INCLUDES FINANCIAL REPORT

2002

2022 Size:

INCLUDES FINANCIAL REPORT

2002

2022 Size:

Our mission is to provide infrastructure and services to facilitate the marketing and distribution of fresh food, flowers and other ancillary products.

2022 is a year that shall not be forgotten. It is the year when Brisbane Markets Limited (BML) celebrates 20 years of ownership and growth of the Brisbane Markets site. It is the year where we faced a post-health pandemic environment and when the resilience of the markets community was put to the test after a natural disaster. While challenges abound, at every step of the way we have proven that we are up to the task.

Despite the trials we have faced, BML has continued to achieve the robust results that have been the hallmark of the past 20 years.

In the 2022 financial year, BML achieved an underlying profit before tax of $19.13 million, reflecting growth of 1.48% when compared to the previous year.

At 30 June 2022, our total assets had grown by 19.72% to $506.97 million, our net asset position was $267.13 million, and our net assets per share was $4.90.

Significant progress has been made on the Building H1 development and the continued expansion of South Gate West (SGW) to ensure the future growth of and continued investment in the Brisbane Markets site and its infrastructure, to facilitate the marketing and distribution of fresh produce, in line with our company mission and our collective ambition to invest in Australia’s central market system.

It is a privilege to be leading the company during our milestone year, with 20 years of responsible stewardship and growth since BML purchased the Brisbane Markets site from the state government in September 2002.

The history of Queensland’s central fruit and vegetable market extends back over 150 years to its humble beginnings on the riverfront at Market, Charlotte and Eagle Streets in 1868.

After years of poor patronage, the original market closed in 1881 and was replaced in 1885 by the purpose-built Municipal

Market in Roma Street, tucked beside the rail line and handy to the wharf area in the heart of the city.

However, by 1906, a group of unhappy Roma Street traders had created a rival market in Turbot Street, known as the Brisbane Fruit and Produce Exchange Ltd. Over the years, the two markets operated in competition and their proximity created a city market precinct.

As the city grew, so did congestion, and in 1964 the city market precinct was moved. Owned by the Queensland Government, the new central market in Rocklea comprised five buildings and a trading area covering just 14 hectares within a larger 50-hectare site.

In the late 1990s, there was growing disquiet at the lack of collaboration and consultation between landlord and tenants, coupled with low priority given to security, maintenance and the site’s operations, prompting Brisbane Markets wholesalers, supported by the industry, to lobby to buy the Brisbane Markets.

The state government announced the sale of the site by public tender in mid-2001. After a fierce, four-stage bidding process, Landacq Limited, a public company comprising 150 predominantly industry-based shareholders, was the successful bidder, buying the then 72-hectare site in September 2002 for $73.85 million. The company subsequently changed its name to Brisbane Markets Limited.

Since that monumental purchase, the Brisbane Markets site has expanded to 77 hectares and BML has invested over $220 million in capital expenditure to upgrade and develop the site. In 2002, the site’s total assets were worth $77 million. Today, that figure is $507 million.

The past 20 years of ownership of Brisbane Markets shows that by working together we can build a dynamic industry, promote the importance of eating fresh fruit and vegetables to consumers in Queensland and beyond, and face the challenges of the future.

The same camaraderie and teamwork that buoyed the markets community during BML’s bid for the landmark site was on display in February and March 2022, when the resilience of the Brisbane Markets community was put to the test as flood waters inundated the site after a period of intense rainfall.

BML's disaster preparedness allowed for the removal and decommissioning of key infrastructure likely to be impacted before flood waters rose.

Once the site became accessible on the afternoon of Tuesday, 1 March, the majority of wholesalers worked around the clock to ensure buyers had access to fresh produce and commenced trading from the Central Trading Area (CTA) some 17 hours later.

Other areas of the site were more significantly impacted by the flood. These were progressively cleaned, and individual businesses recommenced operating from their premises as power and services were reinstated.

BML worked very closely with a small number of service providers and volunteer groups as part of our flood recovery efforts, including Crisp Power and Control, SBP Australia, Eaton Services Group, SUEZ, Origin Energy, Advance Groups, Rapid Relief Team, Rural Fire Brigade and the Australian Defence Force.

Along with staff members, these organisations assisted BML and our tenants to clear almost 4,000 t of flood waste from the Brisbane Markets site, clean all impacted surfaces and reconnect essential services and infrastructure.

By the end of March 2022, power supply was reconnected to all buildings, a process significantly expedited by BML’s prior flood mitigation project to raise electrical substations above flood levels. By the end of May, a site-wide audit was undertaken of all main building and tenancy distribution boards with final repairs completed by mid-September 2022.

The BML Board and senior management wholeheartedly thank and appreciate the hundreds of volunteers, service providers, tenants and staff members who banded together to clean and repair the site to ensure that we could continue to supply Queenslanders with fresh fruit and vegetables.

Despite the challenges of the flood event and the health pandemic, BML has achieved a strong financial outcome and solid growth over the 2022 financial year and, indeed, the 20 years that preceded it.

Our achievements and resilience are testament to the strength and experience of industry-based ownership of the Brisbane Markets.

The results are also a reflection of the ongoing hard work, prudent decision-making and sound investment strategies implemented by the BML Board and senior management team, who are all well equipped to make the most of Brisbane Markets’ considerable opportunities into the future.

BML reported a very positive result for the year and has maintained the operating profit at a consistent level to last year, despite recent impacts of natural disasters.

The conditions of the property market have resulted in a significant increase in the value of the Brisbane Markets property, and a similar result at Perth Markets, where BML owned 41.73% of the company. The underlying operating profit before tax of $19.13 million represents growth of 1.48% on the prior year.

The company recognised an increase in the property value for Brisbane Markets of $42.85 million as outlined in the financial report, and Perth Markets Group Limited (PMGL) has continued to make a solid contribution again this year. A summary of the financial performance for the 2022 year is summarised below.

BML achieved further improvements in its balance sheet position in the 2022 year, with total asset growth of 19.72% and net asset growth of 29.64%, when compared to the prior year.

The reported group revenue for the year was $122.31 million, however underlying revenue was relatively unchanged at $46.32 million for the year, as summarised below:

The reported group expenditure increased to $33.92 million for the year, and underlying expenditure remains slightly lower than the prior year as summarised below.

BML continues to own 41.73% of PMGL.

The performance of PMGL continued to be strong, resulting in a positive result included within the financial report. The summary of the result after removing the one-off impacts is provided below.

BML has been subject to further site operations and property related costs during the 2022 financial year, in particular further increases in insurance premiums and waste disposal costs. General repairs and maintenance costs were lower than the prior year due to the significant focus on flood recovery works in the second half of the year. Expenditure continues to be reviewed by the company ongoing to ensure that we can deliver the required returns to shareholders.

The major asset of the group is the Brisbane Markets properties located at Rocklea, which were independently valued at $425 million at 30 June 2022, and the statement of financial position reflects this fair value. The full detail relating to the properties is included at Note 6 to the financial report.

BML’s flagship project for 2022 is the new, sustainably designed Building H1 development.

This $23.2 million, 5,667 m² warehouse is being constructed at SGW, in close consultation with tenant, Green Endeavour, the parent entity of existing Brisbane Markets tenants, Fruitlink and Suncoast Fresh.

After some delays to construction due to inclement weather, Building H1 is progressing well. Bulk earth and piling works are complete, as is the installation of underground services, the hardstand and ground level offices. Approximately 30% of the concrete hardstand was in place at 30 June 2022.

Practical completion is expected early in 2023. Once complete, the warehouse and distribution facility will have six small commercial vehicle docks, five docks with dock levellers for large commercial vehicles, a finger dock and two forklift ramps.

It will also feature eight cold rooms, supported by a main staging and packing area with varying temperatures, a freezer room, approximately 381 pallet spaces, and two heavy produce rooms, along with an administration hub accommodated in a two-level office wing.

Conceptual designs, development applications and bulk earth works for a new 321-space parking facility in SGW were completed over the 2022 financial year. The car park is designed to provide more accessible parking for Building H1 and provides contingency for future developments in the SGW precinct.

The parking facility tender process is now complete, and the construction phase is expected to reach completion in early 2023.

A new pedestrian access ramp was installed in SGW, linking CP2 with the elevated building platform, the western half of which is the site of the Building H1 development with a future development site to the east. The PWD-compliant pedestrian ramp will provide tenant staff access to CP2, Sherwood Road and the adjacent Commercial Centre.

Planning is underway for several future warehouse developments in SGW, in line with our master plan, with a view to progressing these projects over the coming years.

Elsewhere at the Brisbane Markets site, work is progressing to modify existing buildings to better suit tenant business operations.

The development application, tender process and signed agreement with existing tenant, Alfred E Chave Pty Ltd, have been finalised for a 577 m² extension to Building N and the detailed design process is now underway. The project will extend the existing 1,516 m² warehouse to an estimated gross lettable area of 2,093 m².

During the 2022 financial year, Building M1 was divided into two tenancies and new 10-year leases signed by the existing and new tenants. The project, which progressed over August and September 2021, involved the construction of an intertenancy PIR panel wall with concrete kickers, along with all associated works to split the relevant base building services, including electrical circuits, lighting and fire services.

The 4,704 m² purpose-built warehouse, constructed in October 2011, was originally designed to accommodate two tenants prior to being constructed as a sole occupancy tenancy in accordance with variations to the building plans as requested and approved by the then tenant, Fresh Produce Group of Australia Pty Ltd (FPG).

Unit M1-01 is now a wholly contained tenancy, leased to FPG, with seven dock levellers, a finger dock and a forklift ramp, together with cold rooms and office accommodation on two levels. Unit M1-02, leased by existing tenant Fresh Selections Pty Ltd, features three dock levellers, a forklift ramp and cold rooms, with office accommodation also on two levels.

5

172,146 m² (including

148,144 m² (excluding land leases)

5.63

5.56

In the 2022 financial year, we continued our strategic investments in PMGL and South Australian Produce Market Limited. This investment in other central markets continues to reap benefits, with the increased property valuation contributing to the overall value of BML’s investment of PMGL, as outlined in the financial report.

In April 2022, BML announced its intentions to increase its shares in PMGL from 41.7% to 51%.

BML also works collaboratively with Central Market chambers and wholesalers through our participation in the Hort Connections trade show and our continued investment in the A better choice! national retail program.

In February 2022, the Saturday Fresh Market relocated to the Covered Unloading Area (CUA) within the Brisbane Produce Market. The move facilitates future growth and warehouse developments in the SGW precinct, including the new Building H1 development.

The all-weather venue has been praised by customers and stallholders alike, and since relocating, an average of over 4,400 people attended the Saturday Fresh Market each week.

The Saturday Fresh Market utilises a number of digital marketing channels to communicate with the local and wider Brisbane community. Over the course of the 2022 financial year, these channels reached almost five million people.

The Sunday Discovery Market was retired after attempts to find a suitable alternative venue were unsuccessful.

A focus on parking management within the Northern Industrial Precinct continued in the 2022 financial year, utilising a mobile licence plate recognition camera mounted to the BML security van.

The system allows for the education of repeat offenders and has reduced congestion, increased parking compliance and allowed buyers to access adequate parking options around the CTA and Fresh Centre during peak trading hours.

24,551,501 shares held in Perth Markets Group Limited

98,500 shares held in South Australian Produce Market Limited

261,295 attendees for the year

BML hosted the Brisbane Produce Market Gala Dinner in conjunction with Brismark in July 2021. The event celebrates Queensland’s fresh produce supply industry and was attended by approximately 500 wholesalers, service providers, government representatives and industry organisations.

The popular Brisbane Produce Market Forklift Operator of the Year event ran over September and October and the Brisbane Produce Market Mango Auction was held on Thursday, 16 September. Originally planned as a live event, after a period of uncertainty regarding local COVID-19 restrictions, the decision was made to hold the Mango Auction as an online auction.

For the second year in a row, the national fresh produce industry conference Hort Connections was held in Brisbane in June 2022, and BML staff played a leading role in hosting over 100 growers, industry representatives and delegates from Australia’s other central markets on a tour of the Brisbane Produce Market as part of the conference. BML was also well represented at the conference tradeshow under the banner of Australia’s Fresh Produce Markets - the collaboration between the Central Markets Association of Australia and Fresh Markets Australia.

In October 2021, BML hosted the first Future Fields summit in this site’s CTA. Some 60 delegates attended the summit in person, including representatives from several Brisbane Markets wholesaling businesses, and over 70 people attended online.

Our Memoranda of Understanding with grower organisations and the Bulls Masters continue to promote the Brisbane Markets to regional growing communities. In February 2022, BML arranged a Bulls Masters-hosted barbecue for Bundaberg Fruit and Vegetable Growers as part of our corporate partnerships with both organisations.

In February and March 2022, during and after the flood event at the Brisbane Markets, BML managed a large volume of media requests for comment and footage, resulting in national and local coverage. The overarching messaging to media was for consumers to support growers and the fresh produce supply chain by continuing to purchase fruit and vegetables from independent retailers.

BML also continued to promote the Brisbane Flower Market to florists and event planners in South East Queensland, as well as consumers in the local area.

BML executed wholesale and retail focused advertising campaigns for Valentine's and Mother's Days, promoting online orders and deliveries to combat potential COVID-19 impacts and associated supply chain issues. Coverage of the Brisbane Flower Market featured on local TV news, radio and print media in conjunction with these major trading days.

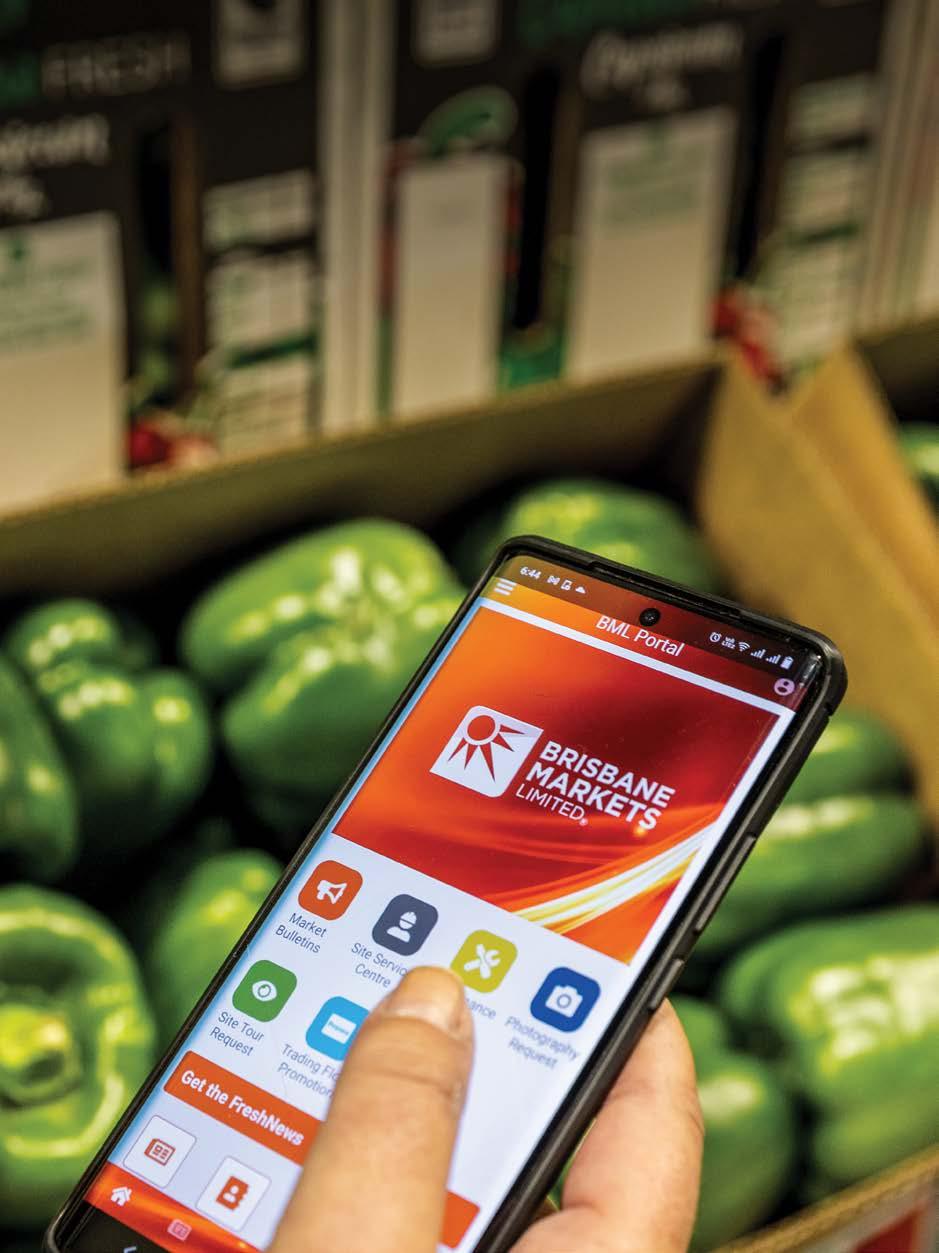

The BML Portal app and Site Service Centre Online web resource continue to work hand-in-hand to ensure markets users can easily find relevant information while on the go with quick access to forms, maps, frequently asked questions and how-to guides. The combination of dedicated web page and mobile app allows for contactless access to important Brisbane Markets information, reducing the face-to-face contact and administrative resources for in-person and phone enquiries.

A new version of the BML Portal app was released in November 2021, complete with updated user interface allowing users to apply for photography, site tours and selling floor promotions, along with requests for maintenance assistance. Registered users can access tenant contact information, bulletins and markets news.

Over the course of the 2022 financial year, Site Service Centre Online was viewed almost 12,500 times and continually updated to create a one-stop-shop for markets users.

Bulletins remain the main vehicle for disseminating important operational, maintenance, safety and administrative information that impacts the operation of tenant businesses. Fresh News is used to communicate newsworthy items to markets users, including updates on developments and maintenance projects, details of leasing opportunities, event participation and promotion, health and other operational messaging.

Fresh Source magazine is distributed throughout Australia to industry organisations, governments at all levels, media outlets, growers, sponsors and the Brisbane Markets community. This respected industry publication provides an overview of the news impacting the fresh produce supply chain, showcasing the diverse people and topics that are of importance to Australia’s horticulture industry.

154,041

514,977 web page views

12,489

Site Service Centre Online unique page views

7,805 News Portal users

19,748

301,437

11,896

614,761

33,013 website users

97,992

While early in the financial year COVID-19 continued to cause disruptions to our ongoing maintenance schedule through staff shortages, supply chain disruptions and lockdowns, the latter part of the financial year saw a focus on flood recovery works for our maintenance team.

An ongoing project is underway to extend BML’s network of inground services to support the new Building H1 warehouse and to future-proof for further development.

These works complement the independent South Gate sewer network, completed in the 2021 financial year, by extending and upgrading underground sewer, water, electricity, and copper and fibre communications networks into the SGW Precinct.

BML is also progressing a high voltage (HV) master plan to oversee an HV network to support future development of SGW. The project will involve upgraded HV underground cabling, the introduction of a new substation, and completing the HV link between the existing substations at Buildings E1 and H1.

The roadways at Brisbane Markets are put through heavy use, resulting in wear and tear over time. For the safety of markets users and the integrity of the fresh produce that is transported around this site, our ongoing asphalt resurfacing works are an important aspect of BML’s scheduled maintenance program.

The 2022 financial year saw a focus on resurfacing and repair works to roads servicing the South Gate Precinct, including Martin Taylor Drive.

Line marking controls were also upgraded across the site to reflect BML’s standards and comply with Department of Transport and Main Roads specifications for line marking and pavement works, improving traffic flow and driver safety by

highlighting exclusion zones, forklift work areas, give way directions and parking spaces.

Over the 2022 financial year, several aging public amenities were upgraded, including removal of asbestos containing material where present.

Mechanical ventilation units were installed in the CUA roof to reduce heat load build during the summer months, and works to retrofit and repair lighting in the CUA under warranty commenced and are expected to be completed early in the 2023 financial year. As part of the scheduled maintenance program, columns and bases in the CUA were painted quarterly, and facias, bollards and Armco barriers were painted as required.

In October 2021, BML installed new cladding and signage on the Fresh Centre. The works were prompted by the reclassification of the aluminium composite material cladding previously used on three sections of the building to flammable. In total, 98 m² of cladding was removed from the Fresh Centre and replaced with new Vitradual panels. The existing building signage was also upgraded.

To provide a consistent approach to pest management across the Brisbane Markets, BML developed and, from July 2021, implemented site-wide minimum standards for pest control in common areas on site in conjunction with contracted pest management service provider, Flick Anticimex.

The latest stage of BML’s roof access upgrade project is underway, with roof access point changes to multiple buildings designed to support safe access for tenants, BML and external service providers for maintenance and servicing requirements.

Electrical infrastructure Fire detection

28 substations

448 electricity meters

40 building main boards

504 tenancy distribution boards

355 hose reels

771 fire extinguishers

363 fire hydrants

40 fire indicator panels

Maintenance Hydraulics infrastructure

1,695 maintenance jobs raised

1,625 maintenance jobs completed

162 dock levellers maintained

23 boom gates

62,853 kilolitres of water consumed

256 water meters

125 backflow prevention devices

15 sewerage pump stations

45 public toilet blocks

Pest management

1,476 bait stations

Brisbane Markets is an operating industrial facility and, as such, safety is a core principle of our people and culture strategic priority, as are the shared values and dedication of the BML Board, management and staff.

The Site Safety Program is a joint initiative between BML and Brismark and has received strong support from tenants and forklift operators alike. A key component of the program is random drug and alcohol testing of forklift operators who hold a BML Forklift Operator Permit.

Since testing started in October 2020, over 640 tests have been undertaken with only two confirmed positive results. After pausing as scheduled in December 2021, and for an unscheduled period after the 2022 floods, random drug and alcohol testing recommenced in May 2022 and, over the 2022 financial year, 481 tests were undertaken with one confirmed positive result.

BML also worked collaboratively with Brismark to mark Safety Month in October 2021. BML presented a selection of safety workshops, covering topics such as forklift safety, drug and alcohol testing process, service provider safety and chain of responsibility, and sponsored Brismark’s Safety Star Award which recognised markets users who had found an innovative solution to a WHS risk on site.

Safety Month culminated in the Brisbane Produce Market Forklift Operator of the Year event, which is another opportunity to reinforce a culture of safety, this time through encouragement and reward.

During the 2021 Gala Dinner, awards were presented by The Hon. Mark Furner, Minister for Agricultural Industry Development and Fisheries, to 17 members of the markets community for 40 years of dedicated service to the Brisbane Markets.

BML’s team values continue to guide the actions and attitude of staff members, focusing on our commitment to customer focus, teamwork, accountability, integrity and proactivity. These team values govern decision-making processes, preferred behaviours and expected team performance in a way that promotes a positive organisational culture that meets the expectations of BML’s Board and senior management.

As Queensland moved to a ‘new normal’ approach to the COVID-19 health pandemic, BML worked in conjunction with Queensland Health and the Department of Agriculture and Fisheries (DAF) to arrange access to fast track vaccinations through state-run centres and pop-up vaccination clinics at Brisbane Markets.

Access controls were increased in the lead-up to borders opening and focused messaging on mask wearing in line with state government guidelines, and guidance to tenants to assist in limiting outbreaks within businesses was prominent. Additional cleaning of high-touch common areas continued, with 995 hours of sanitising cleaning completed across the 2022 financial year.

BML continued to reduce face-to-face contact for frontline staff members with the provision of online inductions, the Site Service Centre Online and BML Portal app.

1,030

forklift operator permits

365 registered forklifts

7,570 access cards issued

386 tenant commercial vehicles

810 registered buyers

5,126 online safety inductions

481 drug and alcohol tests undertaken

All new developments on site undergo environmental management planning to minimise their impact on the local environment. Sustainability was a key criterion for the tenant in the design planning of Building H1.

Just some of the many sustainability features of the build include tilt concrete panels, slabs and walls making use of fly ash material, which is a by-product of power generation that offers environmental benefit through the re-use of waste materials; low toxicity and low volatile organic compounds emission paint throughout the interior of the building; recycled and carbon neutral flooring; and bio-soluble and recycled roof insulation material.

The purpose-built development includes a one-touch warehousing system with eight temperature zones to provide optimum temperatures for specific products, thereby reducing power consumption.

In addition, the roof top terrace will feature raised garden beds growing edible plants and the entry to the building will include a green wall of edible garnishes that can be grown in an indoor environment.

Brisbane Markets is located in a fire ant biosecurity zone and as such BML staff members are trained by the DAF to locate and identify fire ant nests on site. When located, nest areas are marked and reported to DAF for treatment to reduce the spread of this invasive species.

To improve sustainability and reduce electricity costs, solar energy has been utilised as a renewable energy resource at Brisbane Markets since the first pilot solar panel project was launched in 2015.

The 15,603 solar panels installed on 19 buildings across this site generated 5.55 GWh of power during the 2022 financial year, which is over 11% of this site’s electricity usage. This is the equivalent of powering more than 1,100 households for a year.

Our investment in solar energy infrastructure over the past six years exceeds $8 million and our annual return on this investment exceeds $1 million, reflecting savings in electricity purchase costs and large-scale generated certificate credits.

Hand-in-hand with our sustainability goals, BML is conscious of the responsibility we have to the local social environment both through waste management and in our proximity to the Oxley Creek catchment. BML has continued its support of the Oxley Creek Catchment Association, which protects and enhances the

natural environment and resources of the catchment.

During the 2022 financial year, over 410,000 kg of non-food waste (excluding waste generated from the flood event), such as pine pallets and scrap metal, was diverted from landfill, recycled and converted into useable products.

Through our partnership with Foodbank Queensland (FBQ), in which BML promotes awareness of FBQ services to wholesalers, including addressing food insecurity and rescuing fresh produce that would otherwise be dumped, over 700,000 kg of fresh produce was also diverted from landfill and used to feed those in need.

Further afield, BML provides funding to support growing regions throughout Queensland, which we do through Memoranda of Understanding with the Bowen Gumlu Growers Association and Bundaberg Fruit and Vegetable Growers, and sponsorship of the Granite Belt Growers Association’s inaugural Gala Dinner in July 2021.

These grassroots membership organisations provide advocacy, research and workforce development services for growers in their regions.

BML also continued its sponsorship of the Bulls Masters Youth Cup, held in Bundaberg in December 2021. The Bulls Masters take cricket to regional areas and promote our shared values of a healthy lifestyle through regular activity and the consumption of fresh fruit and vegetables.

In September 2021 the Brisbane Produce Market Mango Auction raised $27,444 for Redkite, a charity that assists families of children undergoing treatment for cancer. Since 2002, the Mango Auction has raised over $1 million in donations for nominated charities.

In June, our staff members participated in the Push Up Challenge, raising over $7,000 to promote awareness of mental health issues and aid suicide prevention initiatives.

BML contributed almost $160,000 in charitable donations and other sponsorships during the 2022 financial year, including: Morgans’ Big Dry Friday, a nondenominational day of support for rural Australia held annually; The Lady Musgrave Trust, providing practical solutions for women and children facing homelessness and domestic violence; the Mt Gravatt Bowls Club; the MacGregor Netball Club; and, in conjunction with Brismark, sponsored the Brisbane Produce Market Charity Golf Day in support of Diabetes Australia.

then now

15,603 solar panels

5.55 GWh of electricity produced

11.62% of Brisbane Markets’ electricity usage >1,100 yearly household power equivalent

414.92 t

706.71 t

5 gross pollutant traps

1,693.44 t

152.10 t

103.78 t

*Note: these figures do not include waste that is generated and removed by individual tenants. These figures also do not include waste that was generated during the flood recovery process.

Your Directors present their report on the consolidated entity consisting of Brisbane Markets Limited (BML) and the entities it controlled at the end of, or during, the year ended 30 June 2022.

The following persons were Directors of BML during the year or at the date of this report:

• Anthony Kelly

• Peter Tighe

• Bruce Hatcher

• Stuart Lummis

• Nicole Radice (appointed 10 November 2021)

• Noel Greenhalgh

• Stephen Edwards (appointed 10 November 2021)

• Andrew Young

• Anthony Joseph (retired 10 November 2021)

• Evonne Collier (resigned 8 October 2021)

During the year, the principal continuing activities of the consolidated entity consisted of:

• facilitating the efficient and effective operation and growth of the Brisbane Markets site;

• providing infrastructure and services to facilitate the marketing and distribution of fresh produce, together with flowers and other ancillary products, to domestic and international customers; and

• preserving and promoting the role of the central market for the benefit of industry stakeholders and consumers.

There were no significant changes in the nature of the activities of the consolidated entity during the financial year.

The net profit after income tax of the consolidated entity for the year ended 30 June 2022 was $62.393 million (12 months to 30 June 2021: $18.448 million).

Underlying net operating profit (Non-IFRS measure, unaudited)

The underlying net operating profit before income tax was $19.134 million for the 2022 financial year, compared to $18.855 million for the 2021 year.

The underlying company performance has been very pleasing given the circumstances that existed during the year. The information below provides additional detailed explanation of the consolidated entity operating performance by making adjustments for items relating to fair value movements, flood impacts and income tax adjustments. The Directors’ view is that presentation of the information in this format provides an

accurate representation of the underlying performance that would not otherwise be available.

The net profit after income tax includes the following:

1. The impact of the Brisbane Markets property valuation fair value movement in the current year was an increase of $42.849 million before tax (increase of $18.105 million for the 2021 year).

2. The consolidated entity is making good progress with its flood recovery efforts. Future flood reinstatement works of a capital nature of $6.53 million will be incurred in the 2023 year, and have been reflected as future expenditure on investment property in the valuation undertaken at 30 June 2022. Expenditure of $2.90 million for flood reinstatement works was capitalised to investment property prior to 30 June 2022 and the insurance proceeds have been approved, and are receivable. The impact of the flood event as disclosed above was a $9.402 million contribution to profit, which at this stage is expected to cover the reinstatement costs incurred to date, and in the future, as noted above.

3. The contribution from Perth Markets Group Limited (PMGL) and investments for the current year was a profit of $19.241 million as disclosed in the financial report (profit of $3.289 million for the 2021 year). A significant component of the reported profit of PMGL has resulted from an increase in the property valuation of the Perth Markets site. The table below provides a reconciliation to information contained in the financial report.

At reporting date, BML's drawn down funding facility was hedged under five long-term interest rate swaps to the extent of 46.54%. Hedging is a requirement of the funding facility provided by the company’s banker.

In support of our mission to provide infrastructure to facilitate the distribution of fresh produce, foundations were laid for the expansion of South Gate West (SGW) at Brisbane Markets, through the progression of works to implement and support future development and growth in that precinct.

Progress has been made in the construction of the new $23.2 million, 5,667 m² warehouse, Building H1, purpose-built and sustainably designed for tenant Green Endeavour, the parent entity of existing Brisbane Markets tenants, Fruitlink and Suncoast Fresh. Practical completion is expected early in 2023.

Conceptual designs, development applications and bulk earth works were completed for a new 320-space parking facility to facilitate tenant parking for Building H1 and future developments.

In-ground services, including sewer, water, electricity and communications networks, have been extended and upgraded with the networks designed and engineered to support all future developments in SGW, and the project will continue to progress alongside these developments.

A new pedestrian access ramp has been constructed in SGW, linking CP2 with the raised building platform which houses the Building H1 development and future development sites. The pedestrian ramp will provide future tenant access to CP2, Sherwood Road and the adjacent Commercial Centre.

The Saturday Fresh Market was relocated to the Covered Unloading Area of the Brisbane Produce Market to facilitate the expansion of the SGW precinct; however, the Sunday Discovery Market was retired after attempts to find a suitable alternative venue were unsuccessful.

New extractor fans were installed in the Covered Unloading Area roof to increase airflow in the summer months for both the Brisbane Produce Market and the Saturday Fresh Market.

Building M1 was divided into two tenancies, a new garage was built, and new 10-year leases signed by the existing and new tenants. The project involved the construction of an intertenancy PIR panel wall with concrete kickers along with all associated works to split the relevant base building services including electrical circuits, lighting, and fire services.

The Brisbane Markets site was inundated by floodwater in February 2022. The recovery effort progressed swiftly, with the site operational within 17 hours, and most rectification works to be completed by year's end.

On top of flood recovery works, our scheduled maintenance of the site continued with ongoing painting, asphalt and linemarking works, along with the upgrading of aging amenities, with the refurbishment of public toilets in Buildings L, V and Y as well as scheduled painting works in Buildings B, C and D.

Site-wide minimum standards for pest control for common areas on site were implemented and bird netting was installed under awnings west of Building A and north of Building D.

Drug and alcohol testing continued as part of our Site Safety Program, with an additional 481 tests undertaken in the 2022 financial year and only one confirmed positive test result.

During the 2022 financial year, over 700,000 kg of fresh produce from Brisbane Markets was donated to Foodbank Queensland as part of our partnership to provide support to this valuable organisation and promote awareness of their services to address food insecurity and to rescue fresh produce destined for landfill.

Our annual event, the 2022 Brisbane Produce Market Mango Auction, facilitated the donation of $27,444 for Redkite with the event reaching the milestone of having raised $1 million for charity since 2002.

The Brisbane Markets site has seen an increase on the already exceptional occupancy rates for tenancies at this site, with industrial occupancy sitting at 100% and overall site occupancy of 98.57% at 30 June 2022.

The land and buildings at the Brisbane Markets site were valued by Charter Keck Cramer Pty Ltd at a value of $425.000 million as at 30 June 2022, and the financial accounts of the consolidated entity reflect the fair value of this asset.

The consolidated entity remains in a very sound financial position, with total assets of $506.974 million, and net assets of $267.126 million at 30 June 2022, representing $4.90 per share.

Dividends paid to shareholders during the year were as follows: Final dividend of 8.25 cents per fully paid share on 20 October 2021, fully franked at 30%. $4,496,250 Interim dividend of 8.75 cents per fully paid share on 23 March 2022, fully franked at 30%. $4,768,750

Total dividends paid during 2021/22 financial year $9,265,000 Total dividends paid during 2020/21 financial year $8,856,250

There were no significant changes in the state of affairs of the consolidated entity during the financial year.

Insurance proceeds of $10 million, which were a receivable at year end, have been received in full by the company.

There are no significant events that have occurred subsequent to the end of the financial year that have not been disclosed in this report.

Information in relation to the likely developments of the consolidated entity include:

• The BML Board continues to review its strategic priorities on a regular basis, which includes an ongoing focus being given to the operation and development of the existing Brisbane Markets site.

• The consolidated entity will continue to progress opportunities across the Brisbane Markets site as they arise.

The consolidated entity is not subject to any significant environmental regulation.

Anthony’s career portfolio of directorships includes Brismark (President), Brisbane Markets Limited, Gladstone Ports Corporation, Carter and Spencer Group, Brisbane Lions AFL Football Club (Chairman), Lindsay Australia and Horticulture Innovation Australia Limited, chairing the International Trade Advisory Panel and International Market Access Assessment Panel.

Anthony graduated with a Bachelor of Laws (UQ), and worked in the legal profession as Judge’s Associate and Solicitor. More recently, Anthony’s business experience has extended into his co-ownership of the emerging Veracity Technology in the IT industry.

Anthony has been a Non-Executive Director of Brisbane Markets Limited since 2002.

Special responsibilities

• Chair Member of:

– People, Remuneration and Culture Committee (Chair)

Deputy Chair

Peter has been a Non-Executive Director of Brisbane Markets Limited since 1999. His family has a long history in the Brisbane Markets and Peter is a second-generation member with 45 years’ experience in fruit and vegetable wholesaling. He is currently a consultant for Global Fresh Australia and New Zealand.

Peter was a Director of Brismark from 1988-2021, and is also a Director of a number of private companies. Peter is also the Managing Director of Magic Bloodstock Racing, a thoroughbred horse racing and breeding business.

Peter is a member of the Australian Institute of Company Directors.

Special responsibilities

• Deputy Chair

• Member of:

– Legal and Compliance Committee

– Strategy and Investment Committee

– People, Remuneration and Culture Committee

Bruce has been a Non-Executive Director of Brisbane Markets Limited since November 2012. Bruce has extensive experience in chartered accounting covering many industry sectors, and consults to and serves on the boards of several private and/or family-owned businesses.

Bruce is currently the Chairman of Queensland Rugby League. Formerly, Bruce was the Chair of BDO Queensland, Managing Partner of Horwath Brisbane, Chairman of Horwath Australia, and the Deputy Chairman and Director of 20 years of the Queensland Academy of Sport. Bruce is a regular speaker at industry conferences and professional development seminars nationally and has written many articles on a wide range of family business issues.

Bruce has a Bachelor of Commerce, is a Fellow Chartered Accountant and a Fellow of the Australian Institute of Company Directors. Bruce is also an Adjunct Professor at the Australian Centre for Family Business, Bond University.

Special responsibilities

• Director

Member of:

– Finance and Audit Committee (Chair)

Stuart Lummis

BEc,

DipConstMan, GradDipAcc, FAICD, FFin

Stuart brings many years of experience as a senior executive in the property sector, specifically within ASX-listed groups, government agencies and not-for-profit organisations. Stuart has extensive expertise in the management and development of complex property portfolios through his role as the Head of Corporate Property for Yourtown and previously as the Director of Building, Planning Facilities and Property with the Roman Catholic Archdiocese of Brisbane.

Stuart is Non-Executive Director on the board of several organisations, including Bolton Clarke (formerly RSL Care RDNS), Deaf Services Queensland, Nazareth Care Australasia, National Trust of Queensland, Sisters of St Joseph Stewardship Council and Property Advisory Panel and the Heritage Council of Queensland. Additionally, he is a member of the Property Council of Queensland, sitting on the Social Infrastructure Committee and Chairing the National Trust of Queensland Heritage and Advocacy Committee.

Stuart has a Bachelor of Economics, Post Graduate Diploma in Applied Finance and Investment, Diploma in Project and Construction Management, and is also a Fellow of the Australian Institute of Company Directors.

Special responsibilities

• Director

• Member of:

– Finance and Audit Committee

– Legal and Compliance Committee

– Strategy and Investment Committee (Chair)

– People, Remuneration and Culture Committee

Nicole Radice LLB, BCom, FIML, MAICD

Nicole is a Partner in the Corporate Advisory and Governance practice of HopgoodGanim Lawyers and has worked at the firm for more than 24 years. Throughout her career she has built a highly successful corporate law practice advising public and private companies on corporate structuring, due diligence and corporate governance, capital raisings and mergers and acquisitions. Nicole’s experience includes advising ASX-listed organisations, midcap companies, international firms and overseas entities seeking to expand into the Australian market.

In 2019, she was recognised as a Leading Commercial Lawyer – Queensland in Doyle’s Guide and was most recently named in the 2022 edition of Best Lawyers in Australia for corporate law and corporate/governance practice. Nicole is on the board of The Gregory Terrace Foundation and the Royal Brisbane and Women’s Hospital Foundation (RBWHF).

Nicole holds both a Bachelor of Commerce and a Bachelor of Law (Honours) and was admitted to the Supreme Court of Queensland and the High Court of Australia in 1999. She is a member of the Australian Institute of Company Directors and is a Fellow of the Australian Institute of Management.

Special responsibilities

• Director

• Member of:

– Finance and Audit Committee

– Legal and Compliance Committee (Chair)

Noel has comprehensive knowledge of the fruit and vegetable industry, having been Managing Director of RW Pascoe, a leading Brisbane Markets fruit and vegetable wholesaling business since 1989. During this time he has been involved with all aspects of running this successful business.

Noel is a Director of Smart Berries Pty Ltd, one of the larger berry producing companies in Australia and New Zealand. He has also been a Director of Brismark since 2000.

Noel is a member of the Australian Institute of Company Directors.

Special responsibilities

• Director

• Member of:

– Strategy and Investment Committee

Stephen Edwards LLB, MAICD

Stephen brings 25 years’ experience to the Board and a deep understanding of the wholesaling sector of the fresh produce industry. He has broad commercial experience and business acumen with a detailed understanding of board and corporate governance, succession planning and expertise in a range of compliance matters including quality assurance, food safety and work health and safety. As Managing Director of Murray Bros, Stephen has overseen the growth of the company which is now one of the largest wholesalers in the Brisbane Markets involved in both the domestic and export markets and in servicing all sectors of the industry.

Stephen’s industry knowledge is supported by a broad understanding of the law and legal issues with a special focus on the history and issues surrounding the Horticulture Code of Conduct both practically and through Government lobbying. He has been a Director of Brismark since 2004 and has held the role of Deputy Chair since 2018. Stephen is also a past Director of Fresh Markets Australia, a national organisation representing the interests of fruit and vegetable wholesalers.

Stephen holds Bachelor of Laws from the University of Queensland and has been admitted to both the Supreme Court of Queensland and the High Court of Australia

Special responsibilities

• Director

Member of:

– Legal and Compliance Committee – Finance and Audit Committee

Andrew Young GDipCorpMgmt, BCom, BAgrSc (Hons), FCPA, MAICD

Executive Director

Andrew has a history of employment at a senior management level with extensive experience in policy and strategy formulation, service development, industry representation and market operation and development. His experience in the fresh produce industry includes engaging with relevant stakeholders at a State and Federal level and addressing national issues through his roles with BML, Brismark and Fresh Markets Australia. He has had an active involvement in addressing issues impacting on the wholesaling sector of the fresh produce industry and has conducted research on central markets in Australia and parts of Asia, Europe and the USA.

Andrew played a leading role as part of the project team responsible for what became the successful bid to purchase the Brisbane Markets site in 2002 and as CEO, coordinated the seamless transition of ownership of the Brisbane Markets site to BML.

He has maintained a focus on the upgrading and development of the Brisbane Markets site and the strategies contributing to the ongoing growth and success of the company.

Andrew is a Non-Executive Director of Perth Markets Group Limited having been appointed in 2015 ahead of the acquisition of the Markets in 2016, and an Executive Director of Fresh Markets Australia.

Andrew holds a Bachelor of Commerce, a Bachelor of Agricultural Science with Honours, a Diploma of Corporate Management, is a Certified Chief Executive Officer, is a member of the Australian Institute of Company Directors and is a Fellow Certified Practising Accountant.

Special responsibilities

• Managing Director and CEO

• Member of:

– Finance and Audit Committee

– Legal and Compliance Committee

– People, Remuneration and Culture Committee

– Strategy and Investment Committee

Murray Stewart B.Bus, CA, FGIA, C.Dec

Murray is a Chartered Accountant and Chartered Secretary with significant experience in senior finance roles across a number of industries including retail, manufacturing, franchising, property and freight service industries. Murray’s strengths are in the areas of financial management, accounting, commercial management, dispute resolution, legal interpretation, strategic and operational business, governance, risk, compliance, and company secretarial duties.

Murray has strong financial acumen and an ability to understand key risks and opportunities, and to see how a business can position itself strategically for changes in the external business environment. Murray has worked for Brisbane Markets Limited since 2014 and manages finance, contract management, and human resources functions of the organisation in addition to overseeing the Brisbane MarketPlace operation.

Murray holds a Bachelor of Business (Accounting), is a Chartered Accountant, and is a Fellow of the Governance Institute of Australia.

Special responsibilities

CFO and Company Secretary

Note: Peter Tighe, Noel Greenhalgh and Stephen Edwards are principals of companies that are also shareholder members of The Queensland Chamber of Fruit and Vegetable Industries Co-operative Limited, which is a substantial shareholder of BML. Shareholders of The Queensland Chamber of Fruit and Vegetable Industries Co-operative Limited hold one share in the Chamber, with a nominal value of $20.

The number of meetings of the company's Board of Directors and of each Board Committee held during the year ended 30 June 2022, and the number of meetings attended by each Director were:

1 A Joseph and A Kelly attended various Committee meetings during the year, in their capacity as Chair of the Board.

The Board Committees and the membership of those Committees as at 30 June 2022 is:

Finance and Audit Committee:

Bruce Hatcher (Chair)

Stuart Lummis

Nicole Radice

Stephen Edwards

Andrew Young

Legal and Compliance Committee:

Nicole Radice (Chair)

Peter Tighe

Stuart Lummis

Stephen Edwards

Andrew Young

People, Remuneration and Culture Committee: (committee composition changed in November 2021)

Anthony Kelly (Chair)

Peter Tighe

Stuart Lummis

Andrew Young

Strategy and Investment Committee:

Stuart Lummis (Chair)

Peter Tighe

Noel Greenhalgh

Andrew Young

No options over unissued shares or interests in the company or a controlled entity were granted during or since the end of the financial year and there were no options outstanding at the date of this report.

No person has applied to the Court under Section 237 of the Corporations Act 2001 for leave to bring proceedings on behalf of the company, or to intervene in any proceedings to which the company is a party for the purpose of taking responsibility on behalf of the company for all or any part of those proceedings.

During the financial year, BML paid a premium in respect of a contract insuring directors, secretaries and executive officers of the company and its controlled entities against a liability incurred as director, secretary or executive officer to the extent permitted by the Corporations Act 2001. The contract of insurance prohibits disclosure of the nature of the liability and the amount of the premium.

The company has not otherwise, during or since the end of the financial year, except to the extent permitted by law, indemnified or agreed to indemnify an officer or auditor of the company or any of its controlled entities against a liability incurred as such an officer or auditor.

Section 307C of the Corporations Act 2001 requires the company's auditors, BDO Audit Pty Ltd, to provide the Directors with a written Independence Declaration in relation to their audit of the financial report ended 30 June 2022. The Auditor's Independence Declaration is attached and forms part of this Directors’ Report.

Details of the amounts paid or payable to the auditor for nonaudit services provided during the financial year:

The consolidated entity satisfies the requirements of ASIC Corporations (Rounding in Financial/Directors’ Reports) Instrument 2016/191 issued by the Australian Securities and Investments Commission relating to “rounding off” of amounts in the Directors’ Report and the financial statements to the nearest thousand dollars. Amounts have been rounded off in the Directors’ Report and financial statements in accordance with that ASIC Instrument.

This report is made in accordance with a resolution of the Directors.

The Directors are satisfied that the provision of non-audit services during the financial year, by the auditor (or by another person or firm on the auditor's behalf), is compatible with the general standard of independence for auditors imposed by the Corporations Act 2001.

The Directors are of the opinion that the services as disclosed above do not compromise the external auditor's independence requirements of the Corporations Act 2001 for the following reasons:

• all non-audit services have been reviewed and approved to ensure that they do not impact the integrity and objectivity of the auditor; and

• none of the services undermine the general principles relating to auditor independence as set out in APES 110 Code of Ethics for Professional Accountants issued by the Accounting Professional and Ethical Standards Board, including reviewing or auditing the auditor's own work, acting in a management or decision-making capacity for the company, acting as advocate for the company or jointly sharing economic risks and rewards.

7 September 2022 at Brisbane

Tel: +61 7 3237 5999

Fax: +61 7 3221 9227 www.bdo.com.au

Tel: +61 7 3237 5999

Fax: +61 7 3221 9227

www.bdo.com.au

Level 10, 12 Creek Street

Level 10, 12 Creek Street

Brisbane QLD 4000 GPO Box 457 Brisbane QLD 4001 Australia

1.

DECLARATION OF INDEPENDENCE BY D P WRIGHT TO THE DIRECTORS OF BRISBANE MARKETS LIMITED

As lead auditor of Brisbane Markets Limited for the year ended 30 June 2022, I declare that, to the best of my knowledge and belief, there have been:

1. No contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the audit; and

2. No contraventions of any applicable code of professional conduct in relation to the audit.

This declaration is in respect of Brisbane Markets Limited and the entities it controlled during the year.

D P Wright Director

BDO Audit Pty Ltd

D P Wright Director

Brisbane, 07 September 2022

BDO Audit Pty Ltd

Brisbane, 07 September 2022

For the year ended 30 June 2022

For the year ended 30 June 2022

The above statement of changes in equity should be read in conjunction with the accompanying notes.

For the year ended 30 June 2022

The above statement of cash flows should be read in conjunction with the accompanying notes.

Brisbane Markets Limited (BML) is an unlisted public company limited by shares, incorporated and domiciled in Australia.

(a) Basis of preparation

These general purpose financial statements have been prepared in accordance with Australian Accounting Standards and Interpretations issued by the Australian Accounting Standards Board (‘AASB’) and the Corporations Act 2001, as appropriate for for-profit oriented entities. These financial statements also comply with International Financial Reporting Standards as issued by the International Accounting Standards Board (‘IASB’). The general purpose financial report of the consolidated entity for the year ended 30 June 2022 was authorised for issue in accordance with a resolution of the Directors on 7 September 2022.

Historical cost convention

The financial statements have been prepared under the historical cost convention, except for, share investments, investment properties, and derivative financial instruments.

Unless otherwise stated the financial statements are presented in Australian dollars rounded to the nearest thousand dollars ($’000), in accordance with ASIC Corporations (Rounding in Financial / Directors’ Reports) Instrument 2016/191, which is the functional and presentational currency of the consolidated entity.

(b) Revenue recognition

Rental revenue

Rental revenue from investment properties is recognised on a straight-line basis over the lease term. Revenue not received at the reporting date is reflected in the statement of financial position as a receivable or if paid in advance, as rent in advance (unearned income). Lease incentives granted are considered an integral part of the total rental revenue and are recognised as a reduction in rental income over the term of the lease, on a straight-line basis. Contingent rentals are recognised as income in the periods in which they are earned. Where a lease modification occurs for leases held as a lessor, the revised rental payable is recognised on a straight-line basis over the lease term.

Revenue from contracts with customers

Revenue from contracts with customers is derived from utility services provided to tenants, entry and parking fees, marketing fees and miscellaneous recharges, and is recognised as income in the periods in which services are provided. Revenue not received at the reporting date is reflected in the statement of financial position as a receivable.

Classification and measurement of revenue from contracts with customers

Revenue from contracts with customers is recognised over time if:

• the customer simultaneously receives and consumes the benefits as the entity performs; the customer controls the asset as the entity creates or enhances it; or

• the seller’s performance does not create an asset for which the seller has an alternative use and there is a right to payment for performance to date.

Where the above criteria is not met, revenue is recognised at a point in time.

The table below summarises the revenue earned by the consolidated entity and the appropriate recognition method applied.

The consolidated entity recovers the outgoings associated with general property expenses, site maintenance, and operation, from lessees in accordance with specific clauses within lease agreements. These are invoiced monthly based on an annual estimate. The consideration is due 14 days from invoice date. At year end a true up of recoveries cost is completed and any shortfall or excess is billed or refunded to the customer.

The consolidated entity earns revenue from specific services provided to the lessee. These services are on charged to lessees in accordance with specific clauses within the lease agreements. Revenue from provision of LPG sales, electricity sales, and water charges is recognised as the services are provided. The lessee is invoiced on a monthly basis, where applicable. Consideration is due 14 days from invoice date, and 25 days from invoice date for electricity invoices.

Entry fees and parking

The consolidated entity earns revenue from car parking charges and market entry fees. These fees are either charged to a lessee or buyer account monthly, or collected as an entry fees paid. Where invoiced, the consideration is due 14 days from invoice date. Other fees are payable on the day of entry.

Assets and liabilities are presented in the statement of financial position based on current and non-current classification.

An asset is classified as current when: it is either expected to be realised or intended to be sold or consumed in normal operating cycle; it is held primarily for the purpose of trading; it is expected to be realised within 12 months after the reporting period; or the asset is cash or cash equivalent unless restricted from being exchanged or used to settle a liability for at least 12 months after the reporting period. All other assets are classified as non-current.

A liability is classified as current when: it is either expected to be settled in normal operating cycle; it is held primarily for the purpose of trading; it is due to be settled within 12 months after the reporting period; or there is no unconditional right to defer the settlement of the liability for at least 12 months after the reporting period. All other liabilities are classified as non-current.

Deferred tax assets and liabilities are always classified as non-current.

The consolidated entity has adopted all of the new, revised or amending Accounting Standards and Interpretations issued by the AASB that are mandatory for the current reporting period. The adoption of these Accounting Standards and Interpretations did not have any significant impact on the financial performance or position of the consolidated entity.

The preparation of financial statements requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised and in future periods affected. Information about significant areas of estimation, uncertainty and critical judgments in applying accounting policies that have the most significant effect on the amounts recognised in the financial statements are discussed in the relevant notes below:

• Note 5 - Provision for impairment of receivables;

• Note 6 - Estimates of fair value of investment properties;

• Note 8 - Estimation of useful lives of assets;

• Note 13 and 14 - Tax liability and income tax expense; and

• Note 16 - Estimates of fair value of interest rate derivatives.

An insurance claim was made by the company in relation to material damage costs and business interruption losses, incurred as a result of the February 2022 flood event that impacted the Brisbane Markets. The reinstatement cost assessments undertaken determined that the company would exceed the sub-limit of liability within the insurance policies held, and the insurers of the company approved a payment up to the full value of the policy sub-limit of $15 million, based on the claim information supplied. The insurance proceeds received and receivable at year end are included as revenue.

4. Other current assets

5. Trade and other receivables

Accounting policy

Trade receivables

Trade and other receivables are held for collection of contractual cash flows where those cash flows represent solely payments of principal and interest, and are measured at amortised cost. Interest income from these financial assets is included in finance income using the effective interest rate method. Any gain or loss arising on derecognition is recognised directly in profit or loss. Impairment losses are presented as separate line item.

Impairment

The consolidated entity assesses on a forward-looking basis, the expected credit loss associated with its debt instruments carried at amortised cost.

For trade receivables the consolidated entity applies the simplified approach permitted by AASB 9, which requires expected lifetime losses to be recognised from initial recognition of the trade receivables. Management has determined that assessment of expected credit loss associated with trade receivables is immaterial.

Provision for impairment of trade receivables

The estimated credit loss calculation requires a degree of estimation and judgement. The level of estimated credit loss is assessed by taking into account the recent revenue billings, the aging of trade receivables, historical collection rates and specific knowledge of the individual debtor financial position.

(a) Reconciliation

Reconciliations of the carrying amount of investment properties at the beginning and end of the current and previous periods:

Freehold land, buildings and improvements – 250 Sherwood Road, 320 Sherwood Road and 385 Sherwood Road, Rocklea

*During March 2021, the consolidated entity amalgamated the two lots and all property held is now reported as a single investment property asset.

(b) Amounts recognised in profit or loss for investment property:

(c) Assets pledged as security

Refer to Note 15 for details of investment properties pledged as security.

(d) Leases as a lessor

Investment properties are generally leased to tenants on long-term operating leases with rentals payable monthly. Minimum lease payments receivable under the non-cancellable operating leases of investment property not recognised in the financial statements are as follows:

(e) An independent valuation of investment properties as at 30 June 2022 was carried out by a qualified valuer with relevant experience in the type of property being valued (Ross Farwell – API No 66781 and QVRB No. 3250, and Michael McClifty – API No 65714 and QVRB No 2024, from Charter Keck Cramer Pty Ltd). In assessing the value of the investment property, the independent valuer has considered discounted cash flows, capitalisation of net market income methods and direct comparison. Refer to Note 18 for further discussion of fair value measurement of investment properties.

Investment properties

Investment properties are properties held either to earn rental income, for capital appreciation or for both. Investment properties are initially measured at cost and are subsequently measured at fair value. As part of the process of determining the fair value of all property, an external independent valuer, having appropriate recognised professional qualifications and recent experience in the location and category of property being valued, values the Brisbane Markets property annually.

Property under construction held for future use as investment property is also carried at fair value unless fair value cannot yet be reliably determined. If fair value cannot yet be reliably determined, the property will be accounted for at cost until either the fair value can be reliably determined or when construction is complete.

Changes to fair values of investment properties are recognised in the profit or loss in the period in which they occur.

Estimates of fair value of investment properties

The consolidated entity has investment property with a carrying amount of $425 million (30 June 2021: $372 million) representing estimated fair value at reporting date. The investment property represents a significant portion of the total assets of the consolidated entity. The fair value adopted for the investment property is based on an independent external valuation of investment property at 30 June 2022. In assessing the value of the investment property, the independent valuers have considered discounted cash flows, capitalisation of net market income methods and direct comparison. Refer to Note 18 for further details on significant inputs used in determining fair value of the investment properties.

BML (the parent) holds a 41.73% interest in Perth Markets Group Limited (PMGL) (2021: 41.73%). This investment is measured in accordance with the equity method of accounting.

The principal place of business of PMGL is Canning Vale, Perth, Western Australia. BML has been issued with 24,551,501 ordinary shares in the company.

The investment in PMGL is a strategic investment for the company to diversify the income streams and grow shareholder value.

The carrying amount recorded in the consolidated entity accounts at 30 June 2022, is $56.492 million (2021: $37.638 million).

The table below includes summarised financial information of PMGL.

receivable from associates at year end

Commitments and contingent liabilities in respect of the associate

The consolidated entity is not liable for any contractual commitments arising from its interests in the associate if and when they arise. There are no material contingent liabilities disclosed by the associate.

Significant restrictions

There are no restrictions on the ability of PMGL to transfer funds to the consolidated entity in the form of cash dividends or loans.

Investment in an associate

An associate is an entity over which the consolidated entity has significant influence. Significant influence is the power to participate in the financial and operating policy decisions of the entity but is not control or joint control of these policies. Investments in associates are accounted for in the consolidated financial statements by applying the equity method of accounting, whereby the investment is initially recognised at cost (including transaction costs) and adjusted thereafter for the post-acquisition change in the consolidated entity’s share of net assets in the associate. In addition, the consolidated entity’s share of the profit or loss is included in the consolidated entity’s profit or loss.

The carrying amount of the investment includes, when applicable, goodwill relating to the associate. Any discount on acquisition, whereby the consolidated entity’s share of the net fair value of the associate exceeds the cost of the investment, is recognised in the profit or loss in the period in which the investment is acquired.

Profits and losses resulting from transactions between the consolidated entity and the associate are eliminated to the extent of the consolidated entity’s interest in the associate.

Reconciliations of the carrying amount of property, plant and equipment at the beginning and end of the current and previous periods: Plant and equipment

Refer to Note 14 for property, plant and equipment pledged as security.

Property, plant and equipment

Property, plant and equipment not classified as investment properties are measured on the cost basis and therefore carried at cost less accumulated depreciation and any accumulated impairment. Cost includes expenditure that is directly attributable to the acquisition of the items.

Depreciation

Depreciation of property, plant and equipment is calculated on a straight-line basis over their estimated useful lives commencing from the time the asset is held ready for use. The useful lives for plant and equipment is 3 to 25 years.

Carrying amount

The carrying amount of property, plant and equipment (cost less accumulated depreciation and impairment losses) is reviewed annually by Directors to ensure it is not in excess of the recoverable amount from those assets. A formal assessment of recoverable amount is made when impairment indicators are present. The recoverable amount is assessed on the basis of the expected net cash flows that will be received from the asset’s employment and subsequent disposal. The expected net cash flows have been discounted to their present values in determining recoverable amounts.

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount.

Gains and losses on disposals are determined by comparing proceeds with the carrying amount. These gains and losses are recognised in profit or loss in the period in which they arise.

Estimation of useful lives of assets

The consolidated entity determines the estimated useful lives and related depreciation and amortisation charges for its property, plant and equipment. The useful lives could change significantly as a result of technical innovations or some other event. The depreciation and amortisation charge will increase where the useful lives are less than previously estimated lives, or technically obsolete or non-strategic assets that have been abandoned or sold will be written off or written down.

The consolidated entity holds 98,500 shares in South Australian Produce Market Limited, which are assessed as having a value of $26.00 per share at reporting date.

Financial assets

Investments at fair value through profit or loss are carried in the statement of financial position at fair value with net changes in fair value recognised in the profit or loss.

There were no additions to the right of use assets during the year.

The consolidated entity leases office equipment under agreements of less than five years.

Trade and other payables represent liabilities for goods and services provided to the consolidated entity prior to the year end and which are unpaid at the end of the reporting period. These amounts are unsecured and typically have 14 to 60 day payment terms.

Refer to Note 17 for further information on financial instruments.

The

The balance comprises temporary differences attributable

Movements:

Accounting policy

Income tax

The income tax expense for the year comprises current income tax expense and deferred tax expense.

Current income tax expense charged to profit or loss is the tax payable on taxable income for the current period. Current tax liabilities are therefore measured at the amounts expected to be paid to the relevant taxation authority using tax rates (and tax laws) that have been enacted or substantively enacted by the end of the reporting period.

Deferred income tax expense reflects movements in deferred tax asset and deferred tax liability balances during the year as well as unused tax losses.

Current and deferred income tax expense is charged or credited outside profit or loss when the tax relates to items that are recognised outside profit or loss or arising from a business combination. Except for business combinations, no deferred income tax is recognised from the initial recognition of an asset or liability where there is no effect on accounting or taxable profit or loss.

Deferred tax assets and liabilities are calculated at the tax rates that are expected to apply to the period when the asset is realised or the liability is settled and their measurement also reflects the manner in which management expects to recover or settle the carrying amount of the related asset or liability. With respect to non-depreciable items of property, plant and equipment measured at fair value and items of investment property measured at fair value, the related deferred tax liability or deferred tax asset is measured on the basis that the carrying amount of the asset will be recovered entirely through sale.

When an investment property that is depreciable is held by the entity in a business model whose objective is to consume substantially all of the economic benefits embodied in the property through use over time (rather than through sale), the related deferred tax liability or deferred tax asset is measured on the basis that the carrying amount of such property will be recovered entirely through use.

Deferred tax assets relating to temporary differences and unused tax losses are recognised only to the extent that it is probable that future taxable profit will be available against which the benefits of the deferred tax asset can be utilised.

Where temporary differences exist in relation to investments in subsidiaries, branches, associates and joint ventures, deferred tax assets and liabilities are not recognised where the timing of the reversal of the temporary difference can be controlled and it is not probable that the reversal will occur in the foreseeable future.

Current tax assets and liabilities are offset where a legally enforceable right of set-off exists and it is intended that net settlement or simultaneous realisation and settlement of the respective asset and liability will occur. Deferred tax assets and liabilities are offset where: (i) a legally enforceable right of set-off exists; and (ii) the deferred tax assets and liabilities relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities, where it is intended that net settlement or simultaneous realisation and settlement of the respective asset and liability will occur in future periods in which significant amounts of deferred tax assets or liabilities are expected to be recovered or settled.

(a) The prima facie tax on profit differs from the income tax expense as follows:

(b) The components of tax expense comprise:

Deferred income tax/(revenue) expense included in income tax expense comprises: