MARCH/APRIL 2023

KROGER’S JUAN DE PAOLI SPEAKS P. 32

BREAKFAST SELECTIONS EVOLVE P. 41

Store Brands honors the people, products and brands influencing the private label industry P. 10

MARCH/APRIL 2023

KROGER’S JUAN DE PAOLI SPEAKS P. 32

BREAKFAST SELECTIONS EVOLVE P. 41

Store Brands honors the people, products and brands influencing the private label industry P. 10

8550 W. Bryn Mawr Ave., Ste. 200 Chicago, IL 60631 773.992-4450 Fax 773.992.4455 www.storebrands.com

BRAND MANAGEMENT

Senior Vice President and Group Publisher Paula Lashinsky 917.446.4117 | plashinsky@ensembleiq.com

AND SUPPLIERS NEED TO BE READY TO MEET THIS ENHANCED DEMAND

There’s something happening here, and what it is, is rather clear.

While I’ve borrowed and slightly edited the beginning lyrics from Buffalo Springfield’s 1960s hit For What It’s Worth, this thought has been in my head for a while. The private label industry is experiencing a rather stirring period of evolution, which includes everything from rapid product expansion to how retailers are promoting their store brand products.

Yes, history tells us shopper demand for private label products ebbs and flows with pocketbook issues of the day that are impacting consumers. But what we’re experiencing now feels different. Retailers are seeing a chance to take greater control of what’s on their shelves and web pages while also giving their shoppers a unique assortment of products that can’t be found at the competition up the street.

Throughout the first quarter, I’ve spoken with numerous retailers who had a common message: each wants to expand its private brand assortment. Whether it’s Kroger, Wakefern, Save A Lot or regional grocer Town & Country Markets, which recently added own-brand products for the first time, it’s a good time to be in our business.

Equally important is how retailers are marketing their private brand selections in an effort to raise their profile. No longer content to put products on the shelves and let consumers explore on their own, some retailers now are bringing their message to the living rooms of consumers through aggressive ad campaigns. The goal? Well, for those retailers with a national or broad regional presence, make consumers think of their private brands as national brands.

Including the message “available only at…” in those marketing campaigns also rings true with shoppers and is a great way to build loyalty with those walking in the front door.

As retailers evolve, so must product suppliers. Competition for new business will be fierce, and getting and staying ahead of those around you will be more vital to success. Part of that effort is networking and sharing your company’s story with those looking to buy your products.

Busy retailers want to know what’s happening in the supplier world. From new products, to management changes to expansion of production facilities or warehousing, this information puts retailers in a position to make good decisions about who they should be doing business with.

So drop me a line, and let’s talk about sharing your company’s story. Remember, there’s something happening here.

EDITORIAL

Associate Publisher/ Executive Editor Greg Sleter gsleter@ensembleiq.com

Associate Editor Zachary Russell zrussell@ensembleiq.com

ADVERTISING SALES & BUSINESS

National Sales Manager Natalie Filster 917.690.3245 | nfilster@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

Senior Creative Director Colette Magliaro cmagliaro@ensembleiq.com

Designer Jyoti Patiyar jpatiyar@ensembleiq.com

Production Manager Patricia Wisser pwisser@ensembleiq.com

Marketing Manager Rebecca Welsby rwelsby@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com

Subscription Questions contact@storebrands.com

Chief Executive O cer Jennifer Litterick

Chief Financial O cer Jane Volland

Chief People O cer Ann Jadown

Chief Strategy O cer, Joe Territo

Chief Operating O cer Derek Estey

Albertsons Companies has made changes to two of its most prominent private brands.

The grocer updated the logo and brand design for Open Nature, which now features a more minimal design. The new design is the first update since 2015 for the health-focused private label.

To celebrate the redesign, Albertsons Cos. added 12 new plantbased products to the Open Nature collection, including dairy-free yogurt alternatives, non-dairy cheese alternatives and non-dairy frozen desserts. In addition, Open Nature launched 100% domestic raised grass-fed Angus beef, making the brand one of the largest private label domestic grass-fed programs in the country.

Albertsons Cos. also updated the packaging for its O Organics brand, changing the design while preserving its bright, multicolored logo and the easily identifiable ‘O.’ Launched in 2005, O Organics became a $1 billion brand in 2018.

“Many of our customers have embraced an organic lifestyle and consider it to be a meaningful part of their personal values,” said Brandon Brown, senior vice president of Own Brands at Albertsons Cos. “As the brand has grown with the ever-evolving needs of our customers, we felt its visual identity should, too.”

North Carolina-based retailer The Fresh Market recently launched a new way for shoppers to discover and purchase its private label and prepared food items.

The grocer relaunched its promotional magazine, titled “The Magazine,” as an exclusive, digital-only shoppable publication, allowing customers to find new products, recipes and meal inspiration. Previously available in print, “The Magazine” now features an elevated and fully interactive shoppable experience.

Each page has a “shop now” tab that allows readers to visit The Fresh Market’s online site to purchase items for pickup or delivery. Shoppable videos are also embedded throughout each issue, allowing guests to watch engaging content.

“Our new digital-only shoppable magazine marks our largest and most immersive magazine experience ever, allowing our guests to make both every day and special occasions memorable through a wide variety of recipes, meal solutions, and fresh deals,” said Kevin Miller, chief marketing officer for The Fresh Market. “The magazine will also continue to feature special savings on high quality products at a great value from our vendor partners that our guests love.”

The 1st annual GroceryTech event, produced by Progressive Grocer and RIS News, brings together the combined PG/RIS community of business & technology grocery execs who are on the journey to modernize their technology infrastructure to support innovation.

The event’s theme, Scaling with Personalization

focuses on how grocery execs can build a technology infrastructure to pro tably serve shoppers now and into the future. GT will bring together the full spectrum of grocery stakeholders, including leadership and business implementation executives across IT, supply chain, marketing and store operations.

A cross-functional representation of IT, marketing, merchandising, store operations, supply chain, data/analytics, digital commerce, and corporate leaders across multi-channel large and mid-sized grocers

THANK YOU TO OUR SPONSORS:

As consumer demand for private label products grows, retailers and suppliers continue to up their game bringing to market a bevy of new products across multiple categories. Product launches over the past year show a continued effort to give consumers high

BY GREG SLETER AND ZACHARY RUSSELL

BY GREG SLETER AND ZACHARY RUSSELL

value items that offer retailers the opportunity to differentiate from their competitors.

For the third year, Store Brands is honoring those in private label that are pushing the boundaries and driving the industry forward. Below are the people, product innovations and brands that are this year’s Game Changers.

Focused on providing its shoppers a product selection with affordable options is the daily goal for Dollar General, and that effort on the private label side is led by Jackie Li. Since 2018, he has overseen the retailer’s private brand strategy that includes merchandising, sales, marketing, branding and product development. He also oversees Dollar General’s company-wide global sourcing strategy as well as managing the company’s global operation offices in Hong Kong, Shenzhen, Shanghai and satellite offices in Southeast Asia, Mexico and Europe.

As a 2023 Store Brands Game Changer, Li said his passion for his job has been a key to his success. “I also believe in being customer-centric,” he said. “You must think beyond your business and make a connection to what your customers really want and need.”

To meet the needs of shoppers, Li said his willingness to innovate and challenge the status quo allows for idea generation that goes beyond the norm. He also values the team around him.

“Teamwork is critical,” he said. “I value having the ability to rally crossfunctional teams to execute on the goal based on our global mission of serving others.

In his six years at Dollar General Li said his greatest accomplishment was building a “fantastic” private brand merchandising team as well as a top-notch global sourcing and operations team around the world with members from 11 countries.

“Our team completely revamped Dollar General’s private brand, Clover Valley, and launched multiple new brands in 2022 including OhGood! vitamins, Nature’s Menu super-premium pet food, Wild Tropics Sun Care and more,” he said. “Overall, our consumable private brand sales have and continue to grow.”

Li also feels there are several factors that make him a game changer.

“Staying curious with a beginner’s mindset helps me to see different points of view and new ideas from employees, peers, and industry experts,” he said. “I always set ambitious goals with a forward-thinking vision for the area of the business I am responsible for. I never settle for mediocrity and recognize you must be resilient no matter what is thrown your way. I believe in being courageous when faced with disruptions and seek to uncover new growth opportunities. Finally, I pride myself on my ability to pull people, processes, innovation, and technology together to execute a vision.”

“Staying curious with a beginner’s mindset helps me to see different points of view and new ideas from employees, peers, and industry experts. I always set ambitious goals with a forwardthinking vision for the area of the business I am responsible for.”

— Jackie Li, Dollar GeneralJac Ross VICE PRESIDENT, SPROUTS BRAND Sprouts Farmers Market

In the two years since joining Sprouts Farmers Market, Jac Ross, vice president of Sprouts Brands, has driven private brand growth for the grocer. That effort took another step prior to the start of 2023 as she partnered with senior leadership to make private label growth a top priority for the company.

“I’m very passionate about product and ensuring we have the very best products on our shelves through attention to detail,” said Ross, a 2023 Store Brands Game Changer. “I love working with the private brands industry and especially in retail. It’s such a dynamic industry with so many great people.”

She attributes her success to building a strong network internally and externally, and takes the time to listen and observe before making significant decisions. Also, Ross said her success is driven by her willingness to leverage assistance from others.

“It’s certainly a team effort,” she said. “I certainly couldn’t have achieved a high level of success without the support of my team, both direct and more broadly across the organization and our supplier base.”

According to Ross, her greatest accomplishment has been the Sprouts’ private brand success as the grocer surpassed the $1 billion mark in private

label sales in 2022, which also took the in-house Sprouts Brand to a penetration level of more than 19%.

“This was up significantly from when I joined Sprouts in 2021,” she said. “A big part of this increase was the redesign of our Sprouts Brand packaging. I’m so proud of the work we have done in this area - we are really making things happen.”

As a 2023 Game Changer, Ross said the time spent identifying her purpose – creating lasting memories through courageous adventures – outlines how she thinks about her life both in and out of work.

“This approach to being willing to try new things and driving change through courageous choices is how I have taken risks over my career,” she said. “Combined with having a positive outlook and my approach to problem solving is how I believe I have facilitated and driven change.”

Luigi Lazzareschi CEO Sofidel

It was more than a decade ago that Sofidel established a presence in the United States with its Horsham, Pa., headquarters. The goal was to provide retailers with a source of private label products manufactured locally.

During its time in the U. S. the company continued to expand its presence and today has operations in Ohio, Wisconsin, Florida, Mississippi, Oklahoma and Nevada. Over the past two years, company CEO and 2023 Store Brands

“The approach to being willing to try new things and driving change through courageous choices is how I have taken risks over my career. Combined with having a positive outlook and my approach to problem solving is how I believe I have facilitated and driven change.”

—Jac Ross, Sprouts Farmers Market

Over the past two years, Luigi Lazzareschi has driven Sofidel to invest in technology and personnel to enhance the company’s sustainability efforts. As a result, the company is now offering a product selection that allows retailers to carry national brand equivalent items.

Game Changer Luigi Lazzareschi has driven the company to invest in technology and personnel to enhance the company’s sustainability efforts.

The result has been business expansion with a focus on offering retailers paper goods that allow them to carry a selection of private brand products that are equivalent to similar items offered by national brands.

And the company’s efforts have not gone unnoticed. In 2022, Sofidel received an ESG Risk Rating of 13.6 from Morningstar Sustainalytics, ranking it first out of more than 120 companies in the Household Products industry. The rating recognized Sofidel for its strong commitment to the preservation of biodiversity, anti-corruption strategies, transparency, and efforts to fight climate change and global warming.

With 1,500 employees across the U. S., Sofidel was also placed in the “Low Risk” category as of August 2022. This recognizes companies with a strong ability to manage the environmental, social and governance risks that characterize the three areas of a company’s responsibility.

One of the largest retailers in the country, Lowe’s offers its customers the products they need for home improvement jobs of all shapes and sizes. Philip Walliser, product development senior merchant, oversees the retailer’s Stainmaster brand, which gives customers an in-house choice when it comes to flooring, carpet, tile and more.

A recent accomplishment of Walliser was bringing the brand into a new category: paint. He recognized that customers needed a solution that still provides the quality and performance specifications at a value versus comparable national brands. Walliser partnered with the the retailer’s quality assurance and product development teams, merchants and strategic vendor partners to develop and execute Stainmaster’s paint launch from the ground up.

“Without the exceptional individuals in so many different roles none of this would be possible,” Walliser told Store Brands. “Creating a clear objective, having a mission that people understand and buy-in to, foster the feedback and insights of others, and actually listen to it also contributed to the success.”

Stainmaster paint is backed by a stain resistant lifetime limited warranty, and is available in colors curated by design and trend experts.

“My greatest accomplishment is seeing people excited about what we were doing,” he added. “We were doing things for the first time or challenging the way we had done things previously to get them done more effectively or more quickly to hit our goals.”

“My greatest accomplishment is seeing people excited about what we were doing. We were doing things for the first time or challenging the way we had done things previously to get them done more effectively or more quickly to hit our goals.”

— Philip Walliser, Lowe’s

Bill Bradshaw

Bill Bradshaw

Private label supplier Federated Group serves its retail clients several food and household brands to offer customers. One of the brands, Life Every Day, has seen a recent boost in attention thanks to one of the company’s senior members.

Bill Bradshaw, vice president of Sales at the company, led a successful marketing initiative to not only interact, but to relate and connect directly with consumers on several social media platforms, including TikTok and Instagram.

On Federated Group’s page, foods are showcased in unique ways that can help consumers get a first-glimpse at the products. The initiative of directly engaging with consumers on social media platforms has proven Federated Group’s Life Every Day brand to be a successful link between consumers, customers and suppliers.

“We have put a vigorous social media marketing plan in place to connect with a worldwide audience,” said Bradshaw. “We encourage consumers to participate and engage in our various platforms. We focus our message on the authenticity that today’s consumers are searching for. We can say that our ‘Life Inspires’ brands have earned enthusiastic acceptance by current customers while attracting new customers as well.”

“We have put a vigorous social media marketing plan in place to connect with a worldwide audience. We encourage consumers to participate and engage in our various platforms.”

—Bill Bradshaw, Federated Group

Topco touts its Cornershop Cuts Delicatessen assortment as offering superior flavors, aromas, freshness and selection of a premium deli experience — all at a better price than leading national or regional brands. By curating a wide selection of high-quality meats, cheeses and other products, Cornershop Cuts provides shoppers an everyday indulgence that appeals to their pursuit of taste and quality at a price that’s pleasing to their budgets.

Additionally, Cornershop Cuts offers an Organics sub-brand with premium, certified organic deli products, as well as a Naturals subbrand that includes premium deli meat products raised without antibiotics. A mainstream assortment of bulk deli meats and cheeses completes the line.

Much more than simply a new brand with a pretty label, this private label assortment was carefully conceived, culminating in a true “difference maker” for Topco members and shoppers. Rising to the challenges of marketplace consolidation, increased category costs, supplier minimums and quality consistency, Cornershop Cuts Delicatessen represents the power of aggregation for Topco members. Its ability to be a winning solution within a non-traditional space for retailers, suppliers and shoppers alike makes Cornershop Cuts a game changer in deli.

The Merchandiser from Shelf2Cart offers a new solution for grocery stores that are looking to boost revenue on prepared foods and bakery items. Utilizing a combination of hardware and back-end software, store-branded labels can be created for a variety of items with a touch of a button.

Grocers have the ability to move away from traditional black and white labels and create eye-catching product labels and signs that will capture the attention of shoppers. Whether one needs to adjust nutritional facts, disclose allergens or update ingredients, the process is simple and hassle-free.

G.S. Gelato offers retailers and grocers a unique selection of milk-alternative, non-dairy frozen desserts made from coconut milk, cashew milk, almond milk, oat milk, and peanut milk. The company also offers a portfolio of traditional and unique flavors and dietary preferences including keto and no added sugar options.

While it was once common to only find coconut or almond milk frozen desserts in the freezer aisle, G.S. Gelato has made it possible for private brands to increase their consumer loyalty with decadent flavors made from other types of milk-alternatives. The company works to create traditional and unique flavor options that suit every need from premium indulgence to adhering to growing dietary preferences.

Focused on meeting or exceeding the quality of national brand benchmarks, the company said it is able to adapt instead of reacting to the quick-

ly evolving consumer demands in order to produce the best products possible for its clients.

The company’s research and development team is constantly working with new ingredients and technologies, which allows G.S. Gelato to craft innovative flavors in a variety of ways – from authentic Italian gelato, to vegan sorbetto, and plant-based frozen desserts crafted with virtually any choice of milk alternatives.

Birdzi, told Store Brands. “Essentially it created customized offers for every single shopper. If I think 50¢ off a box of popcorn is going to work for you, you’ll get 50¢ off, and for somebody else it might take 75¢ to trigger that purchase.”

Across all Birdzi customers, the company said that more than 8% of shoppers who receive strategically targeted VISPER 2.0 offers buy one or more items versus the 4.5% of shoppers who buy one or more items from traditional weekly circulars. Overall, Birdzi’s customers saw 38.2% growth in the number of categories shopped and 23.6% growth in the number of trips per shopper.

As the leading certifier of fair trade products in North America, Fair Trade USA helps retailers and consumers identify ethically and sustainably sourced grocery and home products. Through its recently redesigned factory program, the nonprofit is able to streamline factory onboarding, enact progressive requirements that encourage continuous improvement, expand the product categories it certifies, and simplify cost structures for suppliers.

In the grocery world, the adoption of technology continues to allow retailers to better know their customers, and offer them appropriate deals and discounts on private label items. New Jersey-based AI solution firm Birdzi is just one example, working with independent retailers who are seeking to build customer loyalty.

Birdzi’s VISPER 2.0 personalization tool reimagines the weekly ad circular and has increased sales, visits and customer retention for regional supermarket retailers. The solution leverages customer insights and the retailer’s entire product catalog, including private brands, and then automatically suggests specific offers, discounts and communication tailored to each shopper.

“What VISPER 2.0 did was remove the limit on the number of offers,” Shekar Raman, CEO and co-founder of

Through the program, suppliers around the world can take steps towards sustainability and have their products recognized as such. Also in 2022, e.l.f. Beauty became the first supplier in the beauty industry to become Fair Trade Certified for a manufacturing facility. More than 200 e.l.f. products now display the Fair Trade Certified seal.

Last October, Fair Trade USA exceeded $1 billion in financial impact to farmers, workers, fishers and communities around the globe since its inception in 1998.

With health and wellness becoming one of the largest trends in food & beverage, NSI Group’s Airnnuts are changing the game in the snack category. The nut product from the California-based private label snack and ingredient manufacturer offers consumers a new twist on a healthy staple.

Airnuts are a plant-based nut snack made from 80% nuts, and are air-baked as opposed to fried in oil like many traditional snacks. Packed with protein and fiber, Airnuts are gluten-free, non-GMO, vegan and prepared without any added oil. The product comes in a wide variety of flavors, including Himalayan Pink Salt, Chili, Onion & Cheese and Truffle.

“Airnuts are bringing a new snacking experience that is not only delicious, but also guilt-free,” said NSI Group. “The unique texture and the perfect combination of flavors make Airnuts the perfect snack for any time of the day, whether it’s as a quick energy boost in the morning, a satisfying midday pick-meup, or a tasty treat in the evening.”

the Merchandiser®

Start transforming your grocery store marketing strategy today with The Merchandiser® .

Our compact label printing system creates stunning custom branded labels for prepared foods and bakery items that capture customer attention to drive higher revenue.

Print only what you need, when you need it, eliminate waste, and maximize efficiency for both private label and national brands.

Learn more and schedule your DEMO at: Shelf2Cart solutions.com

Convenience has become one of the largest trends in food and beverage, as consumers seek quick and easy ways to meet their nutritional needs. Southeastern Grocers (SEG), Store Brands’ 2022 Retailer of the Year, debuted new powdered drink mix packets that allow customers to stay hydrated and reap the benefits of caffeine, multi-vitamins and electrolytes on the go.

Sold in 10-count boxes, SE Grocers Powdered Drink Mix comes in several flavors. The Peach Mango Green Tea, Grape and Wild Strawberry flavors are caffeinated, while the Cranberry Pomegranate and Lemon Honey Green Tea flavors are not. The mixes boast key vitamins such as C, B6 and B12, A, and E.

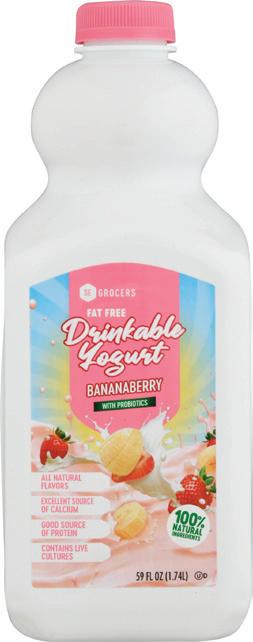

Similar to its assortment of powdered drink mixes, Southeastern Grocers, the parent company of Winn-Dixie, Harveys Supermarket and Fresco y Más, offers its shoppers a convenient beverage option with its line of SE Grocers Drinkable Yogurts. Containing live cultures, the yogurts are a quick and easy way to get needed calcium and protein.

The private label product debuted last year, and is available in flavors such as Bananaberry, Mango and Strawberry. As with other SE Grocers brand items, customers save an average of 20% on the mixes compared to the national brand.

Following the June 2022 launch of its Very Bellissima private label assortment, the initial collection of 150 products proved to be a real beauty for company sales. Offering items including hair accessories, facial care products and the recently launched nail polish, more than 58,000 units have been sold and the assortment continues to grow in popularity with Hy-Vee customers.

The initial success of Very Bellissima has led to expansion with some 250 new products including color cosmetics, bath and body care, facial regimens, and hair care and beauty tools in the pipeline.

All facial care products are gluten free, paraben free and cruelty free and include products like creams, serums and face masks. Product ingredients are comparable to professional brands within the beauty segment – but available at a better value price point.

When introducing Very Bellissima, Hy-Vee added products from the line to its monthly rotation of beauty boxes, which feature small quantities of beauty and hair products for customers to sample. The brand was also scheduled to be featured in the March issue of HyVee Seasons magazine.

Inside its new flagship stores, Hy-Vee introduced Bellissima departments filled with beauty and hair care products available across all pricepoints. The Very Bellissima brand is now available across Hy-Vee’s more than 285 stores, and more than 60 locations today currently offer the expanded Bellissima beauty department.

Four years ago, Misfits Market set out to challenge the inefficiencies that exist in the traditional food supply chain. That effort included the April 2022 debut of the company’s Odds & Ends private label product line, which serves as an outlet to weave food rescue opportunities into the e-grocer’s assortment. The company partners with farmers and producers to reduce waste while delivering quality products at affordable prices across the U.S. Named one of Store Brands’ 2022 Retailer’s to Watch, the Misfits Market team works to continue finding ways to rescue food from less desirable outcomes, leveraging Odds & Ends’ quickly-increasing brand equity and popularity with customers. This results in truly mission-

Since the onset of the COVID-19 pandemic, pet ownership in the U. S. has boomed, along with the rise in premium private label pet foods that prioritize animal wellness. As America’s largest retailer by store count, Dollar General’s reformulated Nature’s Menu brand is changing the pet food game for millions of consumers who rely on Dollar General for their shopping needs. Available at more than 19,000 stores in 47 states, Dollar General’s Nature’s Menu brand dog and cat foods are crafted with natural ingredients including real beef, lamb or farm-raised, cage-free chicken as the number one ingredient. They contain vegetables and wholesome grains and are free from corn, soy, wheat, fillers, animal by-products, artificial colors, flavors and preservatives. Additionally, Nature’s Menu products are enhanced with prebiotics and probiotics to help support healthy digestion and feature added vitamins, minerals

driven product development, at many times allowing for additional revenue streams for farmers and producers while also providing a value to customers.

An example is the Odds & Ends Organic Pumpkin Puree, which is from a portion of its producer’s pumpkin crop with a higher than typical brix content. While slightly beyond the typical specification allowed by other customers, Misfits Market welcomed these cans into their private label for customers to make pumpkin pie at a value and prevent the farmers from experiencing a loss.

Another example is the Odds & Ends Dark Roast Ground Coffee. The direct-trade coffee blend features a “misfit” blend of beans from Brazil that still yields a premium cup of coffee while providing fixed, stable prices to growers to shield them from market volatility and losses.

and other trace nutrients including Omega 3 and six fatty acids for healthy skin and coats.

Prices range from $7 to $20 per bag, giving shoppers an affordable, “super-premium” pet food option. During the ongoing inflationary period, Dollar General is making sure that pet parents won’t have to cut corners when it comes to providing their dog or cat with quality food.

The ongoing and evolving conversation around sustainability remains a hot topic for retailers and suppliers alike as each side of the equation continues to develop new products and packaging with the goal of having a minimal impact on the environment.

While not new to the sustainability discussion, greenwashing has resurfaced recently as the number of claims regarding topics ranging from how products are sourced to whether a packaging is truly recyclable or compostable continues to grow.

Experts that spoke with Store Brands feel the greenwash-

ing discussion has evolved in recent years. In the past, when sustainability initially hit the radar of retailers and product developers, there was a greater sense that claims related to a product’s sustainability bona des were purposely false.

Today, however, the overriding thought from industry insiders related to greenwashing is that false claims largely are not the result of nefarious intentions, but a variety of issues including a lack of understanding of evolving regulations or confusion around rules put in place by local governments.

“(Greenwashing) is de nitely still an issue, but not because companies are trying to greenwash,” said Dawn

Nowicki, vice president of Marketing with packaging supplier MRP Solutions. “Today it’s more from a lack of consistency in standards or a lack of clarity in how certain things are de ned.”

Experts noted that confusion related to recycling and composting claims made on certain types of product packaging have the potential to cause an unintentional greenwashing issue.

Susan Thoman, principal and managing director with the Compost Manufacturing Alliance, noted that consumers who think they have a certain understanding of the claim being made on a product may actually misunderstand what certain terms mean.

“When consumers are confused, they may feel as if they are being greenwashed,” she said.

Another issue pertaining to greenwashing is the point of origin for products in a given segment. Mark Madrack, senior vice president of Sales/Private Label with The So del Group, noted that some retailers overlook the high CO2

When a product has sustainability claims, sometimes consumers and retailers don’t consider the entire supply chain. Some of these products get labels that are not checked and sometimes may even be fake.—

MarkMadrack, The

Sofidel Group

GROWING NUMBER OF PRODUCTS FEATURE INFORMATION ABOUT HOW TO RECYCLE.

impact related to products being manufactured overseas and shipped to the United States.

“When a product has sustainability claims, sometimes consumers and retailers don’t consider the entire supply chain,” he said. “Some of these products get labels that are not checked and sometimes may even be fake. With that said, we understand that going into detail (about sustainability claims) is dif cult and confusing.”

While there continues to be a certain level of confusion with all parties involved, nding greater clarity remains a major challenge. Some feel there needs to be greater continuity among governments. States including California, Washington and Maryland have passed laws in an effort to enhance sustainability efforts and help consumers better understand claims on packaging.

But experts say there remains a long way to go with most states not discussing this issue of greenwashing, much less working to develop legislation, and few have hope of the federal government tackling the issue, given the divisive political climate in the nation’s capital.

However, some experts encourage retailers to become more involved in pushing government efforts to develop laws pertaining to greenwashing and sustainability overall.

“When governmental agencies are looking to develop or rewrite guidelines, this is an opportunity for retailers to have a seat at the table and help in uence the decision being made,” said Christine Miklosko, packaging solutions strategist with Quad. “This will allow them to gure out what the new rules mean and help them long term.”

The route that has been easier for many is working with third-party certi ers, such as Fair Trade USA, that have developed strong sustainability standards related to a variety of issues.

“We have seen the issue of sustainability evolve over the years and now consumers are more aware and holding retailers and product suppliers to higher expectations,” said Abby Ayers, senior director of Retail Partners with Fair Trade USA. “And when we talk about greenwashing, it remains a challenging issue for most retailers and brands.”

(Greenwashing) is definitely still an issue, but not because companies are trying to greenwash. Today it’s more from a lack of consistency in standards or a lack of clarity in how certain things are defined.

— Dawn Nowicki, MRP Solutions

When governmental agencies are looking to develop or rewrite guidelines, this is an opportunity for retailers to have a seat at the table and help influence the decision being made.

— Christine Miklosko, Quad

Within the private label segment, any environmental-positive claims made by products fall to retailers, as their brands are on the packaging. As the work to avoid accidental greenwashing continues, Ayers said there are several steps retailers can take that are not dif cult.

For example, if a retailer is carrying a full line of baking products, she suggests making individual claims on each item and avoiding blanket statements that may not be true for every SKU in the assortment.

Additionally, she encourages retailers and product suppliers to work with third-party certi ers to ensure that all claims being made are accurate.

“We are happy to see that most retailers and product suppliers are bringing Fair Trade and other certi ers to the table to help substantiate claims they are looking to make,” she said. “We offer an understanding of how to talk about certain issues and help them avoid any legal risks.”

So del’s Madrick noted that working with third-party certi ers has had a positive impact on the

— Susan Thoman, Compost Manufacturing

— Susan Thoman, Compost Manufacturing

company and led to accolades for its efforts pertaining to sustainability.

“We’ve heavily invested in third-party certi cations to prioritize transparency,” he said. “As a result, So del is consistently ranked as one of the most sustainable companies in the paper industry according to CDP and EcoVadis. In 2022, Morningstar Sustainalytics ranked So del as the top company in the Household Products category.”

Additionally, So del uses 100% certi ed pulp for its paper products, such as those veri ed by the Forest Stewardship Council.

For retailers, avoiding greenwashing remains a challenge, and beyond not intentionally making false claims, industry experts offered advice on how to ensure claims being made are accurate.

“I think it’s important for companies to stay in their lane,” said Susan Thoman, principal and managing director with the Compost Manufacturing Alliance. “There are many organizations that have great tools and information designed to help make sure claims are accurate. In addition, these organizations know how the system works and make sure suppliers and retailers avoid mistakes.”

Christine Miklosko, packaging solutions strategist with Quad, said, “Develop a road map that outlines the organization’s priorities. It’s important to note that while a company may have a number of things it wants to do related to sustainability, they can’t do everything at once.”

Abby Ayers, senior director of Retail Partners with Fair Trade USA, offered, “Working with a third-party verification company provides a good understanding of the is-

sues. We can show retailers how to talk and not talk about certain topics. And, we also work to ensure that all claims are verifiable.”

Mark Madrack, senior vice president of Sales/Private Label with The Sofidel Group, added, “It’s important for retail leaders to educate themselves on a product’s entire supply chain and ensure they’re engaging with products that can back up sustainability claims. Listening to experts, attending sustainability conferences and ultimately asking questions will allow retail leaders build awareness of this topic. This requires time and dedication, but ultimately will help the planet in the long run.”

There are many organizations that have great tools and information designed to help make sure claims are accurate. In addition, these organizations know how the system works and make sure suppliers and retailers avoid mistakes.

Alliance

Store Brands: Why is the issue of sustainability so important to Sofidel?

SOFIDEL: Sofidel’s growth strategy aligns with the United Nations 2030 Agenda which includes building an inclusive, resilient and sustainable future for people and the planet. Sofidel adopted 8 of the 17 Sustainable Development Goals. Each of these goals focuses on creating a healthier and cleaner environment that betters the well-being of humans and the planet.

SB: What are some of the cutting-edge new items that have been brought to market by Sofidel in recent years?

SOFIDEL: We’re the first company in the U. S. to use paper packaging over plastic for a variety of our products. We aim to achieve a 50% reduction in the use of conventional plastic in production by 2030. We also introduced our award-winning Papernet HyTech Seas dispensers, made with recovered plastic materials from the ocean.

SB: What makes the products offered by Sofidel sustainable?

SOFIDEL: One hundred percent of the pulp we use is certified by independent third parties with sustainable forest certifications (FSC, FSC Controlled Wood and PEFC). Also, Sofidel promotes TenP Paper among its vendors, a sustainable supply chain self-assessment program. Established in 2016, this program recognizes the most sustainable suppliers and supports those working to improve their sustainability performance. Sofidel equipment is state of the art too, which guarantees the lowest use of water in the industry.

SB: What has been a bigger challenge Sofidel has faced related to sustainability and the products offered by the company? How has the company solved this challenge?

SOFIDEL: Our biggest challenge has not been internal, but external. Sustainability is the heart of our mission and our products; however, distributors and consumers don’t

always want to pay more for sustainable paper products. We’re increasingly investing in ESG ratings and communicating our commitment to environmental, social and corporate governance issues. We recently received the Platinum recognition from EcoVadis for our approach to sustainability which confirms our place among the top 1% of companies in our sector worldwide. In 2022, Morningstar Sustainalytics ranked Sofidel #1 for ESG Risk Management in the household products category.

SB: Have there been changes to the company’s supply chain to make the transportation of products less impactful on the environment?

SOFIDEL: Yes! Sofidel is one of the few companies, if not the only company in the U. S. with a very efficient distribution process. We have six plants across the country (Ohio, Oklahoma, Nevada, Florida, Mississippi and Wisconsin). The plants are in proximity to market consumption. When deciding where to put the next factory, Sofidel always looks at where consumption is and stays close to it, reducing unnecessary additional “miles” to deliveries. Currently, the radius of reach of our plants is optimal, making Sofidel an ideal partner for distributors to reduce their national carbon footprint.

SB: What about engagement?

SOFIDEL: We are committed to promoting sustainability practices in the industry where we operate. For this reason, we are a part of the ISSA Sustainability Committee and the Association of National Advertisers (ANA) Sustainability Committee. We are also part of the ISSA Sustainability Leadership Council. SB

Consumers are continuing to become increasingly conscious of sustainability, and are looking for ways to make a difference with their spending habits, according to a recent report by NIQ, formerly NeilsenIQ.

The consumer data rm’s recent report “The Changing Climate of Sustainability” showed that 69% of those surveyed said sustainability has become more important to them over the past two years, citing an increase in information on the topic (48%), as well as personally experiencing the

effects of climate change (47%).

At two recent industry events, Sherry Frey, VP of Total Wellness at NIQ, spoke about consumers’ willingness to support brands and products that they believe are making a positive impact on people and the planet.

“Half of consumers are saying it’s [sustainability] very important to them, and if you think about it, retail is the space where we’ve seen early indicators of sustainability,” Frey said during a presentation at the National Grocers Association’s 2023 Show in Las Vegas. “This is the space on a day-in and dayout basis that consumers are showing

us their values. They’re buying their values. It’s certainly easier to show your support for sustainability on your grocery store visit than it is to rewire your garage and buy an electric car.”

When it comes to leading the charge against climate change, pollution, waste and more, consumers are expecting more from brands. Of those surveyed in the NIQ report, 46% said that brands should be most responsible for progress on sustainability, topping local governments (39%) and consumers (38%).

“There’s an escalating consumer demand: consumers are saying ‘we want more, we care more’ about sustainability,” she added. “They [consumers] tell us they’re hearing about it more in the media, so it’s become front of mind for them. We anticipate this to be one of the major trends to impact businesses dramatically over the next ve years.”

Brands, including private labels, have already begun to see consumers gravitate towards products that make sustainability claims. According to NIQ sales data presented at Natural Products Expo West, of the products that made sustainable claims, including ethically farmed or harvested, organic, non-GMO and more, private brands were among the most popular.

“The brands that performed the best, sustainable attributes versus

Consumers who said sustainability is more important versus 2021

not, were private labels,” said Steve Noble, senior partner at McKinsey & Company. “More than 80% of private label products performed better with a sustainability claim versus not. It’s not just about value, it’s about the consumer de ning value beyond price. It’s what they’re getting for the product, and sustainability does make a difference.”

With 41% of surveyed consumers citing price as the largest factor for them not adopting a more sustainable lifestyle, shoppers are increasingly looking for products they feel good about purchasing that also offer strong price/value.

“The products that did not have any of these [sustainability] claims grew 4.7% per year,” added Noble. “Products that did have these claims grew at almost 6.5%. It doesn’t mean

that it happens for every product or category, but on average, sustainability can have a positive impact on growth.”

Going forward, Frey added that sustainable private label products will also help build loyalty in an increasingly fragmented grocery market, especially on the heels of a record-setting 2022 for private label.

“As these claims become more mainstream in your category, that opportunity declines, but what we recommend more is paying attention to the loyalty that these claims are making from a consumer perspective,” Frey said. “There’s a higher level of repeat [purchasing] for products that make those ESG claims.”

By merging sustainability and innovation, Drylock Technologies creates hygiene products which live up to the expectation of consumers while protecting the environment. We continue to strive for excellence and believe that the future is green.

Sustainability with focus on well-being for people and planet!

Half of consumers are saying it’s [sustainability] very important to them, and if you think about it, retail is the space where we’ve seen early indicators of sustainability.

— Sherry Frey, NIQ

So, what’s next for Kroger’s Our Brands assortment of private label products?

If you ask Juan De Paoli, the grocer’s vice president of Our Brands, he’ll tell you, “a lot.” Overseeing a $30 billion business for Kroger, De Paoli saw sales of the company’s private label products blossom in 2022. Driven by increased consumer demand and an aggressive assortment expansion, the in-store and digital shelves at Kroger will see a host of new items once again throughout 2023.

Beyond the effort to bring new products to its shoppers, the grocer is also focused on changing the consumer mindset related to its private brands. A new TV marketing campaign that placed ads during highly watched professional and college football games in January were designed to drive home the message that Kroger’s Our Brands are not just “me-too” products, but in fact national brands that offer quality items at a value. This branding strategy will continue throughout 2023. Recently, Store Brands spoke with De Paoli about the recent successes Kroger has enjoyed with its Our Brands assortment and what’s next for the grocery giant.

STORE BRANDS: Kroger has cited its assortment of private branded products as a key to its overall sales growth throughout 2022. What were some factors behind the growth and success?

JUAN DE PAOLI: There are a number of factors that led to our success with the Our Brands assortment. Fundamentally, Kroger is built on offering products that are quality and provide value. As we continue to expand the Our Brands assortment, we are focused on continuing to offer products that provide quality and value.

SB: When you look back at 2022, what were some of the products that proved to be resounding successes?

JDP: We launched 680 products last year, and with many exceeding expectations, it’s hard to pick one or two. One of the highlights was our new line of Big K Zero Sugar Cola, which we offered in 12-packs. Our line of artisan breads did really well, as did our Peanut Butter Dippers. These offered consum-

ers packages of wafers lled with peanut butter that could be dipped in various avors of marmalade. It’s a great snack that is high in protein.

SB: How has the product development process for private brand products evolved over the years?

JDP: I’m very fortunate to be part of an amazing organization with Kroger that has a product development process that is focused on building a portfolio of (store) brands that seeks to embellish the idea of having products that are national brand equivalent or better. That thought process is seen in our Simple Truth brand, which accounts for $3 billion in sales, to our Private Selection line that offers our customers a premium culinary experience. We are also focused today on not just developing new products, but building brands.

SB: What type of feedback or suggestions do you receive from shoppers?

JDP: Our customers give us a great deal of feedback about

Our customers give us a great deal of feedback about the quality and value of products. In some cases, they give us ideas for new products and we take those and run with them. In other cases, the feedback we receive allows us to make incremental improvements to our products.

Juan De Paoli, Kroger

the quality and value of products. In some cases, they give us ideas for new products and we take those and run with them. In other cases, the feedback we receive allows us to make incremental improvements to our products. We have a thorough validation process all of our products go through. They are tasted and tested by our customers.

SB: There are approximately 20 retail brands under the Kroger umbrella. Are there noticeable differences in the types of private brand products shoppers purchase at each?

JDP: In addition to the 20 Kroger divisions we have across the country, we also have e-commerce pure play operations in other parts of the country, such as Florida. The customers in our new markets where we have online only operations are welcoming Our Brands more than we expected. That is very encouraging. In general, we meet the needs of our customers through extensive research. We have some 15,000 (private brand) items as part of our selection and have more launching every year. So there is something for everyone.

SB: Within its private label assortment, has Kroger expanded existing categories or moved into new categories to meet consumer demand?

JDP: We are always looking for new areas where we can expand. For example, we have expanded Simple Truth to include plant-based products and are expanding our selection of upcycled products. We also continue to watch trends and changes in consumer behavior.

SB: What steps has Kroger taken to further highlight its private label assortment and communicate the savings consumers are able to realize by purchasing private label products?

JDP: We are building a brand and

treating it as a brand. A great example is the new Kroger television commercials featuring our Krojis (Kroger emojis) with the message that consumers are winning with products that offer high quality and value. We initially featured two core products, peanut butter and ice cream, during recent promotions that aired during the professional and college football playoffs. And there is more to come this year.

SB: There has been discussion by retailers of the need to raise the profile of their private brands on their websites and apps. Is this something that Kroger has done or is looking to do?

JDP: As we continue to build our

presence in markets where we have a heavy digital presence, we are ensuring that our brands are well represented. We have all the assets in place to communicate to our customers.

SB: Is there a ceiling for Kroger with how far it can go with its private brand assortment, or is the sky the limit?

JDP: One could argue that the sky’s the limit. We continue to use data to drive our understanding of the consumer and how we can serve them best. We remain committed to being full, fresh and friendly. And when you look at the impact private brands have within international markets, you could certainly argue that the sky’s the limit.

The Private Label Manufacturers Association (PLMA) and its member organizations will descend on The Netherlands in May for its 2023 “World of Private Label” International Trade Show.

Held at the RAI Exhibition Centre in Amsterdam from May 23-24, the event will feature fresh, frozen and refrigerated foods, dry grocery, and beverages as well as nonfood categories, including cosmetics, health and beauty, household and kitchen, auto aftercare, garden, and housewares & DIY. According to PLMA, private label now accounts for more than 40% of all products sold in seven European countries and for more than 30% in another nine countries in Europe.

The show will also include a special seminar section featuring industry experts. The speaker lineup was not available at press time.

Recently, Store Brands spoke with PLMA Vice President Anthony Aloia who offered insight into the show and what attendees can expect.

STORE BRANDS: How will this year’s event differ from previous Amsterdam shows?

ANTHONY ALOIA: Last year, COVID-19 was a lingering factor that kept some exhibitors home. This May, at the 2023 PLMA Amsterdam Show, an additional hall will be opened

Today’s consumers want great flavor, high quality and convenience in the products they buy — and those preferences are evident in the increasing popularity of canned tomato products.

The numbers tell the story: 211.5 million Americans used canned tomatoes in 2020.1 That year, the global canned tomatoes market size was valued at $11.7 billion, and it is projected reach $19.5 billion by 2030 — a compound annual growth rate of 5.3% from 2021 to 2030.2

When it comes to offering canned tomato products that deliver flavor, quality and convenience, The La Doria Group leads the way. The company, based in southern Italy, is one of the leaders in the production of peeled, chopped and puréed tomatoes in the retail sector.

“Tomato-based products are today considered an area of major excellence for the Italian food industry,” says Export Sales Director Diodato Ferraioli, who notes that the tomatoes — grown entirely in Italy — are the heart of La Doria’s production. “Only the best varieties of 100% Italian, non-genetically modified tomatoes are selected for our canned tomato products. Thanks to the geographical proximity between the plant and the growing fields, they are processed immediately after harvesting, preserving their nutritional values.”

And that means a lot to American consumers: 71% of Americans perceive Italian products to be of higher quality than those of other countries, and more than 8 out of 10 are willing to pay a higher price for the “Made in Italy” guarantee.3

AVAILABLE

La Doria’s portfolio of canned tomato products gives grocery retailers a wealth of options to offer customers — no matter the style, flavor and consistency they’re looking for. “We can make a private label product to suit any retailer’s preference in product style, packaging and brand,” Ferraioli adds.

Peeled Tomatoes. La Doria peeled tomatoes are made from tomatoes grown exclusively in Italy. Harvested at the peak of ripeness and gently steam peeled, La Doria’s peeled tomatoes preserve the taste and aroma of fresh tomatoes. Pulpy, firm and bathed in their own juice, without salt or added ingredients, they are ideal for enhancing dishes that are part of the Mediterranean diet that so many of your shoppers are following today.

Chopped Tomatoes . La Doria’s chopped tomatoes are ideal for those seeking the scent of freshly harvested tomatoes. We prepare the chopped tomatoes by selecting the best tomatoes and, once peeled, chop them into small cubes, then adding their juice. Processed immediately after harvesting, La Doria chopped tomatoes maintain the intense aroma and bright red color of the raw summer tomato, and come in a variety of styles and flavors — no added salt, fine and standard consistency, plain, onion, pepper, garlic, chili, vegetables, basil, herbs.

Tomato Purée. La Doria tomato purée is made with only the best Italian tomatoes that are passed through a fine weave sieve to remove seeds and skins, then cooked gently in the best Italian tradition. This result: a naturally sweet purée with unmistakable flavor that is available in a variety of styles and flavors — no added salt, standard and crunchy/rustica consistency, plain, onion, herbs, vegetables, garlic, chili, olive, basil, olive oil, pepper.

Organic Chopped Tomatoes and Tomato

With the popularity of organic products on the rise, La Doria has created organic chopped tomates and tomato purée, made from the best tomatoes from organic farming and processed with the same care and passion as the non-organic products. “Our organic products are the perfect choice for your customers who are seeking the intense flavor of nature and the wholesomeness of organic products,” Ferraioli says.

1www.statista.com/statistics/280293/us-households-consumption-of-canned-tomatoes/ Published by Statista Research Department, Jun 23, 2022; 2www.alliedmarketresearch.com/ canned-tomatoes-market-A14238…Canned Tomatoes Market by Type…Global Opportunity Analysis and Industry Forecast, 2021-2030); 3ItalianFOOD.net

There will be more than exhibiting companies representing booths from countries. Products on display will include food, snacks, beverages and fresh, frozen and refrigerated goods. Nonfood exhibitors will be presenting baby care, health & beauty, household, kitchenware and general merchandise.

— Anthony Aloia Private Label Manufacturers Association

to accommodate the strong demand for booth space from exhibitors from more countries than ever. We’re expecting a record number of visitors, too.

SB: Is there an estimate of how many exhibitors are expected to attend yet?

ALOIA : The show has been sold-out for many months. There will be more than 2,600 exhibiting companies representing 4,400+ booths from 70 countries. Products on display will include food, snacks, beverages and fresh, frozen and refrigerated goods. Nonfood exhibitors will be presenting baby care, health & beauty, household, kitchenware and general merchandise.

SB: What does the increased penetration of private label in Europe indicate for U.S. retailers? Could Europe be the blueprint for America in this sense?

ALOIA: The European model is a powerful example. Private label sales in Europe grew to a total of—302 billion Euros ($330.75 billion) in 2022, reaching a value share of 37% of the total global market, based on figures compiled by NielsenIQ for PLMA’s 2023 International Private Label Yearbook.

Countries with the highest sales share include Switzerland (52%), The Netherlands (44%), Spain (43%), United Kingdom (43%), Germany (40%), Portugal (39%) and Belgium (38%). Large retail chains there such as Carrefour, Tesco, Rewe, Migros, Aldi and others, emphasize their store brand products with innovative and sustainable packaging, fresh ingredients, quality convenience meals and at value prices. These private label trends and growth are penetrating Eastern Europe, too.

On this side of the Atlantic, American retailing is resilient. Store brands are an important strategy for chains, where they can quickly adapt to consumer shopping trends and the changing demographics in the United States. Whether it’s premium or ethnically authentic or every day private label, quality and innovation will drive store brand penetration.

U. S. private label has shown tremendous growth, reaching nearly $230 billion in sales last year and continues to outpace the national brands this year. Store brand dollar share rose to 19.6% and unit share advanced to 21.1% through this first quarter. The industry is well-positioned for expansion and can reach higher private label penetration as well.

Store brands are pervasive across multiple retail channels and expanding into more and more categories. For example, Kroger continues to invest in its own healthy lifestyle brands and spreading its e-commerce delivery into new markets. European-owned chains such as Aldi and Lidl, where their business models are based on private label products, are opening hundreds and hundreds of stores in the U.S., and new online-only retailers, such as Thrive Market, are launching with a private label-first approach.

Experts in both the U. S. and Europe agree the private brands phenomenon has never been greater than it is today. When you look at the level of exhibitor and visitor participation in both the PLMA Amsterdam and Chicago trade shows, there’s no denying store brands are on a growth trajectory.

By Greg Sleter

By Greg Sleter

Motivated by a desire to live a healthier life, consumers today are on a continual hunt for products that will help them meet their personal health and wellness goals. From using food as medicine, to natural skin care products and items that help get a good night’s sleep, retailers are boosting assortments with the goal of grabbing a part of this ever-growing and ever-changing segment.

In recent weeks, several retailers have continued to boost assortments with a focus on exclusivity. For example, Target added the Gainful line of workout supplements to its assortment of exclusive branded items. The initial selection features 11 products including two protein bases, four choices of flavor boosters, three individual goal boosts and pre-workout and hydration products. Prices range from $3.99 to $19.99.

Dollar General boosted its offering with the launch of its Beauty Reinvention collection of beauty, skin and hair care products. Consumers are able to shop beauty bars that give customers a ‘treasure hunt’ experience with face masks, hair treatments, nail polish, lip gloss, bath bombs and more.

The retailer also announced three new exclusive skin and hair product lines rolling out at stores nationwide, priced at $6 or less. The three collections, Joy Works, Curl Rhythm

Consumers today are more mindful of the entire (health & wellness) segment. It’s not just about beauty or what they eat. They are taking a more holistic approach to the decisions they make about their bodies.

Richie Rubin, Garcoa, Inc.and Yes! Honey, each feature products touted by Dollar General as providing shoppers with the opportunity to improve their skin care and hair care regimens.

“Consumers today are more mindful of the entire (health & wellness) segment,” said Richie Rubin, executive vice president of Garcoa, Inc., a company that manufactures personal care products. “It’s not just about beauty or what they eat. They are taking a more holistic approach to the

DOLLAR GENERAL CONTINUES TO ENHANCE ITS ASSORTMENT OF PRIVATE LABEL HEALTH AND WELLNESS PRODUCTS. SEEN HERE IS THE SCENT HAPPY COLLECTION.

decisions they make about their bodies.”

While the focus on health and wellness is seen across key demographic groups, the up-and-coming Generation Z is beginning to have an impact on the retail marketplace. This young group of consumers is focused on issues related to clean living and sustainability, and seeking products that capture this mindset.

“Gen Z takes a much more mindful approach to how they shop,” Rubin said.

As consumers of all ages become more mindful about health and wellness, one area that continues to gain a great deal of attention is sleep. Whether through consumer advertising or news stories about sleep quality, product suppliers and retailers sensing opportunity have sharpened their focus on new product development and upped their assortment of products related to a good night’s sleep.

“When we looked at the marketplace for insight on what consumers are looking for, we found more than one billion searches on Google for better sleep,” said Adam Scholze, global sales director with French Color & Fragrance.

Although products with melatonin likely are the first that come to mind when thinking about sleep quality, Scholze said fragrances such as lavender and other well known herbs offer properties that allow individuals to feel more relaxed and improve sleep quality.

With specific consumer desires driving new product development, retailers are also expanding their health and wellness assortments with new selections of private label products. This allows them to offer shoppers items that are unique and cannot be found at the competition.

Scholze acknowledged that retailers are seeking items that allow them to differentiate, and private branded products are a solution that is being used with greater frequency. He

cautions, however, that private label products have to be something more than me-too items.

“It’s important to have items that are equal to or better than national brand products,” he said. “It’s also important to be transparent about the ingredients used and the claims that are being made by the products.”

Garcoa’s Rubin noted that retailers are seeking custom formulations for products that allow them to showcase what makes their products and ultimately their store brand different from other items in the market.

“Many retailers are looking for their brands to have a different ethos and speak to different customers,” he said. “We are also seeing more retailers shifting away from thinking of their brands as private label products but as their own brands.”

As retail assortments of health & wellness products evolve, it has become more important to ensure consumers that the claims made by each item are accurate.

Scholze said his company works on a daily basis to match up ingredients it receives from suppliers as part of an effort to create a list for retailers to ensure products are meeting the claims made and also meeting regulatory requirements. One of the concerns for industry insiders is the impact of social media, and claims some products are making without verification.

“There is a lot of greenwashing or cleanwashing out there,” Rubin said. “Information on social media is shared in a limited amount of characters or in video snippets, but there is no effort to go above and beyond and share additional information.”

How to solve the challenges presented by social media remains a challenge for the industry, with experts saying there may need to be some governmental intervention.

Breakfast is known as the most important meal of the day, and with that importance comes consumers’ desire for new and exciting products, particularly ones that are convenient and healthy. According to experts, similar to categories across the grocery store, convenience and better-for-you, clean ingredient options are reigning supreme among breakfast items.

“Although breakfast is a stable routine for most, there are some consumers willing to break out of the mold to experiment with new flavors and formats,” said Paige Moore, manager of Category Solutions at private brand consultancy firm Daymon. “Consumers are looking to food service for inspiration. Trends we are seeing across departments include sweet and savory pairings, like a Monte Cristo or waffle sandwich, toast toppings beyond avocado, and incorporating fruit and veggies in sweet bakery items.”

Kroger’s VP of Our Brands Juan De Paoli said that in the breakfast category overall, customers are looking for fresh items made from cleaner ingredients, citing the growth of

the retailer’s Simple Truth brand. In January, Simple Truth marked its 10th anniversary, accounting for more than $3 billion in sales over the past decade.

“Our Simple Truth own brand offers products that do not have unwanted ingredients,” said De Paoli. “We continue to see a growing trend with consumers who are looking for healthy ingredients in the items they buy.”

At Aldi, value-oriented shoppers are searching for convenient and healthy options to eat in the morning.

“As our shoppers return to their busy schedules and on-the-go lifestyles, they’re looking for options to get out the door quickly,” said an Aldi spokesperson. “This shift from at-home to in-person activities boosted the popularity of handhelds and convenience items, with waffles, French toast sticks and sausage links being our top three most purchased frozen breakfast food items this year. We’ve also seen increased demand for high-protein, low-sugar and multi-serve Greek yogurt as customers look for yogurts that pack a nutritional punch.”

The private label-centric discount retailersaid it relies on

consumer feedback to help determine which limited-edition products to sell permanently.

“Through our ever-changing, limited-time Aldi Finds items, we can test shopper reactions to new breakfast innovations and formats like our popular protein-packed waffles and omelet breakfast bites,” added the spokesperson. “In collaboration with our suppliers, we continue to explore new breakfast ideas and are even testing some of our most exciting Aldi Finds breakfast items in the market to consider making them a permanent fixture in our stores.”

Plant-based products continue to see gains in the breakfast category

products that often include hearty, unique, and locallysourced breakfast items.

— Raj Sukul,It appears that the trend of convenient, yet healthy foods is here to stay, which is pushing suppliers to innovate with new and unique products. When it comes to better-for-you, convenient breakfast options, Maplegrove Foods, an Ontario, Calif.-based manufacturer, recently debuted a new product for private brands.

The company’s new product allows the consumer to have a protein-filled muffin for breakfast just by adding water to the packaged mix and microwaving it. The product debuted in Strawberry/Vanilla, Chocolate Hazelnut and Blueberry Coconut flavors.

“Our muffins are popular with folks who are looking for more nutritious snacks and others who are on a weight loss or bodybuilding program,” said Raj Sukul, president of Maplegrove Foods. “Bodybuilders who are focused on muscle gain and becoming more defined are steady customers.”

Sukul added that the company created the product in response to growing trends of health and wellness, as well as convenience.

“We are most often asked for popular category foods but with better nutritional value,” he added. “Empty calories, high sugar and salt levels are being pushed by nutrientdense foods and the most valued nutrient is protein.”

With many Americans back in offices and commuting to work, convenient prepared food options are also an important segment for retailers to consider when crafting a portfolio of breakfast items. Texas Born (TXB), the Texas-based convenience chain, keeps its visitors on their toes when it comes to food options, offering limited-time

“We always gravitate towards better-for-you, on-thego options when crafting new breakfast menu items with most of our ingredients being Texas-sourced,” said Kevin Smartt, CEO of TXB. “One of our newest limited-timeonly items, the Brisket Egg & Cheese Quesadilla, is a breakfast quesadilla stuffed with savory brisket, fluffy eggs and topped with gooey cheese. Our most popular breakfast quesadillas have been our Meaty Breakfast Quesadilla which includes both sausage and bacon, and our Cheesy Chorizo Breakfast Quesadilla.”

In the world of grab-and-go, TXB’s prepared breakfast options are often sold alongside the chain’s private label beverage options. This past September, the chain expanded its beverage options with bottled juices and teas, as well as coffee such as a House Blend and exclusive Southern Pecan roast.

“Our breakfast sandwiches go great with our private label TXB juices,” said Smartt. “We have a breakfast combo deal that includes any breakfast sandwich or taco, plus a hashbrown and a medium coffee that has been really popular.”

One factor looming over the category has been the price of eggs. According to the Federal Reserve Bank of St. Louis, the average price of one dozen large, Grade A eggs began rising in April of 2022, and accelerated in the fall and winter months, peaking at $4.82 in January of this year.

For February 2023, the average price decreased slightly, reaching $4.21. Experts say the price increases are due to a widespread outbreak of avian flu that began in early 2022. However, the increased egg prices haven’t stopped consumers from slowing their purchases on average.

“According to Nielsen, there is 0.8% growth in units for chicken eggs compared to last year, indicating stability because the rise in egg prices has not impacted consumer demand,” said Moore.

We are most often asked for popular category foods but with better nutritional value. Empty calories, high sugar and salt levels are being pushed by nutrient dense foods and the most valued nutrient is protein.

Maplegrove Foods

At Seneca, we're still doing things the way we always have - the right way. Think globally, grow locally.

of our produce is grown by AMERICAN FARMERS 99%