VISION CREATING

A FOR BISHOP HEIGHTS

Table of Contents

Section 1

BIG PICTURE 7

PROJECT SNAPSHOT

Section 2

DESIGNING FOR THE MARKET 11

SITE PLAN DESIGN CONCEPT AMENITIES / FINISHES RENTER PROFILE

Section 3

PROJECT ECONOMIC ANALYSIS 31

DEVELOPMENT BUDGET COSTS & ECONOMIC RETURNS 10 YEAR HOLD ANALYSIS YEAR 4 / EPC TAKE-OUT

Section 1

BIG PICTURE

Project Snapshot

Section 2

DESIGNING FOR THE MARKET

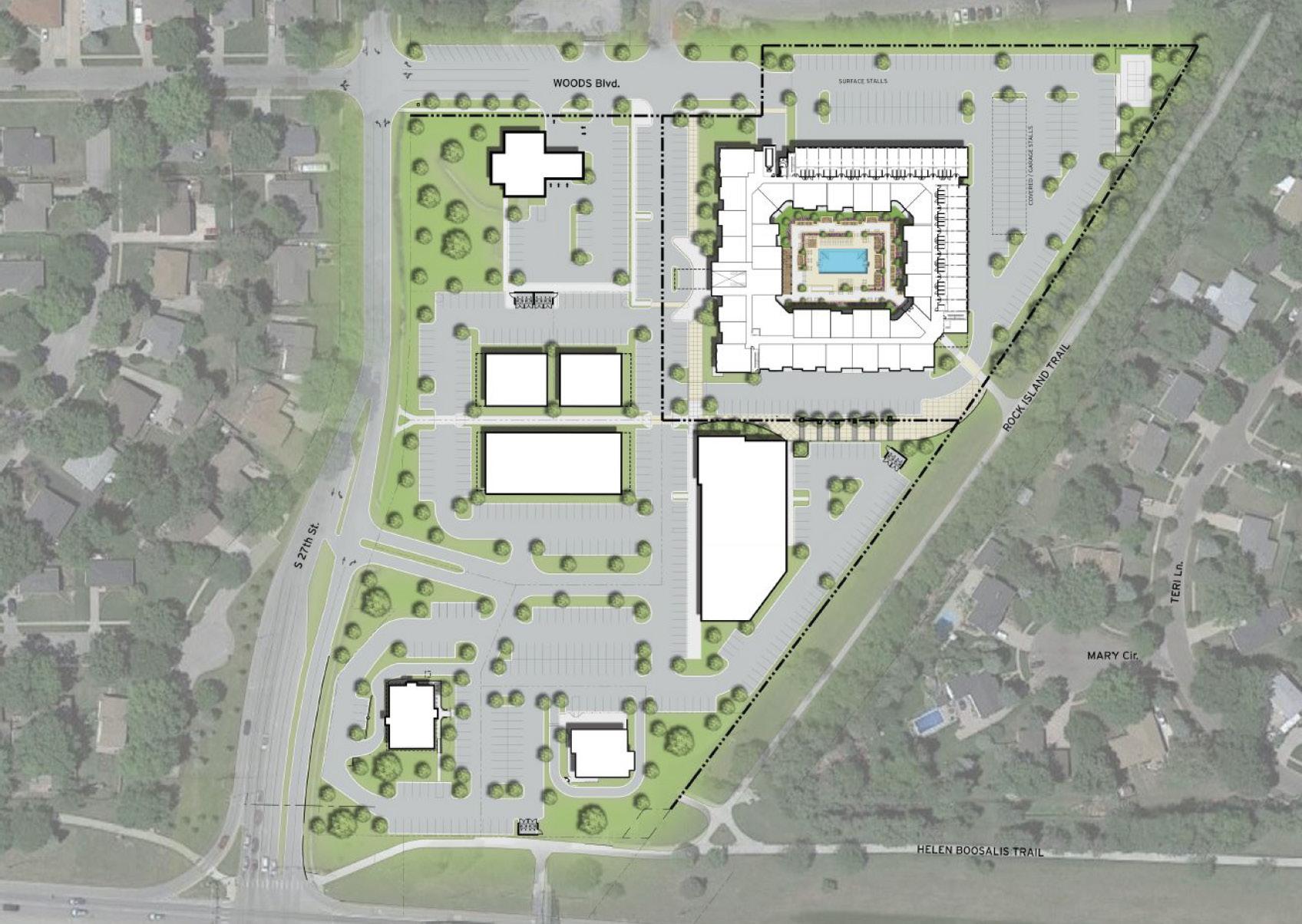

Site Plan

NebraskaParkway

27th Street

Design Concept

EPC Real Estate has designed and will develop 176 luxury market rate units to appeal to the 55 to 75 year old age bracket. The project will be branded as “The Encore” at Bishop Heights and will be one of 3 currently under development by development.

Typically referred to in the market as 55+ or Active Adult our targeted demographic is looking for a living and social experience after selling their home and before considering independent living.

The Encore Brand will create a “Four Seasons” resort feel for those users that remain vibrant and active without the need for physical or medical assistance. We intend to attract and appeal to empty nesters, early retirement and active senior cohorts.

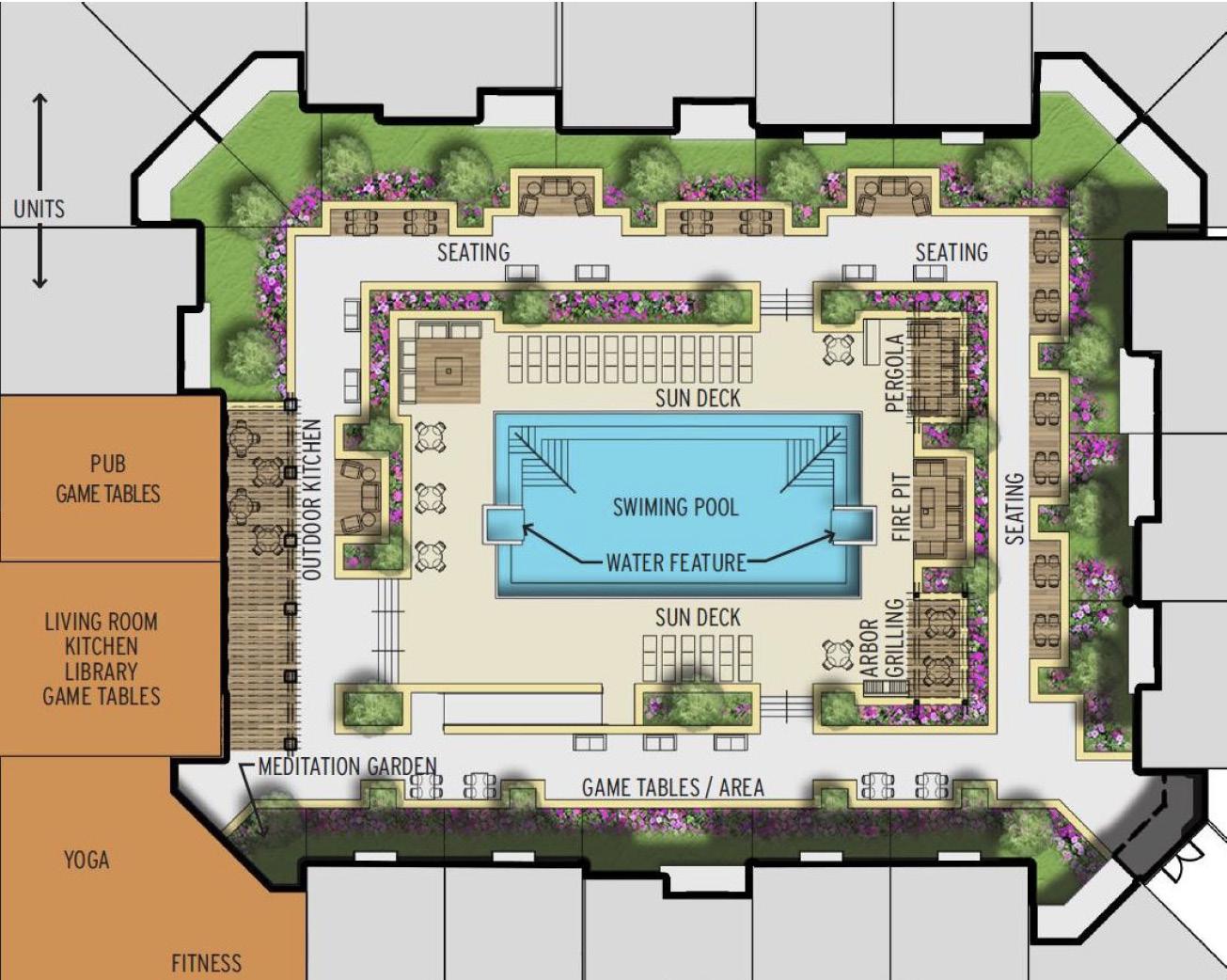

First Level

AMENITY PLANS

Amenities

Residents need to have access to the latest in amenities, promoting healthy living through both health and wellness. This will include full spa services, wellness services; yoga, pilates, spin classes and resistance training to art and ceramic classes. Also included will be wine bars, local taps, coffee bistros and master grilling stations for a complete culinary experience. A further description of amenities can include:

• Multi-purpose room for theatre, academics

• Bistro/grab-and-go

• Event/demonstration kitchen

• Extensive fitness/yoga

• Library with research center

• Salon

• Fireside lounge

• Game room(s)

• Dog park

• Dog grooming

• Outdoor community garden

• Outdoor kitchen and grilles

• Outdoor fire pit/fireplace

• Outdoor gathering spots

• Outdoor pool designed for water aerobics

• Increased storage quantity and sizes

• Art and ceramic studio entertaining local artists

• Craft beer & wine bars

• Continuing education from local colleges and universities

• Community outreach opportunities & disaster relief volunteer program

• Transportation through Uber/Lyft

Finishes

Our team has a high standard for our facility’s interiors. We want to deliver the best to our tenants and have a record of top quality units and common area.

FLOORING: Each project varies slightly as new products hit the market. We make our selections with durability and appearance top of mind. Primarily, the flooring has been wood-like vinyl plank flooring in the kitchen and family room, carpet in the bedrooms, and tile in the restrooms and laundry room

COUNTERTOPS: As a high quality developer we only use granite or quartz. Primarily, we are currently sourcing quartz, but this is constantly threatened by tariffs. We have partners we work closely with to fabricate counter tops overseas in controlled facilities where we can change 1% of the aggregate mix to avoid certain tariffs. Timing of purchase will guide this selection

HARDWARE, SINKS, ETC: Similar to above, we have proprietary sources and also work closely with sub trades to get the most current looks and best value. Since these are showpieces of a unit, we are always top of the market and due to bulk purchasing for all of our properties we get preferred pricing.

Our interior designer will collaborate with Klover to ensure the best applications are selected at the right price point for our target demographic. Below and on the following page are examples of recent projects that are representative of typical unit and common area finishes.

Renter Profile

The mix of lifestyle and economics are pushing healthy, young baby boomers to cons ider alternative housing options shifting away from either a single-family home or traditional senior living. Many 55+ boomers want what senior housing offers but don’t want or need to pay for a care component or meals. They are attracted to an environment that is wellness-based and socially-driven but with greater flexibility. EPC believes Active Adult apartments are the answer.

“Consumer interest is rooted in a senior’s desire to strip away the cost, responsibility and commitment of home ownership and experience an entirely new option. While single-family homes are often isolating and lifestyle redundant day-to-day, the Active Adult environment is designed to be invigorating, collaborative and stimulating at a very competitive cost”.

Age targeted multi-family apartment communities are just beginning to be offered around the country. Unlike traditional senior living, active adult apartments are a separate product type with a different consumer base and unique benefits and risks.

“Active Adult” is different than independent living (IL). The word “senior” is eliminated because it consists of a younger and healthier cohort that dislikes thinking of themselves as senior. Conversely this group identifies with the term “active”.

SOCIOECONOMIC TRAITS OF TARGET USER

• They have cultivated a lifestyle that is both affluent and urban

• More interesting in quality than cost

• Prefer living in established neighborhoods

• Single and married primarily still working and self employed

• 43 percent of Golden Years live in multi-unit dwellings

• Purchasing power to what they want

• Highly educated

• Live balance lifestyle with time for grandkids and maintain close friends

Target

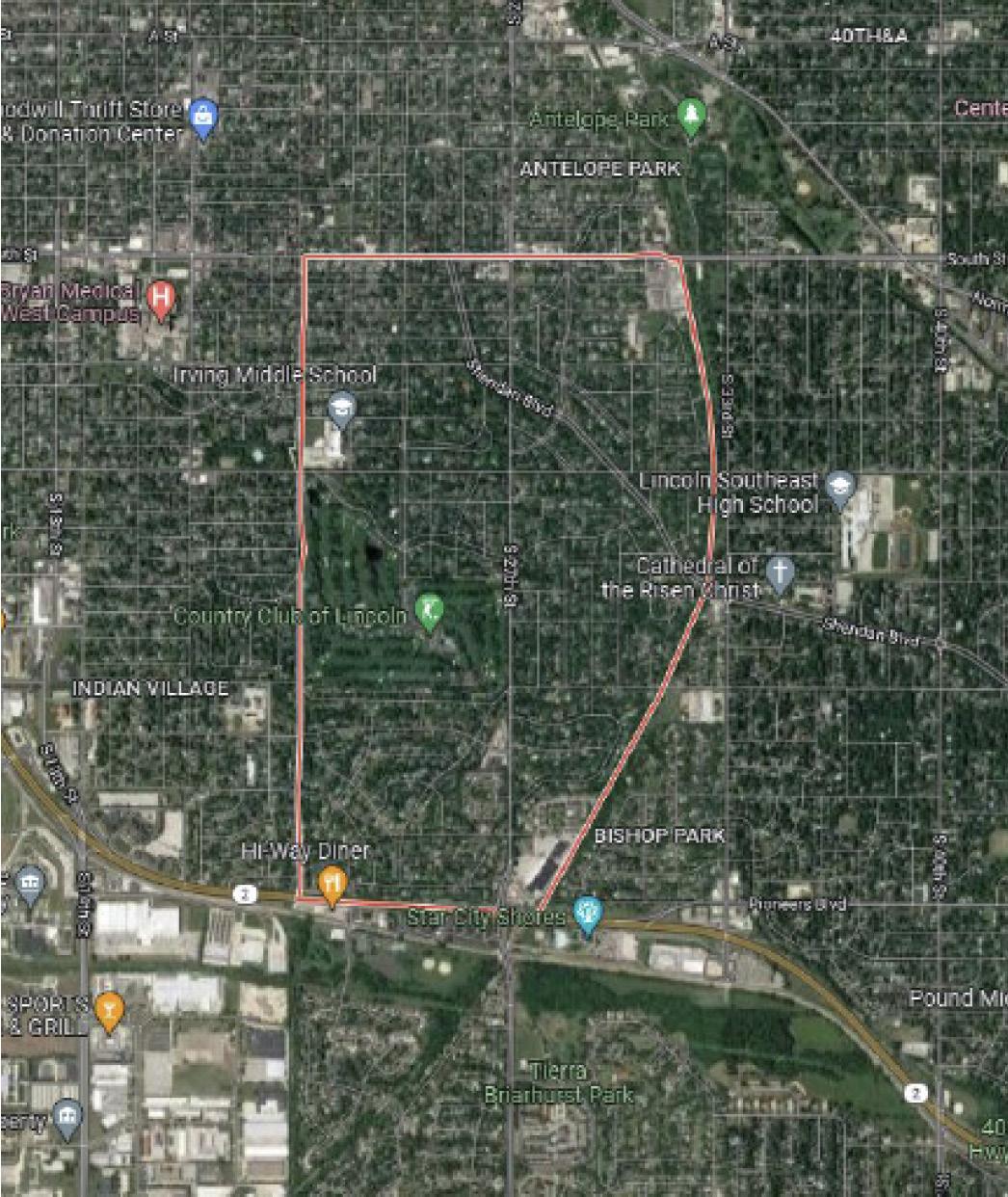

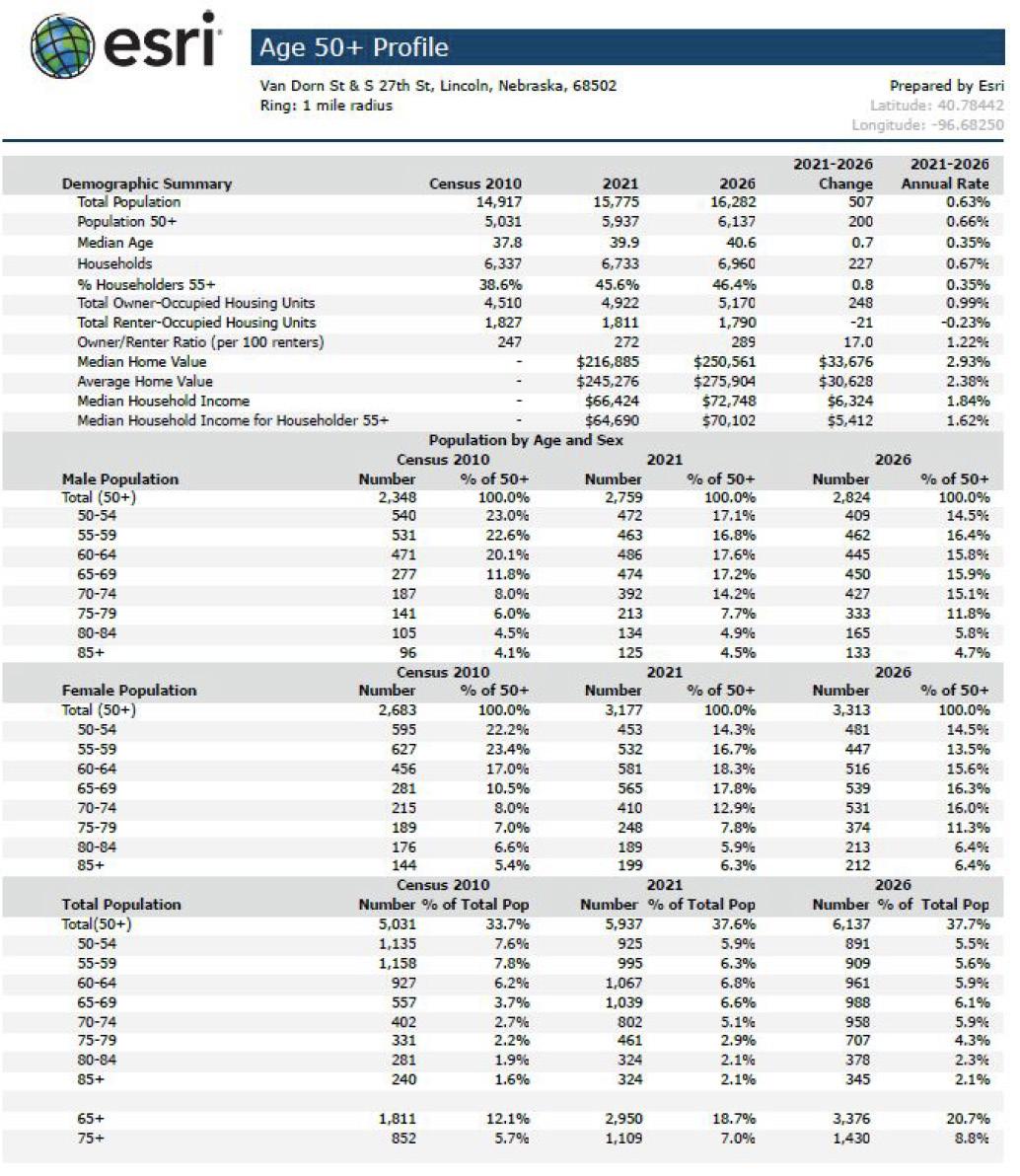

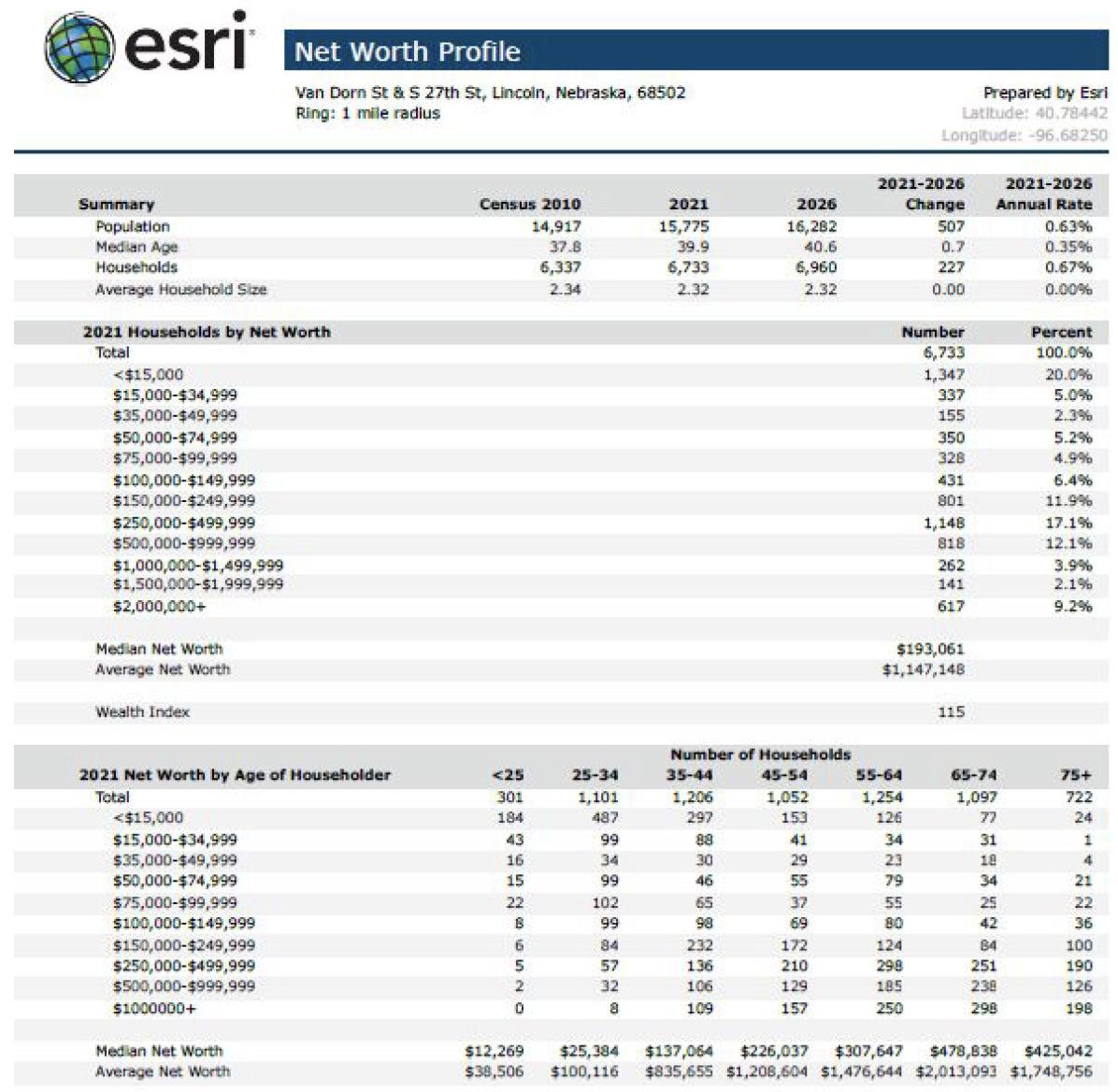

Market - Country Club Neighborhood

Demographics

Demographics

Section 3

PROJECT ECONOMIC ANALYSIS

Development Budget

ACQUISITION COSTS

Land Costs

Closing Costs

Preliminary Assessments

HARD COSTS

Site Work

Construction Costs

Hard Cost Contingency

SOFT COSTS

$5,000,000

$50,000

$0

Total Acquisition Costs: $5,050,000

$3,996,996

$42,070,346

$1,051,759

Total Hard Costs: $46,067,342

Architectural / Engineering / Design

FFE, Gov Fees, Market Study, Startup

Legal

Marketing

Taxes

Insurance

Construction Financing Costs

Soft Cost Contingency

Development OHP

Construction Management OHP

TOTAL PROJECT COSTS

$1,155,015

$2,089,976

$459,000

$228,000

$75,000

$700,000

$5,003,495

$311,961

$1,000,000

$1,000,000

Total Soft Costs: $12,710,659

$64,829,790

Economic Returns

$2,000 - $3,500 Rent Range not including parking, etc..

$2,596 Average Rent/Unit not including parking, etc.. $2.62 Average Rent/SF not including parking, etc..

$104,101,300 10 YR Hold Value 5.0% cap rate exit

Underwriting Approach

EPC FINANCIAL UNDERWRITING METRICS - GO OR NO-GO DECISION

Typical First to Market EPC Profile or Leasehold Interest

Yield on Cost (NOI/Cost) 6.5% - 7%

Typical Exit Cap 4.1% - 5.5%

5 YR Asset IRR Target 20%

10 YR Asset IRR Target 15%

5 YR LP Equity Multiple 2x

10 YR LP Equity Multiple 3x

EPC has adopted a set of metrics specific to the risk profile of the areas in which we develop. Below is a summary of the drivers which allow us and our capital partners to move forward at the outlined metrics for our projects:

1. Market driven lower cap rates at exit

2. Increased interest from capital sources (lower cost of capital due to reduced risk profile)

3. Directly in the growth path

4. Demographic Profile

5. Barrier to entry

6. Unique amenity profile in the community

Ownership Structure

Encore at Bishops Heights, LLC has been formed and will be the owner of the asset. Matterhorn, LLC (Sutton Family) will own 100% of the membership interest and will be the Manager of Encore at Bishop Heights, LLC.

EPC Real Estate Group will be the developer and the asset manager of the property and has a 10% profits interest in the partnership.

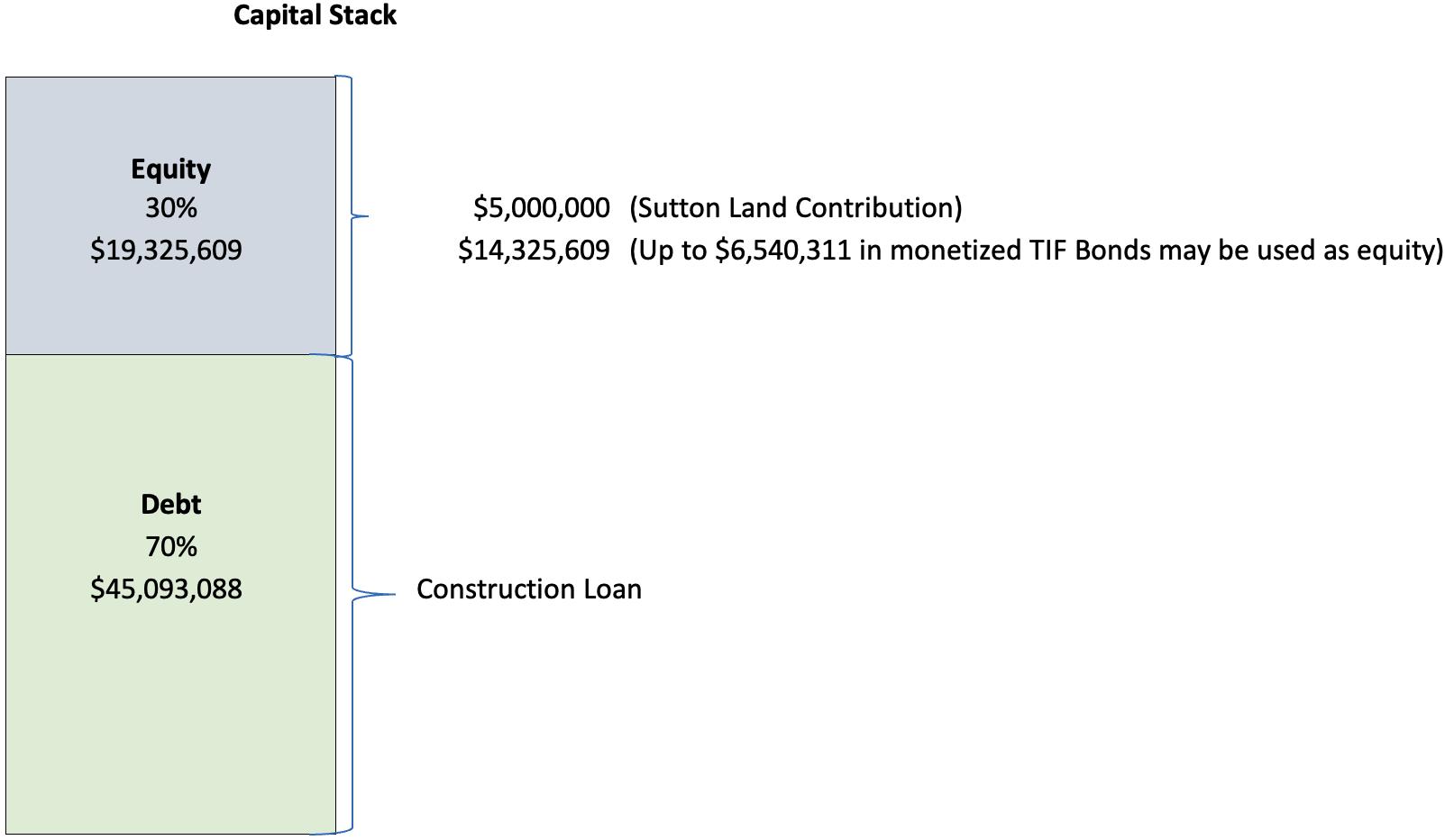

The ownership would like to finance up to 70% of the project cost interest only for a 5 year period with two-one year extensions. It is the owner’s intention to hold the asset long term and plans to convert to permanent financing when stabilized at the end of year 4. The principals of EPC will provide a loan guaranty.

Below is the capital stack for the project.

Why EPC as Partners?

Our Team is ready to deliver on Bishops Heights vision of the highest quality active adult experience in Lincoln. Our expertise in collaboration with the RED Team will make this development a smooth and straight forward process.

In the past nine years EPC has successfully developed, financed, constructed and leased close to 4,000 multifamily units at a cost of approximately $1 Billion.

EPC is in the development phase of more than $300 million in proposed developments. These deals are controlled by EPC, or are actively approaching finalization.

KANSAS CITY

1033

APARTMENTS OWNED & MANAGED BY EPC

OTHER AREAS

635

APARTMENTS OWNED & MANAGED BY EPC

PRODUCT TYPES

APARTMENTS

OFFICE RETAIL

MIXED USE

MEDICAL

SENIOR/ ADULT

10 Year Hold Analysis

totalprojectcost64,829,760100%-constructionloan45,380,83270%totalequity19,448,92830%100% -contributedland(sutton)5,000,0008%26% -monetizedtif00%0%

requiredcashequity14,448,92822%-epccash00%10%

suttoncash14,448,92822%74%

OPERATIONAL FORECAST

netoperatingincome0(107,428)2,931,5474,265,3784,428,8854,552,4564,692,3104,836,4754,985,0835,138,271 +capitalcosts0(4,400)(8,844)(8,932)(9,022)(9,112)(9,203)(9,295)(9,388)(9,482) +$operationsaccountedforinbudget0000000000 +permanentloaninterest00(676,984)(2,707,937)(2,707,937)(2,707,937)(2,707,937)(2,707,937)(2,707,937)(2,707,262) +permanentloanprincipal000000000(135,463) freecashflowfromproperty0(111,828)2,245,7191,548,5081,711,9261,835,4061,975,1702,119,2432,267,7582,286,063 +permanentrefinanceloan0000000000 +constructionloanpayoff0000000000

freecashflowafterrefi002,245,7191,548,5081,711,9261,835,4061,975,1702,119,2432,267,7582,286,063 +salepricenetofbrokerage(5.00%cap)0000000000 +permanentloanpayoff0000000000 totalfreecashflowfromproject002,245,7191,548,5081,711,9261,835,4061,975,1702,119,2432,267,7582,286,063

EPC BUYOUT

SUMMARY

distribution0001,548,5081,711,9261,835,4061,975,1702,119,2432,267,7582,286,063 -investment19,448,9280000000000 netequityflow(19,448,928)0001,548,5081,711,9261,835,4061,975,1702,119,2432,267,7582,286,063 stabilizedavganndistribution(Y5-9)2,032,594 ÷postrefiinvestment17,900,420 stabilizedyield11.4%