Market Report 2025 – Q4

Market Report 2025 – Q4

The summary for the Quarterly Market Report Q4/2025 is as follows:

Transport costs remain high as the freight-to-cargo space ratio is expected to stay above 65:35, leading to increased transport prices. Starting October 1, 2025, a new "Secure Release Order" (SRO) surcharge of EUR 5.00 per import container will be charged in Germany to cover the costs of using the German Ports platform.

After a period of congestion in ports in Asia and the USA, a return to normalcy is expected. Freight rates on major trade routes, such as Asia ↔ Europe, have decreased, despite ongoing detours via the Red Sea and the Cape of Good Hope.

Commodity prices and packaging materials continue to face pressure due to higher transport costs, reduced availability, and bottlenecks, for example in packaging materials. Aluminum prices are forecasted to initially decline during 2025, followed by a slight recovery towards the end of the year.

The fuel surcharge for Q4 2025 is set at 6%.

The import of Argentine and South African lemons to Germany remains stable with prices at last year's level. New Greek lemons are expected to arrive in wholesale markets soon and will play a significant role. The orange market is dominated by local Valencia oranges mainly used for juice production.

In Southern Italy, severe drought and reduced water supply are causing an estimated 30-40% drop in lemon harvests, impacting market stability.

In Murcia, Spain, lemon harvests have started with expected reductions of 15-40%. Producer prices are already higher, and sales prices are projected to peak by year-end. Limited South African lemon supplies are being rapidly depleted.

Overall, the German market faces a challenging season with supply constraints and higher prices.

The 2025 tomato season started with relatively low prices on the domestic market, which producers still consider below average. Cluster tomatoes mainly came from the Netherlands and Belgium, round tomatoes primarily from Poland and Belgium. Almost all beef tomatoes were sourced from Belgium. Cherry tomatoes were mainly supplied from the Netherlands and Italy, complemented by domestic batches. Although supply from southern and southwestern Europe is increasing, prices remain high due to distribution problems in Greece and increased costs. The Spanish tomato export season is currently starting with small volumes, with higher availability expected only from mid-October onwards.

The chanterelle season typically ends by late October. Supply is expected to drop off rapidly, with prices remaining high due to continued limited volumes and competition among buyers. Frozen or preserved alternatives will gain importance. We recommend concluding fresh purchases by early October and shifting procurement to shelf-stable formats thereafter.

Q4 2025 – Outlook & Recommendations for Fruits & Vegetables

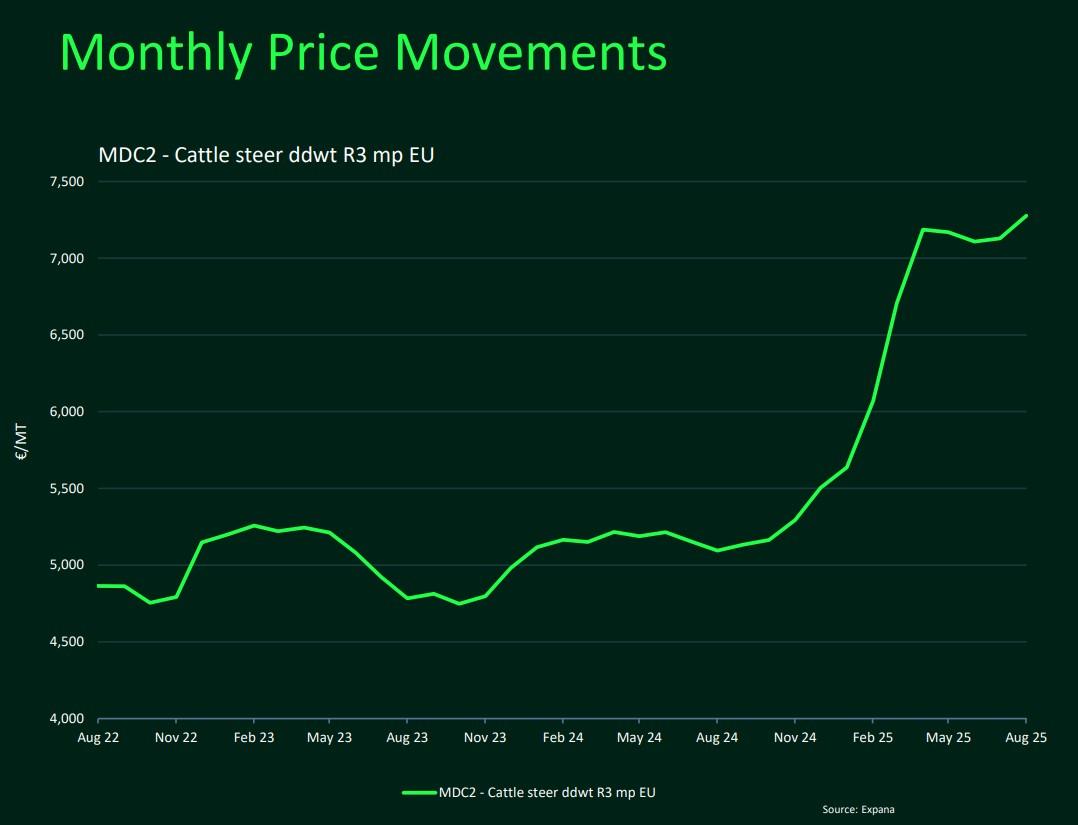

EU initiatives, like the €128 million Dutch compensation fund, encourage farmers to reduce livestock production to meet environmental targets. This, combined with diseases, rising costs, and profitability issues, is shrinking cattle herds and tightening supply.

Early cattle slaughter to capitalize on high prices worsens the shortage, driving prices up. Beef consumption is expected to decline slightly to 6.1 million tons, with per capita consumption at 9.9 kg. Exports are projected to fall by about 5.5%, while imports might increase by 5%.

Trade tensions and competition from major producers like Brazil and Argentina limit export opportunities. The outcome of the EU-Mercosur trade deal and the contested EU Deforestation Regulation will crucially influence future market dynamics.

Overall, expect continued supply constraints, higher prices, and a challenging trade environment in Q4 2025.

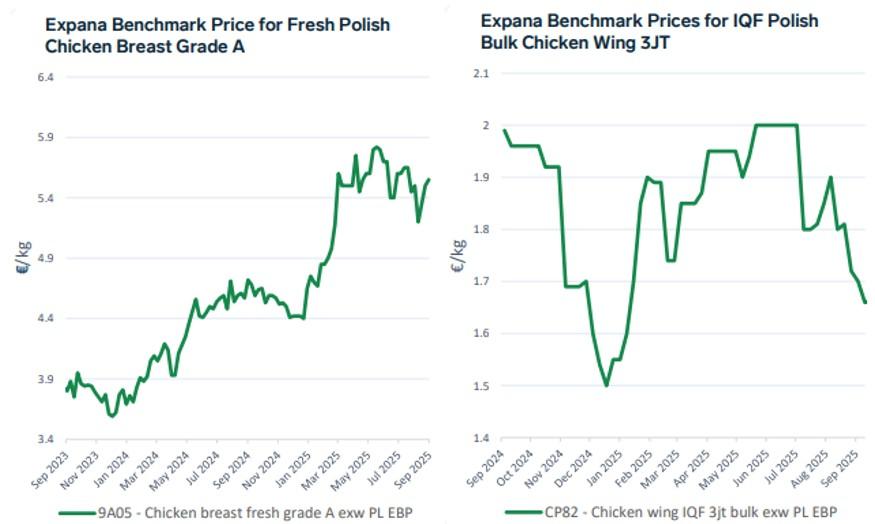

Fresh poultry within the EU, both chicken and turkey, remains stable in September, with the German market maintaining high price levels. From Poland, there have been some price corrections downward due to pre-scheduled slaughter related to bird flu, yet prices in Poland continue to rise, especially for indemand breast meat. Forward contracts secured through late October indicate ongoing strong demand and limited short-term availability.

Overall, supply shortages keep prices elevated across Europe. Poultry continues to be a more affordable protein source compared to red meat. While demand for cheaper parts like drumsticks and thighs grows faster, the need for premium products like breast meat remains stable. This trend reflects consumers shifting toward more economical choices amid rising living costs.

To support the poultry sector, the European Food Safety Authority (EFSA) and the European Commission have launched the “No Bird Flu” toolkit aimed at improving biosecurity, especially for small and mediumsized farms vulnerable due to limited resources.

In summary, the European poultry market remains tight with stable high prices and differentiated demand patterns.

Given the declining exports to some key markets and the significant reduction in imports by China, continued pressure on Norwegian cod exports is expected in the fourth quarter of 2025. The trend toward higher exports of frozen compared to fresh cod is likely to continue, as frozen products have longer shelf life and logistical advantages. At the same time, increased competition in traditional European markets is anticipated, while seasonal

demand increases and possible new trade agreements could support a slight recovery. However, the current geopolitical and economic situation adds uncertainty.

Forecast: Export prices for Norwegian cod are expected to remain high, supported by reduced catch quotas and limited supply. The low catch quota for 2025 (25% less than 2024) suggests a tight product supply, which should keep prices elevated well into 2025. A shift toward frozen products and stable demand from the UK, Denmark, and Portugal is also expected, while the market in China remains weak due to current import restrictions and decreased demand.

Norwegian Atlantic salmon accounted for around 58.9% of total seafood exports in 2024, with a growth of 23.5% up to July. The main markets are Poland, the Netherlands, and China, with China overtaking France as the third-largest market. Chilean Atlantic salmon exports reached 173,976 metric tons by June, with a slight increase of 1.53%. The main destination countries are the US, Brazil, and Russia. While exports to the US and Brazil slightly increased, exports to China fell significantly by 43.4%. Germany is Norway's most important trading partner with a trade volume of over 33 billion euros, particularly in gas imports from Norway and machinery exports to Norway. Norway is the world's largest producer of farmed salmon, with around 1.4 million tons produced in 2024. These data illustrate the strong export growth of Norwegian and Chilean salmon, shifts in key sales markets, and Norway’s central position in the salmon market.

Key expectations for the fourth quarter include the following market trends and strategic priorities:

Opt for flexible sourcing agreements

The sentiment on the German milk market was bearish last week, reflected in falling prices. The reason was ample supply. Despite the favorable market environment, milk consumption exceeded expectations. Farmers increased production, supported by favorable weather conditions and profitable producer prices. Milk quality was rated good, with higher protein and fat content than in previous years at this time.

The producer price for milk (EXW Germany, Expana Code: ED24) was €0.44 per kilogram on September 18th, down 1 cent from the previous week

After a period of stabilization in the previous weeks, EU butter prices continued their downward trend, as the market was assessed as bearish throughout the observation period. Demand for butter remained subdued, and despite decreasing prices and increasing supply volumes, buyers refrained from purchasing in anticipation of further price declines. The ample availability of milk fat during June and July supported butter production, leading to an accumulation of stocks which exerted additional pressure on the spot market.

Indeed, milk fat prices on exchanges have fallen sharply in recent weeks. The butter futures contract for the delivery month of August decreased on the EEX from €7,063 on August 1 to a closing price of €5,583 on September 12, representing a decline of approximately 20% within six weeks.

For October, experts forecast a market milk value of €0.40 per kilogram of milk, based on butter and skimmed milk powder quotations at the futures exchange. Current indicators suggest that

Cheese production in the EU remains stable to slightly increasing, despite a slight decline in milk deliveries during the spring. Markets such as Poland and the Netherlands are particularly driving production.

Stock levels are currently well-filled, and export demand, especially from Asia, remains stable. Prices are expected to stay at a high level due to limited supply and strong demand. Further export growth, particularly to Asia, is also anticipated during the summer.

For the fourth quarter of 2025, a volatile market is expected for wheat, influenced by several factors. While U.S. wheat stocks are declining and climatic risks exist in key growing regions, strong harvests from Australia and Wheat & Oil

Argentina, along with a reduction in China's wheat imports, limit upward price pressure. Geopolitical risks, trade disruptions, and changing demand patterns add further uncertainty. Wheat prices may fluctuate within a stable range of $5.00 to $5.50 per bushel, with possible increases above $6.50 in case of supply shortages or geopolitical tensions. Conversely, further declines to $4.50 or lower are conceivable if supply remains strong and demand weakens.

Expana Benchmark Prices for rapeseed oil FOB Rotterdam rose to €1,080.50/mt on 17 September (+ €16/mt week-on-week). Despite near completion of the new harvest, many European farmers are reluctant to sell due to producer prices close to breakeven levels. This has caused a tight rapeseed market. Additional uncertainty arises from Ukraine’s new 10% export duty on rapeseed, causing delays and congestion at ports. Supply shortages may increase price pressures short term. Traders are advised to review procurement strategies amid ongoing supply uncertainties.

Key summary on Ukraine sunflower production 2025:

Harvest in south and southeast underway, yields reported poor in large areas unsuitable for processing.

Northern regions expected to perform better but currently below prior expectations.

Total crop estimated between 10 and 11.4 million tons, notably down from 13 million tons last year and far below pre-war level of 17.5 million tons.

Official EU report estimating 13.6 million tons considered overly optimistic by market participants.

Ukrainian farmers reluctant to sell sunflower seeds due to anticipated price rises amid tight supply.

Processors increasingly concerned about supply security and availability of sunflower oil for autumn processing, potentially leading to upward price pressure.

Extreme weather events such as drought and frost in major coffee producing countries Brazil and Vietnam have caused significant crop losses. Climate change is increasing the frequency of these extreme events and could halve suitable coffee growing areas worldwide by 2050.

At the same time, global coffee demand is increasing by over 2% annually, especially in emerging markets like Asia, intensifying supply shortages and driving prices higher.

In Germany, raw coffee import prices rose about 53% in April 2025 and roasted coffee producer prices increased up to 45% compared to the previous year. Consumers have seen coffee price hikes of over 12% within one year. Despite high prices, demand remains relatively steady, further fueling price dynamics.

Global coffee exports for 2025/26 are forecast at 122.3 million bags, slightly up from last year, with gains in Vietnam, Indonesia, and Ethiopia offsetting declines in Brazil and Colombia. Total world coffee production is projected at a record 178.7 million bags, with consumption rising to 169.4 million bags, keeping inventories tight at 22.8 million bags.

Coffee acts as an early indicator of climate change’s impact on food prices. Sustainable and climatefriendly consumer choices are essential to support long-term supply stability.

The global walnut market is experiencing strong growth driven by consumer demand for healthy, plantbased snacks and awareness of walnuts' health benefits. Major production regions include the U.S., Europe, and Asia-Pacific, with consumption rising due to shifting dietary trends. The 2025 walnut harvest in Chile is 15% larger than the previous year, and California forecasts an 18% increase in production backed by favorable weather conditions.

In Ukraine, walnut production declines due to small-scale farming and impacts from ongoing conflict, though quality and export prospects are improving in 2025. Overall, the walnut market shows steady growth with challenges from geopolitical and climate uncertainties. Market players should monitor trends to capitalize on demand and market volatility.

For Q4 2025, the hazelnut market for bulk buyers is tight due to a significant production drop in Turkey, the largest global supplier. Turkey's 2025 crop is forecasted at around 609,000 tons, a 22% decrease caused mainly by frost damage. This supply shortfall has driven prices sharply higher, with Turkish hazelnut prices rising about 34-40% since the start of the year. Alternative sources like Italy, Chile, and the USA expect higher yields but cannot fully offset Turkey's decline. Buyers should anticipate limited availability, higher costs, and consider long-term contracts to secure supply.