Global Renewables Market Update Q4 2022

INSIDE THIS REPORT:

• Global Renewables & Carbon Marketplace

• PPA Pricing Trends and Project Availability

• U.S. Renewable Energy Market Trends

• European Renewable Energy Marketplace

• Perspectives Roundup

Meet the Contributors

Mary Kate Francis | Boston, MA

As the Senior Director of Energy Sourcing, Mary Kate leads the team responsible for renewables procurement. She works with project developers to find the right solution for each client to achieve their renewable energy goals.

Corina Melchor | Bucharest, RO

As a Clean Energy Advisor on our European team, Corina manages client relationships by bringing insights to life across our customer’s decarbonization journey. Corina's role is to understand the implications and interdependencies (risk, collateral, etc) that lie in a PPA acquisition and ensure that our tailored solutions meet their sustainability, financial, and strategic goals.

Charlotte Caldwell | Boston, MA

As a Senior Analyst on the Clean Energy Sourcing team at Edison, Charlotte advises clients on renewable energy strategy and economics. She leads the design and development of project economic models and communicates regularly with renewable energy suppliers across all of Edison’s major markets in the United States and Europe.

Kristi Ghosh | Utrecht, NL

As a Clean Energy Analyst on our European team, Kristi is responsible for analyzing renewable energy market risks and opportunities, including policy and regulation, and administration of the project database for market evaluation and diligence.

Andor Savelkouls | Utrecht, NL

As Senior Director of European Energy Advisory, Andor leads our European team (operating as Altenex Energy, a subsidiary of Edison Energy), focusing on both the business development and operational aspects of the company’s consulting activities across Europe.

Tim Broerse | Utrecht, NL

As a Clean Energy Origination Manager, Tim is responsible for leading commercial strategy, structuring energy contracts, and negotiating agreements on behalf of Edison’s clients seeking renewable energy through onsite and offsite generation in Europe. The Clean Energy Origination team focuses on continuous innovation in contract terms to match the fast-changing renewable energy industry.

Matt Donath | Milwaukee, WI

As a Senior Policy Analyst, Matt tracks relevant legislation and regulatory proceedings at the federal, state, and local level and evaluates the potential impact to client’s energy strategy and sustainability goals.

Avery Hammond | Boston, MA

As an Analyst on the Clean Energy Sourcing team, Avery focuses on following key policy and market drivers impacting PPA and REC procurement in North America.

2 Global Renewables Market Update | Q4 2022

Meet the Contributors

Chelsey Harmer | Boston, MA

As a Senior Analyst on the Sustainability Strategy team, Chelsey supports clients at many stages of their decarbonization journey. She specializes in supporting clients to develop credible environmental attribute procurement strategies and helping them procure high-quality carbon offsets.

Lauren Kielley | Boston, MA

As s a Senior Clean Energy Advisor, Lauren helps navigate clients through their renewable procurement process, from early education to strategy setting, continuing to provide support and insight through competitive solicitations, negotiation, all the way to contracting. She supports clients in balancing their particular priorities, risk tolerance and carbon reduction goals in order to find the right individualized solution(s).

Shannon Holzer | Chicago, IL

As the Head of Policy, Shannon tracks regulatory, legislative and administrative proceedings in North America and uses this information to help our clients make better energy procurement decisions.

Elana Knopp | New York, NY

As a Senior Content Writer, Elana is responsible for leading content development, creating thought leadership pieces with Edison team members and industry experts, and crafting client engagement & communications strategies.

Patrick Mingey | Boston, MA

As a Senior Clean Energy Analyst, Patrick analyzes renewable energy strategy and communicates forecasted project economics to clients. He interacts with renewable energy suppliers regularly and evaluates prospective projects throughout North America.

Grace Morrissey | Boston, MA

As a Manager on the Clean Energy Sourcing team at Edison, Grace works with a variety of clients pursuing offsite renewables procurement by advising them on strategic planning, goal setting, market education, competitive solicitation, analysis, and project selection.

Xue Rosenberg | Boston, MA

As a Senior Analyst for the Clean Energy Advisory, Xue leads clients through their EAC procurements to get competitive bids that fit their renewable energy goals. From strategy to contracting, she navigates clients through the entire process. Xue also works closely with the performance validation team to ensure clients receive timely and accurate settlements from their VPPAs.

3 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

Let us know your thoughts

We ask you to take 2-3 minutes to complete a survey that will help us further define current decarbonization practices and plans of our readers. The study will explore the readers' role, responsibility, sustainability initiatives, and organizational goals. Take the survey

4 Global Renewables Market Update | Q4 2022

Introduction 5 Global Renewables & Carbon Marketplace 6 Current Events 6 EAC Market Update 8 Voluntary Carbon Offset Market Update 9 U.S. Renewable Energy Marketplace 10 Project Availability 10 PPA Pricing Trends 11 Renewables Market Trends 13 European Renewable Energy Marketplace 19 Project Availability 19 PPA Pricing Trends 20 Renewables Market Trends 22 Edison Energy Perspectives Roundup 26

Table of Contents

In the 4th quarter of 2022, leaders at the United Nations climate summit COP27 emphasized the urgency of emissions reductions, but buyers across North America and Europe who sought to make those reductions faced a challenging market. Across the continents, demand continued to outpace supply despite policy efforts to ease these constraints.

Corporate energy buyers can expect more stringent requirements around renewable energy procurement on the heels of newly released RE100 guidance. That, paired with recommendations coming out of COP27, will serve to reinforce accountability and transparency when it comes to addressing carbon and avoiding global greenwashing.

In Europe, median PPA prices continued to rise across most markets, as did those in the U.S., albeit at a slower pace than the previous quarter. Supply chain constraints continue to challenge the market, and rising interest rates are making the cost of financing renewable projects more expensive globally.

Governments are aiming to ease some of the market challenges. In Europe, the European Commission recently passed temporary regulations intended to streamline the permitting process for renewable energy projects. However, a proposal from the European Commission aimed at addressing high electricity prices is being adopted by different countries in different ways, causing some uncertainty and potential for PPA contracting to stall, particularly in Poland and Romania.

In the U.S., project developers are beginning to price PPAs more confidently as they digest new guidance on the long-term tax credit extensions in the Inflation Reduction Act (IRA), and a preliminary determination from the U.S. Department of Commerce on solar panel supply impacted by tariff circumvention.

Q4 saw a rise in U.S. National REC prices and have held steady, while the price of European GOs maintained their upward trend, driven by a significant imbalance of supply and demand.

5 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

Introduction

Global Renewables & Carbon Marketplace Current Events

Revised RE100 guidance seeks to limit greenwashing & distinguish European market boundaries

Guidance on achieving 100% renewable electricity is becoming more stringent for RE1001 members. The organization made changes to their guidelines in October, which will go into effect on January 1, 2024.

The first change is targeted at avoiding global greenwashing, requiring corporations to procure renewable electricity from projects that have been commissioned or repowered within the last 15 years. There are several exemptions including self-generation and long-term PPAs where the buyer is the original offtaker. There is also a 15% global threshold under which corporations can source renewable electricity without adhering to these rules. The new rule is expected to put some price pressure on PPAs and EACs, as it decreases the supply of projects that can be drawn on for RE100 compliance. It also may drive increased transparency in the lineage of EACs sold by retailers, as the online date of the renewable energy project the EACs are generated from will be a critical factor in whether a corporation wishes to purchase the product.

The second change impacts Europe: it considers a country to be part of the European market if the country is in the EU single market, is an Association of Issuing Bodies (AIB) member, and has a grid connection to another country that meets the first two rules. This will have no impact on corporations who were already aligning to the CDP disclosure system’s guidance, as this rule aligns to their established guidance. However, for corporations relying solely on RE100 guidance, they will now need to consider the UK, Ireland, Poland, Romania, Serbia, and Bulgaria as distinct markets starting in 2024. This could drive higher local EAC values, as corporations look to draw solely from in-country resources. As more countries gain AIB membership and more physical links are created, the pool of asset buying could expand for corporates.

6 Global Renewables Market Update | Q4 2022

Renewable energy projects will qualify towards RE100 goals for the first 15 years of operation only, with few exceptions.

1. RE100 is a global initiative that has gathered 380+ corporations in pursuit of deriving all of their electricity from renewables across their operations by 2040.

Global Renewables & Carbon Marketplace Current Events

Corporations demonstrate commitments to emissions reductions and accountability during COP27 climate summit

Corporations joined world leaders and activists at the United Nations climate summit, COP27, in Sharm El Sheikh, Egypt, this past November, under the theme “Together for Implementation.” With increased urgency for climate mitigation and adaptation, many hoped that this COP would mark a new era of turning commitment into action. Following the summit, outcomes are mixed, with many dissatisfied with the lack of progress on the phaseout of fossil fuels. However, landmark progress was made on climate justice, with developed nations agreeing to pay the developing world for the damage caused by climate change through a “loss and damage fund.” It was also clear at the conference that corporations have a critical role to play in reducing emissions as quickly as possible. Here are three key takeaways for businesses to keep in mind:

1. All roads lead to net-zero

With commitments from governments falling short, net-zero emissions by 2050 or earlier will continue to be the bar that corporates must hit to demonstrate credibility within the sustainability space. The number of companies setting science-based targets through the Science-based Target Initiative (SBTi) has doubled since COP26 in Glasgow, demonstrating the private sector’s commitment to climate action.

2. Businesses have new guidance on tangible and transparent climate actions

Businesses have more robust guidance from the United Nations on making meaningful environmental claims. At COP27, the UN released a report entitled “Integrity Matters,” aimed to put an end to baseless environmental claims. The report came weeks after RE100 revised its guidance to limit greenwashing (see page 6) and outlines 10 recommendations to promote integrity in setting and meeting net-zero targets.2 The recommendations provide guidance on creating a net-zero transition plan, phasing out fossil fuels, using voluntary credits, investing in just transitions, and more. Transparency and accountability are themes woven throughout the document. One recommendation focuses on aligning lobbying and advocacy efforts with a net-zero future. Corporations should expect increased pressure to go beyond net-zero commitments and to integrate transparent and tangible climate action into all aspects of their business.

3. Focus on methane emissions and super-polluters

Curbing methane emissions was a top priority at COP27. More than 150 countries signed the Global Methane Pledge, promising to reduce global methane emissions by at least 30% by 2030 from a 2020 baseline. Climate TRACE also released its updated inventory of the world's worst polluters - the first inventory to track the largest sources of carbon emissions globally. Nearly 80,000 individual facilities have been observed, with oil and gas fields rising to the top as the world’s largest emitting sites. With this spotlight on super-polluters, cries for accountability on carbon and methane are becoming louder.

7 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

2. United Nations. Integrity Matters: Net Zero Commitments by Businesses, Financial Institutions, Cities and Regions

Global Renewables & Carbon Marketplace EAC Market Update

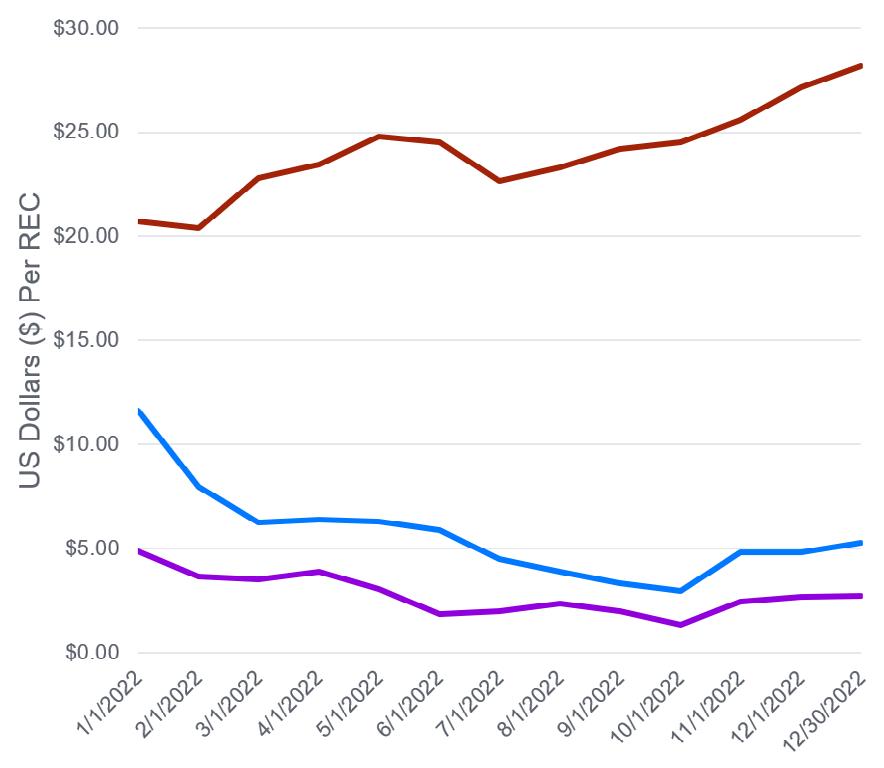

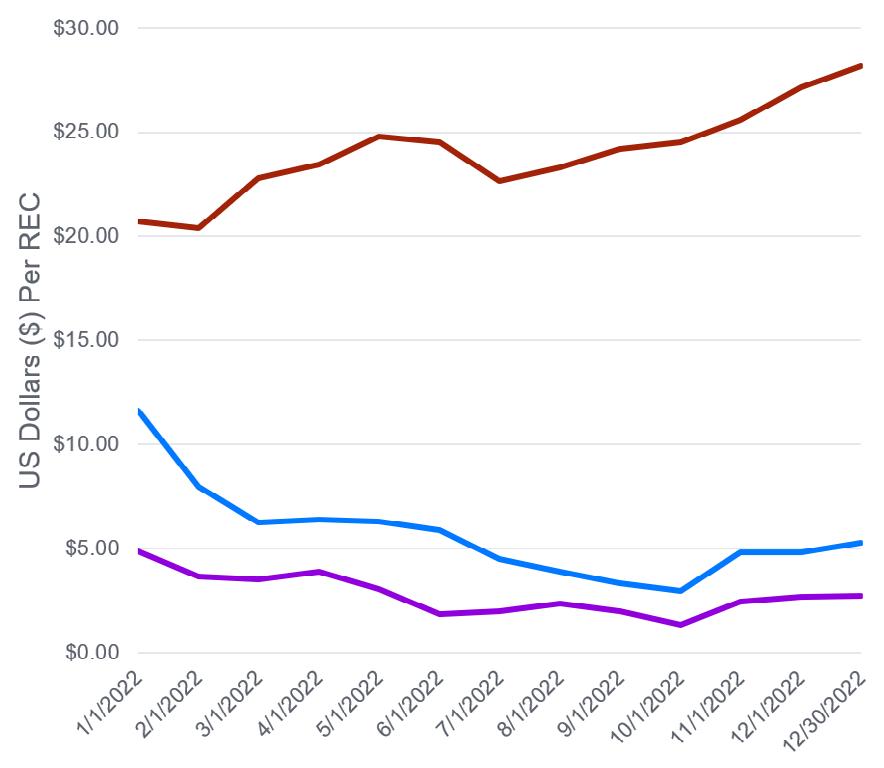

U.S. National REC prices rose in Q4, and PJM Tier 1 values remain high

National Green-e REC prices rose in Q4, with 2022 vintage RECs valued at around $2.70/REC. This is a significant jump compared to the low of around $1.40/ REC at the start of the quarter, as shown in Figure 1. A multi-million REC procurement at the end of October drove vintage 2022 REC prices well past the $2 mark and REC prices have remained higher. 2023 vintage is currently trading above $3.20/REC and future vintages are even higher.

PA Tier I compliance RECs in PJM fluctuated between $24 and $27/REC in Q4. For voluntary buyers interested in procuring PJM RECs, the most cost-effective approach is to purchase Ohio RECs. The price of Ohio RECs for 2022 vintage is currently around $5.50/ REC, while the 2023 vintage is hovering around $5.70/REC.

European Guarantees of Origin (GO) set record high price in Q4

The price of European GOs maintained their upward trend during the fourth quarter, reaching a record high of nearly €10/MWh, before coming down to around €6.5/MWh towards the end of the year. Imbalance of supply and demand drove the price increases: supply of GOs in the market have increased by less than 1% over the course of the year, while demand was up over 11%, according to data from AIB3, and thus generated fewer GOs than ordinarily expected. The GO prices tracked in Figure 2 reflect 2022 vintage GOs, which saw the highest volume of trading activity in this past year; vintage 2023 GOs ended the year at a similar price point of €6.5/MWh.

8 Global Renewables Market Update | Q4 2022

Figure 1. U.S. REC Prices, 2022

Figure 2. EU GO Prices, 2022

3. Association of Issuing Bodies (AIB) Statistics, November 2022

Global Renewables & Carbon Marketplace

Voluntary Carbon Offset Market Update

Carbon credit retirements see no growth from 2021

Following a market dip in Q1 that coincided with Russia’s invasion in Ukraine, voluntary carbon credit market prices regained momentum through the year. Trove Research reports that volume weighted average prices have increased 40% year-over-year.4 Despite the market seemingly bouncing back from Q1, total retirements in 2022 were flat compared to 2021, breaking the trend of increasing credit retirements year-over-year.

Currently, credit vintage is a key driver of credit price. Vintage 2016 credits are no longer eligible, according to the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) as of January 1, 2023, due to CORSIA’s 5-year vintage requirement, and many suppliers are hoping to liquidate their 2016 credits at a low price. Recent vintages, particularly for naturebased solutions and community/livelihood projects, will come at a price premium as corporations seek to achieve their climate commitments.

Credibility and transparency continue to be industry focus

As mentioned on page 7, the United Nations released a report targeting greenwashing, which outlines key recommendations for the use of voluntary carbon credits. The report affirms that offsets cannot be counted towards interim emission reductions required by a net-zero pathway. The report recommends that once interim targets are met, non-state actors on the pathway to net zero use high-integrity carbon credits for the balance of their annual unabated emissions, which are yet to be defined. The report references the highly anticipated Integrity Council for the Voluntary Carbon Market (ICVCM) guidance for defining a highintegrity standard. An update from the ICVCM on its Core Carbon Principles is slated for Q1 2023.

A recent United Nations report has introduced stricter guidance around voluntary carbon credits, but – subject to guidance from the Integrity Council for the Voluntary Carbon Market - there is still much uncertainty around what qualifies as “high-integrity.”

9 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

4. Trove Research. Voluntary Carbon Market 2022 in Review.

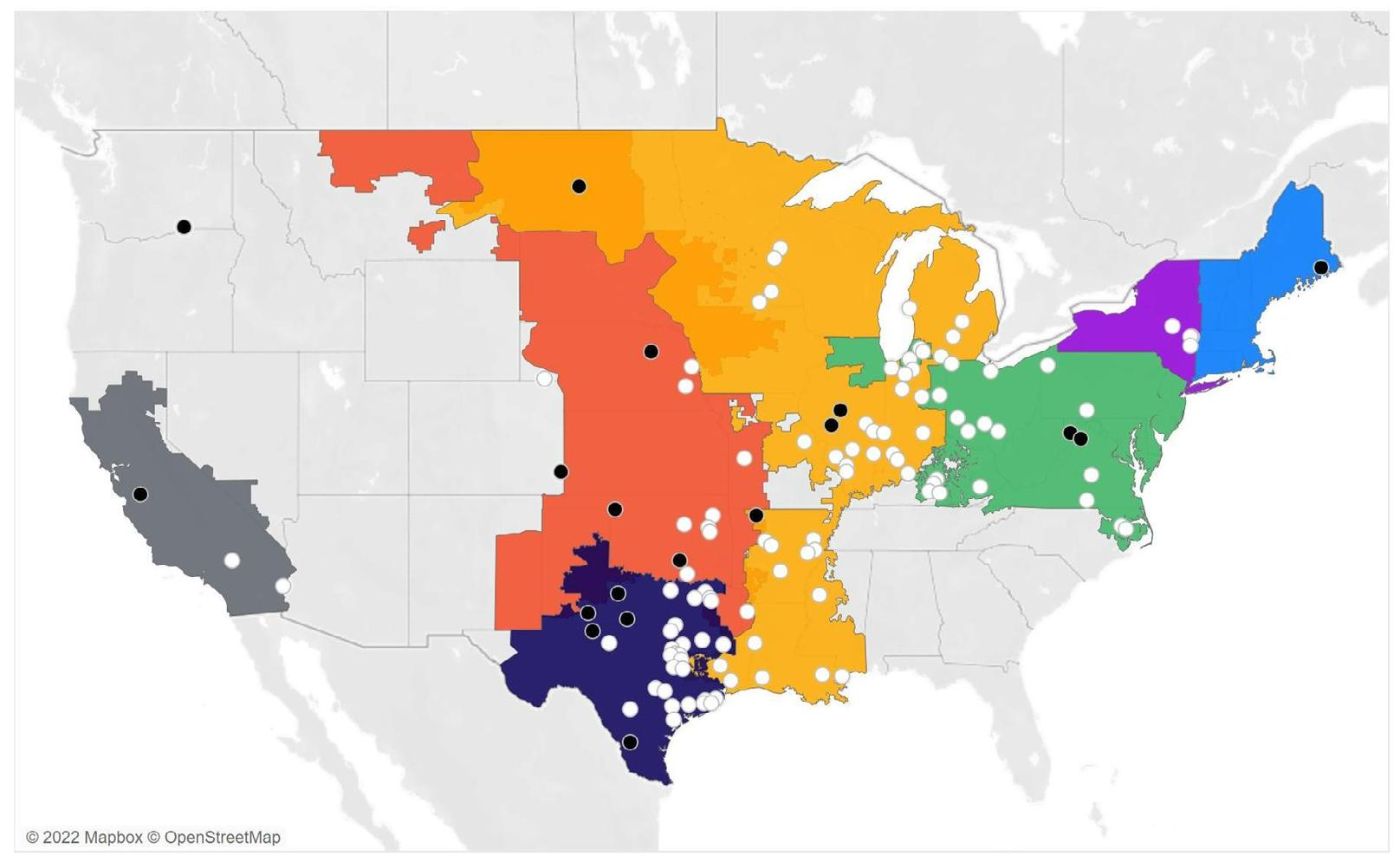

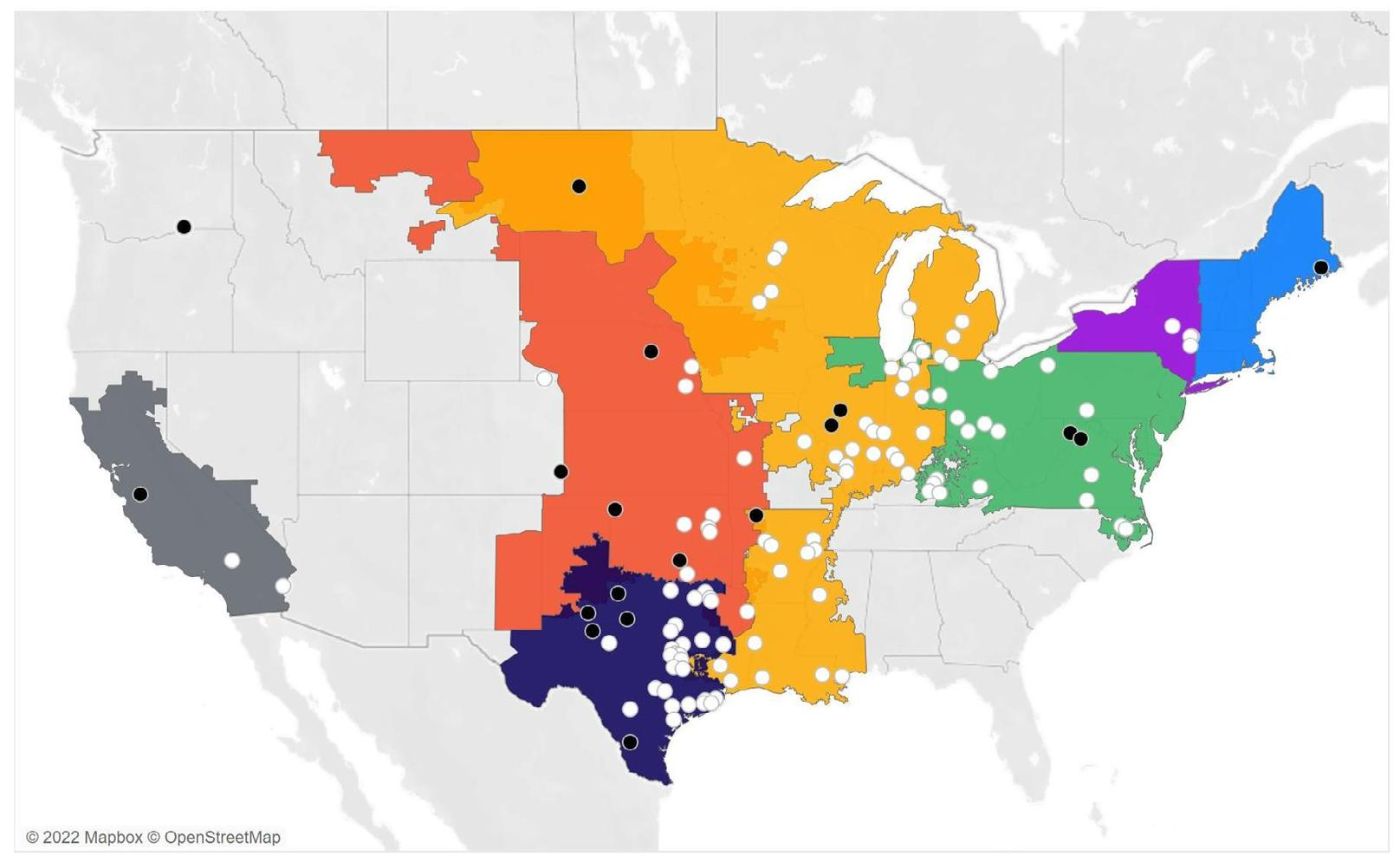

U.S. Renewable Energy Marketplace Project Availability

10 Global Renewables Market Update | Q4 2022

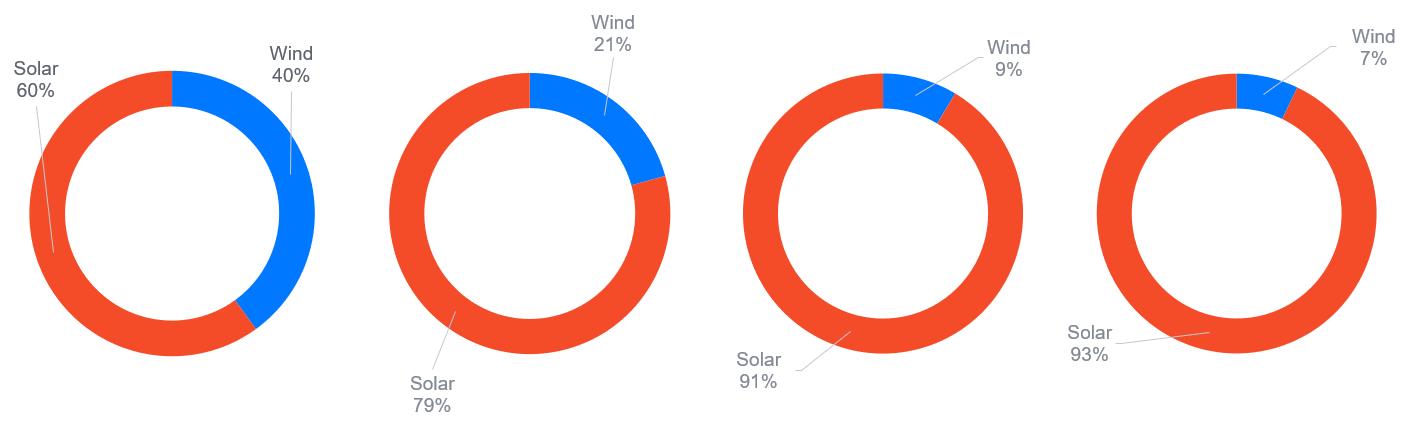

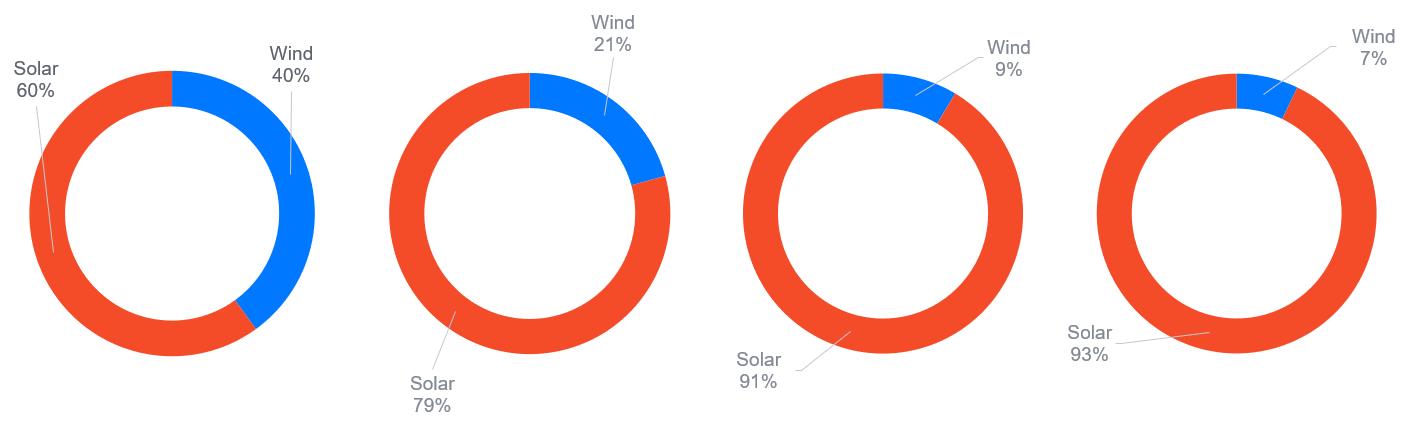

Figure 3. Utility-Scale Projects Marketed to Voluntary Buyers, Q4 2022

Anticipated Online Dates Technology Power Market Solar Wind CAISO ERCOT ISO-NE MISO NYISO PJM SPP 2023 2024 2025 2026 or later 5 Projects 29 Projects 58 Projects 28 Projects Solar 60% Wind 40% Solar 79% Wind 21% Solar 91% Wind 9% Solar 93% Wind 7%

U.S. Renewable Energy Marketplace

PPA Pricing Trends

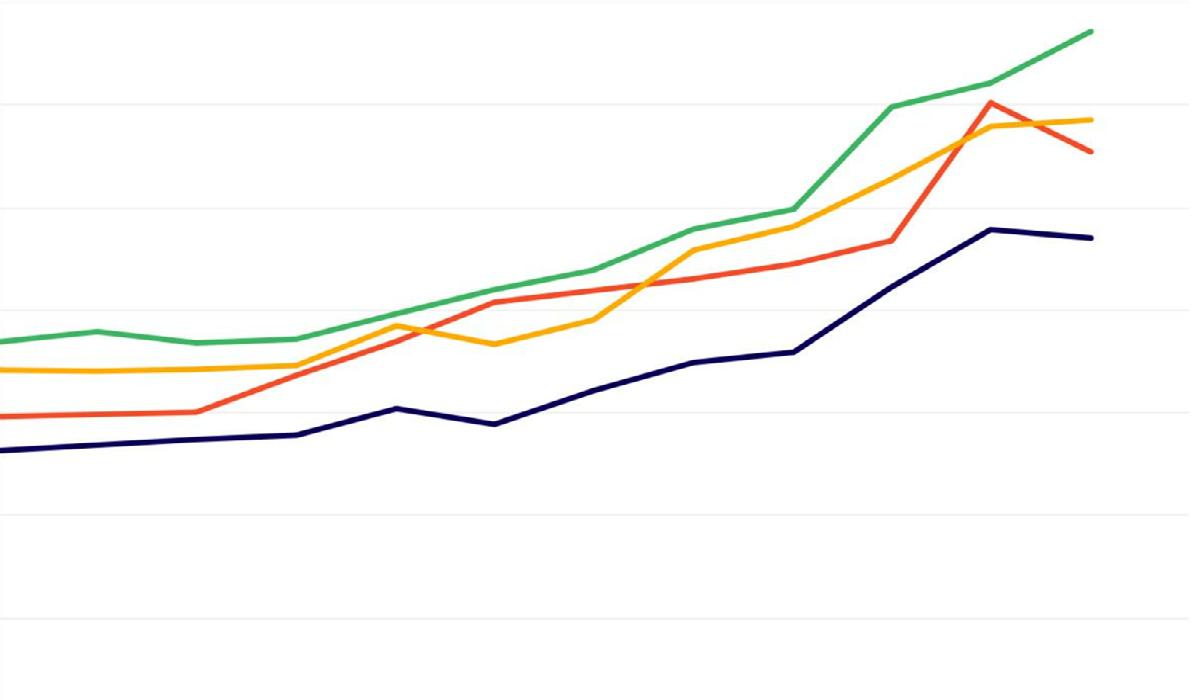

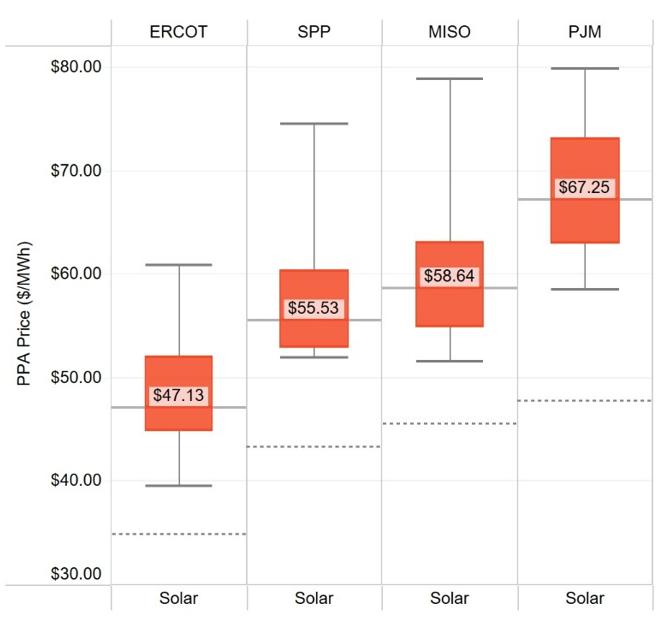

Prices shown reflect the median of flat, hub-settled, unit contingent offers inclusive of project RECs, received over time. Markets and technologies with offers from fewer than five distinct projects in a given quarter are not shown. Wind PPA price trends are not shown this quarter due to fewer than five wind projects seeking offtake in each market.

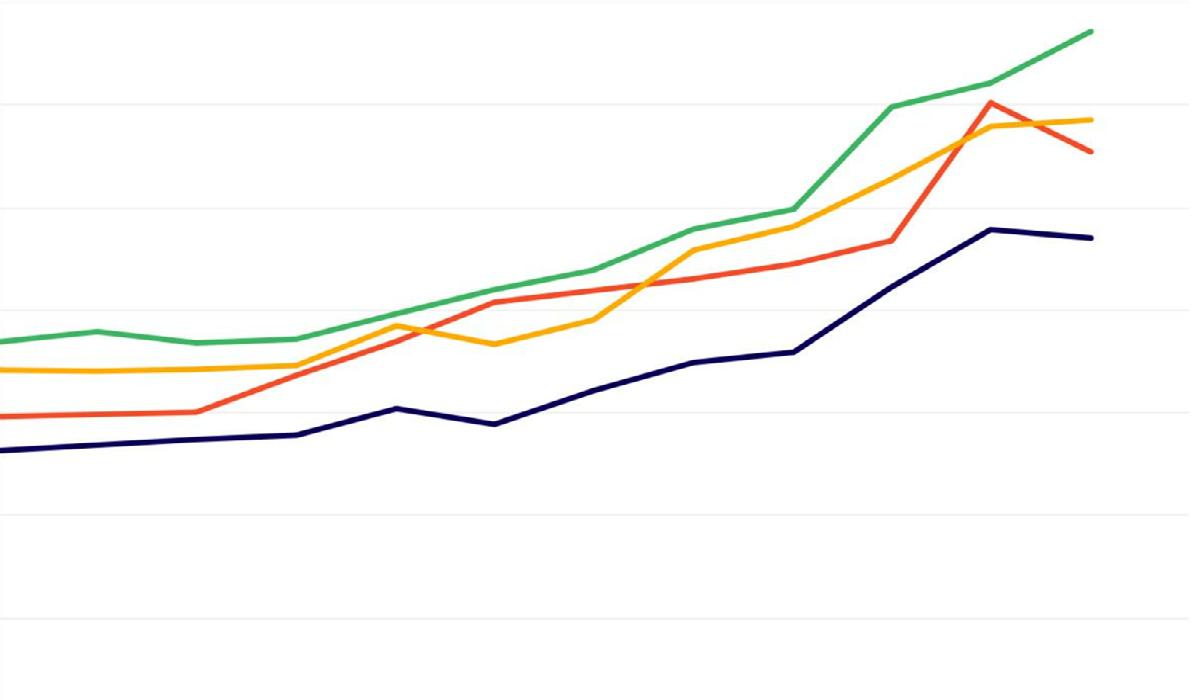

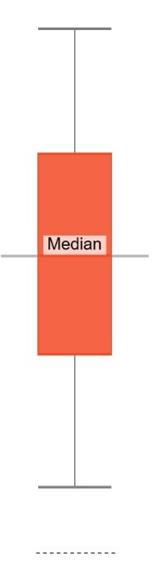

• In Q4, median solar PPA prices grew at a much slower rate than in Q3, up 4% ($2 per MWh) across major U.S. markets. In Q3, these markets - which include ERCOT, MISO, PJM, and SPP - experienced a 17% price spike. In comparison to one year ago, median solar PPA prices are now 48% ($18/MWh) higher.

• PJM experienced the only major median solar PPA price increase in Q4, for a gain of 8% ($5 per MWh). Of the four referenced markets, PJM remains the most expensive, with factors like interconnection reform and permitting challenges limiting supply, while demand from corporate buyers and compliance entities remains steady.

• SPP’s median solar PPA price dropped 8% ($5 per MWh) in Q4 following its record-setting 29% increase in Q3. The only other solar market to experience a price decrease this quarter was ERCOT, which fell by less than $1/MWh.

• The number of actively marketed projects in Q4 increased 40% over the previous quarter. Following an exceptionally low quarter for project availability in Q3, renewable developers are marketing more projects today, buoyed by clearer guidance on solar panel import tariffs and the long-term certainty established by the Inflation Reduction Act.

11 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

Figure 4. Trends in Solar PPA Prices

2020 Q2 2021 Q2 2021 Q4 2022 Q4 2020 Q4 2022 Q2 $60.00 $50.00 $40.00 $30.00 $10.00 $20.00 Median PPA Price ($/MWh) $70.00 ERCOT MISO PJM SPP Market

U.S. Renewable Energy Marketplace

PPA Pricing Trends

PPA prices shown above reflect flat, hub-settled, unit contingent offers inclusive of project RECs received in Q4 2022. Markets and technologies with offers from fewer than five distinct projects are not shown. Some offers shown may no longer be on the market. Dotted line indicates where the median PPA price was one year ago.

12 Global Renewables Market Update | Q4 2022

Figure 5. Current PPA Prices Q4 2022

Solar Upper Whisker — Maximum PPA Price Lower Whisker — Minimum PPA Price InterQuartile Range of PPA Prices Q4 2021 Median PPA Price PPA Price ($/MWh) Solar Solar Solar $70.00 $30.00 $40.00 $50.00 $60.00 $80.00 $70.00 PPA Price ($/MWh)

U.S. Renewable Energy Marketplace Factors Driving the PPA Market

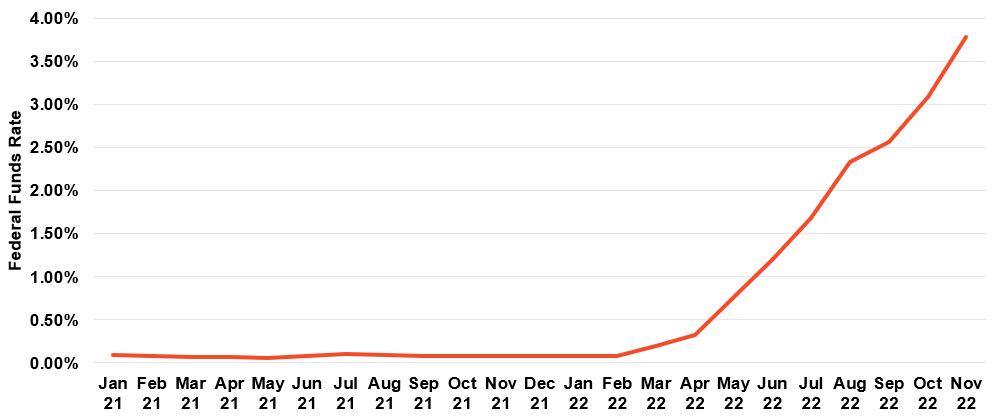

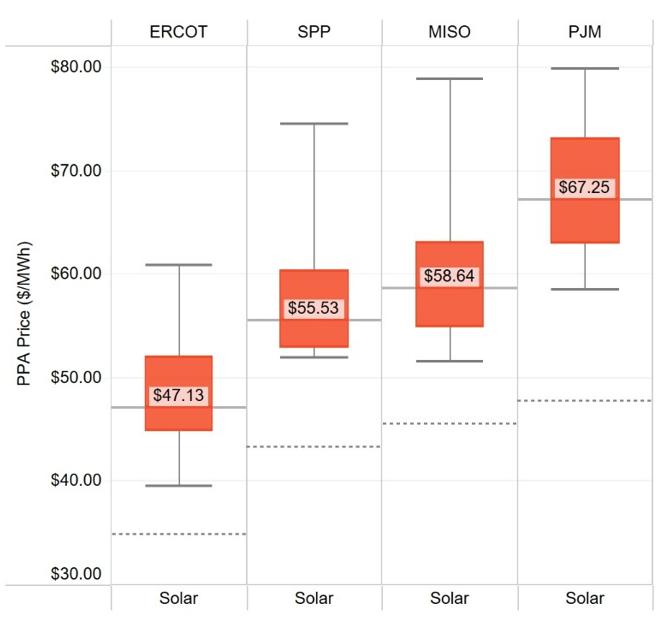

Rising interest rates and falling raw materials costs contribute to a modest rise in PPA prices While macroeconomic factors have been major drivers of cost increases in the U.S. renewables sector this past year, project developers are starting to see some relief. Despite rising interest rates, raw materials costs have begun to fall, and the Inflation Reduction Act has offered some stabilization in the market. These factors helped to slow this past quarter’s median solar PPA price growth rate to 4%, despite median prices being up 48% year over year, per Figure 4.

Recent interest rate hikes have introduced yet another cost that is pushing PPA prices higher for both wind and solar. The Federal Funds rate, which represents the cost of borrowing money, rose 3.7% from January 2022 to November 2022, after staying near zero throughout 2021, as illustrated in Figure 6. The Federal Funds rate greatly influences interest rates felt by any entity requiring a loan – including project developersmaking the cost of financing renewable projects more expensive. Further, developers have been challenged by supply chain constraints, high labor costs, and overwhelming demand from corporate buyers looking

to reach their 2025 and 2030 goals. This has limited their ability to incur any further expenses, and thus the higher cost of borrowing is passed through to buyers via higher PPA pricing.

At the same time, there are also downward pressures on renewables pricing in the form of decreasing raw material costs. Since Q4 2021, copper, aluminum, and North American steel prices have all decreased, by 15%, 10%, and 64%, respectively.5 All three are critical inputs to solar, wind and broader electrical system equipment. Recent reductions in raw material costs are promising, but the effects of these price improvements on PPAs will likely have a lag. Equipment manufacturers, rather than project developers, will be the first to realize the reductions in the raw materials prices, which will ultimately be translated into lower prices on their products. In recent quarters, leading turbine manufacturers, such as Vestas Wind and Siemens Gamesa, took on significant losses due in part to rising raw material costs throughout 2021. As these manufacturers work to make back these recent losses, they are unlikely to lower prices significantly in the near term as material costs decrease. In time, developers, and ultimately buyers, should see a price improvement.

13 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

Figure 6. U.S. Federal Funds Rate, 2021-2022

5. Source: London Metal Exchange

U.S. Renewable Energy Marketplace Factors Driving the PPA Market

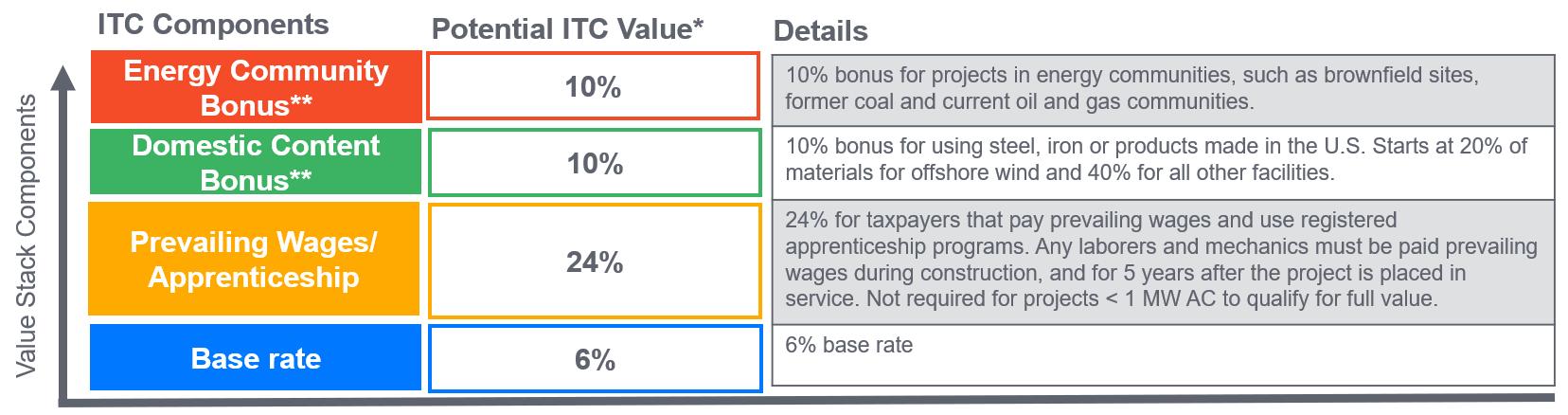

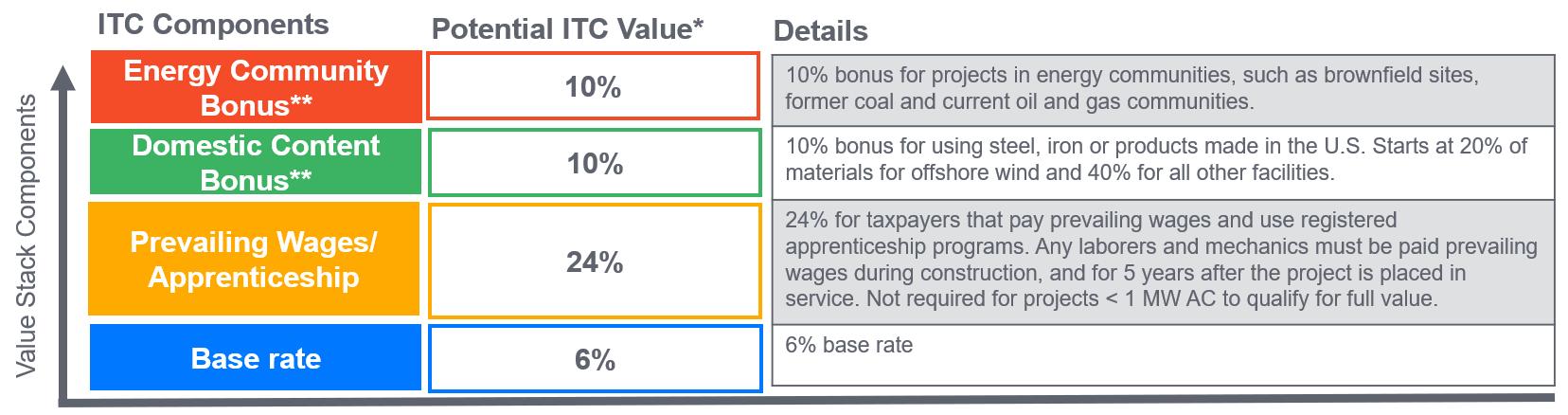

Investment Tax Credit (ITC)

Minimum ITC Value: 6%

Maximum ITC Value: 50%

Production Tax Credit (TC)

* Percentage of total project costs

** Only available for projects placed in service after January 1, 2023

Minimum 2022 PTC Value: $5.5/MWh*

Maximum 2022 PTC Value: $33/MWh*

* Base rate if prevailing wage and apprenticeship requirements (PW&A) are not met. PTC value without PW&A is insufficient for project investment.

** Only available for projects placed in service after January 1, 2023

The IRA extended both the ITC and PTC for clean energy projects placed in service between 2021-2024 and then transitions to a technologyneutral tax credit from 2025-2035. Because of the emissions profile of wind and solar, the tax credit value remains unchanged after the transition. Clean energy projects can achieve tax credit rates higher than the current market allows by meeting requirements for bonus adders.

These bonus adders are intended to incentivize developers to pay prevailing wages, create jobs through apprenticeships, and develop projects in communities that have been disproportionately impacted by emissions and climate change.

14 Global Renewables Market Update | Q4 2022

Figure 7. Stacking Value of the Clean Energy Tax Credits for Utility-Scale Projects under the Inflation Reduction Act

U.S. Renewable Energy Marketplace Factors Driving the PPA Market

Inflation Reduction Act clarifications help guide developers on pricing, while law creates some controversy with Europe

Clarifications from the Internal Revenue Service (IRS) on the Inflation Reduction Act (IRA) are beginning to help developers price PPAs more confidently. This law extends renewable energy project eligibility for tax credits for 10 years. While the availability of these incentives is expected to have a positive impact on PPA pricing in the medium- to long-term, as the value of the credits would have otherwise declined over time, the new law makes the structure of the credits more nuanced, as illustrated in Figure 7. Project developers will need to comply with certain provisions in order to qualify for tax credits, and they are beginning to receive more guidance on how to model the cost of compliance.

Guidance issued by the IRS in late November has provided developers with more clarity on how to price projects that will begin construction by the end of January 2023, and has also indicated that the cost of compliance for projects built beyond that date will negate some of the value of the credit. Specifically, projects that begin construction by January 29, 2023, will automatically qualify for the historical “full value” of the investment tax credit, or 30%.

After that, projects will only be eligible for a base tax credit value of 6%, plus an additional value of 24%, if they comply with the IRS’ newly issued list of requirements for paying construction and repair workers the prevailing wage and meeting the IRS’

apprenticeship labor hours requirement. With this clarification, developers can begin revising their assumptions on the cost to meet these requirements. However, developers are still waiting on additional clarifications that are expected in 2023, on how to qualify for tax credit bonuses based on using domestic content and/or building a project in a location that qualifies due to economic or environmental factors.

Another recent development related to the IRA is backlash from European countries claiming that some requirements in the IRA unfairly benefit U.S. companies. One example is related to the clean energy tax credits: a 10% bonus incentive is available when U.S. steel, iron, or other domestically manufactured products contribute 20% of an offshore wind project’s materials, or 40% of any other facility’s materials.

Members of the European Union (EU) have expressed concerns that the IRA will hinder European companies, and that it violates international trade law. In response, the U.S. and EU have created a joint task force to address these concerns. Project developers will be attentive to any potential changes that may result from these conversations in 2023.

To learn more about the specifics of the IRA and its provisions, please follow this link to Edison’s blog series.

15 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

U.S. Renewable Energy Marketplace Factors Driving the PPA Market

Solar module prices expected to rise, as manufacturers complicit in circumvention will face tariffs

The cost of solar panels is expected to rise, as the Department of Commerce (DOC) preliminarily determined there has been widespread circumvention of tariffs throughout the four Southeast Asian countries that have been under investigation since March 2022. The DOC will impose tariffs on violating suppliers starting in June 2024.

The DOC released a preliminary determination relating to the Auxin petition on December 2, finding that solar cell and module producers in Thailand, Malaysia, Vietnam, and Cambodia are circumventing tariffs. The decision went beyond cells and modules, instead ruling that wafers6 produced in China containing 3 or more of 6 specifically named components also sourced from China would be subject to tariffs: silver paste, aluminum frames, glass, backsheets, ethylene vinyl acetate sheets, and junction boxes.

Any module or cell produced in one of the four countries using Chinese wafers will be subject to tariffs unless it is proven they are below the "wafer +3" threshold. Four suppliers have proven their supply chain is below this threshold and will not be subject to

tariffs: New East Solar, Hanwha Q Cells, Jinko Solar, and Boviet Solar. Suppliers who do not cooperate could be given the China-wide tariff rate of over 250% after the two-year tariff moratorium set by President Biden in an executive action ends in June 2024.

The solar industry is unlikely to have longer-term clarity on module availability and price expectations until the DOC releases tariff rates for this case and a final determination is issued in May 2023. Suppliers will find it challenging to source affordable, responsibly produced modules and prove that their supply chain successfully qualifies for the wafer +3 threshold.

A hopeful result of the DOC’s determination would be expansion of module manufacturing in the U.S. However, there is worry across the industry that President Biden’s two-year tariff moratorium provides too little time for domestic manufacturing to catch up and backfill the module supply, which formerly came from the four countries in the case. Democratic senators are calling for President Biden to extend the two-year tariff waiver. Solar PPA prices are expected to stay high as module manufacturers pay a premium for responsibly sourced input components, and developers remain hesitant to contract with violating module manufacturers.

16 Global Renewables

Update | Q4 2022

Market

6. A wafer is a thin slice of crystalline silicon which acts as a semiconductor and is a key input in the manufacturing of solar cells.

U.S. Renewable Energy Marketplace Factors Driving the PPA Market

Lack of clarity regarding forced labor prevention law implementation contributes to solar project development struggles

The U.S. solar market continues to face equipment import hurdles and is experiencing project construction delays as Customs and Border Protection (CBP) grapples with enforcement of the Uyghur Forced Labor Prevention Act (UFLPA). This law, which has been in full effect since June 2022, assumes that all imports from the Xinjiang region of China are products of forced labor practices. Importers must present “clear and convincing evidence” in order to demonstrate their goods did not involve forced labor. Some manufacturers have struggled to present that high burden of proof, resulting in equipment being detained at the border.

As a result, buyers may experience some movement in project online dates and pricing as they partner with renewable energy developers on PPAs. Alternatives to imported modules are scarce, as domestic panels remain in high demand and low supply. First Solar, one of the few panel manufacturers headquartered in the U.S., has reported they are sold out for 2025 and are nearly sold out for 2026.

Though the UFLPA is a strong signal to the international trade community that the U.S. will dedicate resources to ban imports where forced labor practices are involved, the enforcement has been slow, opaque, and confusing for manufacturers and project developers alike. Oversight by Congressional committees has not yet been effective enough to bring transparency or further instruction to importers, compounded by a lack of coherence regarding CBP’s enforcement of the law. Among other goods essential to the clean energy industry, both polysilicon and critical minerals such as aluminum, cobalt, lithium, and zinc have been identified as high priority for enforcement, though it is unclear how these imports will be screened.

In the meantime, companies are contesting detentions altogether. Enforcement has been inconsistent, and perhaps in some cases, incorrect. As of early December, no review as described in the law has been conducted. Despite limited documentation, some importers are claiming their goods have no inputs from Xinjiang and argue that CBP is misidentifying products.

17 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

U.S. Renewable Energy Marketplace Factors Driving the PPA Market

PJM interconnection queue reform moves ahead with FERC’s approval

The Federal Energy Regulatory Commission (FERC) approved PJM’s interconnection reform filing at the end of November. This decision will cause significant delays in project development in the mid-Atlantic region in the near term, hopefully in exchange for faster development timelines long-term. FERC concluded that the proposed “first ready, first served” clustered study approach and transition mechanism to the new scheme are just and reasonable. FERC concurred with PJM, finding that the upcoming reform should reduce current study backlog more quickly than under current rules and will be more efficient going forward.

The reform is widely supported by PJM stakeholders, as PJM’s interconnection queue has nearly tripled over the past four years alone, with the majority of new service requests being wind, solar, storage, or a combination thereof. FERC’s approval is contingent upon two compliance filings, as well as report submissions detailing progress made during the transition period.

There are two timeframes for moving projects forward in PJM: a ‘fast track,’ and a slower track. Assets projected to have minor upgrade costs and low grid impact will be ‘fast-tracked’ and studied while the larger reform process is under way. The majority of new interconnection requests will not be reviewed by the grid operator until 2026, pushing out approvals to at least 2027. In some cases, new interconnection requests can be processed prior to 2026 if they do not require further studies and have no network upgrade cost allocation. Some renewable developers active in the region have communicated that there will be development delays given the transition timeline, while others have refrained from marketing their PJM portfolio until there is further clarity.

For renewable buyers who have near-term greenhouse gas reduction targets or sustainability goals, a thorough evaluation of interconnection status will be critical to quantify the associated development risk. As is the case with most deregulated wholesale markets, mature PJM development assets have been in demand for some time and are hard to come by. The transition phase is expected to be implemented in early 2023, with further detail on timing still to come.

18 Global Renewables Market Update | Q4 2022

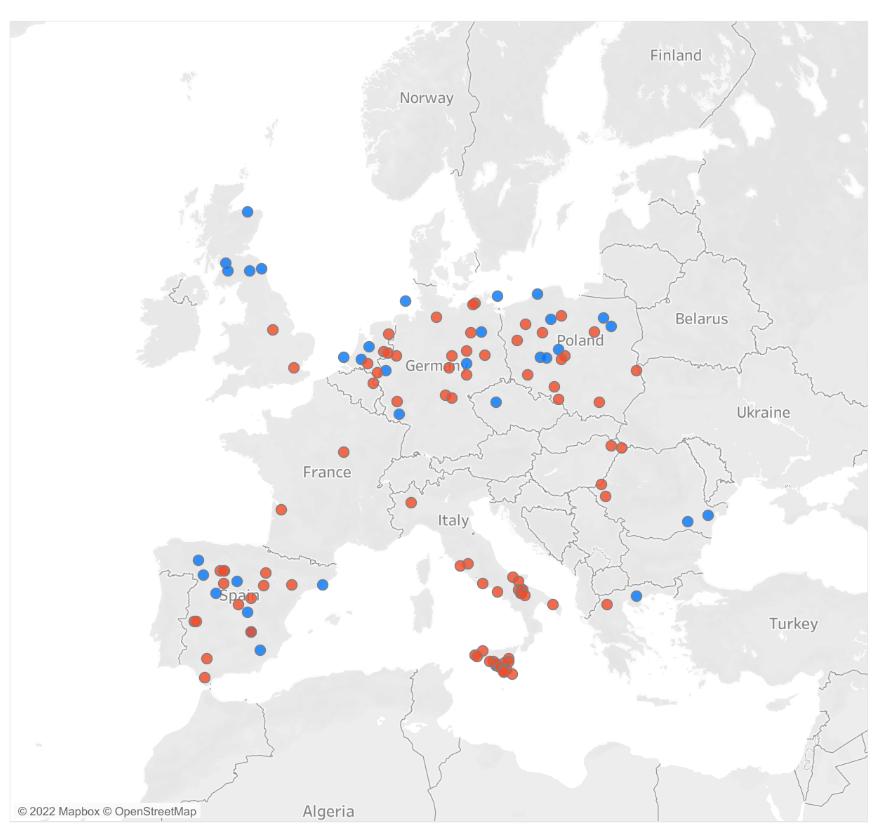

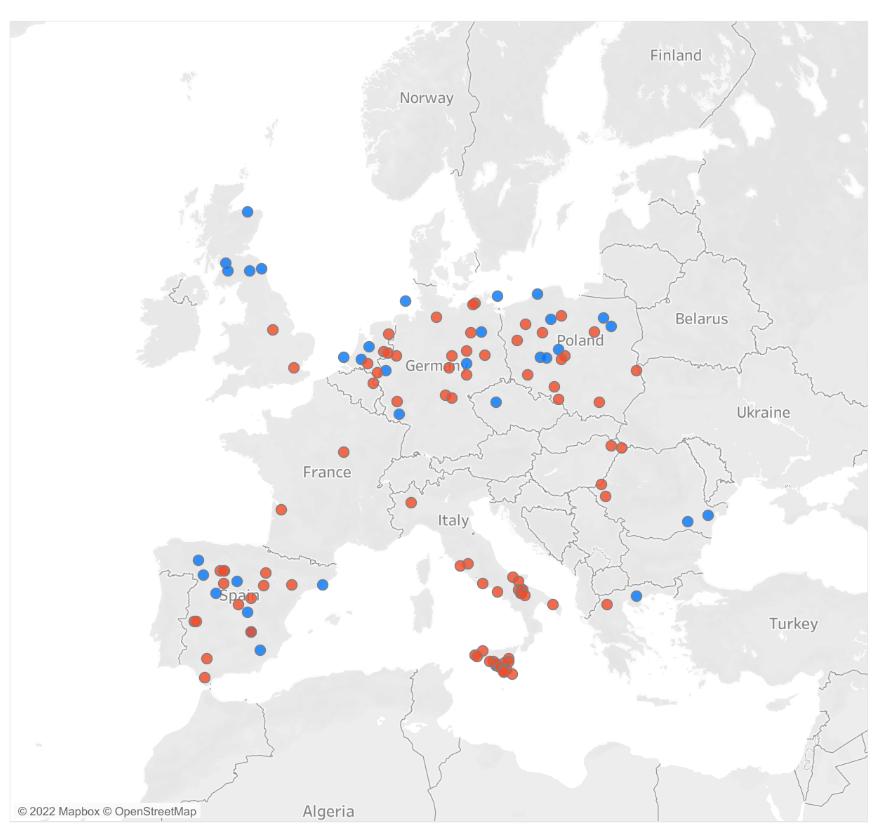

European Renewable Energy Marketplace Project Availability

19 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

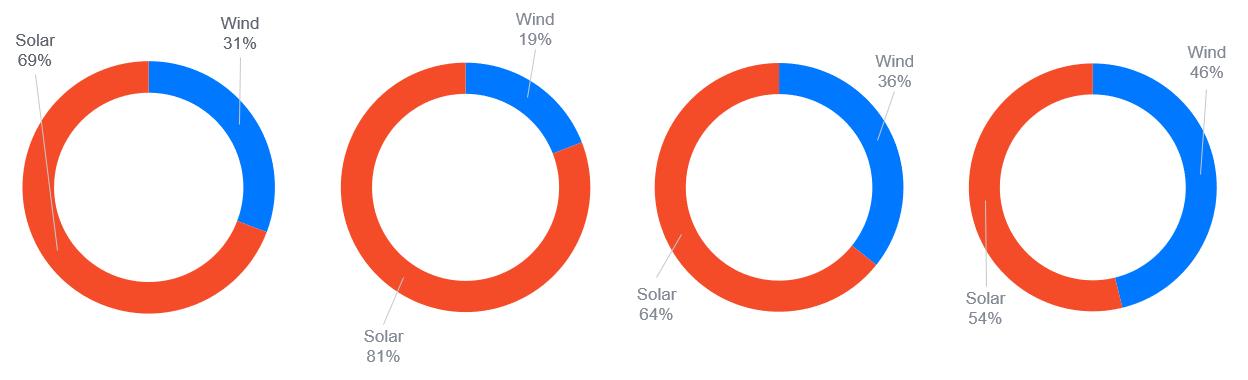

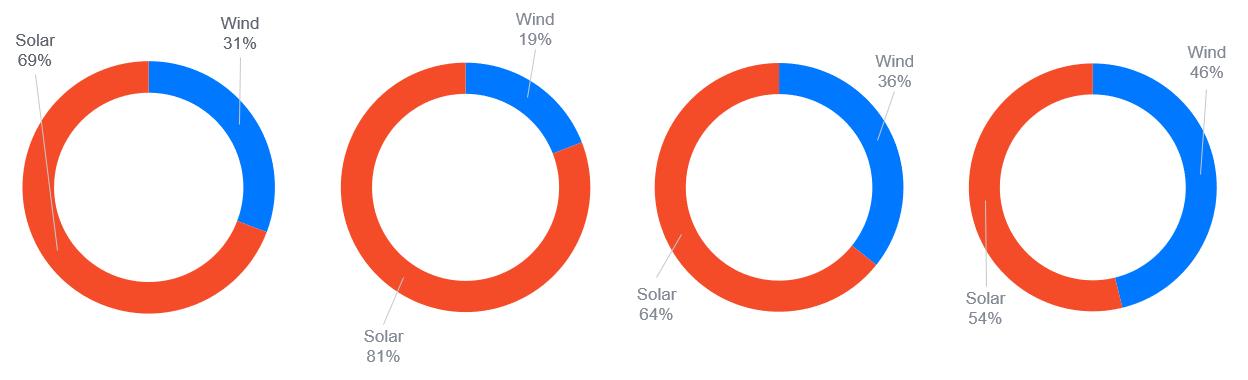

Figure 8. Utility-Scale Projects Marketed to Voluntary Buyers, 2022

Technology Solar Wind Anticipated Online Dates 2023 2024 2026 or later 2025 13 Projects 68 Projects 42 Projects 13 Projects Solar 69% Wind 31% Solar 81% Wind 19% Solar 64% Wind 36% Solar 54% Wind 46%

European Renewable Energy Marketplace

PPA Pricing Trends

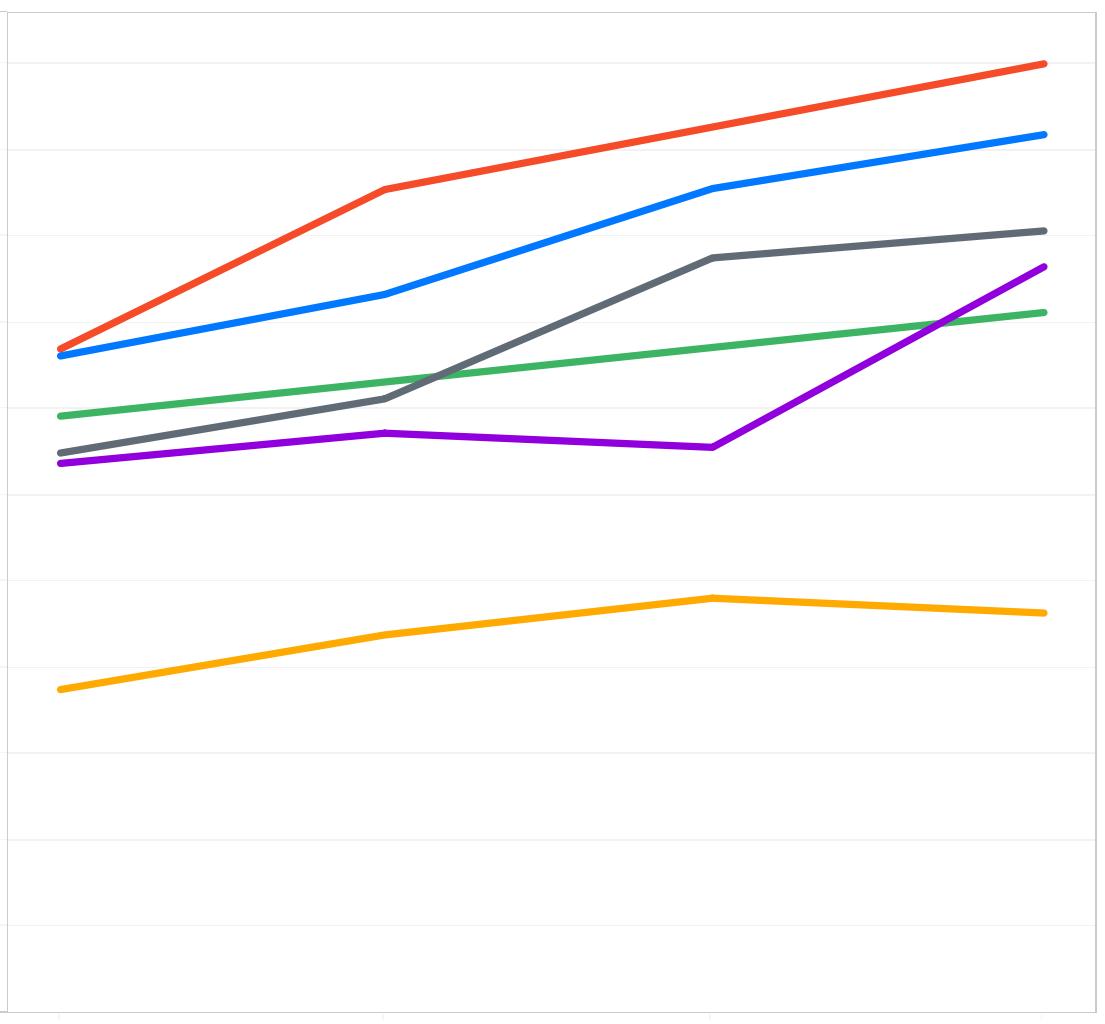

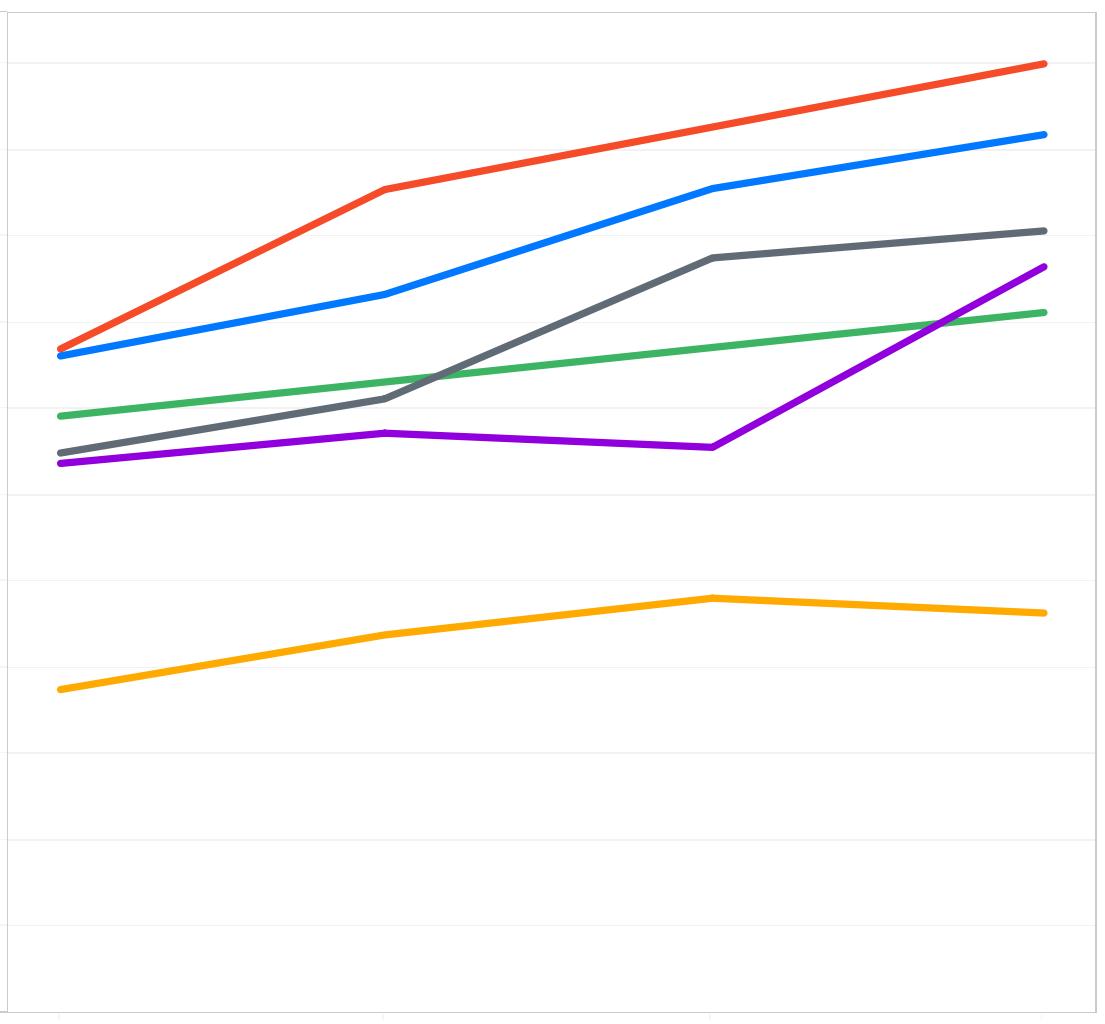

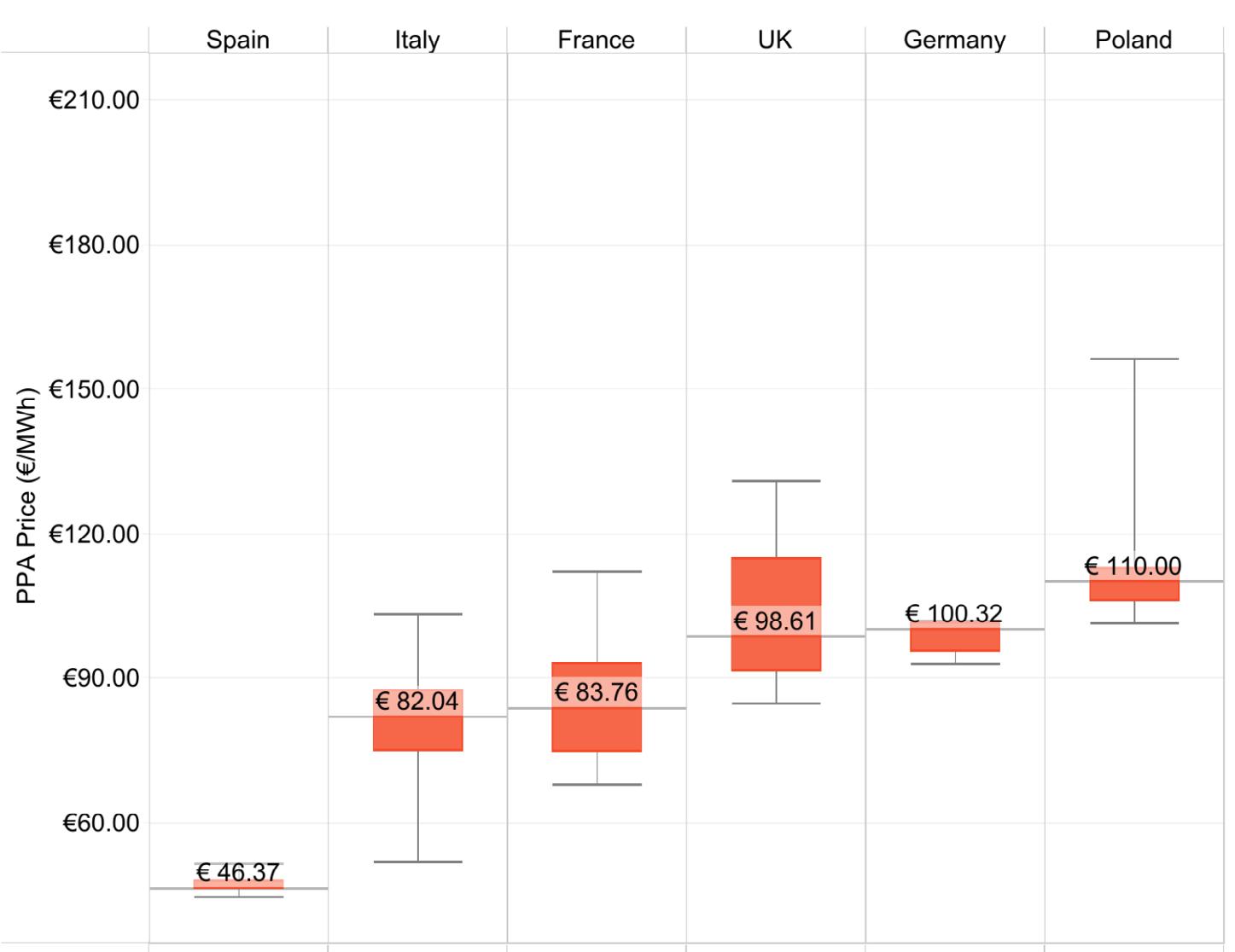

Prices for the five markets shown reflect the median of flat, unit contingent offers inclusive of project GOs, received over time. Markets and technologies with offers from fewer than three distinct projects in a given quarter are not shown. Wind PPA price trends are not shown this quarter due to fewer than three wind projects seeking offtake in each market. The EU PPA Price Index is a weighted average of all PPA prices across Europe.

• The EU PPA Index price is up 3% from Q3. The PPA Index price represents a weighted average of all PPA prices across Europe and in Q4 was 91 €/MWh - up from 88 €/MWh last quarter.

• PPA prices continue to rise across most European markets due to a variety of factors. Project input costs remain high due to supply chain constraints and surging power prices driven by the Russian invasion of Ukraine. Rising interest rates have also led to higher costs of capital for renewable energy project development, resulting in further increases in PPA prices.

• Spain remains the most attractive PPA market. Since Q1 2022, the median solar PPA price in Spain has increased by 25%, driven by high inflation and supply chain issues. Despite this upward trend, the Spanish PPA market offers significantly lower prices than other EU markets. level, despite developers’ eagerness to apply.

• PPA prices in Poland continue to rise. Poland’s PPA prices jumped in 2022 due to an imbalance of supply and demand. High power prices, coupled with a carbon-intensive grid and growing sustainability commitments, have pushed corporates to source more renewable energy projects in Poland. However, the 10H rule, along with insufficient grid capacity, has led to a significant undersupply of projects.

20 Global Renewables Market Update | Q4 2022

EU PPA Price Index Poland Netherlands Italy Germany Spain €80.00 €30.00 €20.00 €10.00 €0.00 €60.00 €50.00 €40.00 €70.00 €100.00 €90.00 €110.00 2022 Q1 2022 Q2 2022 Q4 2022 Q3 Median PPA Price (€/MWh)

Figure 9. Trends in Solar PPA Prices

European Renewable Energy Marketplace

PPA Pricing Trends

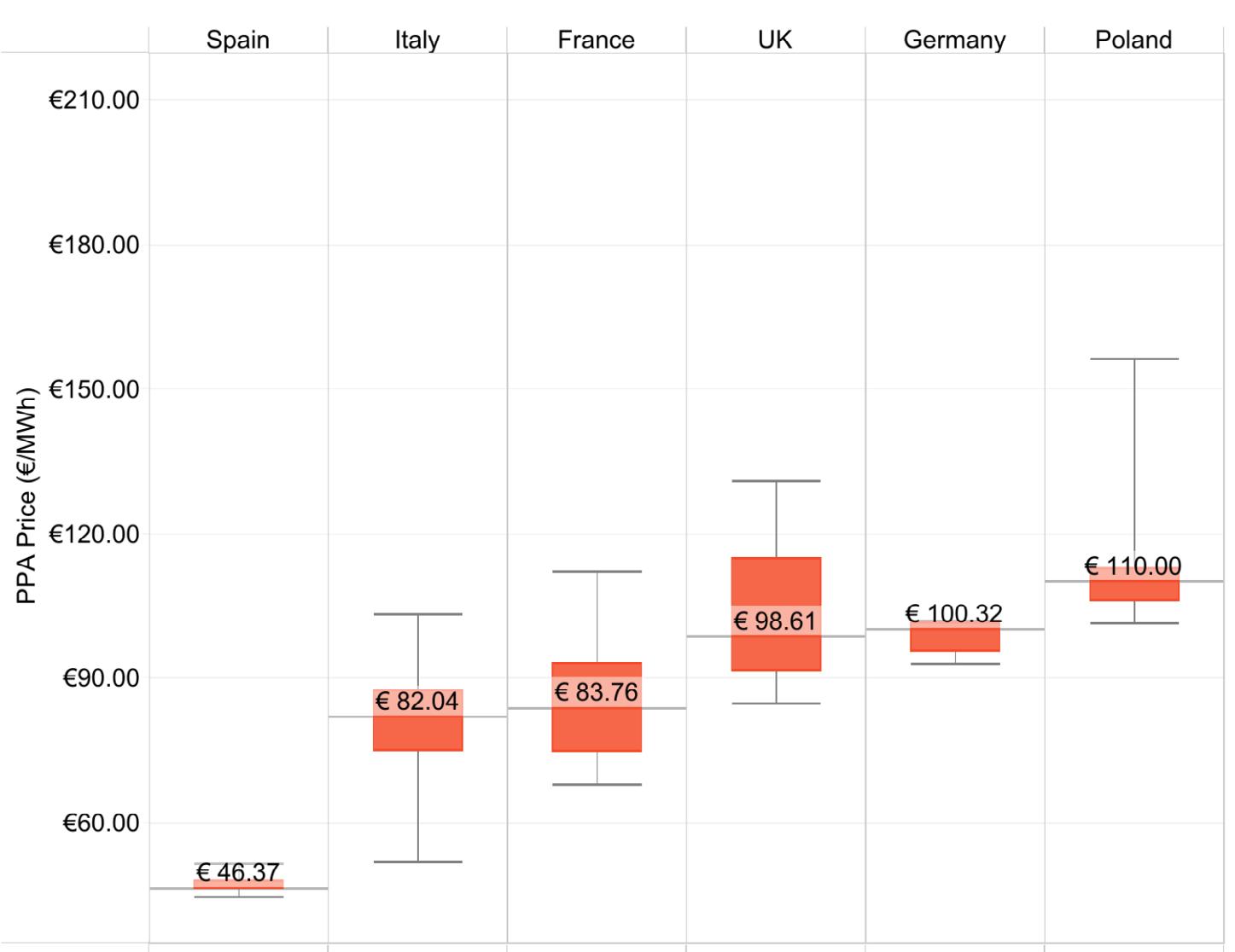

Figure

PPA prices shown above reflect flat, unit-contingent offers received in Q4 2022. Markets and technologies with offers from fewer than three distinct projects are not shown. Some offers shown may no longer be on the market.

21 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

10. Current PPA Prices Q4 2022

Upper Whisker — Maximum PPA Price Lower Whisker — Minimum PPA Price InterQuartile Range of PPA Prices Solar Solar Solar Solar Solar Solar PPA Price (€/MWh) €210.00 €60.00 €90.00 €120.00 €150.00 €180.00

European Renewable Energy Marketplace

PPA Landscape Across Europe

The move to a seller’s market impacts PPA dynamic

An imbalance of supply and demand is contributing to higher renewable energy PPA prices across Europe. These factors are described further below.

On the supply side, global supply chain constraints and cumbersome permitting procedures are limiting project availability. Project developers have cited shortages in materials, labor, and transportation issues as the primary drivers of project cost increases and timing delays. While there are current plans to reshore manufacturing, it remains to be seen how quickly that can yield material changes in renewable project pipelines.

Project developers have also been burdened by onerous permitting restrictions, which have kept projects from coming to fruition. Recognizing this challenge, the European Commission recently passed temporary regulations intended to streamline the permitting process for renewable energy projects. The permitting measure will be in place for at least one year but will likely fall short of unlocking the entire queue of renewable projects that await approval, as it only applies to new permitting requests.

On a positive note, projects phasing out of government subsidies that are eligible for contracting with corporate buyers could increase project

availability. However, buyers should be mindful of recent guidance from RE100 (see page 6) that favors newer projects.

On the demand side, a growing number of buyers are seeking renewable energy PPAs. Similar to the US, buyers in Europe are facing stakeholder pressure to decarbonize their value chains, but in addition to this, many are seeking to mitigate high energy costs. This is more of a consideration for European buyers, given the more common usage of physically delivered renewables PPAs, and due to the greater volatility in power prices experienced recently in the EU than the US. An upward trend in GO pricing is also demonstrating meaningful value to some prospective buyers, as projects’ GOs are bundled into PPAs. Overall, PPAs are the mechanism of choice to show impact and additionality, and to secure affordable power supply.

Higher demand than supply is marking a major shift in how developers generate PPA prices. Historically, PPAs were priced based on the costs of developing and building a project, along with the developer’s required rate of return. Today, sellers are testing buyers’ willingness to pay higher prices than the projects may cost to build, with rising energy prices, a low supply of renewable energy projects, and an upward trend of GO pricing demonstrating meaningful value to some prospective buyers.

22 Global Renewables Market Update | Q4 2022

European Renewable Energy Marketplace

PPA Landscape Across Europe

Macroeconomic Drivers Affecting the Corporate PPA Market in the EU

Supply

Supply chain constraints continue to impact projects

Shortages in material and labor will continue to disrupt production and transport due to the war in Ukraine, Covid lockdowns, and other factors. Re-shoring of manufacturing is planned but will come with time and cost implications.

Delayed and cumbersome permitting procedures limit project development

There continues to be a large pipeline of projects stuck in the queue. Despite recently passed permitting legislation, local impacts may lag.

Sunsetting of government subsidies and exit of RES projects from subsidies

Government subsidies will end or prove insufficient to meet goals and demand.

Demand

Strong corporate demand continues, with increasingly stringent targets

Emissionality is taking center stage in energy procurement. RE100 guidance has changed towards projects commissioned in past 15 years. Load growth is anticipated with increased electrification of vehicles and heating & cooling systems.

New buyers to the market

Buyers such as Apple are requiring and monitoring climate goals for their suppliers. Energy-intensive buyers are turning to long-term PPAs.

PPAs emerging as the prevailing mechanism of renewable procurement

In 2016, approximately 10% of RE100 members’ consumption was sourced via PPAs. In 2020, that number increased to nearly 30%.

23 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

European Renewable Energy Marketplace

PPA Landscape Across Europe

Buyers take on new strategies in PPA market

In today’s market, where demand is outpacing supply, prospective buyers should be prepared to bid into sellers’ auctions. It is becoming increasingly common for sellers to issue “reverse tenders,” in which renewable energy developers or asset owners invite corporates to propose PPA prices, and ultimately negotiate the PPA with the corporate that offers the most competitive bid. Altenex Energy can support buyers in analyzing market dynamics and preparing a competitive bid, which is likely to be received favorably if the buyer has a strong credit rating.

Buyers may also want to consider a wider pool of projects and can potentially benefit from the increased supply of operating projects becoming available for contracting. With projects phasing out of government subsidies across multiple countries – notably Germany - project owners may be willing to offer corporate offtakers one- to seven-year PPAs on these projects. While such contracts do not offer additionality claims, they can help buyers hedge energy price risk and secure EACs in compliance with emissions reduction goals.

It is becoming increasingly common for sellers to issue "reverse tenders" in which renewable energy developers or asset owners invite corporates to propose PPA prices, and ultimately negotiate the PPA with the corporate that offers the most competitive bid.

24 Global Renewables Market Update | Q4 2022

European Renewable Energy Marketplace

PPA Landscape Across Europe

Uncertainty created by price cap mechanisms stalls some PPA contracting, particularly in Poland and Romania

As European nations seek to address high electricity prices, a resulting patchwork of regulations across the EU is creating uncertainty for project developers and threatening to delay PPA contracting. Thus, risk assessment for PPAs is a challenge in the short term.

The core proposal from the European Commission is a cap on electricity market prices, which could result in energy project owners owing the government market revenue that is above the cap. This would be particularly problematic for financial PPA settlements, as the same revenue could be owed back to the government - and to the offtaker.

The European Commission has recommended a price cap of €180/MWh for electricity generation that meets certain criteria. However, individual countries are passing on the cap in a variety of ways, and most countries have set this rule to expire in 2023. One exception is the German market, where the government has extended the revenue cap mechanism until April 2024. Project developers will likely follow the evolution of this policy closely, as there is potential risk that the European Commission and its Member States will make this measure permanent across the EU.

The potential impact appears to be most concerning in Poland and Romania, where the governments have not universally exempted both physical and financial PPAs from the electricity revenue cap mechanism. The European Commission had recommended exempting PPAs from the revenue cap, and most other countries have followed this guidance. However, it will be critical to track whether both physical and financial PPAs have been exempted, country by country.

For buyers aiming to procure in the current market, they may see developers adjusting strategy and investment plans to align with these regulatory market changes, as investors are reluctant to make decisions in the current environment. It is critical for buyers to understand these risks in detail and use available commercial and legal mitigation options when contracting PPAs.

Following auction in Spain, PPA prices expected to be above €47/MWh

The Spanish government’s renewable energy auction in November did not meet expectations, with just 46 MW of new wind energy awarded from an available 3.3 GW, likely due to the government’s low price cap of €47/MWh. The major impact for corporate buyers is that most of the projects remaining on the market are expected to be priced above €47/MWh going forward. One reason for the lackluster outcome of the auction was misalignment between the government and developers. While developers’ bid pricing considered the increased costs of new wind energy projects spurred by inflation, supply chain bottlenecks, and rising raw material and shipping costs, the government’s price ceiling held steady.

Post-election uncertainty could call into question future renewable energy auctions. While solar PV is the most competitive technology and will likely see minimal impact, onshore and offshore wind could potentially face significant barriers to development should auctions be dialed back or discontinued altogether.

This will also contribute to project prices remaining above the € 47/MWh mark, which aligns with current bids and market PPA prices in Spain for corporate buyers, as seen in Figure 10. While this represents a significant price increase - up by at least 30% from last year - projects in Spain continue to show positive expected financial settlements against current long-term energy price forecasts, representing an attractive opportunity for corporate buyers.

25 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

Perspectives Roundup

Pulse on Policy

Growing impact: This Maryland green bank is leveraging millions in private capital to drive clean energy and climateresilient solutions

Featuring Stephen Morel, Chief Investment Officer at Montgomery County Green Bank

Inflation Reduction Act and Biden Administration Push Commercial Energy Efficiency to a New Level

By Matt Donath, Senior Policy Analyst

The Inflation Reduction Act: America’s New Green Industrial Policy

By Matt Donath, Senior Policy Analyst

Battery Storage Series

Growth of U.S. energy storage will hinge on innovation, engagement, and a robust domestic supply chain

Featuring Dr. Christina Lampe-Onnerud, Founder and Chief Executive Officer at Cadenza Innovation

Featuring Dr. M. Stanley Whittingham, Distinguished Professor of Chemistry and Materials Science at the State University of New York

Sustainability

Private sector strategies for building a sustainability-driven business plan

By Erin Williamson, Manager, Energy & Sustainability Strategy

By Erin Williamson, Manager, Energy & Sustainability Strategy

Opportunities for private companies to succeed in a low-carbon economy

By Erin Williamson, Manager, Energy & Sustainability Strategy

COP27’s rallying cry is “Together for Implementation.” Will the private sector deliver?

Featuring Tim Kidman, Managing Director, Sustainability Strategy

26 Global Renewables Market Update | Q4 2022

You don’t want to miss this expertise from our team…

Growing the American battery storage sector

Perspectives Roundup

Electrification

Landmark federal Blueprint targets widespread transportation decarbonization

By Imani Love, Analyst, Transportation Electrification

Distributed Energy: The Win-Win-Win for Electric Vehicle Charging Projects

By By Kyle Manahan, Senior Manager, Energy Storage, and Imani Love, Analyst, Transportation Electrification

By By Kyle Manahan, Senior Manager, Energy Storage, and Imani Love, Analyst, Transportation Electrification

First Nations and their lands have been exploited for centuries. Now, Indigenous communities are using clean energy as a means to equity and autonomy

Featuring Jordyn Burnouf, an Adviser to the Métis Nation-Saskatchewan who also serves as Chair of the Seven Gen Indigenous Youth Council and Efficiency Canada’s Governing Council.

Amid the ongoing energy crisis in Europe, corporates seeking to decarbonize are moving beyond “vanilla” strategies

Featuring Altenex Energy’s John Egbuta, Onsite Solar & Energy Storage Advisor

Clean Energy Advisory

A Different Continent with a Similar Problem – and the Basis Differential

By Jeff Bolyard, Principal, Energy Supply Advisory

Hybrid models, innovative renewables, battery storage: The winning combination that could create a viable market for 24/7 CFE

Featuring Killian Daly, General Manager at EnergyTag

Sluggish Q1 22 followed by two busiest quarters yet, 80% of all signings from tech industry

By Yasiru Jayakody, Sales Analyst

Solar Industry unites behind Supply Chain Sustainability Initiative

Altenex Energy is one of the proud supporters of the Solar Stewardship Initiative.

27 ©Edison Energy. ©Altenex Energy. All rights reserved. | EdisonEnergy.com

You don’t want to miss this expertise from our team…

GET IN TOUCH

Hannah Badrei Vice President, Energy Supply Advisory +1-206-718-6828

Hannah.Badrei@EdisonEnergy.com

Andor Savelkouls

Senior Director, European Energy Advisory, Altenex Energy, BV +31-30-800-9276

Andor.Savelkouls@AltenexEnergy.com

Shannon Holzer Head of Policy +1-773-897-3907

Shannon.Holzer@EdisonEnergy.com

Emily Williams Vice President, Strategy & Sustainability +1-617-681-4208

Emily.Williams@EdisonEnergy.com

Global Reach. Local Impact. Edison Energy LLC (DBA in Europe as Altenex Energy and Alfa Energy) is a global energy and sustainability advisory that provides strategy and implementation services to help large corporate, industrial, and institutional clients navigate the transition to a net-zero future.

With the recent integration of Edison, Altenex, and Alfa into one global company, we bring the strength of combined expertise across energy procurement, optimization, renewables, and sustainability solutions. With advanced technological capabilities and expanded international reach, we enable our clients to achieve more positive, measurable impact. Edison by the numbers: 47 Global Fortune 500 clients; 10+GW of offsite renewable procurement; $7BN+ in energy spend managed; 30+ countries served; 20+ languages spoken.

For more information about visit www.edisonenergy.com.

DID YOU KNOW

Our global team has locations across Bosnia and Herzegovina, Germany, The Netherlands, Romania, Spain, and the UK. We specialize in delivering integrated strategies that best meet the needs, goals, and objectives of our global clients in an evolving energy market.

January 2023

© 2023 Edison Energy Exchange Place, 53 State Street, Suite 3802 | Boston, MA 02109 Central Park, Stadsplateau 19-40, 3521 AZ | Utrecht, NL

Global presence in: North & South America, Europe and Asia-Pacific

By Erin Williamson, Manager, Energy & Sustainability Strategy

By Erin Williamson, Manager, Energy & Sustainability Strategy

By By Kyle Manahan, Senior Manager, Energy Storage, and Imani Love, Analyst, Transportation Electrification

By By Kyle Manahan, Senior Manager, Energy Storage, and Imani Love, Analyst, Transportation Electrification