BEFORE THE FEDERAL ELECTION COMMISSION

Federal Election Commission Office of General Counsel

1050 First Street, NE Washington, DC 20463

In the Matter of:

Complaint Against US Senator Tammy Baldwin’s Campaign Committees, and associated individuals/entities

FORMAL COMPLAINT

Pursuant to 52 U.S.C. § 30109(a)(1), 11 C.F.R. § 111.4, and all those cited below.

TABLE OF CONTENTS

I. INTRODUCTION Page 2-3

II. LEGALAUTHORITY Pages 4-5

III. FACTUALALLEGATIONS Page 6-30

IV. VIOLATIONS ALLEGED Page 30-34

V. REQUESTED ACTIONS Page 34-39

VI. CERTIFICATION Page 40

a. USB stick enclosed containing spreadsheets of FEC data.

I. INTRODUCTION

Complainant respectfully submits this sworn and notarized complaint under penalty of perjury pursuant to 52 U.S.C. § 30109, against Tammy Baldwin for Senate (FEC ID: C00830687), all of the other committees listed further below, and any other persons or entities who coordinated, executed, or facilitated violations of the Federal Election Campaign Act of 1971, as amended (FECA), including but not limited to 52 U.S.C. §§ 30122, 30104, 30116, and 11 C.F.R. §§ 110.4(b), 109.21.

This complaint arises from a multi-state, statistically anomalous series of highvolume, micro-structured political contributions - many appearing to originate from elderly or unemployed individuals, each giving well above lawful limits, and often from different states but at identical timestamps. These are not ordinary donation records. They reflect a sophisticated and likely coordinated effort to launder campaign contributions using digital platforms and bypass federal transparency and reporting obligations.

The Baldwin campaign committees allegedly accepted large volumes of contributions made in the names of other individuals, failed to report their true sources and timing, and facilitated a laundering scheme involving thousands of high-frequency donations from individuals who were unlikely to have the financial means to contribute such amounts.

This complaint relies on data compiled from Baldwin campaign finance filings, bulk contribution exports from the FEC's schedule A reports, and multiple structured Excel spreadsheets - including “Baldwin BIG_PARSE_1.xlsx,” “baldwin_contributions_summary_2024_multiple_statesMAR18th2024.xlsx,” and “Baldwin C00830687 schedule_a-2024-04-24T20_07_03.xlsx.” “Baldwin for SenateV1” Where appropriate, screenshots and extracted images (e.g., “Roberts into Baldwin’s campaign.png”) are referenced.

According to a cumulative analysis of these structured datasets, a total of approximately $36,820,755 in suspect or smurfed donations - consisting of repeatpattern contributions from unemployed donors, retirees, identity-replicated profiles, and temporally synchronized transactions - was accepted by Baldwin’s campaign between 2017 and 2024. These funds represent an aggregation of hundreds of thousands of micro-donations, many in violation of the Federal Election Campaign Act's source, limit, and identity verification provisions. 2

Complainant recognizes the statute of limitations for civil enforcement actions under the Federal Election Campaign Act (FECA) is governed by 28 U.S.C. § 2462, which provides a five-year limitations period for the government to bring any enforcement action involving a civil fine, penalty, or forfeiture. This Compliant is officially for the time allotted by the FEC per that statute. However, the FEC may examine earlier activity if it relates to an ongoing scheme or pattern, or if the effects of the violation (e.g., false reporting, smurfing structures, improper filings) extend into the 5-year window. Where in this Complaint it is alleged a continuing violation(s) (e.g., a donor laundering scheme or false reporting that spans 2017–2024). Baldwin is Smurfing, i.e. using straw donors for one violation, as systemic and ongoing violations. This brings earlier acts under the umbrella of the current illegal conduct. This is known as the “continuing violation doctrine” in FEC enforcement.

In addition, recent investigative journalism and election integrity reports have revealed systemic vulnerabilities in digital donation infrastructure - particularly with platforms like Actblue. Such as Smurfing expert Chris Gleason further detailed below. Another one, to be called a witness, is Draza Smith and her detailed work and discoveries into Smurfing. A third is Substack author Bill Bruch and the Skagit County Republican Party have documented how platforms like Actblue allowed credit card contributions to proceed without requiring CVV codes, enabling high volumes of potentially unauthorized or unverified donations from elderly or unemployed Americans. These reports cite cases where donors were unaware their names appeared in public FEC records. Moreover, multiple investigative sources have raised credible concerns that identities of senior citizens were being used to distribute laundered political contributions across campaigns.

The issues discussed in this complaint are part of a larger national pattern that reflects abuse of online fundraising portals, breakdowns in verification systems, and systemic failure to screen for fraudulent or excessive contributions. Smurfing, in the context of campaign finance, refers to the deliberate fragmentation of large unlawful donations into hundreds or thousands of smaller contributions - often using the names of elderly or unemployed individuals - to evade federal reporting and contribution limits.

II. LEGALAUTHORITY

This complaint is brought pursuant to the enforcement provisions of the Federal Election Campaign Act (FECA) and associated regulations, including but not limited to the following against Baldwin’s campaign committees:

A. Statutory Provisions

52 U.S.C. § 30122 - Contributions in the Name of Another

This statute prohibits any person from contributing in the name of another person, or knowingly permitting their name to be used to affect such a contribution. It also prohibits knowingly accepting a contribution made by one person in the name of another.

52 U.S.C. § 30104 - Disclosure of Receipts and Disbursements

Committees must accurately report the name, address, occupation, and employer of each contributor giving more than $200 in aggregate per cycle. They must also report all disbursements, including the purpose and recipient of each.

52 U.S.C. § 30116 - Contribution Limits

Establishes individual contribution limits of $3,300 per election ($6,600 per cycle when combining primary and general elections).

52 U.S.C. § 30116(a)(7)(B)(i)

Treats coordinated expenditures as contributions that must be reported and are subject to the same limitations.

B. Regulatory Provisions Violated By the Baldwin Committees

11 C.F.R. § 110.4(b)

This regulation reinforces § 30122, prohibiting contributions in the name of another, and details examples of such prohibited activity (e.g., reimbursement schemes, identity misattribution).

11 C.F.R. § 104.3(b)

Requires that committees provide detailed purpose and recipient information for disbursements, including full names and sufficiently descriptive purposes so that the public and the Commission may easily understand the nature of the transaction.

11 C.F.R. § 109.21 - Coordinated Communications and Expenditures

Defines coordinated communications between campaigns and outside entities, which may trigger reporting and contribution obligations under FECA.

C. Relevant Advisory Opinions and Enforcement Precedent Advisory Opinion 1980-57

Contributions made to influence a candidate’s ballot status, even when channeled through third parties or legal entities, are subject to FECA’s contribution and disclosure provisions.

MUR 7923 (Friends of Matt Gaetz)

The FEC investigated and penalized misreported merchant fees and improperly labeled disbursements. The underlying pattern involved large, unexplained expenditures that did not match expected vendor costs - analogous to unexplained donation volumes and identities in the Baldwin matter.

MUR

7291 and MUR 7449 (DNC and related committees)

Violations related to vague or false descriptions of disbursements led to significant civil penalties and conciliation agreements, reinforcing the requirement for specificity and truthfulness in financial disclosures. These provisions, rules, and precedents collectively empower the Commission to investigate the Baldwin campaign’s acceptance of contributions that - based on pattern, origin, and volume - violate FECA’s structural safeguards.

III. FACTUALALLEGATIONS

A. This complaint is supported by extensive data analysis, public Federal Election Commission (FEC) records, and structured datasets obtained from Baldwin for Senate’s campaign filings and independent investigations. The evidence establishes multiple categories of violations. As stated, the violations by Baldwin’s various committees total $36,820,755. However, Complainant knows this number is higher due to this very FEC hiding public campaign finance data. One example is not all contributions are assigned to codes, or are supposed to be. The FEC has over 100 distinct codes. yet there are contributions made but no code is assigned by the FEC, in violation of its own policy.

Based on database throttling, FEC code suppression, and known omissions in public exports, Complainant estimates the true total exceeds $50 million. The $36.8M figure reflects only what could be extracted and cross-referenced using structured data between 2017-2024. That is the major problem, he can only show the dollar numbers of Smurfing for Tammy Baldwin’s committees of the data made available by the FEC.

B. Based on available information, Senator Tammy Baldwin is associated with the following federal political committees registered with the Federal Election Commission (FEC):

1 Tammy Baldwin–Associated Committees (with FEC IDs) Tammy Baldwin for Senate – Principal campaign committee

FEC ID: C00326801

2 People's Voice PAC – Leadership PAC affiliated with Senator Baldwin

FEC ID: C00410092

3 Tammy Baldwin Victory Committee – Joint fundraising committee (Baldwin + People's Voice PAC + others)

FEC ID: C00566133

4 Baldwin Wisconsin Victory Fund – Joint fundraising committee (Baldwin + Democratic Party of Wisconsin)

FEC ID: C00525295

5 Blue Senate Candidate Fund – Joint fundraising committee (includes Baldwin + other Senate candidates)

FEC ID: C00744540

6 Ohio Wisconsin Victory 2024 – Joint fundraising committee (includes Baldwin, limited info)

FEC ID: C00830729

7 Women Senators Making History – Joint fundraising committee supporting Baldwin and other Democratic women senators

FEC ID: C00831255

8 Gillibrand Baldwin Victory Fund – Joint fundraising committee (Gillibrand + Baldwin)

FEC ID: C00833640

9 Green Senate 2024 – Joint fundraising committee (includes Baldwin)

FEC ID: C00837575

10 Senate Victory 2024 – Joint fundraising committee (Baldwin may be participant)

FEC ID: C00841825

11 The Liftoff Fund – Joint fundraising committee (Baldwin included as participant)

FEC ID: C00843250

12 Senate PA & WI – Joint fundraising committee (includes Baldwin)

FEC ID: C00839654

13 Biden Baldwin Victory Fund – Joint fundraising committee (Joe Biden + Tammy Baldwin)

FEC ID: C00849281

14 Justice 2024 – Joint fundraising committee (includes Baldwin)

FEC ID: C00834044

16 Blue Senate 2024 – Joint fundraising committee (includes Baldwin)

FEC ID: C00832113

17 MN NV WAWI Victory – Joint fundraising committee (includes Baldwin) FEC ID: C00866806

While these are the primary committees associated with Senator Baldwin, it's possible that additional committees exist or have existed in the past.

C Tens of thousands of contributions accepted by Baldwin’s campaign committees appear in FEC filings without valid transaction codes, a violation of 11 C.F.R. § 104.3 and 52 U.S.C. § 30104(b). The omission of codes conceals the true nature of these financial transactions and impedes public transparency, raising suspicion that they were structured, synthetic, or intentionally misfiled to avoid detection.

1. When a contribution appears in the FEC’s raw or processed data without a transaction type code, it typically points to one of the following:

a. Incomplete or Improper Filing by the Committee: some political committees fail to properly classify or fill in required fields during their FEC reporting (e.g., Form 3 for House/Senate campaigns).

b. While the FEC requires transaction type codes, committees can submit bulk reports with missing or blank codes, especially when using outdated software or “miscellaneous” labels (like memo-only entries).

c. Consequences: Contributions with blank or “null” codes may bypass basic sorting/filtering in public databases and are harder to audit. Yet, they remain accepted into the record unless flagged for amendment.

2. “Memo Entries” or Linked Transactions

Some contributions may be “memo entries” associated with a parent transaction (e.g., part of a joint fundraising transfer or earmark). In these cases:

-The main transaction has a proper code (like 15Z or 18G).

-The associated memo entry may lack a code, relying on the parent transaction to provide context.

-This occurs frequently in Actblue or joint fundraising committees, where the memo entry reflects the pass-through donation but doesn’t include its own transaction type code.

3. Data Entry or System Error

FEC bulk data feeds are updated from raw filings and occasionally ingest malformed or incomplete records. This includes:

-Contributions without assigned codes,

-Contributions where fields are misaligned, or

-Glitches from proprietary software used by campaigns or PACs.

-These errors typically appear in raw bulk files and not in finalized processed summaries, but thousands of such entries still appear in annual reports.

4. The FEC’s Processing Prioritization and Throttling

As mentioned in this complaint, the FEC: prioritizes “processed” data over raw and throttles high-volume exports. The FEC excludes transactions with blank codes or default them to internal-only processing, making them invisible to the public in common queries or search filters. Thus, the FEC is hiding campaign finance data from the public when one uses their website. This creates a significant transparency gap, where known contributions exist in the database but are not counted, searchable, or sortable. Unless parsed directly from the raw files.

D. High-Dollar Donations by Unemployed or Retired Individuals

(Source: NOT_EMPLOYED_DONORS tab in “Baldwin BIG_PARSE_1.xlsx” and “BaldwinI INDIVIDUALtransaction C00830687 668 schedule_a.xlsx”), enclosed on USB stick.

The Baldwin campaign accepted tens of thousands of dollars from individuals whose listed occupation was “not employed,” “retired,” or “n/a.” Many of these individuals exceeded the federal limit of $6,600 per election cycle, with no credible employment source to justify such giving. Complainant knows from first-

hand experience, and that of private investigators hired with individuals interviewed on video, most of the time “not unemployed” or “unemployed” means the individual is retired.

Each of these examples represents contributions far in excess of legal thresholds, from individuals with no declared employment, and in some cases, from individuals who have also been flagged in investigative reports for not even being aware they were listed as donors.

E. High-Frequency Transactions from Known Donors

(Source: BaldwinSmurfRanking in “Baldwin BIG_PARSE_1.xlsx”)

Data analysis revealed individuals who made tens of thousands of contributions to multiple campaigns, often including Baldwin, with implausible frequency. These names appear in structured donor databases with counts exceeding 17,400–60,000 transactions in a cycle. These show real Smurfs (victims) contributing to Baldwin’s campaigns, but again they did not or at least not the voluminous number of contributions. That is one part of the fraud of Smurfing, it is structured money laundering using strawmen’s identities to carry out the financial transactions:

Name FEC Donations $ to All Campaigns # to Baldwin $ to Baldwin

SONIA

NEWELL, REBECCA

WHITE GILSON, SHARON

ATTANASIO, DEBORAH

$17,550.00 4 $ 15

$17,400.00 2 $ 20

The above Smurfs’ financial records will not match up with what the FEC is showing here. Rarely, but it does happen, are the Smurfs’ own financial accounts used to move the fraudulent money through. This is why none of them are aware of their identities being stolen.

The FEC and Ellen Weintraub allowed this to happen; they intentionally covered it up. The FEC, including but not limited to prior Commissioner Ellen Weintraub, has long been made aware of smurfing via citizen complaints and internal data anomalies. To date, no meaningful enforcement or public disclosure has occurred, raising questions of institutional negligence or deliberate omission.

The last two on the list above show as unemployed. It exemplifies how Smurfing is spread across the nation in small amounts both in contribution numbers and money. The “Not Employed” tab on this spreadsheet includes over 165,000 such contribution records attributed to Baldwin’s campaign between 2017 and 2024. The FEC’s regulatory framework requires campaigns to use best efforts to verify contributor identity and maintain accurate records (52 U.S.C. § 30102(c); 11 C.F.R. § 104.7). The Baldwin campaign failed to do so either, constituting a material violation of FECA and supporting the Counts listed below of this Complaint. Where Baldwin’s committees aided or permitted evasion of contribution limits (52 U.S.C. § 30116), falsely reported donor identity or origin (52 U.S.C. § 30104), and failed to implement compliance safeguards against structured donations. Source: “NOT_EMPLOYED_DONORS” tab, within file “Baldwin BIG_PARSE_1.xlsx” (USB Exhibit)

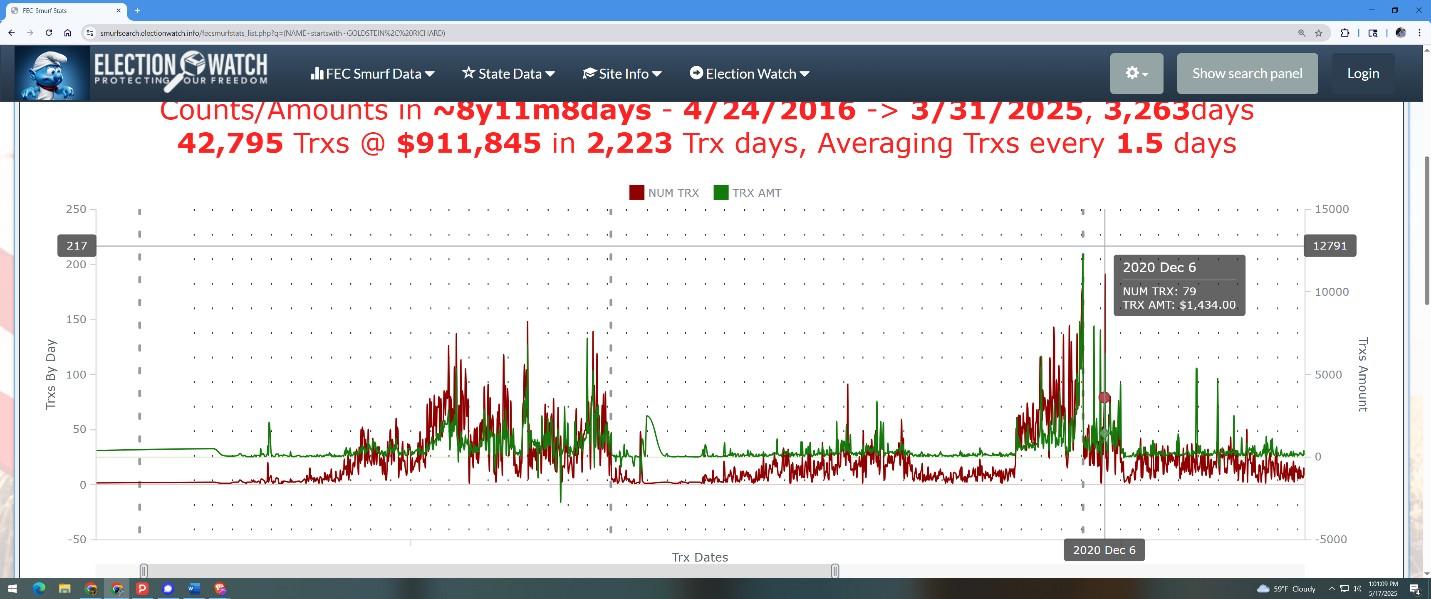

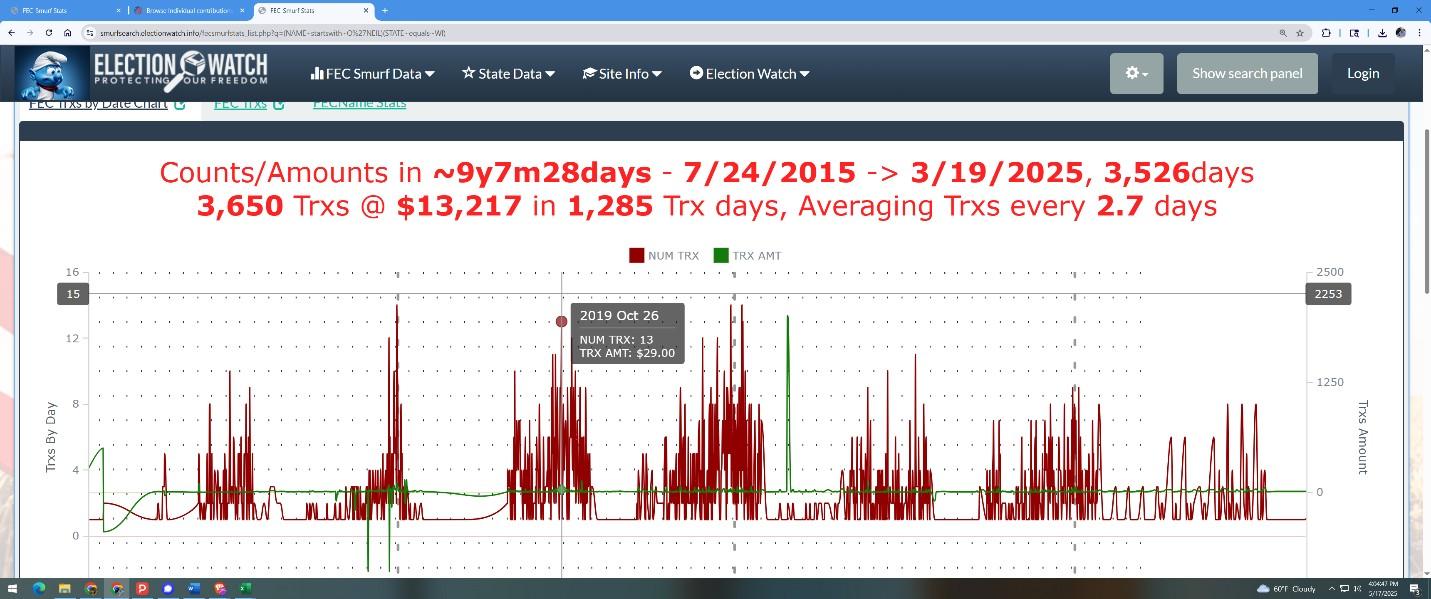

F These patterns are beyond human possibility for manual donations and match smurfing methodologies. Such as this example of Richard Goldstein of the state of New York. My website shows the daily number of contributions (red line) and the corresponding dollar amount (green line) in these interactive charts. This one for Mr. Goldstein shows, for Dec. 6, 2020, he supposedly made 79 contributions totaling $1,434 in one day. See image just below. But he did not, the computer bots of Actblue and other such platforms stole his name, address and account information to launder through these number of contributions and dollars.

Ms. Immasche in, along with dozens upon dozens of other Smurfs interviewed in person, many on video, have denied they made the voluminous contributions of money to Baldwin’s campaign committee(s), nor to the other campaigns across the nation.

The Baldwin campaign accepted contributions from these profiles and failed to investigate or reject them. The above numbers were used to demonstrate how Smurfing is ongoing every day, laundering monies into campaigns such as Baldwins’. It is purposely done with live, existing citizens, however without their knowledge or permission.

G Smurfing is typically implemented where only a handful of contributions from Smurfs (most of the time real live citizens) who did make some real, honest

contributions. Then the bad actors pick up on the Smurfs’ accounts and begin ramming through contributions and associated monies. Where the Smurfs show, for example, two contributions to Baldwin’s campaign committees, yet this same pattern is replicated across dozens of states into hundreds if not thousands of political campaigns. It is structured money laundering in addition to the use of fictitious original donors, strawmen. Furthermore, when a Smurf is asked if he or she is donating to a certain campaign, many times they will answer “yes”, which is truthful but not accurate. Where they may indeed have made a few contributions, but not the hundreds, thousands or tens of thousands which the FEC data shows.

As confirmed in Christopher Gleason’s interviews, by hired licensed private investigators and other field investigations, many of these individuals sincerely believed they had donated once or twice - never realizing that hundreds even thousands of donations had been attributed to their names across dozens of campaigns.

H. Identity Cloning and Geographic Duplication

(Source: NAME_CITY_STATE_MATCH_RANK in “Baldwin BIG_PARSE_1.xlsx”)

1. Multiple contributors with the same name and similar addresses donated nearly identical dollar amounts, sometimes down to the penny. The same identities appear across different FEC filings and are mirrored in other state and federal races.

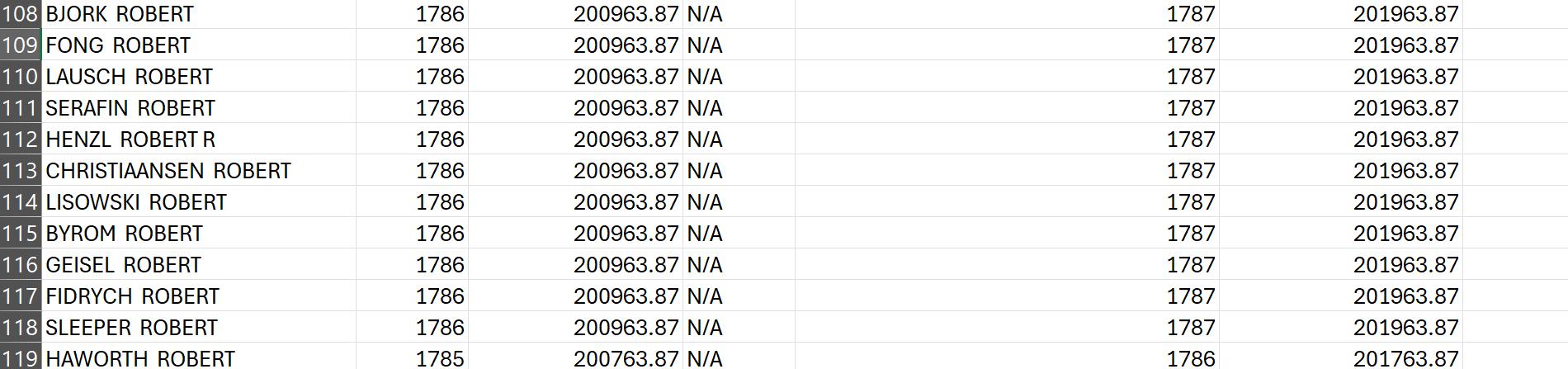

The first column is the row number of the excel sheet of investigator Chris Gleason. All data in the image below is from the FEC, found in Baldwin’s campaign committee. The Second column is the name of the “Robert”. The third column shows the number of transactions. The fourth column is the dollar amountall $200,963.87 except for $20 missing on the last one. The next column employment status of “N/A”.

The recurring amount of $200,963.87 and number of contributions of 1786 (at a snapshot in time) was used across many of these cloned identities, submitted at identical timestamps from different states. This strongly supports an inference of synthetic identity construction along with the use of computer bots.

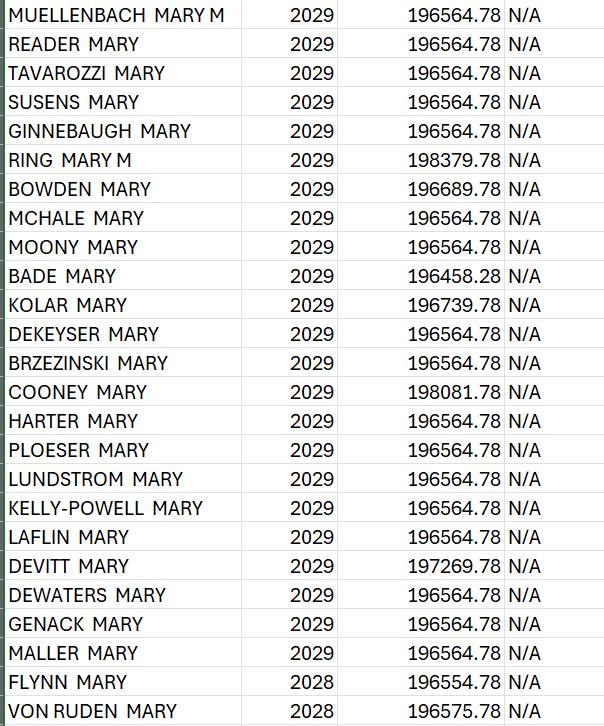

2. “First Name Cluster” Smurfing Using “MARY” Identifiers

(Source: Image Snapshot, “Mary Pattern,” data from Baldwin campaign, compiled by Complainant)

The image below is entitled Mary Pattern Snapshot. It documents a high-volume smurfing structure involving dozens of donor identities, each with the first name “MARY.” This pattern mirrors the one previously documented using “ROBERT” names and is based on public FEC filings downloaded and preserved by the Complainant as a snapshot on a specific day. All contributions were directed to the campaign committees of Senator Tammy Baldwin. The image shows:

-At least 29 individuals listed under various “MARY” first-and-last-name combinations,

-All marked as contributing in the same year (2023),

-Each one donating $196,564.78, or a slight variance (e.g., $196,575.78, $196,739.78),

-Each one donating the same 2,029 times (at that point in time),

-Most donors listed with “N/A” for occupation or employment,

-The contribution count and dollar amount are exactly the same, showing batch processing.

This structured uniformity is statistically impossible under legitimate campaign finance behavior. The recurrence of:

-the same first name (“MARY”),

-the exact same contribution total, and

-identical metadata fields across different surnames

-the dollar amounts of contributions are the same, on the same day, each “Mary” lives in a different state

-strongly indicates that these are not separate donors, but duplicated or synthetic profiles used to distribute unlawful funds in fragments.

This tactic, distinct from timestamp synchronization or ZIP clustering, represents a new method of smurfing, “first name clustering,” where automated scripts use one root identity (e.g., “Mary”, “Robert”) and spin off dozens of donor entries with slight variations in surname to evade detection. Each of these entries is treated in 17

FEC databases as a unique contributor when in fact they likely originate from a single source, split for the purpose of concealing the true origin and size of the donation. This method of First Name Clustering is a sub-type of smurfing characterized by:

-The use of a common first name to group large volumes of synthetic or derivative donor records,

-A consistent donation total and date across those records,

-Deployment in a campaign’s reporting to simulate grassroots diversity, while laundering large contributions under minor identity permutations.

This technique i) evades basic keyword searches, ii) defeats duplicate detection filters, and iii) creates the false appearance of legitimate small-dollar donor breadth, while concealing a centralized, unlawful funding source.

The Baldwin campaign’s acceptance of these transactions without triggering internal compliance alerts represents a severe failure of due diligence, and supports allegations of:

-Knowingly accepting contributions in the name of another (52 U.S.C. § 30122),

-Falsifying contributor identities and violating FEC disclosure rules (52 U.S.C. § 30104),

-Structuring of contributions to conceal excessive donations (52 U.S.C. § 30116(f)),

-Failing to maintain proper contributor records and detect mass identity duplication (52 U.S.C. § 30102(c)).

Source: Image titled “93e7ec10-300f-4298-9ef4-3a2a24468de6.png,” derived from structured data from Baldwin campaign filings, attached on enclosed USB stick.

I. Geographic Overconcentration

(Source: %Rank#byCity and %Rank#byState in “Baldwin BIG_PARSE_1.xlsx”)

Anomalously high volumes of contributions are concentrated in small geographic areas -particularly Baldwin’s home state of Wisconsin - yet the scale and repetition of contributions do not reflect normal grassroots activity.

Location

Wisconsin

The density of repeated transactions from a small pool of ZIP codes in Wisconsin far exceeds the norm and is consistent with central coordination and laundering hubs. However, there is more to this story whereby most contributions to Baldwin in fact come from outside the state of Wisconsin. This is due to nefarious actors such as the DCCC, the DNC federal and DNC state who collected the Smurfed monies from out of state names/addresses, then funnel said monies through their organizations, finally to Baldwin’s committees.

J. Timestamp Synchronization Across States

(Source:

“baldwin_contributions_summary_2024_multiple_statesMAR18th2024.xlsx”, Screenshot: “Roberts into Baldwin’s campaign.png”), on enclosed USB stick.

At least 12 contributors with the first name “ROBERT” and different last names (e.g., FONG, GEISEL, LAUSCH, SERAFIN) each contributed $200,963.87 at the same timestamp from different states. These transactions occurred on the same day, same second, using Actblue as a platform. This timing precision cannot be coincidental. It indicates that:

-Donations were likely entered via automation,

-Multiple synthetic identities were linked to one master payment source,

-This donation scheme was timed and structured intentionally.

These facts - combined with the same dollar amount and uniform identity formatting - support the conclusion that these contributions were not voluntary

donations from lawful individuals, but orchestrated entries designed to evade detection.

K. Smurfed monies came into Baldwin’s campaign committees through other entities also, in addition to those coming from Actblue. One of the leading ones is the federal Democratic National Committee, and then the local DNC at the Wisconsin state level. This was a similar pattern seen in Smurfing into Stacy Abrams in Georgia’s campaign. Where Abrams criminally laundered money into her campaigns.

L. Statement of Facts Regarding Smurfing and Baldwin for Senate Election researcher and campaign finance analyst Christopher Gleason (known publicly via his investigative reporting and social media presence as “@immutablechrist” on X or twitter) has conducted extensive analysis of smalldollar contribution records maintained by the Federal Election Commission (FEC), with a particular focus on patterns of political donation structuring and laundering commonly referred to as “smurfing.” Mr. Gleason is an expert in Smurfing, in campaign finance, in Merchant Services and in computers and computer networks, including coding. Complainant is naming him as an expert witness when this reaches the courtroom.

Mr. Gleason has presented his findings before multiple state legislatures and election commissions, and has collaborated with technical auditors, cybersecurity professionals, data analysts and financial fraud investigators to construct these datasets.

M. In campaign finance, 'Smurfing' refers to the illegal practice of dividing large contributions into many smaller transactions. These are routed through the names of third parties—often unemployed or elderly individuals—to evade contribution limits, obscure the true source of funds, and mask the overall scale of donations.

N. Gleason's findings, supported by structured public datasets and FEC filings, establish that smurfing operations, including Baldwin’s here, rely on:

-Synthetic or duplicated identities (e.g., multiple donors with the same first name, same dollar amount, same timestamp);

-Micro-donations made at abnormal frequency (dozens or hundreds per month by a single donor profile);

-Disproportionately high use of “Not Employed” or “Retired” donor designations, despite donation volumes suggesting significant financial capacity.

-Platform vulnerabilities, especially on Actblue, where credit card verification methods such as CVV input were not enforced until mid-2023.

-Gleason identified multiple indicators of fraud common to campaign finance smurfing:

-Unusually high donation frequency by individuals with no employment.

-Thousands of small-dollar transactions to the same candidate by a limited group of donors’ names.

-Identical donation amounts across multiple states at the same timestamp.

-Confirmation from real individuals who denied making the contributions attributed to them in FEC filings.

O. In early 2024, Gleason's investigations expanded to include donors associated with Tammy Baldwin for Senate (FEC ID: C00830687). Analysis of Baldwin’s 2023-2024 campaign finance data reveals multiple features that mirror Gleason’s national findings on smurfed contribution networks:

-Hundreds of elderly or unemployed donors - often marked as “Not Employed”are listed in Baldwin’s FEC reports as giving far beyond the $6,600 federal limit. In many cases, these individuals donated over $30,000 in small increments.

-Synchronized donation activity: At least twelve donor profiles with the first name “ROBERT” gave exactly $200,963.87, at the same timestamp, from different states. These individuals include: ROBERT GEISEL, ROBERT FONG, ROBERT LAUSCH, and others. This mirrored timestamp behavior is strongly indicative of automation and synthetic identity use. The same was found for the “MARYs”.

-Extremely high frequency micro-donations: Profiles like SONIA IMMASCHE and RICHARD GOLDSTEIN contributed tens of thousands of times each during

the cycle (59,847 and 42,336 respectively across all campaigns), with 100+ donations routed to Baldwin's campaign. These patterns are not humanly feasible without automated input.

-Geographic clustering and statistical anomalies: Over 51.65% of all donations to Baldwin’s campaign originated from Wisconsin ZIP codes, particularly Madison and Milwaukee. Within those ZIPs, numerous duplicate donor profiles, repetitive addresses, and identical donation amounts appear across multiple filings.

-Use of fundraising platforms with weak verification standards: Baldwin’s campaign has heavily relied on Actblue - a platform that, according to Gleason and corroborated sources, did not require CVV verification on credit card donations prior to 2023. This lack of verification likely enabled fraudulent donation scheduling and unauthorized credit card use.

-Total monetary exposure: A forensic review of structured datasets associated with Baldwin’s campaign reveals at least $2,140,585.26 in suspect contributions were accepted during the 2023–2024 cycle. This total is for one method of Smurfing. This number Complainant knows is low, where the FEC throttles access to their database. They also exclude contributions with blank codes (meaning no code assigned) from contributions the public sees on their website, even if using the bulk download. Where the FEC is intentionally limiting access to public data. And intentionally hiding from 30-50% of contributions really given to campaigns.

-Real-world donor denials: Gleason’s field investigations and public reports have identified multiple elderly individuals whose names appear in FEC filings but who flatly denied making any such donations. In several instances, once these individuals were contacted, the donations attributed to them abruptly stoppedindicating they were previously unaware their identities were being used, and that third parties likely submitted the donations without consent.

P. In sum, the Baldwin for Senate campaign has benefited from a pattern of donations that is consistent with structured money laundering via smurfing - a violation of 52 U.S.C. §§ 30122 and 30104. Statistical anomalies, identical timestamp submissions, and vast donation totals from implausible sources warrant immediate investigation and enforcement action. These findings reinforce the systemic nature of the alleged violations and provide further factual foundation for Counts I through VII in this Complaint.

Q. Multi-State Smurfing in Campaign Finance, in Baldwin’s Campaign Committees

1) Multi-state smurfing refers to a campaign finance laundering technique in which large political contributions are unlawfully broken down into thousands of smaller donations, often routed through multiple donor identities, different geographic locations, and disparate states to conceal the true source, scale, and coordination of the original contribution.

This method uses “smurfs” - typically elderly, unemployed, or otherwise unlikely individuals -whose names are entered into Federal Election Commission (FEC) filings as small-dollar contributors. In most cases, these individuals:

-Did not make the donations attributed to them,

-Are unaware their identities were used, or

-Appear as duplicated contributors across multiple campaigns, states, and dates.

-Multi-state smurfing:

-Evades per-election and per-cycle contribution limits under 52 U.S.C. § 30116;

-Falsifies the identity of the true source in violation of 52 U.S.C. § 30122;

-Falsely reports the origin, purpose, and scale of contributions under 52 U.S.C. § 30104(b);

-Obscures jurisdictional scrutiny by dispersing illegal contributions across multiple state-based donor records, sometimes simultaneously.

-Exploits digital fundraising platforms that do not verify cardholder identity (e.g., no CVV requirement).

2) One example, in the context of this complaint, the evidence shows that the Baldwin for Senate campaign received numerous synchronized contributionsoften the exact same amount (e.g., $200,963.87), from donor names like “ROBERT FONG,” “ROBERT GEISEL,” and “ROBERT LAUSCH” - from different states at the same timestamp. As further detailed above already. This

reflects a deliberate attempt to launder funds across state lines under the pretense of grassroots donations, using falsified or borrowed donor credentials, automated input, and fragmented recordkeeping.

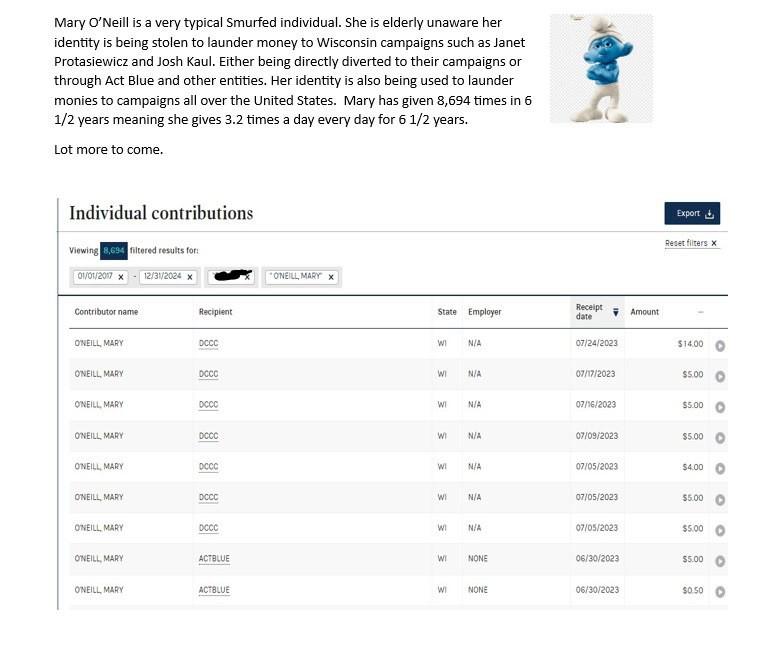

3) Another is Mary O’Neil. She fits the classic pattern of being over the age of 65, making multitudes of small, frequent contributions. See the image below showing, at that point in time, 8,694 contributions.

Below on the next page is Ms. O’Neil’s interactive chart of making contributions, however the whole point is she did not make all these donations. In the image it shows her making 13 contributions totaling $29 in one day. Here again it was computer bots making those contributions, not a human. As of this current date today, Ms. O’Neil has shown making 16,554 contributions since 2018. Of these 177 went to Baldwin, totaling $974.46. Where 90% of them are fictitious as the money did not come from O’Neil.

In addition, 457 contributions are shown being made by O’Neil to the DCCC. And 18 contributions from her to DNC Services Corp., where again she did not make at least 90% of these contributions, possibly none of them. However, Baldwin received monies from both DCCC and DNC Services. This is exactly how Smurfing works, adding one more method. Most of Baldwin’s Smurfed monies did come from these types of groups.

R. Differences in the number and dollar amounts of contributions from one example to another are due to factors such as the date of the data snapshot, the search range used, or variations in donor name formatting (explained further below).

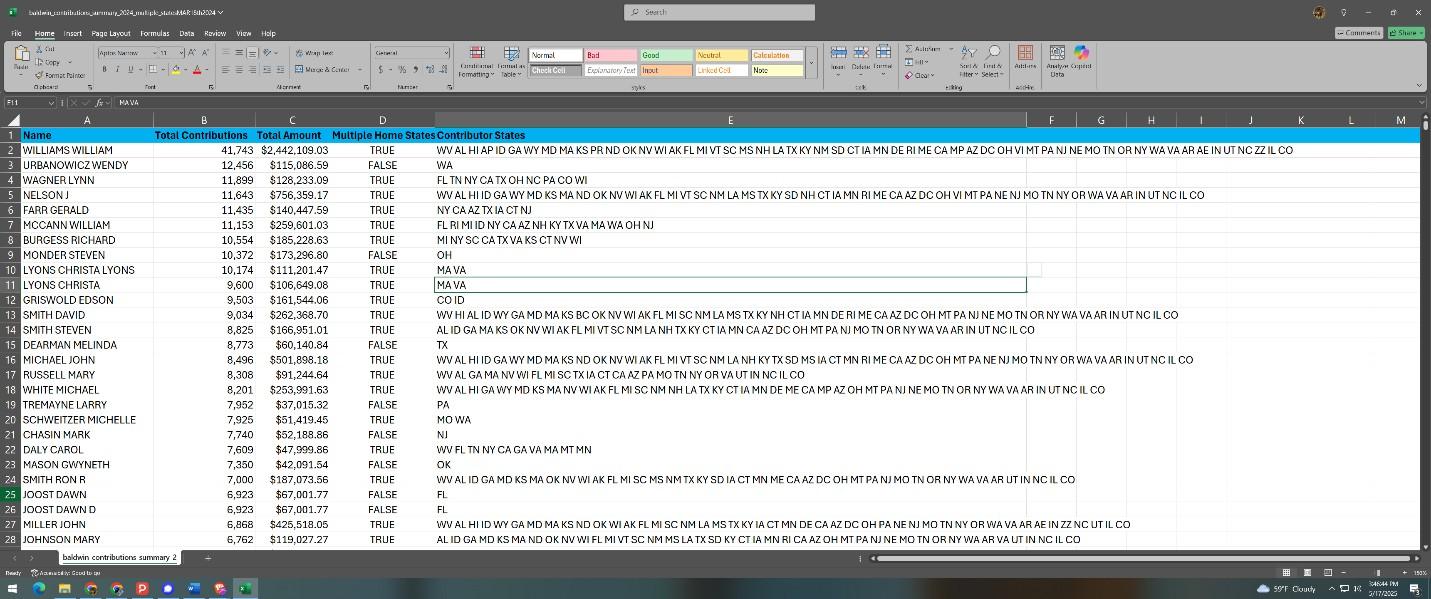

S. Another multi-state Smurfing method is where one name is found in numerous states making contributions. Take William McCann in row 7 for example. It shows Mr. McCann in fifteen (15) different states. Complainant knows there are not 15 different William McCann’s making political campaign contributions, as these 15 McCanns each have made the exact same dollar amount donation, on the same day, to different political campaigns across the nation. Then the next day, none of them made any contribution. This shows a computer bot or bots at work.

These about conducts constitutes a systemic abuse of campaign finance law and demands investigation as both a civil violation under FECA and a potential criminal violation of federal anti-structuring, identity fraud, and wire fraud statutes. The above interstate Smurfing shows a synthetic donor network being utilized by Baldwin’s committee(s).

T. A favorite trick of the bad actors carrying out their Smurfing schemes is to use different derivative spellings of real persons’ names. This person in Pennsylvania for example has ten (10) different spellings. If a person searches the FEC website using just the name on the top of this list, he or she will miss all the other contributions made in the other names below it.

BENGTSON, BRUCE

aka: BENGTSON, BRUCE MR.

aka: BENGTSON, BRUCE MR..

aka: BENGTSON, BRUCE P

aka: BENGTSON, BRUCE P.

aka: BENGTSON, BRUCE P MR

aka: BENGTSON, BRUCE P MR.

aka: BENGTSON, BRUCE P. MR

aka: BENGTSON, BRUCE P. MR.

aka: BENGTSON, BRUCE P MR OTHER

Here is another example of 16 derivatives below of the same person’s name. Complainant has found upwards to 26 derivatives of one contributor so far, with displays like this always being Smurfs (the victims, their identities stolen). There

are well over 500 Smurfs with derivative names spellings found in Baldwin’s committees.

GOLDSTEIN, M

aka: GOLDSTEIN, M.

aka: GOLDSTEIN, MARY

aka: GOLDSTEIN, MARY V

aka: GOLDSTEIN, MARY V.

aka: GOLDSTEIN, MARY VIRGINIA

aka: GOLDSTEIN, MARY VIRGINIA MRS

aka: GOLDSTEIN, MARY VIRGINIA MRS.

aka: GOLDSTEIN, MARY V. MRS.

aka: GOLDSTEIN, MARY V. MS.

aka: GOLDSTEIN, M VIRGINIA

aka: GOLDSTEIN, M. VIRGINIA

aka: GOLDSTEIN, M VIRGINIA MRS.

aka: GOLDSTEIN, M VIRGINIA MS

aka: GOLDSTEIN, M VIRGINIA MS.

aka: GOLDSTEIN, M. VIRGINIA MS.

U. The banks involved in Smurfing of Baldwin’s campaigns include but are not limited to:

Wells Fargo (by far the largest), Bank of America, Associated Bank, Amalgamated Bank then AmEx, Visa, Mastercard as processors.

V. The type of cards used in Baldwin’s committees include seven: credit cards, pre-paid credit cards, debit cards, pre-paid debit cards, international cards, virtual cards and gift cards.

W. The law firm who set up and maintains this criminal money laundering scheme for Actblue, hence Baldwin, is Perkins Coie. Complainant has significant evidence about their involvement with Smurfing. Another legal firm participating in these actions is that of Attorney Marc Elias.

X. The monies coming into Baldwin’s campaigns include but are not limited to the original sources of the US Treasury; NGO’s, China, Venezuela, Ukraine, offshore accounts, billionaires including Reid Hoffman, Johann Georq Hansjorg Wyss (whom Complainant severely questions is even a US Citizen), Gloria Page, Karla Jurvetson and others.

Y. Additional Statement of Facts: Smurf Donor Saturation (Source: Baldwin BIG_PARSE_1.xlsx = Sheet: “BaldwinSmurfRanking”)

Contained on the enclosed USB drive is a spreadsheet titled “Baldwin BIG_PARSE_1.xlsx.” Within that file, the sheet labeled “BaldwinSmurfRanking” documents the top-ranked political donors across the Federal Election Commission’s records - including how many contributions they made to Baldwin for Senate and to other federal political committees.

The following individuals are among the most prolific donors in the entire FEC database, each logging tens of thousands of contributions from 2017 to 2024. These individuals also appear in Baldwin’s campaign finance disclosurescontributing in some cases over 100 times to her committees, typically in smalldollar amounts that align with known smurfing patterns:

Name FEC Donations $ to All Campaigns Donations to Baldwin $ to Baldwin

These numbers are not plausible under natural, human donation behavior. To sustain 59,847 separate contributions, for example, one would have to make an average of 20 contributions per day, every day, for 8 consecutive years in the case of Ms. Immasche. Her contributions are now at least over 101,000. Complainant cannot provide an exact number however because the FEC is hiding some of the data. FEC Commissioner Dara Lindenbaum is believed to be part of this coverup, of hiding not only Smurfing, but campaign finance data which are supposed to be public records.

The smurfing patterns observed here - massive donation volumes, extremely frequent transactions, and minimal total amounts routed to Baldwin - are consistent with what federal enforcement agencies would recognize as structured laundering behavior. In this context:

These individuals (or the identities associated with them) appear to serve as intermediary “smurfs”, used to route illegal donations into Baldwin’s campaign. The true source of the funds is obscured by splitting a larger unlawful contribution into hundreds or thousands of micro-transactions, each attributed to a different name, address, or variation. These profiles are typically flagged with employment designations like “Not Employed”, “Unemployed”, “N/A” or “Retired,” further undermining the plausibility that the money came from them personally.

As detailed in this Complaint, the failure of the Baldwin campaign to investigate, reject, or flag these donors - despite obvious statistical impossibility - demonstrates either willful participation or reckless indifference to a systematized smurfing operation. The presence of these donors across FEC records and within Baldwin’s own filings confirms that her committees materially benefited from these patterns and must be held accountable for violations of 52 U.S.C. §§ 30104 and 30122.

Source: “BaldwinSmurfRanking” tab, within file “Baldwin BIG_PARSE_1.xlsx” (USB Exhibit)

Z. Another key player in Baldwin’s Smurfing is the Federal Election Commission. Where they have known for years, Smurfing has been occurring. This is based on, in part, individual letters and complaints filed by citizens who by chance learned their names and addresses were being used without their knowledge. One of the key people allowing Smurfing fraud into political campaigns across the country was Ellen Weintraub, the former FEC Chairwoman.

ZZ. Other researchers and Complainant, including Chris Gleason and Draza Smith, have identified Smurfing patterns that strongly correlate with other electionrelated data. These patterns include Smurfs being linked to voter registration records maintained by the Electronic Registration Information Center (ERIC) where fake absentee ballots are being cast in some of the very same Smurf names. And, there is a very strong correlation, almost eerie, between states where there is high Smurfing activity and high fentanyl-related deaths.

IV. VIOLATIONS ALLEGED

The conduct described in Section III gives rise to multiple violations of the Federal Election Campaign Act (FECA) and associated federal regulations. Each of the following violations is supported by the structured data, spreadsheet analysis, and third-party reporting referenced in the factual record. Complainant incorporates all violation cited above herewithin this section.

Count I – Contributions in the Name of Another

Violated: 52 U.S.C. § 30122 and 11 C.F.R. § 110.4(b)

The Baldwin campaign accepted contributions that, on their face, were not from the true source. The uniformity of dollar amounts, donor names (e.g., twelve “ROBERT”, 29 “MARY” identities), synchronized timestamps, and identical transactions across multiple states make clear that a single or coordinated entity was contributing in the names of others.

Whether through reimbursement schemes, identity fabrication, or credential pooling, this activity squarely violates FECA’s ban on “contributions in the name of another. This activity constitutes a knowing and willful violation of FECA’s prohibition on contributions in the name of another, and supports both civil and criminal penalties under 52 U.S.C. § 30122 and 11 C.F.R. § 110.4(b).

Count II – Failure to Accurately Report the Purpose or Source of Contributions

Violated: 52 U.S.C. § 30104(b) and 11 C.F.R. § 104.3(b)

Baldwin for Senate failed to accurately disclose the true origin of a large portion of its contributions. Campaign reports list:

-Implausible donors such as elderly unemployed persons giving $30,000+;

-High-frequency accounts that log thousands of entries (e.g., SONIA IMMASCHE with 59,847 transactions);

-Purpose fields that obscure the actual nature of incoming funds.

-Per MUR 7923, the FEC has found that mislabeling or failing to account for the true purpose of disbursements or source of funds constitutes a material violation.

Count III – Acceptance of Excessive Contributions

Violated: 52 U.S.C. § 30116(a)(1)(A)

Dozens of individual donors exceeded the $6,600 cycle limit - some by over 500%:

Donor Total Contributed Legal Limit% Excess

These overages cannot be accidental or attributable to clerical error. The Baldwin campaign failed to monitor compliance with federal contribution caps or willfully ignored systemic red flags.

Count IV – Failure to Implement Internal Controls to Prevent Fraudulent Contributions

Violated: FECA compliance responsibilities; interpreted via prior MURs and Commission guidance. The Baldwin campaign accepted contributions without performing due diligence despite glaring anomalies in:

-Donor employment status,

-Geographic ZIP clustering,

-Uniform contribution amounts,

-Timestamp synchrony.

Under Commission expectations, a reasonable campaign must screen for laundering or identity misuse. The failure to do so - when data was plainly available in the campaign’s own FEC filings - constitutes gross negligence or willful blindness.

Count V – Use of Falsified or Fabricated Contributor Identities

Violated: 52 U.S.C. § 30104(b); see also MURs 7449, 7291

The pattern of donations from identical or nearly identical names (e.g., ROBERT FONG, ROBERT GEISEL, ROBERT LAUSCH), all giving $20,963.87 at the same time, reflects the use of synthetic identities. These names are not one-time anomalies. They appear across multiple datasets, across multiple states, and within seconds of each other - demonstrating coordination and possible softwaregenerated credentialing.

False identification of a contributor is a material misstatement of fact under FECA and violates criminal statutes (e.g., 18 U.S.C. § 1001). This conduct also supports criminal liability under 18 U.S.C. § 1001 (false statements), § 1028 (identity fraud), and § 1962 (RICO), due to its structured, systemic, and coordinated nature.

Count VI – Failure to Maintain Contributor Records

Statute/Rule Violated: 52 U.S.C. § 30102(c)(5), 11 C.F.R. § 102.9(a)–(b)

Campaigns must retain full contributor records, including names, addresses, occupations, and employers, for any contributor whose aggregate total exceeds $200. In Gleason’s findings and Complainant’s statement of facts, numerous contributions appear to be linked to synthetic or cloned donors - some of whom could not be real people or could not have contributed lawfully.

Baldwin for Senate lacked verifiable records for:

-Dozens of “ROBERT” and “MARY” profiles,

-High-volume donors like Sonia Immasche or Richard Goldstein, or

-Elderly individuals whose family members later denied the donations,

-then the campaign failed to maintain complete contributor documentation as required by law.

Count VII – Failing to Use Best Efforts to Obtain Contributor Information

Statute/Rule Violated: 52 U.S.C. § 30102(c)(2), 11 C.F.R. § 104.7(b)

FECA requires committees to exercise “best efforts” to obtain and report the full name, mailing address, occupation, and employer of each contributor.

-Gleason’s findings demonstrate that many donor records:

-Lack valid employer information (e.g., widespread use of “not employed”),

-Contain generic or implausible addresses, or

-Were submitted with known unverifiable payment methods (e.g., via ActBlue without CVV).

Baldwin’s campaigns accepted funds from unverifiable sources and did not follow up to obtain correct identifying information, it violated the best-efforts standard.

Count VIII – Knowingly Accepting Excessive Contributions from a Single Source

Using Different Names: 52 U.S.C. § 30116(f), 11 C.F.R. § 110.9

Even if each smurfed micro-donation was below the $3,300 per-election limit, accepting multiple contributions that were knowingly made by one source using different aliases or straw donors constitutes a single excessive contribution.

Example:

If the twelve “ROBERT” identities donating $200,963.87 at the same timestamp were in fact one source, then the Baldwin campaign accepted an excessive contribution disguised as twelve legal ones. The same with the “MARYS”. This directly violates FECA and constitutes an aggregated excessive contribution.

Count IX – Reporting Fraudulent Contributions as Lawful Contributions

Statute/Rule Violated: 52 U.S.C. § 30104(b)(3), 11 C.F.R. § 104.3(a)(4)

Baldwin’s campaigns reported smurfed contributions using names of individuals who did not give the money, or if contributions were entered automatically or with spoofed credentials, then each such filing constitutes a false report of a lawful contribution. This count reinforces Count II, but focuses specifically on fraudulent misclassification of donations.

Count X – Permitting or Assisting Evasion of Contribution Limits

Statute/Rule Violated: 52 U.S.C. § 30116(a)(8) A lesser-known but critical FECA provision states: “No candidate or political committee shall knowingly accept a contribution made in violation of any provision of this section.” If Baldwin for Senate knowingly accepted contributions that:

-Were structured to evade limits,

-Were entered using known spoofing tactics,

-Were flagged internally but not refunded, then the campaign aided and abetted the evasion of contribution limits and should be held liable.

V. REQUESTED ACTIONS

Based on the statutory violations, structured financial evidence, and public record analysis presented in this complaint, the Commission is urged to take the following actions. These are categorized below into civil enforcement actions under the Commission’s authority, and criminal referrals appropriate under 52 U.S.C. § 30109(c) and 18 U.S.C. §§ 1001, 1343, and 1956.

A. Civil Enforcement – Requested FEC Actions

1 Find Reason to Believe that Tammy Baldwin for Senate and any responsible individuals violated provisions of FECA, all the cited statutes and rules above, including 52 U.S.C. §§ 30122, 30104, and 30116. Conduct a full forensic audit of all contributions by donor name, address, employer, and payment method; trace funds from all ActBlue and DNC-associated joint fundraising entities; reconstruct

donor fingerprints using metadata from payment platforms (e.g., IP address, device ID, browser agent).

2 Open a Full Investigation, including the issuance of subpoenas for:

-Donation metadata from Actblue (IP addresses, submission timestamps, CVV usage logs, financial transactions);

-Merchant Services processors such as Stripe, Gift-To-Gram, Divvy Cards (now Bill.com), Paypal, Democracy Engine, and others to be listed upon request or in future court filing;

-Internal compliance communications and donor vetting procedures.

-Forensic Audit each of Balwin Committees’ Records

3 Conduct a full audit of Baldwin for Senate’s donation processing system, with special attention to: Contributions over $6,600 from single donors; all entries tied to “Not Employed,” “Retired,” “N/A”, or “Unemployed” donors; repeated entries with identical timestamps and dollar amounts.

4

Impose Civil Penalties

-Seek the maximum available monetary penalties under 52 U.S.C. § 30109(d) for:

-Each excessive contribution received.

-Each materially false or misreported entry.

-Each willful failure to refund or report illegal contributions.

5 Order Public Correction of Reports Requiring Baldwin’s Committees to:

-File amended FEC reports correcting all contributions falsely attributed, mischaracterized, or exceeding legal limits.

-Recalculate compliance totals for all donors affected.

-Refund all excessive or illegally attributed contributions.

-Mandate Implementation of Internal Controls

-Direct the campaign to adopt and certify a compliance protocol including:

-CVV requirement for all credit card donations.

-Mandate card verifications to the name of the person, to their physical address, to the name of their financial institution, to the physical address of the associated branch.

-Donor identity verification thresholds.

-Automatic flagging of high-volume micro donors and outlier contribution patterns.

B. Criminal Referral – Requested DOJ Actions

In accordance with 52 U.S.C. § 30109(c), Complainant requests that the FEC refer this matter to the U.S. Department of Justice for criminal investigation. The conduct described herein supports a reasonable inference that knowing and willful violations of federal law have occurred.

1. Refer the Matter to the U.S. Department of Justice – Public Integrity Section For criminal prosecution of:

-18 U.S.C. § 1001 – Filing false statements with a federal agency (false FEC contributor identities);

-18 U.S.C. § 1343 – Wire fraud (use of online systems to defraud the government and the public);

-18 U.S.C. § 1956 – Money laundering (structuring of donations to disguise the source of funds);

-18 U.S.C. § 2 – Aiding and abetting by campaign staff or third-party processors.

2. Investigate Potential Conspiracy

Investigate whether campaign personnel, fundraising vendors, data analysts, or other affiliated individuals or firms conspired to knowingly use software, lists of elderly identities, or alias donation schemes to structure contributions in violation of FECA.

3. Protect Elderly or Vulnerable Donors from Identity Misuse

Investigate whether any civil rights or elder protection laws were violated by the repeated listing of elderly or incapacitated individuals as donors without their knowledge or consent.

4. 18 U.S.C. § 371 – Conspiracy to Commit Offense or to Defraud the United States

If two or more people conspired to structure donations, falsify donor records, or evade FECA reporting requirements, this statute is implicated. Smurfing operations typically involve coordinated behavior among digital payment processors, fundraisers, and data handlers. Example applications: Coordinated donor identity spoofing using Actblue, joint donor laundering strategies by campaign staff and fundraising firms; Perkins Coie law firm, Attorney Marc Elias, the named banks, the named financial processors. It takes a village.

5. 18 U.S.C. § 1028 – Fraud and Related Activity in Connection with Identification Documents

This statute criminalizes knowingly producing or using false identification documents or information - including names, addresses, or employer info - to commit fraud. Example application: Use of fabricated or misappropriated donor names to break up large illegal contributions into smaller ones attributed to straw donors.

6. 18 U.S.C. §

1028A

– Aggravated Identity Theft

If smurfing operations used actual, real people’s identities without their permission (especially seniors), this provision adds a mandatory 2-year consecutive prison sentence. Example application: Baldwin’s donor lists include elderly individuals who deny making donations - indicating their identities were used without authorization.

7. 18 U.S.C. § 1341 – Mail Fraud

Any component of the smurfing operation that involved use of the U.S. Postal Service (e.g., donor confirmation letters, campaign mailers based on fraudulent donor data) triggers this statute. Example application: Campaigns mailing FECmandated donor receipts to people who never made the donations.

8. 18 U.S.C. § 1957 – Engaging in Monetary Transactions in Property Derived from Specified Unlawful Activity

This is similar to § 1956 (money laundering), but applies to spending or transferring criminally derived property valued over $10,000. Smurfed donations could qualify as “proceeds” from unlawful structuring or identity fraud. Example application: Campaign disbursements (e.g., TV ads, staff salaries) funded by laundered, unlawful Smurf donations.

9. 18 U.S.C. § 1030 – Computer Fraud and Abuse Act (CFAA)

Automated donation software, bots, or spoofing scripts were used to access ActBlue or other platforms in excess of authorization to submit fraudulent donations, this triggers CFAA. Example application: A campaign or vendor scripts donations using saved payment credentials to inflate donor counts and launder money.

10. 18 U.S.C. § 1962 - Racketeer Influenced and Corrupt Organizations Act (RICO)

If smurfing into campaigns is part of a broader pattern of criminal enterprise (multiple actors, coordinated use of wire/mail fraud, identity theft, money laundering), then RICO applies. Example application: A nationwide network of political operatives, fundraisers, and payment processors using the same laundering structure across campaigns and platforms.

11. The Bank Secrecy Act (BSA) is relevant and may be implicated in Smurfing operations involving political campaigns, especially when contributions are structured to evade thresholds that would otherwise trigger Suspicious Activity Reports (SARs) or other financial institution reporting duties. The GOP House Judiciary has already publicly announced there are thousands of SARs’ reports by various banks on Smurfing.

The Bank Secrecy Act (BSA) 31 U.S.C. § 5311, enacted in 1970, requires U.S. financial institutions to assist government agencies in detecting and preventing money laundering and other financial crimes. This includes:

-Detecting structuring (breaking up large transactions to evade reporting requirements),

-Filing Suspicious Activity Reports (SARs) when unusual or potentially illicit activity is detected, and

-Reporting cash transactions over $10,000, or repeated smaller transactions that appear coordinated.

-While political campaigns and PACs are not directly regulated under the BSA, banks, credit card processors, and fundraising platforms like Actblue or Stripe are. Smurfed campaign contributions are being routed through Stripe, ActBlue, Democracy Engine, and other merchant banking partners. These funds are structured to evade detection. Structuring political donations in this way may constitute a conspiracy to cause false or omitted reporting by a financial institution, in violation of the Bank Secrecy Act.

The Baldwin for Senate campaign received large volumes of small-dollar contributions that, on information and belief, were structured for the purpose of evading transaction thresholds and risk screening protocols imposed on financial institutions under the Bank Secrecy Act (31 U.S.C. § 5311 et seq.). Such contributions constitute violations of 31 U.S.C. § 5324 (Structuring) and suggest a broader conspiracy to avoid regulatory oversight by concealing the source, volume, and aggregation of campaign funds.

12. 31 U.S.C. § 5324 – Structuring Transactions to Evade Reporting Requirements

Criminalize transactions designed to evade federal transaction reporting thresholds. It applies not only to cash, but also to wire and electronic fund transfers that are split up to avoid scrutiny. Example: A $50,000 donation is split into 500 microdonations of $100 using synthetic donor identities. Each transaction stays below card processor internal flagging levels, evading anti-fraud thresholds and SAR triggers.

VI. CERTIFICATION

This complaint is submitted under oath and penalty of perjury, as required by 52 U.S.C. § 30109(a)(1) and 11 C.F.R. § 111.4. I hereby affirm that the facts stated in this complaint are, upon information and belief, true and correct to the best of my knowledge and belief.

Complainant:

Peter Bernegger

1806 Brynnwood Trace New London, WI 54961 920-551-0510

Signature: _______________________________ Peter Bernegger

Date: ___________________

Notarization:

Subscribed and sworn to before me this 16th day of May 2025.

Notary Public:

My Commission Expires: