8 minute read

San Francisco housing market insights

The arrival of the COVID-19 has created a global economic shock. World economies are enacting policies that are meant to flatten the curve of the potential infection, and these have included the voluntary and mandated lockdowns of large sectors of the economy. Most retail establishments, restaurants, passenger transportation schools and leisure activities have been closed with businesses going almost to the ground, halting for a while as customers face a self-quarantine and practice social distancing.

In San Francisco and the Bay Area, housing affordability has always been an issue, not just for the first-time home buyers, but all buyers in general. This housing market offers these buyers a limited option for their money, and while the mortgage rates have been on the decline for some time now, big down payments and an alltime high price for the homes are suppressing the sales

The San Francisco housing market rivals the New York housing market in terms of the rental prices and rates and the overall price of the real estate market. Lately, the market has been making major news for all the wrong reasons. For quite some time, homelessness has been an issue that spurs public hygiene issues. The city is home to close to 900,000 people; it is the hub for the San Jose- San Francisco- Oakland area. This metro area is home to nearly nine million people.

In terms of real estate, in the latest quarter, the San Francisco housing market appreciation rate has been consistent at around 0.5%. This equates to an annual appreciation rate of 2%. However, due to the ongoing pandemic, prices are expected to drop maybe to 1 or 2%, which is a good sign for the new homebuyers and the investors as far as the affordability issue is concerned. Many of them cannot afford a median-priced home in San Francisco.

Eric Hooks

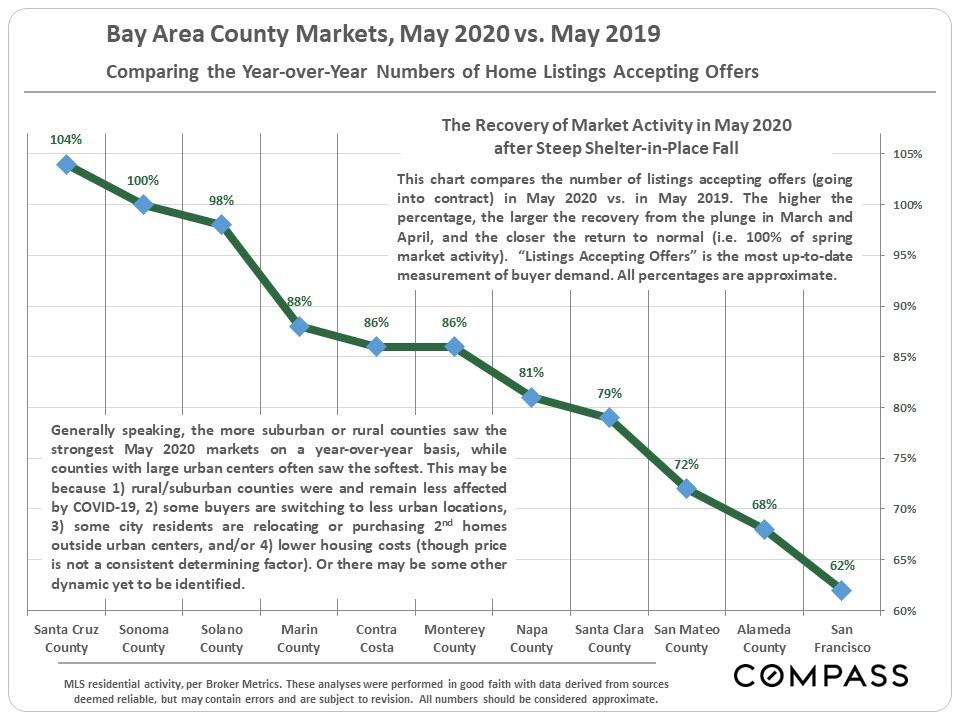

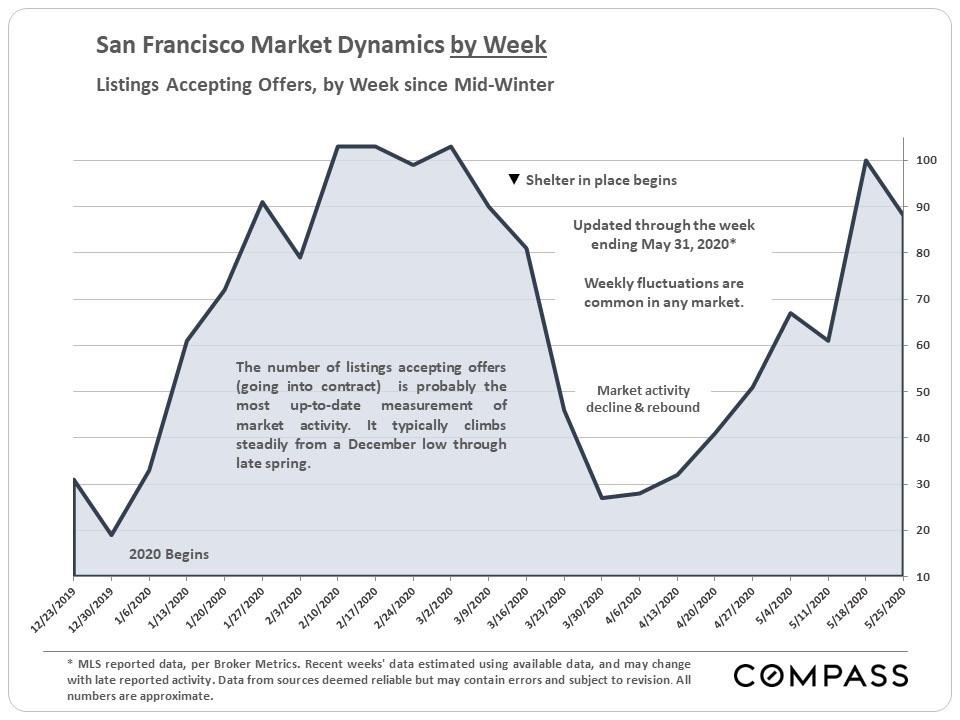

Generally speaking, the San Francisco market activities, characterized by the number of listings that are going into contract, continued to gain traction in May, which is a remarkably quick comeback from the steep plunge they too following the enactment of the shelter-in-a-place orders. May is one of the busiest months in the spring season in so far as real estate transactions are concerned, but this year’s activities remained well below last year’s. However, with the easing of the shelter-in-place, as well as the market’s natural adjustment to the new normal, it is expected that the recovery will continue to surge closer to normal. I see a situation where the SF market might experience busier months than in 2019 due to stronger buyer demand and the fact that real estate activities that would have occurred in spring have been pushed to summer instead.

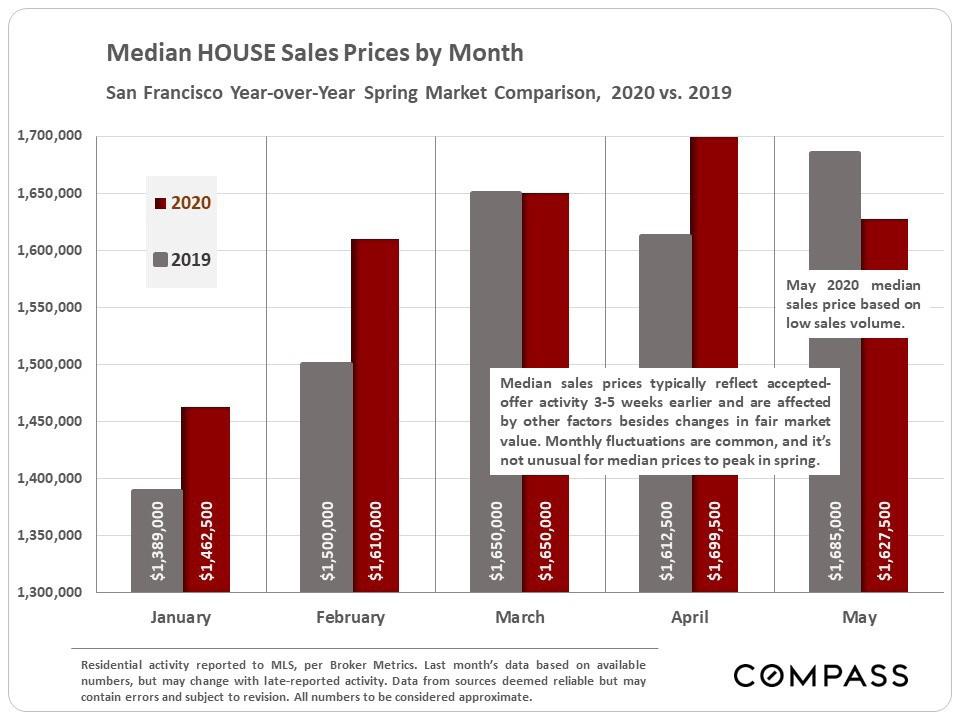

Of importance to highlight is the fact that median sales prices for the houses and the condos also experienced a significant drop in May, however, the figures are based on low volumes of the closed sales in the month. The sales price dropped by about 60% Y-o-Y. Additionally, because the sales figures are a lagging indicator, the sales recorded in May and the sales prices mostly reflect the huge impact of the COVID-19 on the San Francisco housing market in late March and April. There was a huge increase in the accepted-offer activity recorded in May, especially for the higher tier homes; this means that the June sales volumes will be significantly higher, and the coming months will constitute a better indicator of whether the changes in the fair market value are occurring.

The San Francisco housing market, just like many others, was quickly affected by the COVID-19 crisis

and the shelter in place orders, than other local, more suburban, county markets. This led to the SF housing market, seeing larger initial drops in the activities. Despite having a remarkable comeback in May, the recovery is so far lagging than most other counties if we are to look at the year-overyear statistics like Marin and Sonoma (even though they are more rural). Several factors would explain this phenomenon, but we are still in the early days, and therefore, I cannot make any definitive pronouncements with regards to the longer-term real estate market, the general economic outlook, or any effects in demographics. It is only posting the COVID-19 crisis that we can realistically make the assessments of these parameters.

Rents, on the other hand, appear to be dropping quickly than earlier anticipated. This is due to the massive employee layoffs, which has typically impacted the rental market more rapidly and significantly than the for-sale market. The real drop and effects of the SF rental market still vary, with some estimating a 10% drop in the recent months coupled with large increments in the vacancy rates. Some other estimates that the rent dropped by about 25% in the following years. With so many factors influencing the rental outcome, it would be premature to give estimates about the longer-term effects on what has bee the most expensive rental market in the country.

Take a look at the following charts from https://www. bayareamarketreports.com/

If you would like to get more details about the San Francisco housing market or would like to buy or invest in this lucrative market, get in touch today with Eric Hooks. To reach out to Mr. Hooks, use the following link https://thepowerisnow.com/eric-hooks/.

Sources;

https://www.bayareamarketreports.com/trend/sanfrancisco-home-prices-market-trends-news https://www.noradarealestate.com/blog/sanfrancisco-real-estate-market/ https://www.cushmanwakefield.com/en/united-states/ insights/us-marketbeats/san-francisco-marketbeats

www.StopHigherPropertyTaxes.org

Split-Roll Property Tax Measure Hurts Immigrant and Minority Communities Background: Prop 13 Has Helped All Californians for More Than 40 Years

• For more than 40 years, Prop 13 has provided certainty to homeowners, farmers and businesses that they will be able to afford their property tax bills in the future. Under Prop 13, both residential and business property taxes are calculated based on 1% of their purchase price, and annual increases in property taxes are capped at 2%, which limits increases in property taxes, especially when property values rise quickly.

Split-Roll Property Tax Measure Destroys Prop 13 and Makes Our Economic Crisis Worse

• Amid an unprecedented economic crisis, special interests submitted petitions to qualify a measure for the

November 2020 statewide ballot that will destroy Prop 13’s property tax protections and will be the largest property tax increase in California history. The measure will raise taxes on commercial and industrial property by requiring reassessment at current market value at least every three years. This type of property tax is known as a “split-roll tax” because it splits the property tax roll, assessing business property differently than residential property. • We should reject this measure and maintain Prop 13 protections that have kept property taxes affordable and provided every taxpayer who buys a home or business property with certainty that they can afford their property tax bills in the future. Now is not the time to raise taxes and bring more uncertainty to businesses and all Californians.

Gentrifies Our Longtime Communities

• A split-roll property tax will provide a huge financial incentive for local governments to approve business projects to replace existing housing so they can receive higher property tax revenue. It will also push small minority- and immigrant-owned businesses out of our communities when they can’t afford the higher property taxes. This unintended consequence will intensify the gentrification already occurring in much of the Bay Area and Southern

California coastal counties.

Hurts Small Businesses and Consumers

• Most small businesses rent the property on which they operate. The measure’s higher property taxes will mean soaring rents at a time when the federal and state government is trying to provide small businesses with rent relief to keep their doors open. Ultimately, the measure’s tax hike on businesses will get passed on to consumers in the form of increased costs on just about everything people buy and use, including groceries, fuel, utilities, day care and health care.

Hits Minority-, Immigrant-and Female-Owned Businesses the Hardest

• Small businesses are already struggling. This measure will make it even more difficult for them to reopen their doors or stay in business as a result of this economic crisis. Increasing property taxes on businesses by up to $1 2.5 billion a year will hurt female- and minority-owned businesses the most and 120,000 jobs will be lost, according to a

Berkeley Research Group study. Voters are being asked to consider a measure that will only increase job losses at a time when millions of Californians are applying for unemployment benefits. • According to the latest data from the Harvard Business School, about 42% of new companies are founded by immigrants in California and the most recent 2012 Survey of Business Owners by the Census bureau found that 5% of businesses in the state are owned by African Americans. Additionally, the California Latino Economic Institute found that nearly one-quarter of all businesses in California are owned by Latinos, and they are the fastest-growing component of the state’s economy. Most of these businesses start small and stay small, meaning they often rent their property and are subject to higher rents when property taxes increase. • In the most recent 2012 Survey of Business Owners by the Census Bureau, 38% of all non-publicly traded businesses were owned by females and another 9% were owned equally by females and males.

Increases the Cost of Living for Everyone and Makes the Homelessness Crisis Even Worse

• In 2019, US Housing & Urban Development data showed California led the nation with more than one-quarter of the country’s homeless population. • California’s cost of living is already among the nation’s highest. We shouldn't do anything to make it even more expensive to live here. The split-roll measure will only increase homelessness and make life more difficult for

Californians already living paycheck-to-paycheck.

Homeowners Are Under Attack

• If businesses lose their Prop 13 protections, homeowners will be next. Supporters of the measure even admitted that this initiative was the first step in a plan to end Prop 13, which could mean skyrocketing property tax increases for all California homeowners.

Ad paid for by Californians to Save Prop 13 and Stop Higher Property Taxes, sponsored by California homeowners, taxpayers, and businesses Committee major funding from Western Manufactured Housing Communities Association California Business Roundtable California Taxpayers Association Funding details at www.fppc.ca.gov