WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

RISING OPERATIONAL EXPENSES AND FALLING FOOT TRAFFIC ARE CHALLENGING THE INDUSTRY’S SMALL OPERATORS

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals. It’s simpler for associates to execute rather than manually entering in date of birth.

EASY TO EXECUTE

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

Tobacco Product Scanned Prompt to Scan for Age Validation Verify and Scan I.D. POS System Validates Transaction Continues

Weather these trying times using strategies shared at our Outstanding Independents Summit

CONVENIENCE STORE NEWS has long been doing its part to support the industry’s small operator community with Small Operator content in every issue of the magazine, an entire Small Operator section of our website and a weekly Small Operator newsletter delivered every Monday.

For the past six years, we’ve also conducted our annual State of the Small Operator Study, which surveys c-store operators with 20 stores or less to better understand the unique opportunities and challenges they face, and gauge their performance vs. the industry’s larger operators.

Assessing this year’s performance so far, just 29% of the small operators surveyed indicated that 2025 is shaping up to be a better year than 2024 for overall sales and profits. This is a significant change from last year when, at this point, 61% expressed a positive outlook.

What’s causing the negativity? Inflation and rising prices are continuing to erode consumer spending. Increasing store operating costs are pressuring already tight margins. And labor difficulties are raising recruitment costs and limiting service consistency.

But if there’s one thing I’ve come to learn during my years covering this industry, it’s that c-store retailers are a resilient bunch — especially the independents and small chains. To help navigate these trying times, I’d like to offer the following playbook, based on expert advice and actionable knowledge shared at our recent Outstanding Independents Summit:

Play #1: Reign In Operating Costs

“I’m a big believer that you can’t manage what you don’t measure and so, I’m going to try to manage my profit and loss statement throughout the month. And you want to be able to unlock those hidden savings in your profit

EDITORIAL EXCELLENCE AWARDS (2016-2025)

2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business

Award

Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards

Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards Honorable Mention, Best Single Issue, September 2019

and loss statement because there are things that you can manage differently — you have a lot of variable items,” said retail management consultant John Matthews.

Play #2: Take a Proactive Approach to Labor Challenges

“A lot of the new people who are entering the workforce, especially the Gen Zers, are looking for work that coincides with a mission and what they want to accomplish. It’s important that you articulate what you want to accomplish with your store in the wider scope of being part of the community and away from just a profit and loss statement,” small-format retail consultant Roy Strasburger said about improving recruitment and retention.

Play #3: Make Your Stores Extraordinary

“My goal was to invest more into everything screaming quality,” shared Mike Lawson, owner of Roaster’s Market, which operates two stores in Oklahoma. His use of “nice” building materials, such as rock columns, and an attractive fuel canopy results in a store that doesn’t look like a usual c-store. “There’s always a lot of options” to make a store look extraordinary, he said.

Play #4: Deploy Customer Engagement Strategies That Work

“When you’re up against one of the big players, you know they’re looking at things at a much higher level. [Small] operators have the ability to really drill down to the lowest level denominator and really make a difference to their customer base and drive those customers in by personalizing that offer to that particular community,” said Tom Newbould, vice president of business transformation at W. Capra.

Execute these plays effectively and you’re sure to win in your market.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

EDITORIAL ADVISORY BOARD

2016 Trade Association Business Publications Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015 Laura Aufleger OnCue Express Richard Cashion Curby’s Express Market Billy Colemire Majors Management Robert Falciani ExtraMile Convenience Stores Jim Hachtel Core-Mark

2024 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, May 2024

Honorable Mention, Business to Business, Magazine Section, October 2024

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

The 2025 NACS Show is a one-stop crash course on the future of convenience retail

IN A FEW MONTHS, the convenience store industry will convene in Chicago for the 2025 NACS Show, scheduled for October 14-17. This premier event offers c-store retailers, suppliers and service providers the chance to network, see new products and explore business initiatives.

Beyond the expo floor, the NACS Show presents more than 50 education sessions designed to address the challenges and opportunities in today’s dynamic marketplace. These sessions cater to every job responsibility, store size and retailer type — from those emphasizing fresh food to those innovating in fuel services.

Here’s your curated guide to six sessions that could reshape your perspective and bottom line:

Don’t miss the chance to enhance your knowledge and network with industry peers at this year’s event.

TECHNOLOGY — Evaluating Your Tech Stack in a Multiplatform World

With the rapid emergence of new tools and platforms, it’s crucial to assess whether your current technology stack supports or hinders your business. This interactive roundtable with Daniel Gaddy of TXB Stores, Chad Kobayshi of Maverik — Adventure’s First Stop and Christine Loukota of Circle K Stores will help you navigate the complexities of modern tech ecosystems.

OPERATIONS — Forecast, Donate, Reduce: Minimizing Food Waste

Managing perishable inventory is more pressing than ever. This panel featuring Jason Read of Wawa Inc. and Kevin O’Connell of NACS will explore advanced forecasting tools that can reduce food waste and improve operational efficiency.

In today’s competitive market, storytelling is a powerful tool for connecting with your audience. Michele Truelove from High’s of Baltimore will discuss how to effectively convey your brand values and engage customers through compelling narratives.

Many retailers are considering installing electric vehicle (EV) chargers, but uncertain about the return on investment. NACS veteran John Eichberger of the Transportation Energy Institute will provide insight into the performance and profitability of EV charging stations.

CUSTOMER EXPERIENCE — Does Your Store Pass the Vibe Check?

A store’s atmosphere significantly influences customer behavior. In this session, presenters will explain how elements like lighting, music and design affect mood, engagement and spending. Attendees will walk away with simple, powerful ways to finetune their environment.

Hear from women leaders in the convenience industry who have navigated diverse career paths and successfully climbed the corporate ladder. This session will feature Elizabeth Hoffer of Weigel’s, Danielle Holloway of Altria Group Distribution Co. and Elizabeth Salceda of Family Express providing strategies for empowering the next generation of women leaders.

The NACS staff has done a wonderful job of putting together a plethora of educational opportunities tailored to various interests and needs. Don’t miss the chance to enhance your knowledge and network with industry peers at this year’s event.

I know I’ll be attending as many sessions as I can.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

COVER STORY - PAGE 18

FEATURES

COVER STORY

18 The Cost of Doing Business Rising operational expenses and falling foot traffic are challenging the industry’s small operators.

46 Enhancing the Forecourt Experience Upgraded signage and easier payment options are among the investments being made.

E DITOR’S NOTE

4 A Playbook for Small Operator Success

Weather these trying times using strategies shared at our Outstanding Independents Summit.

VIEWPOINT

6 Your C-store MBA Awaits in Chicago The 2025 NACS Show is a one-stop crash course on the future of convenience retail.

12 CSNews Online

17 New Products

INSIDE THE CONSUMER MIND

66 Food First

Convenience store trips are increasingly being driven by prepared food purchases.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

SENIOR ACCOUNT EXECUTIVE Griffin Randall - (404) 702-6931 - grandall@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Cristian Bejarano Rojas crojas@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

MARKETING COORDINATOR Mateo Rosas mrosas@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER

CHIEF FINANCIAL OFFICER

CHIEF PEOPLE OFFICER

CHIEF OPERATING OFFICER

In USA Today’s 2025 10Best Readers’ Choice Awards, Kwik Trip Inc. earned the No. 1 spot in the Best Gas Station Brands and Best Gas Stations for Food categories. This marks the second consecutive year that the retailer claimed the top spot.

Four convenience retail companies have been selected as finalists for the fourth-annual Top Women in Convenience (TWIC) Corporate Empowerment Award: Double Kwik, OnCue, RaceTrac and Rutter’s. Convenience Store News will announce the winner at its 2025 TWIC Awards Gala, being held Oct. 15 in Chicago.

Seven & i Holdings Co. Ltd. shareholders approved Stephen Hayes Dacus as the company’s first foreign CEO during its May 27 annual shareholders’ meeting. Dacus succeeds Ryuichi Isaka, who will remain a senior advisor to Seven & i.

During the Path to Purchase Institute’s recent Retail Media Summit, executives from 7-Eleven Inc. shared how the company is evolving to stay ahead of a shifting retail landscape. The retailer built an “Immediate Consumption Ecosystem,” which comprises inspiration, amplification and customer engagement; awareness, trial and conversion; and data, insights and measurement.

5

Federal authorities seized more than 2 million units of unauthorized vapor products during an operation in Chicago. The seizures were part of a joint federal operation to examine incoming shipments and prevent illegal e-cigarettes from entering the country.

Successfully future-proofing one’s business is achieved through two key imperatives: empowering a future-ready workforce and embracing innovation to unleash efficiency, National Restaurant Association (NRA) President and CEO Michelle Korsmo explained during the 2025 NRA Show in Chicago. Accounting for changes in the ways that food and technology intersect is a necessary consideration for foodservice operators as they pursue these imperatives, she noted. Not only do today’s consumers get more information and make decisions in more targeted ways than ever before, but the rate at which technology is advancing is also accelerating.

Pilot Travel Centers is on a mission to equip drivers with everything they need to recharge and hit the road ready for what’s ahead. To that end, expanding into new communities and modernizing its locations are key to the retailer’s strategy. Over the past few months, the Knoxville, Tenn.-based chain has driven impactful progress across its network with widespread store modernizations, expanding services and introducing a new, 20,000-square-foot flagship store. Convenience Store News caught up with Shannon Stone, director of store modernization, to discuss how the flagship site came to fruition and what’s ahead for the chain.

For more exclusive stories, visit the Special Features section of CSNews.com.

Chester’s Chicken introduces an unsauced version of its Chicken Bites for a limited time. According to the company, the juicy, fried chicken breast chunks in their natural state are less mess, more portable and allow guests to pick their own dipping sauce flavor. Choices include Ranch, Honey Mustard, BBQ, Buffalo or Chester’s Sauce. The unsauced Chicken Bites can be ordered on their own, as a combo or in a kid’s meal. The product will be available nationwide through mid-September.

The retailer added 270 convenience stores during its 2025 fiscal year

By Melissa Kress

THE FAMILIAR RED AND WHITE CASEY’S LOGO is popping up outside more convenience stores and gas stations, and there are no signs of this trend slowing down any time soon.

In November 2024, the Ankeny, Iowa-based convenience retailer made history with its acquisition of Fikes Wholesale, owner of CEFCO convenience stores. With a network of 198 c-stores, including 148 in Texas, the CEFCO pact marked the largest merger-and-acquisition (M&A) deal in Casey’s General Stores Inc.’s history.

This addition also contributed to Casey’s 2025 fiscal year (FY) being the largest store-growth year ever for the retailer. In all, the company completed 35 new-builds and acquired 235 locations, Casey’s reported during its FY 2025 fourth-quarter earnings call on June 10. The chain now operates approximately 2,900 stores in total.

Growing its network is one of the three pillars of Casey’s latest three-year strategic plan, which the company kicked off in June 2023. The other two pillars are accelerating its food business and enhancing operational efficiencies.

With one year left in its latest plan, Casey’s is not ready to stand still. According to Chief Financial Officer Steve Bramlage, the company expects to open at least 80 stores in FY 2026 through a mix of M&A and new store construction. That will bring its three-year strategic plan total to approximately 500 stores added.

Since officially taking ownership of the CEFCO stores in late 2024, Casey’s has been busy identifying the best practices of both CEFCO and Casey’s, and integrating the stores into

its network. Part of that work includes adding or upgrading kitchens in the CEFCO locations to meet Casey’s stated goal to accelerate its foodservice operations.

Within 60 days of closing the deal, Casey’s opened a few proof-of-concept stores that bring together the best of both Casey’s and CEFCO’s propositions.

“We merged the two together. We had a hypothesis going in of what that would look like. In most cases, we were pretty correct. In some cases, we needed to shift and adjust,” Casey’s President and CEO Darren Rebelez said during a media briefing following the company’s June earnings call. “We’re still through that process. We think we’re closer to the end of that assessment period.”

The ability to bring acquired stores into the foodservice fold is key in Casey’s M&A strategy. “I call it mission critical,” Rebelez explained, noting that the ability to accommodate a kitchen is among the checklist items Casey’s considers when looking at any potential acquisition.

Along with exploring new acquisition avenues, Casey’s plans to cut the ribbon on more new-to-industry stores. It’s a balanced approach to growth. As Rebelez outlined, the company first identifies the number of units it wants to target for development each year and then aims to meet that target with a 50-50 split of new-builds and small-deal M&A.

Love’s Travel Stops opened its 100th RV site, located in Carlin, Nev., in June. Amenities for RV travelers include seven RV parking spaces, RV hookups with water and sewer access, an RV dump station and Wi-Fi.

EagleStores, the convenience retail arm of R&R Takhar Oil Co., entered Indiana through a one-store acquisition. The company, which has more than 80 corporate-owned locations across the Midwest, is actively exploring additional acquisition opportunities.

Poppy Markets acquired 11 convenience stores in California from Engineer’s Associates Inc. and its affiliates dba National Petroleum. Poppy Markets opened its first c-store in Santa Clara, Calif., in June 2013 and now operates a network of 50-plus sites.

Nittany MinitMart is serving up summer flavor with a new Signature Burger Menu. When developing the limited-time lineup, the foodservice team tapped into national and local flavor trends, while staying connected to its customer base.

EG America debuted an Express Case filled with fresh sandwiches in easy-to-open clamshell packaging. The grab-and-go program was introduced across the retailer’s network in time for the summer traveling season.

RaceTrac Inc. is streamlining the fueling experience for its trucking customers. The retailer now accepts QuikQ fuel cards at all RaceTrac and RaceWay truck-accessible locations, and is teaming up with the RoadFlex platform.

South Korean convenience store brand CU, operated by BGF Retail, will open its first store in the United States this fall through a master franchise agreement with Hawaiibased CU Hawaii LLC. This will be the first time a Korean c-store chain enters the U.S.

Cumberland Farms, a banner of EG America, is leasing Neon Marketplace’s nine stores, ending the brand’s presence in southern New England. The sites are strategically located near highways, and feature electric vehicle charging stations and drive-thrus.

Parker’s Kitchen cut the ribbon on its 100th convenience store in late April. In honor of the grand opening, the company hosted a communitywide celebration at the Summerville, S.C., store that featured special giveaways and a live DJ booth.

Rocket Stores, a United Pacific retail brand, joined with Lula Commerce to enhance its digital presence and operational efficiency at more than 600 convenience stores. United Pacific’s Alta Convenience brand will team up with Lula’s platform as well.

Global Partners LP is launching a new mobile app and revamped loyalty program, Bee’s Knees Benefits. It coordinates previous loyalty programs, such as Fresh with Benefits and Alltown Neighborhood Perks, into a single platform powered by Paytronix.

CITGO Petroleum Corp. added a new tier to its Club CITGO loyalty program. Premier Status offers enhanced savings, including an additional 3-cents-per-gallon reward that can be combined with existing monthly and bonus day offers.

Bazooka Brands opened a 120,000-squarefoot factory in Moosic, Pa., for production of its Ring Pop brand. The original Ring Pop factory in Scranton, Pa., was forced to close last summer after 47 years in operation due to unexpected structural issues.

Krispy Krunchy Chicken is now the Official Fried Chicken of the Boston Red Sox. The agreement marks the first Major League Baseball deal for Krispy Krunchy.

The Hershey Co., as well as the Milton Hershey School, Hershey Entertainment & Resorts, The M.S. Hershey Foundation and Hershey Trust Co., are partnering with Dandelion Media to tell the story of its founder and chocolate pioneer Milton Hershey and his wife Catherine.

The Coca-Cola Co. brought back its “Share a Coke” campaign. The marketing move includes a digital experience that allows consumers to create fun, unique and personalized videos using their own content.

NielsenIQ acquired Gastrograph AI. The newly acquired entity uses predictive artificial intelligence to develop, test and reformulate products by modeling human sensory perception of flavor, aroma and texture.

The Ryl Co., parent company of Ryl Tea,

Anheuser-Busch and 1st Phorm teamed up to launch a new energy drink, Phorm Energy. The partnership will also include sports and entertainment mogul Dana White, who has built some of the world’s most recognizable brands. Derived from green tea extract, a natural source of caffeine and crafted with zero sugar and no artificial flavors, Phorm Energy is designed to provide the hydration and mental focus needed to reach even the most ambitious goals. Four flavors are available in single 16-ounce cans: Screamin’ Freedom, Blue Blitz, Orange Fury and Grape Smash. ANHEUSER-BUSCH & 1ST PHORM • ST. LOUIS • PHORMENERGY.COM

FULFIL Nutrition introduces three protein innovations: Protein Bites for poppable, power-rich snacking; a Chocolate Peanut Butter Bar made with Reese’s peanut butter; and the FULFIL BIGGEST Bar, which is 15 grams more than the brand’s original 40-gram protein bar. The Chocolate Peanut Butter Bar is available in both 40-gram and 55-gram sizes. The FULFIL BIGGEST Bar also comes in Chocolate Salted Caramel and Chocolate Peanut Caramel flavors. These same flavors are featured in the Protein Bites, which contain seven bites per pouch and are packed with 16 grams of protein. THE HERSHEY CO. • HERSHEY, PA. • LIVEFULFIL.COM

Shaquille O’Neal, a basketball icon, entertainer and entrepreneur, is partnering with BeatBox Beverages to bring BeatBox Blueberry Lemonade nationwide. The exclusive product is a bold, boozy twist on the classic blueberry lemonade bursting with berry goodness, according to the company. With an 11.1% ABV, the drink is low in sugar, gluten-free and features resealable, sustainable packaging. BeatBox Blueberry Lemonade is available in a single 500-milliliter size, as well as in a lemonade variety pack with two other new flavors in the lemonade line: Watermelon Lemonade and Lemon Squeeze. BEATBOX BEVERAGES • AUSTIN, TEXAS • BEATBOXBEVERAGES.COM

Wonderful Pistachios No Shells Dill Pickle

Wonderful Pistachios expands its No Shells line with the addition of a Dill Pickle variety. Available in a 2.25-ounce bag, the new flavor offers a satisfying balance of tangy and savory, catering to consumers seeking adventurous snacking experiences, the company noted. No Shells Dill Pickle delivers 6 grams of protein and 3 grams of fiber per serving. The product joins a flavorful No Shells lineup that already includes Jalapeño Lime, Chili Roasted, Sea Salt & Vinegar, Sea Salt & Pepper, Honey Roasted, Smoky Barbecue and more. WONDERFUL PISTACHIOS • LOS ANGELES • WONDERFULPISTACHIOS.COM

New from Manitowoc Ice, NEO Undercounter Ice Makers feature an innovative design with integrated water filtration, ensuring that cleaner water enters the unit to improve the taste and clarity of every cube. Improved energy efficiency and the use of R290 refrigerant also help operators save on energy costs while reducing their carbon footprint. The sleek, modern appearance of NEO elevates the visual impression of the front-of-house units and rounded corners ensure it is easy to clean. Select models include Manitowoc Ice’s LuminIce II growth inhibitor, an advanced sanitation device, integrated into the machine. MANITOWOC ICE • MANITOWOC, WIS. • MANITOWOCICE.COM

RISING OPERATIONAL EXPENSES AND FALLING FOOT TRAFFIC ARE CHALLENGING THE INDUSTRY’S SMALL OPERATORS

By Linda Lisanti

SPONSORED BY

“IT IS GETTING VERY EXPENSIVE to run a small business.”

This remark from one of the retailers who took part in Convenience Store News’ 2025 State of the Small Operator Study pretty well sums up the general sentiment of the U.S. convenience store industry’s small operators (1-20 stores) at this moment in time.

Inflation and economic uncertainty are continuing to erode consumer spending, while also increasing store operating costs — all of which is pressuring the already tight margins of these businesses, according to the sixth-annual study, which looks at how the convenience channel’s smaller retailers are performing vs. their larger chain counterparts.

Not surprisingly, fewer small operators

Be part of WAM’s Complete Convenience Store Solution to unlock growth and increase your profits. Your store can do more— click here to find a

70+ manufacturers, & strategic channel partners to offer the most complete c-store solution in the market. Our programs are designed to make retailers more competitive & increase sales & profits.

What programs & services do you offer?

Our core offerings are a complete rebate program that allows retailers to earn ongoing rebates on products they buy every day, and a scan data promotional program that gives retailers access to exclusive brand funded scan promotions. We also offer monthly buy-deals, a new item speed-to-shelf program, planogram services, & foodservice solutions. In addition, we have Partner Programs with Buyers Edge, NRS, & Patron Points that provide our retailers with additional foodservice rebates & access to exclusive deals on tobacco scan data programs & POS systems.

Which retailers can benefit most from your services?

Independents & small chains. Our mission is to give these operators the tools to compete against the national chains.

How does the WAM rebate program work & how much does it cost?

It’s FREE! Retailers can earn ongoing rebates on hundreds of programs from the best brands, across all product categories. All of the rebates are tracked in one spot, through our proprietary WAM/InfoBate portal. Your WAM distributor sales rep will act as your sales consultant to help you manage your programs & maximize rebates. Retailers receive one consolidated check at year-end. WAM retailers earned $13M in 2024. High volume stores can earn over $1,000 annually.

How does the OnPoint scan data promotional program work & how much does it cost?

It’s FREE! The program gives retailers access to exclusive brand funded scan promotions to offer their customers better deals. Retailers receive free sign kits (printed & digital) & technical help in setting up the deals. These consumer-facing deals boost sales by enticing customers to purchase more or try new products. Participating retailers sold nearly 500k promotional units in 2024.

What results are you seeing when retailers engage fully with the programs available through WAM?

Partner programs: ?

Their profits increase through rebates they earn on center-store, foodservice, & tobacco products. Their sales increase with the OnPoint scan promotions, our planogram services & our new item speed-to-shelf program. We also see increased customer retention with the tobacco & full loyalty programs provided by Patron Points.

How does a retailer get access to all of this?

In order to get access to the WAM programs & the exclusive deals with our Partner Programs (Buyers Edge, NRS, & Patron Points), you must be serviced by a WAM distributor. The good news is that the WAM group has a national footprint servicing 12,000 zip codes across 47 states. Visit our website or scan the QR code to find a distributor.

Reflecting on 2024, less than half of participants (45%) said their total dollar sales increased for the year, while an even smaller number (35%) reported a gain in total unit volume.

Drilling down, only 38% of small operators reported that their motor fuel dollar sales rose in 2024, compared to 47% who reported growth in in-store merchandise sales and 46% who reported growth in

foodservice sales. In regard to unit volume, there was more parity between fuel and in-store merchandise, with 31% and 33% reporting growth, respectively. Foodservice fared better, with 40% reporting volume growth for the category.

While the total industry’s sales composition leans more toward motor fuels — 61.2% for fuels and 38.8% for in-store — the sales and volume mix for small operators is more evenly distributed. The sales ratio for small operators is 48% fuels and 52% in-store, while the unit volume ratio is 55% in-store and 45% fuels.

Fewer small operators reported growth for 2024, and less than three in 10 anticipate their sales and profit performance to be better this year than last year.

The profit composition for small operators is more in line with the total industry. While the industry’s gross profit dollar mix in 2024 was 60.7% in-store vs. 39.3% fuel, the split for small operators is 62% in-store vs. 38% fuel. Small operators are increasingly relying on in-store performance to drive profitability, as their previous split was 54% in-store vs. 46% fuel.

Foodservice is a significant part of the in-store focus. Nearly all the small operators surveyed offer some form of foodservice, with hot dispensed beverages and prepared food being the most widely available. Nearly eight in 10 operators, though, rate their foodservice offering as average or limited, which signals an opportunity for enhancement and/or expansion.

Among those with foodservice, 42% of respondents reported both greater prepared food volume and dollar sales

“Everything is increasing except the number of customers coming into the stores.”

— Study participant

last year. The cold and frozen dispensed beverage segments also experienced growth, with roughly a quarter of operators reporting volume and dollar sales growth.

Several small operators noted that value-priced food items performed well as people traded down to cheaper products. “We do a daily dinner special and change it up every month,” one retailer shared. Meanwhile, on the beverage side, frozen coffee drinks were highlighted.

Other product categories inside the store that performed well for small operators last year — those with the highest percentage of respondents reporting both sales and volume increases — included salty snacks, other tobacco products and

In-store product categories with the highest sales and volume increases in 2024 were salty snacks, other tobacco products and packaged beverages.

packaged beverages. On the other end of the spectrum, categories with the highest percentage of respondents reporting both sales and volume decreases were health and beauty care, nonedible grocery and general merchandise.

Assessing this year’s performance so far, just 29% of the small operators surveyed indicated that 2025 is shaping up to be a better year than 2024 for overall sales and profits. This is a significant change from last year when, at this point, 61% expressed a positive outlook.

The industry’s smaller retailers are most bullish on foodservice, as nearly four in 10 expect their foodservice performance this year to be better than last year. This compares to 24% who expect the same for their fuel business and 29% for their in-store merchandise business. In last year’s study, these figures stood at 60% for foodservice, 42% for fuel and 54% for in-store.

Inflation and economic issues are once again viewed as the biggest threat to small operators’ 2025 sales and profitability, cited by 78% as their top challenge, up from 58% a year ago. As one retailer noted, “Customers are spending less and will put items back depending on price.”

Increasing operational costs, also a byproduct of inflation, jumped from the fifth most-cited challenge last year to No. 2 this year. The percentage of operators pointing to this as their top business challenge nearly doubled, going from 33% a year ago to 62% this year. “Everything is costing more [and I’m] unable to pass on the price increases due to larger organization competition,” one small operator lamented.

Other obstacles of increasing concern compared to last year are declining tobacco sales volume (cited by 40% this year vs. 21% a year ago) and foot traffic declines (cited by 27% this year vs. 12% a

year ago). Both issues are also offshoots of inflation. “Everything is increasing except the number of customers coming into the stores,” one retailer remarked.

To make their stores more attractive to consumers and more competitive in a

marketplace that is full of bigger and better new-build locations from the industry’s large chains, small operators are investing in store remodeling — 35% cited this as their top area of investment for 2025.

Along the same lines, improving the customer experience is a priority to keep shoppers happy and earn their

Inflation & economic issues

Increasing operational costs

Labor turnover & hiring

Supply chain issues/out-of-stocks

Declining tobacco sales volume

Motor fuel prices

Crime/theft

Tobacco regulation

Industry consolidation & competing with larger chains

Insufficient attention from suppliers that favor larger chains

Foot traffic declines

Changing consumer expectations of “convenience”

Competition from outside the industry

Increasing pressure to invest in foodservice

Keeping up with emerging technologies

Inflation and economic issues are once again viewed as the biggest threat to small operators’ 2025 sales and profitability, cited by 78% as their top challenge, up from 58% a year ago.

loyalty. Nearly a quarter of the retailers surveyed are investing in:

• Training and retention programs for an improved workforce

• Expanding merchandise assortments

• Technology to enhance the customer experience

• Developing and expanding fresh food programs

One other top area of investment for 2025 is aimed at alleviating those rising operating costs that are squeezing small operators’ profitability. Roughly a quarter of participants in this year’s study said they’re investing in technology that will increase their operational efficiency.

Updated systems will also enable them to meet changing consumer expectations and connect with a new generation of shoppers — think online ordering, mobile payment and personalized marketing. As one small operator put it, “We’re living in a digital world.” CSN

Store remodeling

Training & retention programs

Expand merchandise assortments

Technology to increase efficiency for current operations

Technology to enhance the customer experience

Develop/expand fresh prepared food programs

Develop/enhance loyalty program

New store construction

Add/update order & delivery options

Streamline merchandise assortments/reduce SKUs

Digital marketing/personalization Store growth via acquisition

logistics

“... OUR PRODUCTS MEET THE HIGH STANDARDS OUR CUSTOMERS EXPECT AND DESERVE.”

– Lindsay Witmer V P H G b Q

At the core of our mission is an unwavering commitment to quality. We proudly uphold our manufacturing processes to a stringent standard, ensuring our products meet the high standards our customers expect and deserve. ”

At Juul Labs, Quality is More than a Promise, it’s Our Foundation

Extensive Stress-Testing: JUUL D m b m m b

Clean Room Manufacturing: E JUUL D m m m q E m ’ fi k JUUL m

JUULpod Standards: A JUUL

Routine USA Testing: E JUUL fi

“Every JUUL product, whether the JUUL device, JUULpods or an accessory will go through multiple inspection checks before being packed up and sent to your local store.

“ WE HAVE THE TRACK RECORD AND HISTORY TO BACK UP OUR PRIDE IN OUR PRODUCTS. ”

The c-store backbar is evolving, with more innovation on the horizon

By Melissa Kress

AS CIGARETTE SALES continue to ride the wave of traditional declines, alternative tobacco products are rising up to fill the space. Which products will move to the head of the pack remains to be seen, but there are some bright spots — namely, modern oral nicotine products.

In a recent Convenience Store News webinar, “The State of the Backbar,” Ethan Harris, senior business analyst at Cadent Consulting Group, and Keelan Gallagher, vice president of operations at Smoker Friendly International, discussed current and future trends in cigarettes and other tobacco products (OTP).

Any discussion about the tobacco category needs to start with the adult tobacco consumer and the regulatory environment, according to Harris, who explained that there are three main areas of tension:

1. Economic concerns: Consumers are increasingly worried about the economy and their spending power while discretionary tobacco products continue to rise in price.

2. Health awareness: More than ever, health is at the forefront of public consciousness and this is in stark contrast to the well-documented harms of tobacco.

3. Regulatory shifts: Government regulations are reshaping the market landscape, but these are often clashing with market demand and the principles of a free market.

"These three tensions are placing both retailers and manufacturers at a crossroads, making it imperative to address them for the industry's future growth and sustainability," Harris said.

"If these tensions continue to unfold, the tobacco

landscape is undergoing significant change. Traditional tobacco is declining, appealing flavors are less available, and the tobacco backbar is becoming increasingly inaccessible for the c-store consumer," he pointed out, adding that this is all leading to lower backbar sales in convenience stores. "But there is a bright spot — smokeless tobacco alternatives are emerging as the new face of the industry."

According to Harris, there are steps all players in the tobacco space can take to weather the challenges of the backbar. "By implementing smarter assortment pricing strategies, expanding customer education initiatives and operating strategically within the regulatory [landscape], the tobacco industry can resolve the tensions and build a strong and sustainable future," he said.

The Backbar of Today

Smoker Friendly is one tobacco retailer navigating the day-to-day changing landscape of tobacco. As Gallagher noted, tobacco items are performing well across the Boulder, Colo.-based retailer's network, and the total nicotine space "is performing very well."

During the webinar, he offered two key observations, the first around cigarettes and the second around modern oral tobacco.

"Cigarettes continue to be the biggest category and cigarette contracts therefore dictate a lot of what happens on the backbar — and contracts are a main driver of retailers, product assortment, merchandising, layout and even price point," Gallagher said. "And this applies across multiple categories, not just cigarettes."

While Harris had noted previously in the webinar that cigarettes were showing a 5.7% decline, "if you dive one level

deeper and look at the volume by price segment, you'll see premiums really declining closer to 10%. But there's growth in the fourth-tier cigarette brands," Gallagher said. "There's an obvious downtrading in the category. There are certainly consumers who are leaving the space and quitting, going up to other categories, but a lot of consumers are trading down price points as well."

As for modern oral, Gallagher advised retailers to carry a variety of brands, flavors and nicotine levels. "Without a doubt, modern oral tobacco is the fastest-growing category, probably the most exciting. But I always keep my eye on cigarettes as well because of the size of the category," he noted, adding that Smoker Friendly is giving more space to modern oral brands based on manufacturers' data and marketing plans.

The Backbar of the Future

Looking to future innovation in the tobacco and nicotine arena, Harris said he turns an eye toward the past for clues as to what could be coming down the pike.

"There's definitely going to be innovation coming. I think we could definitely look to the history of the industry to inform where it might be going," he said. "I think the vapor products were a really interesting example and if you think back a few years where the innovation in that category came from — a wider array of flavors and a wide array of strengths, anything from nicotine free paper to high nicotine juices — I think

the same can be done for pouches. Even in Europe and in other countries, this is currently being done."

Another area of innovation to watch is other nicotine delivery systems, particularly heat-not-burn technology, which is growing internationally. "Rollouts have started a little bit in the U.S., but they haven't really gone full force yet," Harris said. " I think it'll be really interesting to see if that picks up pace over here in the states."

At Smoker Friendly, Kratom has turned out to be a full new category, according to Gallagher, and it’s doing well. In its merchandise mix are Kratom shots, powder capsules and gummies, with shots performing the best.

“If I were to recommend any of the categories for convenience stores, it would be shots because they’re very straightforward and simple. It requires minimal space. There’s no education required on the dosage, and it’s very straightforward for the consumer and understanding how to use the shot,” he said. “I’d say that Kratom is probably the biggest bright spot that I classify as an alternative non-nicotine

product that still is on the backbar.”

Regardless of innovation and a tobacco retailer’s offer, how a consumer reacts to the backbar may come down to dollars and cents. As Harris cited, economic concerns is one of the top pressure points for the adult tobacco consumer, who is being driven to make some difficult decisions.

“For some of those people, it’s going to be trading down to private label or lower-tier cigarettes that we’ve seen grow. And for some people, they may just end up quitting altogether, contributing to those lower smoking rates we’ve seen,” he said.

What’s interesting, though, is seeing how the manufacturers are responding to this, he added. Citing an earnings report from Philip Morris International earlier this year, Harris pointed out that the company reported revenue growth in its combustibles category. Diving deeper, the growth was driven by price increases rather than volume growth.

“As prices continue to rise, more and more consumers will get priced out of the category, leading to less smokers, leading to less unit growth. And then, manufacturers will once again be required to raise their prices to offset volume declines,” he explained. “You could see how the cycle is going to be self-perpetuating. At a certain level, there will either just be a ceiling to how far they can raise prices or consumers will realize this just isn’t a sustainable product to keep buying in the long term.”

CSN

must be smart and intentional in the ways they develop their foodservice programs

By Angela Hanson

Cautiously optimistic, convenience store operators are banking on long-term investments in prepared food and dispensed beverages

By Angela Hanson

AS THEY FORMULATE PLANS to enrich their foodservice programs, convenience store retailers are thinking about more: more enhancements to their offer, more customer traffic and ultimately, more sales and profits. But while effort and financial investment are necessary for success, without careful planning and strategizing, they will not be sufficient.

FROM A DISTANCE, the current state of the foodservice category is rosy, and convenience store operators are doing everything right. Sales and profits are up, with most retailers predicting continued increases throughout 2024, and companies are investing in new technology, equipment and menu innovation to ensure success in the years to come.

The combination of foodservice’s importance as a c-store category and challenges from rising food costs, lower foot traffic and tightening competition make it critical that operators choose the right moves that will bring them closer to their goals.

However, taking a closer look reveals obstacles that even the best-designed food program can’t ignore. Economic difficulties and concerns about the future are prompting consumers to tighten their purse strings, while rising costs have slowed profit growth compared to last year. Meanwhile, employee recruitment and retention remain a struggle despite some easing of the labor crunch.

According to the findings of the 2025 Convenience Store News Foodservice Study, c-store retailers are focusing first on what can get more hungry customers in the door. Just under half of participants in this year’s study (49%) cited increasing customer counts as the top priority for their foodservice program, up from 43% in last year’s study.

Other top priorities are employee training (45%), menu innovation (40%) and operational efficiencies (29%). Increasing automation is a lower priority (14%), but the percentage of operators who listed it

27% of small operators plan to add third-party delivery, compared to 9% in last year’s study.

jumped 9 points year over year, indicating growing interest.

While just 17% of study participants said upgrading their foodservice equipment is a top priority, 46% intend to make upgrades within the next year. The topmost planned equipment changes include general upgrades such as adding new equipment or replacing older equipment, upgrades for efficiency and speed improvements, and adding new cooking equipment.

“I will look for more energy-efficient equipment, which will reduce utility costs,” one retailer shared.

In terms of foodservice amenities, c-store retailers plan to continue adding in-store comfort and at-home convenience. Third-party delivery is the No. 1 amenity being eyed for the future, with 26% of operators reporting they will add it — particularly small operators, 27% of whom plan to add it compared to 9% in last year’s study. Other top planned amenities are outdoor seating (23%) — which saw a boost in intent among both small and large operators — followed by take-home/heat and eat dinner solutions (20%) and in-house delivery (17%).

The industry’s operators are also continuing a multiyear trend of adding technology-based methods for ordering prepared food and dispensed beverages. Study participants indicated that they are most interested in adding order ahead via app (34%), in-store touchscreen ordering

Explore a powerful portfolio of frozen grab & go favorites from the brands consumers know and love. Our trusted products are popular with both consumers and operators. That’s because they deliver more variety with less labor and product waste, all with the convenience of partnering with a single, trusted supplier. Contact us

(28%), order ahead by computer (26%) and at-pump touchscreen ordering (23%).

Chain size makes a difference in the kinds of ordering technology companies plan to pursue, as small operators are significantly more likely to have plans to add app ordering, while large operators are more interested in adding at-pump ordering.

While retailers view other c-stores as their primary foodservice competition (cited by 57%), grocery stores, fast-casual chains and chain sandwich shops are also perceived as main competitors. In fact, grocery stores saw the biggest bump in perceived competitive strength (cited by 40%, up from 25% last year), along with coffee shops (cited by 31%, up from 16%).

Interestingly, national/regional quick-service restaurants (QSRs) pose less of a threat these days, according to study participants. The percentage of respondents who listed QSRs as a chief competitor declined 13 points compared to last year.

To win out against their competition, c-stores must demonstrate the value of their foodservice offering as economic challenges persist. Most operators said they raised prices in the past year, but not on everything: 48% raised prices on some items, while 46% did so across the board.

To demonstrate value to consumers, they are leaning more into promotional efforts. More than half (55%) said they increased the number of foodservice promotions at their stores in the past year, up from 43% who said the same in 2024.

Social media is the most widely used communication channel for foodservice promotions, with 72% of operators reporting they use it. Loyalty programs come in second at 60%, an 11-point increase from last year’s study. At-pump signage/signage

To demonstrate value to consumers, c-store retailers are leaning more into promotional efforts.

“We continue to fill a need with high-quality, [fairly] priced food.”

Cautiously optimistic, convenience store operators are banking on long-term investments in prepared food and dispensed beverages

— Study participant

By Angela Hanson

outside the store, email and text messages are also widely used promotional channels.

FROM A DISTANCE, the current state of the foodservice category is rosy, and convenience store operators are doing everything right. Sales and profits are up, with most retailers predicting continued increases throughout 2024, and companies are investing in new technology, equipment and menu innovation to ensure success in the years to come.

The most effective foodservice promotions, according to the retailers surveyed, are price discounts (cited by 63%), bundling/meal deals (48%) and buy one, get one offers (40%).

Expectations for foodservice sales and profits in 2025 are positive: 83% of respondents expect their full-year foodservice sales to increase and 77% expect the same for their foodservice profits — a higher level of optimism compared to a year ago.

“We continue to fill a need with high-quality, [fairly] priced food,” one operator noted.

When it comes to threats to their 2025 foodservice success, retailers pointed to supplier price increases and inflation and national economic issues as their biggest obstacles (both cited by 55% of participants), along with customers having less disposable income (48%).

As part of their efforts to manage the challenges posed by inflation and economic issues, 43% of operators said they will adopt pricing and cost management strategies, 26% will focus on operational efficiency, and 17% plan to enact sales and marketing strategies.

However, taking a closer look reveals obstacles that even the best-designed food program can’t ignore. Economic difficulties and concerns about the future are prompting consumers to tighten their purse strings, while rising costs have slowed profit growth compared to last year. Meanwhile, employee recruitment and retention remain a struggle despite some easing of the labor crunch.

Anticipated 2025 Foodservice Sales

“The consumer is tapped out and is not buying with prices continuing to rise,” stated one retailer.

On the bright side, just 45% of retailers mentioned difficulty in hiring and retaining employees as an obstacle to success, down significantly from 73% last year and 80% in 2023.

Improving compensation and benefits has helped c-store operators overcome hiring and retention issues. Other steps taken include recruitment strategies, advances in training and development, improving the work environment and culture, and operational adjustments.

As one retailer shared, “We are providing not just more pay, but also incentives per month if the food sales increase and there is a decrease in throwaway.” CSN

Supplier price increases*

Inflation & national economic issues*

Consumers have less disposable income*

Difficulty in hiring & retaining employees

Operational inefficiencies at store level

Increasing competition for foodservice business

Training employees on foodservice operations*

Lower foot traffic in stores

Finding the right products/programs

Supply chain

Lack of alternative shopping options

Negative consumer perceptions around c-store foodservice

Lack of available funding to invest in foodservice program

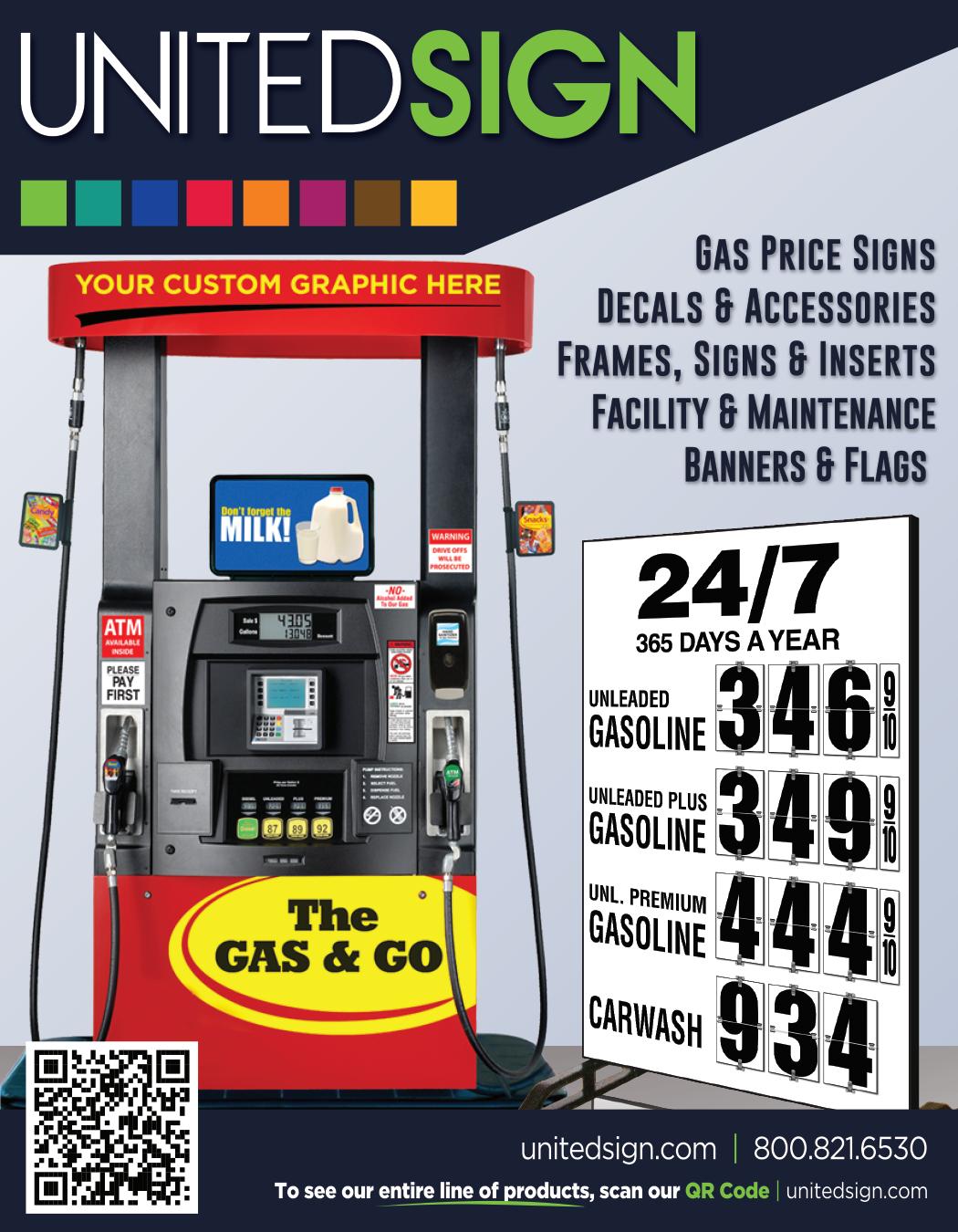

Upgraded signage and easier payment options are among the investments being made

By Tammy Mastroberte

CONVENIENCE STORE OPERATORS are investing in their forecourts to get customers onto the lot, have them enjoy the experience while there, and entice them into the store where higher-margin items await.

“The most important elements in the forecourt to satisfy gas customers are great curb appeal — well-lit and clean — and, of course, competitive gas prices,” said Jordan Mann, senior vice president of corporate strategy, capital markets and investor relations at Richmond, Va.-based ARKO Corp., owner of GPM Investments LLC, which operates more than 3,200 convenience stores throughout the United States.

Likewise, at CITGO Petroleum Corp., the approach is to have all locations maintain a “crisp, clean, quality image” because if customers don’t see that when they drive on the lot, they will drive through, according to Joey Low, manager of loyalty and marketing programs for the Houston-based company that has more than 4,000 locally owned and independently operated locations.

CITGO has 80% of its branded locations converted to a new Illuminate brand image, which swaps out white elements for brushed aluminum on the canopy and dispensers in order to reflect lighting

features and offer stronger visual appeal. “The eyebrow lighting on the canopy brightens the locations, and we use materials that don’t require as much maintenance. We’ve done things to repel dirt to help the operators keep that crisp, clean image,” Low explained.

Lighted signage is another enhancement that c-store operators are using to attract customers to their forecourt and in some cases, advertise their in-store offerings.

“Visibility of fuel prices and grades at a distance and when driving at speed is important,” noted Richard Hirsch, vice president of business development at Able, based in Columbus, Ohio.

Both Exxon and Circle K partner with Able for custom LED signage and digital displays. Retailers can use a content management system to change their fuel pricing and offers per site.

The use of technology to make the fueling experience better is becoming more widespread. Retailers are leveraging tech to make payment easier, introduce new fuel discounts, enhance their loyalty programs and mobile apps, and find more ways to get customers from the pump into the store.

One of the biggest benefits for fuel customers is the ability to pay for their fill-up within the app. This offers a more secure form of payment since it doesn’t require a customer to use a credit card at the pump itself. In addition, some apps even activate the pump.

Shep Digital’s platform connects to any existing fuel dispenser screen

• Use sight and sound to engage your customers

• Target dayparts and conditions like weather

• Drive more of your customers inside

shepdigital.com

The Club CITGO app, which initially offered a coupon-based loyalty program and then moved to rollbacks in August 2022, was in the market for several years before the company decided to add an app payment option. A separate CITGO Pay app was introduced. However, by 2024, the company realized customers needed an easier way, so a consolidated app debuted in 2025.

“All of the features of the payment app were built into the Club CITGO app and consumers with that app only needed to update it to get these features,” Low said, noting that those with the payment app were prompted to download the updated Club CITGO app as a replacement. “We sent emails and push notifications to let them know the old app would be turned off, and every one of them showed up in the new one and were added to the loyalty program.”

The new app makes it even more convenient for customers to pay as the company changed from the use of a PIN number to the use of biometrics for payment, according to Low.

Another innovation making headway on the forecourt is in-vehicle payment. Earlier this year, Sunoco LP announced a partnership with Sheeva.AI and its SheevaConnect platform. Patented geolocation technology enables drivers to pay for fuel and activate the correct pump via a vehicle’s infotainment screen without requiring an additional app, QR codes or hardware.

“Any vehicle from 2022 onwards is a connected vehicle, and any retailer already offering pay at the pump with a mobile app can integrate this technology with the mobile payment processor,” said Evgeny Klochikhin, founder and CEO of Sheeva.AI. “At Sunoco, payment is fully integrated where mobile payments are available for their site and the loyalty program is being integrated now. Once integrated, discounts will automatically apply for consumers.”

The biggest benefit of the SheevaConnect platform, according to Klochikhin, is the seamless, one-touch customer experience. Users can activate a pump and

pay for their fuel without having to open a phone, then open an app, then select a pump, and so on.

Along with adding convenience to the fueling process, enhancements to loyalty programs and apps also aim to compel the fuel customer into the store from the forecourt.

For example, ARKO introduced a “Fueling America’s Future” campaign that allows members of the company’s fas REWARDS loyalty program to stack discounts from qualified purchases and save up to $40 per fill-up at the pump. This not only attracts customers to the pump, but also drives them to make purchases in the c-store, according to Mann.

“Persistent inflationary pressures are driving up costs and hurting our customers’ wallets,” he said. “Our goal was to help ease the burden of fuel prices for our customers, while also converting them to purchase the promotional items in-store.”

ARKO partners with its suppliers to offer promotions on items inside the store and couple them with discounts on fuel. The retailer advertises between two and four promotional offers, but there are approximately 30 offers available at any given time. Purchasing these offers enables loyalty members to save between 10 cents to 50 cents on up to 20 gallons.

“Importantly, these discounts are stackable, meaning our customers can add these discounts for up to $2 off per gallon

“On Triple Tuesday, a club member would get 9 cents, but premier members would get 18 cents, and this happens the first Tuesday of every month. It is very strong for us.”

— Joey Low, CITGO Petroleum Corp.

on up to 20 gallons or $40 per fill-up,” Mann explained.

With the same goal of increasing both fuel and in-store sales, CITGO added Premier Status to its Club CITGO loyalty program and app. Those who purchase fuel 12 times per quarter with at least eight gallons purchased at each visit achieve this status. While the everyday program rollback is 3 cents per gallon, Premier Status members qualify for 6 cents off — and even more on what the company calls “Triple Tuesday.”

“On Triple Tuesday, a club member would get 9 cents, but premier members would get 18 cents, and this

happens the first Tuesday of every month. It is very strong for us,” Low noted. “We believe between 20% to 25% of members will be at premier status by the end of this quarter.”

The company piloted this program in six states last year and saw incremental volume increases of 5% at participating stations, Low reported.

In addition, CITGO has added the ability for some individual locations and operators to do personalized fuel offers based on a customer’s fueling purchase habits. In the future, the company expects to have these tools in place for all its operators.

Using a buy more, get more approach has produced “a quick return on investment,” with an increase in visits of 15% and gallons sold on a monthly basis up 7% from before the start of these marketing campaigns, said Low.

“Having more visits is great because that is more of an opportunity for them to go into the store,” he added. “Customers had to achieve a minimum purchase to qualify for a reward, and we use the offers to maximize their potential and also target them if visits decline.”

At Sunoco, its partnership with Sheeva. AI enables retailers to advertise in-store products and promotions in full color on the infotainment screen in the customer’s car when they’re activating a pump or paying for fuel with the hope of getting them into the store.

“The idea is to lure the customer into the store with higher-margin items,” Klochikhin said.

Able lets retailers allocate different portions of their digital signage to brand, fuel price and in-store advertisements. The signage at high resolution can be see half a mile away, as well as on the forecourt, and can be changed by daypart or at any time of day to highlight different offers.

“At the end of the day, revenue and profitability of gas is one thing, but profitability of soup and sandwiches is exponential. So, how can c-stores interrupt that journey and get them into the store?” Hirsch posed. “One of our sites in Milwaukee, Wis., put only the word 'Beer Cave' [on their signage] and sales went up on beer 42% year over year.” CSN

Adhesive-backed mats stay in place to keep feet dry and floors

•

•

•

•

•

•

•

Convenience store trips are increasingly being driven by prepared food purchases

More than just a bonus draw during fuel trips, convenience stores’ prepared food offerings are increasingly becoming the primary reason shoppers make a visit to a c-store.

According to the 2025 Convenience Store News Realities of the Aisle Study, which surveyed 1,500 consumers who shop a c-store at least once a month, the percentage of participants who said they purchased prepared food at a c-store within the past month jumped 11 points from a year ago and an even more impressive 25 points from two years ago. The research also uncovered:

Among all surveyed shoppers,

80%

said they bought prepared food at a convenience store least once in the past month.

40%

Made-to-order/ freshly made

29% Combination of both

32%

Grab-and-go/ refrigerated

Four in 10 prepared food buyers opted for made-to-order items vs. grab-and-go.

Pizza is the prepared food consumers say they regularly purchase at c-stores.

Rounding out the top five are a hot dog, breakfast sandwich, deli/sandwich and hot snack.

Take-home meals, healthier options and Indian food remain low in overall purchase frequency, but saw boosts in customer interest in this year’s study

According to buyers, the most important factors when purchasing c-store

Price/value

Food quality

Taste

Freshness

Convenience/ portability

Prepared Food Comparison: Convenience vs. Other Channels

More than half of convenience store prepared food shoppers still view fast-casual, grocery and fast-food outlets as superior alternatives to c-store food. However, both fast-casual and grocery saw a decline in food-quality perception compared to a year ago.

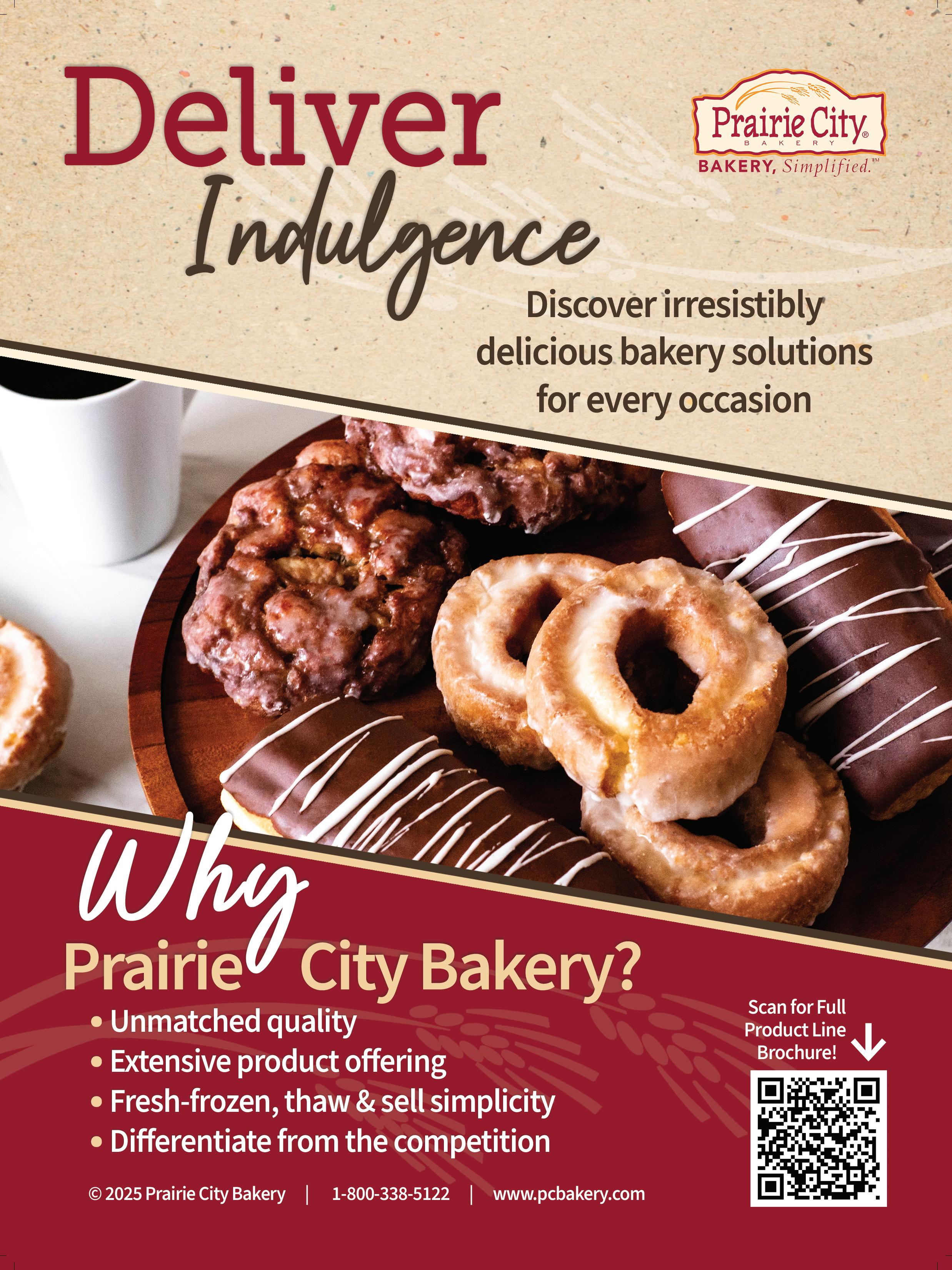

From breakfast to dessert, our ready-to-go baked goods deliver big taste, zero hassle.

Start your day with our Heritage Ovens Pancake Bites — light, fluffy mini pancakes that are microwave-ready and even better topped with Waffle Dust or syrup. End it with cookies that hit every craving: the Cookielossus® chocolate chunk pan cookie, crispy-chewy pre-portioned dough, or graband-go thaw-and-serve favorites. From freezer to plate, these solutions save labor while delivering premium, fresh-baked flavor.

Serve smarter. Delight often.

Ask your Performance sales representative about Heritage Ovens lineup today or scan the QR code for more information.