To keep instances of waning shopper sentiment from turning into a downward trend, convenience store retailers need to reassess their operating strategy

THE EVOLUTION OF CONTACTLESS CHECKOUT

AVT reduces the likelihood of selling tobacco products to underage individuals.

EASY TO EXECUTE

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT). Tobacco

It’s simpler for associates to execute rather than manually entering in date of birth.

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

The health of the convenience store shopper appears to be wavering

DURING THE NATIONAL RETAIL FEDERATION’S (NRF) recent 2024 “State of Retail & the Consumer” discussion on the health of the American consumer and the retail industry, NRF Chief Economist Jack Kleinhenz said: “The economy is primarily supported by consumers who have shown much greater resilience than expected, and it’s hard to be bearish on the consumer. The question for 2024 ultimately is: Will consumer spending maintain its resilience?”

Consumers appear to have a favorable outlook, which should support their willingness to spend. Yet, many are feeling a pinch from tighter credit and inflation, NRF noted while announcing its forecast that U.S. retail sales this year will increase between 2.5% and 3.5%.

The latest meeting of Convenience Store News’ Editorial Advisory Board likewise included a conversation about the health of the c-store shopper. Board members reported that they are seeing a slowdown in foot traffic, which they believe is related to macroeconomic conditions. Additionally, among the customers who are coming into their stores, more shoppers are trading down and more shoppers are paying for their purchases with credit — both signs that things are getting tighter. “I don’t think it’s reached a tipping point yet,” one board member remarked.

In this climate, it is imperative that convenience store retailers offer consumers the products

they want at the prices they’re willing to pay in the manner they want to shop.

The findings of our 15th annual Realities of the Aisle Study (see page 28) revealed that the percentage of shoppers who say they visit a c-store at least once a week declined 4 points compared to a year ago. The percentage who say they visit the same convenience brand each trip also dropped 7 points year over year, while the percentage who say they shop at the same c-store all the time fell 10 points. This also coincides with a rise in shoppers citing more basic factors such as affordable prices and in-stock products as their top requirements for a positive experience.

In this climate, it is also imperative that convenience store retailers focus on improving their forecourt-to-store conversion rate, getting the most out of every person who comes to their site. Check out our feature on page 36 for advice on how to draw motorists inside.

Only 32% of the c-store shoppers surveyed for our Realities of the Aisle Study said they always or almost always purchase in-store items when stopping for fuel. That means nearly seven in 10 do not. Develop a strategic plan today to seize this significant opportunity.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

Something to think about, but today’s price sensitivity makes it challenging

The reality is that buying a hamburger or chicken sandwich is not the same as booking an airline flight.

WHEN I’M TRAVELING, I try to book my departing flight on a Tuesday. Why? Because flights are usually cheaper then. I also do my best to avoid traveling over holidays, such as the Fourth of July or Thanksgiving weekend. Avoiding crowds is one reason, but I also know that I’ll be paying a premium for flights, hotels, car rental, etc., if I travel during those busier times.

If you are someone who uses Uber or Lyft, you’re probably familiar with the rideshare industry’s use of surge pricing — when the cost of a pickup soars because the number of people seeking a ride exceeds the number of drivers trying to meet the demand.

What’s got me thinking about those things is a recent report that Wendy’s, the thirdlargest burger chain in the United States, plans to test new digital menu technology that would allow it to introduce “dynamic pricing” at its restaurants. Simply put, this would mean that its menu prices would fluctuate during the day. Customers would see higher prices during busy dayparts and lower prices during slower dayparts.

Paul Servais, retail foodservice director for La Crosse, Wis.-based Kwik Trip Inc., told me that he thinks consumer price sensitivity is very high right now. “I think when their guests figure out what they are doing, it will hurt them,” he said, adding that Kwik Trip has not talked about surge pricing, but has discussed pricing food by market, as it does with gasoline.

Ryan Krebs, another veteran foodservice leader at Savannah, Ga.-based Enmarket, is not a fan of surge pricing either. “I don’t see it being something that most c-store operators will risk doing,” he said. “With the massive competition and customer awareness of pricing these days (which I think will continue as costs remain unbearable to the average customer), most customers will seek out the competitor that isn’t participating in surge pricing. If I know Wendy’s is on surge pricing but Burger King (BK) is a half block away not participating in it, customers will line up at BK, even if for making a statement alone.”

That doesn’t mean no one will test it. Ed Burcher, a leading convenience store foodservice consultant, thinks surge pricing is worth trying, especially since Wendy’s digital menuboard project would give them the ability to do it. “Many corporate chains with touchscreen ordering (like Wawa, QuikTrip, Sheetz, QuickChek) already have that ability,” he noted. “This is a technology advantage for them.”

Initial public reaction to Wendy’s idea was so negative that the fast-feeder issued a statement saying that the media had misconstrued the intent of its dynamic pricing plans. The chain said the new menuboards would simply allow it to offer discounts and value offers more easily, particularly at slower times of the day.

However, the reality is that buying a hamburger or chicken sandwich is not the same as booking an airline flight. While Wendy’s might pick up some customers during slow hours, traffic will likely decline during the high-priced time periods. I agree with Krebs, who said: “With a million choices and consumer price sensitivity, I don’t see a standard operator getting buy-in from the general public that would benefit their bottom line.”

FEATURES

COVER STORY

28 Warning Signs Ahead

To keep instances of waning shopper sentiment from turning into a downward trend, convenience store retailers need to reassess their operating strategy.

FEATURE

36 Mastering the Forecourt-to-Store Conversion

Store appearance, lighting, marketing technology and personalized offers are helping c-stores draw customers inside to buy higher-margin items.

DEPARTMENTS

E DITOR’S NOTE

4 On Shaky Ground

The health of the convenience store shopper appears to be wavering.

VIEWPOINT

6 Surge Pricing: Yea or Nay?

Something to think about, but today’s price sensitivity makes it challenging.

12 CSNews Online

21 New Products

SMALL OPERATOR

24 Leaning Into Strengths

When it comes to employee relations, small operators have some advantages.

TWIC TALK

61 Women in Frontline Roles Want More

New research finds there is a disconnect between female frontline workers and their employers.

STORE SPOTLIGHT

63 A Cooperative Endeavor

The new-to-market Kudos brand has the backing of the Greater Houston Retailers Cooperative Association.

INSIDE THE CONSUMER MIND

82 The Prepared-Food Picture

Exclusive research finds purchase incidence at c-stores is up significantly from last year.

Help support more warm and fuzzy moments by stocking your shelves with the #1 dog treat brand1 , Milk-Bone®! Proudly produced in the USA, Milk-Bone dog treats are made with USA-raised chicken or beef and real bone marrow. Plus, they come in trial-friendly pack sizes and price points (a win-win for both pet parents and c-stores).

TOBACCO 42 The Backbar’s New Reality Total Product Expo 2024 addressed the challenges and opportunities facing the tobacco industry.

FOODSERVICE 48 Tipping the Scales With Digital Ordering & Delivery What customers consider fundamental aspects of a good experience is shifting.

SNACKS 52 Blurred Lines Snacking and mealtimes meld as consumers seek out convenience and simplicity.

Goose Media Network provides a new way to enhance offerings for its dedicated consumer base. The retail media network enables Wawa’s customers to engage with partner brands through custom ads and campaigns across a variety of digital channels.

The company’s growth plan for the year calls for adding 35 travel centers, remodeling more than 75 locations and expanding its truck maintenance network of Southern Tire Mart at Pilot Flying J shops.

The retailer opened its milestone travel center at the newly rebuilt TA in Walton, Ky. The site features dining options such as HWY Kitchen and KFC, a store with hot and cold food and beverage options, as well as TA Truck Service and other amenities.

The town ordinance banning tobacco sales to anyone born on or after Jan. 1, 2000, will go forward following a ruling by the Massachusetts Supreme Judicial Court. The ordinance took effect in 2021 and remained in effect during the litigation.

The U.S. Food and Drug Administration filed civil money penalty complaints against 20 brick-and-mortar retailers after they failed to take action in response to previously issued warning letters. The agency has not granted the products market authorization.

In a typical restaurant, and more specifically a quick-service restaurant brand, there is no such thing as a “category manager.” They have chefs, buyers, analysts and marketing executives, writes convenience store foodservice expert Ben Lucky. When it comes to convenience foodservice, he suggests the “category manager” of the future be called something else: the corporate foodservice platform manager or the corporate manager of fresh and prepared foods. It’s then known that the person in this position is not the foodservice manager at a single given site, but rather they run the program for the company.

Shoplifting is becoming a larger problem in retail overall. As convenience store executives engage with their designers on new or redeveloped stores, they should discuss a few basic, orienting questions, such as what can be done to fight shrink by adjusting layout, shelf height and other basic elements; what items are highest on would-be thieves’ priority list; and how does the overall approach to security work in terms of technology platforms, personnel, etc.?

For more exclusive stories, visit the Special Features section of csnews.com.

“The answers, in some cases, could help shape the design of the store,” said James Owens, vice president at HFA Architecture + Engineering. “Fortunately, the convenience store sector for many years now has been gravitating toward open, light-filled, high-visibility store environments. More efficient supply chains have made it easier for them to engage in SKU rationalization. Their stores are less like warehouses full of stuff than they were in the past and so, they’re harder to steal from without being seen. They’re also more pleasing to shop.”

BeatBox presents its latest Partner Series custom sports package in collaboration with the NBA’s Dallas Mavericks. For a limited time, new packaging for the brand’s Blue Razzberry flavor will feature the Dallas Mavericks logo overlaid by the BeatBox branding. The combination of flavor and team are intended to be synergistic, as the signature blue of the drink and team colors align. Both local and national chains in the Dallas metro area began receiving the Mavericks Partner Series in late 2023, including 7-Eleven Inc. and QuikTrip Corp.

BeatBox has another Partner Series on deck for this year in collaboration with the Dallas Stars hockey team.

BeatBox Beverages LLC

Austin, Texas

beatboxbeverages.com

WARNING: Cigar smoking can cause cancers of the mouth and throat, even if you do not inhale.

CEO Chuck Maggelet’s May 1 retirement spurs replacement search

CHUCK MAGGELET, CEO and chief adventure guide of Maverik — Adventure’s First Stop, will retire effective May 1. Crystal Maggelet, chairman and CEO of Maverik’s parent company FJ Management Inc. (FJM), will step into the CEO role temporarily while the company begins a “rigorous and robust” search for a full-time replacement.

“To say this was a challenging decision is an understatement. As you hopefully know by now, I think Maverik is a truly special place. The work we do, the people doing it and the bold decisions we make have created an incredible success story, but I really believe this is the right decision at the right time for Maverik and me,” Chuck Maggelet said. “Serving more than seven years as Maverik’s chief adventure guide has been the best job on the planet. No doubt.”

Under his guidance, the Salt Lake City-based convenience store chain acquired Des Moines, Iowa-based Kum & Go last year. When the

deal closed in August, Maverik more than doubled its footprint throughout the western United States and Rocky Mountain region, growing to more than 800 locations and 14,000 employees.

Crystal Maggelet has served 12 years on Maverik’s board of directors. Under her guidance, Maverik’s parent company has grown into a diverse portfolio of businesses, including convenience retailing, petroleum, healthcare and hospitality. Along with Pilot Corp. and Berkshire Hathaway, FJM was a joint owner of Pilot Flying J and Maverik.

“We’ll continue to focus on having fun together, building the coolest convenience experience on the planet. I’m thrilled to be more involved with Maverik and keep the momentum going,” she said.

“You can also expect me to continue my passion for giving back to the communities in which we operate through charitable efforts like our partnership with Feeding America. Our companies are some of the best in their industries, and I’m excited to lead us into another best year ever.”

New markets such as Georgia, Alabama and North Carolina are part of the expansion

WAWA INC. is officially spreading its wings into southern and coastal Georgia, just one stop in its multifaceted growth journey. The convenience store chain broke ground on its first two Peach State stores, located in Brunswick and Jesup, on March 7.

“It’s official — Wawa is coming to Georgia, and we couldn’t be more thrilled to share details of our exciting growth plans with our newest soon-to-be neighbors,” said Robert Yeatts, senior director of store operations for Wawa. “Our two groundbreaking events gave us the opportunity to meet new faces and share with our new markets a little bit about our history and what makes Wawa such an ideal fit for communities here. We are thrilled to break ground on our first stores and get closer to our first grand openings in 2024.”

Wawa has additional Georgia sites under contract in Brunswick, Jesup, Hinesville, Pooler, Waycross, Bainbridge, Tifton, Valdosta and Albany. Over the next five to eight years, the retailer plans to build and open 26 stores in

southern and coastal Georgia, opening three to four locations per year.

In addition to planting its flag in Georgia, Wawa intends to bring its well-known convenience banner to Alabama and North Carolina for the first time. Expansion into these three states is part of its 60th anniversary plan to open more than 70 new stores over the course of the next year.

Wawa will begin ringing up customers at its first Alabama store, located in Fairhope, on April 25. New stores in Mobile and Robertsdale, Ala., are slated to open this summer,

“Since our first store opened its doors 60 years ago, it’s been an honor serving our communities with trusted quality products and convenience to, most importantly, offering comfort and camaraderie to local friends and neighbors,” said Chris Gheysens, president, CEO and lead goose at Wawa.

“We pride ourselves on brightening days and as we continue to grow, we promise to continue fulfilling lives at every new store and look forward to serving the community for many more years to come.”

©2023 Campbell Soup Company

©2023 Campbell Soup Company

The Cigarette Store LLC

dba Smoker Friendly acquired the Richmond-Master Distributors Inc. stores dba Low Bob’s Discount Tobacco based out of South Bend, Ind. All 54 Low Bob’s locations across Indiana will be rebranded.

The stores are located in Michigan, Minnesota, Wisconsin and Florida.

CrossAmerica Partners LP and its Lehigh Gas Wholesale Services Inc. subsidiary signed a purchase agreement to acquire the assets of Applegreen Midwest and Applegreen Florida. The $16.9 million deal comprises 59 locations.

Buc-ee’s opened its first Colorado location on March 18. The 74,000-square-foot store

in Johnstown, which features 116 fueling stations, is the retailer’s first outside the South.

Sheetz Inc. broke ground on its first Michigan convenience store on March 14. Located in Romulus, this will be the first of 50 to 60 locations the retailer plans to open in the Detroit area within the next five to six years.

U-Stop Convenience Shops, headquartered in Lincoln, Kan., purchased Shop Quik Convenience Stores, based in Manhattan, Kan. The 11-store buy will enhance U-Stop’s presence in Kansas, particularly in Manhattan and Junction City.

Urban Value Corner Store is teaming up with Juxta, a venture by Vontier Corp., to pioneer an autonomous micro market strategy within luxury apartment communities. The companies will combine Juxta’s newest initiative, Nest, with Urban Value’s strong brand presence in upscale living environments.

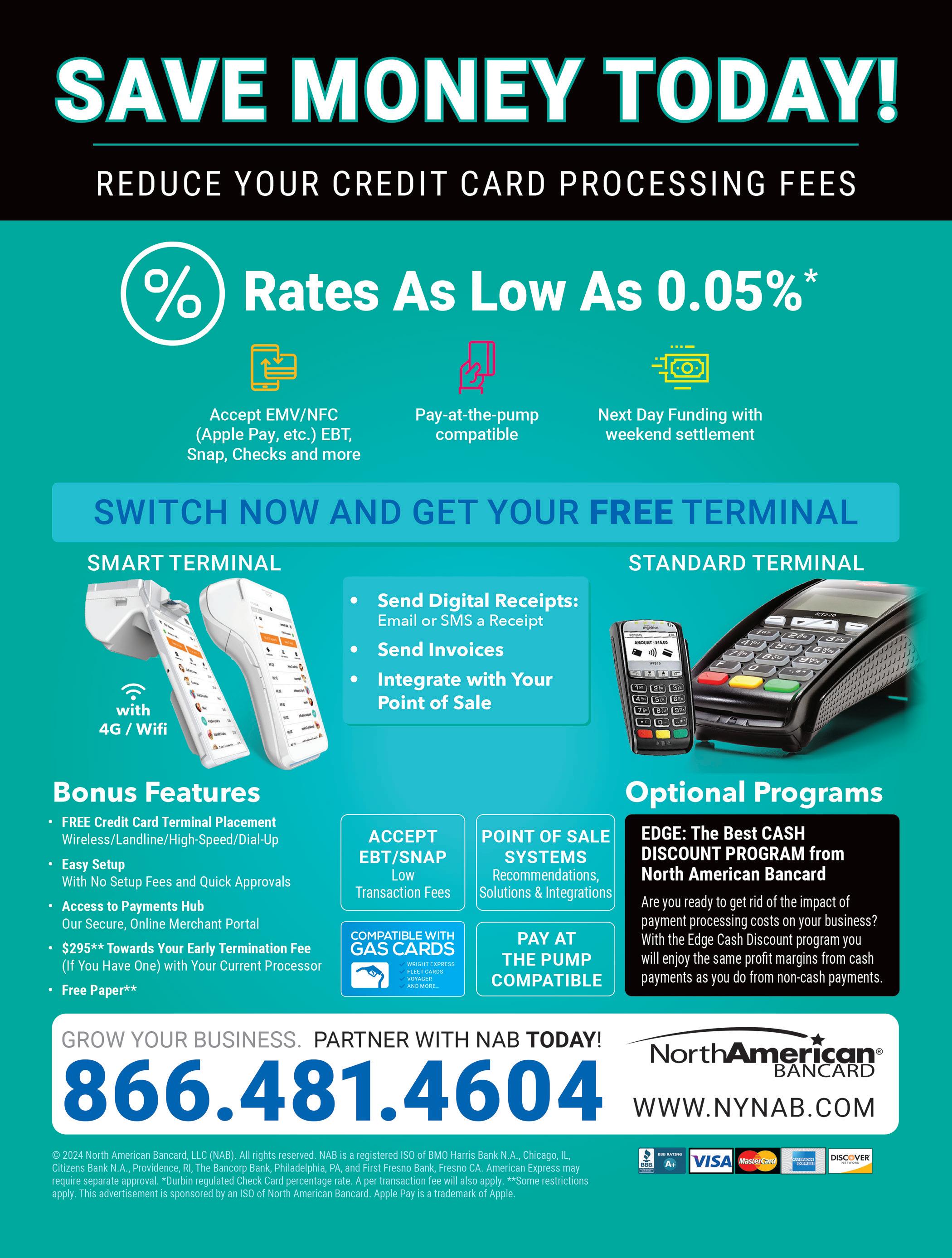

34%

34% of retailers in the convenience and fuel industry have adopted self-checkout, while 37% are currently piloting or scaling deployments.

— NCR Voyix Corp.

40% $10.1B

Nearly 40% of loyalty members indicate that they would stop shopping at a specific location if the store terminated its loyalty program.

— Upside

Sales of store brands increased $10.1 billion to reach a record $236.3 billion last year.

— Private Label Manufacturers Association

Convenience store operators are preparing for the busy summer travel season by adding new team members. Casey’s General Stores Inc., GPM Investments LLC, Love’s Travel Stops, Sheetz Inc. and Wawa Inc. kicked off hiring initiatives in early spring.

Folk Oil Co. and CITGO Petroleum Corp. are piloting an electric vehicle (EV) charging program at a PS Food Mart in Battle Creek, Mich. The EV chargers include both North American Charging Standard and Combined Charging System plugs.

CF Altitude LLC dba Alta Convenience/ Petro-Mart is adding Godfather’s Pizza at 21 Alta Convenience locations. The participating stores are located across several states, including Colorado, Wyoming and Kansas.

Altria Group Inc. is selling a portion of its investment in Anheuser-Busch InBev SA/NV (ABI) through a global secondary offering primarily consisting of ABI shares. Altria holds approximately 197 million shares of ABI, representing roughly 10% ownership.

RaceTrac Inc. and its solely owned franchised brand RaceWay now accept Fuelman fuel and fleet cards. Fuelman card users will be able to fuel at more than 580 RaceTrac locations and 200 RaceWay locations nationwide.

Global Partners LP debuted a new brand identity to reflect the shifting energy landscape. The change includes a new logo, new brand colors and a new tagline, “Putting our Energy to Work.”

Kum & Go’s venture into urban walk-up stores came to end on March 24 when the chain closed its location at 319 Seventh St. in downtown Des Moines, Iowa. The retailer said the fuel-less store concept no longer fits into its long-term plans for the city.

McLane Co. Inc. launched Emerging Brands, a line designed to allow retailers to diversify their product selection with new, innovative and trending brands. A digital marketplace was created in partnership with Mable.

The snacking division of Mars Inc. entered into a pact with Unreasonable Group LLC to create “Unreasonable Food.” The global initiative focuses on supporting rapid-growth companies positioned to redefine food systems through a more regenerative, inclusive and equitable future of food.

For the second year in a row, The Hershey Co. earned a spot among the World’s Most Ethical Companies in 2024, as rated by Ethisphere. Hershey is one of 136 companies that earned the designation this year.

PAR Technology Corp. is acquiring TASK Group for cash and PAR common stock at an implied value of approximately $206 million. This coincides with the company’s completed acquisition of Stuzo Holdings for approximately $190 million.

PDI Technologies expanded GasBuddy’s consumer offers to provide exclusive in-store offers to the community of active users in the GasBuddy app. This integration expands reach for consumer brands and leverages PDI Age Verify capabilities for brands targeting consumers aged 21 and older.

The multichannel initiative is the first since 7-Eleven Inc. acquired the brand in 2021

7-ELEVEN INC. is launching a multichannel campaign in support of its Speedway convenience stores. The Irving, Texasbased convenience retail giant acquired the Speedway brand in 2021 after reaching a $21 billion deal with Marathon Petroleum Corp.

With roughly 3,600 stores, the Speedway network operates in 36 states across the United States, predominately in the Midwest and along the East Coast.

According to 7-Eleven, the new campaign highlights the craveable, high-quality product assortment found at Speedway stores. This includes Big Gulp, Big Bite Hot Dogs, taquitos and 7-Eleven’s frozen beverage, the Slurpee, which is now available at all Speedway stores.

The campaign will run through 2024 and includes 15-second TV spots; 15- and 30-second radio spots; six-, 15- and 30-second social and

online videos; streaming audio and video; out-ofhome marketing; paid digital; and search and programmatic display. At the heart of the campaign is musician and Speedway superfan, JD Eicher.

“We’re proud to unveil this new Speedway campaign, which reinforces to our customers that in addition to being a favorite pit stop for fuel, Speedway is a destination for so much more — like craveable, high-quality snacks at a great value,” said Marissa Jarratt, 7-Eleven’s executive vice president, chief marketing and sustainability officer.

As part of the effort, 7-Eleven also added a Speedway collection of hats, tees, sweatshirts and tote bags to its 7Collection online merchandise store.

Core-Mark International and OLM Food Services present their newest offering, Stuffed Bites. Intended as a hot grab-and-go snack for the convenience store market, the bites come in two varieties: Apple Pie Bites, which contain apples, brown sugar and cinnamon wrapped in a pastry crust; and Breakfast Bites, which contain sausage, egg and cheese in a jalapeño cheddar biscuit. Stuffed Bites can move directly from freezer to oven and bake in 15 minutes, with up to a three-hour warmer time. Each variety comes 194 per case.

CORE-MARK INTERNATIONAL

• WESTLAKE, TEXAS

• CORE-MARK.COM

Gatorade brings its first-ever unflavored water, Gatorade Water, to store shelves. The alkaline water with a pH of 7.5 or higher is electrolyte infused for a refreshing, crisp taste. According to parent company PepsiCo Inc., the premium water was developed for active people looking for an all-day hydration option. Gatorade Water is available in a 1-liter bottle with a suggested retail price of $2.39 to $2.99, and a 700-milliliter bottle that features a sport cap with a suggested retail price of $1.99 to $2.69. The bottles are made from 100% recycled plastic.

Dr. Schär, a leading brand for gluten-free food products, introduces a new addition to its portfolio: Marble Cake. Made with a premium blend of fresh ingredients, the classic treat combines a light and airy texture with decadent cocoa swirls, making it the perfect indulgence for any occasion, according to the company. The Marble Cake is shelf-stable and ready to eat and share. It comes with a suggested retail price of $5.99. The new product is part of Dr. Schär’s mission to improve the lives of individuals with special nutritional needs.

DR. SCHÄR USA INC.

• SWEDESBORO, N.J. • SCHAER.COM/EN-US

Calico Brands Inc. debuts its next generation of utility lighters, the Scripto Aim n’ Flame MAX. The lighter comes in Turbo Flame, Flexible and XL models, all of which include new barrel colors and updated packaging. According to the company, the lighters feature the largest fuel supply of any disposable utility lighter. The Scripto Aim n’ Flame MAX has a one-step EZ light ignition with a patented child resistant mechanism that exceeds Consumer Product Safety Commission requirements, along with a 7.6-gram fuel capacity and adjustable flame. The series is available in single packs and twin packs, which are designed to allow both packaging types to fit into the same single-pack display.

CALICO BRANDS INC. • ONTARIO, CALIF. • CALICOBRANDS.COM

Gilbarco Veeder-Root launches the EVerse Electric Vehicle Charging Infrastructure (EVCI) Finance Program, which is designed to support fuel retailers seeking to adopt EV charging stations into their business. Leveraging special financing options provided by Patriot Capital, the program is intended to address common retailer concerns around implementation costs by offering the only currently available end-to-end e-mobility platform designed for fuel retailers, the company stated. The program offers step-up payment structures, 90-day payment deferrals, and three options for funding via the National Electric Vehicle Infrastructure program.

GILBARCO VEEDER-ROOT

• GREENSBORO, N.C.

• GILBARCO.COM

The Killer Brownie Co. launches its gourmet Kitchen Sink Brownie in individual packaging designed specifically for distribution to convenience stores and other related retailers. The Kitchen Sink Brownie features a mixed topping of rainbow sprinkles, M&M’S and mini chocolate chips, all baked atop a fudge brownie. The company’s wholesale distribution package includes 44 pieces in a case, with brownies that are fully baked and frozen, ready for quick thawing and selling.

THE KILLER BROWNIE CO. • DAYTON, OHIO • KILLERBROWNIE.COM

Danone North America’s International Delight brand introduces Cold Foam Creamer, a new offering intended to turn any hot or cold coffee into a “foaming” coffee shop drink with the flick of a wrist. The creamer comes in three fan-favorite flavors — French Vanilla, Caramel Macchiato, and Sweet & Creamy — and will both foam and cream a customer’s coffee, gradually mixing creamer into the drink without the need for frothers or other tools. International Delight Cold Foam Creamer comes with a suggested retail price of $5.49.

DANONE

BIC debuts its newest series of licensed lighters, the Icons series, featuring Elvis Presley and Marilyn Monroe. The series celebrates the mid-century celebrities, whose images have themselves become a trademark within popular culture, according to the company. The designs capture some of the most recognizable images of the rock-and-roller and blonde movie star while also adding touches of modern design. Like all BIC Maxi Lighters, the Icons series lighters are long-lasting, reliable and 100% quality inspected. They come with a suggested retail price of $2.79 per lighter. BIC USA INC. • SHELTON, CONN. • US.BIC.COM

Clearcor Displays presents a collection of clear acrylic offerings specifically for convenience stores. The items are shipped from stock and come in floor stand displays or countertop models. The company suggests using its line for categories such as liquor, vape, CBD, smokeless tobacco, nicotine pouches, vitamins and supplements, and accessories. All the displays are produced in the United States from high-grade acrylic material and feature a modular, stackable design that allows retailers to add capacity as needed. Removable category headers can be purchased separately. Custom displays with imprinted store names and logos are also available.

CLEARCOR DISPLAYS

• GERALD, MO.

•

CLEARCORDISPLAYS.COM

Retail pricing and analytics solutions provider Revionics unveils its first generative artificial intelligence (GenAI) innovation, a GenAI-powered chatbot that can serve as a knowledge resource for retailers using the company’s intelligent pricing platform. Clients can ask the chatbot questions and get responses back in seconds. The chatbot operates via a retrieval-augmented generation system and draws on Revionics’ user guide library to provide answers, ensuring responses are up-to-date. The chatbot will be available in Revionics’ next software release, targeted for the first quarter of 2024. Additional investments are planned throughout the year, with later phases incorporating advanced data mining and analytics capabilities. REVIONICS LLC • NEW YORK • REVIONICS.COM

NORTH AMERICA

NORTH AMERICA

If you’re competing in B2B you need a strategic creative partner that knows your industry inside and out. Only EnsembleIQ’s BrandLab offers full-service marketing capabilities and deep experience across retail, CPG, and technology, infused with industry knowledge and marketing intelligence.

If you’re competing in B2B you need a strategic creative partner that knows your industry inside and out. Only EnsembleIQ’s BrandLab offers full-service marketing capabilities and deep experience across retail, CPG, and technology, infused with industry knowledge and marketing intelligence.

YOU DON’T NEED a big human resources (HR) department to win over employees. Granted, running a small business in an industry with thin margins and high overhead can be tougher without the backing of a large parent company, but experts say smaller operators should focus on their local advantages in today’s dynamic labor market.

“Small businesses might not be able to offer as high of pay or as rich of benefits as chain stores, but what they do offer is the ability for employees’ voices to be heard and more autonomy,” said Heather Whitney, HR services senior advisor at Paychex Inc., a provider of integrated solutions for payroll, benefits, human resources and insurance services. “Employees have a greater sense of belonging at small stores where they know each of their coworkers vs. in chains where they may never see or know who upper management is.”

Additionally, single-store and small operators should realize they are often viewed with a certain sentimentality and contribute meaningfully to the character of the community, according to Whitney. “As a result, employees at these types of

establishments often see more meaning in their work than their counterparts at national chains, contributing not just to the business’ revenue, but to the community as a whole,” she said.

Smaller retailers would do well to know who they are — and who they are not.

“This is about focusing on the fundamentals, using your resources and not trying to compete with the bigger players in ways you cannot win,” said Aaron Sorensen, partner, chief behavioral scientist and head of transformation at Lotis Blue Consulting.

Based on his company’s recently released “Future of Retail Workforce” study, there are three major factors that are among the top drivers of engagement and retention:

• Interesting and meaningful work;

• Relationships and camaraderie with coworkers, or a sense of team; and

• A high-quality manager/managers.

“Winning on these aspects of the work experience doesn’t require big budgets or large corporate HR departments,” Sorensen told Convenience Store News

Labor experts offer the following tips for small operators looking to wow their workforce:

Join thousands of retailers helping to prevent adult purchases of tobacco and vapor products on behalf of those underage. Prevent

Pay sufficiently. Whitney believes that cost of living raises and merit-based adjustments aren’t just for corporate roles. The way she sees it, if smaller retailers want to keep good people around for the long haul, they must reward tenure with some level of increased wages.

“Pay sufficiently by scanning local pay practices, but recognize that pay isn’t everything. Specifically, competitive pay matters, but paying the most doesn’t lead to attracting more talent and lower turnover,” Sorensen added, noting that it would be best for small operators to focus on the aspects of their employee value proposition that are more desirable.

Make sure you have great store leaders. Hiring and developing store managers is the single greatest opportunity for small operators, according to Sorensen, because great managers create great experiences. He suggests that when hiring, small operators look for leadership experience in sports, military or previous (perhaps competitive) companies.

Emphasize flexibility and accommodation. Small businesses are inherently more flexible than large corporations, which means small operators have a unique advantage to prioritize employee input and communication regarding aspects about the job that really matter to them. “Consider letting employees weigh in on decisions around scheduling, opening on holidays and other [things],” Whitney said. “This helps them feel more connected to the business’ success and more valued in the workplace.”

Along with that, small operators should recognize that circumstances are always changing for employees and if they want to keep them on board, it will help to roll with those personal life punches. “Accommodating changing employee needs — whether long- or short-term — by allowing flexible schedules, adjusted responsibilities or other shifts in their work arrangements can help keep the team strong,” Whitney explained.

Provide a strong sense of safety. Small operators have a good opportunity to maintain strong relationships with local law enforcement, both by bringing them in-store with discounted or free food and beverages and by doing outreach to community organizations, law enforcement and civic groups to strengthen connections and collaboration.

A recent study conducted by the NACS/

According to a new NACS/Coca-Cola Retailing Research Council report that looks at the challenge of attracting and retaining frontline staffers, the most common reasons why non-managers stop working at a convenience store are:

• Looking for a higher salary (49%)

• Found a higher salary wage position (43%)

• Negative work environment and teamwork (23%)

• Safety concern (21%)

• Long hours/shifts (19%)

• Far from home/other job (18%)

• Continuing education (17%)

• Bad benefits/employee perks (17%)

• Poor relationship with manager (16%)

• Lack of flexible schedule (16%)

• Lack of recognition and appreciation from managers (15%)

Coca-Cola Retailing Research Council (CCRRC) found that maintaining strong community ties allows individual retailers to access police, first responder and social resources more effectively and can serve as a natural deterrent to safety incidents, while bringing peace of mind to employees.

Promote “good news” community stories. The NACS/ CCRRC study also found that smaller operators have an excellent opportunity through social media and local media to promote community angles and celebrate local employees as heroes. Individual retailers can — and should — make a more concentrated effort to tell their own stories to improve customer interactions and establish a sense of pride with employees.

Plan to invest in labor management technology/ services. This can help significantly as it allows the small operator to outsource administration, payroll and compliance-related tasks to experts, according to Whitney. “That gives them what everyone needs: more time in the day. Small operators who use that time to focus on the things that make their store special — to employees and patrons — will see their labor challenges become more manageable.”

In the coming years, success will be all about playing to strengths and focusing on what makes your local business attractive to customers, Whitney concluded.

“A small business that is more active in the community and knows itself as a company is more likely to attract and retain the right employees,” she said. “Sometimes, it is as simple as acknowledging your employees’ needs within their communities and figuring out how the company can take part in growing that.” CSN

EnsembleIQ is the premier resource of actionable insights and connections powering business growth throughout the path to purchase. We help retail, technology, consumer goods, healthcare and hospitality professionals make informed decisions and gain a competitive advantage.

EnsembleIQ delivers the most trusted business intelligence from leading industry experts, creative marketing solutions and impactful event experiences that connect best-in-class suppliers and service providers with our vibrant business-building communities.

TO KEEP INSTANCES OF WANING SHOPPER SENTIMENT FROM TURNING INTO A DOWNWARD TREND, CONVENIENCE STORE RETAILERS NEED TO REASSESS THEIR OPERATING STRATEGY

BY ANGELA HANSON

BY ANGELA HANSON

But there are warning signs on the horizon.

FROM A DISTANCE, the convenience store industry is doing well as store counts grow, foodservice programs stay competitive with restaurant channels and several packaged product categories are on pace to see consistent growth this year.

Data from Convenience Store News’ 15th annual Realities of the Aisle Study indicates shopper satisfaction and loyalty are slipping in certain areas. Nearly two-thirds of shoppers (64%) visit a c-store at least once a week, but that figure declined 4 points compared to last year. Many competing retail channels are also seeing decreases in weekly shoppers, suggesting a shift toward less frequent shopping trips overall.

For convenience store retailers, which strongly benefit from shoppers who make a habit of visiting their preferred store, it may be more alarming that the percentage of shoppers who say they visit the same convenience brand each trip dropped 7 points year over year, while the percentage who say they shop at the same c-store all the time fell 10 points.

This doesn’t mean the c-store industry is facing a loyalty crisis, as nearly three-quarters of shoppers do typically stick to the same c-store brand and 84% typically shop at the same store. However, the data does signal that retailers can’t take their customers for granted.

As c-store operators firm up their plans for the rest of 2024, they should approach the year as a make-or-break opportunity to take stock of their current strategy and performance, and make active choices to engage with customers around what they want — because if they go on autopilot, what could be just a bump in the road may turn into a bigger problem down the line.

The good news is that c-store shoppers continue to give the channel high marks for its core attributes of general convenience and speed of shopping, with just over two-thirds of shoppers rating c-stores as excellent/ very good in these areas. The bad news is that most other attributes are seeing performance ratings fall, with declining shopper satisfaction particularly prominent around the price of products, embrace of technology, store organization and employee helpfulness.

At the same time, consumers are less concerned with “the shopping experience” than they were a year ago. Less than half of surveyed shoppers say experience is very important/important to them, a 5 point drop from last year’s study. This coincides with a rise in shoppers listing factors such as affordable prices and in-stock products as their top requirements for a positive experience.

Surveyed shoppers report noticing fewer out-of-stock products in the convenience channel than they did one year ago, which is good news considering that the percentage of shoppers who say they will leave without making a purchase upon encountering an out-of-stock situation rose 7 points this year to 37%. A third of shoppers say they will go to a different store.

The timing and nature of c-store shopping trips has largely remained consistent from last year: 61% of respondents say they shop at c-stores while running other errands, with special trips from home being the second most common. Trip counts grow throughout the day, peaking at the 4 p.m. to 6:59 p.m. daypart, when 38% of surveyed shoppers report they typically make their c-store visits.

The percentage of shoppers who visit a c-store at least once a week declined 4 points compared to a year ago.

74%

Generation Z (aged 18-26) and millennials (aged 27-42) drive the late afternoon/early evening foot traffic, with 49% of Gen Z and 46% of millennials saying they typically shop during this time.

Despite inflation, the average spending per c-store trip is holding steady at $12, with shoppers most likely to pay using a debit card (43%). The use of cash rose 5 points this year to 35%.

Shoppers say they are purchasing most product categories at the same rate as they did a year ago. However, general merchandise, prepared food, packaged snacks and edible grocery all saw a decline in the highest level of purchase frequency.

Salty snacks are the food item most frequently purchased at c-stores, with 44% of surveyed shoppers reporting they made such a purchase within the past month, followed by candy/gum/mints (42%), grab-and-go prepared food (39%) and packaged sweet snacks (38%). Eight of the top 10 food items showed growth year over year.

Conversely, when it comes to beverage items, bottled/ canned soda (the most frequently purchased beverage type) and bottled water were the only segments to post growth this year. Liquor, beer and energy shots showed the greatest declines year over year.

Meanwhile, fuel and lottery tickets remain the top nonedible items purchased, by a significant margin, with shoppers reporting no change in these purchases compared to a year ago.

84%

Less than half of surveyed shoppers say “the shopping experience” is very important/important to them, a 5 point drop from last year’s study.

LIGHT RIGHT. SECURE SPACES. EARN MORE. A TRUSTED INDUSTRY INNOVATOR FOR OVER 45 YEARS

As an industry leader in Lighting, Graphics, and Display fixtures, companies turn to LSI to solve their challenges in enhancing their brand, safety, and profitability.

Price/value

Food quality

Freshness

Taste

Convenience/on-the-go

Sanitation

Speed of service

Location

Shoppers consider price/value the most when they purchase prepared food at a c-store.

Feeling hungry/thirsty is the No. 1 factor shoppers cite as influencing their decision to purchase in-store products while on a fuel trip — 60%, up 11 points from a year ago. Additionally, 69% of surveyed shoppers report having bought prepared food at a convenience store at least once in the past month, up an impressive 14 points from last year’s study.

Still, among shoppers who did not buy prepared food, the percentage who cite a preference not to purchase such items at a c-store rose 11 points to 41%, indicating that retailers still have work to do to win over those customers who don’t look to the channel to satisfy their appetite.

Prepared food shoppers at c-stores are largely

satisfied with what they buy, though the percentage of respondents who said they were extremely/very satisfied with their most recent purchase fell 8 points from last year. This should be a signal to retailers that despite the category’s overall good performance, they need to be vigilant about keeping their foodservice program standards high.

Shoppers consider price/value the most when they purchase prepared food at a c-store, indicating that they are still feeling the pinch of economic factors even as inflation eases somewhat. C-store operators should balance pricing with the other top attributes of food quality, freshness and taste. Compared to one year ago, freshness, sanitation and menu choices increased significantly in importance among surveyed shoppers.

As convenience store retailers take stock of their

Participation in C-store Loyalty Programs

Does the convenience store you shop most often have a loyalty program?

I would not enroll even if they did

17%

I am not enrolled 19%

I am enrolled but do not use 14%

I am enrolled and actively use

If they did, I would enroll 42%

Extremely/ very satisfied

The percentage of enrolled and active members who say they are extremely/very satisfi ed with their preferred c-store’s loyalty program dropped 6 points year over year.

strengths and weaknesses and consider how they can better meet shopper expectations, they should be sure to include loyalty programs in their analysis. Just under 20% of surveyed shoppers cite frequent buyer/loyalty programs as influencing their decision to shop for in-store products while on a fuel trip.

Although approximately two-thirds of respondents say the c-store they visit most often has a loyalty program, and participation in such programs remains steady at 42% of shoppers enrolled and actively using a program, satisfaction with the member experience has fallen. The percentage of enrolled and active members who say they are extremely/very satisfied with their preferred c-store’s loyalty program dropped 6 points compared to last year.

Awareness of and engagement with loyalty program mobile apps has also dropped — 60% say they have used their program’s mobile app, down 10 points from last year, while the percentage who say their loyalty program

has an app but they have not used it rose 5 points to 21%.

Offering loyalty program members personalized deals and promotions could be the way to prompt more shoppers to make frequent use of their loyalty program membership rather than leaving it as just another installed but never-used app on their phones.

Close to eight in 10 active loyalty program participants indicate that they are at least somewhat comfortable with personalized/targeted ads, while 32% describe themselves as very comfortable. Just 8% say they are not at all comfortable with personalized/targeted ads.

Less-than-satisfied loyalty program members feel that the rewards are not valuable to them and too many purchases are required to obtain rewards.

“Too much money spent to earn tiny rewards that are usually worthless,” summarized one surveyed shopper. CSN

Store appearance, lighting, marketing technology and personalized offers are helping c-stores draw customers inside to buy higher-margin items

By Tammy MastroberteFOR YEARS, convenience store operators have been focused on getting gas-only customers to come into the c-store where the high-margin items are found. Today, many have broadened their efforts to increase the number of customers coming onto the lot as well, and in the expanding electric vehicle (EV) charging market, this is yet another customer available to bring to the lot and convert to an in-store shopper.

The key to conversion often comes down to first, knowing your brand and your customers and then, making sure you are effectively communicating what you have to offer them.

“First and foremost, retailers have to know what makes the experience with their brand different, and how they surprise and delight to engage customers,” said Kay Segal, founding partner of Business Accelerator Team, a Phoenix-based consultancy. “After that, is your store assortment appropriate for

the customer you are trying to bring in, and how are you communicating that by marketing with the intent of what you want the customer to do?”

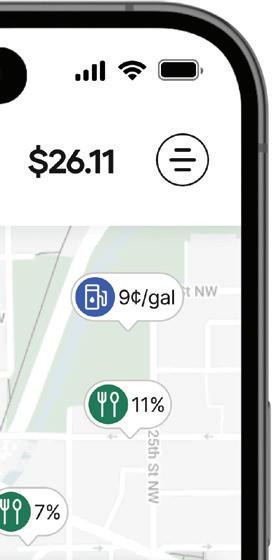

In today’s digital world, it’s important to engage people how and when they want to be engaged, and to make the engagement personal because that is what consumers expect now, according to David Poulnot, vice president of multivertical sales at digital marketplace Upside, based in Washington, D.C. Consumers are used to highly personalized and “curated experiences” with the internet and are expecting that in the brick-and-mortar world as well, he noted.

“Pumptoppers and television screens at the pump are static and one size fits all, so retailers need to think of ways to also move past that and capture customers’ attention in the moment, and in a way that is relevant to them,” Poulnot said.

While technology is key to marketing in today’s world, retailers must also remember the basics, according

to Peter Rasmussen, CEO and founder of Convenience and Energy Advisors, a consulting firm based in St. Petersburg, Fla. This includes a welcoming and inviting store, clean bathrooms and proper lighting.

“When you think about what drives you to a destination, you could have video at the pump or the right POP [point of purchase], but is your location consistently clean and attractive?” he posed. “Clean bathrooms matter because that will get people into the store.”

New marketing technology allows c-stores to personalize offers, especially through loyalty programs that track customers’ past purchases. Pairing this with geofencing technology to target customers who are near the store or on the forecourt can generate a lift in traffic to the store.

“Consumers want connection, and it’s not just an AI [artificial intelligence] driven personalized offer that is not really personalized where they get the same offer three days in row for something they just bought. You can’t completely take human interaction out of the equation,” said Segal.

When it comes to a loyalty program, there needs to be a good initial offer to get people to sign up and then, from that point on, a c-store can start to personalize and target a customer with offers based on what they typically purchase using some elements of AI, said Rasmussen. For instance, an offer such as 10 cents off gas based on when the consumer was there last and would typically need fuel again.

Marketing shouldn’t solely focus on loyalty members, though. C-store operators need to think beyond that and look at a total digital strategy, even utilizing social media,

according to Segal, noting that the retailers with the best social media platforms are not only posting what is on promotion, but also looking to create a community through events and more.

“What is your brand doing to support the local community and how does that play into your strategy?” she posed. “For example, Casey’s [General Stores Inc.] gives back to charities in each of the areas they have stores, and other brands do that as well.”

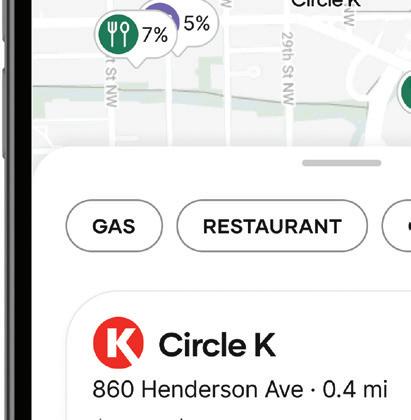

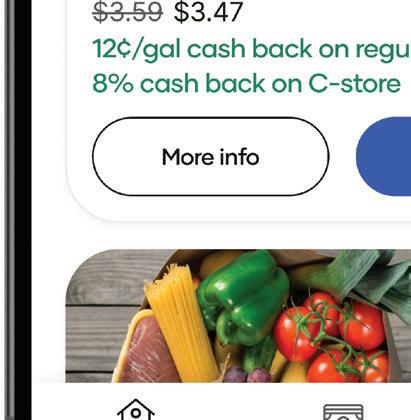

Retailers also need to look at consumers who are not yet shopping their stores or pulling onto their lot for fuel so that they can expand their reach. Technology can play a role here as well. There are mobile apps such as Upside — and Mudflap in the truck stop market — that are designed to drive people to a location, Rasmussen pointed out.

“In many cases, a customer’s experience is beginning prior to visiting a location and starts with why they want to stop there,” he said, explaining that mobile apps like Upside offer personalized promotions aimed at driving new customers to a store. C-store retailers including Terrible Herbst Oil Co., Circle K Stores Inc. and Road Ranger partner with Upside in this way.

“Convenience stores need to continually focus on ways in which to acquire new customers and think about how to grow the business long-term. That comes with investing in ways to personalize the experience to consumers, both at the pump and before they get to the stores,” said Poulnot.

Many c-stores utilize video screens at the pump to drive in-store traffic as well, either built into the pump or added on. Some of these screens simply advertise in-store offers, while others enable ordering at the pump.

“Running your own programming at the pump instead of selling to outside ads gives you a captive audience,” said Rasmussen. “Also, strong foodservice offers can drive orders from the pump, or a mobile app while at the pump.”

Mobile apps such as Upside and Mudflap are designed to drive new customers to a location.

“The forecourt needs to look good, and the store needs to be bright and clean. A lot of new store designs are featuring bigger glass in the front of the store to essentially bring the store out to the forecourt.”

— Kay Segal, Business Accelerator Team

Even with a mobile app, digital coupons, personalized offers and geofencing, c-store operators cannot forget the basics of attracting a customer to their location and that encompasses the overall look and feel of the store, including lighting, clear windows, clean restrooms, etc.

“The forecourt needs to look good, and the store needs to be bright and clean,” Segal advised. “A lot of new store designs are featuring bigger glass in the front of the store to essentially bring the store out to the forecourt.”

The look of a location during the day is just as important as at night. Lighting can make a significant difference in portraying a c-store as safe and inviting to consumers.

Robin Hood, executive vice president at Cincinnati-based LSI Industries Inc., recommends retailers do a site audit at night, taking photographs from a variety of angles and distances to understand how the site is perceived by a customer and uncover where they can improve.

“Safety and security are factors for the overall experience, especially at night. Also, if it’s dark outside a store, it can give the impression that it’s dirty, which can carry over to the daytime and overall cleanliness and perception — especially with c-stores offering fresh food,” Hood noted.

LSI Industries provides outdoor lighting that directs light from the canopy into the store. The supplier has seen a lift in in-store sales and traffic among those that have incorporated this “forward throw lighting,” along with archer lighting that shines around the perimeter of the store.

Dale Lovejoy, director of petroleum lighting as LSI Industries, pointed out that once on a site, what is influencing customers to go inside the store, especially at night, is illumination paired with some type of advertising or graphics.

“Most marketers understand the importance of lighting, but after day one of the store opening, they don’t often look at making improvements in this area,” he said. “It’s one of the lower investments that can offer a significant improvement to getting customers into the store.”

While lighting is often thought of as “functional,” it can be used strategically to throw light from under the canopy to the store and actually light the pathway into the store. This can lead to an increase in sales, which Hood said LSI has measured with its c-store customers.

Segal acknowledged that historically, c-stores have been better at merchandising than marketing, but she said it all starts with understanding the customer need state — whether a fuel fill-up or an EV vehicle charge — and then thinking through what a retailer can offer that customer.

“When do your customers utilize your site — on the way to work, on their way home from work, on a highway trip?” she questioned. “Need states will vary. Communication of what could be of interest to them before, during and after the visit is key.” CSN

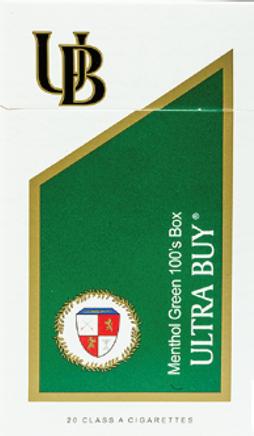

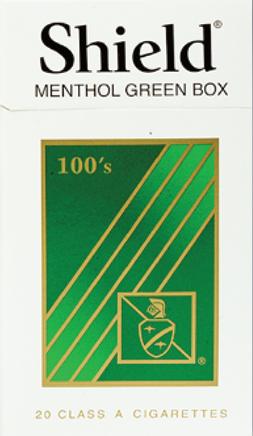

CONTENDING WITH the changing regulatory environment and continual sales declines in the cigarettes category, tobacco and nicotine companies of all sizes are pivoting to embrace alternative backbar products. The goal of a smokefree future, however, may be easy in concept but challenging in reality.

In the opening session of Total Product Expo (TPE) 2024, entitled "Industry Outlook: The Path Ahead,” Tobacco Manufacturers’ Association (TMA) President and CEO Chris Greer outlined the three biggest issues the industry is dealing with as a whole. They are:

1. Regulations;

2. Business operating environment; and

3. Regulatory uncertainty.

A discussion about the tobacco industry and its future would not be complete without the mention of flavors. Currently, the White House Office of Management and Budget (OMB) is reviewing the U.S. Food and Drug Administration’s (FDA) proposals to prohibit the use of menthol in cigarettes, roll-your-own and heated tobacco products, in addition to prohibiting all characterizing flavors (other than tobacco) in cigars.

The OMB’s review of the economic impact of the proposed product standards is

required before the standards can go into effect.

However, some in the industry are questioning if any action will proceed with the presidential election on the line this November.

In the absence of federal action on flavored tobacco products, state and local officials have taken matters into their own hands. As Greer pointed out, five states and nearly 400 localities in 12 states have enacted some kind of flavor ban to date.

Additionally, the FDA’s Center for Tobacco Products has issued numerous marketing denial orders for premarket tobacco product applications for flavored products.

“This is basically a de facto ban. Everything that has been knocked out has been a flavor,” Greer told attendees of the largest TPE event to date.

As the industry awaits a decision — one way or the other from the OMB — some insiders aren’t betting on a decision anytime soon. Participants in a “Future of Flavors” panel discussion mostly agreed that they were not surprised the Biden Administration pushed the decision back from yearend 2023 to early 2024. Even if a decision does come through sometime this year, it will not bring an end to the debate on flavors, they believe.

“I am not surprised by anything the government or a government agency does, and I think we will see this go on for years,” said Terry Gallagher, CEO of Boulder, Colo.-based Smoker Friendly. The largest licensee of Smoker Friendly International, The Cigarette Store LLC,

Products shine with siffron’s many display options

siffron is your one-stop source for all of your display and merchandising fixture needs. With the industry’s widest selection and largest inventory, siffron has more than 6,000 products, including pegboard hooks, pricing strips, shelf dividers, impulse merchandisers, shelf management, wire display racks, loss prevention solutions and so much more!

Convenience Store News: Siffron is a leading provider of retail fixtures, store shelving and shelf management systems to c-stores. What issues are c-stores facing today as they relate to merchandising product in-store?

Robb Northrup: Operational efficiency is one of the most significant focus areas. Over the past couple of years, we have seen an increase in the number of retailers testing and implementing electronic shelf labels (ESLs) to replace paper labels on fixtures. While implementing ESLs requires a considerable investment, it also results in tremendous efficiency gains. A typical price change could take days from initial launch to implementation. With ESLs, price changes can be automatically pushed out and updated instantly, reducing the potential for lost revenue due to incorrect price marking. Additionally, pricing can be optimized for various times of the day, week, or month and adjusted, helping retailers maximize opportunities as they arise.

Retailers also are struggling with labor issues. It is essentially about making do with less. They are looking for efficient fixtures that help reduce the time it takes to manage products on-shelf.

Finally, there is retail theft, which also has an employee safety component. According to the National Retail Federation’s National Retail Security Survey 2023, retail shrink rose to $112.1 billion — and theft accounted for 65 to 70 percent of that. Consequently, c-stores are looking for solu-

tions and best practices that will prevent theft and reduce workplace violence.

CSN: How can stores tackle those problems, and how can Siffron help? RN: Implementing ESLs is one solution, and our expertise in attaching price marking to any fixture helps reduce any friction to implementation. We have an extensive catalog of solutions for ESL tags, and work with our customers to develop specific applications that don’t already exist. We rapid-prototype concepts to verify fit and function and can turn finished products in a short time frame. This allows ESL companies to focus on tag availability and software functionality while we provide the attachment methods to keep projects on time and within budget.

In terms of labor-saving solutions, our customers have leveraged our products to optimize time spent managing merchandise on the floor. Our NEXT Pullout Tray has been a popular solution, especially in the bagged candy and snack aisle. Retailers have found they can gain 25 to 30 percent more facings in the same planogram when using the tray instead of peg hooks, and the pullout feature lets them more quickly load product and ensure stock rotation to eliminate loss due to product expirations. The pullout feature also reduces the time it takes for cycle-counting products for inventory verification while increasing the accuracy of those counts. When a fixture helps organize products and makes it easier for customers to find products and for staff to do their jobs, it’s a win-win for everyone.

When it comes to loss prevention, a single-solution approach is not the way

“Retailers have found they can gain 25 to 30 percent more facings in the same planogram when using the tray instead of peg hooks.”

to go. Many factors go into the decision about the level of protection needed and where it will be implemented. Siffron offers solutions that completely lock products up and more open solutions like our Invisi-Shield™ that limits access to merchandise via sliding protective tiles. In our work with the Loss Prevention Research Council, we have found a multi-tiered approach often works best.

Layers of deterrence increase the risk for offenders while keeping products available to honest customers. Siffron’s SONR System provides that protection by creating alerts and alarms at the display level, echoing them across the store. It also can connect to in-store systems like CCTV or public viewing monitors to show and record activity. Combining these components presents a high level of deterrence with minimal impact on everyday customers and can be used with pegged or shelf-based products.

CSN: How can retailers decide which merchandising solutions are most appropriate for their stores?

RN: Siffron has partnered with retailers large and small for over 60 years. Our experts can advise and recommend best-in-class solutions that meet each store’s operational, category, and budget objectives.

is the biggest tobacco store retailer in the United States.

Prohibiting the sale of menthol cigarettes and flavored cigars would have a huge impact on the convenience channel from both a consumer and retailer perspective, the panelists explained.

According to Jessica Zdinak, chief research officer at Applicated Research and Analysis Co., roughly 40% of the sample in its focus groups and surveys are menthol cigarette smokers. Menthol cigarettes are favored by the non-Hispanic Black population, among whom say, “Don’t take my menthol cigarettes away from me,” she noted.

On the retailer side, Gallagher cited NACS data that puts menthol at 34% of the c-store market. Additionally, 51% of flavored cigars are sold in convenience stores.

What can tobacco retailers do to prepare for any potential federal ban? According to Gallagher, they should:

• Stay focused on what they do day to day.

• Look for alternative products to take the place of flavored products on the backbar.

• Work with their manufacturer and distributor partners to manage inventory.

While questions swirl around a federal ban on flavors, states such as California and Massachusetts have already approved statewide prohibitions. Smoker Friendly licensee dealers in those states prepared

for the implementation dates by eliminating products from their shelves, Gallagher explained.

After implementation — January 2021 in California and June 2020 in Massachusetts — retailers in both states lost sales, he shared, pointing out that Massachusetts retailers saw business cross the border into New Hampshire.

“What really hurts them is that there are a lot of outlaws in the retail business who continue to sell those products and there is very little enforcement on the state and local levels,” Gallagher said. “[Bans] force the consumer to either go across the border or look for black-market products, and that impacts retailers’ sales.”

Industry watchers trying to predict which states will follow the lead of California and Massachusetts should look to how Tobacco 21 spread across the United States, Zdinak said, noting that Hawaii was the first state to raise the legal minimum age to buy tobacco products to 21.

“[Bans] force the consumer to either go across the border or look for black-market products, and that impacts retailers’ sales.”

— Terry Gallagher, Smoker Friendly

If the day comes when a federal ban on flavors gets the greenlight, Bryan Haynes, a lawyer at Troutman Sanders LLP, expects the rule will face several legal challenges.

“The big part of legal challenges depends on justification for the rule and how the FDA responds to comments during the rulemaking process,” he said.

Looking at the number of nicotine users in the United States, combustible nicotine users make up the lion’s share while

noncombustible nicotine users account for less than half that number. As a result, “there is a lot of runway for noncombustible products,” TMA’s Greer observed.

That’s the good news. The bad news is that innovation is constrained in the U.S., largely because of legislation and regulation. As a result, some companies are looking outside the U.S. where innovation is picking up globally, Greer said, noting that the divergence between the U.S. and global market when it comes to tobacco “has always been there.”

Aside from stalled innovation, noncombustible and harm-reduction products face another obstacle: consumer perception. As MARC Research Executive Vice President Brad Seipel pointed out, many of the innovative products coming to the market today have been talked about for the past 10 years.

“We are now living in a post-tobacco market. It is a nicotine market,” he said.

With today’s innovation focus on smoke-

free and reduced-risk products, Seipel acknowledged that there have been “winners and losers as this space has ebbed and flowed” over the past decade. For example, snus paved the way for changes in the tobacco/nicotine marketplace, but the products have not gained much traction in the U.S. Dissolvable products and lozenges have not really found their footing in the U.S. either, he said.

As harm reduction drives the competitive landscape, the industry faces an uphill battle with how adult consumers view harm reduction. According to Seipel, adult consumers largely understand the continuum of risk, with combustibles like cigarettes on the very end of the spectrum. However, they do not separate nicotine from tobacco and continue to associate nicotine with smoking. Seipel cited that 79% of adult consumers agree that nicotine equals tobacco, 89% believe tobacco is addictive and a nearly equal number (86%) believe nicotine is addictive.

“While tobacco is seen as the most harmful perception, nicotine is trailing closely,” he said, adding that similarly, the perceived health risks of consuming tobacco are closely associated with nicotine as both are conceived as harmless regardless of the delivery method.

TPE 2024 took place Jan. 30 through Feb. 2 at the Las Vegas Convention Center. Chemular, a tobacco regulatory consulting firm, sponsored the education portion of the event. CSN

FROM AN OPERATIONAL standpoint, the prospect of adding delivery to a foodservice program has notable pros, but also distinct cons with convenience store retailers listing lower profit margins, disruptions to kitchen flow and ceding control to third-party drivers as their top concerns.

However, when c-store retailers factor in the evolution of customer expectations and what shoppers currently value most when it comes to convenience and a good experience, pairing delivery with a digital order-ahead option has the potential to yield long-term boosts to sales and profits.

When digital ordering and delivery services first launched, they were much more strongly associated with restaurants than convenience stores. Today, time and a boost from the COVID-19 pandemic have changed consumer perceptions.

“I believe the whole perception of convenience stores has changed since the pandemic. While our chain has always had a food-centric focus, the industry really

took on the idea of providing high-level foodservice,” said Chris Hartman, vice president of fuels, advertising and development at York, Pa.-based Rutter’s. “This has opened the door for customers to feel comfortable ordering convenience store food from an Uber Eats or DoorDash because they do it on a frequent basis already.”

Rutter’s, which operates 85 c-stores across Pennsylvania, Maryland and West Virginia, launched Paytronix Online Ordering in 2023 whereby its VIP Rewards members can order food online or through the Rutter’s mobile app. As a result, the retailer has seen a 25% increase in visits among loyalty members and a 10% boost to their check size, Hartman reported.

Matt Emmert, Uber’s head of strategic operations for grocery and convenience in the United States, told Convenience Store News that as consumers evolve to a “get-anything-delivered mindset,” the delivery platform is helping raise awareness of c-store operators. “Grocery and retail, which includes convenience, is now around a $7 billion business worldwide and is still growing rapidly,” he said.

At Irving, Texas-based 7-Eleven Inc., the largest c-store chain in the U.S., offering delivery is paying off, according to a company spokesperson, who explained that through the retailer’s 7NOW Delivery program, 7-Eleven has been

able to expand the reach of its foodservice offerings, enhance convenience, and foster brand loyalty among new and existing customers.

“Notably, our fresh food selection has experienced a surge in popularity through 7NOW. Customers appreciate the convenience of enjoying high-quality food and beverages without leaving the comfort of their home or office,” the spokesperson said.

While 7-Eleven caters to both in-store shoppers and 7NOW customers, the company has begun adding more specific delivery-focused deals, such as a recent app-only discount on Pi Day (March 14). “We’ve observed that our customers utilize both shopping options in different ways, so our promotions aim to accommodate this diverse shopping behavior,” the spokesperson added.

As consumer acceptance of digital ordering and delivery has evolved, so too has the process of getting started in this space. Retailers that might have once balked at the process, particularly small chains and independents, may now find it worthwhile to move forward.

“The technology has come a long way, so the startup cost to do apps and online ordering isn’t what it once was,” Rutter’s Hartman conveyed. “Convenience is critical to our customers who are generally timestarved, so the more convenient you make things, the higher ceiling you have.”

C-store retailers venturing into digital ordering and delivery have options beyond retrofitting technology originally meant for restaurants, as ordering platforms and third-party delivery partners have adapted to the convenience channel’s unique needs.

“For our smaller partners, we ship a tablet or mobile device that they can use to manage operations — including updating their catalog, leveraging demand generation tools like item and order level promotions and sponsored listings, and accepting/fulfilling orders,” explained Uber’s Emmert. “For larger partners, we can also integrate directly into their existing POS [point-ofsale] system. In either case, we have an onboarding and account management team to make the process as seamless as possible and ensure the retailer is set up for success.”

Adding delivery doesn’t have to mean adding a complicated new dimension to a store’s operations. Retailers can tailor the level of integration to their needs and limitations.

“I’d say that it’s quite easy to get started and start generating incremental revenue from the large consumer base on Uber who are coming to our apps to make purchases for delivery. This is especially straightforward for independent c-stores who want to give it a try,” Emmert said.

Larger operators also work with Uber for last-mile delivery of orders that originate from the retailer’s own apps and channels via its Uber Direct product. “There really are options for c-stores of all sizes depending on their needs and their business goals,” noted Emmert.

Convenience retailers that decide to add digital ordering and delivery must make sure they properly set up the backend so that in-store employees aren’t scrambling to get everything done. If they opt to incorporate multiple

third-party delivery partners, a technical setup that consolidates incoming orders to one location will keep things streamlined. As long as the preparation area is organized appropriately, digital ordering could even boost efficiency by helping employees prioritize tasks.

“Digital ordering capabilities help employees better perform their duties, especially in foodservice,” said Bonnie Woods, convenience strategist for Newton, Mass.-based Paytronix, a provider of digital guest engagement platforms. “Customers are given a time period of when their order should be ready, so it gives employees a buffer to get it fulfilled at a high level, while also taking care of customers in the store. I don’t believe it’s a replacement for employees, but it does alleviate some of the stresses of their job.”

One downside to third-party delivery is loss of control over the full customer experience. If a customer has a problem with an order, retailers risk being associated with the bad experience despite having no hand in the delivery. To mitigate this, Uber invests in courier education programs that emphasize the importance of customer satisfaction and proper order handling. It also collaborates with retailers on proper picking and packaging to ensure orders are ready for delivery.

“Our systems are built to monitor delivery experience and both make improvements in real time and importantly to take action on the merchant’s behalf when things go wrong so that consumers feel they’ve had a positive experience end to end,” Emmert said.

Loyalty programs can serve as the cornerstone of a successful digital ordering program.

Rutter’s Hartman recommends developing digital ordering in tandem with a loyalty program rather than rolling out digital ordering once a loyalty program is in place and mature.

“Loyalty programs are about a value proposition, so giving customers more reasons to sign up will always be key to the success of the program,” he reasoned.

C-store retailers that already have a loyalty program, but are earlier in their foodservice journey can also boost profits by adding digital ordering, according to Paytronix’s Woods.

“Digital ordering is more critical for brands with strong or growing foodservice brands, but is quickly becoming table stakes for traditional c-stores as well,” she said. “For brands with kitchens and/or established foodservice programs, first-party online ordering with integrated loyalty is a great way to drive additional value to consumers, build a more complete guest profile and improve the overall guest experience with your brand.”

Woods added that “loyalty is no longer optional” in the convenience channel.

Key advantages of developing digital ordering and loyalty simultaneously, she said, include offering digital ordering-specific loyalty benefits and being able to build out the user experience from a comprehensive digital perspective, among others.

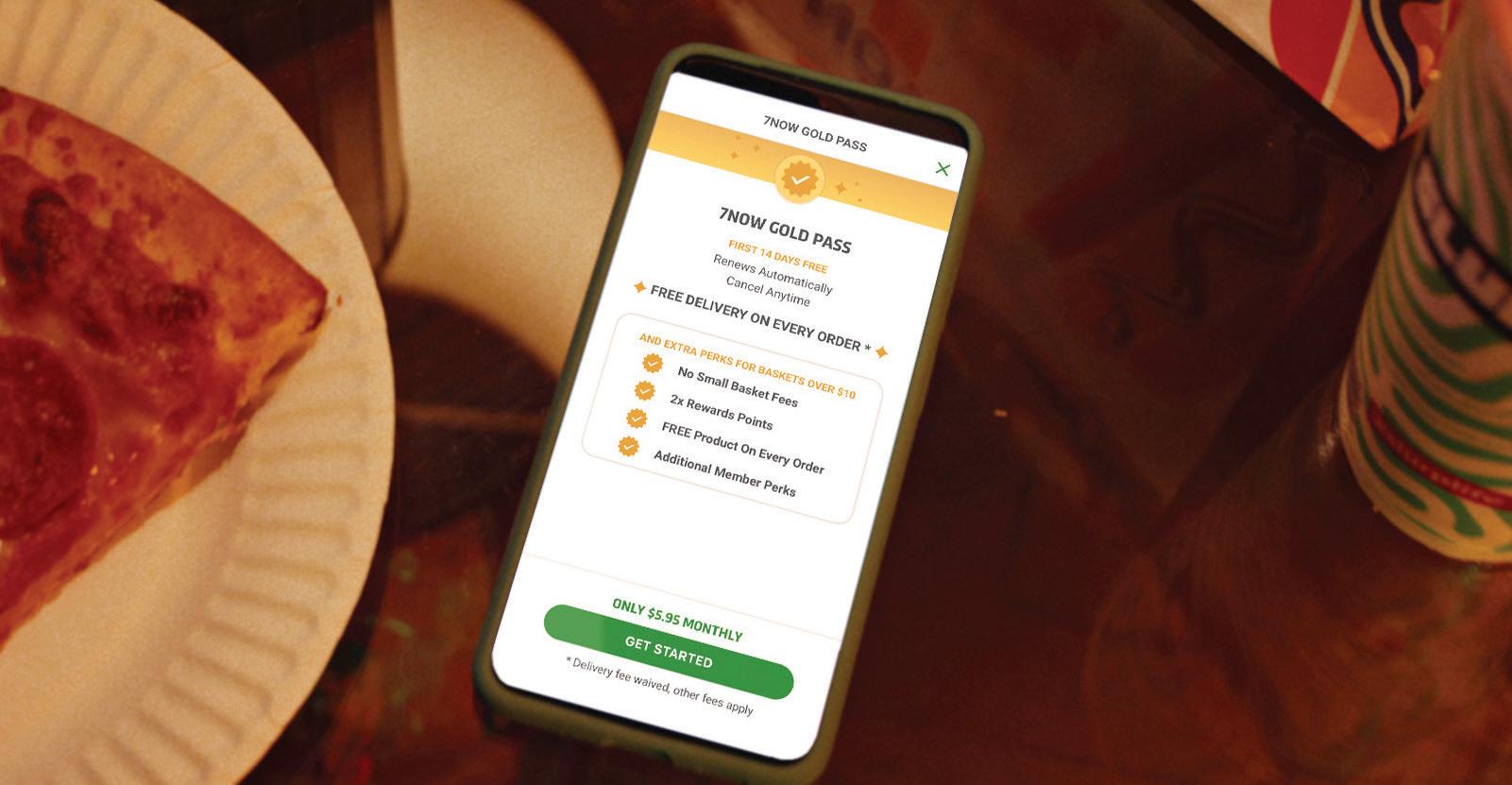

C-store brands of the right size and with the right offer might also find value in adding a subscription service. 7-Eleven customers can sign up for the 7NOW Gold Pass to get more than 3,000 of their favorite products delivered to their door in about 30 minutes.

“The subscription model creates deeper brand loyalty while saving customers money on each order, and the 7NOW Gold Pass service pays for itself in about three delivery orders per month,” said the company’s spokesperson. CSN

Open-air cooler snack items have grown in popularity at Love's Travel Stops.

IN A PRE-PANDEMIC WORLD, it wasn’t like Americans were short on snacks. However, the COVID-19 pandemic accelerated snacking habits so much so that snacking evolved into the “fourth daypart” in the convenience channel. Now, in the post-pandemic world of remote work and inflationary pressures, the once clearly defined line between “snack” and “meal” continues to blur, with 2024 expected to see even more melding of the two.

“The snack category will continue to be shaped by consumers’ desire for foods that offer emotional comfort, timesaving convenience and health benefits. Snacks that can bridge these attributes will stand out in the market,” said Michael Berro, CEO of Chipoys, a rolled tortilla chip brand inspired by authentic Mexican flavors.

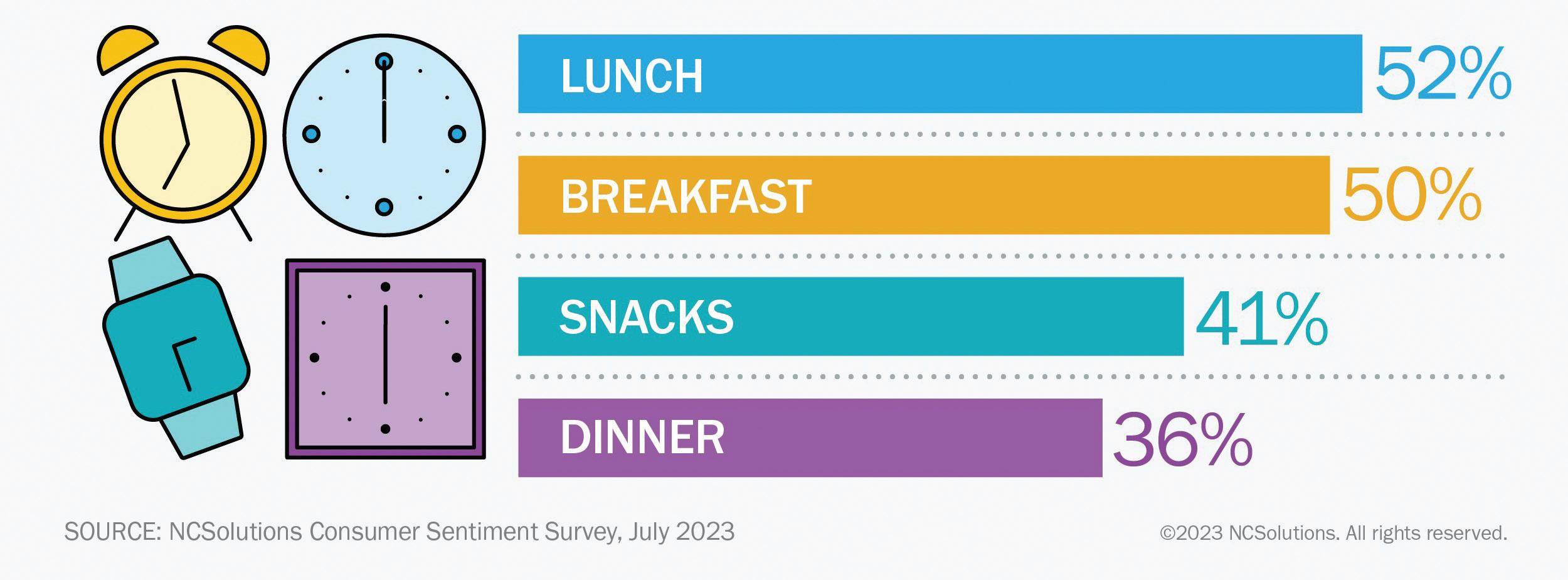

The blurring line between snacks and meals is being driven by consumers’ growing desire for convenience and simplicity in their eating habits. Recent research shows an increased prevalence of between-meal occasions, particularly

during midday, and highlights a shift in consumer behavior toward more flexible and snack-centric meal patterns.