4 minute read

In letter to FED and Treasury, Waters presses for emergency lending programs not to support predatory

IN LETTER TO FED AND TREASURY, WATERS PRESSES FOR EMERGENCY LENDING PROGRAMS NOT TO SUPPORT PREDATORY LENDERS

The number of unemployed Americans keep on rising each day as the number of confirmed COVID-19 cases soars. Federal regulators are looking for ways to chip in and get the cash into the hands of the vulnerable people in our society; one new initiative seems to be offering a solid way out, get more banks and credit unions to follow suit, offering small personal loans at low-interest rates!

In March, five federal agencies- the federal reserve system, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, National Credit Union Administration and the Consumer

Financial Protection Bureau came together to issue a joint statement urging the financial institutions to “offer responsible small-dollar loans to consumers and small businesses in response to COVID-19.”

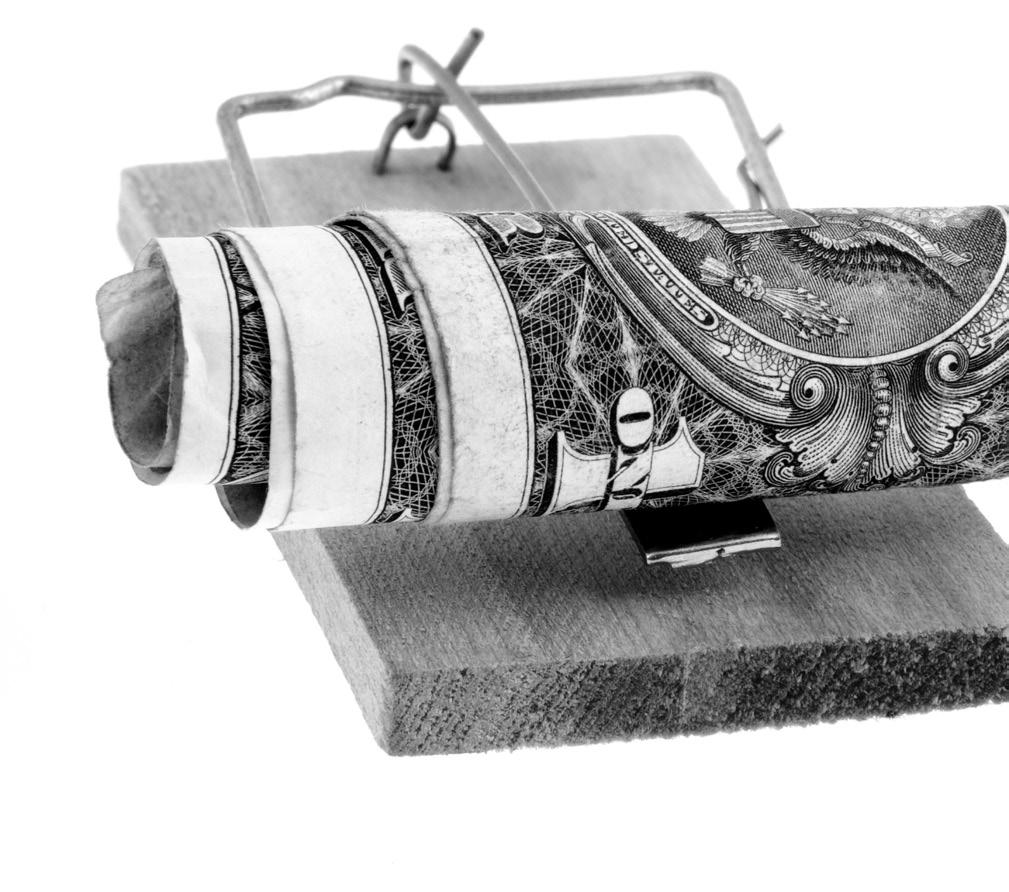

While a good and honest move, something else is happening. Right now, the COVID-19 Crisis has created a perfect opportunity for predatory lenders. In a letter to the Federal Reserve System, the Chairwoman of the House Committee on Financial Services- Congresswoman Maxine Waters (D-CA) wrote to Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, and Steven Mnuchin, Secretary of the U.S. Department of the Treasury, following up on conversations to ensure that the Federal Reserve and Treasury programs and facilities to respond to the COVID-19 Crisis do not support predatory lenders.

The letter states; “I write to follow up on our recent conversations confirming that predatory consumer loans offered by payday, installment or other lenders are not eligible to be pledged as collateral to the Term Asset-Backed Securities Loan Facility (TALF) or any other Federal Reserve program or facility that is supported by funds appropriated by Congress and approved by the Secretary of the Treasury,” Chairwoman Waters wrote. “While many Americans struggle with access to credit for a variety of reasons, research shows that the decline in credit conditions and the dramatic rise in unemployment during the Great Recession caused an uptick in borrowers’ reliance on payday loans. I’m glad we agree that using the Federal Reserve’s TALF to directly or indirectly support such loan products with triple-digit interest rates or predatory features that target vulnerable communities is not appropriate, especially during this Crisis.”

The danger of Payday Lenders at a time of Crisis Millions of Americans are living on a paycheck to paycheck basis, and in light of the heightening health crisis, more people are finding it hard to manage their growing obligations. Other than offering solutions to forbearance and payment deferrals to homeowners and eviction moratoriums to renters, the government, through the Federal Reserve, announced that it would be dropping one of its benchmark interests rates to zero.

The Federal Reserve “is prepared to use its full range of tools to support the flow of credit to households and businesses,” the central bank said in a statement. Moreover, while the Fed fund rate is usually not the rate that consumer pay, the Fed’s move could ultimately affect borrowing rates consumers see each day. of importance to note is that even with a lowinterest rate, not all types of borrowing will be a bargain which forces the consumer’s hand.

Payday loans seem convenient for most, but they are the worst offenders. And while these are some of the easiest ways one could get a quick short-term loan, the danger is that the interest charged on them could run easily into the triple digits. Depending on the state you are in, payday loans usually require the person to pay back the money owed in two weeks and must be paid off with interest accrued and the service fees. However, most states set a maximum amount of the payday loan fees ranging from $10 to $30 for every $100 borrowed. However, going by the calculation by the CFPB, a two-week payday loan with a $15 per $100 fee equals an annual percentage rate of over 400%.

“Struggling consumers need relief, not predatory high-cost loans that will send them into a debt-trap spiral. As the Financial Services Committee has learned from experts, payday and car-title loans offer products with an annual percentage rate (APR) of 391 percent on average. While some installment loans have different features than payday loans, such as having higher loan amounts and longer and multiple payment periods, predatory highcost lending is also a severe problem in the installment lending industry. Installment loans can be expensive for consumers and difficult to repay. The Consumer Financial Protection Bureau (CFPB), notes that the average APR for installment payday loans at $1,000, for example, is 237%. The CFPB has also found that nearly a quarter of payday installment loans result in default. With regard to how many of these loans are refinanced, the CFPB found that 1 in 5 installment car-title loans and nearly 2 in 5 of payday installment loans are refinanced by consumers.” Maxine Waters.

Sources;

https://financialservices.house.gov/news/ documentsingle.aspx?DocumentID=406571 https://www.cnbc.com/2020/03/18/the-bestand-worst-ways-to-borrow-money-during-acrisis.html https://www.cnbc.com/2020/03/27/americansmay-soon-have-more-loan-options-hereswhat-to-know.html