2 minute read

U.S. Renewable Energy Marketplace Factors Driving the PPA Market

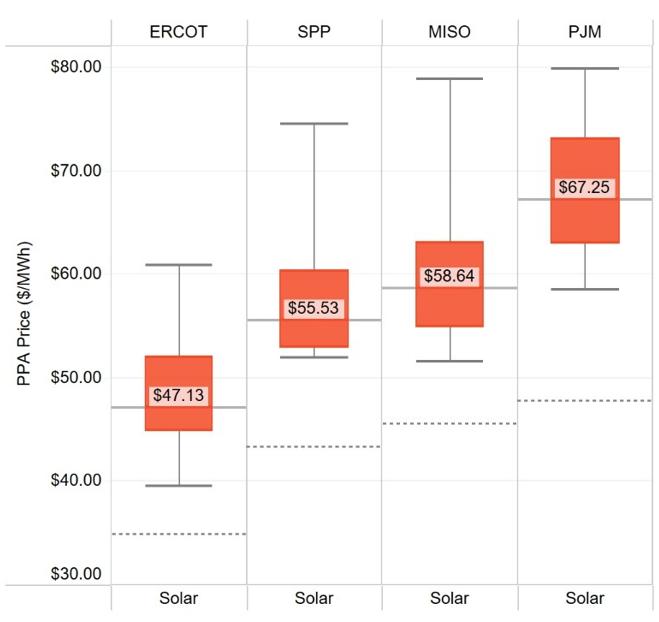

InterQuartile Range of PPA Prices

PPA

Solar

Lower Whisker — Minimum PPA Price

Q4 2021 Median PPA Price

PPA prices shown above reflect flat, hub-settled, unit contingent offers inclusive of project RECs received in Q4 2022. Markets and technologies with offers from fewer than five distinct projects are not shown. Some offers shown may no longer be on the market. Dotted line indicates where the median PPA price was one year ago.

Rising interest rates and falling raw materials costs contribute to a modest rise in PPA prices to reach their 2025 and 2030 goals. This has limited their ability to incur any further expenses, and thus the higher cost of borrowing is passed through to buyers via higher PPA pricing.

While macroeconomic factors have been major drivers of cost increases in the U.S. renewables sector this past year, project developers are starting to see some relief. Despite rising interest rates, raw materials costs have begun to fall, and the Inflation Reduction Act has offered some stabilization in the market. These factors helped to slow this past quarter’s median solar PPA price growth rate to 4%, despite median prices being up 48% year over year, per Figure 4.

At the same time, there are also downward pressures on renewables pricing in the form of decreasing raw material costs. Since Q4 2021, copper, aluminum, and North American steel prices have all decreased, by 15%, 10%, and 64%, respectively.5 All three are critical inputs to solar, wind and broader electrical system equipment. Recent reductions in raw material costs are promising, but the effects of these price improvements on PPAs will likely have a lag. Equipment manufacturers, rather than project developers, will be the first to realize the reductions in the raw materials prices, which will ultimately be translated into lower prices on their products. In recent quarters, leading turbine manufacturers, such as Vestas Wind and Siemens Gamesa, took on significant losses due in part to rising raw material costs throughout 2021. As these manufacturers work to make back these recent losses, they are unlikely to lower prices significantly in the near term as material costs decrease. In time, developers, and ultimately buyers, should see a price improvement. Figure 6. U.S. Federal Funds Rate, 2021-2022 5. Source: London Metal Exchange

Recent interest rate hikes have introduced yet another cost that is pushing PPA prices higher for both wind and solar. The Federal Funds rate, which represents the cost of borrowing money, rose 3.7% from January 2022 to November 2022, after staying near zero throughout 2021, as illustrated in Figure 7. The Federal Funds rate greatly influences interest rates felt by any entity requiring a loan – including project developersmaking the cost of financing renewable projects more expensive. Further, developers have been challenged by supply chain constraints, high labor costs, and overwhelming demand from corporate buyers looking

©Edison Energy. ©Altenex Energy. All rights reserved. EdisonEnergy.com