HomesEAST BAY

n A home away from home (town)

n Who’s buying houses in the East Bay?

n Selling a home, one song at a time

n Everything to know about lawn care

n A home away from home (town)

n Who’s buying houses in the East Bay?

n Selling a home, one song at a time

n Everything to know about lawn care

I'm here to guide you through your mortgage journey, ensuring you secure the home of your dreams within your budget using St. Anne's flexible loan programs. With tailored fixed or adjustable rates, MassHousing programs and support for first-time homebuyers, I'm committed to simplifying the process for you. Join our free seminars, available virtually or in-person, to gain valuable insights into homeownership. Contact me today for your complimentary prequalification to enhance your negotiating power

Your road to homeownership starts here!

In today’s seller’s market, firsttime homebuyers are often forced to search outside their hometowns to secure a home within their budget

BY MICHELLE MERCURE mmercure@eastbaymediagroup.com

Leaving the nest isn’t easy for millennials, for at least two reasons — prices being one, the other being options. Abandoning the hometown where they grew up becomes almost inevitable in today’s competitive seller’s market. This is a reality that hits close to home for Maddie (26) and Ryan (29) Coccio, a young couple from Bristol County.

“Even though millennials are being priced out of the areas they grew up in, it is important for them to never feel like they are settling for a house. It’s a massive decision, and you want the right one.”

MATT ROMANO

“We’d probably still be holding out hope for prices to drop if we didn’t have a child now,” Maddie said. The need for more space pushed Maddie and Ryan to begin their search for a

first home in January 2025. But they knew from the start that their hunt would have to exclude their hometowns — Bristol and Warren — where

Local real estate experts bring in-depth market knowledge and neighborhood insights to help you find the perfect home that fits your needs and budget.

prices were (and are) simply out of reach.

Matt Romano, a real estate advisor with Romano Realty Group who has

focused on the East Bay Area — including Warren, Bristol, and Barrington — during his six years in the business, shared his insight on the matter. He said, “Natives to the area are being forced to look elsewhere in the state for more affordable housing — with some even considering nearby states like Connecticut or Massachusetts.”

According to Romano, many buyers fall into a lower purchase bracket between $300,000 and $400,000, which limits their options to dated properties or homes that need significant repairs — options that are nearly impossible to find in Bristol County.

With a slightly higher budget, between $400,000 and $450,000, Romano was able to help the Coccio family find a home in Riverside. However, this came after seeing several unacceptable options in surrounding

areas. Maddie said, “We saw one in Tiverton listed for $400,000, but it had a giant hole in the wall from the chimney separating from the house, and it also needed a new septic system. And that house sold shortly after for more than the asking price.”

The home the Coccio family ultimately chose only required mostly minor cosmetic repairs, such as redoing the floors, painting, and installing new appliances. As a result, they had to invest an additional $10,000 before moving into their “home away from their hometowns,” but according to Maddie, they are enjoying being new homeowners.

Romano emphasized the importance of choosing a home that fits the buyer’s needs — even in a seller’s market where options are limited. He said, “Even though millennials are being priced out of the areas they grew up in, it is important for them to never feel like they are settling for a house. It’s a massive decision, and you want the right one.” His advice is to set realistic expectations without settling.

A single income borrower in 2020 could make $60,000 to $80,000 and be able to afford a home, but now it’s more in the $125,000 to $140,000 ballpark (nearly double), according to Romano.

Not only is it necessary to have a significantly higher income to afford a home (even outside of a preferred area), buyers in Rhode Island face competition from out-of-state buyers, according to Sarah Huard of Mott & Chase Sotheby’s International Realty. And yet, buyers aren’t willing to settle. Huard said, “Buyers have become more particular, I’ve noticed. They pause when the backyard isn’t big enough, and they hesitate if the home doesn’t have everything they want. Either they don’t have excess equity, or they’re simply not willing to throw it around.”

Sellars are running into issues as well, as rents are too high and condos are full. Huard said, “They don’t want to list if there is nowhere to go.” Between sellers who want to sell but have nowhere to go and buyers, being more particular and willing to wait for the right one, Huard has taken on a different role as a real estate agent. She said, “Counseling is 90 percent of what I do at this point.” She helps her clients

RICHARD W. DIONNE JR.

Despite the challenges of a seller’s market, first-time homebuyers Maddie Coccio (left), her 11-month-old son, and husband Ryan moved into their first home on April 10, 2025, after finding a property within their $400,000 to $450,000 budget that offered a backyard, a laundry room, and ample space for their growing family.

with all aspects of planning and takes steps to make sure they are getting what they want in their home purchase, without having to settle — the backyard, the laundry room …

The Coccio family, with the help of Romano, only looked at options within their budget — a step that helped them make a realistic choice without set tling. Maddie said, “We were so frus trated we couldn’t afford them, so we didn’t look at any in Warren or Bristol.”

The towns they considered included Tiverton, Somerset, Rehoboth and Riv erside — the latter being the one where they found a home away from their hometowns that they felt they could call their “home sweet home.”

Still, the couple hasn’t taken homeownership in Bristol or Warren off the table. “Our hearts will always be in Bristol and Warren,” said Maddie.

Recent data shows dramatic shift in buyers, who are increasingly older and from out of state

While the residential real estate market continues to be slow due to high interest rates and the lack of housing turnover caused by so many homeowners being locked into 2.5%-3.5% mortgages, there is some buying going on.

So, where are these buyers coming from who are buying homes in our East Bay towns and neighborhoods? There is no data available in the Easy Bay towns that summarizes who these buyers are, but one can review a larger sub-set of data and extrapolate that down to the East Bay. According to the Rhode Island

Association of Realtors, 25% of all residential buyers of Rhode Island residential homes are from out of state! Rhode Island’s prices, which are historically the highest they have ever been, are being bought at “bargain prices,” especially from Massachusetts residents, because to them our prices are “affordable” compared to theirs! That influx of buyers is contributing to our higher prices, especially in the East Bay, given our proximity to Narragansett Bay and the Atlantic Ocean.

Another factor is Newport, which attracts not just out of state buyers, but enjoys a world-wide market of buyers, from all seven continents on our earth. Therefore, I would logically conclude that the East Bay has a far higher number of out of state buyers than the rest of Rhode Island.

Anecdotally, I can share a story of a house I had for sale in Bristol in 2024.

In a one-week period of time, I had 12 parties come through to see the property. Of those 12 parties, 10 were from out of state. The eventual buyer is from Long Island. That kind of story could be told by hundreds of Realtors in Rhode Island.

What generation is buying the most homes

Besides where East Bay real estate buyers are coming from, it is worth noting who they are specifically as an age group. In 2024 a shift in a decadelong pattern emerged. Millennials over the past decade led all generations in buying homes nationally, but in 2024, their parents’ generation taught those whipper snappers a lesson and snatched back the lead as the generation buying most of the homes. Yes, Baby Boomers recaptured the lead percentage of buyers from their offspring, the Millennial Generation!

Once again, there is no solid data that I can analyze to solve the question of age specifically buying in the East Bay, but I can extrapolate from a larger subset of data provided by the National Association of Realtors (see accompanying chart).

According to the NAR report, Baby Boomers accounted for 40% of sales in the U.S in 2024, compared with Millennials, who bought 29% of homes on the market. The percentage drop was dramatic, as Millennials had purchased 38% of all home sales in 2023, and in 2024 it dropped 9%. So, what is happening in the market to cause this generational shift to older folks buying more homes than their offspring?

The hypothesis

One answer, I believe, is in the numbers. Residential housing has become so expensive in the past six years, nationally, in the Northeast especially, and in Rhode Island and the East Bay particularly, that the younger generation is being priced out of the market. The other part of this equation is Boomers are downsizing to smaller homes, and they have the cash, after a lifetime of working, saving and building equity.

According to the NAR report, 39% of Young Boomers (61-70), and 51% of Older Boomers (71-79) paid for their homes with cash in 2023 and 2024. Whereas 90% of all buyers who were either Millennials or Gen Z’s (45 or younger), relied on financing and family support.

This younger generation is faced with limited inventory, housing affordability, and difficulty in saving for a downpayment, as rents are now historically high too,

Another offshoot of the high cost of

housing here in the East Bay is more and more buyers are buying “multigenerational” homes, to be able to live in their own homes. The inventory for 2-4 family homes is almost nil, pointing to the high demand being waged by investors versus those seeking homeownership but can’t afford it without help and assistance of some kind.

It is easy to conclude that in Rhode Island, having one of the highest median ages in the country and a growing elderly population, we probably exceed the averages that the NAR Report provided. And combined with East Bay’s appeal to out of state buyers, one has to wonder …where will our children live?

Douglas Gablinske owns AppraiseRI, a 29 year old statewide real estate appraisal company located in Bristol, RI. He is Chairman of the Warren Taxpayer Appeal Board, is a member of the RI Real Estate Appraisal Board, Licensed Real Estate Appraiser and Real Estate Broker. He can be reached at Doug@AppraiseRI.biz

The latest data from the R.I. Assocation of Realtors shows a small decline in home sales and another 6% increase in the median sales price

In the first quarter of the year, the number of single-family home sales in Rhode Island fell 3.2% year over year, despite a four-month upward trend that began in October 2024 and ran through January of this year. According to statistics from the Rhode Island Association of Realtors, the median sales price climbed to $465,000 from $440,000, a 5.7% increase.

“With all the economic uncertainty around us, many buyers seem to be temporarily pumping the brakes on their home search. However, the chance of rates falling any time soon seems very unlikely. Historically, mortgage rates are still below the 54-year average, so playing the waiting game may not be the best decision. The best time to buy a home was yesterday. The second-best time is today. Our median price here in the Ocean State is only going to continue to rise in the foreseeable future. Considering that the National Association

of Realtors estimates the median net worth of a homeowner to be $430,000 in 2025 compared to the median net worth of a renter at $10,000, buyers who are choosing to sit on the sidelines could be missing an opportunity to build wealth that could help insulate them from future economic uncertainty,” said Chris Whitten, president of the Rhode Island Association of Realtors.

In contrast to single-family home sales, closing activity in the condominium market rose by 12% in the first quarter, accompanied by a 14% gain in median price to $390,000. Particularly attractive to first-time buyers, empty nesters and single adults, condominiums are an attractive option to gain a foothold into home ownership.

High demand for multifamily homes also continued in quarter one, buoyed by the ability to provide strong rental income for investors and owners. Sales of multifamily homes in the first quarter increased by 5.2%, and the median price grew to $570,000, a 12% annual increase from a year ago.

“Though we still have a long way to go to get to a balanced market, the good news is we’re seeing an increase in homes for sale and so far, interest rates are remaining stable. For those who want to build genera-

tional wealth, now could be the perfect time to jump back into the market. But, be sure to do so with a trusted Realtor by your

Real estate has long been touted as a worthy long-term investment. With that conventional wisdom in mind, young adults often make buying a home one of their first big-ticket purchases. Though real estate remains a potentially lucrative investment, the market for homes has been difficult to navigate for several years running.

High mortgage interest rates and low inventory have left many buyers feeling priced out of the real estate market. Others may find the competitive nature of the modern real estate market too stressful. No one can predict if or when the real estate market might be less challenging, but the following are some ways those looking for a house can navigate that process.

It goes without saying that prospective buyers must get their financial affairs in

order before they begin shopping for a house. But finding a home in the current market takes time, and some buyers might have let their mortgage preapproval letter expire without realizing it. Others might have experienced a dip in their credit rating as they turned to credit cards to confront inflation. That means buyers who began looking for a home months or even years ago might not be positioned to buy now should they find a home to their liking.

Revisit your finances if it’s been awhile. Pay off any consumer debt that has accumulated in recent months and reapply for mortgage pre-approval if necessary.

Data from the National Association of Realtors found that the average home spent 32 days on the market before being sold in Nov. of 2024, which was a full week longer than a year earlier. That’s good news for buyers, but it still means buyers must be ready to pounce if they find a home and home price to their liking.

The hectic pace of the modern real estate market can be difficult for anyone

to keep up with. But real estate agents keep up with the market for a living, and they can be invaluable resources for buyers whose commitments to work and family are making it difficult to keep pace.

According to Zillow, the median list price of homes in the United States was just under $387,000 by the end of Jan. 2025. But buyers must also recognize that 22.4 percent homes sold above list price in that month, according to a Redfin analysis of MLS data and/or public records. Buying a home is more than an investment in a property. It’s also in some way an investment in the town where the home is located and in a homeowners’ future.

So while it can be tempting to buy a home with the lowest asking price, home buyers should also seek homes that figure to experience the best long-term growth in value. Homes situated in safe and welcoming towns with good schools are arguably a better investment than homes with lower sticker prices but no such amenities.

The real estate market has been challenging for buyers over the last several years. Various strategies can help buyers find a home that suits them and their budgets.

With new advances in technology every day, creating a tech space in the home is a must

Life in the 21st century can feel like it’s moving at breakneck speed. Perhaps nowhere is that feeling more pronounced than within the technology sector, where new products are often upstaged by more advanced models, sometimes within a few weeks of an item’s initial release.

The speed with which technology advances can make it difficult to keep up. However, it’s important to note that software updates can bring devices up to speed in a matter of minutes, often at no cost to users. That can quiet concerns some may have about investing in entertainment room technology. For those ready to move forward with their entertainment room remodel, these tech upgrades can take such spaces to the next level.

FACING PAGE

The McCauley Duo

Father/Daughter Real Estate Team

Father/Daughter Real Estate Team

Father/Daughter Real Estate Team

Father/Daughter Real Estate Team

McCauley Duo

Let us put our years of experience to work for you!

Father/Daughter Real Estate Team

Let us put our years of experience to work for you!

Let us put our years of experience to work for you! 52 years

us put our years of

Let us put our years of experience to work for you!

to work for you!

Dave McCauley, Broker Associate 51 years 401-862-6206

Dave McCauley, Broker Associate 51 years 401-862-6206

Let us put our years of experience to work for you!

Dave McCauley, Broker Associate 51 years 401-862-6206

Dave McCauley, Broker Associate 51 years 401-862-6206

dave@themccauleyduo.com

dave@themccauleyduo.com

dave@themccauleyduo.com

Dave McCauley, Broker Associate 51 years 401-862-6206

Dawn McCauley, Sale Associate, SRES 36 years 401-864-6348

dave@themccauleyduo.com

Dawn McCauley, Sale Associate, SRES 36 years 401-864-6348

Dawn McCauley, Sale Associate, SRES 36 years 401-864-6348

Dawn McCauley, Sale Associate, SRES 36 years 401-864-6348

dave@themccauleyduo.com

dawn @themccauleyduo.com

SRES 37 years

dawn @themccauleyduo.com

dawn @themccauleyduo.com

Dawn McCauley, Sale Associate, SRES 36 years 401-864-6348

dawn @themccauleyduo.com

@themccauleyduo.com

dawn @themccauleyduo.com

Consumers who like to watch television but are not necessarily into what makes certain televisions more suitable to their viewing habits than others may find their heads spinning when they begin their search for a new device. Indeed, the alphabet soup of OLED, QLED, 4K, and other television styles can be difficult to navigate. If confusion reins over your television shopping trips, it might help to identify what you watch most often and then find the type of TV that most suits your viewing habits.

Though opinions vary and consumers should always trust their own eyes, the United Kingdom-based Smart Home Sounds recommends OLED televisions for movie and television lovers as well as gamers who require fast response times. Sports fans may benefit by prioritizing refresh rate when shopping for a new television. Though refresh rate is not the only variable to consider, a faster refresh rate can ensure games don’t look fuzzy when the action picks up.

Surround sound can take any entertainment setup to the next level. Modern televisions are slim and that sleek design does not always translate to great built-in sound. Though some recent models feature dramatically improved built-in sound capabilities compared to their slim screen ancestors, a home theater system featuring superior sound is still a must. A home theater surround sound system with subwoofer and Bluetooth connectivity can greatly improve the viewing expe-

rience no matter what’s on-screen.

For consumers working on a tight budget, a soundbar that can be upgraded with additional surround sound speakers down the road can be a great way to slowly build a theater-like sound system in your living room. When purchasing a surround sound system, consumers also can consider speaker stands that hold larger rear speakers in place.

Entertainment room lighting can be

easy to overlook, particularly when consumers go down the television and sound system rabbit holes. But the right lighting can set the perfect tone in an entertainment room. The decision of which lighting to go with should include consideration of how the space will (or won’t) be used when you aren’t watching the latest blockbuster or big game. If the room is exclusively for movies or big games, then lighting that calls to mind a movie theater, complete with LED strip lights on the walls, is an option worth considering.

If the entertaining space is your living room and a space where you’re just as likely to read a book as enjoy a family movie night, then recessed lighting in the ceiling with dimmable bulbs allows you to pivot back and forth between lighting schemes depending on how the room is being used at any given moment.

It’s easy to get lost when considering tech upgrades for an entertainment room. But pairing the right television with great sound and appropriate lighting can make for a consistently impressive viewing experience.

Kim Marion has found a new upbeat way to engage clients in the real estate market — using her musical talents

BY MICHELLE MERCURE mmercure@eastbaymediagroup.com

The stress of buying and selling keeps emotions high in the real estate world, so when a realtor breaks into a catchy, upbeat tune to showcase a home for sale, that energy inevitably becomes contagious. Portsmouth resident and global real estate advisor Kim Marion has added a unique marketing strategy to her repertoire — something she enjoys and that clients are now eagerly requesting.

“Sittin’ on the deck today, watching the boats in Bristol Harbor sway. I’m inviting you to come in — this video tour is where we’ll begin.”

KIM MARION

Marion, a real estate advisor, singer, and marketer, is a lively, driven individual who has found a way to combine all three of these talents to help her clients during a time when the housing market causes stress for both sellers and buyers.

Marion is no stranger to singing or selling. “I have been singing since I was a little kid. I used to get the neighborhood kids together and make them all practice with me because I wanted to audition for a show called ‘Community Auditions.’ ” Marion sold her friends on that idea and later applied those same “selling” skills during a 25-year career in the corporate world before taking a leap into the real estate business in 2017.

Real estate wasn’t a huge leap for Marion, as she is used to selling ideas — just like she did with her friends as a child.

“Even when I worked at Coastal Medical, I had to think about engagement. I had to get creative with strategies to get patients to come in and do their bloodwork. It’s all about how you communicate, and I carry that mindset with me wherever I go and in everything I do,” Marion said.

After years of considering how to incorporate music into her marketing strategy — and with a close friend jokingly issuing an ultimatum, ‘If you don’t do this, I

won’t be your friend anymore’ — Marion was finally ready to create her first music video for a client in 2024.

“Sittin’ on the deck today, watching the boats in Bristol Harbor sway. I’m inviting you to come in — this video tour is where we’ll begin,” Marion sang in one of her videos debuting a home her clients had listed for sale in Bristol. These lyrics, a playful nod to Otis Redding’s classic “(Sittin’ On) The Dock of the Bay,” set the tone (and the tune) for her creative approach to real estate marketing.

Being in real estate means Marion is often on the road — and that’s a good thing. Her creativity gets sparked in the car when she turns on the radio and a catchy tune reminds her of a home she’s trying to sell.

“I was in my car by myself, thinking about this cute coastal cottage and listening to the radio when ‘Sunday Morning’ came on — and I knew right then it couldn’t be anything else,” Marion said in reference to a home she sold in Westerly.

Marion chooses a song that almost everyone will be familiar with once they hear the tune. And she doesn’t let clients pick the song, because it has to be the right tune for her, or the lyrics won’t come as easily. “Once I have the tune, the words just come to me — they are simple and about the house,” Marion said.

“ ‘When is my song going to be ready?’ is a question I often get nowadays. This has really become a thing,” said Marion. Though everything is about the client and what they want, she can’t make a music video for every listing. It all depends on timing — and finding the right tune.

As it is a seller’s market with little inventory for buyers to choose from, timing is often the biggest hurdle when it comes to creating a music video. “A client in Warren listed a home recently, and it had offers before they could even do an open house,” Marion said. For a home like this, it’s not possible to choose a song, write lyrics, shoot a video, and complete editing in time. When possible, she does create one — and it doesn’t cost anything extra for her clients. “If they want it, if I have time, and if I am inspired by a song, then I do it,” she said.

So far, Marion has filmed five music videos for various clients, to the tunes of: “Flowers” by Miley Cyrus, “We Are Family” by Sister Sledge, “(Sittin’ On) The Dock of the Bay” by Otis Redding, “Sunday Morning” by Maroon 5, and “Smooth Operator” by Sade. She is currently working on her sixth and seventh music videos — so stay tuned for those tunes.

With lawn care a top priority during the summer months, now is the ideal time to learn how to scarify a lawn

To those unfamiliar with lawn maintenance, the term “scarify” might sound like something horror movie directors hope to do to audiences who watch their films. But scarifying has nothing to do with frightening filmgoers, and everything to do with promoting a lush, green and healthy lawn.

What does it mean to scarify a lawn?

Scarifying a lawn involves the utilization of a scarifier to remove dead organic matter that can build up on a lawn over time. When such thatch develops and settles in on a lawn, it can hinder growth by blocking water and nutrients from reaching the soil. Scarifying with a scarifier, or a rake in a smaller lawn or one where thatch buildup is not significant, can help to ensure a lawn can benefit from water and nutrients, such as those which are

often found in fertilizers.

Is a scarifier necessary?

Lawn and garden tools make yard work easier, and a scarifier is no exception. Scarifiers range in price, but many effective machines are relatively inexpensive when compared to more costly machines like lawn mowers and aerators. While a scarifier certainly can make dethatching easier, some homeowners might be able to get by with a spring-tined rake. However, it’s less labor-intensive to forgo a rake and use a scarifier on larger properties.

Are there additional reasons to scarify?

Thatch buildup also can promote the growth of moss, so scarifying can decrease the chances that healthy grass is pushed to the side by sponge-like moss that can quickly overtake a prop erty.

Is there anything I should know about scarifying?

A lawn that has never before been scarified is likely to produce a substan

tial amount of thatch, which can be made up of old grass clippings, leaves and moss. Though many scarifiers come with attachable buckets that collect the thatch, such baskets tend to be rather small and fill up quickly, forcing frequent stopping that can add a considerable amount of time to the job. If possible, homeowners with lawns that have significant thatch buildup might want to scarify without the bucket attached. Doing so will leave lots of piles of dead organic matter strewn about the yard, but the job is likely to go more quickly if those heaps

Are all scarifiers the same?

Homeowners are urged to do their homework and read product reviews before choosing a scarifier. The majority of scarifiers now on the market are electric, so homeowners will need the ability to plug into a power source when using such products. They also will need to negotiate around the cord, which should be a lengthy extension designed for outdoor use.

Homeowners with particularly large properties may want to purchase a gaspowered scarifier, but such products are harder to come by than their electric coun-

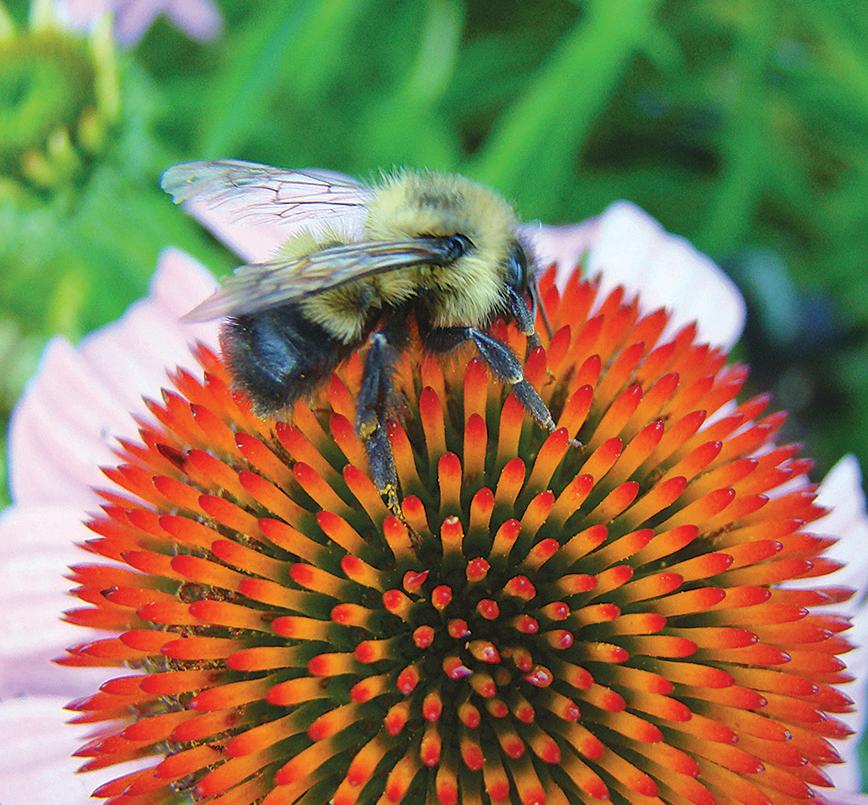

Many people live busy lives, but when they stop to smell the roses they might see a pollinator balanced on the petals. It’s easy to think of pollen only in terms of what it does to those suffering from seasonal allergies, but pollen is essential for plant and animal life.

The Ecological Society of America says pollen is a plant’s male sex cells that must be transferred from one flower to the stigma of the same flower or another for the plant to produce fruit and seed. Although some of this pollination occurs naturally, such as that aided by the wind or among plants that are self-pollinating, the vast majority of plants cannot move pollen without helpers, or pollinators. Check out these facts about pollinators and pollination to learn why they’re important to ecological health.

n Insects are the primary pollinators, although birds, bats and other creatures also can spread pollen around. The Xerces Society for Invertebrate Conservation credit honeybees, bumblebees, butterflies, moths, wasps, flies, and beetles with pollinating the most plants. However, the ESA says between 200,000 and 300,000 invertebrate species are estimated to serve globally as pollinators.

n Bees and other pollinators play critical roles in food production. The United States Department of Agriculture says more than 100 U.S.-grown crops rely on pollinators.

n About 75 percent of all flowering plants rely on animal pollinators.

n Pollinator.org says blueberries, chocolate, coffee, vanilla, almonds, pumpkins, and peaches are just some

of the foods and beverages that are produced with the help of pollinators.

n Most bee species native to North America are “solitary bees.” They don’t live in colonies and rarely sting unless physically threatened or injured. Bees largely can be left alone to do their thing and people can cohabitate comfortably nearby.

n Honeybees have different jobs than other species. A honeybee colony is made up of one reproductive queen, sexually undeveloped female workers and male drones. Drones mate with the queen so she can lay eggs, and the workers are responsible for caring for eggs, cleaning the hive and collecting nectar, pollen and other resources for the colony.

n Pollinators have been on the decline for a number of reasons. The Pollinator Partnership says threats to pollinators include pollution, pests, pathogens, changes in land use that degrades their habitats, and climate change. Honeybees, monarch butterflies and native bumblebees have all exhibited declines in recent years, according to the USDA Animal and Plant Health Inspection Service.

n People can help protect pollinators by creating pollinator-friendly garden habitats with native plants best suited to local areas. Individuals also can select old fashioned varieties of flowers whenever possible, since breeding has caused some modern blooms to lose the nectar/pollen needed to feed pollinators. Also, install houses for bats and native bees to encourage them to take up residence, and avoid the use of pesticides around the landscape.

Pollinators are vital to the health of the ecosystem. Without pollinators, food supplies would dwindle and the planet’s plant life would suffer.

Hoses, sprinklers and strategies are equally important when looking for a healthy lawn

A number of factors can affect how well a garden or lawn takes root. Watering is a key element of any landscape care strategy, and one that homeowners should educate themselves about if they want to maintain a lush, healthy lawn throughout spring and summer.

Homeowners hoping to keep their lawns lush and green throughout summer can learn some effective watering strategies to achieve that goal.

Water Sense®, an EPA Partnership Program, advises following four steps at the start of spring: inspect, connect, direct, and select for clock timer-controlled irrigation systems. Make sure the system doesn’t have any clogged, broken or missing sprinkler heads. Examine points where the sprinkler heads attach to pipes or hoses to make sure there are no leaks. The EPA says even a leak as small as the tip of a pen can waste 6,300 gallons of water per month. Adjust the sprinkler

heads so that they only hit the landscape elements rather than sidewalks or driveways. Align the watering schedule with the seasons.

An impact sprinkler on a tripod can be an effective option for those without built-in irrigation systems. These sprinklers rotate in circles to help deliver an even spray of water that mimics rainfall. It’s easy to adjust their spray pattern and

a sprinkler on a tripod can spray over the top of bushes and flower gardens.

According to Rainbird.com, drip irrigation tubing and emitters slowly distribute water to the right spots of a landscape. They can be placed at ground level or buried underground. Water soaks directly to the roots, minimizing water loss from runoff and evaporation. Some research suggests drip irrigation can

effectively cover 25 percent more area than the average sprinkler system. It also tends to deliver more than 95 percent water efficiency.

Watering a lawn or garden should not be ruled by a schedule, but other factors that will determine when water is needed, suggests Family Handyman. Daytime temperatures, wind conditions, soil type, lawn type, and recent rainfall will determine how much water the landscape really needs. Overwatering can be just as bad as underwatering. For those with underground watering systems, water sensors can trigger the system to turn on rather than a time on a clock.

Avoid midday watering

The sun is hottest in the middle of the day. Watering during this time means that much of the water will be lost to evaporation before it can get to thirsty lawns and plants. It pays to be smart about watering. Homeowners also can consider rain collection barrels to offset municipal or well water usage and be more eco-conscious about their watering efforts.

Buying a home is the most expensive purchase many people make in their lifetimes. Some people do it only once, while others are in the market with greater frequency. In any instance when the home buying process involves securing a mortgage, buyers can benefit from knowing a thing or two about mortage interest rates. A mortgage interest rate can help buyers determine if a given home is affordable or beyond their budget. Rocket

When a person buys a home with a mortgage, he or she doesn’t just pay back the amount borrowed, which is called the principal. The loan also requires paying interest, which is essentially the cost of borrowing money. Mortgage interest is calculated as a percentage of the remaining principal, says Investopedia.

Mortgage rates are not determined by a single variable. They are derived from a combination of factors that includes the Federal Reserve’s monetary policy, economic conditions and a borrower’s personal financial situation. The Federal

creditworthiness. They will look at, among other things, a borrower’s credit score and debt-to-income ratio. A higher credit score typically results in a lower interest rate. A lower DTI indicates a lower risk to the lender, also potentially resulting in a lower interest rate. Squaring away finances well in advance of applying for a mortgage can help home buyers secure lower interest rates that could save them considerable sums of money over the life of their mortgages.

interest rate, or even interest-only mortgages.

According to Bankrate, with a fixedrate mortgage, the interest rate remains the same throughout the life of the loan, meaning the payment for principal and interest will remain consistent. Additional charges that are wrapped into mortgage payments could change, however. Property taxes and homeowners’ insurance charges could increase, for example. Fixed rates tend to be lower when the term of the mortgage is shorter. So borrowers can opt for a 20-year mortgage over a 30-year to save some money on interest.

An adjustable-rate mortgage (ARM) will see the interest rate change during the repayment period. It may start with a low introductory rate for the first several years of the loan, but then can go up or down depending on market indexes and benchmarks. Many lenders put a cap on how high the interest rate can go, however.

A home buyer will pay interest no matter the mortgage type, but there are options to select a fixed or adjustable

Various factors determine mortgage interest rates for home buyers, including market conditions, credit standing, federal rates, the type of loan, and term length.

sale price by

People considering buying or selling a home are facing a unique market. The real estate market has been in flux for several years, and high interest rates have made it more expensive to borrow.

The Mortgage Bankers Association is projecting that 30-year mortgage rates will level out to 6.5 percent for the forseeable future. That means that people who have been waiting for changes in the real estate market could be disappointed, and hesitant buyers may finally just bite the bullet and buy even if mortgage rates are not where they hoped they’d be in 2025. Homeowners with properties they are considering listing for sale would be wise to make certain changes that will help garner the best prices from buyers.

The kitchen is the heart of many homes. Real estate agents may recommend that homeowners make minor to moderate

kitchen upgrades like resurfacing cabinets, upgrading countertops and changing fixtures or hardware to give the room an overhaul.

Homeowners also should look to bathroom updates as smart investments that can improve home value. Katie Severance, author of The Brilliant Home Buyer, characterizes kitchens and baths as “money rooms” that add the most value to a home.

Homeowners should clean out items they no longer need. Decluttering can make a space feel bigger, which is beneficial in a market where open concept floor plans remain popular among home buyers.

When buyers walk through a prospective home, they want to envision themselves living there, something that is more easily done if the home isn’t overrun with

the current homeowner’s belongings.

Get to painting

Painting a home is a cost-effective renovation with a lot of oomph. Freshly painted rooms appear clean and updated, says HGTV, and that can appeal to buyers. Homeowners should choose neutral colors to accommodate the widest array of potential buyers.

The exterior of a home is the first thing potential buyers will see as they roll up to view a property or look at a listing online. Homeowners should start by evaluating and enhancing the landscaping. Ensure the lawn is well-maintained and add plants that provide color without a lot of maintenance.

Homeowners can think about adding to the usable space in a home. This translates into finishing basements or attics or even converting garages to rooms. Or it may involve adding a three-season room. Homeowners can consider a number of improvements to increase the resale value of their properties.

LITTLE COMPTON - BAYBERRY FARM

$22,500,000

An unparalleled 108-acre waterfront estate Substantial and brilliantly designed, this dramatic illustration of New England Vernacular architecture is set on high, presiding over the Sakonnet Passage and ocean beyond

Contact Will Milbury at 508 525 5200

WESTPORT $875,000

This 2,418 s f home set on 1 6 private acres, offers three bedrooms and four baths including a spacious first level primary bedroom suite.

Contact Sarah Meehan at 508 685 8926

WESTPORT $2,745,000

This mid-century classic is a true Westport Point masterpiece, presiding over nearly three acres with heated swimming pool, tennis/pickleball court, guest house and distant views to Westpo rt Harbor

Contact Will Milbury at 508 525 5200 SOLD

WESTPORT - WYNDFIELD

$6,475,000

A Magnificent Saltwater Farm! This supremely private estate features curated gardens, meticulous orchards, private two-bedroom guest house, studio and barn complementing a spectacular main house Acres cascade to the water's edge with a dock on the Acoaxet branch of the Westport River A truly magnificent property!

Contact Will Milbury 508 525 5200

TIVERTON - LAND $6,499,000

This 90-acre parcel offers a myriad of development opportunities . . . features include farmland, rolling meadows, three waterfalls, a brook and 1-2 acre pond

Contact Tom Chace 401 965 3257

WESTPORT $1,775,000

This contemporary Colonial on nearly 2 5 acres offers four bedrooms, four baths, inground heated pool and professional landscaping

Contact Sarah Meehan 508 685 8926

NORTH KINGSTOWN $409,900

This two-bedroom, two-bath ranch with finished basement is set on a 17 acre lot, conveniently located to schools, shopping, train and restaurants

Contact Tom Chace 401 965 3257