We’ll help find the perfect product fit for your case.

8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631 Phone: 773-992-4450 Fax: 773-992-4455 www.ensembleiq.com

BRAND MANAGEMENT

VICE PRESIDENT & GROUP BRAND DIRECTOR Paula Lashinsky 917-446-4117 plashinsky@ensembleiq.com

EDITORIAL EDITOR-IN-CHIEF Gina Acosta gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com

SENIOR DIGITAL & TECHNOLOGY EDITOR Marian Zboraj mzboraj@ensembleiq.com

SENIOR EDITOR Lynn Petrak lpetrak@ensembleiq.com

MULTIMEDIA EDITOR Emily Crowe ecrowe@ensembleiq.com

CONTRIBUTING EDITORS Mike Duff, Jenny McTaggart and Barbara Sax

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER (INTERNATIONAL, SOUTHWEST, MI) Tammy Rokowski 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALE MANGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

REGIONAL SALES MANAGER (EAST COAST) Dave Cappelli 312-505-3385 dcappelli@ensembleiq.com

ACCOUNT EXECUTIVE/CLASSIFIED ADVERTISING Terry Kanganis 201-855-7615 • Fax: 201-855-7373 tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley 856-809-0050 marybeth@marybethmedley.com

PROJECT MANAGEMENT/PRODUCTION/ART

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

MARKETING MANAGER Rebecca Welsby rwelsby@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Single copy price $14, except selected special issues. Foreign single copy price $16, except selected special issues. Subscription: $125 a year; $230 for a two year supscription; Canada/Mexico $150 for a one year supscription; $270 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $170 a one year supscrption; $325 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices. Printed in USA.

POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Copyright ©2023 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

rogressive Grocer just had its first annual GroceryTech conference in Cincinnati, Ohio, in July, and one thing is certain: Nothing is certain in the grocery industry anymore, not even Christmas.

But technology can help.

At PG’s GroceryTech event, one food retailer based in the Northeast talked about how an unprecedented amount of snowfall led to store closures in the weeks before Christmas. Cities were shut down and residents were told to stay in their homes.

When the streets were safe again, the grocer was able to leverage technology to deploy employees to deliver groceries to hundreds of customers stuck in their homes without a way to obtain fresh food.

That was just one of many captivating stories from GroceryTech, which featured a theme of Scaling With Personalization. Progressive Grocer and sister brand RIS News hosted the event featuring timely sessions on personalization, technology transformation, customer experience, artificial intelligence, automation, and more. Speakers hailed from companies such as Kroger, Google, Giant Eagle, Mercatus, The Fresh Market, Inmar Intelligence, Wakefern Food Corp., Preferabli and many more.

The conference was the capstone to a summer focused on grocery technology here at Progressive Grocer. We also co-sponsored with RIS News the 8th annual Grocery Tech Trends Study, which surveyed both grocery executives and consumers and was brilliantly summarized by PG contributing editor Jenny McTaggart.

The survey showed that retailers are making solid investments for the future and prioritizing the right customer-facing tech. Consumers meanwhile said they’re eager to try new technology that can save money and make their shopping experiences better; yet like retailers, they don’t want tech to overtake the human connection that they’ve come to appreciate in the in-store environment. At the same time, more shoppers — especially younger generations — are increasingly relying on the convenience of online ordering and delivery.

Progressive Grocer and sister brand RIS News hosted GroceryTech in July featuring timely sessions on personalization, technology transformation, customer experience, artificial intelligence, automation, and more.

More than half of retailers surveyed (57%) say they expect their tech spending to increase in the next 12 to 18 months. They recognize that they’ll have to make tradeoffs between upgrades and new tech, and for now they’re split on whether to concentrate on customer-facing tech (46%) or back-end tech (39%).

When it comes to the back end, grocers anticipate spending more on store operations, namely in the areas of data analytics and people management. This year’s study found that e-commerce is expected to be one

of the greatest growth drivers over the next year and a half. Looking ahead, 65% expect that delivery will drive the most growth, and 50% are betting on ultra-fast delivery in 30 minutes or less.

Meanwhile consumers told us that nearly four in 10 now shop online for delivery monthly, and around 50% of Generation Z and Millennials shop online using either delivery, curbside pickup or in-store pickup monthly. Interestingly, only 5% of shoppers surveyed currently feel ready to try ultra-fast delivery, but that could very well change as the service becomes more prevalent. The consumer survey unmasked some of the top barriers to online grocery shopping, led by “prefer to pick products myself, in person” (72%), followed by “don’t trust the quality of products selected” (43%).

Technology is also playing a significant role often before the shopping trip even begins. Almost three-fourths of grocery shoppers (72%) say they use digital coupons regularly or occasionally, while 67% use loyalty programs. Just over half use digital sales flyers (59%) or cash-back reward programs (53%) such as Ibotta and Shopkick.

For those who missed the Grocery Tech Trends Study or GroceryTech event and want a review of some of the buzziest ideas in the industry right now, click on the QR code alongside this column to get more information. We are already in the planning stages for next year’s event and study, and we welcome your ideas about transformational technology in grocery.

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

1 Balloons Around the World Day, or just for sale outside of your store(s), with the proceeds going to a worthy charity.

2 National Child Health Day. Have resources on hand for parents looking to improve their children’s nutritional intake and fitness levels.

3 National Kevin Day. Any one of your customers or associates answering to this name gets a free piece of produce.

Fair Trade Month

National Apple Month

National Biscuit Month

National Cookie Month

4 National Taco Day. It’s not just for Tuesdays.

National Dessert Month

National Pasta Month

National Pizza Month

National Seafood Month

8 National Heroes Day. Ask customers and associates alike to identify the people they look up to most, and share the responses on social media.

15 World Students’ Day

9 International Beer and Pizza Day. Put up signage reminding shoppers to bring home this unbeatable combination.

10 World Mental Health Day. Make sure that your associates know where they can get help rather than suffer in silence.

11

It’s My Party Day. Before they cry if they want to, tell customers you have everything they need for a fun get-together.

5 International Get Funky Day. Perhaps playing classic disco music in the aisles is enough.

6

Inbox Zero Day. We can dream, can’t we?

12

World Arthritis Day. Offer information on remedies across the store that may ease joint inflammation.

13

World Egg Day. This incredible edible item is central to so many delicious dishes.

7 World Card Making Day. Enable your shoppers to get a little more creative in this area — using supplies purchased in your store(s)

14 Be Bald and Be Free Day. The razors and shaving cream are waiting in the personal care aisle.

22 National Make a Dog’s Day. Prepare a display of treats and toys created just for Fido.

16 World Allergy Awareness Day. Direct sufferers of hay fever, hives and more to the pharmacy department for some seasonal relief.

17 National Mulligan Day. Everyone deserves a do-over sometimes.

18 Support Your Local Chamber of Commerce Day. Your business should, too, if it doesn’t already do so.

19 National New Friends Day. What better way to bond with a recently acquired pal than a joint shopping trip?

20 International Chefs Day. Shine the spotlight on the culinary team behind your stellar foodservice menu.

21 National Check Your Meds Day. Your in-store pharmacy can emphasize the importance of this as part of routine health maintenance.

23 National iPod Day. You can teach the kids about this wondrous invention by blasting your painstakingly curated music selection on shuffle.

24

National Jamaican Jerk Day. Teach the uninitiated about the uses of this peerless West Indian seasoning with a live in-store cooking demo.

25

National I Care About You Day. This is the perfect occasion for a card, whether store-bought or homemade.

26

National Day of the Deployed. Spare a thought for active-duty military members, as well as their steadfast families.

27 National Mentoring Day. This is a good time to reach out to those in whom you see potential, as a way to pay forward the help you’ve received with your own career development.

28 International Immigrants Day. Urge your associates born in other countries to share their cultures through cuisine.

29 National Internet Day. Reflect on whether your business is making the best possible use of this vast global system, and make changes accordingly.

30 Haunted Refrigerator Night. Oh, no! Some of the stuff left in there could be truly terrifying.

31 Halloween. Let your associates dress up to create a spooktacular atmosphere for shoppers.

By Joe Toscano, Vice President, Trade & Industry Development at Purina

By Joe Toscano, Vice President, Trade & Industry Development at Purina

Like all t hings in life, i t can be t empting to chase the latest trends. They’re new and o ffer an e x citing wo rld o f p o ssibilities . H owever, in pe t f oo d, we’ve seen t ha t pe t ow ners are bec o ming m o re actively engaged and inf o rmed ab o u t t he heal t h o f t heir f o ur-legged friends, and ins t ead o f f oo ds w i t h t rendy ingredien t s, super premium pe t f oo ds w i t h sciencebased, t arge t ed nu t riti o n are gr ow ing in p o pulari t y In fac t, super premium is curren t ly t he larges t price tier w i t hin t he tot al d o g and ca t pe t f oo d ca t ego ry and has t he larges t d o llar gr owt h w i t hin t he dry d o g pe t f oo d ca t ego ry.

Since t he fi rs t day to ge t her w i t h y o ur pe t, y o u pr o mised t hem t heir bes t life p o ssible F o r m o s t c o nsumers, t ha t s t ar t s w i t h feeding t hem pr o ven nu t riti o n t ha t can lead to visible differences in t heir heal t h, inside and o u t. Nu t riti o n t ha t n ot o nly t as t es goo d bu t is als o heal t hy and enables t hem to live t heir bes t life Targe t ed nu t riti o n f o rmulas mee t differen t nu t riti o nal needs depending o n t he d o g’s o r ca t ’s age, size, activi t y level and special needs such as sensitive skin and s to mach . In fac t, t hree-quar t ers o f d o g ow ners t hink i t is imp o r t an t to buy f oo d f o rmula t ed f o r t heir d o g’s size, breed, life s t age o r ot her need F o ur o u t o f 10 pe t ow ners say t hey “ wo uld pay m o re f o r a f oo d t ha t w as made speci fi cally f o r t heir pe t ’s nu t riti o nal needs ” Ou t c o me-based brands, such as Purina ONE®, are driving m o s t o f t he gr owt h in super premium

We believe nu t riti o n s t ar t s w i t h unders t anding nu t rien t s, n ot jus t ingredients. The best ingredients are the o nes t ha t wo rk to ge t her to enhance o ne an ot her’s perf o rmance A smar t er nu t rien t blend is m o re digestible and effective f o r a pet than a single ingredient. That’s why we d o n’t f o rmula t e o ur pe t f oo d o n an ingredien t basis bu t ins t ead measure h ow differen t f o rmulati o ns affec t a pe t ’s o verall heal t h . Every ingredien t in every Purina d o g and ca t f oo d recipe w as selec t ed f o r a speci fi c purp o se, and w i t h y o ur pe t ’s heal t h in mind Yo u can visi t purina c o m/ ingredien t s to see pic t ures and read ingredien t descripti o ns and bene fit s o f every ingredien t in every Purina f oo d

We als o believe t ha t inn o vati o n sh o uld be pursued relen t lessly, al w ays f o cusing o n t he pe t ’s nu t riti o nal needs, safe t y and well-being Our inn o vati o n and pr o duc t cycles are guided by research, and we apply o ur unrivaled scienti fi c e x perience in pe t nu t riti o n, physi o l o gy and behavi o r to make ne w disc o veries and push b o undaries, creating real nu t riti o nal s o luti o ns t ha t make a pr o f o und difference in t he lives o f pe t s We have m o re t han 500 scientis t s, ve t erinarians and nu t riti o nis t s o n s t aff, w h o wo rk tirelessly to unc o ver break t hr o ugh nu t riti o n t ha t helps d o gs and ca t s live l o nger, heal t hier lives This dedicati o n to advancing nu t riti o nal science to help pe t s live l o nger, heal t hier lives led us to es t ablish t he Purina Insti t u t e, t he gl o bal v o ice o f Purina’s science, in 2018 . The Purina Insti t u t e is pi o neering t he science o f pe t heal t h . I t is bringing a v o ice to research to reinf o rce o ur c o mmi t men t to nu t riti o n— because science is m o re p owerful w hen i t is shared As a gl o bal pr o fessi o nal o rganiz ati o n, t he Purina Insti t u t e shares Purina’s leading-edge research, as well as evidence-based inf o rmati o n fr o m t he w ider scienti fi c c o mmuni t y, in an accessible, acti o nable w ay s o ve t erinary pr o fessi o nals

are emp owered to pu t nu t riti o n a t t he f o refr o n t o f pe t heal t h discussi o ns to fur t her impr o ve and e xt end t he heal t hy lives o f pe t s t hr o ugh nu t riti o n

The resul t o f o ur f o cus o n science and research is a series o f recen t nu t riti o nal inn o vati o ns like Purina ONE® w i t h

Micr o bi o me Balance® dry d o g and dry ca t f o rmulas t ha t have been sh ow n to help balance bac t eria in 28 days, pr o m o ting gu t heal t h, pr o viding immune supp o r t and supp o rting yo ur pe t ’s micr o bi o me Our Purina ONE® Vibran t Ma t uri t y® f o rmula helps fuel seni o r d o gs and pr o m ot e men t al sharpness, and t he Purina ONE® +Plus J o in t Heal t h f o rmula dry d o g f oo d c o n t ains fi sh o il and gluc o samine to supp o r t y o ur d o g’s j o in t heal t h and m o bili t y

As c o nsumers sh o p f o r t he t arge t ed nu t riti o n t heir pe t s need, ensure yo ur s to res have t he righ t ass o r t men t o f sciencebacked f o rmulas y o ur c o nsumers are l oo king f o r. Re t ailers carrying t he t arge t ed d o g and ca t f oo d pr o duc t s t heir c o nsumers w an t are able to t urn sh o ppers in to l o yal c o nsumers w h o kn ow t hey wo n’t have to l oo k any w here else to fi nd w ha t t heir pe t s need.

p d d ‘ - p d

fi

T A ,

d d p -p d

d 2023 IDDBA

A , C , d

d S P ‘ P d p

d d d p p d

d Progressive Grocer d S B dd , G p

C D S P B , p - d

Progressive Grocer: Why has brioche captured the hearts, minds and basket spend of US shoppers?

Sarah Boddy: I , -

d $113 B

; 13 5 dd d p d 1 W

d , $37 ,

d d pp 2

T pp US pp p d

S P z d A

p d d d d d

US pp F pp , p d ;

p d F , - fi

— pp p d d p , d p

PG: Brands are outperforming private label in the category in value and volume. Why?

SB: P 14 p d j

2 p ; d d p 23 p

d 14 p 3 I d

‘ d p I pp , d d T

p q d

W d d d fi , d p d p - d p d T q p , p d

d F - , dd d D d d

d d d p , p p , p fi

d d

W fi d d p US O q A d and p 73 p

d d ISB 4

PG: Why did St Pierre launch in the in-store bakery?

SB: W fi dd - I

pp d p fi d p ,p d C d p d

p d T p j ISB

d S pp d p d B

G , p p

PG: Can you tell us a little about seasonality?

Are sales strong year-round?

SB: O p d — B B B , S d d B B B d B H D R — p d S , - d p d M D , J

4 , d L D WA 5 — d d 2022 6 W p d p d p B S d , p , p d T d C O d - d, T 12 p ; , S P p 11 p T fl p d d - d

10 p W fl A

PG: What’s next for the St Pierre brand?

SB: W j d ‘fi - - p d 2023: B P z R I dd d d d pp fl pp q F B

P z R - d 73 p d d d d 7 B p p , S P p d pp d p A p d, B P z R d d , d d q p d d d A d d d p d W p — M d , W C d W N C S I , K d M — dd T pp A p d d

1 Nielsen xAOC to 06/17/23

2 Total bakery is down on units -2.6% ($37b) source: IRI, L52 weeks, W/E 06/18/23, Total US multi Outlet

3 Nielsen Brioche L52 wks, XAOC to 06/17/23

4 Nielsen xAOC to 06/17/23

5 Nielsen xAOC to 06/17/23

6 Nielsen xaoc to

7

Our revolutionary Tray and WonderBar® Merchandising System is designed and manufactured with the most innovative accessories to increase facings, maximize visibility, enhance package billboarding, ensure product rotation, and reduce shrinkage for a full range of frozen, refrigerated and general merchandise products. Easy to install and adjust, this complete merchandising system also ensures quick restocking.

Trion will help you optimize your display space, attract customers, increase sales and cut labor costs—and our products are built to last. No wonder we’re the industry’s leading manufacturer and supplier, with more than five million trays earning high praise from retailers and shoppers every day!

The smaller yogurt drink segment will drive category growth for the foreseeable future, because such products meet many “new-normal” conditions and needs, including hybrid lifestyles and nutritional convenience.

Yogurt buyers who anticipate increased household yogurt consumption cite personal physical, mental and fi nancial goals as the reasons for this.

As infl ation wanes and prices normalize, spoonable yogurt should lose steam while yogurt drinks continue to trend up.

Accessibly priced yogurt aligns with consumer needs related to health, versatility and convenience.

Yogurt drinks have the benefi t of straddling the worlds of snacks and beverages, making them a more fl exible option.

A disconnect between interest in new yogurt styles and purchasing habits indicates that niche styles need to increase visibility and make it clear to consumers how they differ from regular and Greek styles.

Connecting yogurt drinks to nontraditional and emerging occasions can help brands rewire how consumers think about yogurt, serving as a tool to offset looming category stagnancy.

Brands have a role in helping consumers approach their goals and stick to their habits, in turn benefiting their own brand health and vitality.

To reach a whole new generation of health-minded consumers, yogurt brands should focus on the natural sources from which properties such as sugar, calories and fats are derived; position attributes in a positive light (e.g., sugar as energy or calories as fuel); or direct attention toward other attributes (e.g., probiotics, vitamins, active cultures) as a means of offsetting such less desirable attributes as artificial sweeteners or low fat.

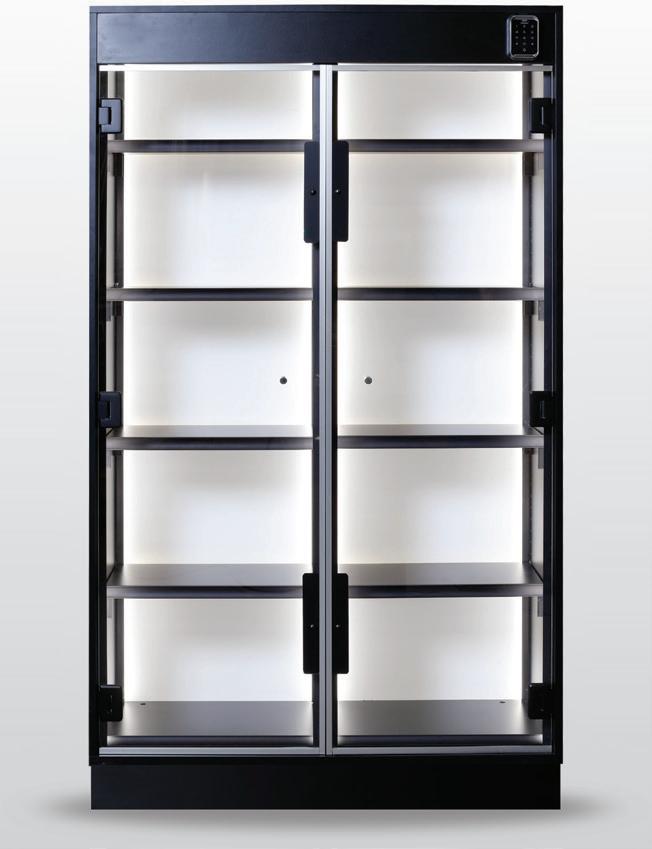

Bright LED floods interior with light.

Powerful magnetic locks stand up to 600 lbs. of pressure per door. Fast automatic relock with battery backup.

Low leverage door pulls.

Half inch acrylic doors are half the weight and 17x stronger than tempered glass.

Reinforced metal trim.

The Secure Display case from Modern Store Equipment offers an unparalleled level of protection from theft. Electromagnetic technology secures the acrylic French-swing doors and provides the strength to withstand up to 600 lbs. of force per door. All while presenting your merchandise in the best light.

Designed and built in America.

3 modes of entry: code, key card, key fob. Also available with smart monitoring via an app.

Backlit panels make merchandise pop.

8 adjustable shelves with price tag moulding.

Heavy duty hinges.

French swing doors open independently.

he grocery store has become more than just a transactional place to purchase food and other goods.

It’s now many consumers’ first stop not only for refilling prescriptions and getting inspired about food, but also for seeking medical care, learning how to cook, getting in shape and improving their diet. In fact, according to FMI — The Food Industry Association’s 2022 “U.S. Grocery Shopper Trends — Shopping Trends” report, shoppers identified registered dietitians (48%), their primary food store (46%) and grocery store pharmacists (44%) as key resources when it comes to helping them stay healthy. Offering relevant wellness education programs may be the competitive edge that retailers need to get shoppers in the door and engaging with their stores.

Besides medication dispensing and medication management, most pharmacies also provide biometric health screenings and smoking cessation classes. These can be offered alongside other retail health programs or as stand-alone services to inform and improve customer health. Wellness programs tailored to certain themes, such as American Heart Month in February or World No Tobacco Day on May 31, can help make customers intentional about initiating change at a certain time. Ask your pharmacists and pharmacy technicians about what common requests or questions shoppers have about wellness at the pharmacy counter.

Programs focused on getting shoppers in the kitchen to create flavorful, original and creative dishes are usually the objective of every cooking experience. Adding extra considerations, such as meals designed for certain budgets, kitchen competencies, stage of life, health needs or time restraints, can get your shoppers even more excited. Coborn’s Kids Cook at Home virtual cooking class series programming even provides a shopping list, recipes and a setup guide for attendees. See whether a cooking class subscription service with meal kits might be a worthwhile endeavor for your customers.

Wellness programs that include an exercise component are more effective than focusing solely on eating habits. Consumers can get moving via on-site physical therapists (offered at H-E-B), virtual “Short & Sweat” fitness videos (offered at Hy-Vee), or Kroger’s Welsana wellness program, which provides the ability to log exercise and receive health coaching to improve fitness. If your retailer can’t assemble a formal exercise program but has the store space inside or out for group fitness, develop a set of recurring exercise classes like yoga or Zumba, and market these on a monthly calendar in-store and online.

Registered dietitians (RDs) are your grocery chain’s food and nutrition experts. Currently, around 81% of food retailers employ dietitians: 65% at the corporate level, 21% in-store or virtual, and 12% regionally, per FMI’s 2021 “Report on Retailer Contributions to Health and Well-being.” Dietitians help build customer trust, translate nutrition science into product recommendations, and are well positioned to create and execute successful wellness education programs. For instance, Canadian food retailer Loblaws offers three popular dietitian programs: diabetes, heart health and weight management.

A wellness program that targets associates’ health is not only the right thing to do for your employees, but it can also enhance productivity, decrease absenteeism and lower health care-associated costs. Considerations such as fl exible hours for participation, adapting material to be relevant for employees’ lifestyles, offering incentives for involvement and using digital tools to track success are key elements of this type of programming. Wellness education programs are now offered with various components, including pharmacy services, cooking, exercise, nutrition and employee health. Determine what mix of programming could reach the most customers and with the most impact at your business.

WELLNESS EDUCATION PROGRAMS CAN BE AN IMPORTANT RESOURCE FOR GROCERS EAGER TO TEACH CONSUMERS ABOUT HEALTHIER LIFESTYLES.Molly Hembree, MS, RD, LD, is a registered dietitian for Kroger Health.

O ering relevant wellness education programs may be the competitive edge that retailers need to get shoppers in the door and engaging with their stores. stores.

The importance of sustainability continues to increase for grocers, but it’s not all about booming shopper interest in reducing plastics or consuming plantbased foods. Grocery retailers do have a clear understanding that shoppers want to see more sustainable products, more transparency and more companies taking the lead on things like decarbonization. However, inflation, smaller baskets and cost pressures are increasingly prompting grocers to invest in sustainable measures as a way to bolster profits while keeping pace with shopper preferences.

According to a survey of senior grocery executives by Incisiv and Wynshop via Grocery Doppio, 76% of grocers regard

sustainability as a C-level issue and 43% will appoint a senior executive to lead their sustainability efforts this year.

Those findings support the notion that the proverbial rubber is meeting the road when it comes to environmentally responsible actions, according to Gaurav Pant, chief insights officer of both Incisiv and Grocery Doppio, in Jacksonville, Fla.

“I think firms have been greenwashing for a period of time. The reality is that while sustainability has been at the top of the agenda, it hasn’t moved forward as much as we’d like,” Pant told Progressive Grocer, adding that things may be changing this year, thanks to a greater focus on energy and power efficiencies, waste reduction commitments, and pressures from investors. “To me, it’s getting there. At the same time, I think the only way it happens is when you have an executive sponsor of sustainability.”

The current operating environment in grocery is challenging, but it offers opportunities to grocers that act boldly when it comes to protecting people, planet and profitability. With that in mind, PG spoke to four innovative solution providers in the sustainability space that are helping grocers become more profitable — and more sustainable — no matter the challenge.

1Greener grocers are reducing food waste.

Trusted by more than 300 grocery retailers across 18 countries, , the fresh-native platform for fresh food retail operations, is at the forefront of accelerating the digital transformation of fresh food retail operations worldwide, enabling retailers to optimize merchandising and replenishment processes while prioritizing compliance and sustainability.

Stephen Midgley, VP of marketing at Mississauga, Ontario-based Invafresh, says that the company helps grocers improve their sustainability cred by staying committed to embracing emerging technologies and providing the essential products and services required to address the unique challenges of fresh food retail operations.

“A significant source of food waste in grocery stores is over-ordering,” Midgely explains. “Grocery stores often order more food than they need, which can lead to spoilage and waste. However automated data analytics tools can analyze sales data to identify trends and patterns in customer behavior. This data can then be used to adjust order quantities and ensure that sustainable grocery stores are only ordering what they need. This can help reduce overordering, which, in turn, reduces the amount of unsold inventory that goes to waste.”

Invafresh’s automated data analytics technology can help grocery stores make more informed decisions about their orders, reducing over-ordering and food waste.

According to Midgely, grocery retailers’ top priorities when it comes to ESG (environmental, social and governance) now are:

Increase operating margins: achieved through accurate demand forecasting and accurate markdown pricing of near-to-expire products

Improve sustainability: achieved through reducing shrink

Improve the shopping experience: fresher food on shelves, improved quality and availability leads to increased customer lifetime value

“Our Invafresh collaboration will help us automate processes, such as ordering, production and inventory management, so that we are meeting customers’ expectations with the freshest foods while also more accurately predicting demand,” notes Bob Gleeson, SVP of merchandising and marketing at Sunbury, Pa.-based Weis Markets. “We expect this platform to reduce food waste and improve efficiencies.”

Food retailers generate 10.5 million tons of food waste, with almost one-third of that wasted food sent to landfills. Suppliers, retailers and consumers waste approximately 45% of all fruits and vegetables, 35% of fish and seafood, and 20% of meat and dairy products annually.

“Invafresh has helped Price Chopper to produce the

excess shrink,” says Patrick Iannotti, director of retail operations at Schenectady, N.Y.-based Price Chopper/Market 32. “We are working on enhancements with Invafresh that will further our effort in exceeding our customers’ expectations for delivering fresh products while limiting the spoilage that ends up in landfill.”

Price Chopper’s partnership with Invafresh has proved to be a game-changer. Each week, the retailer prevented a staggering 20 tons of fresh food from going to waste, resulting in a projected prevention of more than 3,000 tons of food waste over the next three years. Moreover, by aligning its operations with sustainable practices, Price Chopper succeeded in reducing methane emissions from landfills and minimizing its carbon footprint. Price Chopper’s successful collaboration with Invafresh not only enhanced the grocer’s sustainability efforts, but also positioned it as a frontrunner in the fresh retail industry.

For more than 100 years, Bridgeton, Mo.-based Hussmann has been innovating the way that food retailers merchandise their products. Founder Harry Hussmann patented the first meat display case in 1917 to provide customers a better way to view his products while maintaining food safety standards — thereby changing how fresh food is merchandised and sold today.

Lianne Tombol, VP of portfolio solutions at Hussmann, says that retailers are increasingly looking to the company as a strategic consultant to navigate the complex and ever-changing regulatory requirements with smarter, energy-efficient, low-GWP (global-warming potential)

“With new regulations rolling out, retailers want trusted providers … to guide them on the best solution that will help them achieve their goals.”

—Lianne Ttombol, HussmannPrice Chopper’s partnership with Invafresh has proved to be a game-changer. Each week, the retailer prevented a staggering 20 tons of fresh food from going to waste, resulting in a projected prevention of more than 3,000 tons of food waste.

refrigeration solutions to enable them to reduce their energy consumption and carbon emissions.

“One way we are supporting our customers is through the Shop The Future mobile experience,” notes Tombol. “This summer, our team of experts is on the road with our 53-foot mobile showroom, visiting grocers across the country and sharing the latest in sustainable technologies that will help them meet their individual ESG goals.”

She adds that retailers are looking for more guidance from Hussmann on how they can achieve their ESG goals.

“With new regulations rolling out, retailers want trusted providers, like Hussmann, to guide them on the best solution that will help them achieve their goals,” asserts Tombol. “Our latest sustainable-refrigerant solutions offer the low GWP they need, along with the training and support they will require.”

Hussmann refrigeration solutions, paired with leak-detecting technology called StoreConnect, help retailers optimize operations by providing predictive diagnostics that stay on top of maintenance and prevent downtime in their stores.

When it comes to measuring ESG performance, that’s “an ever-evolving journey,” admits Tombol.

“Optimizing retail conditions for food and shoppers can be achieved in different ways,” she observes. “For example, new merchandisers can lead to enhanced energy efficiency, systems utilizing the newest refrigerants can help with meeting GWP targets ,and electronic shelf labels can reduce waste and improve shoppability.”

Greener grocers are maximizing profi ts Matt Schwartz, CEO and co-founder of San Francisco-based fresh food operations platform Afresh, started learning about the food industry as part of Stanford University’s Earth Program, and also by participating in an internship with food tech investor Dave Friedberg.

“Through that, I got an advanced education, with a front-row seat to food tech innovation,” notes Schwartz.

This focus on fresh food led Schwartz and his Afresh co-founder, Nathan Fenner, to spend thousands of hours speaking with hundreds of people in the food supply chain and shadowing store employees to learn about the challenges facing the grocery industry.

“We quickly realized that, despite the increasing importance of fresh food for food retailers, there wasn’t any technology optimized for managing fresh food,” recounts Schwartz. “We were going to all these multibillion-dollar chains, and they were all running this process on pen and paper. Some retailers had even taken center store, non-fresh technology and worked with an IT consulting shop to unsuccessfully bend it to work in fresh.”

In response, Schwartz and Fenner started Afresh in 2017, a fresh food technology company with the ultimate goal of helping eliminate food waste and make fresh food accessible to all.

Afresh’s first product, an AI-powered predictive ordering and inventory management solution, is the only built-for-fresh solution that intelligently navigates hard-to-predict and error-prone data to drive optimal decisions in grocers’ fresh departments. Afresh manages the complexities of fresh food, including seasonality and perishability, to drive more efficient store teams and more profit for grocers that are already operating on razor-thin margins.

“Afresh unifies previously disjointed processes, from forecasting and inventory to store operations, driving transformative results that help grocery retailers stock the freshest food for customers, increase cost savings and reduce shrink,” asserts Schwartz. “We’re using machine learning to determine the absolute profit-maximizing and shrink-minimizing order quantity for every fresh item at a store daily for grocers like Albertsons, Cub, Fresh Thyme, Heinen’s and more.”

shrink-minimizing order quantity for every fresh Cub, Fresh Thyme, Heinen’s and more.”

He adds that social impact, when paired with profit incentives, can be a mechanism for positive change in the grocery industry, evolving our food system for the better while maximizing the business incentives of an industry that feeds and hires billions of people worldwide.

“Afresh unifies previously disjointed processes, from forecasting and inventory to store operations, driving transformative results that help grocery retailers stock the freshest food for customers, increase cost savings and reduce shrink.”

—Matt Schwartz, AfreshAfresh’s first product, an AI-powered predictive ordering and inventory management solution, is the only built-for-fresh solution that intelligently navigates hard-to-predict and error-prone data to drive optimal decisions in grocers’ fresh departments. driving transformative results that help grocery

Freight transport is becoming more efficient, as well as both environmentally and socially responsible. Its future is bright because SmartWay is sharing with its Partners — nearly 4,000 companies and organizations — information about market-based incentives and technology solutions to help cut fuel costs and reduce emissions. Being a SmartWay Partner is free. If your company ships and/or receives almost any retail or grocery item, SmartWay has the roadmap to help you achieve greater freight sustainability.

Learn all the benefits of being a SmartWay Partner at epa.gov/smartway

SmartWay. Driving sustainable freight.

According to Schwartz, the top priority for grocers now is reducing shrink.

“Afresh helps grocers reduce their shrink by an average of 25%,” says Schwartz. “This is millions of dollars in savings and millions of pounds of food waste saved annually.”

In 2022, Afresh completed a chain-wide rollout at Cub’s 80 corporate stores. With Afresh implemented across every item in every produce department, Cub expects to prevent at least 2.1 million pounds of food waste annually, reduce greenhouse-gas emissions by 1,264 tons, and save 43 million gallons of water. Additionally, since adopting an AI-based system from Afresh, Cub has seen an 18% reduction in produce shrink.

Afresh has also rolled out chain-wide across Albertsons’ 2,200-plus stores to help improve ordering and better manage its inventory of fresh fruits and vegetables. As a result of this rollout, by simply investing in the right technology, the company was able to increase access to fresher products for customers and make meaningful progress toward achieving its goal of having zero food waste going to landfill by 2030, notes Schwartz.

4— both in Ohio — shoppers in the produce department perused pesticide-free bagged lettuces with names such as “Butter Me Up,” “Fresh Squeeze” and “Rhine Garden,” all of them produced by industry-leading indoor-farming company 80 Acres Farms. The Hamilton, Ohio-based company currently serves a growing list of food retailers looking to expand its assortment of farm-to-table produce, including in addition to Jungle Jim’s and The Kroger Co., Whole Foods Market, The Fresh Market, and other regional retailers, as well as foodservice distributors.

Today, 80 Acres Farms has five production farms in southwestern Ohio, a new farm in Florence, Ky.; a future farm in Covington, Ga.; and R&D facilities in Arkansas and the Netherlands.

Earlier this year, 80 Acres Farms teamed up with Munich-based Siemens to apply innovative technology within the agriculture industry — fostering sustainable, healthy, traceable and more productive farming practices. Siemens’ technology and capital is helping 80 Acres Farms and its technology subsidary, Infinite Acres, meet global food supply demands. Using Siemens’ software and hardware solutions, spanning intelligent facility and energy management systems to advanced industrial automation technology, 80 Acres Farms is well positioned to meet its goal to optimize and standardize its operations — with the vision to support food security worldwide, the company says. In consequence, grocery retailers looking to expand access to fresher food are paying attention.

“Everyone deserves easy access to fresh, affordable, delicious food,” notes Dan De La Rosa, group VP of fresh merchandising at Cincinnati-based Kroger. “Our newly expanded partnership [with 80 Acres] means more communities will have just-picked produce at their fingertips 365 days a year. We’re proud to partner with 80 Acres Farms as we work together to create a world with Zero Hunger | Zero Waste.”

Food packaging plays an essential role in feeding people throughout the world, but when it is not collected and recycled, it can be a source of waste.2 In places where collection infrastructures are still being built, we’re teaming up with stakeholders to improve collection, sorting and recycling — and we design our carton packages to increase the fiber content and use of recycled materials. Let’s not settle for what we can achieve today. Let’s go further together.

Go nature. Go carton.

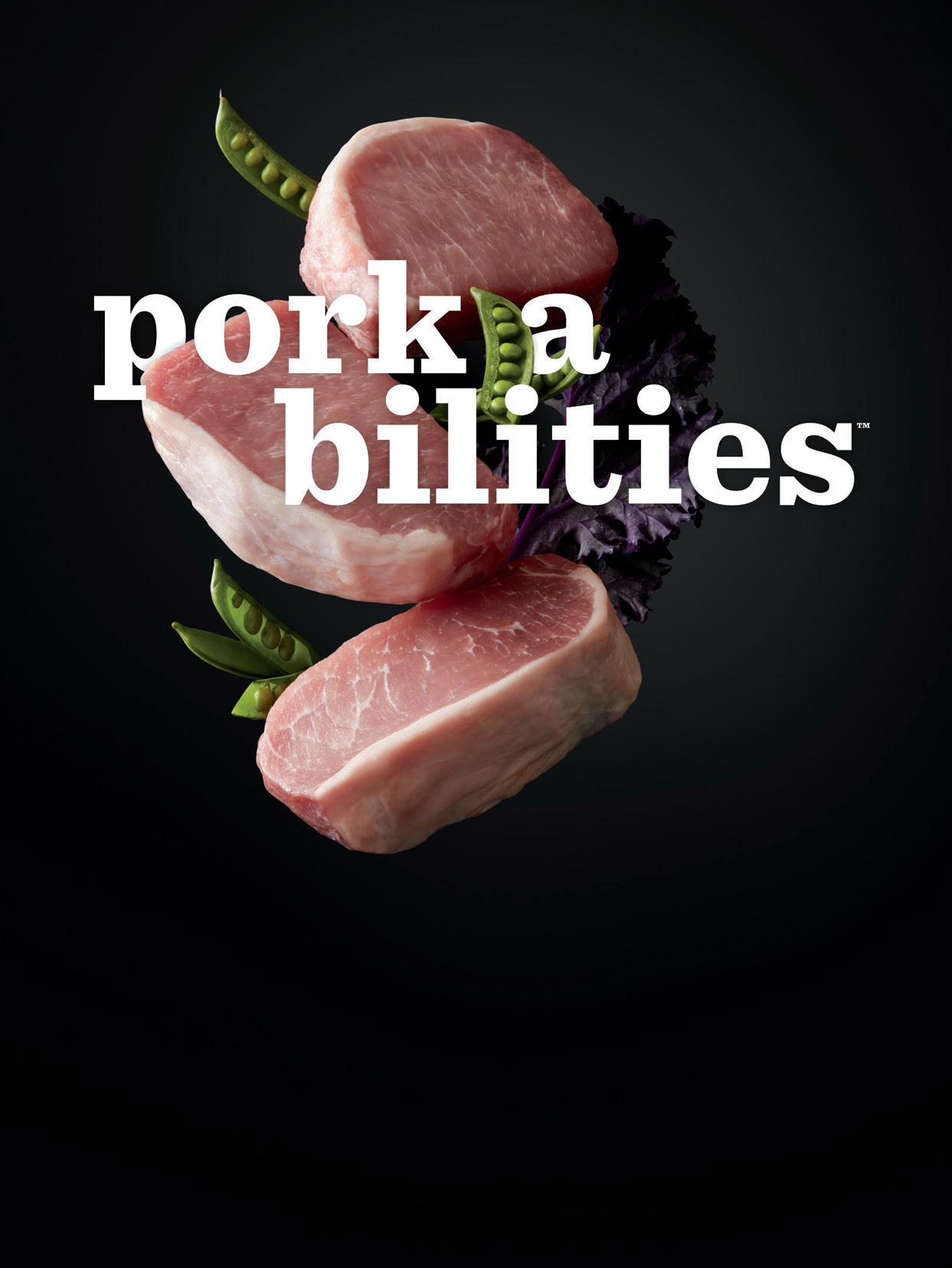

ou don’t have to go far in the fresh perimeter to see the intersections of retail and foodservice, value and premium, and flavorful and familiar. Value-added meat, poultry and seafood products reflect consumer demand for products that meet their tastes and lifestyles.

Pre-portioned, pre-seasoned and pre-marinated proteins have been around for a while, but the value-added protein subcategory is evolving with the times. For example, as foodservice inflation continues to outpace grocery inflation, consumers are looking to recreate restaurant experiences at home.

The definition of “value” has grown to encompass price and time-saving attributes.

Product innovation in this space includes blends, kits, new cuts of meat, bold flavors, and items that integrate prep and cooking steps. Grocers are also getting into the value-added act with storebranded offerings.

People are better at that, too, having honed their cooking skills during the pandemic and remote-work era. According to the 2023 “Power of Meat” study published by FMI — The Food Industry Association and the North American Meat Institute, purchases of value-added meats have risen “dramatically” over the past few years. In 2020, 60% of consumers said that they sometimes or frequently bought pre-marinated, pre-cut or pre-seasoned meat — a base that jumped to 73% in 2022.

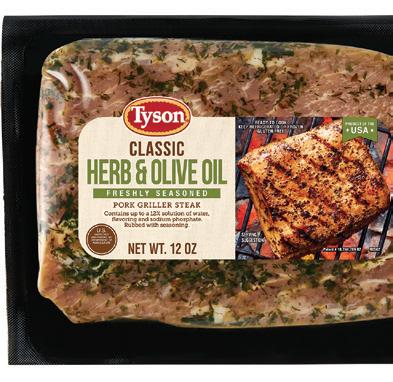

Rikki Ingram, director of fresh meats marketing at Springdale, Ark.-based Tyson Foods, says that such data affirms the value of value-added offerings. “The 2023 ‘Power of Meat’ study showed that value-added engagement and sales are on a multiyear growth path — so the demand is not slowing down,” observes Ingram. “This demand is driving not only volume growth of the category, but also innovation that meets consumers’ demands of convenience, flavor and simplifying their lives.”

This sentiment is shared by Michael Uetz, principal at Chicago-based Midan Marketing and a longtime meat industry and marketing pro. “Value-added meat products have been gaining in popularity for several years,” affirms Uetz, also citing the latest “Power of Meat” report. “Nearly three-quarters of shoppers are purchasing these products. This is double what it was just seven years ago.”

While the category is clearly expanding, so is the definition of value. For example, although fresh meat prices are coming down from their highs, the ongoing inflationary environment means that value encompass-

VALUE-ADDED PROTEINS ARE GAINING MOMENTUM AT THE MEAT CASE AS CONSUMERS SEEK MORE OPTIONS FOR CONVENIENCE, EXPERIENCE, PRICE AND FLAVOR.

By Lynn Petrak

Imagine

Prairie Fresh USA Prime® is the best of our best. Our industry-leading proprietary technology helps to select premium cuts based on superior marbling, color and tenderness. So you can deliver a higher level of consistency and quality to your shoppers.

That’s the Prairie Fresh® Way.

prairiefreshway.com

Tyson has added a seasoned pork griller steak, novel to the category in both format and flavor.

seeing more products that are meat-vegetable blends in this space,” observes Uetz.

es the price-value proposition.

“Value means more than just price, so for more cost-conscious consumers, we’re seeing they’re interested in buying in bulk and stretching that protein across several meals,” notes Ingram. “Blended proteins, such as a ground-beef-and-pork blend that has a familiar flavor profile while capturing some cost savings, are also popular with this consumer.”

Value also takes the form of having help in the kitchen, including, but not limited to, time-saving attributes. “Alongside this, consumers have moved from primarily cooking from scratch to using a mix of prepared and scratch-made elements in their meals,” says Uetz.

Ingram echoes the fact that today’s meat buyers are mixing it up a bit and seeking ease, but also some buy-in and bragging rights. “The key is infusing enough culinary creativity that home cooks can get a jump-start on their meal, but with enough versatility that they can make the seasoned/ marinated items their own,” she asserts.

Value-added offerings, then, look a little different from how they did even a few years ago. “In addition to the traditional pre-marinated and pre-seasoned products, we have started

He offers other examples of innovation in this space. “New proteins are entering the mix, like pre-seasoned lamb leg from Walmart’s Marketside Butcher,” says Uetz. “We’ve also seen full sandwich kits, with all the ingredients for a Chicago-style beef sandwich or a Philly cheesesteak. These options offer flavorful, innovative meal solutions for shoppers looking for a quick meal.”

Tyson, for its part, is working on new types of value-added items, including those in different formats. “Other examples of innovations outside of sliced, diced and cubed protein or pre-seasoned and -marinated meats include innovation with various cuts of meat,” notes Ingram. “For example, we introduced a boneless pork loin griller steak last spring that is causing a disruption with its unique shape and tender eating experience. Ranch steak, also known as pub steak, is another cut that we have been exploring lately. It’s from the chuck and cooks up well after marinating.”

The current crop of value-added proteins also reflects consumers’ growing taste for bold and global flavors. For instance, the Signature line, from the Prairie Fresh division of Seaboard Foods, includes a boneless pork shoulder roast dry-rubbed with carnitas seasoning, and a honey sriracha-seasoned pork filet, among other items.

“Our team responded to the increased demand for spicy foods by introducing

“The key is infusing enough culinary creativity that home cooks can get a jump-start on their meal, but with enough versatility that they can make the seasoned/marinated items their own.”

—Rikki Ingram, Tyson Foods

Prairie Fresh Signature Honey Sriracha tenderloin to retail, which brings a unique and exciting flavor profile for adventurous appetites,” affirms Emma Pierce, brand manager for Shawnee Mission, Kan.-based Seaboard Foods.

Other value-added cuts integrate prep and cooking steps. The Prairie Fresh portfolio includes a cook-in-bag line, with varieties like a pork loin filet with applewood bacon. Tyson also has a cook-in-bag pork product that can be customized with the addition of a favorite sauce.

Fully cooked meats fall under the value-added umbrella, too, and there are plenty of examples of innovation in this subcategory.

Westminster, Colo.-based Niman Ranch, for example, touts a heat-and-serve line including grass-fed Angus pulled beef, applewood-smoked pulled pork, pulled pork with barbecue sauce, and half and full slabs of St. Louis-style pork ribs with barbecue sauce.

As grocers partner with suppliers to fi ll their cases with branded value-added products, they are also creating value in-house for proteins in their service cases, at their butcher counters or included in their store-brand programs.

“Grocers themselves are also entering this space,” says Uetz. “Many retailers have started to offer a wider variety of prepared meals, meal kits and chef-prepared meals in their stores. From H-E-B Fresh Bites to Fresh to Table from ShopRite, offering one-stop shopping for a full meal is becoming more and more popular.”

Indeed, many food retailers are getting inventive with format and fl avor in the value-added space. Rochester, N.Y.-based Wegmans Food Market, for instance, sells a ready-to-cook organic lime cilantro boneless skinless chicken breast, while the collection of value-added meats from Phoenix-based Sprouts Farmers Market includes a pineapple teriyaki “no antibiotics ever” chicken thigh.

THE MORNING MEAL OCCASION HAS GIVEN RISE TO CERTAIN MAJOR TRENDS — INCLUDING WHAT TIME OF DAY SUCH FOODS ARE EATEN.

By Bridget Goldschmidthat’s more quintessentially American than those inviting signs at diners, coffee shops and fast-casual eateries across the country beckoning customers with the promise of “Breakfast All Day”? Now it seems that consumers are taking that directive to heart even when eating at home.

“The trend of all-day availability with breakfast foods has been taking on new legs,” affirms Cindy Wu, VP of marketing at Hayward, Calif.-based Sukhi’s Gourmet Indian Foods, which recently came out with a line of frozen breakfast-style Naanwiches. “Whether it’s at fast-food or sit-down restaurants, we’ve noticed menus offering eggs, bacon and various breakfast dishes at all hours. Breakfast foods are also comfort foods that are associated with calming weekend mornings, slower starts and starting your day off right. People are taking that positive association of breakfast and carrying it through their day.”

“We … believe the breakfast space will continue to become the ‘anytime’ space as more consumers eat breakfast foods for lunch, dinner and anywhere in between,” agrees Karuna Rawal, CMO of Chicago-based Nature’s Fynd, whose offerings include Meatless Breakfast Patties and Dairy-Free Cream Cheese. (Read more about alt-protein breakfast options on page 36.)

Just as more people are eating breakfast foods all day, increasing numbers of consumers are opting for items not normally associated with that daypart.

“The ‘first meal of the day’ will continue to evolve and expand to include ‘nontraditional’ breakfast foods, with a blurring of eating occasions,” observes Carrie Sander, general manager, portable wholesome snacks at Battle Creek, Mich.based Kellogg Co., long known for its wide array of breakfast foods, including new

flavors from iconic waffle brand Eggo released during National Brunch Month in April: Vanilla Bean Grab & Go Liège-Style Waffles, Chocolatey Chip Banana Waffles, and Berry Blast Mini Toast Waffles.

“With the trend of breakfast all day, dinner all day also works in reverse,” notes Wu. “People easily switch between flavors. So, [Sukhi’s] Chicken Tikka Street Wrap is as easily consumed as a breakfast item as the Egg, Pepper & Cheese [Naanwich]. We like to present our varieties together in retail stores so that consumers can choose what they want to eat and when.”

Beyond what times people consume breakfast foods, a key ongoing trend in this space is health, particularly in relation to one crucial nutrient.

Ricardo Fernandez, president, morning foods at Minneapolis-based General Mills, points out that “consumers are seeking products with added protein and other nutritional benefits. That’s why we are continuing to expand our portfolio of high-protein products, including :ratio PROTEIN Yogurt, :ratio Cereal and Nature Valley Protein Granola.”

“The importance of protein in the morning continues to grow,” notes Sander. “Consumers are busier than ever and looking

Breakfast foods are no longer confined to the morning, and consumers are increasingly choosing to break their fast with items not typically associated with that daypart.

Other major trends in this space include health, convenience, sustainability and the rise of snacking as opposed to full meals. For certain breakfast foods, evoking fond memories of youth is a critical component of marketing.

for a quick energy boost. Manufacturers are leaning in with protein-forward products.”

Among those products are offerings from Egglife Foods, whose refrigerated egg white wraps come in several flavor profiles, including recently released Garden Salsa wraps available exclusively at ALDI. “Protein can build healthy tissue, produce energy, promote muscle growth, support mental performance, help stabilize blood sugar, enhance immunity and help curb your appetite until your next meal,” says Dave Kroll, CEO of Chicago-based Egglife. He adds that the company’s “wraps are nutritious alternatives to traditional corn or flour tortillas and add 5-plus grams of protein to any breakfast, from burritos and quesadillas to crepes and rollups.” The wraps also fit a variety of dietary need states such as gluten-free, keto, diabetic and Whole30 lifestyles.

Among the other health trends influencing the breakfast food category are “intermittent fasting, eating frequent small meals and keeping energy stable throughout the day, [which] are changing when people ‘break their fast’ [and leading] to an increase in ‘micro meals’ and snacking behavior versus the traditional morning meal,” notes Sander. “For portability and protein, [snacking division] Kellanova has strong brands such as Nutri-Grain, RXBAR and Special K Bars that serve the morning occasion.”

“The intersection of health and convenience is going to continue to be a place consumers are looking for new breakfast solutions,” agrees Kroll. To that end, “Sukhi’s developed breakfast-style Naanwiches to address a need for clean-ingredient, easy-to-heat-and-eat, flavorful breakfast options,” notes Wu.

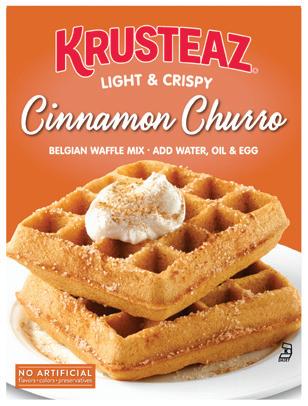

“Consumers will continue to seek out convenience to meet busy schedules, as well as versatility to cater to creating and experimenting in the kitchen, and we’re happy to be able to offer products that meet both needs,” says Caroline Platt, director of brand marketing at The Krusteaz Co., based in Tukwila, Wash. The brand’s recently introduced Cinnamon Churro Waffle Mix taps into the rising momentum of churro-flavored items for breakfast.

Thomas’ also believes in making things as easy as possible for the morning meal occasion. “When it comes to breakfast, many consumers have a love-hate relationship with it,” observes Mary Pensiero, brand manager at Horsham, Pa.-based Bimbo Bakeries USA, parent company of Thomas’. “They enjoy breakfast and breakfast’s traditional offerings but struggle to find a product that aligns with their on-thego lifestyle to enjoy in the mornings. Luckily, Thomas’ Breads has made it a point to evolve with on-the-go breakfast trends and work to introduce new products that meet consumers’ busy lifestyles. In June 2023, Thomas relaunched Muffin Tops, which come in two flavors: Blueberry Oat and Chocolate Chip.”

Citing Circana data, Pensiero also notes, “As more on-the-go, convenient breakfast options continue to rise, so does morning snacking.” Individually wrapped Muffin Tops also deliver in that regard, making the line “the perfect option for consumers looking for convenient breakfast and snacking options.”

Alongside health and convenience, breakfast food shoppers “will place more value on sustainability and purpose-driven brands,” asserts Sander. “Kellogg’s has a strong ESG plan in place, and we continue to give back through our Better Days promise … to advance sustainable and equitable access to food by addressing the intersection of well-being, hunger, sustainability, and equity, diversity and inclusion for 3 billion people by the end of 2030.”

“Trends seem to spread across sweet indulgence, health and wellness, and sustainability,” says Cameron Meekins, of Boston-based Stone & Skillet, whose English muffin varieties include an upcycled product made with grain left over from the beer-brewing process. “We launched a new French toast flavor that is performing well as a sweet item, but health and wellness is really the biggest trend in breakfast. With the addition of all the fiber and protein in the upcycled Super Grains item, it really hits that consumers need to start the day feeling good with natural energy. And then when they learn of the story and upcycled thought leadership that goes into this Super Grains product, they fall in love with it and spread the good word.”

For certain breakfast foods, evoking fond memories of youth is a critical component of marketing.

“We are continuing to see an increased emphasis on breakfast foods that tap into culture and nostalgia,” notes General Mills’ Fernandez. “Our consumers want foods that connect to their lives and interests, as well as breakfast foods that tap into childhood nostalgia. Our recent Cinnamoji Toast Crunch cereal x WWE partnership and the upcoming return of Monsters

Cereals — including new updates like introducing the fi rst female mascot! — are great examples of how we’re leveraging these trends, or our focus on Yoplait

Krusteaz is capitalizing on the rising popularity of churro-flavored items for breakfast with a recently introduced waffle mix.

Did you know that plant-based food sales reached $7.4 billion in 2021?

100% Plant-Based. 100% for your store.

Shoppers seeking plant-based products spend more than other shoppers — and there are more of them than ever before. Find the products that will make your store stand out to this rapidly growing (and highly valuable) consumer segment at Plant Based World Expo, the only 100% plant-based event for retail and foodservice.

With access to hundreds of well-known and emerging brands, just-launched items and proven bestsellers, you’ll source the items that will fly off your shelves — and differentiate your offerings in an increasingly competitive marketplace.

Discover the power of plant-based Sept. 7-8 at the Javits Center.

this summer and its role as America’s favorite strawberry yogurt.”

It’s not all about reliving bygone days, however, and not even just for breakfast.

“Our retail customers ... are also catering to the demands of their consumers who want to pair those family favorites with innovations, product crossovers and seasonal fl avors,” says Fernandez. “We’ve had tremendous success expanding our portfolio both inside and out of the cereal aisle through the popularity of some of our most well-loved brands such as Yoplait yogurt and

NEW ITEMS APPEAR IN FROZEN FOOD AND REFRIGERATED SECTIONS.

As plant-based eating evolves from a novelty to a permanent feature of many consumers’ diets — either for every meal or as part of a flexitarian approach to cutting down on meat consumption — food manufacturers are responding to this movement with a greater number of plant-based products in categories where such items have been underrepresented.

For instance, Alpha Foods recently revealed an upcoming collaboration with Alameda, Calif.-based Just Egg, the market leader in the plant-based egg category, on protein-rich breakfast selections “as they both work towards a healthier and more sustainable breakfast landscape,” according to Glendale, Calif.-based Alpha.

Meanwhile, Chicago-based Nature’s Fynd, which develops microbe-based proteins for meat and dairy substitutes — technically not made from plants, but free of animal protein nonetheless — is expanding distribution of its Meatless Breakfast Patties nationwide, following the frozen product’s debut at Whole Foods Market a little over a year ago.

“What we’re seeing is an increased interest in protein for breakfast foods as well as an increasing interest in getting that protein via non-meat breakfast foods,” notes Nature’s Fynd CMO Karuna Rawal. “Traditional sausage patties and breakfast foods like bacon have protein but are higher in saturated fat and calories [and,] for many people, are comfort foods. Nature’s Fynd Meatless Breakfast Patties have 75% less fat than pork sausage per serving. Our fungi-based patties offer that high-protein comfort aspect with lower fat content and fiber.”

The company promotes the patties and its Dairy-Free Cream Cheese (in Original and Chive & Onion fl avors) as sustainable, better-for-you breakfast options across its owned channel and paid channels, out of home, and through a sampling program and brand activation programs. “This year, we’ve sampled at events like Vegan Women Summit, SXSW and Vegandales across the U.S., distributing over 200,000 samples in the last year,”

cereal snacks (Yoplait topped with Lucky Charms or Cinnamon Toast Crunch in one package), Trix Popcorn, Lucky Charms S’Mores, and Cinnamon Toast Crunch Bugles.”

says Rawal. Every time we sample, we receive overwhelmingly positive feedback from consumers.”

She adds: “We believe that non-animal-based breakfast options will continue to grow, as will the desire for more protein via sustainable sources like our Fy protein.” Rawal attributes this rising consumer interest to “younger consumers, who historically seek better-for-you foods [and are continuing] to increase their purchasing power.”

Meanwhile, for plant-based eaters who aren’t fond of dry toast, vegan butter brand Naturli’ has introduced its award-winning products in H-E-B stores across Texas, marking the Danish brand’s U.S. debut. Made with cocoa butter, almond butter, coconut oil and canola oil, Naturli’s butters are 100% dairy- and palm-oil free, as well as being lower in saturated fat and cholesterol than traditional butter, with a lower environmental impact. In another part of the refrigerated section, The Forager Project has rolled out additional varieties of its cashewmilk yogurt: 100% bee-free Honey Alternative in a 24-ounce container and, for its convenient line of 3.2-ounce pouches, Peach and Strawberry Banana flavors.

At the time of the launch of Forager Project’s latter two products this past June, Stephen Williamson, co-founder and CEO of the San Francisco-based company, noted: “We’re still working to pave the way in the category for more family-friendly vegan and organic food options that taste good, and expanding our pouches product line is one way to do this. We want there to be a flavor that everyone in the family is excited about, and we’re confident … this new lineup will offer just that.”

It’s not just smaller companies that are taking notice of plant-based eating patterns, however. Carrie Sander, general manager, portable wholesome snacks at Battle Creek, Mich.-based Kellogg Co., observes that in response to the projected growth of plant-based diets, the CPG giant intends “to monitor this trend for future food development” in regard to the breakfast daypart. Of course, Kellogg is already a leader in plant-based foods through such brands as MorningStar Farms, which offers various frozen meatless breakfast products.

— Bridget GoldschmidtRETAILERS THAT INCORPORATE TIME SAVINGS, GOOD DEALS AND COMMUNITY OUTREACH IN THEIR BACK-TO-SCHOOL PROMOTIONS WILL EARN AN A+ FROM SHOPPERS.

By Jenny McTaggartere’s an assignment for grocers across the country as the 2023 back-to-school season gets underway: Find new ways to help your shoppers save time and money while promoting health, wellness and happiness. This mission certainly sounds like a heavy lift, but harried parents and stressed-out students need more help than ever as they face busy, on-the-go schedules.

Of course, back-to-school shopping can mean many things for supermarkets, ranging from basic school supplies like pencils and paper to food and beverage items that can be incorporated into bagged lunches, along with breakfast, snacks and dinner. Nonfood products like lunch bags, water bottles

The more that grocers can offer solutions to make shoppers’ lives easier, the stronger their brand loyalty will become.

It’s essential for supermarkets to offer competitive pricing where they can through special sales or through promotions tied to their private brands.

Large chains have recognized the value of offering community support, especially for teachers lacking needed school supplies.

Just in time for the 2023 back-to-school shopping season, several industry groups and research firms have come out with fresh consumer insights that can help retailers in their planning. Here are some highlights from a few of the latest surveys:

Consumers are expected to spend record amounts for both backto-school and back-to-college shopping this year, according to an annual survey released July 13 by the National Retail Federation and Prosper Insights & Analytics. Back-to-school spending could reach an unparalleled $41.5 billion, up from $36.9 billion last year. Meanwhile, back-to-college spending is expected to hit $94 billion, about $20 billion more than last year’s record. The increase in expected spending is primarily driven by more demand for electronics, but in the case of college spending, necessities like food also account for more than half of the anticipated increase.

Many shoppers are still concerned about the economy — and their shopping patterns will likely reflect that, according to insights from data platform company Inmar Intelligence. Rob Weisberg, EVP and president of incentives and loyalty at Inmar Intelligence, notes that 88% of shoppers surveyed say that their shopping behavior will change as a result of continued economic friction this season. Meanwhile, 72% say that they would switch, or consider switching, to a different brand because of a coupon or discount.

Most back-to-school shopping at supermarkets will happen in stores, although a sizable number of shoppers like to shop both in stores and online, according to Inmar Intelligence. Almost half of those surveyed (48%) say that they plan to purchase grocery items in stores, while 17% plan to purchase such items online and 33% plan to purchase these products using both channels.

The 2023 Back-to-School Survey from marketing platform Optimove suggests that budget-conscious consumers are willing to invest more in educational needs. Still, more than 70% of those surveyed say that they continue to prioritize price and quality, aligning with trends observed in Optimove’s previous surveys. Pini Yakuel, CEO of Optimove, suggests that retailers build their brand loyalty by “adopting strategies that put customers first, such as attractive loyalty programs and high-value products.” He also notes that having a commitment to education and creating localized programs can strengthen connections with consumers.

and reusable snack bags also make smart additions to the merchandising mix. But ultimately, the more that grocers can offer solutions to make shoppers’ lives easier, the stronger their brand loyalty will become.

Katie Macarelli, manager of public relations at Lakewood, Colo.-based Vitamin Cottage Natural Food Markets, notes that at Natural Grocers stores, “we expand our purchasing and promotional efforts to include how we can truly support our community.” As she puts it, “Back-to-school prep doesn’t have to stop with supplies like scissors and glue sticks.”

Over the years, Natural Grocers has increased its back-to-school promotions, even addressing the topic of boosting immunity in the September 2022 issue of its magazine and online, according to Macarelli. She says that the chain’s efforts have resulted in “positive engagement” from its customers, both in stores and online.

Midwestern supercenter chain Meijer perennially touts convenience and savings in its back-to-school promotions. More recently, the Grand Rapids, Mich.-based retailer has encouraged customers to take advantage

The amount back-to-school spending could reach, up from $36.9 billion last year. Meanwhile, back-to-college spending is expected to hit $94 billion.

Source: National Retail Federation and Prosper Insights & Analytics

“Back-to-school prep doesn’t have to stop with supplies like scissors and glue sticks.”

—Katie Macarelli, Natural GrocersWalmart is offering backpacks and other items at “last year’s prices,” according to the retailer.

When you choose Westfalia Fruit as your avocado provider, you're partnering with the market leader in growing, shipping, ripening, handling, and distribution. For over 70 years, we’ve been committed to providing customers with safe, high-quality fruit while ensuring the sustainable and responsible management of our bio-resources. EXPERIENCE

of its home delivery, pickup, shop-and-scan, and in-store shopping options, according to Karen Langeland, VP of merchandising.

Meanwhile, for the third consecutive year, Meijer has rolled out back-to-school savings of 15% on school and home office equipment for teachers, and this year the chain has expanded the teachers’ discount to include additional categories such as kids’ apparel and accessories through Sept. 4.

While community outreach is important, it’s absolutely essential for supermarkets to offer competitive pricing where they can this year, whether through special sales or through promotions tied to their own private brands. Even though price inflation has been easing in recent months, many shoppers are still very concerned about spending (See the accompanying sidebar on page 40 for more information on back-to-school consumer insights).

Large national chains like Kroger and mass merchandisers such as Walmart and Target are in a league of their own when it comes to competitive pricing. In July, Cincinnati-based Kroger was promoting more than 250 school supplies priced at $3 and under, along with a 30%-off offer on back-to-school gear on its website. Shoppers could also mix and match five or more participating snack/lunch items to save $1 each with a Kroger Plus card, according to a company representative.

Minneapolis-based Target, meanwhile, was selling glue sticks for

just 25 cents apiece, and Bentonville, Ark.-based Walmart promised school supplies and backpacks at “last year’s prices” while touting Pen + Gear and its other store brands. Walmart, Target and Seattle-based Amazon also got an early jump on back-to-school sales by highlighting these products during their midsummer sales periods (Walmart Week, Target Circle Week and Amazon Prime Days, all which occurred in July).

In addition to offering such enticing sales, the large chains have recognized the value of offering community support, especially for teachers who often lack needed school supplies. This year, Walmart launched a Classroom Registry that allows teachers to post their supply wish lists via an online registry. The retailer is also continuing its service of offering online school supply lists curated by school districts and/or individual teachers. Further, in a truly unique service, Walmart has begun offering special sensory-friendly shopping hours during the 2023 back-to-school season.

Target, for its part, is offering Target Circle members a 20%-off College Student Appreciation deal from July 16 through Aug. 26, and has expanded its Target Circle Teacher Appreciation Event (also running July 16 through Aug. 26) to give teachers a one-time 20% discount on an entire shopping trip, either in stores or online.

Whether supermarkets offer competitive pricing, convenience or community outreach — or preferably, all three — they’ll earn high marks this year by more closely considering all of their shoppers’ needs.

Supermarkets will have plenty of new products and promotions to feature as class gets back in session. Here are a few standouts that were recently shared with Progressive Grocer’s editors:

Lunchables, the iconic brand owned by Chicago-based Kraft Heinz, will now be available for purchase by schools nationwide. Two popular offerings — Turkey and Cheddar and Extra Cheesy Pizza — have been reformulated to better meet National School Lunch Program guidelines. Meanwhile, Lunchables with Fresh Fruit will hit the retail market in limited distribution this month, thanks to a partnership with Coral Gables, Fla.based Del Monte Produce Inc. The new line features fresh offerings containing pineapple, clementines, grapes and apples, and initially will be sold in the produce section of select retailers in the South Central region.

Charlotte, N.C.-based Dole is offering in-store signage and point-of-sale materials for retailers. The company also plans to collaborate with social influencers.

Two popular brands from Purchase, N.Y.-based PepsiCo, Jack Link’s and Frito-Lay, are uniting to offer an “iconic collaboration”: new Jack Link’s Doritos Spicy Sweet Chili and Flamin’ Hot original beef jerky and meat sticks.

PepsiCo’s Simply brand has expanded with Simply Smartfood whole grain popcorn, currently available in Sea Salt and White Cheddar fl avors. The betterfor-you snack food, which is non-GMO Project Verifi ed and contains no artifi cial colors or fl avors, is available in two sizes: 5.25 ounces and 1.625 ounces.

Lakeville-Middleborough, Mass.-based Ocean Spray recently launched Snack Medley, single-serve pouches of dried cranberries paired with other premium fruits. The three varieties are Cran-Blueberry, Cran-Pineapple and Cran-Mango. Each box contains fi ve single-serve 1-ounce pouches.

Through Sept. 1, Dole Food Co. is running a back-to-school promotion featuring its beloved mascot Bobby Banana and his friend Pinellopy Pineapple. The campaign features banana stickers and pineapple tags that have a QR code leading to the Dole website, where kids can find digital downloads and printable activities, including a Spotify playlist for Wake Up! Weekdays. Meanwhile, parents will find 15 kid-friendly recipes, lunchbox affirmation notes and more.

MadeGood Mornings Soft Baked Oat Bars, available in Blueberry, Chocolate Chip and Cinnamon Bun flavors, are the first breakfast product from the MadeGood brand, which is known for its organic bars containing no gluten, nuts, dairy or GMOs. The bars are featured in Share Some Good, a back-to-school campaign that allows students to recognize great teachers. Several major retailers are planning to use point-of-sale signage or digital displays in connection with the launch, according to the Vaughan, Ontario-based brand.

Four well-loved snack brands from East Hanover, N.J.-based Nabisco — Teddy Grahams, Chips Ahoy!, Oreo Mini and Ritz Bits — will feature characters from popular Nintendo Switch games on their packaging for a limited time (until Oct. 31). Sold in 12-count multipacks, the snacks are also part of a sweepstakes that features the chance to win a Nintendo Switch Prize Pack.

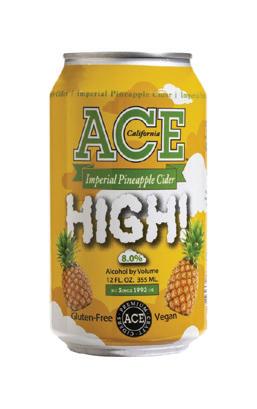

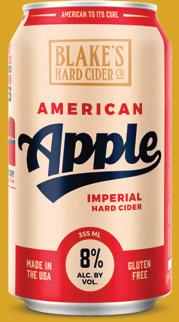

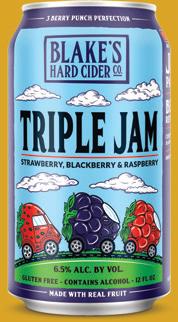

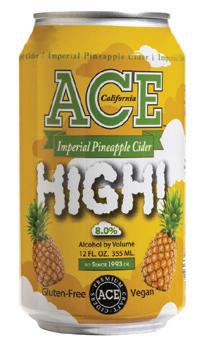

ard seltzers and flavorful ready-todrink cocktails may be darlings in the adult-beverage world right now, but hard ciders are still finding a place in shoppers’ carts. According to Chicago-based insights firm NielsenIQ (NIQ), hard-cider sales racked up $530 million in 2022. Cider is appealing in that it crosses adult beverage types, typically categorized with beer, sometimes produced by wineries and occasionally competing with seltzers. It’s a versatile beverage, too, available in a range of flavors and styles, including sweet and dry.

Although cider sales are off from previous highs — sales have slipped 6% over the past two years, per NIQ — there are innovations and opportunities for future growth in the category. In its report on hard ciders released earlier this year, NIQ underscores the growing appeal of local brands, akin to the craft beer movement, and shares the finding that 54% of total hard-cider sales come from regional and local brands. Other research shows that regional ciders are outpacing many categories within the total beer sector in terms of year-over-year growth.

Blake’s Hard Cider, one of the largest craft cideries in the Midwest, has tapped into that market successfully.

“Millennials continue to drive the growth of the craft beverage segment, due to their views on supporting local/regional brands and wanting products that are made on a more micro scale versus macro; these products tend to have a more authentic and feel-good story,” points out Chelsea Cox, VP of marketing for the Armada, Mich.-based company, adding, “The gluten-free fruited alcohol

Blake's Hard Cider, one of the best-selling Midwest brands, goes big on flavor and offers seasonal variety packs, too.

category continues to see monumental growth, and it’s not from women alone — more men are consuming hard cider now than in the last 50 years.”

In addition to local appeal, flavor is a competitive advantage for hard ciders. According to NIQ’s report, the flavors showing the biggest year-over-year growth include cucumber, blueberry, passionfruit, tea peach and strawberry lemonade. Cucumber hard-cider sales alone rose 3,960%, the data shows.

Cox agrees that flavor is a draw for these adult-beverage products. “We’re also seeing the pendulum swing back from faint-flavor beverages like seltzers to full flavor,” she notes. Among other new items, Blake’s Hard Cider rolled out a Cherry Limeade variety this year.

On that flavor note, other hard-cider brands are leaning into flavor to juice up the category. Walden, N.Y.-based Angry Orchard Cider Co. recently added a Blueberry Rosé hard cider to its assortment. Meanwhile, Corvallis, Ore.-based 2 Towns Ciderhouse often releases limited varieties like Piña Fuego, a chipotle pineapple cider, and Spice, Spice Baby, a honey-spiced cider.

Variety packs are a way to deliver more flavor options to consumers looking to mix

Although cider sales are off from previous highs, there are innovations and opportunities for future growth in the category. Local appeal and flavor are competitive advantages for hard ciders, while seasonality plays into their merchandising and sales, and higher-ABV imperial cider is an emerging subcategory. Hard-cider brands with sustainability or health claims can gain traction among mindful drinkers.

it up. Woodchuck Hard Cider, based in Middlebury, Vt., offers a Brunch Box containing Paloma, Mimosa, Bellini and Bubbly Pearsecco flavors, while Virtue Cider, of Fennville, Mich., has put together a variety pack with Brut, Rosé, Apple and Cherry hard ciders. Additionally, Angry Orchard’s new Blueberry Rosé is part of a pack with Crisp Apple, Green Apple and Tropical Hard Fruit ciders.