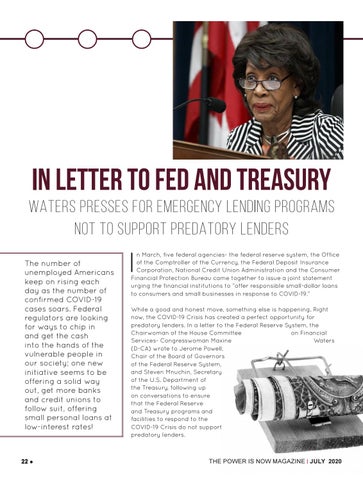

IN LETTER TO FED AND TREASURY WATERS PRESSES FOR EMERGENCY LENDING PROGRAMS NOT TO SUPPORT PREDATORY LENDERS The number of unemployed Americans keep on rising each day as the number of confirmed COVID-19 cases soars. Federal regulators are looking for ways to chip in and get the cash into the hands of the vulnerable people in our society; one new initiative seems to be offering a solid way out, get more banks and credit unions to follow suit, offering small personal loans at low-interest rates!

22

l

I

n March, five federal agencies- the federal reserve system, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, National Credit Union Administration and the Consumer Financial Protection Bureau came together to issue a joint statement urging the financial institutions to “offer responsible small-dollar loans to consumers and small businesses in response to COVID-19.� While a good and honest move, something else is happening. Right now, the COVID-19 Crisis has created a perfect opportunity for predatory lenders. In a letter to the Federal Reserve System, the Chairwoman of the House Committee on Financial Services- Congresswoman Maxine Waters (D-CA) wrote to Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, and Steven Mnuchin, Secretary of the U.S. Department of the Treasury, following up on conversations to ensure that the Federal Reserve and Treasury programs and facilities to respond to the COVID-19 Crisis do not support predatory lenders.

THE POWER IS NOW MAGAZINE | JULY 2020