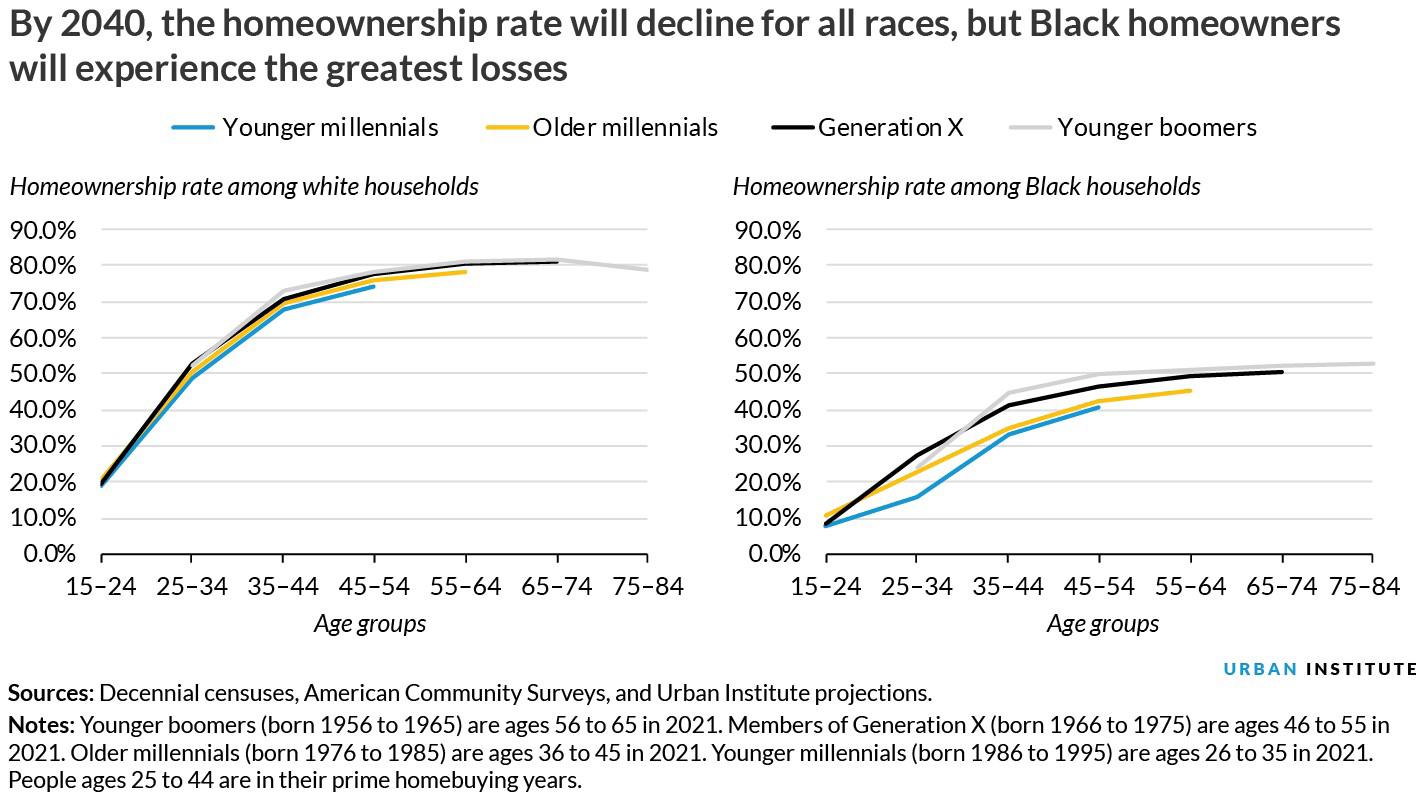

The report projects that there will be an 8.5 million increase from 2020 to 2030 and then a decline to 7.6 million between the years 2030 and 2040. The report prepared by Laurie Goodman and Jun Zhu also highlights that the net household growth will be from the households of color in that between now and 2040, there will be an addition of 16.1 million net new households. The Hispanic household will grow by a whopping 8.6 million while other households will, especially households of Asian descent will grow by 4.8 million. Still, on that, Black households will grow by 3.4 million while white households will decline by 0.6 million. Of the 16.1 million new households, most growth will be led by senior households. In fact, 13.8 million households will be headed by someone who is over 65 years. The younger millennials who will reach ages 45 to 54 will have a homeownership rate of 64 percent compared to the 72 percent of the younger boomers. Additionally, right now, the prime buying years, that is between 25 to 44 will decline by 6.5 to 9.0 percentage points between the boomers and younger generations. In their prime buying years, homeownership for black households will decline quite significantly. This cuts across the board with such shortfalls shared equally among different racial groups. Younger black millennials in their prime buying years in 2040 will have a homeownership rate of 41 percent compared to the 50 percent homeownership rate among the younger black boomers at the same age. Meantime, for the younger white millennials who will be in their prime buying years in 2040, their homeownership rate will be only 4 percentage points lower than it was for the younger white boomers when they were the same age.

THE POWER IS NOW MAGAZINE | MAY 2021